UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(RULE

14a-101)

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to Section 240.14a-12 |

Sigma

Additive Solutions, Inc.

(Exact

name of registrant as specified in its charter)

N/A

(Name

of person(s) filing proxy statement, if other than the registrant)

Payment

of Filing Fee (check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SIGMA

ADDITIVE SOLUTIONS, INC.

3900

Paseo del Sol

Santa

Fe, New Mexico 87507

TO

THE STOCKHOLDERS OF Sigma Additive Solutions, Inc.:

You

are cordially invited to attend an Annual Meeting of the stockholders of Sigma Additive Solutions, Inc., a Nevada corporation (referred

to herein as “SASI,” “Sigma,” the “Company,” “we,” “us”

or “our”), which will be held virtually, via live webcast on December 28, 2023, at 10:00 a.m. Mountain

Time. You will be able to attend the Annual Meeting by first registering at http://www.viewproxy.com/Sigma/2023/htype.asp no later than

December 27, 2023, at 11:59 p.m. Eastern Time. After registering, you will receive a meeting invitation and password via e-mail

with your unique link to join the meeting. Stockholders will be able to listen, vote and submit questions during the virtual Annual Meeting.

At

the Annual Meeting, our stockholders will be asked to consider and vote upon a proposal, which we refer to as the “Acquisition

Proposal,” to approve the issuance of shares of our common stock pursuant to that certain Share Exchange Agreement dated October

12, 2023 (as amended from time to time, the “Exchange Agreement”) among Sigma, NextTrip Holdings, Inc. (“NextTrip”),

NextTrip Group, LLC, the parent company of NextTrip (the “NextTrip Parent”), and William Kerby, in the capacity as

the “NextTrip Representative”, in exchange for all of the issued and outstanding capital stock of NextTrip. We refer

to the exchange as the “Acquisition” and to the shares of our common stock issuable pursuant to the Exchange Agreement

as the “Exchange Shares.” A copy of the Exchange Agreement is attached to the accompanying proxy statement as Annex

A. In connection with the Acquisition, we are asking our stockholders to approve amendments to our Amended and Restated

Articles of Incorporation (the “Articles of Incorporation”) as reflected in the form of Certificate of Amendment

to the Articles of Incorporation attached as Annex B to the accompanying proxy statement (the “Amendment”).

Upon

the closing of the Acquisition, the NextTrip Parent’s members, which we sometimes refer to as the “NextTrip Sellers,”

will be issued a number of Exchange Shares equal to 19.99% or our issued and outstanding shares of common stock immediately prior to

the closing of the Acquisition. Under the Exchange Agreement, the NextTrip Sellers will be entitled to receive additional Exchange Shares,

which are referred to as the “Contingent Shares,” subject to NextTrip’s achievement of future milestones specified

in the Exchange Agreement. The Contingent Shares, together with the Exchange Shares issued at the closing of the Acquisition, will not

exceed 6,000,000 shares of our common stock. Assuming all the business milestones are achieved and no other change in our outstanding

shares as of September 30, 2023, the NextTrip Sellers will receive Exchange Shares equal to approximately 88.5% of the outstanding shares

of our common stock immediately following the issuance of all the Exchange Shares and Sigma stockholders as of immediately prior to closing

of the Acquisition will retain the balance of approximately 11.5% of such outstanding shares. Following the closing of the Acquisition,

and subject to stockholder approval, the Company will change its corporate name to “NextTrip, Inc.” References to NextTrip,

Inc. mean the Company following the Acquisition and such name change.

Apart

from the Acquisition, Sigma entered into an Asset Purchase Agreement with Divergent Technologies, Inc. (“Divergent”),

dated October 6, 2023, pursuant to which Sigma has agreed to sell to Divergent certain assets, consisting primarily of patents,

software code and other intellectual property (the “Asset Sale”). It is anticipated that the Asset Sale

will take place promptly after the closing of the Acquisition.

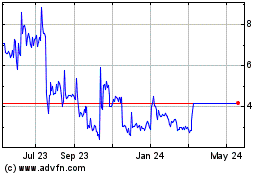

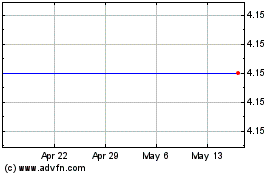

Sigma’s

common stock is listed on The Nasdaq Capital Market under the symbol “SASI.” We currently expect that the trading symbol

for the common stock will be changed in connection with the Acquisition to better align with the new name of the Company.

In

connection with its evaluation of the Acquisition, the board of directors of Sigma (the “Board”) engaged Lake Street

Capital Markets, LLC (“Lake Street”) to act as its financial advisor. Lake Street has rendered its opinion

that, based upon and subject to the assumptions, limitations and qualifications set forth in their opinion, the issuance of the Exchange

Shares to the NextTrip Sellers under the Exchange Agreement is fair, from a financial point of view, to Sigma. A copy of Lake Street’s

written opinion is attached as Annex C to the accompanying proxy statement.

At

the Annual Meeting, our stockholders will be asked to consider and vote upon:

| |

1) |

the

Acquisition Proposal to approve the issuance of the Exchange Shares in exchange for all the capital stock of NextTrip and the other

terms and conditions of the Exchange Agreement and the transactions contemplated thereby; |

| |

|

|

| |

2) |

the

approval of the Amendment to (a) change the Company’s corporate name to “NextTrip, Inc.” (the “Name Change”

and the “Name Change Proposal”) following completion of the Acquisition; |

| |

|

|

| |

3) |

the

approval of the Amendment to increase the authorized shares of our common stock (the “Capital Increase” and “Capital

Increase Proposal”) from 1,200,000 shares to 100,000,000 shares; |

| |

|

|

| |

4) |

the

election of two Class III directors (the “Election of Directors Proposal”) to serve until the 2026 annual meeting

of stockholders and until their respective successors are duly elected and qualified, subject to their earlier death, resignation

or removal; |

| |

|

|

| |

5) |

the

approval, on a non-binding advisory vote basis, of the compensation payable to Sigma’s named executive officers as disclosed

in the accompanying proxy statement (the “Say on Pay” and the “Say on Pay Proposal”); |

| |

|

|

| |

6) |

the

recommendation, on a non-binding advisory vote basis, of the frequency of future advisory votes on executive compensation (the “Frequency

of Say on Pay” and the “Frequency of Say on Pay Proposal”); |

| |

|

|

| |

7) |

the

approval of the Sigma Additive Solutions, Inc. 2023 Equity Incentive Plan (the “Equity Incentive Plan” and the

“Equity Incentive Plan Proposal”); |

| |

|

|

| |

8) |

the

ratification of Haynie & Company as our independent registered public accounting firm for our fiscal year ending December 31,

2023 (the “Ratification of Accountant Proposal”); |

| |

|

|

| |

9) |

the

adjournment of the Annual Meeting by the Chairman thereof to a later date to permit further solicitation and vote of proxies if,

based upon the tabulated vote at the time of the Annual Meeting, there are not sufficient votes to approve the Acquisition Proposal

or the Amendment (the “Adjournment Proposal”); and |

| |

|

|

| |

10) |

the

transaction of such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Each

of these proposals is more fully described in the accompanying proxy statement, which each stockholder is encouraged to carefully read

and consider.

We

are providing the proxy statement and accompanying proxy card to our stockholders in connection with the solicitation of proxies to be

voted at the Annual Meeting and at any adjournment or postponement of the Annual Meeting. Whether or not you plan to attend the Annual

Meeting, please take the time to vote by one of the means described in the accompanying proxy statement. YOUR VOTE IS VERY IMPORTANT.

