As filed with the Securities and Exchange

Commission on November 27, 2023

Registration No. 333-273370

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SENESTECH, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

2879 |

|

20-2079805 |

| (State or other jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Classification Code Number) |

|

Identification Number) |

23460 N 19th Ave., Suite 110

Phoenix, Arizona 85027

(928) 779-4143

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Joel L. Fruendt

President and Chief Executive Officer

SenesTech, Inc.

23460 N 19th Ave., Suite 110

Phoenix, Arizona 85027

(928) 779-4143

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Brian H. Blaney, Esq.

Katherine A. Beck, Esq.

Stephanie T. Graffious, Esq.

Greenberg Traurig, LLP

2375 E. Camelback Road, Suite 800

Phoenix, Arizona 85016

(602) 445-8000 |

Rick A. Werner, Esq.

Jayun Koo, Esq.

Haynes and Boone, LLP

30 Rockefeller Plaza, 26th Floor

New York, New York 10112

(212) 659-7300 |

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On August 18, 2023, our stockholders approved

a reverse stock split of our common stock, par value $0.001 per share, at a ratio of not less than 1-for-2 and not more than 1-for-12,

with the actual ratio to be determined by our board of directors (the “2023 Reverse Split”). On November 7, 2023, our board

of directors determined that the 2023 Reverse Split shall be completed as a 1-for-12 reverse stock split. Following such approval, we

filed an amendment to our amended and restated certificate of incorporation with the Secretary of State of the State of Delaware to effect

the 2023 Reverse Split, with an effective time of 4:01 p.m. Eastern Time on November 16, 2023. The number of authorized shares of our

common stock remains unchanged at 100,000,000 shares after the 2023 Reverse Split. As a result of the 2023 Reverse Split, every 12 shares

of our common stock, either issued or outstanding, immediately prior to the filing and effectiveness of our amendment to amended and

restated certificate of incorporation filed with the Secretary of State of the State of Delaware, was automatically combined and converted

(without any further act) into one share of fully paid and nonassessable share of common stock. No fractional shares were issued in connection

with the 2023 Reverse Split. Each fractional share of common stock was either (i) rounded up to the nearest whole share of common stock,

if such shares of common stock were held directly; or (ii) rounded down to the nearest whole share of common stock, if such shares were

subject to an award granted under our 2018 Equity Incentive Plan, in order to comply with the requirements of Sections 409A and 424 of

the Internal Revenue Code of 1986 (and no consideration paid therefor). The 2023 Reverse Split had the effect of reducing the aggregate

number of outstanding shares of common stock from 5,899,060 shares on a pre-reverse split basis to a total of 492,293 shares outstanding

on a post-reverse split basis and reducing the percentage of common stock held by our existing stockholders on a post-offering basis

from 5.9% of our 100,000,000 authorized shares to 0.05% of our 100,000,000 authorized shares (assuming that none of the warrants to be

issued in connection with this offering are exercised).

All financial information, share numbers,

option numbers, warrant numbers, other derivative security numbers and exercise prices appearing in this registration statement have

been adjusted to give effect to the 2023 Reverse Split. Documents incorporated by reference into this registration statement that were

filed prior to November 16, 2023 do not give effect to the 2023 Reverse Split.

The information in

this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed

with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we

are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION, DATED NOVEMBER 27, 2023 |

SenesTech, Inc.

Up to 2,020,202 Shares of Common Stock

and Accompanying Series D Warrants to Purchase up to 2,020,202 Shares of Common Stock and Series E Warrants to Purchase up to 2,020,202

Shares of Common Stock

Pre-Funded Warrants to Purchase up to 2,020,202

Shares of Common Stock and Accompanying Series D Warrants to Purchase up to 2,020,202 Shares of Common Stock and Series E Warrants to

Purchase up to 2,020,202 Shares of Common Stock

Up to 2,020,202 Shares of Common Stock Underlying

the Pre-Funded Warrants, up to 2,020,202 Shares of Common Stock Underlying the Series D Warrants and up to 2,020,202 Shares of Common

Stock Underlying the Series E Warrants

Placement Agent Warrants to Purchase

151,515 Shares of Common Stock

Up to 151,515 Shares of Common Stock Underlying

the Placement Agent Warrants

We are offering up to 2,020,202 shares

of our common stock, par value $0.001 per share (“Common Stock”), together with Series D warrants (the “Series D Warrants”)

to purchase up to 2,020,202 shares of our Common Stock and Series E warrants (the “Series E Warrants” and, together

with the Series D Warrants, the “Series Warrants”) to purchase up to 2,020,202 shares of our Common Stock at an assumed

combined public offering price of $2.97 per share of Common Stock and the accompanying Series D Warrant and Series E Warrant, which is

equal to the last reported sale price per share of our Common Stock on the Nasdaq Capital Market (“Nasdaq”) on November 20,

2023, (and the shares of Common Stock that are issuable from time to time upon exercise of the Series Warrants) pursuant to this prospectus.

Each share of Common Stock is being offered together with a Series D Warrant to purchase one share of Common Stock and a Series E Warrant

to purchase one share of Common Stock. The shares of Common Stock and Series Warrants will be issued separately but must be purchased

together. The Series Warrants have an exercise price of $[●] per share and will become exercisable on the effective date of stockholder

approval for the issuance of the shares upon exercise of the Series Warrants (or, if permitted by the applicable rules and regulations

of Nasdaq, upon payment by the holder of $0.125 per share in addition to the applicable exercise price). The Series D Warrants will expire

five years from the date of issuance, and the Series E Warrants will expire 18 months from the date of issuance.

We are also offering to those purchasers,

if any, whose purchase of our Common Stock in this offering would otherwise result in such purchaser, together with its affiliates and

certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common

Stock immediately following the consummation of this offering, the opportunity, in lieu of purchasing Common Stock, to purchase pre-funded

warrants to purchase up to 2,020,202 shares of our Common Stock (the “Pre-Funded Warrants”). Each Pre-Funded Warrant is being

issued together with the same Series Warrants described above being issued with each share of Common Stock. The purchase price of each

Pre-Funded Warrant will equal the price per share at which shares of our Common Stock are being sold to the public in this offering,

minus $0.0001, and the exercise price of each Pre-Funded Warrant will equal $0.0001 per share of Common Stock. Each Pre-Funded Warrant

will be exercisable upon issuance and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. The Pre-Funded

Warrants and Series Warrants must be purchased together but are immediately separable and will be issued separately in this offering.

