Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-252196

The

information in this preliminary prospectus supplement and the accompanying prospectus, relating to an effective registration statement

under the Securities Act of 1933, as amended, is not complete and may be changed. This preliminary prospectus supplement and the accompanying

prospectus are not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where

the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS SUPPLEMENT |

Subject

to Completion |

Dated

November 30, 2023 |

(to

Prospectus dated January 28, 2021)

Shares

of Common Stock

Pre-Funded

Warrants

Polar

Power, Inc.

We

are offering shares of our common stock, par value $0.0001 per share. The purchase price for each share is $ .

We

are also offering pre-funded warrants (each a “Pre-funded Warrant”) to purchase shares of our common stock, exercisable at

an exercise price of $0.0001 per share, to those purchasers whose purchase of common stock in this offering would otherwise result in

the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of

the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering. The purchase price of

each Pre-funded Warrant is equal to the price per share of common stock being sold to the public in this offering, minus $0.0001. The

Pre-funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-funded Warrants are exercised

in full.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “POLA.” On November 29, 2023, the last reported

sale price of our common stock on The Nasdaq Capital Market was $0.80 per share. There is no established trading market for

the Pre-funded Warrants and we do not intend to list the Pre-funded Warrants on any securities exchange or nationally recognized trading

system.

As

of the date of this prospectus supplement, the aggregate market value of our outstanding common stock held by non-affiliates, or our

public float, was approximately $ based on outstanding shares of common stock held by non-affiliates and a per share price of , the

closing price of our common stock on , which is the highest closing sale price of our common stock on The Nasdaq Capital Market

within the prior 60 days. During the

12-calendar month period that ends on, and includes, the date of this prospectus supplement (but excluding this offering), we have

not offered and sold any of our securities pursuant to General Instruction I.B.6 of Form S-3.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-3 of this prospectus supplement

and the documents incorporated by reference into this prospectus supplement for a discussion of information that you should consider

in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Share | | |

Per Pre-Funded Warrant | | |

Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Underwriting discounts and commissions (1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds to us, before expenses | |

$ | | | |

$ | | | |

$ | | |

| (1) |

We

refer you to “Underwriting” beginning on page S-10 of this prospectus supplement for additional information regarding

underwriters’ compensation. |

We

have granted a 45-day option to the representative of the underwriters to purchase up to additional shares of common stock (and/or Pre-funded

Warrants in lieu thereof) solely to cover over-allotments, if any.

The

underwriters expect to deliver the shares to purchasers on or about , 2023.

ThinkEquity

The

date of this prospectus supplement is , 2023.

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement relates to the offering of our common stock and Pre-funded Warrants. Before buying any of the common stock or Pre-funded

Warrants that we are offering, you should carefully read the accompanying base prospectus, this prospectus supplement, any supplement

to this prospectus supplement, the information and documents incorporated herein by reference and the additional information under the

heading “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

These documents contain important information that you should consider when making your investment decision.

We

provide information to you about this offering of our common stock and Pre-funded Warrants in two separate documents that are bound together:

(i) this prospectus supplement, which describes the specific details regarding this offering; and (ii) the accompanying base prospectus,

which provides general information, some of which may not apply to this offering. Generally, when we refer to this “prospectus,”

we are referring to both documents combined. If information in this prospectus supplement is inconsistent with the accompanying base

prospectus, you should rely on this prospectus supplement. To the extent there is a conflict between the information contained in this

prospectus supplement, on the one hand, and the information contained in any document incorporated by reference in this prospectus supplement,

on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent

with a statement in another document having a later date—for example, a document incorporated by reference into this prospectus

supplement—the statement in the document having the later date modifies or supersedes the earlier statement.

You

should rely only on this prospectus supplement and the information incorporated or deemed to be incorporated by reference in this prospectus

supplement or in any free writing prospectuses we provide you. We have not, and the underwriters have not, authorized anyone to provide

you with information that is in addition to, or different from, that contained or incorporated by reference in this prospectus supplement.

If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not,

offering to sell securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information

contained or incorporated by reference in this prospectus supplement is accurate as of any date other than as of the date of this prospectus

supplement or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of

this prospectus supplement or any sale of our common stock and Pre-funded Warrants. Our business, financial condition, liquidity, results

of operations, and prospects may have changed since those dates.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This

prospectus supplement and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described

herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety

by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated herein

by reference as exhibits to the registration statement, and you may obtain copies of those documents as described below in the section

entitled “Where You Can Find More Information.”

This

prospectus supplement and the accompanying prospectus contain and incorporate by reference market data and industry statistics and forecasts

that are based on independent industry publications and other publicly-available information. Although we believe these sources are reliable,

we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. Although

we are not aware of any misstatements regarding the market and industry data presented in this prospectus supplement, accompanying prospectus

or the documents incorporated herein by reference, these estimates involve risks and uncertainties and are subject to change based on

various factors, including those discussed in the section entitled “Risk Factors” in this prospectus supplement and the accompanying

prospectus, and under similar headings in the other documents that are incorporated herein by reference. Accordingly, investors should

not place undue reliance on this information.

When

used in this prospectus supplement, the terms “Polar Power,” “we,” “our” and “us” refer

to Polar Power, Inc., unless otherwise specified.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the base prospectus and the documents incorporated by reference into this prospectus supplement and the base prospectus

contain “forward-looking statements” and are intended to be covered by the safe harbor provided for under Section 27A of

the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or

the Exchange Act. These forward-looking statements involve substantial risks and uncertainties. All statements, other than statements

of historical facts, included in this prospectus supplement regarding our strategy, future events, future operations, future financial

position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth, among others, are forward-looking

statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “might,” “plan,” “predict,” “project,” “would,” “will,”

“should,” “could,” “objective,” “target,” “ongoing,” “contemplate,”

“potential” or “continue” or the negative of these terms and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain these identifying words.

We

may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place

undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations

disclosed in our forward-looking statements. We have included important factors in the cautionary statements included in this prospectus

supplement, particularly in the “Risk Factors” section, which could cause actual results or events to differ materially from

such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake

any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as

required by law.

PROSPECTUS

SUPPLEMENT SUMMARY

The

information below is a summary of the more detailed information included elsewhere in or incorporated by reference into this prospectus

supplement. Because this is only a summary, however, it does not contain all of the information that may be important to you. You should

carefully read this prospectus supplement and the accompanying base prospectus, including the documents incorporated by reference, which

are described under “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference”

in this prospectus supplement. You should also carefully consider the matters discussed in the section in this prospectus supplement

entitled “Risk Factors.”

