Castor Maritime Inc. Announces the Sale of the M/V Magic Moon for $11.8 Million and the Completion of the Sale of the M/V Magic Phoenix

November 28 2023 - 9:00AM

Castor Maritime Inc. (NASDAQ: CTRM), (“Castor” or the “Company”), a

diversified global shipping company, announces that on November 10,

2023, the Company entered into an agreement with an unaffiliated

third party for the sale of the M/V Magic Moon, a 2005-built

Panamax bulk carrier vessel, for a price of $11.8 million. The

vessel is expected to be delivered to its new owner by the end of

the fourth quarter of 2023.

The Company expects to record during the fourth

quarter of 2023 a net gain of approximately $3.0 million from the

sale of the M/V Magic Moon, excluding any transaction related

costs.

Furthermore, on November 27, 2023, the Company

completed the previously announced sale of the M/V Magic Phoenix, a

2008-built Panamax bulk carrier vessel, for a price of $14.0

million, by delivering the vessel to its new owner.

The Company expects to record during the fourth

quarter of 2023 a net loss of approximately $2.6 million from the

sale of the M/V Magic Phoenix, excluding any transaction-related

costs.

About Castor Maritime Inc.

Castor Maritime Inc. is an international

provider of shipping transportation services through its ownership

of oceangoing cargo vessels.

Castor owns a fleet of 18 vessels, with an

aggregate capacity of 1.5 million dwt, currently consisting of one

Capesize vessel, six Kamsarmax vessels, including the M/V Magic

Argo that the Company agreed to sell on September 22, 2023, nine

Panamax dry bulk vessels, including the M/V Magic Moon, and two

2,700 TEU containership vessels.

For more information, please visit the Company’s

website at www.castormaritime.com. Information on our website does

not constitute a part of this press release.

Cautionary Statement Regarding

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”)

and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Forward-looking statements include statements

concerning plans, objectives, goals, strategies, future events or

performance, and underlying assumptions and other statements, which

are other than statements of historical facts. We are including

this cautionary statement in connection with this safe harbor

legislation. The words “believe”, “anticipate”, “intend”,

“estimate”, “forecast”, “project”, “plan”, “potential”, “will”,

“may”, “should”, “expect”, “pending” and similar expressions

identify forward-looking statements. The forward-looking statements

in this press release are based upon various assumptions, many of

which are based, in turn, upon further assumptions, including

without limitation, our management’s examination of current or

historical operating trends, data contained in our records and

other data available from third parties. Although we believe that

these assumptions were reasonable when made, because these

assumptions are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond our control, we cannot assure you that we will achieve or

accomplish these forward-looking statements, including these

expectations, beliefs or projections. We undertake no obligation to

update any forward-looking statement, whether as a result of new

information, future events or otherwise. In addition to these

important factors, other important factors that, in our view, could

cause actual results to differ materially from those discussed in

the forward‐looking statements include factors and uncertainties

related to the Company’s and its counterparty’s ability to

consummate the transaction discussed herein or the occurrence of

any event, change or other circumstance that could cause us to

record a different net gain or loss than expected on the sale of

the M/V Magic Phoenix, the M/V Magic Moon and the M/V Magic Argo,

factors and uncertainties in connection with the effects of the

Company’s spin-off transaction or any similar transaction, our

business strategy, dry bulk and containership market conditions and

trends, the rapid growth of our fleet, the consummation of any sale

of any of our vessels, our relationships with our current and

future service providers and customers, our ability to borrow under

existing or future debt agreements or to refinance our debt on

favorable terms and our ability to comply with the covenants

contained therein, our continued ability to enter into time or

voyage charters with existing and new customers and to re-charter

our vessels upon the expiry of the existing charters, changes in

our operating and capitalized expenses, our ability to fund future

capital expenditures and investments in the acquisition and

refurbishment of our vessels, instances of off-hire, future sales

of our securities in the public market and our ability to maintain

compliance with applicable listing standards, volatility in our

share price, potential conflicts of interest involving members of

our board of directors, senior management and certain of our

service providers that are related parties, general domestic and

international political conditions or events (including armed

conflicts, “trade wars”, global public health threats and major

outbreaks of disease), existing or future disputes, proceedings or

litigation, including the outcome or costs associated with the

Company’s previously announced efforts to recover compensation and

damages in relation to the terminated prior sale of the M/V Magic

Moon, changes in seaborne and other transportation, changes in

governmental rules and regulations or actions taken by regulatory

authorities, and the impact of adverse weather and natural

disasters. Please see our filings with the Securities and Exchange

Commission for a more complete discussion of these and other risks

and uncertainties. The information set forth herein speaks only as

of the date hereof, and we disclaim any intention or obligation to

update any forward‐looking statements as a result of developments

occurring after the date of this communication.

CONTACT DETAILS

For further information please contact:

Petros PanagiotidisCastor Maritime Inc. Email:

ir@castormaritime.com

Media Contact: Kevin Karlis Capital LinkEmail:

castormaritime@capitallink.com

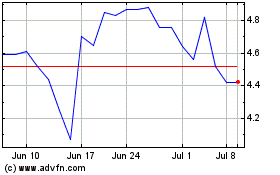

Castor Maritime (NASDAQ:CTRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

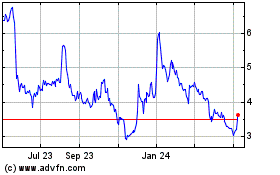

Castor Maritime (NASDAQ:CTRM)

Historical Stock Chart

From Apr 2023 to Apr 2024