Thank

you for your participation. We look forward to your continued support.

| |

Sincerely, |

| |

|

| December 1, 2023 |

/s/

Jacob Brunsberg |

| |

Jacob

Brunsberg

President

and Chief Executive Officer |

SIGMA

ADDITIVE SOLUTIONS, INC.

3900

Paseo del Sol

Santa

Fe, New Mexico 87507

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS.

To

Be Held on December 28, 2023

YOUR

VOTE IS VERY IMPORTANT.

PLEASE

VOTE YOUR SHARES PROMPTLY.

NOTICE

IS HEREBY GIVEN, that you are cordially invited to attend an Annual Meeting (the “Annual Meeting”) of stockholders

of Sigma Additive Solutions, Inc., to be held virtually, via live webcast

The

purpose of the Annual Meeting is to consider and vote upon:

1)

the Acquisition Proposal – approval of the issuance of the Exchange Shares in exchange for all the capital stock of NextTrip and

the other terms and conditions of the Exchange Agreement and the transactions contemplated thereby;

2)

the Name Change Proposal – the approval of the Amendment to change the Company’s corporate name to “NextTrip

Inc.” following completion of the Acquisition;

3)

the Capital Increase Proposal – the approval of the Amendment to increase the authorized shares of our common stock from

1,200,000 to 100,000,000 shares;

4)

the Election of Directors Proposal – the election

of two Class III directors to serve until the 2026 annual meeting of stockholders and until their respective successors are duly elected

and qualified, subject to their earlier death, resignation or removal;

5)

the Say on Pay Proposal – the approval, on

a non-binding advisory vote basis, of the compensation payable to Sigma’s named executive officers as disclosed in the accompanying

proxy statement;

6)

the Frequency of Say on Pay Proposal – the

recommendation, on a non-binding advisory vote basis, of the frequency of future advisory votes on executive compensation;

7)

The Equity Incentive Plan Proposal – the approval

of the Sigma Additive Solutions, Inc. 2023 Equity Incentive Plan;

8)

the Ratification of Accountant Proposal –

to ratify the appointment of Haynie & Company as our independent registered public accounting firm for our fiscal year ending December

31, 2023;

9)

the Adjournment Proposal – the approval of

the adjournment of the Annual Meeting by the Chairman thereof to a later date to permit further solicitation and vote of proxies if,

based upon the tabulated vote at the time of the Annual Meeting, there are not sufficient votes to approve the Acquisition Proposal or

the Amendment; and

10)

the transaction of such other business as may properly

come before the Annual Meeting or any adjournment or postponement thereof.

The

accompanying proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which is part of

these proxy materials, can be accessed directly at the following Internet address: http://www.viewproxy.com/Sigma

Only

holders of record of the Company’s common stock at the close of business on November 20, 2023, or the “Record Date,”

are entitled to notice of the Annual Meeting and to vote and have their votes counted at the Annual Meeting and any adjournment or postponement

of the Annual Meeting. We intend to mail these proxy materials beginning on or about December 1, 2023 to all stockholders of record

entitled to vote at the Annual Meeting.

A

complete list of the stockholders entitled to vote at the Annual Meeting will be available for examination during regular business hours

for the ten (10) days prior to the Annual Meeting by request. You may email us at frank.orzechowski@sigmaaddditive.com to coordinate

arrangements to view the stockholder list.

After

careful consideration, the Board unanimously recommends that you vote, or instruct your broker or the agent to vote:

| |

☐ |

“FOR”

the Acquisition Proposal; |

| |

☐ |

“FOR”

the Name Change Proposal; |

| |

☐ |

“FOR”

the Capital Increase Proposal; |

| |

☐ |

“FOR” each of the individuals nominated

for election as Class III directors pursuant to the Election of Directors Proposal; |

| |

☐ |

“FOR”

the Say on Pay Proposal; |

| |

☐ |

“EVERY

THREE YEARS” on the Frequency of Say on Pay Proposal; |

| |

☐ |

“FOR”

the Equity Incentive Plan Proposal; |

| |

☐ |

“FOR”

the Ratification of Accountant Proposal; and |

| |

☐ |

“FOR”

the Adjournment Proposal, if presented. |

YOUR

VOTE IS IMPORTANT

WHETHER

OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, WE ENCOURAGE YOU TO SUBMIT YOUR PROXY AS PROMPTLY AS POSSIBLE (1) THROUGH THE

INTERNET, (2) BY PHONE OR (3) BY MARKING, SIGNING AND DATING THE ENCLOSED PROXY CARD AND RETURNING IT IN THE POSTAGE-PAID ENVELOPE PROVIDED.

You may revoke your proxy or change your vote at any time before the closing of voting at the Annual Meeting. If your shares are held

in the name of a bank, broker or other nominee, please follow the instructions on the voting instruction card furnished to you by such

bank, broker or other nominee, which is considered the stockholder of record, in order to vote. As a beneficial owner, you have the right

to direct your broker or other agent on how to vote the shares in your account. Without your instructions, your broker can vote your

shares only with respect to routine matters such as the Name Change Proposal, the Ratification of Accountant Proposal and the

Adjournment Proposal. Without your instructions, your broker or other agent cannot vote on the Acquisition Proposal, the Capital

Increase Proposal, the Election of Directors Proposal, the Say on Pay Proposal, the Frequency of Say on Pay Proposal or the

Equity Incentive Plan Proposal.

If

you fail to return your proxy card, grant your proxy electronically over the Internet, submit your vote over the phone, or vote virtually

at the Annual Meeting, your shares will not be counted for purposes of determining whether a quorum is present at the Annual Meeting.

If you are a stockholder of record as of the Record Date, voting virtually at the Annual Meeting will revoke any proxy that you previously

submitted. If you hold your shares through a bank, broker or other nominee, you must obtain from the record holder a valid “legal”

proxy issued in your name in order to vote virtually at the Annual Meeting.

We

encourage you to read the accompanying proxy materials carefully. If you have any questions concerning the Acquisition, the Annual Meeting

or the accompanying proxy materials, would like additional copies of the proxy materials or need help voting your shares of common stock,

please contact our Chief Financial Officer and Secretary, Frank Orzechowski, at (203) 733-1356 or frank.orzechowski@sigmaadditive.com.

Thank

you for your participation. We look forward to your continued support.

| |

By

Order of the Board of Directors, |

| |

|

| |

Sigma

Additive Solutions, Inc. |

| |

|

| |

/s/

Jacob Brunsberg |

| |

Jacob

Brunsberg |

| |

President

and Chief Executive Officer |

TABLE

OF CONTENTS

| ANNEX

A |

Share

Exchange Agreement, dated October 12, 2023 by and among Sigma Additive Solutions, Inc., NextTrip Holdings, Inc., NextTrip Group, LLC

and William Kerby, in the capacity as the NextTrip Representative, as amended by the First Amendment thereto dated as of November

19, 2023. |

| |

|

| ANNEX

B |

Form of Certificate of Amendment to Amended and Restated Articles of Incorporation |

| |

|

ANNEX

C

|

Opinion of Lake Street Capital Markets, LLC |

| |

|

| ANNEX

D |

Sigma Additive Solutions, Inc. 2023

Equity Incentive Plan |

FORWARD-LOOKING

STATEMENTS

This

proxy statement, including information incorporated by reference into this proxy statement, contains forward-looking statements regarding,

among other things, Sigma’s plans, strategies and prospects, both business and financial. Although Sigma believes that its plans,

intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, Sigma cannot assure you that

we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties

and assumptions including, without limitation, the factors described under “Risk Factors” in this proxy statement

and from time to time in Sigma’s other filings with the Securities and Exchange Commission, or the “SEC”. Many

of the forward-looking statements contained in this presentation may be identified by the use of forward-looking words such as “believe”,