When

used herein, unless the context requires otherwise, references to the “Company,” “we,” “our” and

“us” refer to Polar Power, Inc., a Delaware corporation, unless otherwise indicated or required by the context.

Our

Business

Overview

We

design, manufacture and sell DC power generators, renewable energy and cooling systems for applications primarily in the telecommunications

market and, to a lesser extent, in other markets, including military, electric vehicle, marine and industrial. We are continuously diversifying

our customer base and are selling our products into non-telecommunication markets and applications at an increasing rate.

Within

the various markets we service, our DC power systems provide reliable and low-cost DC power to service applications that do not have

access to the utility grid (i.e., prime power and mobile applications) or have critical power needs and cannot be without power in the

event of utility grid failure (i.e., back-up power applications).

It’s

more efficient to build power systems around the DC generator because it’s simpler to integrate with battery storage and solar

photovoltaics which also operate on DC. Many applications in communications, water pumping, lighting, vehicle and vessel propulsion,

security systems operate on DC power only. Many micro-grids and energy storage are DC based and use inverters to convert the DC to AC.

Serving

these various markets, we offer the following configurations of our DC power systems, with output power ranging from 5 kW to 50 kW:

| |

● |

Base

power systems. These stationary systems integrate a DC generator and automated controls with remote monitoring, which are

typically contained within an environmentally regulated enclosure. |

| |

|

|

| |

● |

Hybrid

power systems. These systems incorporate lithium-ion batteries (or other advanced battery chemistries) with our proprietary

battery management system into our standard DC power systems. |

| |

|

|

| |

● |

DC

solar hybrid power systems. These stationary systems incorporate photovoltaic and

other sources of renewable energy into our DC hybrid power systems.

Mobile

power systems. These are very light weight and compact power systems used for EV charging, robotics, communications, security. |

Our

DC power systems are available in diesel, natural gas, LPG / propane and renewable formats, with diesel, natural gas and propane gas

being the predominate formats.

Corporate

Information

We

were incorporated in 1979 in the State of Washington as Polar Products, Inc., and in 1991 we reincorporated in the State of California

as Polar Power, Inc. In December 2016, we reincorporated in the State of Delaware. Our principal executive offices are located at 249

E. Gardena Blvd., Gardena, California 90248. Our telephone number is (310) 830-9153 and our Internet website is www.polarpower.com.

The

Offering

| Common

stock offered by us |

|

shares. |

| |

|

|

| Pre-funded

Warrants offered by us |

|

Pre-funded

Warrants to purchase up to shares of common stock. Each Pre-funded Warrant entitles the holder

to purchase one share of common stock at an exercise price of $0.0001 per share. The purchase

price of each Pre-funded Warrant is equal to the price per share of common stock being sold

to the public in this offering minus $0.0001. The Pre-funded Warrants will be immediately

exercisable and may be exercised at any time until exercised in full.

This

prospectus also relates to the offering of common stock issuable upon exercise of the Pre-funded Warrants. |

| |

|

|

| Public

offering price |

|

$

per share of common stock ($ per Pre-funded Warrant). |

| |

|

|

| Underwriter’s

over-allotment option |

|

We

have granted a 45-day option to the underwriters, exercisable one or more times in whole or in part, to purchase up to an additional

shares of common stock and/or up to an additional Pre-funded Warrants, representing 15% of the shares of common stock and/or Pre-funded

Warrants sold in the offering, in each case, solely to cover over-allotments, if any. |

| |

|

|

| Common

stock outstanding immediately prior to this offering |

|

12,961,612

shares. |

| |

|

|

| Common

stock to be outstanding immediately after this offering |

|

shares,

assuming the full exercise of the Pre-funded Warrants (or shares if the underwriters exercise the over-allotment option to purchase

additional securities in full). |

| |

|

|

| Use

of proceeds |

|

We

expect to receive net proceeds from the sale of shares of our common stock and/or Pre-funded Warrants in this offering of approximately

$ , after deducting fees and our estimated offering expenses. We intend to use the net proceeds of this offering for general corporate

purposes, including working capital, research and development, capital expenditures and potential acquisitions. See “Use of

Proceeds” on page S-7. |

| |

|

|

| Risk

factors |

|

Investing

in our common stock and Pre-funded Warrants involves substantial risks. See “Risk Factors” beginning on page S-3 of

this prospectus supplement for a discussion of factors that you should read and consider before investing in our common stock and

Pre-funded Warrants. |

| |

|

|

| The

Nasdaq Capital Market symbol |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “POLA.” There is no established trading market for

the Pre-funded Warrants, and we do not expect a trading market to develop. We do not intend to list the Pre-funded Warrants on any

securities exchange or nationally recognized trading system. |

The

number of shares of common stock shown above to be outstanding after this offering is based on the 12,961,612 shares outstanding as of

November 17, 2023 and excludes the following as of that date:

| |

● |

140,000

shares of common stock issuable upon the exercise

of outstanding options, having a weighted average exercise price of $5.22 per share; and |

| |

|

|

| |

● |

1,453,038

shares of common stock reserved for future issuance

under our 2016 Stock Incentive Plan, or 2016 Plan. |

Unless

otherwise indicated, this prospectus supplement reflects and assumes no exercise of the outstanding options and no exercise by the underwriters

of their over-allotment option described above.

RISK

FACTORS

Investing

in our shares of common stock and Pre-funded Warrants involves a high degree of risk. You should carefully consider the risks, uncertainties

and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports

on Form 10-Q and current reports on Form 8-K that we have filed or will filed with the Securities and Exchange Commission, or the SEC,

and in other documents incorporated by reference to our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act and all other information contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus,

including our consolidated financial statements and the related notes, before investing in our common stock. If any of these risks materialize,

our business, financial condition or results of operations could be materially harmed. In that case, the trading price of our common

stock could decline, and you may lose some or all of your investment. The risks and uncertainties we describe are not the only ones facing

us. Additional risks not presently known to us, or that we currently deem immaterial, may also impair our business operations. If any

of these risks were to occur, our business, financial condition, or results of operations would likely suffer. In that event, the trading

price of our common stock could decline, and you could lose all or part of your investment.

Risks

Related to Our Business

We

have received a class action complaint for damages related to alleged violations of certain provisions of the California Labor Code,

which could result in substantial costs.