For each Pre-Funded Warrant and accompanying Series Warrants purchased in this offering in lieu of Common Stock, we will reduce the number

of shares of Common Stock being sold in the offering by one. Pursuant to this prospectus, we are also offering the shares of Common Stock

issuable upon the exercise of the Series Warrants and the Pre-Funded Warrants. This prospectus also relates to the offering of 151,515

Placement Agent Warrants (as such term is defined below) and 151,515 shares of Common Stock issuable upon exercise of the Placement Agent

Warrants.

Each Pre-Funded Warrant is exercisable for one

share of our Common Stock (subject to adjustment as provided for therein), provided that the holder will be prohibited from exercising

Pre-Funded Warrants for shares of our Common Stock if, as a result of such exercise, the holder, together with its affiliates, would own

more than 4.99% of the total number of shares of our Common Stock then issued and outstanding. However, any holder may increase such percentage

to any other percentage not in excess of 9.99%, provided that any increase in such percentage shall not be effective until 61 days after

such notice to us.

We have engaged H.C. Wainwright & Co.,

LLC (the “Placement Agent”) to act as our exclusive placement agent in connection with the securities offered by this prospectus.

The Placement Agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus.

The Placement Agent is not purchasing or selling any of the securities we are offering, and the Placement Agent is not required to arrange

the purchase or sale of any specific number of securities or dollar amount. This offering will terminate on [●], 2023 unless the

offering is fully subscribed before that date or we decide to terminate the offering (which we may do at any time in our discretion)

prior to that date. There will only be one closing in connection with this offering. The combined public offering price per share (or

Pre-Funded Warrant) and Series Warrants will be fixed for the duration of this offering.

Our Common Stock is listed on Nasdaq under the

symbol “SNES.” There is no established public trading market for the Pre-Funded Warrants or Series Warrants, and we do not

expect a market to develop. In addition, we do not intend to apply for the listing of the Pre-Funded Warrants or Series Warrants on any

national securities exchange. Without an active trading market, the liquidity of the Series Warrants and the Pre-Funded Warrants will

be limited.

Effective

November 16, 2023, we amended our amended and restated certificate of incorporation to effect

a 1-for-12 reverse split of our issued and outstanding shares of our Common Stock. All share

and per share data in this prospectus gives effect to the reverse stock split. Documents

incorporated by reference into this prospectus that were filed prior to November 16, 2023

do not give effect to the reverse stock split.

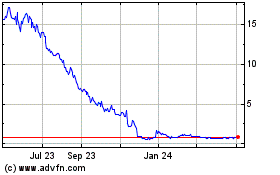

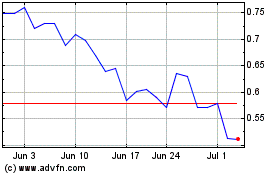

On

November 20, 2023, the last reported sale price for our Common Stock on Nasdaq was $2.97

per share. The public offering price per share of Common Stock and/or any Pre-Funded Warrant,

together with the Series Warrants that accompany Common Stock or a Pre-Funded Warrant, will

be determined between us, the Placement Agent and the investors in this offering at the time

of pricing and may be at a discount to the current market price. Therefore, the recent market

price of $2.97 per share of Common Stock used throughout this prospectus as the assumed combined

public offering price per share of Common Stock or Pre-Funded Warrant, as applicable, and

accompanying Series Warrants may not be indicative of the actual combined public offering

price per share for our Common Stock or Pre-Funded Warrant, as applicable, and the accompanying

Series Warrants.

We

have agreed to pay the Placement Agent the Placement Agent fees set forth in the table below, which assumes that we sell all of the securities

offered by this prospectus. We will bear all costs associated with this offering. See “Plan of Distribution” on page 20 of

this prospectus for more information regarding these arrangements. There is no minimum number of shares of Common Stock or Pre-Funded

Warrants or minimum aggregate amount of proceeds that is a condition for this offering to close. We may sell fewer than all of the shares

of Common Stock and Pre-Funded Warrants (and accompanying Series Warrants) offered hereby, which may significantly reduce the amount

of proceeds received by us, and investors in this offering will not receive a refund if we do not sell all of the securities offered

hereby. There is no minimum number of securities or amount of proceeds required as a condition of closing of this offering. In addition,

since we will deliver the securities to be issued in this offering upon our receipt of investor funds, we have not established an escrow

account, trust or similar arrangement in connection with this offering. Because there is no escrow account, trust or similar arrangement

in connection with this offering and no minimum number of securities or amount of proceeds, investors could be in a position where they

have invested in us, but we have not raised sufficient proceeds in this offering to adequately fund the intended uses of the proceeds

as described in this prospectus. Further, any proceeds from the sale of securities offered by us will be available for our immediate

use despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. See the section

entitled “Risk Factors” on page 6 for more information.

| | |

Per

Share and

Series Warrants | | |

Per Pre-Funded Warrant

and Series Warrants | | |

Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Placement Agent fees(1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds, before expenses, to us(2) | |

$ | | | |

$ | | | |

$ | | |

| (1) | We

have agreed to (i) pay the Placement Agent a cash fee equal to 7.5% of the aggregate gross

proceeds raised in this offering, (ii) pay the Placement Agent a management fee equal

to 1.0% of the aggregate gross proceeds raised in this offering, (iii) pay the Placement

Agent for non-accountable expenses in an amount up to $40,000 or 3% of the aggregate gross

proceeds of this offering, whichever is less, (iv) pay the Placement Agent for its reasonable

and documented out-of-pocket expenses, including legal fees of up to $100,000, and (v) pay

the Placement Agent for its closing costs, including clearing fees, in an amount of up to

$15,950 in connection with this offering. In addition, we have agreed to issue to the Placement

Agent or its designees as compensation in connection with this offering warrants (the “Placement

Agent Warrants”) to purchase a number of shares of Common Stock equal to 7.5% of the

shares of Common Stock sold in this offering (including the shares of Common Stock issuable

upon the exercise of the Pre-Funded Warrants), at an exercise price of $[●] per share,

which represents 125% of the combined public offering price per share and accompanying Series

Warrants. See “Plan of Distribution” for a description of the compensation to

be received by the Placement Agent. |

| (2) | We

estimate the total expenses of this offering payable by us, excluding the placement agent fees, will be approximately $195,000. Because

there is no minimum number of securities or amount of proceeds required as a condition to closing in this offering, the actual public

offering amount, Placement Agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than

the total maximum offering amounts set forth above. For more information, see “Plan of Distribution.” |

This prospectus, including such information that

is incorporated by reference, contains summaries of certain provisions contained in some of the documents described herein, but reference

is made to the actual documents for complete information. All the summaries are qualified in their entirety by the actual documents. Copies

of some of the documents referred to herein have been filed or have been incorporated by reference as exhibits to the registration statement

of which this prospectus forms a part, and you may obtain copies of those documents as described in this prospectus under the heading

“Where You Can Find Additional Information.”

