U.S. index futures show a slight decline in Monday’s pre-market.

This scenario is a response to the recent increase in U.S. interest

rates, the drop in oil prices, and unfavorable economic indicators

from China influencing market movements.

As of 05:59 AM, Dow Jones futures (DOWI:DJI) fell 28 points, or

0.08%. S&P 500 futures declined by 0.08% and Nasdaq-100 futures

dropped 0.07%. The yield on 10-year Treasury bonds was at

4.466%.

In the commodities market, West Texas Intermediate crude for

January fell 1.71%, to $74.25 per barrel. Brent crude for January

decreased by 1.63%, near $79.27 per barrel. Iron ore with a 62%

concentration, traded on the Dalian exchange, rose 0.36%, priced at

$136.93 per ton.

On the economic agenda this Friday, investors await, at 10:00

AM, the Census Bureau’s report on new home sales. It’s expected

that sales of newly constructed single-family homes will fall to a

seasonally adjusted annual rate of 700,000 in October, from 759,000

in September. The Dallas Fed will release its November

manufacturing index at 10:30 AM. At 11:00 AM, the government will

hold an auction for two-year Treasuries, and at 13:00 PM, a

five-year Treasury auction will take place.

U.S. retail sales on Black Friday increased by 2.5% from the

previous year, excluding the automotive sector, as reported by

Mastercard SpendingPulse. While online sales grew by 8.5%, in-store

sales increased by 1.1%. American shoppers spent $9.8 billion

online, aligning with Adobe Analytics’ forecasts.

In Europe, with a light agenda, agents await a speech at 09:00

AM by Christine Lagarde, President of the European Central Bank

(ECB), at the European Parliament.

Asian markets closed lower, influenced by concerns about the

Chinese economy, which showed its weakness with a 7.8% drop in

industrial profits in October. In China, the Beijing Stock

Exchange, established two years ago to support small businesses,

adopted a new policy prohibiting major shareholders of listed

companies from selling their shares. Meanwhile, in Japan, the

president of the Central Bank, Kazuo Ueda, stated that the

institution is not sure of sustainably and stably achieving the 2%

inflation target.

U.S. stocks had a weak performance on Friday due to the

Thanksgiving holiday, with the Dow Jones and S&P 500 reaching

their best closing levels in three months. The Dow rose 0.33% and

the S&P 500 advanced 0.06%, while the Nasdaq fell 0.11%.

Sectors such as airlines and tobacco saw gains, while the computer

hardware market experienced losses.

Investors will be watching Monday’s corporate earnings reports

from Cerence (NASDAQ:CRNC), Anavex Life

Sciences (NASDAQ:AVXL) before the market opens. After the

close, reports from Zscaler (NASDAQ:ZS),

Seadrill (NYSE:SDRL), Grupo

Supervielle (NYSE:SUPV), among others, will be

observed.

This week, Zscaler and

Crowdstrike (NASDAQ:CRWD) are expected to

highlight the focus on cybersecurity following recent corporate

attacks. Salesforce (NYSE:CRM) and Dell

Technologies (NYSE:DELL) are expected to report slower

sales growth due to reduced corporate IT spending. Other results,

such as those from Foot Locker (NYSE:FL) and

Intuit (NASDAQ:INTU), will also reflect the trend

of reduced business and consumer spending. Canadian banks’ profits

will show the impact of higher interest rates and a weaker economy,

with weak loan demand and slowing bank deposit growth.

Wall Street Corporate Highlights for Today

Amazon (NASDAQ:AMZN), Walmart

(NYSE:WMT) – On Cyber Monday, record spending of $12 billion is

expected, up 5.4% from last year. Retailers like Amazon and Walmart

offered significant discounts, with expectations of mobile

purchases surpassing desktop for the first time. Late shopping may

boost additional sales.

Alibaba (NYSE:BABA) – Alibaba Group has closed

its quantum computing research lab, signaling a possible

continuation of cuts to improve financial results. The company will

donate equipment to Zhejiang University, and about 30 employees may

lose their jobs. The decision comes amid a reform led by Joseph

Tsai and Eddie Wu, raising speculation about additional changes at

the company. Additionally, Jack Ma sparked speculation about his

next ventures by founding “Hangzhou Ma’s Kitchen Food,” a packaged

agricultural products company with an initial capital of $1.4

million. Since his step back following the government crackdown in

2020, Ma has devoted himself to agricultural and educational

activities.

