0001596961

false

0001596961

2023-11-20

2023-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 20, 2023

RumbleOn, Inc.

(Exact name of registrant as specified in its

charter)

| Nevada |

|

001-38248 |

|

46-3951329 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

901 W. Walnut Hill Lane, Suite 110A

Irving, Texas |

|

75038 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (214) 771-9952

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class B Common Stock, $0.001 par value |

|

RMBL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into Material Definitive Agreement.

As previously disclosed, on August 8, 2023, RumbleOn,

Inc. (the “Company”) entered into a Standby Purchase Agreement (the “Standby Purchase Agreement”) with Mark Tkach

(“Tkach”), William Coulter (“Coulter”) and Stone House Capital Management, LLC, a Delaware limited liability company

(“Stone House” and, collectively with Tkach and Coulter, the “Standby Purchasers”). The Standby Purchase Agreement

provides a binding commitment from the Standby Purchasers to purchase up to $100.0 million of shares of Class B common stock of the Company,

par value $0.001 per share (the “Class B common stock”), in the aggregate from the Company if the Rights Offering is not fully

subscribed.

On November 20, 2023, the Company and the Standby

Purchasers entered into Amendment No. 1 to the Standby Purchase Agreement (“Amendment No. 1”), pursuant to which the parties

agreed to extend the outside date by which the Standby Purchasers may terminate the agreement if the Rights Offering has not been consummated,

from December 1, 2023 to December 8, 2023.

The foregoing

description of Amendment No. 1 is qualified in its entirety by reference to the full text

of the document, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 8.01 Other Events.

On November 22, 2023, the Company extended the

expiration date of the previously announced $100.0 million equity rights offering (the “Rights Offering”) to 5:00 p.m. Eastern

Time on December 5, 2023. This extension will allow eligible stockholders who are entitled to participate in the Rights Offering (stockholders

of record of the Company’s Class A common stock, par value $0.001 per share, and Class B common stock as of November 13, 2023) additional

time to participate.

A copy of the press release announcing the extension

of the Rights Offering is attached hereto as Exhibit 99.1 and incorporated by reference herein.

The Rights Offering will be made only by means

of a prospectus filed with the SEC as part of the Registration Statement on Form S-3, as amended (No. 333-274859) relating to the Rights

Offering (the “Registration Statement”), which was declared effective by the SEC on November 13, 2023. This communication

shall not constitute an offer to sell or solicitation of an offer to buy, nor shall there be any sale of these securities in any state

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state

or jurisdiction.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RUMBLEON, INC. |

| |

|

|

| Date: November 22, 2023 |

By: |

/s/ Mathew W. Grynwald |

| |

|

Mathew W. Grynwald |

| |

|

General Counsel and Secretary |

2

Exhibit 10.1

AMENDMENT No. 1 to

STANDBY PURCHASE AGREEMENT

This Amendment No. 1 to the Standby

Purchase Agreement (this “Amendment”) is made and entered into on November 20, 2023, by and among Mark Tkach (“Tkach”),

William Coulter (“Coulter”) and Stone House Capital Management, LLC, a Delaware limited liability company (“Stone

House” and, collectively with Tkach and Coulter, the “Standby Purchasers”), and RumbleOn, Inc., a Nevada

corporation (the “Company”) (collectively, the Standby Purchasers and the Company are herein referred to as the “Parties”).

RECITALS

WHEREAS, as of a record date

of November 13, 2023, the Company distributed, at no charge, to each holder of record of the Class A Common Stock, par value $0.001 per

share, and Class B Common Stock, par value $0.001 per share (collectively, the “Common Stock”), of the Company non-transferable

rights (the “Subscription Rights”) to subscribe for and purchase additional shares of Class B Common Stock (the “Rights

Offering”);

WHEREAS, the Company and the

Standby Purchasers entered into the Standby Purchase Agreement (the “Agreement”) on or about August 8, 2023 whereby

the Standby Purchasers agreed and committed to purchase, at the Subscription Price, upon the terms and subject to the conditions set forth

the Agreement, any shares of Class B Common Stock that are not purchased upon exercise of the Subscription Rights distributed in the Rights

Offering; and

WHEREAS, the Company and Standby

Purchasers intend to amend the Agreement to permit the Company to extend expiration of the Rights Offering to provide additional time

for holders of Common Stock to exercise their rights under the Rights Offering.

AMENDMENT TO AGREEMENT

NOW THEREFORE, in consideration

of the foregoing, the terms and provisions set forth herein, the mutual benefits to be gained by the performance thereof and other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.

All terms not otherwise defined herein shall have the meanings set forth in the Agreement.

2.

Clause (iii) of Section 8(a) Agreement is hereby amended by deleting the words “December 1, 2023” and replacing them

with the following:

“December 8, 2023”

3.

The Agreement is hereby ratified by each of the parties hereto and, except as expressly set forth herein, all terms and provisions

of the Agreement shall remain in full force and effect as set forth therein.

4.