Investing in our securities involves a high

degree of risk. Please read “Risk Factors” beginning on page 6 of this prospectus as well as any other risk factors

and other information contained in any other document that is incorporated by reference herein.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense. The securities are not being offered in any jurisdiction where the offer is

not permitted.

Delivery of the Common Stock, Pre-Funded Warrants

and the Series Warrants offered hereby is expected to be made on or about [●], 2023, subject to satisfaction of certain customary

closing conditions.

H.C.

Wainwright & Co.

The date of this prospectus is

, 2023

TABLE OF CONTENTS

You should read this prospectus and the information

incorporated by reference in this prospectus and any applicable prospectus supplement before making an investment in our securities. Please

read “Where You Can Find Additional Information” for more information. We have not and the Placement Agent has not authorized

anyone to provide you with any information or to make any representation, other than those contained in this prospectus and the documents

incorporated by reference or any free writing prospectus we have prepared. We take no responsibility for, and provide no assurance as

to the reliability of, any other information that others may give you. The information contained in this prospectus or incorporated by

reference in this prospectus is accurate only as of its date, or the date of the applicable document incorporated by reference, regardless

of the time of delivery of this prospectus or of any sale of our Common Stock and Series Warrants. Our business, financial condition,

results of operations and prospects may have changed since that date.

For investors outside the United States: We have

not done anything that would permit possession or distribution of this prospectus in any jurisdiction where action for that purpose is

required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves

about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United

States.

about

this prospectus

The registration statement of which this prospectus

forms a part that we have filed with the Securities and Exchange Commission (the “SEC”) includes exhibits that provide more

detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together

with the additional information described under the headings “Where You Can Find Additional Information” and “Incorporation

of Certain Information by Reference” before making your investment decision.

You should rely only on the information provided

in or incorporated by reference in this prospectus, in any prospectus supplement or in a related free writing prospectus, or documents

to which we otherwise refer you. We have not authorized anyone else to provide you with different information.

We have not authorized any dealer, agent or other

person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus

and any accompanying prospectus supplement or any related free writing prospectus. You must not rely upon any information or representation

not contained or incorporated by reference in this prospectus or an accompanying prospectus supplement or any related free writing prospectus.

This prospectus and any accompanying prospectus supplement and any related free writing prospectus, if any, do not constitute an offer

to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus

and any accompanying prospectus supplement and any related free writing prospectus, if any, constitute an offer to sell or the solicitation

of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You should not assume that the information contained in this prospectus and any accompanying prospectus supplement and any related free

writing prospectus, if any, is accurate on any date subsequent to the date set forth on the front of such document or that any information

we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though

this prospectus and any accompanying prospectus supplement and any related free writing prospectus is delivered or securities are sold

on a later date.

We have not done anything that would permit this

offering or possession or distribution of this prospectus or any free writing prospectus in any jurisdiction where action for that purpose

is required, other than in the United States. You are required to inform yourself about and to observe any restrictions relating as to

this offering and the distribution of this prospectus and any such free writing prospectus outside the United States.

We further note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus

were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among

the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should

not be relied on as accurately representing the current state of our affairs.

You should also read and consider the information

in the documents to which we have referred you under the caption “Where You Can Find Additional Information” in this prospectus.

In addition, this prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference

is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents.

Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to

the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the

heading “Where You Can Find Additional Information.”

Unless

the context otherwise requires, references in this prospectus to “SenesTech,”

“we,” “us,” “our” and “our company” refer

to SenesTech, Inc., a Delaware corporation, and our subsidiaries. Our registered trademarks

currently used in the United States include SenesTech, our logo, including “Sound science.

Effective solutions.”, Contrapest, and Evolve. Solely for convenience, trademarks and

tradenames referred to in this prospectus may appear without the ® or ™ symbols,

but such references are not intended to indicate in any way that we will not assert, to the

fullest extent under applicable law, our rights, or that the applicable owner will not assert

its rights, to these trademarks and tradenames. We do not intend our use or display of other

companies’ trade names or trademarks to imply a relationship with, or endorsement or

sponsorship of us by, any other companies.

This prospectus contains and incorporates by reference

market data and industry statistics and forecasts that are based on our own internal estimates as well as independent industry publications

and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness

of this information and we have not independently verified this information. Although we are not aware of any misstatements regarding

the market and industry data presented in this prospectus or the documents incorporated herein by reference, these estimates involve risks

and uncertainties and are subject to change based on various factors, including those discussed under the headings “Risk Factors”

in this prospectus, and under similar headings in the other documents that are incorporated herein by reference. Accordingly, investors

should not place undue reliance on this information.

FORWARD-LOOKING

STATEMENTS

The statements contained in this prospectus that

are not historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). All statements other than statements of historical

facts contained or incorporated herein by reference in this prospectus, including statements regarding our future operating results, future

financial position, business strategy, objectives, goals, plans, prospects, markets, and plans and objectives for future operations, are

forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,”

“estimates,” “expects,” “intends,” “suggests,” “targets,” “contemplates,”

“projects,” “predicts,” “may,” “might,” “plan,” “would,” “should,”

“could,” “can,” “potential,” “continue,” “objective,” or the negative of those

terms, or similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these

identifying words. Specific forward-looking statements in this prospectus include statements regarding:

| ● | our belief that ContraPest is unique in the pest control industry in attacking the reproductive systems

of both male and female rats; |

| ● | our belief that our field data shows ContraPest will result in a sustained reduction of the rat population; |

| ● | our belief that ContraPest is the first and only fertility control product designed to be non-lethal that

has been registered with the EPA for the management of rat populations; |

| ● | our expectation to continue to pursue regulatory approvals and amendments to the existing U.S. registration

for ContraPest and regulatory approvals for additional jurisdictions beyond the United States; |

| ● | our expectation that we will continue to seek to comply with completion of testing and certifications

required by the EPA and state registrations; |

| ● | our belief that we will continue to research and develop enhancements to ContraPest that align with our

target verticals and to develop other potential fertility control options for additional markets and species; |

| ● | our expectation regarding the number of shares outstanding after this offering; |

| ● | our expectation to continue to incur significant expenses and operating losses for the foreseeable future; |

| ● | our intention to use the net proceeds of this offering for general corporate purposes, which may include

research and development expenses, capital expenditures, working capital and general and administrative expenses, and potential acquisitions

of or investments in businesses, products and technologies that complement our business, although we have no present commitments or agreements

to make any such acquisitions or investments as of the date of this prospectus; |

| ● | pending the intended uses described herein, our intention to invest the net proceeds of this offering

in short-term, investment grade, interest-bearing securities; and |

| ● | our belief that we do not anticipate paying any cash dividends to stockholders in the foreseeable future. |