Walt Disney (NYSE:DIS) – Disney’s “Wish” failed

at the holiday box office, ranking third with $19.5 million, behind

Lions Gate’s “Hunger Games” and Sony’s “Napoleon.” This marks a

decline for Disney, which previously dominated this season.

EQT AB (NYSE:EQT) – Swedish EQT AB acquired a

majority stake in Japanese HR software startup HRBrain Inc. Founder

Hiroki Hori will retain a significant stake. Financial details were

not disclosed. EQT seeks to boost young companies in Japan, aiming

for more similar deals.

HSBC (NYSE:HSBC) – HSBC customers in the UK

reported issues accessing mobile and online banking services on

Friday, with over 4,000 complaints at the peak. The bank confirmed

the outage, attributed to an internal problem, during one of the

busiest shopping days.

UBS (NYSE:UBS) – UBS Asset Management is

focusing on improving its existing infrastructure investments due

to the weak trading environment. They are upgrading wind parks in

Texas and fiber networks in France and Germany. The company is

targeting companies involved in the energy transition and

digitalization.

Deutsche Bank (NYSE:DB) – Deutsche Bank’s asset

manager DWS hired Dan Robinson to lead alternative credit in EMEA,

targeting growth in private credit. This is part of the company’s

expansion strategy in alternatives and partnerships with regional

German banks.

Berkshire Hathaway (NYSE:BRK.B) – Warren

Buffett’s Berkshire Hathaway sold its stake in India’s Paytm for

approximately $164.70 million through a bulk deal. BH International

Holdings offloaded over 15.6 million shares of the digital payments

company at an average price of 877.29 rupees per share. The sale

follows stake reductions by SoftBank (TG:SFTA) and

Alibaba (NYSE:BABA), with the buyer of Paytm’s

shares still unknown.

Sumitomo Mitsui Financial Group (NYSE:SMFG) –

Sumitomo Mitsui Financial Group CEO Jun Ohta passed away on

November 25 at 65 due to pancreatic cancer. Japan’s second-largest

bank will soon announce a successor, with Vice President Toru

Nakashima temporarily taking over. Ohta, who led SMFG since April

2019, was also vice-chairman of Keidanren and sought international

expansion in partnership with Jefferies Financial

Group (NYSE:JEF).

Lloyds Banking Group (NYSE:LYG) – Lloyds Bank,

the UK’s largest high street bank, may cut about 2,500 jobs in a

restructuring, aiming to reduce costs. The move includes

consultations with several employees, with plans to create 120 new

positions, according to a source familiar.

Tesla (NASDAQ:TSLA) – Elon Musk will visit

Israel to meet with political leaders and discuss online

anti-Semitism, following controversies at X. He will also explore

the Starlink project to support communications during war.

Additionally, tension between Swedish unions and Tesla escalated

with Hydro Extrusions supporting the demand for a collective work

agreement for Tesla’s mechanics in Sweden. About 50 Hydro workers

stopped, aiming to pressure Tesla to negotiate. Elsewhere, Tesla

plans to invest up to $2 billion to establish a factory in India,

conditional on reducing import taxes to 15% for the first two

years, according to the Economic Times. Tesla is willing to invest

$500 million for 12,000 vehicles and up to $2 billion for 30,000,

awaiting government approval.

Toyota Motor Corp (NYSE:TM) – Toyota has the

largest gap between its corporate guidance and analysts’ average

net income projection for the fiscal year on the Topix index. This

reflects optimistic expectations due to the weak yen. Other

companies also have profit forecasts above analysts’ estimates, but

Toyota leads this trend. The automaker raised its profit outlook,

driven by the weak yen and better raw material prices, but still

fell short of analysts’ average projections. Analysts believe

Toyota issues conservative forecasts and is already ahead of its

production plans.

Philip Morris International (NYSE:PM) – The

Foundation for a Smoke-Free World, initially backed by Philip

Morris International, will reject future funding from the nicotine

industry to gain credibility in tobacco control, as stated by the

CEO. The foundation, established in 2017 with financial commitment

from PMI, seeks new funders, rebranding its image and identity.

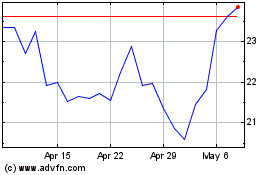

Foot Locker (NYSE:FL)

Historical Stock Chart

From Mar 2024 to Apr 2024

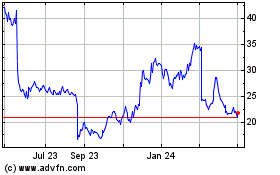

Foot Locker (NYSE:FL)

Historical Stock Chart

From Apr 2023 to Apr 2024