From

time to time, we are a party to litigation arising in the ordinary course of our business. Related thereto, we have received a class

action complaint filed in the Superior Court of the State of California. The complaint was filed by a certain ex-employee, individually,

and on behalf of other members of the general public similarly situated, for damages related to alleged violations of certain provisions

of the California Labor Code, which could result in substantial costs. We plan to file a response denying all such claims in December

2023. While it is difficult to ascertain the outcome of this matter, we believe that it is without merit, and intend to vigorously defend

the action. We are currently unable to estimate the amount of potential damages, if any, we could incur as a result of this claim and

have not established a reserve for this litigation. Despite our beliefs about the merit of the claim, the costs related to defend this

action, as well as an award, if any, that an arbitrator or court were to issue in favor of the plaintiff(s), could substantially diminish

our available cash, or otherwise have a material adverse effect on the Company.

Risks

Related to This Offering and Ownership of Our Common Stock and Pre-funded Warrants

You

will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

Since

the offering price per share of common stock being offered is substantially higher than the net tangible book value per share of our

common stock, you will suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering.

Based on the offering price of (i) $ per share of common stock and (ii) $ per Pre-funded Warrants, if you purchase shares of common stock

and/or Pre-funded Warrants in this offering, you will suffer immediate and substantial dilution of $ per share in the net tangible book

value of the common stock.

We

have broad discretion as to the use of the net proceeds we receive from this offering and may not use them effectively.

We

retain broad discretion to use the net proceeds from this offering and may use the net proceeds for working capital needs, capital expenditures,

acquisitions and other general corporate purposes. Accordingly, you will have to rely upon the judgment of our management with respect

to the use of those net proceeds. Our stockholders may not agree with the manner in which our management chooses to allocate and spend

the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase our profitability or

our market value. The failure by our management to allocate these funds effectively could harm our business. See “Use of Proceeds”

on page S-7.

Future

sales of substantial amounts of our common stock could adversely affect the market price of our common stock.

Future

sales of substantial amounts of our common stock, or securities convertible or exchangeable into shares of our common stock, into the

public market, including shares of our common stock issued upon exercise of options, or perceptions that those sales could occur, could

adversely affect the prevailing market price of our common stock and our ability to raise capital in the future.

Based

on the sale of (i) shares of our common stock and (ii) Pre-funded Warrants in this offering, we will be selling a number of shares of

common stock and/or Pre-funded Warrants which represents approximately % of the number of shares of common stock that we currently have

outstanding (assuming the immediate exercise of such Pre-Funded Warrants). Resales of substantial amounts of the shares of our common

stock issued in this offering, together with shares of our common stock issuable upon conversion or exercise of Pre-funded Warrants or

currently outstanding derivative securities, could have a negative effect on our stock price.

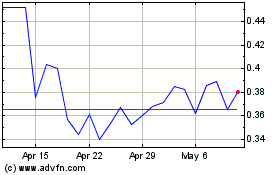

Our

stock price is highly volatile, which could result in substantial losses for investors purchasing shares of our common stock and in litigation

against us.

The

market price of our common stock has fluctuated significantly in the past and may continue to fluctuate significantly in the future.

The market price of our common stock may continue to fluctuate in response to one or more of the following factors, many of which are

beyond our control:

| |

● |

fluctuations

in the market prices of our DC power generators and related products; |

| |

|

|

| |

● |

fluctuations

in the costs of key production components; |

| |

|

|

| |

● |

the

volume and timing of the receipt of orders for our products from customers; |

| |

|

|

| |

● |

write-downs

of the value of our inventories; |

| |

|

|

| |

● |

competitive

pricing pressures; |

| |

|

|

| |

● |

anticipated

trends in our financial condition and results of operations; |

| |

|

|

| |

● |

changes

in market valuations of companies similar to us; |

| |

|

|

| |

● |

stock

market price and volume fluctuations generally; |

| |

|

|

| |

● |

regulatory

developments or increased enforcement; |

| |

|

|

| |

● |

fluctuations

in our quarterly or annual operating results; |

| |

|

|

| |

● |

additions

or departures of key personnel; |

| |

● |

our

ability to obtain any necessary financing; |

| |

|

|

| |

● |

our

financing activities and future sales of our common stock or other securities; and |

| |

|

|

| |

● |

our

ability to maintain contracts that are critical to our operations. |

The

price at which you purchase shares of our common stock may not be indicative of the price that will prevail in the trading market. You

may be unable to sell your shares of common stock at or above your purchase price, which may result in substantial losses to you and

which may include the complete loss of your investment. In the past, securities class action litigation has often been brought against

a company following periods of high stock price volatility. We may be the target of similar litigation in the future. Securities litigation

could result in substantial costs and divert management’s attention and our resources away from our business.

Because

we do not intend to pay any cash dividends on our shares of common stock in the near future, our stockholders will not be able to receive

a return on their shares unless and until they sell them.

We

intend to retain a significant portion of any future earnings to finance the development, operation and expansion of our business. We

do not anticipate paying any cash dividends on our common stock in the near future. The declaration, payment, and amount of any future

dividends will be made at the discretion of our board of directors, and will depend upon, among other things, the results of operations,

cash flows, and financial condition, operating and capital requirements, and other factors as our board of directors considers relevant.

There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount

of any such dividend. Unless our board of directors determines to pay dividends, our stockholders will be required to look to appreciation

of our common stock to realize a gain on their investment. There can be no assurance that this appreciation will occur.

Our failure to satisfy certain listing requirements may result in

our common stock being delisted from the Nasdaq Capital Market, which may make it more difficult for investors to sell shares of our common

stock.

Our common stock is listed on

Nasdaq. Nasdaq has several quantitative and qualitative requirements companies must comply with to maintain this listing, including a

$1.00 minimum bid price per share (the “Bid Price Rule”). On November 24, 2023, we received a deficiency letter from the

Listing Qualifications Department of The Nasdaq Stock Market (“Nasdaq”) indicating that our common stock is subject to potential

delisting from the Nasdaq because for a period of 30 consecutive business days, the bid price of our common stock has closed below the

minimum $1.00 per share requirement for continued inclusion under Nasdaq Marketplace Rule 5550(a)(2) (the “Bid Price Rule”).

The Nasdaq deficiency letter has no immediate effect on the listing of our common stock, and our common stock will continue to trade

on The Nasdaq Capital Market under the symbol “POLA” at this time.

The Nasdaq notice indicated

that, in accordance with Nasdaq Marketplace Rule 5810(c)(3)(A), we will be provided 180 calendar days, or until May 22, 2024, to regain

compliance. If, at any time before May 22, 2024, the bid price of our common stock closes at $1.00 per share or more for a minimum of

10 consecutive business days, Nasdaq staff will provide written notification that we have achieved compliance with the Bid Price Rule.