These forward-looking statements are not guarantees

of future performance and involve known and unknown risks, uncertainties and situations that are difficult to predict and that may cause

our own, or our industry’s, actual results to be materially different from the future results that are expressed or implied by these

statements. Accordingly, actual results may differ materially from those anticipated or expressed in such statements as a result of a

variety of factors, including those discussed in Item 1A-“Risk Factors” of Part I of our Annual Report on Form 10-K, for the

year ended December 31, 2022, filed with the SEC on March 17, 2023, and those contained from time to time in our other filings with the

SEC. A number of factors could cause our actual results to differ materially from those indicated by the forward-looking statements. Such

factors include, among others, the following:

| ● | the successful commercialization of our products; |

| ● | market acceptance of our products; |

| ● | our financial performance, including our ability to fund operations; |

| ● | our ability to regain and maintain

compliance with Nasdaq’s continued listing requirements; and |

| ● | regulatory approval and regulation of our products and other factors and risks identified from time to

time in our filings with the SEC, including this prospectus. |

All forward-looking statements included herein

are based on information available to us as of the date hereof and speak only as of such date. Except as required by law, we undertake

no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. The forward-looking

statements contained in or incorporated by reference into this prospectus reflect our views as of the date of this prospectus about future

events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results, performance

or achievements to differ significantly from those expressed or implied in any forward-looking statement. Although we believe that the

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, performance or achievements.

PROSPECTUS

SUMMARY

This summary highlights information contained

in other parts of this prospectus or incorporated by reference into this prospectus from our filings with the SEC, as described later

in the prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing

in our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing

elsewhere in this prospectus, including the information incorporated by reference in this prospectus. You should read the entire prospectus

and the information incorporated by reference herein carefully, including the sections titled “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” our audited financial statements and the related notes,

which are incorporated herein by reference from our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC

on March 17, 2023, and our unaudited financial statements and the related notes, which are incorporated herein by reference from our

Quarterly Report on Form 10-Q for the three month period ended March 31, 2023, filed with the SEC on May 11, 2023, our Quarterly Report

on Form 10-Q for the three and six month periods ended June 30, 2023, filed with the SEC on August 11, 2023, and our Quarterly Report

on Form 10-Q for the three and nine month periods ended September 30, 2023, filed with the SEC on November 9, 2023. Please read “Where

You Can Find Additional Information” on page 23 of this prospectus.

Our Company

Overview

We have developed and are commercializing

a global, proprietary technology for managing animal pest populations, initially rat populations, through fertility control. Although

there are myriad tools available to control rat populations, most rely on some form of lethal method to achieve effectiveness. Each of

these solutions is inherently limited by rat species’ resilience and survival mechanisms as well as their extraordinary rate of

reproduction. ContraPest®, our initial product, is unique in the pest control industry in affecting the reproductive systems

of both male and female rats, which our field data shows will result in a sustained reduction of the rat population.

Rats have plagued humanity throughout history.

They pose significant threats to the health and food security of many communities. In addition, rodents cause significant product loss

and damage through consumption and contamination. Rats also cause significant damage to critical infrastructure by burrowing beneath foundations

and gnawing on electrical wiring, insulation, fire proofing systems, electronics and computer equipment.

The most prevalent solution to rat infestations

is the use of increasingly powerful rodenticides. Although these solutions provide short term results, there are growing concerns about

secondary exposure and bioaccumulation of rodenticides in the environment, about the development of resistance over time, as well as concerns

about rodenticides that have no antidotes. The pest management industry and pest management professionals (“PMPs”) are being

asked by their customers and their communities for new solutions that are both effective and less toxic. Our goal is to provide customers

with not only a highly effective solution to combat their most difficult rat problems, but also offer a non-lethal option to serve customers

that are looking to decrease or remove the amount of rodenticide used in their pest control programs.

ContraPest is a liquid bait containing the active

ingredients 4-vinylcyclohexene diepoxide (“VCD”) and triptolide, a botanically derived compound. ContraPest limits reproduction

of male and female rats beginning with the first breeding cycle following consumption. ContraPest is currently being marketed for use

in controlling Norway and roof rat populations.

We began the registration process with the United

States Environmental Protection Agency (the “EPA”) for ContraPest on August 23, 2015. On August 2, 2016, the EPA granted an

unconditional registration for ContraPest as a Restricted Use Product (“RUP”), due to the need for applicator expertise for

deployment. On October 18, 2018, the EPA approved the removal of the RUP designation. In addition to the EPA registration of ContraPest

in the United States, ContraPest must obtain registration from the various state regulatory agencies prior to selling in each state. We

have received registration for ContraPest in all 50 states and the District of Columbia, 49 of which have approved the removal of the

RUP designation.

We believe ContraPest is the first and only fertility

control product designed to be non-lethal that has been registered with the EPA for the management of rat populations. In case studies,

the addition of ContraPest to an integrated pest management system has improved the efficacy of the program up to 90% or more. ContraPest

is marketed to PMPs for incorporation into their services, as well as to end users who wish to perform their own pest management. We have

established a field sales force of six individuals who are arranged geographically as well as an e-commerce platform for direct sales

to consumers.

In the first quarter of 2022, we received approval

for and began marketing an additional dispenser format for ContraPest, the Elevate® Bait System with ContraPest. This system

provides an additional delivery method particularly appropriate for roof rat populations or any rat infestations that manifest above ground.

We expect to continue to pursue regulatory approvals

and amendments to the existing U.S. registration for ContraPest and regulatory approvals for additional jurisdictions beyond the United

States. On April 1, 2023 and May 18, 2023, we signed distribution agreements for the commercialization of ContraPest in the Maldives and

South Africa. In certain cases, our EPA and state registrations require completion of testing and certifications even though we have received

approval for the product or its labelling. We continue to seek to comply with these requirements.

We also continue to research and develop enhancements

to ContraPest that align with our target verticals and to develop other potential fertility control options for additional markets and

species. In November 2023, we launched our latest product, Evolve™, a soft bait containing the active ingredient cottonseed oil.

Evolve limits reproduction of male and female rats after one to two breeding cycles following consumption. Evolve is being developed

and marketed for use in controlling rat populations as a minimum risk pesticide under Section 25(b) of the U.S. Environmental Protection

Agency Federal Insecticide, Fungicide, and Rodenticide Act. We must obtain registration from the various state regulatory agencies that

do not accept the federal exemption. To date, we are authorized to sell Evolve in 15 states.