This Amendment may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together

shall constitute one and the same instrument.

[Signature

Page Follows]

IN WITNESS WHEREOF, each of the

parties has executed this Agreement on and as of the date first set forth above.

| |

COMPANY: |

| |

|

| |

RUMBLEON, INC. |

| |

|

| |

By: |

/s/ Blake Lawson |

| |

Name: |

Blake Lawson |

| |

Title: |

CFO |

| |

|

|

| |

STANDBY PURCHASERS: |

| |

|

| |

MARK TKACH |

| |

|

| |

By: |

/s/ Mark Tkach |

| |

Name: |

Mark Tkach |

| |

|

|

| |

WILLIAM COULTER |

| |

|

| |

By: |

/s/ William Coulter |

| |

Name: |

William Coulter |

| |

|

|

| |

STONE HOUSE CAPITAL MANAGEMENT, LLC |

| |

|

| |

By: |

/s/ Mark Cohen |

| |

Name: |

Mark Cohen |

| |

Title: |

Managing Member |

Exhibit 99.1

RumbleOn Announces Extension of $100 Million

Rights Offering Subscription Period

IRVING, Texas - RumbleOn, Inc. (NASDAQ: RMBL)

(the “Company” or “RumbleOn”), the largest powersports retailer in North America, today announced that its Board of

Directors is extending the Rights Offering subscription period an additional week until December 5, 2023, in order to better ensure that

holders of its Class A common stock and Class B common stock (together, the “Eligible Stockholders”) have sufficient time to

subscribe for shares of Class B Common Stock of RumbleOn.

The Company has distributed one Subscription Right

for each share of the Company’s Class A common stock and Class B common stock held by Eligible Stockholders as of the Record Date. Each

Subscription Right entitles Eligible Stockholders to purchase 1.078444 shares of the Company’s Class B common stock at the Subscription

Price of $5.50 per share. The Rights Offering is fully backstopped pursuant to a standby purchase agreement between the Company and certain

of its stockholders.

Other Important Information

The Registration Statement relating to the Rights

Offering has been filed with the U.S. Securities and Exchange Commission (“SEC”), and became effective on November 13, 2023.

The Company reserves the right to cancel or terminate the Rights Offering at any time. This press release does not constitute an offer

to sell or the solicitation of an offer to buy any Subscription Rights or any other securities to be issued in the Rights Offering or

any related transactions, nor shall there be any offer, solicitation or sale of Subscription Rights or any other securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful. Copies of the prospectus are being mailed to all Eligible Stockholders as

of the Record Date and may also be obtained free of charge at the website maintained by the SEC at www.sec.gov or by contacting the information

agent for the Rights Offering, Broadridge Corporate Issuer Solutions, LLC, at (888)789-8409 (toll-free).

About RumbleOn

RumbleOn is the largest powersports retailer in

North America, offering a wide selection of new and used motorcycles, all-terrain vehicles, utility terrain vehicles, personal watercraft,

and other powersports products, including parts, apparel, accessories, and aftermarket products from a wide range of manufacturers. As

of November 2023, we operate 55 retail locations, each equipped with full service departments, as well as 5 regional fulfillment centers.

Our retail locations are run by our highly-trained and knowledgeable team and are primarily located in the Sun Belt of the United States.

To learn more please visit us online at https://www.rumbleon.com/.

Cautionary Note on Forward-Looking Statements

This press release may contain “forward-looking

statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified

by words such as “expects,” “projects,” “will,” “may,” “anticipates,” “believes,”

“should,” “intends,” “estimates,” and other words of similar meaning. Readers are cautioned not to place

undue reliance on these forward-looking statements, which are based on our expectations as of the date of this press release and speak

only as of the date of this press release and are advised to consider the factors listed under the heading “Forward-Looking Statements”

and “Risk Factors” in the Company’s SEC filings, as may be updated and amended from time to time. We undertake no obligation

to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except

as required by law.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20231122379197/en/

Investor Relations Contact:

Will Newell

investors@rumbleon.com

v3.23.3

Cover

|

Nov. 20, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 20, 2023

|

| Entity File Number |

001-38248

|

| Entity Registrant Name |

RumbleOn, Inc.

|

| Entity Central Index Key |

0001596961

|

| Entity Tax Identification Number |

46-3951329

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

901 W. Walnut Hill Lane

|

| Entity Address, Address Line Two |

Suite 110A

|

| Entity Address, City or Town |

Irving

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75038

|

| City Area Code |

214

|

| Local Phone Number |

771-9952

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class B Common Stock, $0.001 par value

|

| Trading Symbol |

RMBL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

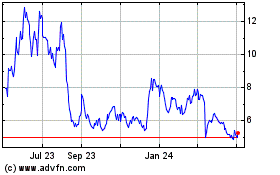

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

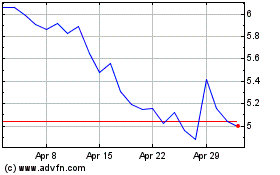

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024