If we fail to regain compliance

with the Bid Price Rule before May 22, 2024 but meet all of the other applicable standards for initial listing on The Nasdaq Capital

Market with the exception of the minimum bid price, then we may be eligible to have an additional 180 calendar days, or until November

18, 2024, to regain compliance with the Bid Price Rule. If we do not regain compliance with the Bid Price Rule by the end of the compliance

period (or the second compliance period, if applicable), our common stock will become subject to delisting. In the event that we receive

notice that our common stock is being delisted, the Nasdaq listing rules permit us to appeal a delisting determination by Nasdaq to a

hearings panel.

We intend to monitor the closing

bid price of our common stock and may, if appropriate, consider available options to regain compliance with the Bid Price Rule. However,

there can be no assurance that we will be able to regain compliance with the Bid Price Rule or will otherwise be in compliance with other

Nasdaq listing rules. If the stock is delisted, we may trade

on the over-the-counter market, or even in the pink sheets, which would significantly decrease the liquidity of an investment in our

common stock.

The Nasdaq Capital Market

may seek to delist our common stock if it concludes this offering does not qualify as a Public Offering as defined under Nasdaq’s

stockholder approval rule.

The continued listing of our common stock on The Nasdaq Capital Market

depends on our compliance with the requirements for continued listing under the Nasdaq Marketplace Rules, including but not limited to

Market Place Rule 5635, or the stockholder approval rule. The stockholder approval rule prohibits the issuance of shares of common stock

(or derivatives) in excess of 20% of our outstanding shares of common stock without stockholder approval, unless those shares are sold

at a price that equals or exceeds the Minimum Price, as defined in the stockholder approval rule, or in what Nasdaq deems a Public Offering,

as defined in the stockholder approval rule. The securities sold in this offering may be sold at a significant discount to the Minimum

Price as defined in the stockholder approval rule, and we do not intend to obtain the approval of our stockholders for the issuance of

the securities in this offering. Accordingly, we have sought to conduct, and plan to continue to conduct, this offering as a Public Offering

as defined in the stockholder approval rule, which is a qualitative analysis based on several factors as determined by Nasdaq, including

by broadly marketing and offering these securities in a firm commitment underwritten offering registered under the Securities Act. Demand

for the securities sold by us in this offering, and the final offering price for these securities, will be determined following a broad

public marketing effort over several trading days, and final distribution of these securities will ultimately be determined by the underwriter.

Nasdaq has also published guidance that an offering of securities that are “deeply discounted” to the Minimum Price (for example

a discount of 50% or more) will typically preclude a determination that the offering qualifies as Public Offering for purposes of the

stockholder approval rule. We cannot assure you that Nasdaq will determine that this offering will be deemed a Public Offering under the

stockholder approval rule. If Nasdaq determines that this offering was not conducted in compliance with the stockholder approval rule,

Nasdaq may cite a deficiency and move to delist our common stock from The Nasdaq Capital Market. Upon a delisting from The Nasdaq Capital

Market, our stock would likely be traded in the over-the-counter inter-dealer quotation system, more commonly known as the OTC. OTC transactions

involve risks in addition to those associated with transactions in securities traded on the securities exchanges, such as The Nasdaq Capital

Market, or, together, Exchange-listed stocks. Many OTC stocks trade less frequently and in smaller volumes than Exchange-listed stocks.

Accordingly, our stock would be less liquid than it would be otherwise. Also, the prices of OTC stocks are often more volatile than Exchange-listed

stocks. Additionally, institutional investors are usually prohibited from investing in OTC stocks, and it might be more challenging to

raise capital when needed.

There

is no established public trading market for the Pre-funded Warrants being offered in this offering, and we do not expect a market to

develop for the Pre-funded Warrants.

There

is no established public trading market for the Pre-funded Warrants being offered in this offering, and we do not expect a market to

develop. In addition, we do not intend to apply to list the Pre-funded Warrants on any national securities exchange or other nationally

recognized trading system. Without an active market, the liquidity of the Pre-funded Warrants will be limited. Further, the existence

of the Pre-funded Warrants may act to reduce both the trading volume and the trading price of our common stock.

The

Pre-funded Warrants are speculative in nature.

Except

as otherwise provided in the Pre-funded Warrants, until holders of Pre-Funded Warrants acquire our common stock upon exercise of the

Pre-funded Warrants, holders of Pre-funded Warrants will have no rights with respect to our common stock underlying such Pre-funded Warrants.

Upon exercise of the Pre-funded Warrants, the holders will be entitled to exercise the rights of a stockholder of our common stock only

as to matters for which the record date occurs after the exercise date.

Moreover,

following this offering, the market value of the Pre-funded Warrants is uncertain. There can be no assurance that the market price of

our common stock will ever equal or exceed the price of the Pre-Funded Warrants, and, consequently, whether it will ever be profitable

for investors to exercise their Pre-funded Warrants.

USE

OF PROCEEDS

We

estimate that the net proceeds from the sale of our common stock and Pre-funded Warrants in this offering will be approximately $ after

deducting the estimated underwriting discounts and commissions and estimated expenses payable by us.

Our

expected use of the net proceeds from this offering represents our current intentions based upon our present plans and business condition.

As of the date of this prospectus, we cannot predict with certainty all of the particular uses for the net proceeds to be received upon

completion of this offering, or the amounts that we will actually spend on the uses set forth above. However, we currently intend to

use the net proceeds to us from this offering for general corporate purposes, including working capital, research and development, capital

expenditures and potential acquisitions. Pending the uses described above, we intend to invest the net proceeds from this offering in

short term, interest-bearing securities such as money market accounts, certificates of deposit, commercial paper, or direct or guaranteed

obligations of the U.S. government.

The

amounts and timing of our actual use of the net proceeds will vary depending on numerous factors, including our ability to gain access

to additional financing if needed. As a result, our management will have broad discretion in the application of the net proceeds, and

investors will be relying on our judgment regarding the application of the net proceeds of this offering. In addition, we might decide

to postpone or not pursue certain activities if the net proceeds from this offering and any other sources of cash are less than expected.

DIVIDEND

POLICY

We

have never paid cash dividends on our common stock and do not intend to pay cash dividends on our common stock in the foreseeable future.

We anticipate that we will retain any earnings for use in the continued development of our business.

DESCRIPTION

OF PRE-FUNDED WARRANTS

The

following is a brief summary of certain terms and conditions of the Pre-funded Warrants being offered in this offering. The following

description is subject in all respects to the provisions contained in the Pre-funded Warrants.

Form

The

form of Pre-funded Warrant will be filed as an exhibit to a Current Report on Form 8-K that we will file with the SEC.

Term

The

Pre-funded Warrants will not expire until they are fully exercised.