Our intellectual property portfolio supporting

ContraPest consists of nine international patent filings (in the United States, Europe, Canada, Brazil, Russia, Japan, Mexico, South

Korea and Australia) addressing the ContraPest compound. Claims directed toward the compound include composition-of-matter involving

a diterpenoid epoxide or salts thereof in combination with an organic diepoxide and use claims for inducing follicle depletion and for

reducing the reproductive capability of a mammalian animal or non-human mammalian population. Issued claims will have a patent term extending

to 2033 or longer based on patent term determinations in each of the filing countries. The novelty of ContraPest extends to its method

of field distribution and has required innovation to perfect the dosing of our product to rodents. We recently filed and received approval

for a U.S. patent application covering our liquid delivery system, which is used in our EVO bait station. The patent will expire in 2038.

We also recently filed a U.S. patent application covering our new soft bait product, Evolve.

For

a complete description of our business, financial condition, results of operations and other

important information, please read our filings with the SEC that are incorporated by reference

in this prospectus, including our Annual Report on Form 10-K for the year ended December

31, 2022; our Quarterly Reports on Form 10-Q for the periods ended March 31, 2023, June 30,

2023, and September 30, 2023; and our Current Reports on Form 8-K. For instructions on how

to find copies of these documents, please read “Where You Can Find Additional Information”

and “Incorporation of Certain Information by Reference.”

August 2023 Warrant Exercise and Issuance

On August 21, 2023, we entered into an inducement

offer letter agreement (the “Inducement Letter”) with a certain holder (the “Holder”) of certain of our existing

warrants to purchase up to (i) 6,453 shares of our common stock issued on October 26, 2020 and subsequently amended on November 16, 2022,

at an exercise price of $37.98 per share, as amended (the “October 2020 Warrants”), and (ii) 238,095 shares of common stock

issued on November 18, 2022, at an exercise price of $37.98 per share (the “November 2022 Warrants” and together with the

October 2020 Warrants, the “Existing Warrants). Pursuant to the Inducement Letter, the Holder agreed to exercise for cash its Existing

Warrants to purchase an aggregate of 244,548 shares of our common stock at a reduced exercise price of $8.6424 per share in consideration

of our agreement to issue new common stock purchase warrants (the “New Warrants”), as described below, to purchase up to

an aggregate of 489,097 shares of our common stock (the “New Warrant Shares”).

Our aggregate gross proceeds from the exercise

of the Existing Warrants by the Holder were approximately $2.1 million, before deducting placement agent fees and other offering expenses

payable by us. The transactions contemplated pursuant to the Inducement Letter closed on August 24, 2023. We used the net proceeds from

the transaction for general corporate purposes.

In connection with the transaction, we also

issued to H.C. Wainwright & Co, LLC, as the exclusive placement agent in connection with the transaction, or to its designees, as

part of the placement agent’s compensation, warrants to purchase up to 12,229 shares of common stock, which have the same terms

as the New Warrants except the placement agent warrants have an exercise price equal to $10.8036 per share.

Nasdaq Listing

Minimum Public Float Requirement

On November 20, 2023, we received a letter

from the listing qualifications staff (the “Staff”) of Nasdaq providing notification that we no longer meet the minimum of

500,000 publicly held shares requirement pursuant to Nasdaq Listing Rule 5550(a)(4). In accordance with Nasdaq rules, we have until January

4, 2024 to provide the Staff with a specific plan to achieve and sustain compliance with all listing requirements of Nasdaq, including

the time frame for completion of this plan. After reviewing our plan, Nasdaq will provide written notice of their decision. If Nasdaq

does not accept our plan, we will have the opportunity to appeal their decision to a hearings panel.

Minimum Bid Price Requirement

As previously disclosed, on August 25, 2023,

we received a letter from the Staff of Nasdaq providing notification that the bid price for our Common Stock had closed below $1.00 per

share for the previous 30 consecutive business days and our Common Stock no longer met the minimum bid price requirement for continued

listing under Nasdaq Listing Rule 5550(a)(2). We were provided a period of 180 calendar days, or until February 21, 2024, in which to

regain compliance with Nasdaq Listing Rule 5550(a)(2). To regain compliance, the closing bid price of our Common Stock must be $1.00

per share or more for a minimum of 10 consecutive business days at any time before February 21, 2024.

If we do not regain compliance with Nasdaq

Listing Rule 5550(a)(2) by February 21, 2024, we may be eligible for an additional 180 calendar day compliance period. To qualify, we

would need to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards

for the Nasdaq Capital Market, with the exception of the minimum bid price requirement, and would need to provide written notice of our

intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. However, if it

appears to the Staff that we will not be able to cure the deficiency, or if we are otherwise not eligible, Nasdaq would notify us that

our securities would be subject to delisting. In the event of such notification, we may appeal the Staff’s determination to delist

our securities, but there can be no assurance the Staff would grant our request for continued listing.

2023 Reverse Stock Split

On August 18, 2023, our stockholders

approved a reverse stock split of our Common Stock at a ratio of not less than 1-for-2 and not more than 1-for-12, with the actual

ratio to be determined by our board of directors (the “2023 Reverse Split”). On November 7, 2023, the Reverse Split

Committee of our board of directors approved a final split ratio of 1-for-12. Following such approval, we filed an amendment to our

amended and restated certificate of incorporation with the Secretary of State of the State of Delaware to effect the 2023 Reverse

Split, with an effective time of 4:01 p.m., Eastern Time on November 16, 2023. The 2023 Reverse Split had the effect of reducing the

aggregate number of our outstanding shares of common stock from 5,899,060 shares on a pre-reverse split basis to a total of 492,293

shares outstanding on a post-reverse split basis. The number of authorized shares of our Common Stock will remain unchanged at

100,000,000 shares after the 2023 Reverse Split. For more information, see “Selected Financial Data.”

Unless otherwise noted, the financial information,

share numbers, option numbers, warrant numbers, other derivative security numbers and exercise prices appearing in this prospectus, including

those as of dates prior to the completion of the 2023 Reverse Split, have been adjusted to give effect to the 2023 Reverse Split. Documents

incorporated by reference into the registration statement of which this prospectus forms a part that were filed prior to November 16,

2023 do not give effect to the 2023 Reverse Split.

Corporate and Other Information

We were incorporated in Nevada in July 2004

and reincorporated in Delaware in November 2015. Our principal executive offices are located at 23460 N 19th Ave., Suite 110,

Phoenix, AZ 85027, and our telephone number is (928) 779-4143. Our corporate website address is www.senestech.com. The information

contained on or accessible through our website is not a part of this prospectus and should not be relied upon in connection with making

an investment decision.

SUMMARY

OF THE OFFERING

| Common Stock to be Offered |

|

Up to 2,020,202 shares of Common

Stock on a “best efforts” basis. |

| |

|

|

| Description of Series Warrants |

|

We are issuing to purchasers of shares of our Common Stock and/or

our Pre-Funded Warrants in this offering a Series D Warrant to purchase up to one share of our Common Stock and a Series E Warrant to

purchase up to one share of our Common Stock for each share and/or Pre-Funded Warrant purchased in this offering for a combined public

offering price of $[●] per share and accompanying Series Warrants (less $0.0001 per Pre-Funded Warrant). The Series D Warrants

and the Series E Warrants are referred to herein together as the “Series Warrants.” Because a Series D Warrant and a Series

E Warrant, each to purchase share(s) of our Common Stock, are being sold together in this offering with each share of Common Stock and,

in the alternative, each Pre-Funded Warrant to purchase one share of Common Stock, the number of Series Warrants sold in this offering

will not change as a result of a change in the mix of the shares of our Common Stock and Pre-Funded Warrants sold. The Series Warrants

have an exercise price of $[●] per share and will become exercisable on the effective date of stockholder approval for the issuance

of the shares upon exercise of the Series Warrants (or, if permitted by the applicable rules and regulations of Nasdaq, upon payment

by the holder of $0.125 per share in addition to the applicable exercise price). The Series D Warrants will expire five years from the

date of issuance, and the Series E Warrants will expire 18 months from the date of issuance. The shares of Common Stock and Pre-Funded

Warrants, and the accompanying Series Warrants, as the case may be, can only be purchased together in this offering but will be issued

separately and will be immediately separable upon issuance. See “Description of Securities We Are Offering — Series Warrants.”

This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Series Warrants and the Placement

Agent Warrants. |

| |

|

|

| Description of Pre-Funded Warrants |

|

We are also offering to each purchaser whose purchase of shares

of Common Stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties,

beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock immediately following

the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, Pre-Funded Warrants to purchase up to

2,020,202 shares of our Common Stock, in lieu of shares of Common Stock that would otherwise result in the purchaser’s beneficial

ownership exceeding 4.99% of our outstanding Common Stock. Subject to limited exceptions, a holder of Pre-Funded Warrants will not

have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially

own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of Common Stock outstanding immediately

after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one share of our Common Stock. The purchase

price of each Pre-Funded Warrant will equal the price per share at which the shares of Common Stock are being sold to the public

in this offering, minus $0.0001, and the exercise price of each Pre-Funded Warrant will be $0.0001 per share. This offering also

relates to the shares of Common Stock issuable upon exercise of any Pre-Funded Warrants sold in this offering. For each Pre-Funded

Warrant we sell, the number of shares of Common Stock we are offering will be decreased on a one-for-one basis. |

| |

|

|

| Common Stock Outstanding Prior to This Offering |

|

492,293 shares. |

| |

|

|

| Common Stock to be Outstanding After This Offering |

|

2,512,495 shares (assuming no sale of any Pre-Funded Warrants and

assuming none of the Series Warrants issued in this offering or Placement Agent Warrants issued to the Placement Agent or its designees

as compensation in connection with this offering are exercised). |

| Use of Proceeds |

|

We estimate that the net proceeds

to us from this offering will be approximately $5.1 million, after deducting the Placement Agent fees and estimated offering expenses

payable by us and assuming no exercise of the Series Warrants. We intend to use the net proceeds from the sale of the securities

for general corporate purposes, which may include research and development expenses, capital expenditures, working capital and general

and administrative expenses, and potential acquisitions of or investments in businesses, products and technologies that complement

our business, although we have no present commitments or agreements to make any such acquisitions or investments as of the date of

this prospectus. Pending these uses, we intend to invest the funds in short-term, investment grade, interest-bearing securities.

It is possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable, or any, return for

us. See “Use of Proceeds.” |

| |

|

|

| Risk Factors |

|

You should carefully read and consider the information set forth under “Risk Factors” in this prospectus on page 6 and under similar headings in the documents incorporated by reference herein before deciding to invest in our securities. |

| |

|

|

| Lock-Up Agreements |

|

We and all of our executive officers and directors will enter into lock-up agreements with the Placement Agent. Under these agreements, we and each of these persons may not, without the prior written approval of the Placement Agent, offer, sell, contract to sell or otherwise dispose of or hedge Common Stock or securities convertible into or exchangeable for Common Stock, subject to certain exceptions. The restrictions contained in these agreements will be in effect for a period of 90 days after the date of the closing of this offering. For more information, see “Plan of Distribution.” |

| |

|

|

| Market for Common Stock |

|

Our Common Stock is listed on Nasdaq under the symbol “SNES.” |

| |

|

|

| Listing of Series Warrants |

|

We do not intend to list the Pre-Funded Warrants or the Series Warrants

on any securities exchange or nationally recognized trading system, including on Nasdaq. Without a trading market, the liquidity

of the Pre-Funded Warrants and the Series Warrants will be extremely limited. |

The

discussion above is based on 492,293 shares of our Common Stock outstanding as of November 20, 2023, which excludes the following as

of such date:

| |

● |

37,357 shares of Common Stock issuable upon the

exercise of outstanding options with a weighted average exercise price of $122.51 per share; |

| |

● |

596,508 shares of Common Stock issuable upon the

exercise of outstanding warrants with a weighted average exercise price of $22.69 per share; |

| |

● |

41,392 shares of Common Stock available for grant

under our 2018 Equity Incentive Plan; |

| |

● |

4,040,404 shares of our Common Stock issuable

upon the exercise of Series Warrants to be issued in this offering; and |

| |

● |

151,515 shares of Common Stock issuable upon the

exercise of the Placement Agent Warrants to be issued to the Placement Agent or its designees as compensation in connection with

this offering and pursuant to this prospectus. |

The discussion above assumes no sale of Pre-Funded

Warrants, which, if sold, would reduce the number of shares of Common Stock that we are offering on a one-for-one basis.

RISK

FACTORS

Investing in our securities, including

our Common Stock, our Pre-Funded Warrants and our Series Warrants, involves a number of risks. You should not invest unless you are able

to bear the complete loss of your investment. You should carefully consider the risks described below and discussed under the section

entitled “Risk Factors” in our most recent Annual Report on Form 10-K, which is incorporated herein by reference, together

with other information in this prospectus and the information and documents incorporated by reference in this prospectus, including our

future reports on Form 10-K, Form 10-Q and Form 8-K. The risks and uncertainties we have described below and under the section entitled

“Risk Factors” in our most recent Annual Report on Form 10-K incorporated herein by reference are not the only risks and

uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair

our business operations. If any of the following risks actually occur, our business could be harmed. In such case, the trading price

of our Common Stock could decline and investors could lose all or a part of the money paid to buy our securities. Our actual results

could differ materially from those anticipated in these forward-looking statements as a result of these and other factors.