“expect”, “anticipate”, “should”, “planned”, “will”, “may”, “intend”,

“estimated”, “aim”, “on track”, “target”, “opportunity”, “tentative”,

“positioning”, “designed”, “create”, “predict”, “project”, “seek”,

“would”, “could”, “continue”, “ongoing”, “upside”, “increases”

and “potential”, among others. Important factors that could cause actual results to differ materially from the forward-looking

statements we make in this proxy statement and the materials incorporated by reference herein are set forth in other reports or documents

that we file from time to time with the SEC, and include, but are not limited to:

| |

● |

the

occurrence of any event, change or other circumstances that could give rise to the termination of the Exchange Agreement; |

| |

|

|

| |

● |

the

ability to maintain the listing of NextTrip, Inc. common stock on Nasdaq following the Acquisition; |

| |

|

|

| |

● |

expectations

as to when the Acquisition will close; |

| |

|

|

| |

● |

changes

adversely affecting the business of the Company or NextTrip before or after the Acquisition; |

| |

|

|

| |

● |

management

of NextTrip, Inc.’s growth; |

| |

|

|

| |

● |

general

economic conditions; |

| |

|

|

| |

● |

NextTrip,

Inc.’s business strategy and plans; |

| |

|

|

| |

● |

the

result of future financing efforts; and |

| |

|

|

| |

● |

and

the other factors summarized under the section entitled “Risk Factors.” |

You

are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy statement.

All forward-looking statements included herein attributable to any of Sigma, NextTrip, the NextTrip Parent or any person acting on any

party’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

Except to the extent required by applicable laws and regulations, none of Sigma, NextTrip and the NextTrip Parent have any obligation

to update these forward-looking statements to reflect events or circumstances after the date of this proxy statement or to reflect the

occurrence of unanticipated events.

SUMMARY

TERM SHEET

This

Summary Term Sheet provides an overview of material information regarding the proposed Acquisition and may not contain all of the information

that is important to you. You should carefully read this entire proxy statement, including the Exchange Agreement attached as Annex

A and the written opinion of Lake Street relating to the Acquisition attached as Annex C, for a more complete

understanding of the Acquisition and the Exchange Agreement and related matters. You may obtain the information incorporated by reference

into this proxy statement without charge by following the instructions in the section titled “Where You Can Find More Information”

beginning on page 124.

| |

|

The

Acquisition (page 32) |

|

Sigma,

NextTrip, the NextTrip Parent, and the NextTrip Representative have entered into the Exchange Agreement. The Exchange Agreement provides

for our acquisition of all the capital stock of NextTrip in exchange for our issuance to the NextTrip Sellers the number of shares

of our common stock equal to 19.99% of the outstanding shares of our common stock immediately prior to the closing of the Acquisition

(the “Closing Shares”), plus additional Contingent Shares upon NextTrip’s achievement of milestones specified

in the Exchange Agreement as follows: |

| |

|

|

|

Milestone |

|

Date

Earned |

|

Contingent

Shares |

| |

|

|

|

Launch

of NextTrip’s leisure travel booking platform by either (i) achieving $1,000,000 in cumulative sales under its historical “phase

1” business, or (ii) commencement of its marketing program under its enhanced “phase 2” business. |

|

As

of a date six months after the closing date |

|

1,450,000

Contingent Shares |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

Launch

of NextTrip’s group travel booking platform and signing of at least five (5) entities to use the groups travel booking platform. |

|

As

of a date nine months from the closing date (or earlier date six months after the closing

date)

|

|

1,450,000

Contingent Shares |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

Launch

of NextTrip’s travel agent platform and signing up of at least 100 travel agents to the platform (which calculation includes

individual agents of an agency that signs up on behalf of multiple agents). |

|

As

of a date 12 months from the closing date (or earlier date six months after the closing date) |

|

1,450,000

Contingent Shares |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

Commercial

launch of PayDelay technology in the NXT2.0 system. |

|

As

of a date 15 months after the closing date (or earlier date six months after the closing date) |

|

1,650,000

Contingent Shares, less the Exchange Shares issued at the closing of the Acquisition |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

Alternatively,

independent of achievement of the foregoing milestones, for each month during the 15-month period following the closing date

in which $1,000,000 or more in gross travel bookings are generated by NextTrip, Inc., to the extent not previously issued, the Contingent

Shares will be issuable in the order indicated above up to the maximum Exchange Shares issuable under the Share Exchange Agreement. |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

In

no event, however, will the Contingent Shares, together with the Closing Shares, exceed 6,000,000 shares of our common stock, subject

to adjustment in the event of future stock splits, reverse stock splits and similar events. |

| |

|

|

|

Our

stockholders immediately prior to the closing of the Acquisition will continue to own their shares of our common stock. As a result

of the Acquisition, NextTrip will become a wholly owned subsidiary of Sigma, which, subject to stockholder approval of the Name Change

Proposal, will change its name to “NextTrip, Inc.”

Assuming

all the milestones are achieved and no change in our outstanding shares as of September 30, 2023, the NextTrip Sellers will receive

Exchange Shares equal to approximately 88.5% of the outstanding shares of our common stock immediately following the issuance of

all the Exchange Shares and Sigma stockholders as of immediately prior to closing of the Acquisition will retain the balance of approximately

11.5% of such outstanding shares.

The

Exchange Shares will be issued without registration under the Securities Act of 1933, as amended (the “Securities Act”),

in reliance upon an exemption from registration for transactions not involving a public offering and, as such, will constitute “restricted

securities” within the meaning of Rule 144 under the Securities Act.

The Exchange Agreement provides that in the

event our stockholders approve the Acquisition Proposal but not the Capital Increase Proposal, to the extent that we do not have

sufficient authorized shares of common stock available for issuance of the Exchange Shares, in lieu thereof, we will issue shares

of a new series of convertible preferred stock in form and substance satisfactory to the NextTrip Representative which, among other

things, will provide for voting on an as-converted basis and will be automatically converted (on a one-for-one basis) into shares

of our common stock once stockholder approval for an increase in our authorized shares of common stock has been obtained. |

| |

|

|

|

|

| |

|

NextTrip

Holdings, Inc. (page 78) |

|

NextTrip

is a closely held, innovative technology company engaged in building next-generation solutions to power the travel industry based

upon its proprietary NXT2.0 booking technology platform acquired in June 2022. Previously, this technology powered the business of

Bookit.com, an online leisure travel agent generating over $450 million in annual sales as recently as 2019 (pre-COVID-19 pandemic). |

| |

|

|

|

|

| |

|

Management

following the Acquisition (page 33) |

|

Neither

Sigma nor any of its affiliates has an ownership interest in or is otherwise affiliated

with NextTrip or its affiliates and, except for the Acquisition, there have been no transactions

or dealings between Sigma and the other parties to the Exchange Agreement or their affiliates

during the periods for which financial statements of the parties are included in this

proxy statement. |

| |

|

|

|

|

| |

|

|

|

Jacob

Brunsberg, our current President and Chief Executive Officer, will resign from such position upon the closing of the Acquisition.

William Kerby, the co-founder and Chief Executive Officer of NextTrip, and Donald P. Monaco, a member of the Board of Managers

of the NextTrip Parent, will be appointed as Chief Executive Officer and as a director, respectively, of NextTrip, Inc.

It is anticipated that four of the five current directors, including Mr. Brunsberg, and the Chief Financial Officer of Sigma will continue to serve

in the same capacities with NextTrip, Inc. and that the executive officers of NextTrip will continue to serve as its executive officers

following the acquisition. |

| |

|

|

|

|

| |

|

Stockholders’

Meeting (page 10) |

|

At

the Annual Meeting to be held virtually, via live webcast on December 28, 2023, at 10:00 a.m. Mountain Time, our stockholders

will be asked to approve the issuance of the Exchange Shares and other terms and conditions of the Exchange

Agreement and the transactions contemplated thereby. Our stockholders also will be asked to approve the related Name Change Proposal

and the Capital Increase Proposal, as well as the Election of Directors Proposal, the Say on Pay Proposal, the Frequency of Say on Pay Proposal, the Equity Incentive Plan Proposal, the Ratification

of Accountant Proposal and, if presented, the Adjournment Proposal. |

| |

|

|

|

|

| |

|

Financial

Accommodations (page 33) |

|

Subject

to certain limitations, NextTrip agrees in the Exchange Agreement to provide us with a line of credit of up to $400,000, which

may be used to support our business and operations, pay transaction expenses and other liabilities. |

| |

|

Nasdaq

Listing (page 33) |

|

Our

common stock is listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “SASI.”

We currently expect that the trading symbol for our common stock will be changed after the Acquisition to better align with the new name of the Company. The closing of

the Acquisition is subject to the satisfaction of Nasdaq’s standards for continued

listing of NextTrip, Inc. common stock, among other conditions referred to below.

|

| |

|

|

|

|

| |

|

Certain

Covenants (page 36) |

|

The

Exchange Agreement contemplates that following the Acquisition we will sell certain patents, trademarks and other intellectual property

pursuant to the previously announced Asset Purchase Agreement, dated as of October 6, 2023, with Divergent Technologies, Inc.,

or Divergent. The Exchange Agreement also contains customary covenants of the parties regarding the operation of their respective

businesses pending the closing of the Acquisition or termination of the Exchange Agreement. |

| |

|

|

|

|

| |

|

Closing

Conditions (page 38) |

|

The

closing of the Acquisition is subject to our stockholders’ approval of our issuance

of the Exchange Shares in connection with the Acquisition, as well as other customary conditions.

We currently expect that the Acquisition will be completed promptly following the Annual

Meeting if the Acquisition is approved.

|

| |

|

|

|

|

| |

|

Our

Board’s Recommendations (page 82)

|

|

Our

Board of Directors has unanimously approved the Exchange Agreement, the Acquisition

and the other transactions contemplated thereby and the related Amendment of our Amended

and Restated Articles of Incorporation and recommends that our stockholders approve the issuance

of the Exchange Shares in the Acquisition and other terms and conditions of the Exchange

Agreement and the transactions contemplated thereby and the Amendment.

|

| |

|

|

|

|

| |

|

Opinion

of Lake Street Capital Markets, LLC (page 48) |

|

Lake

Street Capital Markets, LLC has provided a written opinion, dated October 12, 2023,

to our Board of Directors to the effect that, as of the date of the written opinion and based

on and subject to the matters described in the written opinion, the issuance of the Exchange

Shares to the NextTrip Sellers under the Exchange Agreement is fair, from a financial point

of view, to Sigma. |

QUESTIONS

AND ANSWERS ABOUT THE PROPOSALS AND THE ANNUAL MEETING

The

following are answers to some questions that Sigma stockholders may have regarding the Acquisition Proposal, the Name Change Proposal,

the Capital Increase Proposal and the other matters being considered at Sigma’s Annual Meeting of Stockholders, which is referred

to herein as the “Annual Meeting.” We urge you to carefully read the remainder of this proxy statement because the

information in this section does not provide all the information that might be important to you with respect to the Acquisition and the

other matters being considered at the Annual Meeting. Additional important information is also contained in the Annexes to this proxy

statement and in the documents incorporated by reference herein.

| Q: |

Why

am I receiving this proxy statement? |

| |

|

| A: |

The

Board is soliciting your proxy to vote at the Annual Meeting because you owned shares of

Sigma common stock at the close of business on November 20, 2023 (the “Record

Date”) for the Annual Meeting and are therefore entitled to vote at the Annual

Meeting. This proxy statement summarizes the information that you need to know in order to

cast your vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote

your shares of Sigma common stock.

|

| |

Under

rules adopted by the SEC, we have mailed the full set of our proxy materials, including this proxy statement, the proxy card and

our Annual Report on Form 10-K for the year ended December 31, 2022, to our stockholders of record as of the Record Date, beginning

on or around December 1, 2023. The proxy materials are also available to view and download at http://www.viewproxy.com/Sigma/2023. |

| |

|

| Q: |

When

and how will the Annual Meeting be held? |

| |

|

| |

The

Annual Meeting will be held virtually at 10:00 a.m. Mountain Time on December 28,

2023. In order to attend the meeting, you must register at http://viewproxy.com/Sigma/2023/htype.asp

by 11:59 p.m. Eastern Time on December 27, 2023. You will not be able to attend

the Annual Meeting in person.

|

| Q: |

How

do I attend and participate in the Annual Meeting online?

|

| A: |

The

Annual Meeting will be a completely virtual meeting of stockholders and will be webcast live

over the Internet. Any stockholder can attend the virtual meeting live by registering at

http://www.viewproxy.com/Sigma/2023/htype.asp. The webcast will start at 10:00

a.m. Mountain Time. Stockholders as of the Record Date may vote and submit questions while

attending the Annual Meeting online. You will not be able to attend the Annual Meeting in

person. Stockholders attending the Annual Meeting online will be afforded the same rights

and opportunities to participate as they would at an in-person meeting.

|

| |

To

enter the Annual Meeting, you will need the control number, which is included in your proxy

materials if you are a stockholder of record of shares of our common stock or included with

your voting instructions and materials received from your broker, bank or other agent if

you hold your shares of common stock in a “street name.” Instructions on how

to attend and participate are available at http://www.viewproxy.com/Sigma/2023/htype.asp.

We recommend that you log in a few minutes before 10:00 a.m. Mountain Time to

ensure you are logged in when the Annual Meeting starts. The webcast will open 15 minutes

before the start of the Annual Meeting.

If

you would like to submit a question during the Annual Meeting, you may log in to the virtual meeting using your control number, type your question into the “Ask a Question” field, and click “Submit.”

|

| |

|

| Q: |

What

happens if there are technical difficulties during the Annual Meeting? |

| |

|

| A: |

We

will have technicians ready to assist you with any technical difficulties you may have accessing

the Annual Meeting, voting at the Annual Meeting or submitting questions at the Annual Meeting.

If you encounter any difficulties accessing the virtual Annual Meeting during the check-in

or meeting time, please refer to the technical support information located at http://www.viewproxy.com/Sigma/2023/htype.asp.

If

we experience technical difficulties at the Annual Meeting and are not able to resolve them within a reasonable amount of time, we

will adjourn the Annual Meeting to a later date and will provide notice of the date and time of such adjourned meeting at http://sigmaadditive.com/investors/proxy-materials

and in a Current Report on Form 8-K that we will file with the SEC. For additional information on how you can attend any postponement

or adjournment of the Annual Meeting, see “What happens if the Annual Meeting is postponed or adjourned” below. |

| |

|

| Q: |

Will

a list of record stockholders as of the Record Date be available?

|

| A: |

For

the ten days prior to the Annual Meeting, the list of stockholders of record on the Record

Date will be available for examination by any stockholder of record for a legally valid purpose

by request. You can contact our Chief Financial Officer and Secretary, Frank Orzechowski,

at (203) 733-1356 or at frank.orzechowski@sigmaadditive.com to coordinate arrangements to

view the stockholder list.

|

| Q: |

On

what matters will I be voting? |

| |

|

| A: |

Sigma,

NextTrip, the NextTrip Parent, and the NextTrip Representative have entered into the Exchange

Agreement dated as of October 12, 2023 pursuant to which Sigma has agreed to issue the Exchange

Shares in exchange for all the capital stock of NextTrip, which we refer to as the Acquisition.

A copy of the Exchange Agreement is attached to this proxy statement as Annex A,

and Sigma encourages you to read it in its entirety.

Sigma’s

stockholders are being asked to consider and vote upon proposals relating to the Acquisition; specifically, to adopt and approve

the Acquisition Proposal, the Amendment to effect the Name Change and the Capital Increase, which, among other things, provide

for: (a) issuing the Exchange Shares; (b) changing the Company’s name to “NextTrip, Inc.” following the Acquisition;

and (c) increasing the authorized shares of our common stock from 1,200,000 to 100,000,000 shares. Sigma’s stockholders are also being asked to approve the election of two

Class III directors, the Say on Pay Proposal, the Frequency of Say on Pay Proposal, the

Equity Incentive Plan Proposal and the Ratification of Accountant Proposal.

Sigma’s

stockholders may also be asked to consider and vote upon the Adjournment Proposal to authorize the Chairman of the Annual Meeting

to adjourn the Annual Meeting to a later date or dates to permit further solicitation and vote of proxies if, based upon the tabulated

vote at the time of the Annual Meeting, there are not sufficient votes to approve the Acquisition Proposal or the Amendment.

|

Stockholders

are encouraged to vote as soon as possible after carefully reviewing this proxy statement and the Annexes attached hereto. If Sigma stockholders

fail to adopt and approve the Acquisition Proposal, the Acquisition cannot be completed.

| Q: |

Why

is Sigma proposing the Acquisition? |

| |

|

| A: |

Based

on a lengthy and extensive evaluation of possible strategic transactions, due diligence investigation of NextTrip and the industry

in which it operates, including the financial and other information provided by NextTrip, our Board of Directors believes

that the Acquisition will provide Sigma stockholders with an opportunity to participate in the future growth potential of NextTrip.

The Asset Sale as contemplated by the Exchange Agreement will allow our stockholders to realize the value of Sigma’s

current assets as well. |

| Q: |

Who

will be the directors of the Company following the Acquisition? |

| |

|

| A: |

As

of the closing of the Acquisition, Donald P. Monaco, a member of the Board of Managers of the NextTrip Parent, will be appointed

as a director of NextTrip, Inc. We currently anticipate that four of the five current directors of Sigma, including Jacob Brunsberg, will continue to

serve as directors of NextTrip, Inc. Under the Exchange Agreement, the NextTrip Representative will be entitled to appoint one additional

director of NextTrip, Inc. to replace a then-existing director (other than individuals previously appointed by the NextTrip Representative)

upon NextTrip’s achievement of each of the milestones specified in the Exchange Agreement. |

| Q: |

Who

will be the executive officers of the Company immediately following the Acquisition? |

| |

|

| A: |

Immediately

following the Acquisition, the executive management team of NextTrip, Inc. is expected to be as follows: |

| Name |

|

Position |

| William

Kerby |

|

Chief

Executive Officer |

| Frank

Orzechowski |

|

Chief

Financial Officer |

| |

It

is anticipated that the current executive officers of NextTrip will continue to serve as

its executive officers following the Acquisition.

|

| Q: |

Will

the Company continue business and operations after the Acquisition? |

| |

|

| A: |

Yes,

the Company will continue the business and operations of NextTrip after the Acquisition.

NextTrip is an innovative technology company that is building next-generation solutions to

power the travel industry. NextTrip, together with its wholly owned subsidiaries, is a travel

company that connects people to new places and discoveries by utilizing digital media engagement,

seasoned planning expertise, and unique inventory to curate custom vacations across the globe.

By bridging technology, media and product offerings, NextTrip engages with the travelers

of today while also building relationships with the travelers of tomorrow. The Exchange

Agreement contemplates that the Asset Sale will take place promptly after the closing

of the Acquisition.

Pending

the Acquisition and the Asset Sale, the Company has reduced its employee headcount and suspended

product development activities to reduce our expenses. The Company is continuing to operate

and support its existing customers who have maintenance agreements and leases in place, supporting

new installations in the field, and actively seeking potential sales of the PrintRite3D systems

and software to customers who have lease agreements in place, systems on consignment, or

otherwise express interest in Sigma’s products available for sale. The Company completed

two such sales in the quarter ended September 30, 2023, and believes additional sales are

achievable going forward as we progress towards closing the Acquisition and the Asset Sale. |

| |

|

| Q: |

What

material factors did the Board consider in approving the Acquisition? |

| |

|

| A: |

In

approving the Acquisition, the Board considered a number of positive and negative factors

described in the “Sigma’s Reasons for the Acquisition” section beginning

on page 41 of this proxy statement, and overall believes that the positive factors

outweigh any negative factors.

Please

also read with particular care the detailed description of the risks described in the “Risk Factors” section beginning

on page 19 of this proxy statement. |

| |

|

| Q: |

Why

is Sigma proposing the Name Change? |

| |

|

| A: |

The Board is submitting the Name Change Proposal for our stockholders’

approval to better align our name to reflect the NextTrip business following the Acquisition. |

| |

|

| Q: |

Why

is Sigma proposing the Capital Increase? |

| |

|

| A:

|

On

September 22, 2023, we effected a 1-for-20 reverse split of our outstanding shares of common stock and authorized shares of common

stock to regain compliance with the minimum bid price requirement for continued listing or our common stock on Nasdaq. The Board

is submitting the Capital Increase Proposal for our stockholders’ approval to provide sufficient authorized shares of common

stock to issue the Exchange Shares in the Acquisition, to implement the Equity Incentive Plan and for future capital raising, incentivizing

directors, officers and employees, possible strategic acquisitions and other corporate transactions, whether or not the Acquisition

is completed. |

| |

|

| Q: |

Why

is Sigma proposing the Election of Directors? |

| |

|

A:

|

The

term of our Class III directors ends at the Annual Meeting. Our Nominating and Corporate

Governance Committee has recommended, and our Board of Directors has approved, the nominations

of Dennis Duitch and Kent Summers for re-election as Class III directors. If elected, Messrs.

Duitch and Summers will serve as directors until the 2026 annual meeting of stockholders

and until their respective successors are duly elected and qualified, subject to their earlier

death, resignation or removal.

|

| |

|

| Q: |

Why

is Sigma proposing the Say on Pay Proposal? |

| |

|

| A: |

The

Say on Pay Proposal is an advisory vote required by SEC regulations that is non-binding and affords an opportunity for our stockholders

to weigh in on executive compensation for Sigma executives as disclosed in this proxy statement, including compensation payable

in connection with the Acquisition. Although it is non-binding, our Board of Directors will give consideration to the outcome

of the vote in connection with its future executive compensation decisions. |

| |

|

Q:

|

Why

is Sigma proposing the Frequency of Say on Pay Proposal?

|

| |

|

| A: |

SEC

regulations require Sigma to conduct a non-binding advisory vote at least every six years on the frequency of future advisory

votes on executive compensation. Although it is non-binding, our Board of Directors will give consideration to the outcome

of the vote in connection with determining the frequency of future advisory votes on executive compensation. |

Q:

|

Why

is Sigma proposing the Equity Incentive Plan Proposal?

|

| |

|

A:

|

Our

Board of Directors has adopted the Equity Incentive Plan, subject to stockholder approval, to replace Sigma’s former 2013 Equity

Incentive Plan, which has expired. Our Board of Directors believes the Equity Incentive Plan is necessary to attract and retain the

types of employees, consultants and directors who will contribute to our long-range success, provide incentives to align their interests

with those of our stockholders and promote the success of our business following the Acquisition, or otherwise. |

| |

|

| Q: |

Why

is Sigma proposing the Ratification of Accountant? |

| |

|

| A:

|

The

Ratification of Accountant Proposal is to afford our stockholders an opportunity weigh in on of our appointment of Haynie & Company

as our independent registered public accounting firm in connection with the preparation of our audit financial statements for the

year ending December 31, 2023 and other financial disclosures. |

| |

|

| Q: |

What

common stock will current Sigma stockholders and the NextTrip Sellers hold in the Company after the Acquisition? |

| |

|

A:

|

Upon

the closing of the Acquisition, the NextTrip Sellers will be issued Exchange Shares equal

to 19.99% of our issued and outstanding shares of common stock immediately prior to the closing.

Under the Exchange Agreement, the NextTrip Sellers will be entitled to receive additional

Contingent Shares, subject to NextTrip’s achievement of future milestones specified

in the Exchange Agreement. The Contingent Shares together with the Exchange Shares issued

at the closing will not exceed 6,000,000 shares of our common stock, subject to adjustment

in the event of stock splits, reverse stock splits and similar events. If all the milestones

are achieved and assuming no other change in our outstanding shares as of September 30, 2023,

the NextTrip Sellers will receive Exchange Shares equal to approximately 88.5% of our issued

and outstanding shares of common stock immediately following the issuance of all the Exchange

Shares and Sigma stockholders immediately prior to the closing of the Acquisition will retain

the balance of approximately 11.5% of such outstanding shares.

The Exchange

Agreement provides that in the event our stockholders approve the Acquisition Proposal but

not the Capital Increase Proposal, to the extent that we do not have sufficient authorized

shares of common stock available for issuance of the Exchange Shares, in lieu thereof, we

will issue shares of a new series of convertible preferred stock in form and substance satisfactory

to the NextTrip Representative which, among other things, will provide for voting on an as-converted

basis and will be automatically converted (on a one-for-one basis) into shares of our common

stock once stockholder approval for an increase in our authorized shares of common stock

has been obtained. |

| |

|

| Q: |

Will

there be any controlling stockholder after the closing of the Acquisition? |

| |

|

| A: |

No.

The closing of the Acquisition will not constitute a change in control of the Company, and there will not be a controlling stockholder

immediately after closing of the Acquisition. However, depending upon the achievement of milestones under the Exchange Agreement

and other changes in the outstanding shares of our common stock, the issuance of the Contingent Shares might result in a change in

control of NextTrip, Inc. at that time and could result in the NextTrip Sellers as a group holding a controlling interest

in the Company. |

| |

|

| Q: |

What

conditions must be satisfied to complete the Acquisition? |

| |

|

| A: |

The

Exchange Agreement sets forth a number of conditions to the completion of the Acquisition, including the approval of the Acquisition

Proposal and the Amendment at the Annual Meeting, satisfaction of Nasdaq’s continued listing standards and other customary

closing conditions. For a summary of the conditions that must be satisfied or waived prior to completion of the Acquisition, see

the section entitled “The Exchange Agreement” beginning on page 32 of this proxy statement. |

| |

|

| Q: |

Will

the Exchange Shares be subject to any transfer restrictions? |

| |

|

| A: |

Yes.

The Exchange Shares will be issued without registration under the Securities Act, in reliance upon an exemption from registration

for transactions not involving a public offering and, as such, will constitute “restricted securities” within the meaning

of Rule 144 under the Securities Act. Under Rule 144, the Exchange Shares generally may not be offered or sold publicly unless the

Exchange Shares have been held for at least six months and subject to other conditions. |

| Q: |

When

is the Acquisition expected to be completed? |

| |

|

| A: |

If

approved at the Annual Meeting, it is currently anticipated that the Acquisition will be completed promptly following the Annual

Meeting, provided that the conditions to the completion of the Acquisition have been satisfied or waived. |

| |

|

| Q: |

What

will happen to Sigma if, for any reason, the Acquisition is not completed? |

| |

|

| A: |

If

the Acquisition Proposal is not approved at the Annual Meeting or the Acquisition is not completed for any reason, we intend to proceed

with the Asset Sale and may attempt to complete another strategic transaction, such as a reverse merger, if there is a viable option

to do so. Otherwise, our Board of Directors is likely to consider winding up and dissolving Sigma, which would require stockholder

approval under the NGCL. If the Acquisition in not completed and another strategic transaction were to materialize, there can be

no assurance that it would be on terms as attractive as those provided for in the Exchange Agreement. While the Exchange Agreement

is in effect, and subject to very narrowly defined exceptions, Sigma is prohibited from soliciting, initiating, encouraging or entering

into certain extraordinary transactions, such as a merger, sale of assets or other business combination except with NextTrip. Completion

of the Acquisition also is part of our plan submitted to Nasdaq to regain compliance with Nasdaq’s minimum stockholders’

equity requirement. If the Acquisition is not

completed, it is likely that our common stock would be delisted from Nasdaq, with all the attendant risks described in the “Risk

Factors Relating to the Acquisition” section of this proxy statement, |

| |

|

| Q: |

What

happens if I sell my shares after the Record Date, but before the Annual Meeting? |

| |

|

| A: |

If

you sell or transfer your shares of the Company after the Record Date but before the Annual Meeting, you will retain your right to

vote at the Annual Meeting but will transfer ownership of the shares and will not hold an interest in NextTrip, Inc. if the Acquisition

is completed. |

| |

|

| Q: |

Are

there risks associated with the Acquisition that I should consider in deciding how to vote? |

| |

|

| A: |

Yes.

There are a number of risks related to the Acquisition and other transactions contemplated by the Exchange Agreement that are discussed

in this proxy statement. Please read with particular care the detailed description of the risks described in “Risk Factors”

beginning on page 19 of this proxy statement. |

| |

|

| Q: |

How

does the Board recommend that I vote? |

| |

|

| A: |

Our

Board of Directors recommends that Sigma stockholders vote, or instruct their broker or other agent to vote: |

“FOR”

the Acquisition Proposal;

“FOR”

the Name Change Proposal;

“FOR”

the Capital Increase Proposal;

“FOR”

each of the individuals nominated for appointment as Class III directors pursuant to the Election of Directors Proposal;

“FOR”

the Say on Pay Proposal;

“EVERY

THREE YEARS” on the Frequency of Say on Pay Proposal;

“FOR”

the Equity Incentive Plan Proposal;

“FOR”

the Ratification of Accountant Proposal; and

“FOR”

the Adjournment Proposal, if presented.

You

should read the discussion in the “Background of the Acquisition” section beginning on page 42 and the

discussion of each of the proposals for a discussion of the factors that the Board considered in deciding to recommend the approval of

the Acquisition Proposal and related proposals.

| Q: |

How

do I vote? |

| |

|

| A:

|

After

you have carefully read this proxy statement and have decided how you wish to vote your shares of Sigma common stock, please vote

promptly. |

Stockholders

of Record and Voting

If

your shares of Sigma common stock are registered directly in your name with Sigma’s transfer agent, Issuer Direct Corporation,

you are the stockholder of record of those shares and these proxy materials have been mailed or e-mailed to you by the Company. You may

vote your shares by Internet, telephone or by mail as further described below. Your vote authorizes Jacob Brunsberg, the President and

Chief Executive Officer of the Company, as your proxy, with the power to appoint his substitute, to represent and vote your shares as

you direct.

| |

● |

To

vote online during the Annual Meeting, follow the provided instructions to join the meeting at http://www.viewproxy.com/Sigma/2023/htype.asp,

starting at 10:00 a.m. Mountain Time on December 28, 2023. The webcast will open 15 minutes before the start of the

Annual Meeting. |

| |

|

|

| |

● |

To

vote in advance of the Annual Meeting through the internet, go to www.FCRVote.com/SASI to complete

an electronic proxy card. You will be asked to provide the company number and control number from the Notice or the printed proxy

card. Your internet vote must be received by 11:59 p.m. Eastern Time on December 27, 2023 to be counted. |

| |

|

|

| |

● |

To

vote in advance of the Annual Meeting by telephone, dial 1-866-402-3905 and follow the recorded instructions. You

will be asked to provide the company number and control number from the Notice or the printed proxy card. Your telephone vote must

be received by 11:59 p.m. Eastern Time on December 27, 2023 to be counted. |

| |

|

|

| |

● |

To

vote using the enclosed proxy card, complete, sign and date the enclosed proxy card and return it promptly in the accompanying postage-paid

envelope. If you return your signed proxy card to us before the Annual Meeting, the proxy will vote your shares as you direct. If

no directions are given, the proxy will vote your shares in accordance with our Board’s recommendations. |

Beneficial

Owners

If

your shares of Sigma common stock are held in a stock brokerage account, by a bank, broker or other nominee, you are considered the beneficial

owner of shares held in street name and these proxy materials are being forwarded to you by your bank, broker or nominee that is considered

the holder of record of those shares. As the beneficial owner, you have the right to direct your bank, broker, trustee or nominee on

how to vote your shares via the Internet or by telephone if the bank, broker, trustee or nominee offers these options. You can also sign

and return a proxy card. Your bank, broker, trustee or nominee will send you instructions for voting your shares. Please note that you

may not vote shares held in street name by returning a proxy card directly to Sigma or by voting at the Annual Meeting unless you provide

a “legal proxy,” which you must obtain from your broker, bank or nominee. Furthermore, brokers, banks and nominees who hold

shares of Sigma common stock on your behalf may not give a proxy to Sigma to vote those shares without specific instructions from you.

For

a discussion of the rules regarding the voting of shares held by beneficial owners, please see the question below entitled “If

I am a beneficial owner of shares of Sigma common stock, what happens if I don’t provide voting instructions?” “What

is discretionary voting?” and “What is a broker non-vote?”

| Q: |

How

many shares must be present to hold the Annual Meeting? |

| |

|

| A: |

The

presence in person or by proxy of at least one-third of the outstanding shares of Sigma common stock entitled to vote at the Annual

Meeting is necessary to constitute a quorum at the Annual Meeting. The inspector of election will determine whether a quorum is present.

If you are a beneficial owner (as defined above) of shares of the Company’s common stock and you do not instruct your bank,

broker or other nominee how to vote your shares on any of the proposals, your shares will nonetheless be counted as present at the

Annual Meeting for purposes of determining whether a quorum exists. Stockholders of record who are present at the Annual Meeting

in person or by proxy will be counted as present at the Annual Meeting for purposes of determining whether a quorum exists even if

such stockholders abstain from voting. |

| |

|

| Q: |

How

many votes do I and others have? |

| |

|

| A: |

You

are entitled to one vote for each share of Sigma common stock that you held as of the Record Date. As of the close of business on

the Record Date, there were 780,423 shares of Sigma common stock outstanding. |

| Q: |

What

vote is required to approve each proposal? |

| |

|

| A:

|

The

Acquisition Proposal, as well as the Say on Pay Proposal

and the Frequency of Say on Pay Proposal, which are advisory votes, and the Equity Incentive Plan Proposal and the Ratification

of Accountant Proposal will each be approved if the number of votes cast in favor of each such Proposal exceeds the number of votes

cast against each such Proposal. The affirmative vote of the holders of a majority of the outstanding shares of our common stock

as of the Record Date is required to approve the Name Change Proposal and the Capital Increase Proposal. The two nominees for election

as Class III directors receiving the highest number of votes will be elected as Class III directors. If presented, the Adjournment

Proposal will be approved, whether or not a quorum is present at the Annual Meeting, if the number of votes cast for the Adjournment

Proposal exceeds the number of votes cast against the Proposal. |

| |

|

| Q: |

How

will our directors and executive officers vote on the Amendment, Acquisition Proposal and the Executive Compensation Proposal? |

| |

|

| A: |

As

of the Record Date, the directors and executive officers of Sigma as a group owned and were entitled to vote approximately

4,827 shares of our common stock, representing less than 1% of the outstanding shares. Sigma expects that each of its

directors and executive officers will vote their shares in accordance with the recommendations of our Board of Directors. |

| |

|

| Q: |

What

will happen if I fail to vote, or I abstain from voting? |

| |

|

| A: |

Your

failure to vote or your abstention from voting will have the same effect as a vote against the Name Change Proposal and the Capital Increase

Proposal. Abstentions will not have any effect on the outcome of the vote on the Acquisition Proposal, the Election of Directors Proposal,

the Say on Pay Proposal, the Frequency of Say on Pay Proposal, the Equity Incentive Plan Proposal, the Ratification of Accountant

Proposal or the Adjournment Proposal, if presented for a vote. |

| |

|

| Q: |

If

I am a beneficial owner of shares of Sigma common stock, what happens if I don’t provide voting instructions? What is discretionary

voting? What is a broker non-vote? |

| |

|

| A: |

If

you are a beneficial owner and you do not provide voting instructions to your broker, bank or other holder of record holding shares

for you, your shares will not be voted with respect to any proposal for which your broker does not have discretionary authority to

vote. Even though Sigma’s common stock is listed on Nasdaq, the rules of the New York Stock Exchange determine whether proposals

presented at stockholder meetings are “discretionary” or “non-discretionary.” If a proposal is determined

to be discretionary, your broker, bank or other holder of record is permitted under New York Stock Exchange rules to vote on the

proposal without receiving voting instructions from you. If a proposal is determined to be non-discretionary, your broker, bank or

other holder of record is not permitted under New York Stock Exchange rules to vote on the proposal without receiving voting instructions

from you. A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner

does not vote on a non-discretionary proposal because the holder of record has not received voting instructions from the beneficial

owner. |

We

are advised that the Name Change Proposal,

the Ratification of Accountant Proposal and the Adjournment Proposal are discretionary proposals; however, each of the other proposals

to be presented at the Annual Meeting is a non-discretionary proposal. Accordingly, if you are a beneficial owner and you do not provide

voting instructions to your broker, bank or other holder of record holding shares for you, your shares may not be voted with respect

to any of the proposals other than the Name Change Proposal, the Ratification of Accountant and the Adjournment Proposal, if

presented. A broker non-vote would have the same effect as a vote against the Name Change Proposal and the Capital Increase

Proposal. Broker non-votes will have no effect on the outcome of the vote on any of the other proposals.

| Q: |

What

will happen if I return my proxy card without indicating how to vote? |

| |

|

| A: |

If

you sign and return your proxy card without indicating how to vote on one or more of the proposals, the Sigma common stock represented

by your proxy will be voted in favor of each such proposal. Proxy cards that are returned without a signature will not be counted

as present at the Annual Meeting and cannot be voted. |

| Q: |

Can

I change my vote after I have returned a proxy or voting instruction card? |

| |

|

| A: |

Yes.

You can change your vote at any time before your proxy is voted at the Annual Meeting. You can do this in one of four ways: |

| |

● |

you

can grant a new, valid proxy bearing a later date; |

| |

|

|

| |

● |

you

can send a signed notice of revocation; |

| |

|

|

| |

● |

if

you are a holder of record, you can attend the Annual Meeting and vote at the Annual Meeting, which will automatically cancel any

proxy previously given, or you may revoke your proxy in person, but your attendance alone will not revoke any proxy that you have

previously given; or |

| |

|

|

| |

● |

if

your shares of Sigma common stock are held in an account with a broker, bank or other nominee, you must follow the instructions on

the voting instruction card you received in order to change or revoke your instructions. |

If you choose either of the first two methods, you

must submit your written notice of revocation or your new proxy to the Secretary of Sigma, as specified below under “What

is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to

serve as directors?” no later than the beginning of the Annual Meeting. If your shares are held in street name by

your broker, bank or nominee, you should contact them to change your vote.

| Q: |

Do

I need identification to attend the Annual Meeting? |

| |

|

| A: |

Yes.

You will be asked to provide the company number and control number from the printed proxy card. |

| |

|

| Q: |

Are

Sigma stockholders entitled to dissenters’ or appraisal rights? |

| |

|

| A: |

No.

Sigma stockholders do not have dissenters’ or appraisal rights in connection with any of the proposals under the NGCL and will

not be afforded any such rights. |

| |

|

| Q: |

What

do I do if I receive more than one set of voting materials? |

| |

|

| A:

|

You

may receive more than one set of voting materials for the Annual Meeting, including multiple copies of this proxy statement, proxy

cards and/or voting instruction forms. This can occur if you hold your shares of common stock in more than one brokerage account,

if you hold shares directly as a record holder and also in street name, or otherwise through a nominee. Other circumstances may apply.

If you receive more than one set of voting materials, each should be voted and/or returned separately in order to ensure that all

of your shares of common stock are voted. |

| |

|

| Q: |

How

can I find out the results of the voting at the Annual Meeting? |

| |

|

A:

|

Preliminary

voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on

Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to

us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we intend to file a Current Report

on Form 8-K to publish preliminary voting results and, within four business days after the final results are known to us, file an

additional Current Report on Form 8-K to publish the final results. |

| |

|

Q:

|

What

proxy materials are available on the internet?

|

| |

|

A:

|

This

proxy statement, and the documents incorporated by reference herein, are available at http://www.viewproxy.com/Sigma/2023. |

| |

|

| Q: |

Whom

may I call with questions about the Annual Meeting, the Acquisition, or the other Proposals? |

| |

|

| A: |

Sigma

stockholders should contact our Chief Financial Officer and Secretary, Frank Orzechowski, via email at frank.orzechowski@sigmaadditive.com

or by telephone at (203) 733-1356 with any questions regarding the Annual Meeting or any of the proposals to be presented at the

Annual Meeting. |

| Q: |

What

is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals

to serve as directors? |

|

| |

|

|

| A: |

Stockholders

may present proper proposals for inclusion in our proxy statement and for consideration at

the next annual meeting of stockholders by submitting their proposals in writing to our Corporate

Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in

our proxy statement for our 2024 annual meeting of stockholders, our Corporate Secretary

must receive the written proposal at our principal executive offices not later than August

2, 2024, which is 120 days prior to the first anniversary of the mailing date of this

proxy statement. In addition, stockholder proposals must comply with the requirements of

Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials.

Stockholder proposals should be addressed to:

Sigma

Additive Solutions, Inc.

Attention:

Corporate Secretary

3900

Paseo del Sol

Santa

Fe, New Mexico 87507

As

for stockholders who wish to present a proposal or to nominate a director candidate at the 2024 annual meeting of stockholders, but

not to include the proposal or nomination in our proxy statement, our amended and restated bylaws state that the proposal or nomination

must be received by us no later than August 2, 2024, which is 120 days prior to the first anniversary of the mailing date

of this proxy statement. The proposal or nomination must also contain the information required by our amended and restated bylaws.

A proposal or nomination to be presented directly at the 2024 annual meeting should be addressed to us as set forth above. For the

2024 annual meeting, we will be required pursuant to Rule 14a-19 under the Exchange Act to include on our proxy card all nominees

for director for whom we have received notice under the rule, which must be received no later than 60 calendar days prior to the

anniversary of the Annual Meeting. For any such director nominee to be included on our proxy card for next year’s annual meeting,

notice must be received no later than October 28, 2024. |

RISK

FACTORS

Post-Acquisition,

NextTrip, Inc. will be faced with a market environment that cannot be predicted and that involves significant risks, many of which will

be beyond its control. In addition to the other information contained in this proxy statement, you should carefully consider the material

risks described below before deciding how to vote your shares of Sigma common stock. You should also read and consider the risks associated

with the business of Sigma because these risks may also affect NextTrip, Inc. after closing of the Acquisition. These risks can

be found in Sigma’s Annual Report on Form

10-K for the year ended December 31, 2022 and most recent Quarterly Reports on Form 10-Q, which are incorporated herein by reference.

If any of the following risks and uncertainties develops into actual events, these events could have a material adverse effect on Sigma

or the businesses, financial conditions or results of operations of NextTrip, or ownership of NextTrip, Inc. securities following the

Acquisition. You should also read and consider the other information in this proxy statement and the other documents incorporated by

reference into this proxy statement. Please see the sections titled “Other Matters” and “Where You Can

Find More Information” on pages 124 and 124 of this proxy statement. In addition, past financial performance may not be

a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods.

Risks

Related to the Acquisition

Failure

to complete the Acquisition could negatively impact Sigma’s stock price and we may not be able to avoid dissolution.

If

the Acquisition Proposal is not approved at the Annual Meeting, or the Acquisition is not completed for any reason, we intend to proceed

with the Asset Sale and may undertake to windup and dissolve the Company unless another strategic transaction such as a reverse merger

transaction materializes. Completion of the Acquisition is part of our plan submitted to Nasdaq to regain compliance with Nasdaq’s

minimum stockholders’ equity requirement. If the Acquisition is not completed, it is likely that our common stock would be delisted

from Nasdaq, with all the attendant risks described below in his section. Furthermore, if the Acquisition is not completed, the price

of Sigma’s common stock may decline significantly. If that were to occur, it is uncertain when, if ever, the price of Sigma’s

common stock would reach the price implied in the Acquisition or at which it trades as of the date we announced the Exchange Agreement

or the date of this proxy statement. Accordingly, if the Acquisition is not completed, there can be no assurance as to the effect on

the future value of your shares of our common stock.

Subsequent

to the consummation of the Acquisition, we may be required to take write-downs or write-offs, restructuring and impairment or other charges

that could have a significant negative effect on our financial condition, results of operations and share price, which could cause you

to lose some or all of your investment.

Although

we have conducted due diligence on NextTrip, we cannot assure you that this diligence revealed all material issues that may be present

in NextTrip’s business, that it would be possible to uncover all material issues through a customary amount of due diligence, or