Exercisability

The

Pre-funded Warrants are exercisable at any time until they are fully exercised. The Pre-funded Warrants will be exercisable, at the option

of each holder, in whole or in part by delivering to us a duly executed exercise notice and payment of the exercise price. No fractional

shares of common stock will be issued in connection with the exercise of a Pre-funded Warrant. Rather, we will, at our election, either

pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price or round

up to the next whole common share. The holder of the Pre-funded Warrant may also satisfy its obligation to pay the exercise price through

a “cashless exercise,” in which the holder receives the net value of the Pre-funded Warrants in shares of common stock determined

according to the formula set forth in the Pre-funded Warrant.

Exercise

Limitations

Under

the terms of the Pre-funded Warrants, the Company may not effect the exercise of any such warrant, and a holder will not be entitled

to exercise any portion of any such warrant, if, upon giving effect to such exercise, the aggregate number of shares of common stock

beneficially owned by the holder (together with its affiliates, any other persons acting as a group together with the holder or any of

the holder’s affiliates, and any other persons whose beneficial ownership of common stock would or could be aggregated with the

holder’s for purposes of Section 13(d) or Section 16 of the Securities Exchange Act of 1934, as amended) would exceed 4.99% of

the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined

in accordance with the terms of such warrant, which percentage may be increased or decreased at the holder’s election upon 61 days’

notice to the Company subject to the terms of such warrants, provided that such percentage may in no event exceed 9.99%.

Exercise

Price

The

exercise price of our shares of common stock purchasable upon the exercise of the Pre-funded Warrants is $0.0001 per share. The exercise

price of the Pre-funded Warrants and the number of shares of common stock issuable upon exercise of the Pre-funded Warrants is subject

to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications

or similar events affecting our shares of common stock, as well as upon any distribution of assets, including cash, stock or other property,

to our stockholders.

Transferability

Subject

to applicable laws, the Pre-funded Warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange

Listing

We

do not intend to list the Pre-funded Warrants on The Nasdaq Capital Market, any other national securities exchange or any other nationally

recognized trading system.

Fundamental

Transactions

Upon

the consummation of a fundamental transaction (as described in the Pre-funded Warrants, and generally including any reorganization, recapitalization

or reclassification of our shares of common stock, the sale, transfer or other disposition of all or substantially all of our properties

or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding shares of common

stock, or any person or group becoming the beneficial owner of 50% of the voting power of our outstanding shares of common stock), the

holders of the pre-funded warrants will be entitled to receive, upon exercise of the Pre-funded Warrants, the kind and amount of securities,

cash or other property that such holders would have received had they exercised the pre-funded warrants immediately prior to such fundamental

transaction, without regard to any limitations on exercise contained in the Pre-funded Warrants. Notwithstanding the foregoing, in the

event of a fundamental transaction where the consideration consists solely of cash, solely of marketable securities or a combination

of cash and marketable securities, then each Pre-funded Warrants shall automatically be deemed to be exercised in full in a cashless

exercise effective immediately prior to and contingent upon the consummation of such fundamental transaction.

No

Rights as a Stockholder

Except

by virtue of such holder’s ownership of shares of common stock, the holder of a Pre-funded Warrant does not have the rights or

privileges of a holder of our shares of common stock, including any voting rights, until such holder exercises the Pre-funded Warrant.

Governing

Law

The

Pre-funded Warrants are governed by New York law.

DILUTION

If

you invest in our common stock and/or Pre-funded Warrants, you will experience dilution to the extent of the difference between the public

offering price per share/Pre-funded Warrant and the net tangible book value per share of our common stock immediately after this offering.

Our

net tangible book value as of September 30, 2023, was approximately $14,787,864, or $1.14 per share of our common stock.

“Net tangible book value” is total assets minus the sum of liabilities and intangible assets. “Net tangible book value

per share” is net tangible book value divided by the total number of shares outstanding. Dilution in net tangible book value per

share represents the difference between the amount per share paid by purchasers of shares of common stock in this offering and the net

tangible book value per share of our common stock immediately after this offering.

After

giving effect to the sale of shares of our common stock and Pre-funded Warrants in this offering at the public offering price of $ per

share and $ per Pre-funded Warrant and after deducting the estimated underwriting discounts and commissions and estimated offering expenses

payable by us, our as adjusted net tangible book value as of September 30, 2023, would have been approximately $ , or $ per share. This

represents an immediate increase in net tangible book value of $ per share to existing stockholders and immediate dilution in net tangible

book value of $ per share to new investors purchasing our common stock and Pre-funded Warrants in this offering at the public offering

price per share. The following table illustrates this dilution on a per share basis:

| Offering

price per share |

|

|

|

|

|

$ |

|

|

| Net

tangible book value per share as of September 30, 2023 |

|

$ |

1.14 |

|

|

|

|

|

| Increase

in net tangible book value per share attributable to new investors |

|

$ |

|

|

|

|

|

|

| As

adjusted net tangible book value per share after giving effect to this offering |

|

|

|

|

|

$ |

|

|

| Dilution

in net tangible book value per share to investors in this offering |

|

|

|

|

|

$ |

|

|

The

number of shares of common stock shown above to be outstanding after this offering is based on the 12,949,550 shares outstanding as of

September 30, 2023 and excludes the following as of that date:

| |

● |

140,000

shares of common stock issuable upon the exercise

of outstanding options, having a weighted average exercise price of $5.22 per share; |

| |

|

|

| |

● |

1,453,038 shares of common stock reserved for future

issuance under our 2016 Stock Incentive Plan, or 2016 Plan; and |

| |

|

|

| |

● |

12,062

shares of common stock issued after September 30, 2023. |

The

above illustration of dilution per share to the investors participating in this offering assumes no exercise of outstanding options to

purchase shares of our common stock and no exercise by the underwriters of their over-allotment option. To the extent that options outstanding

as of September 30, 2023 or issued thereafter have been or may be exercised or other shares issued, the investors purchasing shares of

our common stock and Pre-funded Warrants in this offering may experience further dilution.

UNDERWRITING

ThinkEquity

LLC, is acting as the representative of the underwriters of the offering. We have entered into an underwriting agreement dated , 2023

with the representative. Subject to the terms and conditions of the underwriting agreement, we have agreed to sell to each underwriter

named below, and each underwriter named below has severally agreed to purchase, at the public offering price less the underwriting discounts

set forth on the cover page of this prospectus, the number of shares of common stock (and/or Pre-funded Warrants in lieu thereof) at

the public offering price, less the underwriting discounts and commissions, as set forth on the cover page of this prospectus, the number

of shares of common stock (and/or Pre-funded Warrants in lieu thereof) listed next to its name in the following table:

| Underwriter |

|

Number

of Shares of Common Stock |

|

|

Number

of Pre-Funded Warrants |

|

| ThinkEquity

LLC |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

The

underwriters are committed to purchase all the shares of common stock (and/or Pre-funded Warrants in lieu thereof) offered by the Company.