See also the statements contained under the

heading “Forward-Looking Statements.”

Risks Related to the 2023 Reverse Split

and our Common Stock

If we are unable to continue as a going

concern, our securities will have little or no value.

We have incurred operating losses since our

inception, and we expect to continue to incur significant expenses and operating losses for the foreseeable future. Based upon our current

operating plan, we expect that cash and cash equivalents at September 30, 2023, in combination with anticipated revenue and any additional

sales of our equity securities, will be sufficient to fund our current operations for at least the next three months. Our financial statements

as of December 31, 2022 and 2021 have been prepared under the assumption that we will continue as a going concern. Our independent registered

public accounting firm included in its opinion for the years ended December 31, 2022, and 2021 an explanatory paragraph referring

to our net loss from operations and net capital deficiency and expressing substantial doubt in our ability to continue as a going concern

without additional capital becoming available. If we encounter continued issues or delays in the commercialization of our fertility control

products or greater than anticipated expenses, our prior losses and expected future losses could have an adverse effect on our financial

condition and negatively impact our ability to fund continued operations, obtain additional financing in the future and continue as a

going concern. There are no assurances that such financing, if necessary, will be available to us at all or will be available in sufficient

amounts or on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

If we are unable to generate additional funds in the future through financings, sales of our products, licensing fees, royalty payments

or from other sources or transactions, we will exhaust our resources and will be unable to continue operations. If we cannot continue

as a going concern, our stockholders would likely lose most or all of their investment in us.

We may not be able to comply with all

applicable listing requirements or standards of the Nasdaq Capital Market, and Nasdaq could delist our Common Stock.

Our Common Stock is listed on Nasdaq. In order

to maintain that listing, we must satisfy minimum financial and other continued listing requirements and standards. Previously, on September

26, 2018, March 20, 2019, February 20, 2020, March 2, 2022, and, most recently, on August 25, 2023, we received a letter from the listing

qualifications staff of Nasdaq providing notification that the bid price for our Common Stock had closed below $1.00 per share for the

previous 30 consecutive business days and our Common Stock no longer met the minimum bid price requirement for continued listing under

Nasdaq Listing Rule 5550(a)(2). In each case, in accordance with Nasdaq Listing Rule 5810(c)(3) (A), we had an initial period of 180

calendar days to regain compliance. To regain compliance, the closing bid price of our Common Stock had to be $1.00 per share or more

for a minimum of 10 consecutive business days at any time before the expiration of the initial compliance period.

In

the event that we are unable to regain compliance with Rule 5550(a)(2) during the initial compliance period, Nasdaq rules provide that

we may be eligible for an additional 180 calendar day compliance period. To qualify, we need to meet the continued listing requirement

for market value of publicly held shares and all other initial listing standards for Nasdaq, with the exception of the minimum bid price

requirement, and to provide written notice of our intention to cure the deficiency during the second compliance period, by effecting

a reverse stock split, if necessary. On August 18, 2023, our stockholders approved a reverse stock split of our Common Stock at a ratio

of not less than 1-for-2 and not more than 1-for-12, with the actual ratio to be determined by our board of directors. On November 7,

2023, the Reverse Split Committee of our board of directors approved a final split ratio of 1-for-12. Following such approval, we filed

an amendment to our amended and restated certificate of incorporation with the Secretary of State of the State of Delaware to effect

the reverse stock split, with an effective time of 4:01 p.m., Eastern Time on November 16, 2023. However, even if a stock split

has a positive effect on the market price for the common stock immediately following a reverse stock split, performance of our business

and financial results, general economic conditions and the market perception of our business, and other adverse factors which may not

be in our control, could lead to a decrease in the price of our common stock following the reverse stock split.

In addition, on November 20, 2023, we received

a letter from the Staff of Nasdaq providing notification that we no longer meet the minimum of 500,000 publicly held shares requirement

pursuant to Nasdaq Listing Rule 5550(a)(4). In accordance with Nasdaq rules, we have until January 4, 2024 to provide the Staff with

a specific plan to achieve and sustain compliance with all listing requirements of Nasdaq, including the time frame for completion of

this plan. After reviewing our plan, Nasdaq will provide written notice of their decision. If Nasdaq does not accept our plan, we will

have the opportunity to appeal their decision to a hearings panel.

In the event that we are unable to establish

compliance, or again become non-compliant, with Rule 5550(a)(2) and/or Rule 5550(a)(4) and cannot re-establish compliance within the

required timeframes, our Common Stock could be delisted from Nasdaq, which could have a material adverse effect on our financial condition

and which would cause the value of our Common Stock to decline. If our Common Stock is not eligible for listing or quotation on another

market or exchange, trading of our Common Stock could be conducted in the over-the-counter market or on an electronic bulletin board

established for unlisted securities such as the Pink Open Market operated by the OTC Markets Group, Inc. In such event, it would become

more difficult to dispose of, or obtain accurate price quotations for, our Common Stock, and there would likely be a reduction in our

coverage by security analysts and the news media, which could cause the price of our Common Stock to decline further. In addition, it

may be difficult for us to raise additional capital if we are not listed on a national securities exchange.

Our reverse stock splits may decrease the

liquidity of the shares of our Common Stock.

On

August 18, 2023, our stockholders approved a reverse stock split of our Common Stock at a

ratio of not less than 1-for-2 and not more than 1-for-12, with the actual ratio to be determined

by our board of directors. On November 7, 2023, the Reverse Split Committee of our board

of directors approved a final split ratio of 1-for-12 to regain compliance with the Nasdaq

minimum bid price requirement. The liquidity of the shares of our Common Stock may be affected

adversely by the reverse stock splits given the reduced number of shares that are outstanding

following the reverse stock splits. In addition, the reverse stock splits increase the number

of stockholders who own odd lots (less than 100 shares) of our Common Stock, creating the

potential for such stockholders to experience an increase in the cost of selling their shares

and greater difficulty effecting such sales.

Following a reverse stock split, the resulting

market price of our Common Stock may not attract new investors, including institutional investors, and may not satisfy the investing requirements

of those investors. Consequently, the trading liquidity of our Common Stock may not improve.

Although

we believe that a higher market price of our Common Stock may help generate greater or broader

investor interest, there can be no assurance that a reverse stock split, including the 2023

Reverse Split, will result in a share price that will attract new investors, including institutional

investors. In addition, there can be no assurance that the market price of our Common Stock

will satisfy the investing requirements of those investors. As a result, the trading liquidity

of our Common Stock may not necessarily improve. The primary intent for the 2023 Reverse

Split was that the anticipated increase in the price of our Common Stock immediately following

and resulting from a reverse stock split due to the reduction in the number of issued and

outstanding shares of Common Stock would help us meet the minimum bid price requirement pursuant

to Nasdaq Listing Rules. It cannot be assured that a reverse stock split, including the 2023

Reverse Split, will result in any sustained proportionate increase in the market price of

our Common Stock, which is dependent upon many factors, including our business and financial

performance, general market conditions, and prospects for future success, which are unrelated

to the number of shares of our Common Stock outstanding. It is not uncommon for the market

price of a company’s common stock to decline in the period following a reverse stock

split.

Our

share price is volatile, which could subject us to securities class action litigation, and your investment in our securities could decline

in value.

Our

stock could be subject to wide fluctuation in response to many risk factors listed in this section, and others beyond our control, including

the following:

| ● | market

acceptance and commercialization of our products; |

| ● | our

being able to timely demonstrate achievement of milestones, including those related to revenue

generation, cost control, cost effective source supply and regulatory approvals; |

| ● | our

ability to regain compliance with Nasdaq’s Listing Rules and remain listed on Nasdaq; |

| ● | results

and timing of our submissions with the regulatory authorities; |

| ● | failure

or discontinuation of any of our development programs; |

| ● | regulatory

developments or enforcements in the United States and non-U.S. countries with respect to

our products or our competitors’ products; |

| ● | failure

to achieve pricing acceptable to the market; |

| ● | regulatory

actions with respect to our products or our competitors’ products; |

| ● | actual

or anticipated fluctuations in our financial condition and operating results or our continuing

to sustain operating losses; |

| ● | competition

from existing products or new products that may emerge; |

| ● | announcements

by us or our competitors of significant acquisitions, strategic arrangements, joint ventures,

collaborations or capital commitments; |

| ● | issuance

of new or updated research or reports by securities analysts; |

| ● | announcement

or expectation of additional financing efforts, particularly if our cash available for operations

significantly decreases or if the financing efforts result in a price adjustment to certain

outstanding warrants; |

| ● | fluctuations

in the valuation of companies perceived by investors to be comparable to us; |

| ● | share

price and volume fluctuations attributable to inconsistent trading volume levels of our shares; |

| ● | disputes

or other developments related to proprietary rights, including patents, litigation matters

and our ability to obtain patent protection for our technologies; |

| ● | entry

by us into any material litigation or other proceedings; |

| ● | sales

of our Common Stock by us, our insiders or our other stockholders; |

| ● | exercise

of outstanding warrants; |

| ● | market

conditions for equity securities; and |

| ● | general

economic and market conditions unrelated to our performance. |

Furthermore,

the capital markets can experience extreme price and volume fluctuations that may affect the market prices of equity securities of many

companies. These broad market and industry fluctuations, as well as general economic, political and market conditions such as recessions,

interest rate changes or international currency fluctuations, may negatively impact the market price of shares of our Common Stock. In

addition, such fluctuations could subject us to securities class action litigation, which could result in substantial costs and divert

our management’s attention from other business concerns, which could seriously harm our business. You may not realize any return

on your investment in us and may lose some or all of your investment.

Risks Related to this Offering

Management will have broad discretion as

to the use of proceeds from this offering and we may use the net proceeds in ways with which you may disagree.

We intend to use the net proceeds of this offering

for general corporate purposes, which may include research and development expenses, capital expenditures, working capital and general

and administrative expenses, and potential acquisitions of or investments in businesses, products and technologies that complement our

business, although we have no present commitments or agreements to make any such acquisitions or investments as of the date of this prospectus.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways

that do not improve our results of operations or enhance the value of our Common Stock. Accordingly, you will be relying on the judgment

of our management on the use of net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether

the proceeds are being used appropriately. Our failure to apply these funds effectively could have a material adverse effect on our business

and cause the price of our Common Stock to decline.

Pending these uses, we intend to invest the funds

in short-term, investment grade, interest-bearing securities. It is possible that, pending their use, we may invest the net proceeds in

a way that does not yield a favorable, or any, return for us.

The public offering price will be set by

our board of directors and does not necessarily indicate the actual or market value of our Common Stock.

Our

board of directors will approve the public offering price and other terms of this offering

after considering, among other things: the number of shares authorized in our amended and

restated certificate of incorporation; the current market price of our Common Stock; trading

prices of our Common Stock over time; the volatility of our Common Stock; our current financial

condition and the prospects for our future cash flows; the availability of and likely cost

of capital of other potential sources of capital; the characteristics of interested investors

and market and economic conditions at the time of the offering. The offering price is not

intended to bear any relationship to the book value of our assets or our past operations,

cash flows, losses, financial condition, net worth or any other established criteria used

to value securities. The public offering price may not be indicative of the fair value of

the Common Stock.

Purchasers who purchase our securities in

this offering pursuant to a securities purchase agreement may have rights not available to purchasers without the benefit of a securities

purchase agreement.

In addition to rights and remedies available to

all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement

will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract provides those

investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement, including the following:

(i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for one year from closing, subject to certain

exceptions; (iii) agreement to not enter into any financings for 90 days from closing; and (iv) indemnification for breach of contract.

You may experience future dilution as

a result of future equity offerings and other issuances of our shares of Common Stock and other securities. In addition, this offering

and future equity offerings and other issuances of our shares of Common Stock or other securities may adversely affect our shares of

Common Stock.

In

order to raise additional capital, we may in the future offer additional shares of Common

Stock or other securities convertible into or exchangeable for shares of Common Stock at

prices that may be higher or lower than the price per share in this offering. We cannot assure

you that we will be able to sell shares or other securities in any other offering at a price

per share that is equal to or greater than the price per share paid by investors in this

offering, and investors purchasing shares or other securities in the future could have rights

superior to our existing stockholders.

Additionally, we are generally not

restricted from issuing additional securities, including shares of our Common Stock, securities that are convertible into or

exchangeable for, or that represent the right to receive, shares of our Common Stock or substantially similar securities. The

issuance of additional shares of our Common Stock in future offerings could be dilutive to stockholders, including investors in this

offering, if they do not invest in future offerings. Moreover, to the extent that we issue options or warrants to purchase, or

securities convertible into or exchangeable for, shares of our Common Stock in the future and those options, warrants or other

securities are exercised, converted or exchanged, stockholders may experience further dilution. In addition, the sale of shares in