UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

TO

(Amendment

No. 2)

TENDER

OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1) OF THE SECURITIES EXCHANGE ACT OF 1934

SIDECHANNEL,

INC.

(Name

of Subject Company (Issuer) and Name of Filing Person (Issuer))

Warrants

to Purchase Common Stock with an Exercise Price of $0.36

(Title

of Class of Securities)

N/A

(CUSIP

Number of Warrants)

Ryan

Polk

Chief

Financial Officer

SideChannel,

Inc.

146

Main Street, Suite 405

Worcester,

MA 01608

Phone:

(508) 925-0114

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

with

a copy to:

Michael

E. Storck, Esq. Paul J. Schulz, Esq. Lippes Mathias LLP

50

Fountain Plaza, Suite 1700

Buffalo,

New York 14202

(716)

853-5100

CALCULATION

OF FILING FEE

Transaction

valuation* $4,463,442.48; Amount of filing fee* $658.80

*

Estimated for purposes of calculating the amount of the filing fee only. SideChannel, Inc. (“SideChannel” or the “Company”)

is offering to holders of certain of its warrants, as more fully described herein, the opportunity to exchange such warrants for shares

of the Company’s common stock, par value $0.001 per share (“Shares” or “Common Stock”) by tendering six

(6) warrants with an exercise price of $0.36 in exchange for one (1) share of our Common Stock and to exchange such warrants for new

warrants (“New Warrant” or “New Warrants”) by tendering two and one-half (2.5) warrants with an exercise price

of $0.36 in exchange for one (1) New Warrant. The amount of the filing fee assumes that all outstanding warrants that are the subject

of the offer will be exchanged and is calculated pursuant to Rule 0-11(b) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). The transaction value was determined assuming that all warrants to purchase SideChannel’s Common Stock eligible to

participate in the Offer are exchanged, and that the approximately 9,276,824 Shares issued as a result of the Offer have an aggregate

value of $463,841.20 calculated based on the average of the low and high trading price on October 31, 2023 which was $0.05, and that

the approximately 22,219,896 New Warrants issued as a result of the Offer have an aggregate value of $3,999,581.28 calculated using an

exercise price of $0.18.

The

amount of the filing fee, calculated in accordance with Rule 0-11(b) under the Exchange Act, equals $147.60 per million dollars

of the transaction valuation.

| Amount

Previously Paid: N/A |

Filing

Party: N/A |

| Form

or Registration No.: N/A |

Date

Filed: N/A |

| ☐ |

Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check

the appropriate boxes below to designate any transactions to which the statement relates:

| |

☐ |

third-party

tender offer subject to Rule 14d-1. |

| |

☒ |

issuer

tender offer subject to Rule 13e-4. |

| |

☐ |

going-private

transaction subject to Rule 13e-3. |

| |

☐ |

amendment

to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ☐

SCHEDULE

TO

Amendment

No. 2

This

Amendment No. 2 (this “Amendment”) amends the Tender Offer Statement (together with any amendments and supplements thereto,

the “Schedule TO”), filed with the Securities and Exchange Commission on November 7, 2023 by SideChannel, Inc., a Delaware

corporation (the “Company” or “SideChannel”).

This

Schedule TO relates to the offer by the Company to holders of certain of the Company’s outstanding warrants (“2021 Investor

Warrants”). The offer is made upon the terms and subject to the conditions set forth in the Company’s offer to exchange,

dated November 6, 2023 (the “Offer to Exchange”), and in the related Offer to Exchange materials which are filed as Exhibits

(a)(1)(A), (a)(1)(B), (a)(1)(C), and (a)(1)(F) to this Schedule TO (which the Offer to Exchange and related Offer to Exchange materials,

as amended or supplemented from time to time, collectively constitute the “Offer Materials”). This is an Offer for all or

none of the 2021 Investor Warrants. The Offer is subject to the requirement that all of the 2021 Investor Warrants must be tendered by

all eligible holders of the 2021 Investor Warrants.

The

55,549,615 2021 Investor Warrants subject to our Offer to Exchange consist of warrants to purchase an aggregate of 55,549,615 Shares

issued to certain investors in 2021 with a five (5) year term and with an exercise price of $0.36. Under the Offer to Exchange,

the holders of the 2021 Investor Warrants will be entitled to receive one (1) share of Common Stock for each six (6) 2021 Investor Warrants

exchanged (“Investor Exchange Ratio for Stock”) and one (1) New Warrant (attached as Exhibit (a)(1)(F)) for each two and

one half (2.5) 2021 Investor Warrants exchanged, exercisable for five (5) years at an exercise price of $0.18 per share (“Investor

Exchange Ratio for Warrants”). The Investor Exchange Ratio for Stock and the Investor Exchange Ratio for Warrants are collectively

referred to as the “Investor Exchange Ratios”. The “Offer Period” is the period commencing on November 6, 2023

and ending at 5:00 p.m., Eastern Time, on December 15, 2023, or such later date to which the Company may extend the Offer (the “Expiration

Date”). If all of the 2021 Investor Warrants are tendered, the Company will issue approximately 9,267,824 Shares and 22,219,896

New Warrants. The Investor Exchange Ratios were selected by the Company in order to provide the holders of the 2021 Investor Warrants

with an incentive to exchange the 2021 Investor Warrants.

Except

as otherwise set forth in this Amendment, the information set forth in the Schedule TO remains unchanged and is incorporated herein by

reference to the extent relevant to the items in this Amendment. Capitalized terms used but not defined herein have the meanings ascribed

to them in the Schedule TO.

Items

1 through 10 and 12

Items

1 through 10 and 12 of the Schedule TO, including items that incorporate by reference the information contained in the Offer to Exchange,

are hereby amended by adding the following text thereto:

“On

December 1, 2023, the Company amended the Offer to Exchange Common Stock for Certain Outstanding Warrants attached as Exhibit (a)(1)(A).

The modifications include correcting typographical errors, clarifying defined terms, and adding disclosures as suggested by the Securities

and Exchange Commission (“SEC”) in a letter to the Company dated November 21, 2023 (“Amended Offer to Exchange”).

The form of the Amended Offer to Exchange is attached as Exhibit (a)(1)(H).

No

changes were made to the Investor Exchange Ratios or other terms of the Offer to Exchange.

References

to consideration in the Schedule TO whether stated only as “Shares” or as “Shares and New Warrants” are intended

to convey all of the consideration appropriate for the context of the Schedule TO Item.

Item

4(a) of this Schedule TO erroneously indicated we were authorized to issue “10,0000,000” undesignated shares of Preferred

Stock. Schedule TO Item 4(a) is amended to clarify in pertinent part that “Our Certificate of Incorporation authorizes the issuance

of 10,000,000 undesignated shares of Preferred Stock and permits our Board of Directors to issue Preferred Stock with rights, powers,

prerogatives or preferences that could impede the success of any attempt to change control of the Company.”

Item

5(a) of this Schedule TO is amended to provide that: “In July 2021, we engaged Paulson Investment Company (“Paulson”)

for strategic advisory services to be delivered over a four-year term in exchange for 4,000,000 shares of common stock. We have been

consulting with Paulson regarding the Offer to Exchange through this strategic advisory services agreement. We did not incur additional

costs with Paulson related to the Offer to Exchange. Paulson did not solicit the tender of any of the 2021 Investor Warrants.”

Schedule

TO Item 7(a) is amended to provide that “No funds will be paid by the Company to exchanging 2021 Investor Warrant holders in connection

with the Offer to Exchange. The Company will use funds on hand to pay the other expenses of issuing Shares and New Warrants. The Company

will use newly issued Shares or Shares held in treasury, if any, to effect the Offer to Exchange.”

Item

10 of this Schedule TO incorporates by reference the information in Item 8 of the Offer to Exchange, Financial Information Regarding

the Company, including the summarized financial information contained therein. We have determined that pro forma financial information

is not material in the context of this Offer to Exchange because the tender does not impact earnings, assets, or liabilities.

The

Company has indicated that as of 5:00 p.m. Eastern Time on November 30, 2023, approximately 35,097,127 warrants had been validly tendered

into and not validly withdrawn from The Offer, representing approximately 63.2% of the 2021 Investor Warrants.”

Amendments

to the Offer to Exchange and Exhibits to the Schedule TO

All

references to the Offer to Exchange Common Stock for Certain Outstanding Warrants (Exhibit (a)(1)(A) are hereby amended and replaced

with the Amended Offer to Exchange attached hereto as Exhibit (a)(1)(H).

Exhibit (a)(1)(J), a break-even

analysis prepared for discussion with the Holders of the 2021 Investor Warrants, has been added to the Schedule TO.

The

Company has amended the Calculation of Filing Fee Section to include the New Warrants in the calculation and has updated the format of

the Filing Fee Table to this Schedule TO as Exhibit 107.

Item

12. Exhibits.

*

Filed herewith.

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| SIDECHANNEL,

INC. |

|

|

| |

|

|

| Date:

December 4, 2023 |

By: |

/s/

Ryan Polk |

| |

Name: |

Ryan

Polk |

| |

Title: |

Chief

Financial Officer |

Exhibit

99(a)(1)(H)

OFFER

TO EXCHANGE COMMON STOCK

FOR

CERTAIN OUTSTANDING WARRANTS OF

SIDECHANNEL,

INC.

NOVEMBER

6, 2023

(Amended

December 1, 2023)

THE

OFFER PERIOD AND YOUR RIGHT TO WITHDRAW WARRANTS THAT YOU TENDER WILL EXPIRE AT 5:00 P.M., EASTERN TIME, ON DECEMBER 15, 2023, UNLESS

THE OFFER PERIOD IS EXTENDED. THE COMPANY MAY EXTEND THE OFFER PERIOD AT ANY TIME. THIS IS AN OFFER FOR ALL OR NONE OF THE WARRANTS SUBJECT

TO THE OFFER.

THE

OFFER IS BEING MADE SOLELY UNDER THIS OFFER LETTER AND THE RELATED LETTERS OF TRANSMITTAL TO ALL HOLDERS OF CERTAIN WARRANTS DESCRIBED

HEREIN. THE OFFER IS NOT BEING MADE TO, NOR WILL TENDERS BE ACCEPTED FROM OR ON BEHALF OF, HOLDERS OF WARRANTS RESIDING IN ANY U.S. STATE

IN WHICH THE MAKING OF THE OFFER OR ACCEPTANCE THEREOF WOULD NOT BE IN COMPLIANCE WITH THE SECURITIES, BLUE SKY OR OTHER LAWS OF SUCH

U.S. STATE.

SideChannel,

Inc. which is referred to in this Offer to Exchange as “we”, “us”, “our”, “SideChannel”

or the “Company” is making an offer, upon the terms and conditions in this Offer to Exchange and the related Letters

of Transmittal (which together constitute the “Offer”), to holders of certain of the Company’s outstanding warrants

to receive an aggregate of approximately 9,276,824 shares of the Company’s common stock, par value $0.001 per share (“Common

Stock” or “Shares”) and 22,219,896 new warrants to purchase Common Stock at an exercise price of $0.18 per

share for a period of five (5) years (“New Warrants”).

The

warrants subject to our Offer to Exchange consist of warrants to purchase an aggregate of 55,549,615 Shares issued to certain

investors in 2021 with a five-year term and with an exercise price of $0.36 (“2021 Investor Warrants”). Under this

Offer to Exchange, the holders of the 2021 Investor Warrants will be entitled to receive one (1) share of Common Stock for every six

(6) 2021 Investor Warrants exchanged and one (1) New Warrant for every two and one half (2.5) 2021 Investor Warrants exchanged.

The

foregoing offer is for all outstanding 2021 Investor Warrants. All 2021 Investor Warrants must be tendered for the Offer to Exchange

to close, subject to SideChannel’s right to waive the requirement. The “Offer Period” is the period commencing

on November 6, 2023 and ending at 5:00 p.m., Eastern Time, on December 15, 2023, or such later date to which the Company

may extend the Offer (the “Expiration Date”). If all of the 2021 Investor Warrants are tendered, the Company will

issue approximately 9,276,824 Shares and 22,219,896 New Warrants.

Our

Shares trade on the OTCQB, under the symbol SDCH. On November 30, 2023, the closing sales price for the Shares was $0.04 per share.

No

scrip or fractional shares will be issued. 2021 Investor Warrants may only be exchanged for whole shares and whole warrants. Holders

of 2021 Investor Warrants who would otherwise have been entitled to receive fractional shares will, after aggregating all such fractional

shares and fractional warrants of such holder, receive the number of shares and warrants as rounded up to the nearest whole share and

warrant. Holders continue to be entitled to exercise their 2021 Investor Warrants on a cash basis, as applicable, during the Offer Period

in accordance with the terms of such 2021 Investor Warrants until the expiration date of such 2021 Investor Warrants.

This

Offer is for all or none of the 2021 Investor Warrants and is subject to the condition that all of the 2021 Investor Warrants must be

tendered for the Offer to close, which SideChannel may waive. If you elect to tender 2021 Investor Warrants in response to the Offer,

please follow the instructions in this Offer to Exchange and the related documents, including the Letter of Transmittal. If you elect

to exercise your 2021 Investor Warrants on a cash basis in accordance with their terms, please follow the instructions for exercise included

in the 2021 Investor Warrants.

If

you tender 2021 Investor Warrants, you may withdraw your tendered 2021 Investor Warrants before the Expiration Date and retain them on

their terms by following the instructions herein.

Investing

in the Shares involves a high degree of risk. See the “Risk Factors” section of this Offer to Exchange for a discussion of

information that you should consider before tendering 2021 Investor Warrants in the Offer.

The

Offer will commence on November 6, 2023 (the date the materials relating to the Offer are first sent to the 2021 Investor Warrant holders)

and end on the Expiration Date. Only the 2021 Investor Warrants are subject to the Offer.

A

detailed discussion of our Offer to Exchange Common Stock for the 2021 Investor Warrants is contained in this Offer to Exchange. Holders

of the 2021 Investor Warrants are strongly encouraged to read this entire package of materials, and the publicly filed information about

the Company referenced herein, before deciding regarding the Offer.

THE

COMPANY’S BOARD OF DIRECTORS HAS APPROVED THE OFFER. HOWEVER, NONE OF THE COMPANY, ITS DIRECTORS, OFFICERS OR EMPLOYEES (EACH AS

DEFINED BELOW) MAKES ANY RECOMMENDATION WHETHER YOU SHOULD EXCHANGE YOUR WARRANTS. EACH HOLDER OF A 2021 INVESTOR WARRANT MUST MAKE HIS,

HER OR ITS OWN DECISION WHETHER TO TENDER ALL OF HIS, HER OR ITS WARRANTS.

WE

HAVE NOT AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION ON OUR BEHALF AS TO WHETHER OR NOT YOU SHOULD PARTICIPATE IN THE OFFER TO EXCHANGE.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED OR INCORPORATED BY REFERENCE IN THIS DOCUMENT.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission, bureau or authority has approved

or disapproved of this transaction or passed upon the fairness or merits of this transaction or the accuracy or adequacy of the information

contained in this Offer to Exchange. Any representation to the contrary is a criminal offense.

IMPORTANT

PROCEDURES

If

you want to tender all of your 2021 Investor Warrants, you must:

| |

● |

complete

and sign the Letter of Transmittal applicable to the 2021 Investor Warrants you are tendering according to its instructions, and

deliver the Letter of Transmittal, together with any other documents required by the Letter of Transmittal, to the Company. |

TO

TENDER YOUR 2021 INVESTOR WARRANTS, YOU MUST CAREFULLY FOLLOW THE PROCEDURES DESCRIBED IN THIS OFFER LETTER, THE LETTER OF TRANSMITTAL

APPLICABLE TO YOUR 2021 INVESTOR WARRANTS AND THE OTHER DOCUMENTS DISCUSSED HEREIN RELATED TO THE OFFER. NO SCRIP OR FRACTIONAL SHARES

WILL BE ISSUED. WARRANTS MAY ONLY BE EXCHANGED FOR WHOLE SHARES AND WHOLE NEW WARRANTS.

Holders

of 2021 Investor Warrants who would otherwise have been entitled to receive fractional shares will, after aggregating all such fractional

shares of such holder, receive the number of shares as rounded up to the nearest whole share.