The obligations of the underwriters may be terminated upon the occurrence of certain events specified in the underwriting agreement.

Furthermore, the underwriting agreement provides that the obligations of the underwriters to pay for and accept delivery of the shares

offered by us in this prospectus are subject to various representations and warranties and other customary conditions specified in the

underwriting agreement, such as receipt by the underwriters of officers’ certificates and legal opinions.

We

have agreed to indemnify the underwriters against specified liabilities, including liabilities under the Securities Act, and to contribute

to payments the underwriters may be required to make in respect thereof.

The

underwriters are offering the shares of common stock (and/or Pre-funded Warrants in lieu thereof) subject to prior sale, when, as and

if issued to and accepted by them, subject to approval of legal matters by their counsel and other conditions specified in the underwriting

agreement. The underwriters reserve the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in

part.

We

have granted the Representative an over-allotment option. This option, which is exercisable for up to 45 days after the date of this

prospectus supplement, permits the underwriters to purchase up to an aggregate of additional shares of common stock (and/or Pre-funded

Warrants in lieu thereof) (equal to 15% of the total number of shares of common stock and/or Pre-funded Warrants sold in this offering)

at the public offering price per share, less underwriting discounts and commissions, solely to cover over-allotments, if any. If the

underwriters exercise this option in whole or in part, then the underwriters will be severally committed, subject to the conditions described

in the underwriting agreement, to purchase the additional shares of common stock (and/or Pre-funded Warrants in lieu thereof) in proportion

to their respective commitments set forth in the prior table.

Discounts,

Commissions and Reimbursement

The

representative has advised us that the underwriters propose to offer the shares of common stock (and/or Pre-funded Warrants in lieu thereof)

to the public at the public offering price per share set forth on the cover page of this prospectus supplement. The underwriters may

offer securities to securities dealers at that price less a concession of not more than $ per share or Pre-funded Warrant of which up

to $ per share or Pre-funded Warrant may be reallowed to other dealers. After the offering to the public, the public offering price and

other selling terms may be changed by the representative.

The

following table summarizes the underwriting discounts and commissions and proceeds, before expenses, to us:

| |

|

|

|

|

|

|

|

|

|

Total |

|

| |

|

Per

Share |

|

|

Per

Pre-Funded Warrant |

|

|

Without

Option |

|

|

With

Option |

|

| Public

offering price |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Underwriting

discounts and commissions (6%) |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Proceeds,

before expenses, to us |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

In

addition, we have also agreed to pay up to $75,000 of the representative’s actual accountable expenses for the offering.

We

estimate the expenses of this offering payable by us, not including underwriting discounts and commissions, will be approximately $ .

Lock-Up

Agreements

The

Company and each of its directors and officers have agreed for a period of (i) 60 days after the date of the underwriting agreement in

the case of directors and officers and (ii) two months after the date of the underwriting agreement in the case of the Company, without

the prior written consent of the representative, not to directly or indirectly:

| |

● |

issue

(in the case of us), offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract

to sell, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of any shares of common stock or other

capital stock or any securities convertible into or exercisable or exchangeable for our common stock or other capital stock; or |

| |

● |

in

the case of us, file or cause the filing of any registration statement under the Securities Act with respect to any shares of common

stock or other capital stock or any securities convertible into or exercisable or exchangeable for our common stock or other capital

stock; or |

| |

● |

complete

any offering of debt securities of the Company, other than entering into a line of credit, term loan arrangement or other debt instrument

with a traditional bank; or |

| |

● |

enter

into any swap or other agreement, arrangement, hedge or transaction that transfers to another, in whole or in part, directly or indirectly,

any of the economic consequences of ownership of our common stock or other capital stock or any securities convertible into or exercisable

or exchangeable for our common stock or other capital stock, whether any transaction described in any of the foregoing bullet points

is to be settled by delivery of our common stock or other capital stock, other securities, in cash or otherwise, or publicly announce

an intention to do any of the foregoing. |

Electronic

Offer, Sale and Distribution of Securities

A

prospectus in electronic format may be made available on the websites maintained by one or more of the underwriters or selling group

members. The representative may agree to allocate a number of securities to underwriters and selling group members for sale to its online

brokerage account holders. Internet distributions will be allocated by the underwriters and selling group members that will make internet

distributions on the same basis as other allocations. Other than the prospectus in electronic format, the information on these websites

is not part of, nor incorporated by reference into, this prospectus or the registration statement of which this prospectus forms a part,

has not been approved or endorsed by us, and should not be relied upon by investors.

Stabilization

In

connection with this offering, the underwriters may engage in stabilizing transactions, over-allotment transactions, syndicate-covering

transactions, penalty bids and purchases to cover positions created by short sales.

Stabilizing

transactions permit bids to purchase shares so long as the stabilizing bids do not exceed a specified maximum, and are engaged in for

the purpose of preventing or retarding a decline in the market price of the shares while the offering is in progress.

Syndicate

covering transactions involve purchases of shares in the open market after the distribution has been completed in order to cover syndicate

short positions.

Penalty

bids permit the representative to reclaim a selling concession from a syndicate member when the shares originally sold by that syndicate

member are purchased in stabilizing or syndicate covering transactions to cover syndicate short positions.

These

stabilizing transactions, syndicate covering transactions and penalty bids may have the effect of raising or maintaining the market price

of our shares of common stock or preventing or retarding a decline in the market price of our shares of common stock. As a result, the

price of our common stock in the open market may be higher than it would otherwise be in the absence of these transactions. Neither we

nor the underwriters make any representation or prediction as to the effect that the transactions described above may have on the price

of our common stock. These transactions may be effected in the over-the-counter market or otherwise and, if commenced, may be discontinued

at any time.

Passive

Market Making

In

connection with this offering, the underwriters and any selling group members may engage in passive market making transactions in our

common shares on Nasdaq in accordance with Rule 103 of Regulation M under the Exchange Act during a period before the commencement of

offers or sales of common shares and/or Pre-Funded Warrants and extending through the completion of the distribution. A passive market

maker must display its bid at a price not in excess of the highest independent bid of that security. However, if all independent bids

are lowered below the passive market maker’s bid, that bid must then be lowered when specified purchase limits are exceeded.

Other

Relationships

Certain

of the underwriters and their affiliates may in the future provide various investment banking, commercial banking and other financial

services for us and our affiliates for which they may in the future receive customary fees.

