Diana Shipping Inc. (NYSE: DSX), (the “Company”), a global shipping

company specializing in the ownership and bareboat charter-in of

dry bulk vessels, today announced that its Board of Directors has

declared a distribution of warrants (the “Warrants”) to holders of

the Company's common stock (the “Holders”) as of December 6, 2023

(the “Record Date”). Holders may exercise their Warrants for shares

of common stock as will be specified under the terms in the warrant

agreement.

Details of Warrant

Distribution

The Warrants will be distributed pro-rata to

Holders of the Company’s common stock. Holders will receive one

Warrant for every five shares of issued and outstanding shares of

common stock held as of the Record Date (rounded down to the

nearest whole number for any fractional Warrant). Each Warrant will

entitle the Holder to purchase, at the Holder’s sole and exclusive

election, at the exercise price, one share of common stock plus, to

the extent described below, the Bonus Share Fraction. A Bonus Share

Fraction entitles a Holder to receive an additional 0.5 of a share

of common stock for each Warrant exercised (the “Bonus Share

Fraction”) without payment of any additional exercise price.

Mrs. Semiramis Paliou, Director and Chief

Executive Officer of the Company, stated: “We are pleased to

announce this distribution of warrants pro-rata to all our

shareholders. The warrants may raise new equity capital for general

corporate purposes without causing dilution to any of our

shareholders, large or small. This distribution illustrates our

proactive management of our capital structure to uphold our robust

balance sheet.”

The right to receive the Bonus Share Fraction

will expire at 5:00 p.m. New York City time (the “Bonus Share

Expiration Date”) upon the earlier of (i) the date specified by the

Company upon not less than 20 business days’ notice and (ii) the

first business day following the last day of the first 30

consecutive trading day period in which the daily VWAP of the

shares of common stock has been at least equal to the then

applicable trigger price for at least 20 trading days (whether or

not consecutive) (the “Bonus Price Condition”). Any Warrant

exercised with an exercise date after the Bonus Share Expiration

Date will not be entitled to any Bonus Share Fraction. The Company

will make a public announcement of the Bonus Share Expiration Date

(i) at least 20 business days prior to such date, in the case of

the Company setting a Bonus Share Expiration Date and (ii) prior to

market open on the Bonus Share Expiration Date in the case of a

Bonus Price Condition.

The distribution of the Warrants has not been

registered under the Securities Act because the issuance of a

dividend in the form of a Warrant or as an adjustment to an

outstanding equity-based incentive award for no consideration is

not a sale or disposition of a security or interest in a security

for value pursuant to Section 2(a)(3) of the Securities Act. The

Company will file a prospectus supplement, under its existing shelf

registration statement, registering the shares of common stock

underlying the Warrants.

The Company will distribute the Warrants on or

about December 14, 2023, to Holders as of the Record Date. The

Warrants are expected to trade on the New York Stock Exchange.

For more information about the transaction,

Holders are encouraged to visit the "Warrants Information" section

of the Company’s “Investors” page at

https://www.dianashippinginc.com, which may be updated from time to

time.

B. Dyson Capital Advisors is serving as

financial advisor and Seward & Kissel LLP is serving as legal

advisor to the Company.

No Offer or Solicitation

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of, these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction. A Form 8-A registration statement and

prospectus supplement describing the terms of the Warrants will be

filed with the Securities and Exchange Commission (the "SEC") and

will be available on the SEC's website located at

http://www.sec.gov. Holders should read the prospectus supplement

carefully, including the Risk Factors section included and

incorporated by reference therein. This press release contains a

general summary of the Warrants. Please read the warrant agreement

when it becomes available as it will contain important information

about the terms of the Warrants.

About the Company

Diana Shipping Inc. is a global provider of

shipping transportation services through its ownership and bareboat

charter-in of dry bulk vessels. The Company’s vessels are employed

primarily on short to medium-term time charters and transport a

range of dry bulk cargoes, including such commodities as iron ore,

coal, grain and other materials along worldwide shipping

routes.

Cautionary Statement Regarding

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts.

The Company desires to take advantage of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995 and is including this cautionary statement in

connection with this safe harbor legislation. The words “believe,”

“anticipate,” “intends,” “estimate,” “forecast,” “project,” “plan,”

“potential,” “may,” “should,” “expect,” “pending” and similar

expressions identify forward-looking statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, Company management’s examination of historical

operating trends, data contained in the Company’s records and other

data available from third parties. Although the Company believes

that these assumptions were reasonable when made, because these

assumptions are inherently subject to significant uncertainties and

contingencies that are difficult or impossible to predict and are

beyond the Company’s control, the Company cannot assure you that it

will achieve or accomplish these expectations, beliefs or

projections.

In addition to these important factors, other

important factors that, in the Company’s view, could cause actual

results to differ materially from those discussed in the

forward-looking statements include the continuing impacts of the

COVID-19 pandemic; the strength of world economies and currencies,

general market conditions, including fluctuations in charter rates

and vessel values, changes in demand for dry bulk shipping

capacity, changes in the Company’s operating expenses, including

bunker prices, drydocking and insurance costs, the market for the

Company’s vessels, availability of financing and refinancing,

changes in governmental rules and regulations or actions taken by

regulatory authorities, potential liability from pending or future

litigation, general domestic and international political

conditions, including risks associated with the continuing conflict

between Russia and Ukraine and related sanctions, potential

disruption of shipping routes due to accidents or political events,

including the escalation of the conflict in the Middle East, vessel

breakdowns and instances of off-hires and other factors. Please see

the Company’s filings with the U.S. Securities and Exchange

Commission for a more complete discussion of these and other risks

and uncertainties. The Company undertakes no obligation to revise

or update any forward-looking statement, or to make any other

forward-looking statements, whether as a result of new information,

future events or otherwise.

Corporate Contact:

Ioannis Zafirakis

Director, Chief Financial Officer,

Chief Strategy Officer, Treasurer and Secretary

Telephone: + 30-210-9470-100

Email: izafirakis@dianashippinginc.com

Website: www.dianashippinginc.com

Twitter: @Dianaship

Investor and Media Relations:

Edward Nebb

Comm-Counsellors, LLC

Telephone: + 1-203-972-8350

Email: enebb@optonline.net

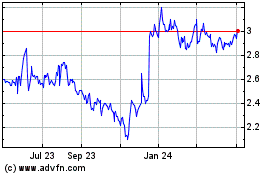

Diana Shipping (NYSE:DSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

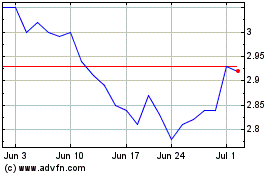

Diana Shipping (NYSE:DSX)

Historical Stock Chart

From Apr 2023 to Apr 2024