If

you have any questions or need assistance, you should contact SideChannel, Inc. You may request additional copies of this Offer to Exchange

and the Letter of Transmittal from the Company. The Company may be reached at:

The

address of the Company is:

SideChannel,

Inc.

146

Main Street, Suite 405

Worcester,

MA 01608

Email:

accounting@sidechannel.com

Phone:

(508) 925-0114

TABLE

OF CONTENTS

| SUMMARY |

1 |

| |

|

| CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS |

3 |

| |

|

| RISK

FACTORS |

4 |

| |

|

| THE

OFFER |

5 |

| |

|

| 1. |

GENERAL

TERMS |

5 |

| |

|

|

| 2. |

PROCEDURE

FOR TENDERING WARRANTS |

6 |

| |

|

|

| 3. |

BACKGROUND

AND PURPOSE OF THE OFFER |

10 |

| |

|

|

| 4. |

PRICE

RANGE OF SHARES |

12 |

| |

|

|

| 5. |

SOURCE

AND AMOUNT OF FUNDS |

12 |

| |

|

|

| 6. |

FEES

AND EXPENSES |

12 |

| |

|

|

| 7. |

TRANSACTIONS

AND AGREEMENTS CONCERNING THE WARRANTS |

12 |

| |

|

|

| 8. |

FINANCIAL

INFORMATION REGARDING THE COMPANY |

12 |

| |

|

|

| 9. |

EXTENSIONS;

AMENDMENTS; CONDITIONS; TERMINATION; PLANS |

13 |

| |

|

|

| 10. |

MATERIAL

U.S. FEDERAL INCOME TAX CONSEQUENCES |

14 |

| |

|

|

| 11. |

ADDITIONAL

INFORMATION; MISCELLANEOUS |

16 |

SUMMARY

The

following summary is qualified in its entirety by the more detailed information appearing elsewhere in this Offer to Exchange. An investment

in our Shares involves risks. You should carefully consider the information provided under the heading “Risk Factors.”

| |

A.

|

The

Company - SideChannel, Inc., a Delaware corporation. Our principal executive offices are located at 146 Main Street, Suite 405,

Worcester, MA 01608. |

| |

|

|

| |

B.

|

The

2021 Investor Warrants - As of September 30, 2023, the Company has a total of

69,281,020 warrants to purchase shares of Common Stock outstanding (“Outstanding

Warrants”). Of the Outstanding Warrants, 55,549,615 warrants to purchase

an aggregate of 55,549,615 Shares that were issued to certain investors in 2021 with a five-year

term and with an exercise price of $0.36 (“2021 Investor Warrants”) are

subject to the Offer. By their terms, the 2021 Investor Warrants will expire on dates varying

from March 31, 2026 to April 16, 2026.

Only

the 2021 Investor Warrants are eligible to be tendered for exchange in this Offer. |

| |

|

|

| |

C.

|

Market

Price of the Shares - Our Shares trade on the OTCQB, under the symbol SDCH . On November 30, 2023, the closing

sales price for the Shares was $0.04 per share. |

| |

|

|

| |

D.

|

The

Offer - After the closing of the Offer, the holders who have tendered their 2021 Investor Warrants will be entitled to receive

one (1) share of Common Stock for every six (6) 2021 Investor Warrants tendered for exchange (“Investor Exchange Ratio for

Stock”), and one (1) New Warrant for every two and one half (2.5) 2021 Investor Warrants tendered for exchange (“Investor

Exchange Ratio for Warrants”). The Investor Exchange Ratio for Stock and the Investor Exchange Ratio for Warrants are collectively

referred to as the “Investor Exchange Ratios”. |

The

Investor Exchange Ratios were selected by the Company in order to provide the holders of the 2021 Investor Warrants with an incentive

to exchange the 2021 Investor Warrants. The “Offer Period” is the period commencing on November 6, 2023 and ending

at 5:00 p.m., Eastern Time, on December 15, 2023, or such later date to which the Company may extend the Offer (the “Expiration

Date”). This is an all or none offer pursuant to which all 2021 Investor Warrants outstanding are required be tendered subject

to SideChannel’s reserved right to waive this requirement.

If

all of the 2021 Investor Warrants are tendered as required, the Company will issue approximately 9,276,824 Shares and 22,219,896

New Warrants. A holder must tender all or none of the 2021 Investor Warrants they hold to participate in the Offer. 2021 Investor

Warrants may only be exchanged for whole shares. Holders continue to be entitled to exercise their 2021 Investor Warrants on a cash basis

during the Offer Period in accordance with the terms of the 2021 Investor Warrants. See Section 1, “General Terms”.

| |

E. |

Material

Terms of the New Warrants – The New Warrants contain the following material terms: |

| |

● |

Each

(1) New Warrant can subscribe for and purchase one (1) share of common stock from the Company at an exercise price of eighteen cents

($0.18) during a five (5) year period from the date of issuance. |

| |

● |

The

New Warrant can be exercised on a cash or cashless basis. |

| |

● |

The

New Warrants will automatically convert if the common stock trades at a bid price equal to or greater than thirty-six cents ($0.36)

for thirty (30) consecutive trading days. New Warrant holders will be notified if the automatic conversion is triggered and will

be provided with twenty (20) trading days to deliver a notice of exercise to the Company. |

| |

● |

The

New Warrants will be adjusted for stock dividends and stock splits should such an event occur during the term of the New Warrant. |

| |

F.

|

Reasons

for the Offer - The Offer is being made to all holders of certain classes of 2021 Investor Warrants. The purpose of the Offer

is to (i) remove impediments to effectively engaging the capital markets caused by certain terms in the 2021 Investor Warrants (ii)

reduce the aggregate number of warrants outstanding, and (iii) increase the number of Shares in the market. See Subsection 3(C),

“Background and Purpose of the Offer— Purpose of the Offer.” |

| |

|

|

| |

G.

|

Expiration

Date of Offer - The Expiration Date is 5:00 p.m., Eastern Time, on December 15, 2023, or such date to which we may extend the

Offer. All 2021 Investor Warrants and related paperwork must be received by the Company by this time, as instructed herein. See Section

9, “Extensions; Amendments; Conditions; Termination; Plans.” |

| |

H.

|

Withdrawal

Rights - If you tender your 2021 Investor Warrants and change your mind, you may withdraw your tendered 2021 Investor Warrants

at any time until the Expiration Date, as described in greater detail in Section 2 herein. See Section 2.B., “Withdrawal Rights.” |

| |

|

|

| |

I.

|

Participation

by Officers and Directors - No directors or officers hold any warrants subject to the Offer (see Subsection 3(D)., “Background

and Purpose of the Offer—Interests of Directors and Officers”). |

| |

J.

|

Conditions

of the Offer - The conditions of the Offer are that no action or event shall have occurred, no action shall have been taken,

and no statute, rule, regulation, judgment, order, stay, decree or injunction shall have been promulgated, enacted, entered or enforced

applicable to the Offer or the exchange of 2021 Investor Warrants for Shares and New Warrants under the Offer by or before any court

or governmental regulatory or administrative agency, authority or tribunal of competent jurisdiction, including, without limitation,

taxing authorities, that challenges the making of the Offer or the exchange of 2021 Investor Warrants for Shares and New Warrants

under the Offer or would reasonably be expected to, directly or indirectly, prohibit, prevent, restrict or delay consummation of,

or would reasonably be expected to otherwise adversely affect in any material manner, the Offer or the exchange of 2021 Investor

Warrants for Shares and New Warrants under the Offer, and that all of the 2021 Investor Warrants must be tendered; however, the Company

may waive this condition in its discretion if all 2021 Investor Warrants are not tendered by the Expiration Date. |

| |

|

|

| |

K.

|

Termination

- We may terminate the Offer if the Conditions of the Offer are not satisfied prior to the Expiration Date. See Section 9, “Extensions;

Amendments; Conditions; Termination.” |

| |

|

|

| |

L.

|

Fractional

Shares and Fractional Warrants - No scrip or fractional shares or warrants will be issued. 2021 Investor Warrants may only be

exchanged for whole Shares and whole New Warrants. Holders of 2021 Investor Warrants who would otherwise have been entitled to receive

fractional shares or fractional warrants will, after aggregating all such fractional shares and warrants of such holder, receive

the number of Shares and New Warrants as rounded up to the nearest whole Share and New Warrant. See Subsection 1(B), “General

Terms—Partial Tender Permitted.” |

| |

|

|

| |

M.

|

Board

of Directors’ Recommendation - Our Board of Directors has approved the Offer. However, none of the Company, its directors,

officers or employees makes any recommendation as to whether to tender 2021 Investor Warrants. You must make your own decision as

to whether to tender some or all of your 2021 Investor Warrants. See Subsection 1(C), “General Terms—Board Approval of

the Offer; No Recommendation; Holder’s Own Decision.” |

| |

|

|

| |

N.

|

Solicitation

Agent - The Company has not retained a solicitation agent for the Exchange Offer. |

| |

|

|

| |

O.

|

How

to Tender 2021 Investor Warrants - To tender your 2021 Investor Warrants, you must complete

the actions described herein under Section 2 before the Offer expires. You may also contact

the Company for assistance. The contact Information for the Company is SideChannel, Inc.,

146 Main Street, Suite 405, Worcester, MA 01608, Phone: (508) 925-0114. You may also contact

the Company via email using accounting@sidechannel.com.

See

Section 2, “Procedure for Tendering 2021 Investor Warrants.” |

| |

P.

|

Certain

Material U.S. Federal Tax Consequences - Holders are urged to consult their personal tax advisors concerning the tax consequences

of an exchange pursuant to the Offer based on their particular circumstances. For a general discussion of certain tax considerations,

see Section 10, “Material U.S. Federal Income Tax Consequences.” |

| |

|

|

| |

Q.

|

Further

Information - Please direct questions or requests for assistance, or for additional copies

of this Offer to Exchange, Letter of Transmittal or other materials, in writing, to the Company

at:

SideChannel,

Inc., 146 Main Street, Suite 405, Worcester, MA 01608

Email

accounting@sidechannel.com

Phone:

(508) 925-0114.

See

Section 11, “Additional Information; Miscellaneous.” |

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Offer to Exchange contains forward-looking statements. Forward-looking statements are those that predict or describe future events or

trends and that do not relate solely to historical matters. You can generally identify forward-looking statements as statements containing

the words “believe,” “expect,” “may,” “anticipate,” “intend,” “estimate,”

“project,” “plan,” “assume,” “potential,” “could,” “should,”

or other similar expressions, or negatives of those expressions, although not all forward-looking statements contain these identifying

words. All statements contained or incorporated by reference in this Offer to Exchange regarding our future strategy, future operations,

projected financial position, estimated future revenues, projected costs, future prospects, the future of our industries and results

that might be obtained by pursuing management’s current plans and objectives are forward-looking statements.

You

should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown

risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based

on the information currently available to us and speak only as of the date on the cover of this Offer to Exchange, or, in the case of

forward-looking statements in documents incorporated by reference, as of the date of the date of the filing of the document that includes

the statement. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they

may affect us. Over time, our actual results, performance or achievements will likely differ from the anticipated results, performance

or achievements that are expressed or implied by our forward-looking statements, and such difference might be significant and materially

adverse to our security holders. Except with respect to our obligation to provide amendments for material changes to this Offer to Exchange

during the duration of the Offer, we do not undertake and specifically disclaim any obligation to update any forward-looking statements

or to publicly announce the results of any revisions to any statements to reflect new information or future events or developments.

We

have identified some of the important factors that could cause future events to differ from our current expectations and they are described

in this Offer to Exchange under the caption “Risk Factors,” below, and elsewhere in this Offer to Exchange which you should

review carefully. Please consider our forward-looking statements in light of those risks as you read this Offer to Exchange.

RISK

FACTORS

An

investment in our Shares involves a high degree of risk. You should carefully consider each of the risks described below, together with

all of the other information set forth elsewhere on this Offer to Exchange and the risks and other information described in our annual

report on Form 10-K filed on December 20, 2022 and our subsequently filed quarterly reports on Form 10-Q. Additional risks and uncertainties

not presently known to the Company or that the Company currently deems immaterial also may impair our business operations. If any of

the matters identified as potential risks materialize, our business could be harmed. In that event, the trading price of our Common Stock

could decline.

There

is no guarantee that your decision whether to tender your 2021 Investor Warrants in the Offer will put you in a better future economic

position.

We

can give no assurance as to the price at which a stockholder may be able to sell our Common Stock in the future following the completion

of the Offer. If you choose to tender your 2021 Investor Warrants in the Offer, certain future events may cause an increase in our Common

Stock price and may result in receiving fewer shares of Common Stock now than you might receive from future warrant exercises had you

not agreed to exchange your 2021 Investor Warrants. Similarly, if you do not tender your 2021 Investor Warrants in the Offer, you will

continue to bear the risk of ownership of your 2021 Investor Warrants after the closing of the Offer, which includes the expiration of

the 2021 Investor Warrants by their own terms, and there can be no assurance that you can sell your 2021 Investor Warrants (or exercise

them for Common Stock) in the future at a higher price than would have been obtained by participating in the Offer. You should consult

your own individual tax and/or financial advisor for assistance on how this may affect your individual situation.

There

is no assurance that the Offer will be successful.

There

is no assurance that all of the 2021 Investor Warrants will be tendered in the Offer or that the Company will exercise its right to waive

that requirement. Moreover, there is no assurance that the price of our Common Stock will increase. The price of our Common Stock and

the decision of any investors to make an equity investment in the Company are based on numerous material factors, of which our 2021 Investor

Warrant overhang is only one. Eliminating or significantly reducing our 2021 Investor Warrant overhang will not generate any capital

for our Company.

If

the holders of all of our 2021 Investor Warrants accept the Offer, we will issue them additional shares of Common Stock. The issuance

of additional Common Stock upon the exchange of tendered 2021 Investor Warrants will dilute our existing stockholders as well as our

future stockholders. The issuance will dilute the percentage ownership interests in the Company of other stockholders.

The

market price of our Common Stock will fluctuate, and it may adversely affect 2021 Investor Warrant holders who tender their 2021 Investor

Warrants for Common Stock.

The

market price of our Shares will fluctuate between the date the Offer is commenced, the Expiration Date of the Offer and the date on which

Shares are issued to tendering 2021 Investor Warrant holders. Accordingly, the market price of Shares upon settlement of the Offer could

be less than the price at which the 2021 Investor Warrants could be sold or the price of our Common Stock when the 2021 Investor Warrants

were tendered. The Company does not intend to re-adjust the Investor Exchange Ratios based on any fluctuation in the price of our Shares.

The

value of the Shares and New Warrants that you receive may fluctuate.

We

are offering Shares and New Warrants for validly tendered 2021 Investor Warrants. The price of our Shares may fluctuate widely in the

future. If the market price of our Shares declines, the value of the Shares and New Warrants you will receive in exchange for your 2021

Investor Warrants will decline. The trading value of our Shares could fluctuate depending upon any number of factors, including those

specific to us and those that influence the trading prices of equity securities generally, many of which are beyond our control.

The

number of Shares outstanding as a result of the Offer may depress the price of the Common Stock.

As

a result of this Offer, the number of Shares outstanding and trading will increase. This could adversely affect the prevailing market

price of the Shares. As a result, holders may not be able to sell the Shares at or above their purchase price or exercise New Warrants

and it may impair the Company’s ability to raise capital through future sales of Common Stock or other equity securities.

No

rulings or opinions have been received as to the tax consequences of the Offer to holders of 2021 Investor Warrants.

The

tax consequences that will result to a 2021 Investor Warrant holder that participates in the Offer are not well defined by the existing

authorities. No ruling of any governmental authority and no opinion of counsel has been issued or rendered on these matters. 2021 Investor

Warrant holders must therefore rely on the advice of their own tax advisors in assessing these matters. For a general discussion of certain

tax considerations, see Section 10, “Material U.S. Federal Income Tax Consequences.”

Our

Common Stock is deemed a “Penny Stock” and, as a result, holders of our Common Stock may have their ability to sell their

Shares of the Common Stock impaired.

Our

Common Stock is considered a “penny stock” subject to the requirements of Rule 15g-9, promulgated under the Exchange Act

of 1934, as amended (“Exchange Act”). “Penny Stock” is generally defined as any equity security not traded

on an exchange or quoted on NYSE or Nasdaq that has a market price of less than $5.00 per share. Under such rule, broker-dealers who

recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice

requirements, including making an individualized written suitability determination for the purchaser and obtaining the purchaser’s

consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure

in connection with any trades involving a stock defined as a penny stock.

The

required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining the penny

stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the

ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose restrictions

on transferring “penny stocks” and as a result, investors in the common stock may have their ability to sell their shares

of the common stock impaired.

THE

OFFER

Risks

of Participating In the Offer

Participation

in the Offer involves a number of risks, including, but not limited to, the risks identified in “Risk Factors” above. Holders

should carefully consider these risks and are urged to speak with their personal financial, investment and/or tax advisors as necessary

before deciding whether to participate in the Offer. In addition, the Company strongly encourages you to read this Offer to Exchange

in its entirety and review the documents referred to in “Risk Factors,” above as well, including the risks and other information

described in our annual report on Form 10-K filed on December 20, 2022 and our subsequently filed quarterly reports on Form 10-Q .

Subject

to the terms and conditions of the Offer, the Company is making an offer to the holders of certain of our warrants to tender their warrants

in exchange for Shares of our Common Stock and New Warrants. The warrants subject to our Offer to Exchange are warrants to purchase an

aggregate of 55,549,615 Shares that were issued to certain investors in 2021 with a five-year term and with an exercise price

of $0.36 (“2021 Investor Warrants”). Under this Offer to Exchange, (i) the holders of the 2021 Investor Warrants will

be entitled to receive one (1) share of Common Stock for every six (6) 2021 Investor Warrants exchanged (“Investor Exchange Ratio

for Stock”) and one (1) New Warrant for every two and one half (2.5) 2021 Investor Warrants exchanged (“Investor Exchange

Ratio for Warrants”). The “Offer Period” is the period commencing on November 6, 2023 and ending at 5:00

p.m., Eastern Time, on December 15, 2023, or such later date to which the Company may extend the Offer (the “Expiration

Date”).

This

Offer is an all or none offer, and holders must tender all their 2021 Investor Warrants to participate. The Offer is subject to the condition

that all the 2021 Investor Warrants must be tendered for exchange for the Offer to close, subject to the Company’s reserved right

to waive the requirement and close the Offer. 2021 Investor Warrants may only be exchanged for whole shares and whole warrants. No scrip

or fractional shares or warrants will be issued. Holders of 2021 Investor Warrants who would otherwise have been entitled to receive

fractional shares or warrants will, after aggregating all such fractional shares of such holder, receive the number of shares and warrants

as rounded up to the nearest whole share and warrant. Holders continue to be entitled to exercise their 2021 Investor Warrants on a cash

basis during the Offer Period in accordance with the terms of the warrant.

If

you elect to tender 2021 Investor Warrants in response to the Offer, please follow the instructions in this Offer to Exchange and the

related documents, including the Letter of Transmittal.

If

you tender your 2021 Investor Warrants, you may withdraw your tendered 2021 Investor Warrants before the Expiration Date and retain them

on their terms by following the instructions herein.

This

Offer to Exchange is made pursuant to the exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended

(the “Securities Act”).

The

Offer will only be open for a period beginning on November 6, 2023 and ending on the Expiration Date. The Company expressly reserves

the right, in its sole discretion, at any time or from time to time, to extend the period of time during which the Offer is open. There

can be no assurance, however, that the Company will exercise its right to extend the Offer.

| |

B. |

Partial

Tender Not Permitted |

This

is an all or none Offer. If you choose to participate in the Offer, you must tender all of your 2021 Investor Warrants pursuant to the

terms of the Offer. Although the Company has reserved the right to waive this condition, there can be no assurance that the Company will

in fact waive this condition if all eligible 2021 Investor Warrants are not tendered.

HOLDERS

MAY ALSO BE ENTITLED TO EXERCISE THEIR 2021 INVESTOR WARRANTS ON A CASH BASIS DURING THE OFFER PERIOD IN ACCORDANCE WITH THE TERMS OF

THE 2021 INVESTOR WARRANT, RATHER THAN TENDERING THEM FOR EXCHANGE.

| |

C. |

Board

Approval of the Offer; No Recommendation; Holder’s Own Decision |

THE

COMPANY’S BOARD OF DIRECTORS HAS APPROVED THE OFFER. HOWEVER, NONE OF THE COMPANY, ITS DIRECTORS, OFFICERS OR EMPLOYEES MAKES ANY

RECOMMENDATION AS TO WHETHER TO TENDER WARRANTS. EACH HOLDER OF A 2021 INVESTOR WARRANT MUST MAKE HIS, HER OR ITS OWN DECISION AS TO

WHETHER TO TENDER SOME OR ALL OF HIS, HER OR ITS 2021 INVESTOR WARRANTS.

| |

D. |

Extensions

of the Offer |

The

Company expressly reserves the right, in its sole discretion, and at any time or from time to time, to extend the period of time during

which the Offer is open. There can be no assurance, however, that the Company will exercise its right to extend the Offer. If the Company

extends the Offer, it will give notice of such extension by press release or other public announcement no later than 9:00 a.m., Eastern

Time, on the next business day after the previously scheduled Expiration Date of the Offer.

| 2. |

PROCEDURE

FOR TENDERING WARRANTS |

| |

A. |

Procedures

for Tendering 2021 Investor Warrants |

You

do not have to participate in the Offer. If you decide not to participate in the Offer, you do not need to do anything, and your 2021

Investor Warrants will remain outstanding until they expire or are exercised in accordance with their terms.

To

participate in the Offer, you must properly complete, sign and date the Letter of Transmittal and mail or otherwise deliver to the Company

the Letter of Transmittal so that the Company receives it no later than 5:00 P.M., Eastern Time, on the Expiration Date (or such later

date and time if we extend the Offer), at the address set forth in the Letter of Transmittal. The Company will accept email delivery

of the Letter of Transmittal and any related documents at accounting@sidechannel.com.

The

Letter of Transmittal must be executed by the record holder of the tendered 2021 Investor Warrants. However, if the signature is by a

trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or another person acting in a fiduciary or representative

capacity, the signer’s full title and proper evidence of the authority of such person to act in such capacity must be indicated

on the Letter of Transmittal.

If

you do not submit a Letter of Transmittal for your 2021 Investor Warrants prior to the Expiration Date of the Offer, or if you submit

an incomplete or incorrectly completed Letter of Transmittal, you will be considered to have rejected the Offer to Exchange.

THE

METHOD OF DELIVERY OF THE APPLICABLE LETTER OF TRANSMITTAL AND ALL OTHER REQUIRED DOCUMENTS TO THE COMPANY IS AT THE ELECTION, EXPENSE

AND RISK OF THE HOLDER. IT IS RECOMMENDED THAT HOLDERS ALLOW SUFFICIENT TIME TO ASSURE DELIVERY TO THE COMPANY BEFORE THE EXPIRATION

DATE.

You

may change your election and withdraw your tendered 2021 Investor Warrants only if you properly complete, sign and date the Withdrawal

Form included with the Offer and mail, email or otherwise deliver the Withdrawal Form to us so that we receive it no later than 5:00

P.M., Eastern Time, on the Expiration Date, Attention: SideChannel, Inc., 146 Main Street, Suite 405, Worcester, MA 01608 or by email

at accounting@sidechannel.com. You may also withdraw your tendered 2021 Investor Warrants pursuant to Rule 13e-4(f)(2)(ii) under the

Exchange Act, if they have not been accepted by us within forty (40) business days from the commencement of the Offer. Delivery of the

Withdrawal Form by facsimile will not be accepted.

The

Withdrawal Form must be executed by the record holder of the 2021 Investor Warrants to be withdrawn. However, if the signature is by

a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or another person acting in a fiduciary or representative

capacity, the signer’s full title and proper evidence of the authority of such person to act in such capacity must be indicated

on the Withdrawal Form.

Withdrawals

of 2021 Investor Warrants may not be rescinded. Any 2021 Investor Warrants properly withdrawn will thereafter be deemed not to have been

validly tendered for purposes of the Offer. However, withdrawn 2021 Investor Warrants may be re-tendered by again following one of the

procedures described in the Offer at any time prior to the Expiration Date.

ALL

QUESTIONS AS TO THE FORM AND VALIDITY (INCLUDING TIME OF RECEIPT) OF ANY NOTICE OF WITHDRAWAL WILL BE DETERMINED BY THE COMPANY, IN ITS

REASONABLE DISCRETION, WHOSE DETERMINATION WILL BE FINAL AND BINDING. NONE OF THE COMPANY OR ANY OTHER PERSON WILL BE UNDER ANY DUTY

TO GIVE NOTIFICATION OF ANY DEFECTS OR IRREGULARITIES IN ANY NOTICE OF WITHDRAWAL OR INCUR ANY LIABILITY FOR FAILURE TO GIVE ANY SUCH

NOTIFICATION.

NOTWITHSTANDING

THE FOREGOING, THE 2021 INVESTOR WARRANT HOLDERS ARE NOT FORECLOSED FROM CHALLENGING THE COMPANY’S DETERMINATION IN A COURT OF

COMPETENT JURISDICTION.

THE

METHOD OF DELIVERY OF YOUR WITHDRAWAL FORM TO THE COMPANY IS AT THE ELECTION, EXPENSE AND RISK OF THE HOLDER. INSTEAD OF DELIVERY BY

MAIL, IT IS RECOMMENDED THAT HOLDERS USE AN OVERNIGHT, HAND DELIVERY SERVICE, OR ELECTRONIC DELIVERY AND THE DELIVERY WILL BE DEEMED

MADE ONLY WHEN ACTUALLY RECEIVED OR CONFIRMED BY THE COMPANY. IN ALL CASES, SUFFICIENT TIME SHOULD BE ALLOWED TO ASSURE DELIVERY TO THE

COMPANY BEFORE THE EXPIRATION DATE.

| |

C. |

Determination

of Validity; Rejection of 2021 Investor Warrants; Waiver of Defects; No Obligation to Give Notice of Defects |

We

will determine, in our discretion, all questions as to form, validity, including time of receipt, eligibility and acceptance of any tender

of 2021 Investor Warrants or withdrawal of tendered 2021 Investor Warrants. Our determination of these matters will be final and binding

on all parties. We may reject any or all tenders of or withdrawals of tendered 2021 Investor Warrants that we determine are not in appropriate

form or that we determine are unlawful to accept or not timely made. Otherwise, we expect to accept all properly and timely tendered

2021 Investor Warrants which are not validly withdrawn. We may waive, as to all eligible 2021 Investor Warrant holders, any defect or

irregularity in any tender with respect to any particular warrant. Any waiver granted as to one 2021 Investor Warrant holder will be

afforded to all holders of 2021 Investor Warrants. We may also waive any of the conditions of the Offer in our reasonable discretion,

so long as such waiver is made with respect to all 2021 Investor Warrant holders. No tender of 2021 Investor Warrants or withdrawal of

tendered 2021 Investor Warrants will be deemed to have been properly made until all defects or irregularities have been cured by the

tendering 2021 Investor Warrant holder or waived by us. Notwithstanding the foregoing, the 2021 Investor Warrant holders are not foreclosed

from challenging the Company’s determination in a court of competent jurisdiction.

NEITHER

WE NOR ANY OTHER PERSON IS OBLIGATED TO GIVE NOTICE OF ANY DEFECTS OR IRREGULARITIES IN TENDERS OR WITHDRAWALS, AND NO ONE WILL BE LIABLE

FOR FAILING TO GIVE NOTICE OF ANY DEFECTS OR IRREGULARITIES.

| |

D. |

Acceptance

of 2021 Investor Warrants; Issuance of Common Stock |

The

Offer is scheduled to expire at 5:00 P.M., Eastern Time, on the Expiration Date, December 15, 2023, (subject to our right to extend the

Offer). Upon the terms and subject to the conditions of the Offer, we expect, upon the expiration of the Offer, to:

| |

● |

accept

for exchange 2021 Investor Warrants properly tendered and not validly withdrawn pursuant to the Offer; and |

| |

|

|

| |

● |

issue

Common Stock and New Warrants in exchange for tendered 2021 Investor Warrants pursuant to the Offer, within two (2) trading days

after the Expiration Date. The Company will round the number of Shares and New Warrants to which such holder is entitled, after aggregating

all fractions, up to the next whole number of Shares and New Warrants. |

If

you elect to tender your 2021 Investor Warrants pursuant to the Offer and you do so according to the procedures described herein, you

will have accepted the Offer. Our acceptance of your outstanding 2021 Investor Warrants for tender in the Offer will form a binding agreement

between you and us upon the terms and subject to the conditions of the Offer upon the expiration of the Offer. A tender of 2021 Investor

Warrants made pursuant to any method of delivery set forth herein will also constitute an acknowledgement by the tendering 2021 Investor

Warrant holder that regardless of any action that we take with respect to any applicable tax related to the Offer and the disposition

of 2021 Investor Warrants, such 2021 Investor Warrant holder acknowledges that the ultimate liability for all tax is and remains his,

her or its sole responsibility. In that regard, a tender of 2021 Investor Warrants authorizes us to withhold such Shares of Common Stock

as may be necessary to cover any applicable tax payable by a tendering 2021 Investor Warrant holder.

If

you elect not to participate in the Offer, your 2021 Investor Warrants will remain outstanding until they expire or are exercised by

their original terms.

Our

Common Stock is considered a “penny stock”, and subject to the requirements of Rule 15g-9, promulgated under the Exchange

Act of 1934, as amended. “Penny stock” is generally defined as any equity security not traded on an exchange or quoted on

NASDAQ that has a market price of less than $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons

other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that

they make an individualized written suitability determination for the purchaser and receive the purchaser’s consent prior to the

transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection

with any trades involving a stock defined as a penny stock.

The

required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining the penny

stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the

ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose restrictions

on transferring “penny stocks” and as a result, investors in the common stock may have their ability to sell their shares

of the common stock impaired.

If

you tender 2021 Investor Warrants pursuant to the Offer, you will receive restricted Shares, that may not be resold or transferred by

you, except pursuant to an available exemption such as Rule 144 of the Securities Act and you will generally be entitled to “tack”

your holding period of the 2021 Investor Warrants so tendered for purposes of Rule 144. The Shares and New Warrants are being issued

by the Company in reliance on the exemption from registration set forth in Section 3(a)(9) of the Securities Act.

| |

E. |

Extension

of the Offer; Termination; Amendment |

Although

we do not currently intend to do so, we may, from time to time, at our discretion, extend the Offer at any time as provided above. If

we extend the Offer, we will continue to accept validly tendered 2021 Investor Warrants until the new Expiration Date.

We

also expressly reserve the right, in our reasonable judgment, prior to the Expiration Date, to terminate or amend the Offer and to postpone

our acceptance of any tendered 2021 Investor Warrant upon the occurrence of any of the conditions specified below under “The Offer—Conditions

to the Offer.”

Extension

or amendments to, or a termination of, the Offer may be made at any time and from time to time by an announcement. In the case of an

extension, the announcement must be issued no later than 9:00 A.M., Eastern Time, on the next business day after the last previously

scheduled or announced Expiration Date. Any announcement made pursuant to the Offer will be disseminated promptly to holders of 2021

Investor Warrants in a manner reasonably designed to inform such holders of such amendment. Without limiting the manner in which we may

choose to make an announcement, except as required by applicable law, we have no obligation to publish, advertise or otherwise communicate

any such announcement other than by issuing a press release.

If

we materially change the terms of the Offer or the information concerning the Offer, or if we waive a material condition of the Offer,

we will extend the Offer to the extent required by Rules 13e-4(d)(2), 13e-4(e)(3), and 13e-4(f)(1)(ii) under the Exchange Act. These

rules require that the minimum period during which an offer must remain open following material changes in the terms of the Offer or

information concerning the offer, other than a change in price or a change in percentage of securities sought, will depend on the facts

and circumstances, including the relative materiality of such terms or information.

| |

F. |

Conditions

of the Offer |

The

Offer is subject to the following conditions: no action or event shall have occurred, no action shall have been taken, and no statute,

rule, regulation, judgment, order, stay, decree or injunction shall have been promulgated, enacted, entered or enforced applicable to

the Offer or the exchange of 2021 Investor Warrants for Shares and New Warrants under the Offer by or before any court or governmental

regulatory or administrative agency, authority or tribunal of competent jurisdiction, including, without limitation, taxing authorities,

that challenges the making of the Offer or the exchange of 2021 Investor Warrants for Shares and New Warrants under the Offer or would

reasonably be expected to, directly or indirectly, prohibit, prevent, restrict or delay consummation of, or would reasonably be expected

to otherwise adversely affect in any material manner, the Offer or the exchange of 2021 Investor Warrants for Shares and New Warrants

under the Offer.

The

Offer is also subject the condition that all of the 2021 Investor Warrants must be tendered for exchange; however, the Company may waive

this condition in its reasonable discretion if all 2021 Investor Warrants are not tendered by the Expiration Date.

We

may terminate the Offer if the Conditions of the Offer are not satisfied prior to the Expiration Date. In the event that we terminate

the Offer, all 2021 Investor Warrants tendered by a 2021 Investor Warrant holder in connection with the Offer shall be returned to such

2021 Investor Warrant holder and the 2021 Investor Warrants will expire in accordance with their terms on their respective expiration

dates and will otherwise remain subject to their original terms.

| 3. |

BACKGROUND

AND PURPOSE OF THE OFFER |

| |

A. |

Information

Concerning SideChannel, Inc. |

SideChannel’s

mission is to make cybersecurity simple and accessible for mid-market and emerging companies, a market we believe is currently underserved.

Our cybersecurity offerings identify and develop cybersecurity, privacy, and risk management solutions for our customers. We target customers

that need cost-effective security solutions. Our growth plan to address the needs of our customers is to provide more effective and cost-efficient

products and tech-enabled services cybersecurity and related including virtual Chief Information Security Officer (“vCISO”),

zero trust, third-party risk management, due diligence, privacy, threat intelligence, and managed end-point security solutions.

Our

growth strategy focuses on these three initiatives: (i) securing new vCISO clients; (ii) adding new Cyber Security Software and Services

(“Cyber Security Software” and “Services”); and (iii) increasing adoption of Cybersecurity Software,

including our new product we are developing known as Enclave.

Our

principal executive offices are located at 146 Main Street, Suite 405, Worcester, MA 01608. Our telephone number is: (508) 925-0114.

| |

B. |

Establishment

of Offer Terms; Approval of the Offer |

The

Company’s Board of Directors has approved the terms of the Offer, including the Investor Exchange Ratios, but are not recommending

whether you should or should not tender your 2021 Investor Warrants, nor passing upon the fairness of the Investor Exchange Ratios. The

Board set the Investor Exchange Ratios to provide the holders of the 2021 Investor Warrants with an incentive to exchange the 2021 Investor

Warrants.

SideChannel

is pursuing growth through organic initiatives and acquisition opportunities. Further, the Company is considering an uplist on a national

stock exchange. Successfully executing one or more of these objectives may require the issuance of equity. The warrants issued in the

2021 Private Placement contain anti-dilution clauses that impede the Company’s ability to effectively engage the capital markets

in support of these objectives. As such, the Company believes the warrants are inhibiting its ability to grow and create value.

Secondarily,

the purpose of the Offer is to increase the public float as a percentage of the total outstanding Shares in the market. In the event

the Company’s Board authorizes a reverse stock split, the public float percentage of total outstanding Shares would be unchanged.

The

Offer is being made to all holders of 2021 Investor Warrants, as more particularly described above.

We

conducted a tender offer in August 2023 to accomplish these purposes. The August 2023 tender offer provided certain warrant holders Shares

only. This Offer differs from the August 2023 tender offer in that it provides a New Warrant in addition to the Shares provided in the

August 2023 tender offer. The August 2023 tender included 2021 Investor Warrants and warrants held by placement agents of Paulson Investment

Company versus only the 2021 Investor Warrants. The August 2023 tender offer was intended to accomplish the same purpose as this Offer.

Since

the current exercise price of the 2021 Investor Warrants is significantly higher than the market price of the Shares and the 2021 Investor

Warrants may expire on their respective expiration dates “out-of-the-money” according to their terms, the Company’s

Board of Directors established the condition that all of the 2021 Investor Warrant holders must tender their 2021 Investor Warrants.

Holders who tender 2021 Investor Warrants will receive Shares with a legend and holders will generally be entitled to “tack”

their holding period for purposes of Rule 144. Therefore, the Board of Directors expects the number of freely tradable shares will increase

as a result of the completion of this Offer.

In

addition, the Company’s Board of Directors believes that by allowing holders of 2021 Investor Warrants to exchange their warrants

for Shares of Common Stock and New Warrants according to the Investor Exchange Ratios, the Company can potentially reduce the substantial

number of Shares that would be issuable upon exercise of the 2021 Investor Warrants, thus providing investors and potential investors

with greater certainty as to the Company’s capital structure.

The

Offer is not made pursuant to a plan to periodically increase a securityholder’s proportionate interest in the assets or earnings

and profits of the Company. The 2021 Investor Warrants acquired pursuant to the exchange will be retired and cancelled.

| |

D. |

Interests

of Directors and Officers |

The

names of the executive officers and directors of the Company are set forth below. The business address for each such person is: SideChannel,

Inc., 146 Main Street, Suite 405, Worcester, MA 01608, and the telephone number for each such person is (508) 925-0114.

| Name |

|

Position |

| Anthony

Ambrose |

|

Director |

| Brian

Haugli |

|

Chief

Executive Officer, Director |

| Deborah

MacConnel |

|

Director,

Chairwoman |

| Kevin

Powers |

|

Director |

| Hugh

Regan, Jr. |

|

Director |

| Ryan

Polk |

|

Chief

Financial Officer |

None

of the Directors or Executive Officers possess SideChannel warrants.

Except

as set forth below, there are no present plans or proposals by the Company that relate to or would result in: (a) an extraordinary corporate

transaction, such as a merger, reorganization or liquidation involving the Company or any of its subsidiaries; (b) a purchase, sale or

transfer of a material amount of assets of the Company or any of its subsidiaries; (c) any change in the present Board of Directors or

management of the Company including, but not limited to, any plans or proposals to change the number or the term of directors, to fill

any existing vacancy on the Board or to change any material term of the employment contract of any executive officer; (d) any material

change in the present dividend rate or policy, or indebtedness or capitalization of the Company; (e) any other material change in the

Company’s corporate structure or business; (f) changes in the Company’s Articles of Incorporation or instruments corresponding

thereto or other actions which may impede the acquisition of control of the Company by any person; (g) a class of equity security of

the Company becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange Act; or (h) the suspension

of the issuer’s obligation to file reports pursuant to Section 15(d) of the Exchange Act. The following are exceptions to the foregoing

statement: (i) the exchange of 2021 Investor Warrants pursuant to the Offer will result in the acquisition of one (1) Share of the Company

for every six (6) 2021 Investor Warrants and one (1) New Warrant for every two and one half (2.5) 2021 Investor Warrants and (ii) at

the Company’s Annual Meeting of Stockholders held on February 15, 2023, SideChannel’s stockholders granted discretionary

authority to our Board of Directors to combine outstanding shares of our common stock into a lesser number of outstanding shares, or

a “reverse stock split,” at a specific ratio within a range of 2-to-1 to a maximum of a 100-1 combination, with the exact

ratio to be determined by our Board of Directors in its sole discretion; and to effect the reverse stock split, if at all, within two

years of the date the proposal is approved by stockholders. The Board of Directors has not yet determined what if any action will be

taken pursuant to this reverse stock split authorization. In the event of a reverse stock split, the 2021 Investor Warrant quantities

and exercise price would be adjusted by the reverse stock split ratio such that the aggregate value of the exercise price multiplied

by the quantities after the reverse stock split would be equal to the aggregate value prior to the reverse stock split.

THE

COMPANY’S BOARD OF DIRECTORS HAS APPROVED THE OFFER. HOWEVER, NONE OF THE COMPANY, ITS DIRECTORS, OFFICERS OR EMPLOYEES OR MAKES

ANY RECOMMENDATION WHETHER YOU SHOULD TENDER ANY 2021 INVESTOR WARRANTS. EACH HOLDER OF A 2021 INVESTOR WARRANT MUST MAKE HIS, HER OR

ITS OWN DECISION WHETHER TO TENDER SOME OR ALL OF HIS, HER OR ITS 2021 INVESTOR WARRANTS.

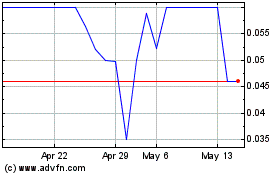

Our

shares traded on the OTCQB under the symbol SDCH. On November 30, 2023, the closing sales price for the Shares was $0.04. Our 2021 Investor

Warrants are not publicly traded.

The

Company recommends that holders obtain current market quotations for the Common Stock, among other factors, before deciding whether or

not to tender their 2021 Investor Warrants.

The

high and low closing sales price per share of the Company’s common stock for each quarter during the last three (3) fiscal years.

| | |

Low | | |

High | |

| Fiscal

Year 2023 | |

| | | |

| | |

| Fourth

Quarter (July 1 – September 30) | |

$ | 0.05 | | |

$ | 0.12 | |

| Third

Quarter (April 1 – June 30) | |

$ | 0.05 | | |

$ | 0.12 | |

| Second

Quarter (January 1 – March 31) | |

$ | 0.06 | | |

$ | 0.12 | |

| First

Quarter (October 1 – December 31) | |

$ | 0.09 | | |

$ | 0.15 | |

| | |

| | | |

| | |

| Fiscal

Year 2022 | |

| | | |

| | |

| Fourth

Quarter (July 1 – September 30) | |

$ | 0.08 | | |

$ | 0.18 | |

| Third

Quarter (April 1 – June 30) | |

$ | 0.07 | | |

$ | 0.12 | |

| Second

Quarter (January 1 – March 31) | |

$ | 0.09 | | |

$ | 0.15 | |

| First

Quarter (October 1 – December 31) | |

$ | 0.08 | | |

$ | 0.19 | |

| | |

| | | |

| | |

| Fiscal

Year 2021 | |

| | | |

| | |

| Fourth

Quarter (July 1 – September 30) | |

$ | 0.14 | | |

$ | 0.24 | |

| Third

Quarter (April 1 – June 30) | |

$ | 0.19 | | |

$ | 0.50 | |

| Second

Quarter (January 1 – March 31) | |

$ | 0.19 | | |

$ | 0.45 | |

| First

Quarter (October 1 – December 31) | |

$ | 0.24 | | |

$ | 0.52 | |

| 5. |

SOURCE

AND AMOUNT OF FUNDS |

Because

this transaction is an offer to holders to exchange their existing 2021 Investor Warrants for Shares and New Warrants, there is no source

of funds to disclose as there is no cash consideration being paid by the Company to those tendering the 2021 Investor Warrants. The Company

will use funds on hand to pay any incidental expenses.

The

Company has not retained a solicitation agent for the exchange offer. We will use our existing funds to pay expenses associated with

the Offer. We will not receive any proceeds from this Offer.

| 7. |

TRANSACTIONS

AND AGREEMENTS CONCERNING THE WARRANTS |

There

are no agreements, arrangements or understandings between the Company, or any of its directors or executive officers, and any other person

with respect to the 2021 Investor Warrants, other than our engagement of Paulson as a consultant regarding the structure of the Offer

to Exchange.

In

July 2021, we engaged Paulson Investment Company (“Paulson”) for strategic advisory services to be delivered over a four-year

term in exchange for 4,000,000 shares of common stock. We have been consulting with Paulson regarding the Offer to Exchange through this

strategic advisory services agreement. We did not incur additional costs with Paulson related to the Offer to Exchange. Paulson has not

and will not solicit tender of the 2021 Investor Warrants.

| 8. |

FINANCIAL

INFORMATION REGARDING THE COMPANY |

The

Company incorporates by reference the Company’s financial statements that were filed in Item 8 of its Annual Report on Form 10-K

filed with the SEC on December 20 2022. Additionally, the Company incorporates by reference the Company’s unaudited financial statements

that were filed in Part 1, Item 1 of its Quarterly Reports on Form 10-Q filed with the SEC on February 9, 2023, May 9, 2023, and August

9, 2023.

The

full text of the Quarterly Reports on Form 10-Q and the Annual Report on Form 10-K, as well as the other documents the Company has filed

with the SEC prior to, or will file with the Commission subsequent to, the filing of this Tender Offer Statement on Schedule TO, can

be accessed electronically on the SEC’s website at www.sec.gov. Copies of our SEC filings are also available without charge

upon written request addressed to SideChannel, Inc., at 146 Main Street, Suite 405, Worcester, MA 01608, attn.: Corporate Secretary .

Our telephone number is: (508) 925-0114.

Net

loss per common share is provided in the table below for the four most recent financial statements files with the SEC.

| | |

Twelve

Months Ended

September 30,

2022 | | |

Three

Months Ended

December 31,

2022 | | |

Three

Months Ended

March 31,

2023 | | |

Three

Months Ended

June 30,

2023 | |

| Net loss

per common share (1) | |

$ | (0.14 | ) | |

$ | (0.00 | ) | |

$ | (0.01 | ) | |

$ | (0.00 | ) |

| (1) | Diluted

loss per share is the same as basic loss per share during periods where net losses are incurred

since the inclusion of the potential common stock equivalents would be anti-dilutive as a

result of the net loss. |

Our

book value as of June 30, 2023 was approximately $7.8 million or approximately $0.04 per share. Book value per share represents

our total assets less total liabilities, divided by the number of shares of common stock outstanding as of June 30, 2023.

Our

tangible book value as of June 30, 2023 was approximately $1.5 million or approximately $0.01 per share. Tangible book value per share

represents our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of June 30,

2023.

| 9. |

EXTENSIONS;

AMENDMENTS; CONDITIONS; TERMINATION; PLANS |

The

Company expressly reserves the right, in its reasonable discretion, and at any time or from time to time, to extend the period of time

during which the Offer is open. There can be no assurance, however, that the Company will exercise its right to extend the Offer. If

the Company extends the Offer, it will give notice of such extension by press release or other public announcement no later than 9:00

a.m., Eastern Time, on the next business day after the previously scheduled Expiration Date of the Offer.

Amendments

to the Offer will be made by written notice thereof to the holders of the 2021 Investor Warrants. Material changes to information previously

provided to holders of the 2021 Investor Warrants in this Offer to Exchange or in documents furnished subsequent thereto will be disseminated

to holders of 2021 Investor Warrants. Also, should the Company, pursuant to the terms and conditions of the Offer, materially amend the

Offer, the Company will ensure that the Offer remains open long enough to comply with U.S. federal securities laws.

The

minimum period during which an Offer must remain open following any material change in the terms of the Offer or information concerning

the Offer (other than a change in price or change in percentage of securities sought, all of which require up to 10 additional business

days) will depend on the facts and circumstances, including the relative materiality of such terms or information.

The

Offer is subject to the conditions that no action or event shall have occurred, no action shall have been taken, and no statute, rule,

regulation, judgment, order, stay, decree or injunction shall have been promulgated, enacted, entered or enforced applicable to the Offer

or the exchange of 2021 Investor Warrants for Shares and New Warrants under the Offer by or before any court or governmental regulatory

or administrative agency, authority or tribunal of competent jurisdiction, including, without limitation, taxing authorities, that challenges

the making of the Offer or the exchange of 2021 Investor Warrants for Shares and New Warrants under the Offer or would reasonably be

expected to, directly or indirectly, prohibit, prevent, restrict or delay consummation of, or would reasonably be expected to otherwise

adversely affect in any material manner, the Offer or the exchange of 2021 Investor Warrants for Shares and New Warrants under the Offer.

The Offer is also subject the condition that all of the 2021 Investor Warrants must be tendered for exchange; however, the Company may

waive this condition in its reasonable discretion if all 2021 Investor Warrants are not tendered by the Expiration Date.

We

may terminate the Offer if the conditions of the Offer are not satisfied prior to the Expiration Date. In the event that we terminate

the Offer, all 2021 Investor Warrants tendered by a 2021 Investor Warrant holder in connection with the Offer shall be returned to such

2021 Investor Warrant holder and the 2021 Investor Warrants will expire in accordance with their terms on their respective expiration

dates and will otherwise remain subject to their original terms. If you tender your 2021 Investor Warrants, you will be agreeing to purchase