Offer

restrictions outside the United States

Other

than in the United States, no action has been taken by us or the underwriters that would permit a public offering of the securities offered

by this prospectus in any jurisdiction where action for that purpose is required. The securities offered by this prospectus may not be

offered or sold, directly or indirectly, nor may this prospectus or any other offering material or advertisements in connection with

the offer and sale of any such securities be distributed or published in any jurisdiction, except under circumstances that will result

in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus comes are

advised to inform themselves about and to observe any restrictions relating to the offering and the distribution of this prospectus.

This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus in

any jurisdiction in which such an offer or a solicitation is unlawful.

Australia

This

prospectus is not a disclosure document under Chapter 6D of the Australian Corporations Act, has not been lodged with the Australian

Securities and Investments Commission and does not purport to include the information required of a disclosure document under Chapter

6D of the Australian Corporations Act. Accordingly, (i) the offer of the securities under this prospectus is only made to persons to

whom it is lawful to offer the securities without disclosure under Chapter 6D of the Australian Corporations Act under one or more exemptions

set out in section 708 of the Australian Corporations Act, (ii) this prospectus is made available in Australia only to those persons

as set forth in clause (i) above, and (iii) the offeree must be sent a notice stating in substance that by accepting this offer, the

offeree represents that the offeree is such a person as set forth in clause (i) above, and, unless permitted under the Australian Corporations

Act, agrees not to sell or offer for sale within Australia any of the securities sold to the offeree within 12 months after its transfer

to the offeree under this prospectus.

China

The

information in this document does not constitute a public offer of the securities, whether by way of sale or subscription, in the People’s

Republic of China (excluding, for purposes of this paragraph, Hong Kong Special Administrative Region, Macau Special Administrative Region

and Taiwan). The securities may not be offered or sold directly or indirectly in the PRC to legal or natural persons other than directly

to “qualified domestic institutional investors.”

European

Economic Area—Belgium, Germany, Luxembourg and Netherlands

The

information in this document has been prepared on the basis that all offers of securities will be made pursuant to an exemption under

the Directive 2003/71/EC (“Prospectus Directive”), as implemented in Member States of the European Economic Area (each, a

“Relevant Member State”), from the requirement to produce a prospectus for offers of securities.

An

offer to the public of securities has not been made, and may not be made, in a Relevant Member State except pursuant to one of the following

exemptions under the Prospectus Directive as implemented in that Relevant Member State:

| |

● |

to

legal entities that are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose

corporate purpose is solely to invest in securities; |

| |

● |

to

any legal entity that has two or more of (i) an average of at least 250 employees during its last fiscal year; (ii) a total balance

sheet of more than €43,000,000 (as shown on its last annual unconsolidated or consolidated financial statements) and (iii) an

annual net turnover of more than €50,000,000 (as shown on its last annual unconsolidated or consolidated financial statements); |

| |

● |

to

fewer than 100 natural or legal persons (other than qualified investors within the meaning of Article 2(1)(e) of the Prospectus Directive)

subject to obtaining the prior consent of the Company or any underwriter for any such offer; or |

| |

● |

in

any other circumstances falling within Article 3(2) of the Prospectus Directive, provided that no such offer of securities shall

result in a requirement for the publication by the Company of a prospectus pursuant to Article 3 of the Prospectus Directive. |

France

This

document is not being distributed in the context of a public offering of financial securities (offre au public de titres financiers)

in France within the meaning of Article L.411-1 of the French Monetary and Financial Code (Code Monétaire et Financier) and Articles

211-1 et seq. of the General Regulation of the French Autorité des marchés financiers (“AMF”). The securities

have not been offered or sold and will not be offered or sold, directly or indirectly, to the public in France.

This

document and any other offering material relating to the securities have not been, and will not be, submitted to the AMF for approval

in France and, accordingly, may not be distributed or caused to distributed, directly or indirectly, to the public in France.

Such

offers, sales and distributions have been and shall only be made in France to (i) qualified investors (investisseurs qualifiés)

acting for their own account, as defined in and in accordance with Articles L.411-2-II-2° and D.411-1 to D.411-3, D.744-1, D.754-1

;and D.764-1 of the French Monetary and Financial Code and any implementing regulation and/or (ii) a restricted number of non-qualified

investors (cercle restreint d’investisseurs) acting for their own account, as defined in and in accordance with Articles L.411-2-II-2°

and D.411-4, D.744-1, D.754-1; and D.764-1 of the French Monetary and Financial Code and any implementing regulation.

Pursuant

to Article 211-3 of the General Regulation of the AMF, investors in France are informed that the securities cannot be distributed (directly

or indirectly) to the public by the investors otherwise than in accordance with Articles L.411-1, L.411-2, L.412-1 and L.621-8 to L.621-8-3

of the French Monetary and Financial Code.

Ireland

The

information in this document does not constitute a prospectus under any Irish laws or regulations and this document has not been filed

with or approved by any Irish regulatory authority as the information has not been prepared in the context of a public offering of securities

in Ireland within the meaning of the Irish Prospectus (Directive 2003/71/EC) Regulations 2005 (the “Prospectus Regulations”).

The securities have not been offered or sold, and will not be offered, sold or delivered directly or indirectly in Ireland by way of

a public offering, except to (i) qualified investors as defined in Regulation 2(l) of the Prospectus Regulations and (ii) fewer than

100 natural or legal persons who are not qualified investors.

Israel

The

securities offered by this prospectus have not been approved or disapproved by the Israeli Securities Authority (the ISA), or ISA, nor

have such securities been registered for sale in Israel. The shares may not be offered or sold, directly or indirectly, to the public

in Israel, absent the publication of a prospectus. The ISA has not issued permits, approvals or licenses in connection with the offering

or publishing the prospectus; nor has it authenticated the details included herein, confirmed their reliability or completeness, or rendered

an opinion as to the quality of the securities being offered. Any resale in Israel, directly or indirectly, to the public of the securities

offered by this prospectus is subject to restrictions on transferability and must be effected only in compliance with the Israeli securities

laws and regulations.

Italy

The

offering of the securities in the Republic of Italy has not been authorized by the Italian Securities and Exchange Commission (Commissione

Nazionale per le Societ—$$—Aga e la Borsa, “CONSOB” pursuant to the Italian securities legislation and, accordingly,

no offering material relating to the securities may be distributed in Italy and such securities may not be offered or sold in Italy in

a public offer within the meaning of Article 1.1(t) of Legislative Decree No. 58 of 24 February 1998 (“Decree No. 58”), other

than:

| |

● |

to

Italian qualified investors, as defined in Article 100 of Decree no.58 by reference to Article 34-ter of CONSOB Regulation no. 11971

of 14 May 1999 (“Regulation no. 1197l”) as amended (“Qualified Investors”); and |

| |

● |

in

other circumstances that are exempt from the rules on public offer pursuant to Article 100 of Decree No. 58 and Article 34-ter of

Regulation No. 11971 as amended. |

Any

offer, sale or delivery of the securities or distribution of any offer document relating to the securities in Italy (excluding placements

where a Qualified Investor solicits an offer from the issuer) under the paragraphs above must be:

| |

● |

made

by investment firms, banks or financial intermediaries permitted to conduct such activities in Italy in accordance with Legislative

Decree No. 385 of 1 September 1993 (as amended), Decree No. 58, CONSOB Regulation No. 16190 of 29 October 2007 and any other applicable

laws; and |

| |

● |

in

compliance with all relevant Italian securities, tax and exchange controls and any other applicable laws. |

Any

subsequent distribution of the securities in Italy must be made in compliance with the public offer and prospectus requirement rules

provided under Decree No. 58 and the Regulation No. 11971 as amended, unless an exception from those rules applies. Failure to comply

with such rules may result in the sale of such securities being declared null and void and in the liability of the entity transferring

the securities for any damages suffered by the investors.

Japan

The

securities have not been and will not be registered under Article 4, paragraph 1 of the Financial Instruments and Exchange Law of Japan

(Law No. 25 of 1948), as amended (the “FIEL”) pursuant to an exemption from the registration requirements applicable to a

private placement of securities to Qualified Institutional Investors (as defined in and in accordance with Article 2, paragraph 3 of

the FIEL and the regulations promulgated thereunder). Accordingly, the securities may not be offered or sold, directly or indirectly,

in Japan or to, or for the benefit of, any resident of Japan other than Qualified Institutional Investors. Any Qualified Institutional

Investor who acquires securities may not resell them to any person in Japan that is not a Qualified Institutional Investor, and acquisition

by any such person of securities is conditional upon the execution of an agreement to that effect.

Portugal

This

document is not being distributed in the context of a public offer of financial securities (oferta pública de valores mobiliários)

in Portugal, within the meaning of Article 109 of the Portuguese Securities Code (Código dos Valores Mobiliários). The

securities have not been offered or sold and will not be offered or sold, directly or indirectly, to the public in Portugal. This document

and any other offering material relating to the securities have not been, and will not be, submitted to the Portuguese Securities Market

Commission (Comissăo do Mercado de Valores Mobiliários) for approval in Portugal and, accordingly, may not be distributed

or caused to distributed, directly or indirectly, to the public in Portugal, other than under circumstances that are deemed not to qualify

as a public offer under the Portuguese Securities Code. Such offers, sales and distributions of securities in Portugal are limited to

persons who are “qualified investors” (as defined in the Portuguese Securities Code). Only such investors may receive this

document and they may not distribute it or the information contained in it to any other person.

Sweden

This

document has not been, and will not be, registered with or approved by Finansinspektionen (the Swedish Financial Supervisory Authority).

Accordingly, this document may not be made available, nor may the securities be offered for sale in Sweden, other than under circumstances

that are deemed not to require a prospectus under the Swedish Financial Instruments Trading Act (1991:980) (Sw. lag (1991:980) om handel

med finansiella instrument). Any offering of securities in Sweden is limited to persons who are “qualified investors” (as

defined in the Financial Instruments Trading Act). Only such investors may receive this document and they may not distribute it or the

information contained in it to any other person.

Switzerland

The

securities may not be publicly offered in Switzerland and will not be listed on the SIX Swiss Exchange (“SIX”) or on any

other stock exchange or regulated trading facility in Switzerland. This document has been prepared without regard to the disclosure standards

for issuance prospectuses under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses

under art. 27 ff. of the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland.

Neither this document nor any other offering material relating to the securities may be publicly distributed or otherwise made publicly

available in Switzerland.

Neither

this document nor any other offering material relating to the securities have been or will be filed with or approved by any Swiss regulatory

authority. In particular, this document will not be filed with, and the offer of securities will not be supervised by, the Swiss Financial

Market Supervisory Authority (FINMA).

This

document is personal to the recipient only and not for general circulation in Switzerland.

United

Arab Emirates

Neither

this document nor the securities have been approved, disapproved or passed on in any way by the Central Bank of the United Arab Emirates

or any other governmental authority in the United Arab Emirates, nor has the Company received authorization or licensing from the Central

Bank of the United Arab Emirates or any other governmental authority in the United Arab Emirates to market or sell the securities within

the United Arab Emirates. This document does not constitute and may not be used for the purpose of an offer or invitation. No services

relating to the securities, including the receipt of applications and/or the allotment or redemption of such shares, may be rendered

within the United Arab Emirates by the Company.

No

offer or invitation to subscribe for securities is valid or permitted in the Dubai International Financial Centre.

United

Kingdom

Neither

the information in this document nor any other document relating to the offer has been delivered for approval to the Financial Services

Authority in the United Kingdom and no prospectus (within the meaning of section 85 of the Financial Services and Markets Act 2000, as

amended (“FSMA”) has been published or is intended to be published in respect of the securities. This document is issued

on a confidential basis to “qualified investors” (within the meaning of section 86(7) of FSMA) in the United Kingdom, and

the securities may not be offered or sold in the United Kingdom by means of this document, any accompanying letter or any other document,

except in circumstances which do not require the publication of a prospectus pursuant to section 86(1) FSMA. This document should not

be distributed, published or reproduced, in whole or in part, nor may its contents be disclosed by recipients to any other person in

the United Kingdom.

Any

invitation or inducement to engage in investment activity (within the meaning of section 21 of FSMA) received in connection with the

issue or sale of the securities has only been communicated or caused to be communicated and will only be communicated or caused to be

communicated in the United Kingdom in circumstances in which section 21(1) of FSMA does not apply to the Company.

In

the United Kingdom, this document is being distributed only to, and is directed at, persons (i) who have professional experience in matters

relating to investments falling within Article 19(5) (investment professionals) of the Financial Services and Markets Act 2000 (Financial

Promotions) Order 2005 (“FPO”), (ii) who fall within the categories of persons referred to in Article 49(2)(a) to (d) (high

net worth companies, unincorporated associations, etc.) of the FPO or (iii) to whom it may otherwise be lawfully communicated (together

“relevant persons”). The investments to which this document relates are available only to, and any invitation, offer or agreement

to purchase will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document

or any of its contents.

Canada

The

securities may be sold in Canada only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors,

as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted

clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale

of the securities must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements

of applicable securities laws. Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies