UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

November

17, 2023

Commission

File Number: 001-37968

YATRA

ONLINE, INC.

Gulf

Adiba, Plot No. 272,

4th

Floor, Udyog Vihar, Phase-II,

Sector-20,

Gurugram-122008, Haryana

India

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Other

Events

On

November 17, 2023, Yatra Online, Inc. issued an earnings release announcing its unaudited financial and operating results for the three

months ended September 30, 2023. A copy of the earnings release is attached hereto as Exhibit 99.1.

This

Report on Form 6-K is hereby incorporated by reference into Yatra Online, Inc.’s registration statements on Form F-3 (Registration

Statement Nos. 333-215653 and 333-256442) filed with the Securities and Exchange Commission on April 11, 2018 and May 24, 2021 (and subsequently

amended on July 7, 2021), respectively, to be a part thereof from the date on which this report is submitted, to the extent not superseded

by documents or reports subsequently filed or furnished.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

YATRA ONLINE, INC. |

| |

|

|

| Date: November 17, 2023 |

By: |

/s/ Dhruv

Shringi |

| |

|

Dhruv Shringi |

| |

|

Chief Executive Officer |

Exhibit

99.1

YATRA

ONLINE, INC. ANNOUNCES RESULTS FOR

THE

THREE MONTHS SEPTEMBER 30, 2023

Gurugram,

India and New York November 17, 2023— Yatra Online, Inc. (NASDAQ: YTRA) (the “Company”), India’s leading

corporate travel services provider and one of India’s leading online travel companies, today announced its unaudited financial

and operating results for the three months ended September 30, 2023.

“We

delivered strong growth of Air Passengers booked up 31.2% YoY far outpacing domestic air passenger industry growth of 22.7% YoY,

clearly demonstrating our ability to gain market share and the strength of the YATRA brand. Our revenue for the quarter ended September

30, 2023, was reported at INR 947.6 million (USD 11.4 million) up 14.0% YoY. Adjusted Margin from Air Ticketing of USD 12.3 million was

down by 4.8% YoY largely on account of a 14.7% YoY softening in Air ticket prices. Adjusted EBITDA for the quarter reached INR

34.9 million (USD 0.4 million), lower vs. the September 2022 quarter at INR 77.7 million (USD 0.9 million).

Yatra

Online Limited, our Indian subsidiary, was successfully listed on the National Stock Exchange of India Limited and on the Bombay Stock

Exchange on September 28, 2023 consummating the IPO of INR 7,750 million. The proceeds from this milestone will predominantly fuel our

strategic growth, technology advancements, and customer-centric initiatives.

We

believe the IPO will also be beneficial to

the consolidated company on several fronts as it provides a liquid stock that can be used for M&A in India. In

addition, the transaction expands the shareholder base of the consolidated company by adding retail and institutional investors

in India already familiar with Yatra’s business and brand while increasing its visibility

through a larger pool of equity analysts.

Additionally,

I would also like to share that the Board has authorized a share repurchase of up to $5 million of our NASDAQ listed YTRA shares, underscoring

our confidence in Yatra’s future and our steadfast commitment to delivering shareholder value. This authorization represents approximately

5% of Yatra Online, Inc’s market capitalization based on the current share price.

In

conclusion, as we navigate the evolving landscape, our commitment remains unwavering—to leverage growth opportunities and ensure

Yatra’s continued ascent” - Dhruv Shringi, Co-founder and CEO.

Financial

and operating highlights for the three months ended September 30, 2023:

| ● |

Revenue

of INR 947.6 million (USD 11.4 million), representing an increase of 14.0% year-over-year basis (“YoY”). |

| ● |

Adjusted

Margin (1) from Air Ticketing of INR 1,018.3 million (USD 12.3 million), representing a decrease of 4.8% YoY. |

| ● |

Adjusted

Margin (1) from Hotels and Packages of INR 278.3 million (USD 3.3 million), representing an increase of 15.6% YoY. |

| ● |

Total

Gross Bookings (Air Ticketing, Hotels and Packages and Other Services)(3) of INR 17,520.3 million (USD 210.9 million),

representing an increase of 10.2% YoY. |

| |

|

| ● |

Loss

for the period was INR 272.9 million (USD 3.3 million) versus a loss of INR 71.2 million (USD 0.9 million) for the three months

ended September 30, 2022, reflecting an increase in loss by INR 201.6 million (USD 2.4 million) YoY. |

| ● |

Result

from operations were a loss of INR 120.6 million (USD 1.5 million) versus a loss of INR 5.8 million (USD 0.1 million) for the

three months ended September 30, 2022, reflecting an increase in loss by INR 114.8 million (USD 1.4 million) YoY. |

| ● |

Adjusted

EBITDA(2) Profit was INR 34.9 million (USD 0.4 million) reflecting a decrease of 55.1% YOY. |

| | |

Three months ended September 30, | | |

| |

| | |

2022 | | |

2023 | | |

2023 | | |

| |

| | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

YoY Change | |

| (In thousands except percentages) | |

INR | | |

INR | | |

USD | | |

% | |

| Financial Summary as per IFRS | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| 831,378 | | |

| 947,574 | | |

| 11,405 | | |

| 14.0 | % |

| Results from operations | |

| (5,761 | ) | |

| (120,598 | ) | |

| (1,454 | ) | |

| 1993.4 | % |

| Loss for the period | |

| (71,221 | ) | |

| (272,862 | ) | |

| (3,287 | ) | |

| (283.1 | )% |

| Financial Summary as per non-IFRS measures | |

| | | |

| | | |

| | | |

| | |

| Adjusted Margin (1) | |

| | | |

| | | |

| | | |

| | |

| Adjusted Margin - Air Ticketing | |

| 1,069,744 | | |

| 1,018,276 | | |

| 12,257 | | |

| (4.8 | )% |

| Adjusted Margin - Hotels and Packages | |

| 240,708 | | |

| 278,271 | | |

| 3,349 | | |

| 15.6 | % |

| Adjusted Margin - Other Services | |

| 41,053 | | |

| 49,561 | | |

| 597 | | |

| (20.7 | )% |

| Others (Including Other Income) | |

| 164,377 | | |

| 169,115 | | |

| 2,036 | | |

| 2.9 | % |

| Adjusted EBITDA (2) | |

| 77,717 | | |

| 34,888 | | |

| 420 | | |

| (55.1 | )% |

| Operating Metrics | |

| | | |

| | | |

| | | |

| | |

| Gross Bookings (3) | |

| 15,893,648 | | |

| 17,520,272 | | |

| 210,884 | | |

| 10.2 | % |

| Air Ticketing | |

| 13,200,796 | | |

| 14,771,705 | | |

| 177,801 | | |

| 11.9 | % |

| Hotels and Packages | |

| 1,947,481 | | |

| 2,183,857 | | |

| 26,286 | | |

| 12.1 | % |

| Other Services (6) | |

| 745,371 | | |

| 564,710 | | |

| 6,797 | | |

| (24.2 | )% |

| Adjusted Margin %*(4) | |

| | | |

| | | |

| | | |

| | |

| Air Ticketing | |

| 8.1 | % | |

| 6.9 | % | |

| | | |

| | |

| Hotels and Packages | |

| 12.4 | % | |

| 12.7 | % | |

| | | |

| | |

| Other Services | |

| 5.5 | % | |

| 8.8 | % | |

| | | |

| | |

| Quantitative details (5) | |

| | | |

| | | |

| | | |

| | |

| Air Passengers Booked | |

| 1,266 | | |

| 1,660 | | |

| | | |

| 31.2 | % |

| Stand-alone Hotel Room Nights Booked | |

| 412 | | |

| 440 | | |

| | | |

| 6.8 | % |

| Packages Passengers Travelled | |

| 5 | | |

| 5 | | |

| | | |

| 3.6 | % |

Note:

| |

(1) |

As

certain parts of our revenue are recognized on a “net” basis and other parts of our revenue are recognized on a “gross”

basis, we evaluate our financial performance based on Adjusted Margin, which is a non-IFRS measure. |

| |

(2) |

See

the section below titled “Certain Non-IFRS Measures.” |

| |

(3) |

Gross

Bookings represent the total amount paid by our customers for travel services, freight services and products booked through us, including

taxes, fees and other charges, and are net of cancellation and refunds. |

| |

(4) |

Adjusted

Margin % is defined as Adjusted Margin as a percentage of Gross Bookings. |

| |

(5) |

Quantitative details are

considered on a gross basis. |

| |

(6) |

Other Services primarily

consists of freight business, bus, rail and cab and others services. |

As

of September 30, 2023, 64,183,695 ordinary shares (on an as-converted basis), par value $0.0001 per share, of the Company (the “Ordinary

Shares”) were issued and outstanding.

Convenience

Translation

The

interim unaudited condensed consolidated financial statements are stated in INR. However, solely for the convenience of readers, the

unaudited interim condensed consolidated statement of profit or loss and other comprehensive loss for the three months and six months

ended September 30, 2023, the unaudited interim condensed consolidated statement of financial position as at September 30, 2023, the

unaudited interim condensed consolidated statement of cash flows for the six months ended September 30, 2023 and discussion of the results

of the three months ended September 30, 2023 compared with three months ended September 30, 2022, were converted into U.S. dollars at

the exchange rate of 83.08 INR per USD, which is based on the noon buying rate as at September 30, 2023, in The City of New York for

cable transfers of Indian rupees as certified for customs purposes by the Federal Reserve Bank of New York. This arithmetic conversion

should not be construed as representation that the amounts expressed in INR may be converted into USD at that or any other exchange rate

as well as that such numbers are in compliance as per the requirements of the International Financial Reporting Standards (“IFRS”).

Recent

developments

On November 17, 2023 the Company announced that its Board of Directors has approved a share repurchase program, pursuant

to which the Company is authorized to purchase up to $5 million of its outstanding ordinary shares listed on NASDAQ, par value

$0.0001 per share (“Ordinary Shares”), over an unlimited time period.

Results

of Three Months Ended September 30, 2023

Revenue.

We generated Revenue of INR 947.6 million (USD 11.4 million) in the three months ended September 30, 2023, an increase of 14.0% compared

with INR 831.4 million (USD 10.0 million) in three months ended September 30, 2022.

The

increase in revenue was primarily due to the sustained elevated travel demand in India in the quarter ended September 30, 2023 as compared

to the quarter ended September 30, 2022 and an accrual of threshold bonus for Global Distribution System (“GDS”) contracts

in the three months ended September 30, 2023.

Service

cost. Our Service cost increased to INR 166.1 million (USD 2.0 million) in the three months ended September 30, 2023, compared

to Service cost of INR 94.1 million (USD 1.1 million) in the three months ended September 30, 2022, primarily due to higher package sales

in the three months ended September 30, 2023 on account of recovery in consumer travel markets.

The

following table reconciles our Revenue (an IFRS measure) to Adjusted Margin (a non-IFRS measure), for further details, see section below

titled “Certain Non-IFRS Measures.”

Reconciliation

of Revenue (an IFRS measure) to Adjusted Margin (a non-IFRS measure)

| | |

Reportable Segments | |

| | |

Air Ticketing | | |

Hotels and Packages | | |

Other Services | |

| | |

Three months ended September 30, | |

| Amount in INR thousands (Unaudited) | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| Revenue as per IFRS - Rendering of services | |

| 428,595 | | |

| 391,961 | | |

| 267,281 | | |

| 365,820 | | |

| 34,599 | | |

| 45,459 | |

| Customer promotional expenses | |

| 641,149 | | |

| 626,315 | | |

| 67,575 | | |

| 78,576 | | |

| 6,454 | | |

| 4,102 | |

| Service cost | |

| - | | |

| - | | |

| (94,148 | ) | |

| (166,125 | ) | |

| | | |

| | |

| Adjusted Margin | |

| 1,069,744 | | |

| 1,018,276 | | |

| 240,708 | | |

| 278,271 | | |

| 41,053 | | |

| 49,561 | |

Air

Ticketing. Revenue from our Air Ticketing business was INR 392.0 million (USD 4.7 million) in the three months ended September

30, 2023 as compared to INR 428.6 million (USD 5.2 million) in the three months ended September 30, 2022, reflecting an decrease of 8.5%.

Adjusted

Margin (1) from our Air Ticketing business decreased to INR 1,018.3 million (USD 12.3 million) in the three months ended September

30, 2023, as compared to INR 1,069.7 million (USD 12.9 million) in the three months ended September 30, 2022. In the three months ended

September 30, 2023, Adjusted Margin (1) for Air Ticketing includes the add-back of INR 626.3 million (USD 7.5 million) of

consumer promotion and loyalty program costs, which reduced Revenue as per IFRS 15, against an add-back of INR 641.1 million (USD 7.7

million) in the three months ended September 30, 2022. Decline in margins is due to limited access to airlines deals in Q2.

Hotels

and Packages. Revenue from our Hotels and Packages business was INR 365.8 million (USD 4.4 million) in the three months ended

September 30, 2023, as compared to INR 267.3 million (USD 3.2 million) in the three months ended September 30, 2022, reflecting an increase

of 36.9%.

Adjusted

Margin (1) for this segment increased by 15.6% to INR 278.3 million (USD 3.3 million) in the three months ended September

30, 2023 from INR 240.7 million (USD 2.9 million) in the three months ended September 30, 2022. In the three months ended September

30, 2023, Adjusted Margin (1)l for Hotels and Packages includes the add-back of customer promotional expenses, which had

been reduced from Revenue as per IFRS 15 of INR 78.6 million (USD 0.9 million) against an add-back of INR 67.6 million (USD 0.8

million) in the three months ended September 30, 2022. The increase in Revenue and Adjusted Margin in the three months ended

September 30, 2023 is on account of recovery in domestic travel, along with addition of new distribution partners and on

account of change in mix of corporate business.

Other

Services. Our Revenue from Other Services was INR 45.5 million (USD 0.5 million) in the three months ended September 30, 2023,

an increase from INR 34.6 million (USD 0.4 million) in the three months ended September 30, 2022.

Adjusted

Margin for this segment increased by 20.7% to INR 49.6 million (USD 0.6 million) in the three months ended September 30, 2023, from INR

41.1 million (USD 0.5 million) in the three months ended September 30, 2022. In the three months ended September 30, 2023, Adjusted Margin

includes the add-back of consumer promotion expenses, which had been reduced from Revenue of INR 4.1 million (USD 0.1 million) against

an add-back of INR 6.5 million (USD 0.1 million) in the three months ended September 30, 2022 pursuant to IFRS 15. This increase in Adjusted

Margin is primarily due to an increase in revenue from our B2C other services.

| |

(1) |

See the section titled “Certain Non-IFRS Measures.” |

Other

Revenue. Our Other Revenue was INR 144.3 million (USD 1.7 million) in the three months ended September 30, 2023, an increase

from INR 100.9 million (USD 1.2 million) in the three months ended September 30, 2022 due to an increase in advertising revenue.

Other

Income. Our Other Income decreased to INR 24.8 million (USD 0.3 million) in the three months ended September 30, 2023 from INR

63.5 million (USD 0.8 million) in the three months ended September 30, 2022 due to due to decrease in write back of liabilities no longer required to be paid.

Personnel

Expenses. Our personnel expenses increased by 34.3% to INR 386.3 million (USD 4.7 million) in the three months ended September

30, 2023 from INR 287.6 million (USD 3.5 million) in the three months ended September 30, 2022. Excluding employee share-based compensation

costs of INR 107.3 million (USD 1.3 million) in the three months ended September 30, 2023, compared to INR 36.5 million (USD 0.4 million)

in the three months ended September 30, 2022, personnel expenses increased by 11.2% in the three months ended September 30, 2023 due

to the impact of annual appraisal cycle.

Marketing

and Sales Promotion Expenses. Marketing and Sales Promotion Expenses increased by 51.7% to INR 123.3 million (USD 1.5 million)

in the three months ended September 30, 2023 from INR 81.3 million (USD 1.0 million) in the three months ended September 30, 2022. Adding

back the expenses for consumer promotions and loyalty program costs, which have been deducted from Revenue per IFRS 15, our marketing

spend would have been INR 832.3 million (USD 10.0 million) in the three months ended September 30, 2023 against INR 796.5 million (USD

9.6 million) in the three months ended September 30, 2022, increased by 4.5% on a YoY.

Other

Operating Expenses. Other operating expenses decreased by 5.5% to INR 369.0 million (USD 4.4 million) in the three months ended

September 30, 2023 from INR 390.7 million (USD 4.7 million) in the three months ended September 30, 2022 primarily due to decrease in

provision for doubtful receivables and insurance cost, which is partially offset by increase in commission, legal and professional charges,

payment gateway charges, travelling and conveyance.

Depreciation

and Amortization. Our depreciation and amortization expenses increased by 2.7% to INR 48.2 million (USD 0.6 million) in the three

months ended September 30, 2023 from INR 46.9 million (USD 0.6 million) in the three months ended September 30, 2022 primarily due to

increase in amortization, which is partially offset by assets fully amortized/depreciated in previous period in the three months

ended September 30, 2023.

Results

from Operations. As a result of the foregoing factors, our Results from Operations were a loss of INR 120.6 million (USD 1.5

million) in the three months ended September 30, 2023. Our loss for the three months ended September 30, 2022 was INR 5.8 million (USD

0.1 million). Excluding the employee share-based compensation costs, Adjusted Results from Operations(1) would have been a

loss of INR 13.3 million (USD 0.2 million) for three months ended September 30, 2023 as compared to a profit of INR 30.8 million (USD

0.4 million) for three months ended September 30, 2022.

| |

(1) |

See the section titled “Certain Non-IFRS Measures.” |

Finance

Income. Our finance income decreased to INR 7.5 million (USD 0.1 million) in the three months ended September 30, 2023 from INR

9.5 million (USD 0.1 million) in the three months ended September 30, 2022. This was primarily due to a decrease in the foreign exchange

gain which is partially offset by an increase in interest income earned from our bank deposits.

Finance

Costs. Our finance costs of INR 81.9 million (USD 1.0 million) in the three months ended September 30, 2023 which includes interest

on the lease liability of INR 8.2 million (USD 0.1 million) increased by INR 21.9 million (USD 0.3 million) from finance cost of INR

60.0 million (USD 0.7 million) in the three months ended September 30, 2022, which includes interest on the lease liability of INR 9.1

million (USD 0.1 million). The increase was due to increase in interest on borrowings and increase in borrowings facilities which includes

invoice discounting/working capital facilities and non-convertible debenture.

Listing

and related expenses. Listing and related expenses relate to the expenses incurred in connection with the the

initial public offering of Yatra Online Limited, our Indian subsidiary (“Indian IPO”),. During the three month

ended September 30, 2023, the Company has incurred INR 68.2 million (USD 0.8 million) compared to an expense of INR 6.3 million (USD

0.1 million) during the three months ended September 30, 2022 is charged to the profit and loss.

Income

Tax Expense. Our income tax expense during the three months ended September 30, 2023 was INR 9.6 million (USD 0.1 million) compared

to INR 8.7 million (USD 0.1 million) during the three months ended September 30, 2022.

Loss

for the Period. As a result of the foregoing factors, our loss in the three months ended September 30, 2023 was INR 272.9 million

(USD 3.3 million) as compared to a loss of INR 71.2 million (USD 0.9 million) in the three months ended September 30, 2022. Excluding

the employee share based compensation costs and listing and related expenses, the Adjusted loss(1) would have been INR 97.4

million (USD 1.2 million) for the three months ended September 30, 2023 and Adjusted Profit(1) of INR 28.4 million (USD 0.3

million) for the three months ended September 30, 2022.

Adjusted

EBITDA(1). Due to the foregoing factors, Adjusted EBITDA Profit(1) decreased to

INR 34.9 million (USD 0.4 million) in the three months ended September 30, 2023 from an Adjusted EBITDA Profit(1) of INR 77.7

million (USD 0.9 million) in the three months ended September 30, 2022.

Basic

Loss per Share. Basic Loss per Share was INR 4.21 (USD 0.05) in the three months ended September 30, 2023 as compared to Basic

Loss per share of INR 1.14 (USD 0.01) in the three months ended September 30, 2022. After excluding the employee share-based compensation

costs and listing and related expenses, Adjusted Basic Loss per Share(1) would have been INR 2.38 (USD 0.03) in the

three months ended September 30, 2023, as compared to Adjusted Basic Earnings INR 0.47 (USD 0.01) in the three months ended September

30, 2022.

Diluted

Loss per Share. Diluted Loss per Share was INR 4.21 (USD 0.05) in the three months ended September 30, 2023 as compared to Diluted

Loss per share of INR 1.14 (USD 0.01) in the three months ended September 30, 2022. After excluding the employee share-based compensation

costs and listing and related expenses, Adjusted Diluted Loss per Share(1) would have been INR 2.38 (USD 0.03) in the

three months ended September 30, 2023 as compared to Adjusted Diluted Earnings INR 0.47 (USD 0.01) in the three months ended September

30, 2022.

Liquidity.

As of September 30, 2023, the balance of cash and cash equivalents and term deposits on our balance sheet was INR 7,174.4 million

(USD 86.4 million).

| |

(1) |

See the section titled

“Certain Non-IFRS Measures.” |

Conference

Call

The

Company will host a conference call to discuss its unaudited results for the three months ended September 30, 2023 beginning at 8:30

AM Eastern Daylight Time (or 7:00 PM India Standard Time) on November 17, 2023. Dial in details for the conference call is as follows:

US/International dial-in number: +1 404 975 4839. Confirmation Code: 182496 (Callers should dial in 5-10 minutes prior to the start time

and provide the operator with the Confirmation Code). The conference call will also be available via webcast at https://events.q4inc.com/attendee/513072489

..

Certain

Non-IFRS Measures

As

certain parts of our Revenue are recognized on a “net” basis and other parts of our Revenue are recognized on a “gross”

basis, we evaluate our financial performance based on Adjusted Margin, which is a non-IFRS measure.

We

believe that Adjusted Margin provides investors with useful supplemental information about the financial performance of our business

and more accurately reflects the value addition of the travel services that we provide to our customers. The presentation of this non-IFRS

information is not meant to be considered in isolation or as a substitute for our unaudited condensed consolidated financial results

prepared in accordance with IFRS as issued by the International Accounting Standards Board (“IASB”). Our Adjusted Margin

may not be comparable to similarly titled measures reported by other companies due to potential differences in the method of calculation.

In

addition to referring to Adjusted Margin, we also refer to Adjusted EBITDA Profit, Adjusted Results from Operations, Adjusted Profit/(Loss)

for the Period and Adjusted Basic and Adjusted Diluted Earnings/(Loss) Per Share which are also non-IFRS measures. For our internal management

reporting, budgeting and decision-making purposes, including comparing our operating results to that of our competitors, these non-IFRS

financial measures exclude employee share-based compensation cost, impairment of loan to joint venture and listing and related expenses.

Our non-IFRS financial measures reflect adjustments based on the following:

| |

● |

Employee share-based compensation

cost - The compensation cost to be recorded is dependent on varying available valuation methodologies and subjective assumptions

that companies can use while valuing these expenses especially when adopting IFRS 2 “Share-based Payment”. Thus,

the management believes that providing non-IFRS financial measures that exclude such expenses allows investors to make additional

comparisons between our operating results and those of other companies. |

| |

● |

Impairment of loan to joint

venture - The impairment cost to be recorded is dependent on varying available valuation methodologies and subjective assumptions

that companies can use while valuing the fair value of the assets on the balance sheet date. Thus, the management believes that providing

non-IFRS financial measures that exclude such expenses allows investors to make additional comparisons between our operating results

and those of other companies. |

| |

● |

Listing and related expenses

- These primarily reflect the non-recurring expenses incurred on the Indian IPO process. |

We

evaluate the performance of our business after excluding the impact of the above measures and believe it is useful to understand the

effects of these items on our results from operations, Profit/(Loss) for the period and Basic and Diluted Loss Per Share. The presentation

of these non-IFRS measures is not meant to be considered in isolation or as a substitute for our unaudited condensed consolidated financial

results prepared in accordance with IFRS as issued by the IASB. These non-IFRS measures may not be comparable to similarly titled measures

reported by other companies due to potential differences in the method of calculation.

A

limitation of using Adjusted EBITDA Profit, Adjusted Results from Operations, Adjusted Profit/(Loss) for the period and Adjusted

Basic and Adjusted Diluted Earnings/(Loss) Per Share as against using measures in accordance with IFRS as issued by the IASB are that

these non-IFRS financial measures exclude share-based compensation cost, listing and related expenses, impairment of loan to joint venture

and depreciation and amortization in case of Adjusted EBITDA profit. Management compensates for this limitation by providing specific

information on the IFRS amounts excluded from Adjusted EBITDA profit, Adjusted Results from Operations, Adjusted Profit/(Loss) for the

Period and Adjusted Basic and Adjusted Diluted Earnings/(Loss) Per Share.

The

following table reconciles our Losses for the periods (an IFRS measure) to Adjusted EBITDA (a non-IFRS measure) for the periods indicated:

| Reconciliation of Adjusted EBITDA (unaudited) | |

Three months ended | | |

Six months ended | |

| Amount in INR thousands | |

September 30, 2022 | | |

September 30, 2023 | | |

September 30, 2022 | | |

September 30, 2023 | |

| Loss for the period as per IFRS | |

| (71,221 | ) | |

| (272,862 | ) | |

| (78,185 | ) | |

| (296,806 | ) |

| Employee share-based compensation costs | |

| 36,531 | | |

| 107,256 | | |

| 71,021 | | |

| 121,671 | |

| Depreciation and amortization | |

| 46,947 | | |

| 48,230 | | |

| 102,091 | | |

| 96,498 | |

| Impairment of loan to joint venture | |

| - | | |

| - | | |

| 1,000 | | |

| - | |

| Finance income | |

| (9,540 | ) | |

| (7,493 | ) | |

| (19,861 | ) | |

| (15,961 | ) |

| Finance costs | |

| 59,979 | | |

| 81,918 | | |

| 90,683 | | |

| 167,357 | |

| Listing and related expenses | |

| 6,293 | | |

| 68,221 | | |

| 16,933 | | |

| 54,238 | |

| Tax expense | |

| 8,728 | | |

| 9,618 | | |

| 17,580 | | |

| 23,296 | |

| Adjusted EBITDA | |

| 77,717 | | |

| 34,888 | | |

| 201,262 | | |

| 150,293 | |

| Reconciliation of Adjusted Results from Operations (unaudited) | |

Three months ended | | |

Six months ended | |

| Amount in INR thousands | |

September 30, 2022 | | |

September 30, 2023 | | |

September 30, 2022 | | |

September 30, 2023 | |

| Results from operations (as per IFRS) | |

| (5,761 | ) | |

| (120,598 | ) | |

| 27,150 | | |

| (67,876 | ) |

| Employee share-based compensation costs | |

| 36,531 | | |

| 107,256 | | |

| 71,021 | | |

| 121,671 | |

| Impairment of loan to joint venture | |

| - | | |

| - | | |

| 1,000 | | |

| - | |

| Adjusted Results from Operations | |

| 30,770 | | |

| (13,342 | ) | |

| 99,171 | | |

| 53,795 | |

| Reconciliation of Adjusted Loss (unaudited) | |

Three months ended | | |

Six months ended | |

| Amount in INR thousands | |

September 30, 2022 | | |

September 30, 2023 | | |

September 30, 2022 | | |

September 30, 2023 | |

| Profit/(Loss) for the period (as per IFRS) | |

| (71,221 | ) | |

| (272,862 | ) | |

| (78,185 | ) | |

| (296,806 | ) |

| Employee share-based compensation costs | |

| 36,531 | | |

| 107,256 | | |

| 71,021 | | |

| 121,671 | |

| Impairment of loan to joint venture | |

| - | | |

| - | | |

| 1,000 | | |

| - | |

| Listing and related expenses | |

| 6,293 | | |

| 68,221 | | |

| 16,933 | | |

| 54,238 | |

| Adjusted Profit/(Loss) for the period | |

| (28,397 | ) | |

| (97,385 | ) | |

| 10,769 | | |

| (120,897 | ) |

| | |

Three months ended | | |

Six months ended | |

| Reconciliation of Adjusted Basic Earnings/(Loss) (Per Share) (unaudited) | |

September 30, 2022 | | |

September 30, 2023 | | |

September 30, 2022 | | |

September 30, 2023 | |

| Basic Earnings/(Loss) per share (as per IFRS) | |

| (1.14 | ) | |

| (4.21 | ) | |

| (1.26 | ) | |

| (4.61 | ) |

| Employee share-based compensation costs | |

| 0.57 | | |

| 1.14 | | |

| 1.12 | | |

| 1.30 | |

| Impairment of loan to joint venture | |

| | | |

| | | |

| 0.02 | | |

| | |

| Listing and related expenses | |

| 0.10 | | |

| 0.69 | | |

| 0.27 | | |

| 0.55 | |

| Adjusted Basic Earnings/(Loss) Per Share | |

| (0.47 | ) | |

| (2.38 | ) | |

| 0.15 | | |

| (2.76 | ) |

| | |

Three months ended | | |

Six months ended | |

| Reconciliation of Adjusted Diluted Earnings/(Loss) (Per Share) (unaudited) | |

September 30, 2022 | | |

September 30, 2023 | | |

September 30, 2022 | | |

September 30, 2023 | |

| Diluted Earnings/(Loss) per share (as per IFRS) | |

| (1.14 | ) | |

| (4.21 | ) | |

| (1.26 | ) | |

| (4.61 | ) |

| Employee share-based compensation costs | |

| 0.57 | | |

| 1.14 | | |

| 1.12 | | |

| 1.30 | |

| Impairment of loan to joint venture | |

| | | |

| | | |

| 0.02 | | |

| | |

| Listing and related expenses | |

| 0.10 | | |

| 0.69 | | |

| 0.27 | | |

| 0.55 | |

| Adjusted Diluted Earnings/(Loss) Per Share | |

| (0.47 | ) | |

| (2.38 | ) | |

| 0.15 | | |

| (2.76 | ) |

The

following table reconciles our Revenue (an IFRS measure), to Adjusted Revenue (a non-IFRS measure):

Reconciliation

of Revenue (an IFRS measure) to Adjusted Revenue (a non-IFRS measure)

| | |

Reportable Segments | |

| | |

Air Ticketing | | |

Hotels and Packages | | |

Other Services | |

| | |

Three months ended September 30, | |

| Amount in INR thousands (Unaudited) | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| Revenue as per IFRS - Rendering of services | |

| 428,595 | | |

| 391,961 | | |

| 267,281 | | |

| 365,820 | | |

| 34,599 | | |

| 45,459 | |

| Customer promotional expenses | |

| 641,149 | | |

| 626,315 | | |

| 67,575 | | |

| 78,576 | | |

| 6,454 | | |

| 4,102 | |

| Service cost | |

| - | | |

| - | | |

| (94,148 | ) | |

| (166,125 | ) | |

| | | |

| | |

| Adjusted Margin | |

| 1,069,744 | | |

| 1,018,276 | | |

| 240,708 | | |

| 278,271 | | |

| 41,053 | | |

| 49,561 | |

| | |

Reportable Segments | |

| | |

Air Ticketing | | |

Hotels and Packages | | |

Other Services | |

| | |

Six Months ended September 30, | |

| Amount in INR thousands | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| Revenue | |

| 804,289 | | |

| 881,330 | | |

| 657,983 | | |

| 818,375 | | |

| 82,126 | | |

| 72,177 | |

| Add: Customer promotional expenses | |

| 1,060,333 | | |

| 1,295,978 | | |

| 126,239 | | |

| 152,662 | | |

| 10,363 | | |

| 10,112 | |

| Service cost | |

| - | | |

| - | | |

| (240,861 | ) | |

| (385,145 | ) | |

| | | |

| | |

| Other income | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| | |

| Adjusted Revenue | |

| 1,864,622 | | |

| 2,177,308 | | |

| 543,361 | | |

| 585,892 | | |

| 92,489 | | |

| 82,289 | |

Safe

Harbor Statement

This

earnings release contains certain statements concerning the Company’s future growth prospects and forward-looking statements, as

defined in the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, as amended. These forward-looking

statements are based on the Company’s current expectations, assumptions, estimates and projections about the Company and its industry.

These forward-looking statements are subject to various risks and uncertainties. Generally, these forward-looking statements can be identified

by the use of forward-looking terminology such as “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “will,” “project,” “seek,” “should” similar expressions and the

negative forms of such expressions. Such statements include, among other things, statements regarding the long-term growth trajectory

for the Indian travel market, statements concerning management’s beliefs as well as our strategic and operational plans; the anticipated

benefits of the Indian IPO; the degree to which and how we will utilize debt facilities or the proceeds from the Indian IPO and the results

we anticipate from how such funds are utilized; and our future financial performance, including statements about our Revenue, cost of

Revenue, operating expenses, our expectations regarding Air Ticketing margin improvements and our ability to achieve and maintain profitability,

strengthen our balance sheet or take advantage of the rapidly recovering leisure and business travel market in India. Forward-looking

statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from

those contained in any forward-looking statement. Potential risks and uncertainties include, but are not limited to, the impact of increasing

competition in the Indian travel industry and our expectations regarding the development of our industry and the competitive environment

in which we operate; the slowdown in Indian economic growth and other declines or disruptions in the Indian economy in general and travel

industry in particular, including disruptions caused by safety concerns, terrorist attacks, regional conflicts (including the ongoing

conflict between Ukraine and Russia), pandemics and natural calamities, our ability to successfully negotiate our contracts with airline

suppliers and global distribution system service providers and mitigate any negative impacts on our Revenue that result from reduced

commissions, incentive payments and fees we receive; the risk that airline suppliers (including our GDS service providers) may reduce

or eliminate the commission and other fees they pay to us for the sale of air tickets; our ability to pursue strategic partnerships and

the risks associated with our business partners; the potential impact of recent developments in the Indian travel industry on our profitability

and financial condition; political and economic stability in and around India and other key travel destinations; our ability to maintain

and increase our brand awareness; our ability to realize the anticipated benefits of any past or future acquisitions; our ability to

successfully implement our growth strategy; our ability to attract, train and retain executives and other qualified employees, including

suitable replacements for any members of our senior management team or other employees who may seek other employment opportunities as

a result of the certain cost reduction initiatives that we have taken in response to the COVID-19 pandemic; and our ability to successfully

implement any new business initiatives. These and other factors are discussed in our reports filed with the U.S. Securities and Exchange

Commission. All information provided in this earnings release is provided as of the date of issuance of this earnings release, and we

do not undertake any obligation to update any forward-looking statement, except as required under applicable law.

About

Yatra Online, Inc.

Yatra

Online, Inc. is the ultimate parent company of Yatra Online Limited, a public listed company on the NSE and BSE (Formerly known as Yatra

Online Private Limited, hereinafter referred to as “Yatra India”), whose corporate office is based in Gurugram, India. Yatra

India is India’s largest corporate travel services provider in terms of number of corporate clients with approximately 813 large

corporate customers and approximately 50,000 registered SME customers and the third largest online travel company (OTC) in India among

key OTA players in terms of gross booking revenue and operating revenue for Fiscal 2023 (Source: CRISIL Report). Leisure and business

travelers use Yatra India’s mobile applications, its website, www.yatra.com, and its other offerings and services to explore, research,

compare prices and book a wide range of travel-related services. These services include domestic and international air ticketing on nearly

all Indian and international airlines, as well as bus ticketing, rail ticketing, cab bookings and ancillary services within India. With

approximately 105,600 hotels in approximately 1,490 cities and towns in India as well as more than 2 million hotels around the world,

Yatra India has the largest hotel inventory amongst key Indian online travel agency (OTA) players (Source: CRISIL Report).

For

more information, please contact:

Manish

Hemrajani

Yatra

Online, Inc.

VP,

Head of Corporate Development and Investor Relations

ir@yatra.com

Yatra

Online, Inc.

UNAUDITED

INTERIM CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE LOSS FOR THREE AND SIX MONTHS ENDED SEPTEMBER 30,

2023

(Amount

in thousands, except per share data and number of shares)

| | |

Three months ended September 30, | | |

Six months ended September 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

INR | | |

INR | | |

USD | | |

INR | | |

INR | | |

USD | |

| | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

Unaudited | |

| Revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Rendering of services | |

| 730,475 | | |

| 803,239 | | |

| 9,668 | | |

| 1,544,399 | | |

| 1,771,881 | | |

| 21,327 | |

| Other revenue | |

| 100,903 | | |

| 144,335 | | |

| 1,737 | | |

| 186,024 | | |

| 281,509 | | |

| 3,388 | |

| Total revenue | |

| 831,378 | | |

| 947,574 | | |

| 11,405 | | |

| 1,730,423 | | |

| 2,053,390 | | |

| 24,715 | |

| Other income | |

| 63,474 | | |

| 24,780 | | |

| 298 | | |

| 83,118 | | |

| 41,593 | | |

| 501 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service cost | |

| 94,148 | | |

| 166,125 | | |

| 2,000 | | |

| 240,861 | | |

| 385,145 | | |

| 4,636 | |

| Personnel expenses | |

| 287,557 | | |

| 386,282 | | |

| 4,650 | | |

| 557,455 | | |

| 662,081 | | |

| 7,969 | |

| Marketing and sales promotion expenses | |

| 81,291 | | |

| 123,311 | | |

| 1,484 | | |

| 112,191 | | |

| 254,329 | | |

| 3,061 | |

| Other operating expenses | |

| 390,670 | | |

| 369,004 | | |

| 4,442 | | |

| 772,793 | | |

| 764,806 | | |

| 9,206 | |

| Depreciation and amortization | |

| 46,947 | | |

| 48,230 | | |

| 581 | | |

| 102,091 | | |

| 96,498 | | |

| 1,162 | |

| Impairment of loan to Joint venture | |

| - | | |

| - | | |

| - | | |

| 1,000 | | |

| - | | |

| - | |

| Results from operations | |

| (5,761 | ) | |

| (120,598 | ) | |

| (1,454 | ) | |

| 27,150 | | |

| (67,876 | ) | |

| (818 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Finance income | |

| 9,540 | | |

| 7,493 | | |

| 90 | | |

| 19,861 | | |

| 15,961 | | |

| 192 | |

| Finance costs | |

| (59,979 | ) | |

| (81,918 | ) | |

| (986 | ) | |

| (90,683 | ) | |

| (167,357 | ) | |

| (2,014 | ) |

| Listing and related expenses | |

| (6,293 | ) | |

| (68,221 | ) | |

| (821 | ) | |

| (16,933 | ) | |

| (54,238 | ) | |

| (653 | ) |

| Loss before taxes | |

| (62,493 | ) | |

| (263,244 | ) | |

| (3,171 | ) | |

| (60,605 | ) | |

| (273,510 | ) | |

| (3,293 | ) |

| Tax expense | |

| (8,728 | ) | |

| (9,618 | ) | |

| (116 | ) | |

| (17,580 | ) | |

| (23,296 | ) | |

| (280 | ) |

| Loss for the period | |

| (71,221 | ) | |

| (272,862 | ) | |

| (3,287 | ) | |

| (78,185 | ) | |

| (296,806 | ) | |

| (3,573 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Items not to be reclassified to profit or loss in subsequent periods (net of taxes) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Remeasurement gain on defined benefit plan | |

| (10,634 | ) | |

| (1,041 | ) | |

| (13 | ) | |

| (9,772 | ) | |

| (971 | ) | |

| (11 | ) |

| Items that are or may be reclassified subsequently to profit or loss (net of taxes) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation differences loss | |

| (12,997 | ) | |

| (29,379 | ) | |

| (354 | ) | |

| (23,201 | ) | |

| (14,168 | ) | |

| (170 | ) |

| Other comprehensive loss for the period, net of tax | |

| (23,631 | ) | |

| (30,420 | ) | |

| (367 | ) | |

| (32,973 | ) | |

| (15,139 | ) | |

| (181 | ) |

| Total comprehensive loss for the period, net of tax | |

| (94,852 | ) | |

| (303,282 | ) | |

| (3,654 | ) | |

| (111,158 | ) | |

| (311,945 | ) | |

| (3,754 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss attributable to : | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Owners of the Parent Company | |

| (71,372 | ) | |

| (269,396 | ) | |

| (3,243 | ) | |

| (79,096 | ) | |

| (294,190 | ) | |

| (3,541 | ) |

| Non-Controlling interest | |

| 151 | | |

| (3,466 | ) | |

| (44 | ) | |

| 911 | | |

| (2,616 | ) | |

| (32 | ) |

| Loss for the period | |

| (71,221 | ) | |

| (272,862 | ) | |

| (3,287 | ) | |

| (78,185 | ) | |

| (296,806 | ) | |

| (3,573 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive loss attributable to : | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Owners of the Parent Company | |

| (94,850 | ) | |

| (299,485 | ) | |

| (3,605 | ) | |

| (111,925 | ) | |

| (309,001 | ) | |

| (3,719 | ) |

| Non-Controlling interest | |

| (2 | ) | |

| (3,797 | ) | |

| (49 | ) | |

| 767 | | |

| (2,944 | ) | |

| (35 | ) |

| Total comprehensive loss for the period | |

| (94,852 | ) | |

| (303,282 | ) | |

| (3,654 | ) | |

| (111,158 | ) | |

| (311,945 | ) | |

| (3,754 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss per share | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (1.14 | ) | |

| (4.21 | ) | |

| (0.05 | ) | |

| (1.26 | ) | |

| (4.61 | ) | |

| (0.06 | ) |

| Diluted | |

| (1.14 | ) | |

| (4.21 | ) | |

| (0.05 | ) | |

| (1.26 | ) | |

| (4.61 | ) | |

| (0.06 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average no. of shares | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 62,771,809 | | |

| 63,955,457 | | |

| 63,955,457 | | |

| 62,706,102 | | |

| 63,844,450 | | |

| 63,844,450 | |

| Diluted | |

| 62,771,809 | | |

| 63,955,457 | | |

| 63,955,457 | | |

| 62,706,102 | | |

| 63,844,450 | | |

| 63,844,450 | |

Yatra

Online, Inc.

UNAUDITED

INTERIM CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT SEPTEMBER 30, 2023

(Amounts

in thousands, except per share data and number of shares)

| | |

March 31, 2023 | | |

September 30, 2023 | | |

September 30, 2023 | |

| | |

INR | | |

INR | | |

USD | |

| | |

Audited | | |

Unaudited | |

| Assets | |

| | | |

| | | |

| | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property, plant and equipment | |

| 45,843 | | |

| 47,411 | | |

| 571 | |

| Right-of-use assets | |

| 200,760 | | |

| 178,434 | | |

| 2,148 | |

| Intangible assets and goodwill | |

| 778,963 | | |

| 807,542 | | |

| 9,720 | |

| Prepayments and other assets | |

| 1,177 | | |

| 1,058 | | |

| 13 | |

| Other financial assets | |

| 49,864 | | |

| 30,693 | | |

| 369 | |

| Term deposits | |

| 6,158 | | |

| 1,911,673 | | |

| 23,010 | |

| Other non financial assets | |

| 195,491 | | |

| 197,638 | | |

| 2,379 | |

| Deferred tax asset | |

| 11,086 | | |

| 11,418 | | |

| 137 | |

| Total non-current assets | |

| 1,289,342 | | |

| 3,185,867 | | |

| 38,347 | |

| | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Inventories | |

| 76 | | |

| 52 | | |

| 1 | |

| Trade and other receivables | |

| 3,061,210 | | |

| 3,924,455 | | |

| 47,237 | |

| Prepayments and other assets | |

| 951,924 | | |

| 1,058,623 | | |

| 12,743 | |

| Income tax recoverable | |

| 308,716 | | |

| 366,393 | | |

| 4,408 | |

| Other financial assets | |

| 68,997 | | |

| 105,971 | | |

| 1,276 | |

| Term deposits | |

| 581,217 | | |

| 465,571 | | |

| 5,604 | |

| Cash and cash equivalents | |

| 503,601 | | |

| 4,797,149 | | |

| 57,741 | |

| Total current assets | |

| 5,475,741 | | |

| 10,718,214 | | |

| 129,010 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| 6,765,083 | | |

| 13,904,081 | | |

| 167,357 | |

| | |

| | | |

| | | |

| | |

| Equity and liabilities | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Share capital | |

| 850 | | |

| 854 | | |

| 10 | |

| Share premium | |

| 20,388,799 | | |

| 20,464,517 | | |

| 246,323 | |

| Treasury shares | |

| (11,219 | ) | |

| (11,219 | ) | |

| (135 | ) |

| Other capital reserve | |

| 281,394 | | |

| 321,362 | | |

| 3,868 | |

| Accumulated deficit | |

| (19,921,095 | ) | |

| (15,012,193 | ) | |

| (180,696 | ) |

| Foreign currency translation reserve | |

| (31,034 | ) | |

| (45,202 | ) | |

| (544 | ) |

| Total equity attributable to equity holders of the Company | |

| 707,695 | | |

| 5,718,119 | | |

| 68,826 | |

| Total Non-controlling interest | |

| 11,624 | | |

| 2,221,072 | | |

| 26,734 | |

| Total equity | |

| 719,319 | | |

| 7,939,191 | | |

| 95,560 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Borrowings | |

| 19,274 | | |

| 275,981 | | |

| 3,322 | |

| Deferred tax liability | |

| 7,150 | | |

| 5,749 | | |

| 69 | |

| Employee benefits | |

| 40,747 | | |

| 41,581 | | |

| 500 | |

| Lease liability | |

| 203,393 | | |

| 177,292 | | |

| 2,134 | |

| Total non-current liabilities | |

| 270,564 | | |

| 500,603 | | |

| 6,025 | |

| | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Borrowings | |

| 2,333,378 | | |

| 1,466,470 | | |

| 17,651 | |

| Trade and other payables | |

| 2,176,353 | | |

| 2,613,153 | | |

| 31,453 | |

| Employee benefits | |

| 56,020 | | |

| 48,972 | | |

| 589 | |

| Deferred revenue | |

| 45,721 | | |

| 5,889 | | |

| 71 | |

| Income taxes payable | |

| 31,850 | | |

| 54,984 | | |

| 662 | |

| Lease liability | |

| 47,835 | | |

| 49,941 | | |

| 601 | |

| Other financial liabilities | |

| 417,014 | | |

| 428,155 | | |

| 5,154 | |

| Other current liabilities | |

| 667,029 | | |

| 796,723 | | |

| 9,591 | |

| Total current liabilities | |

| 5,775,200 | | |

| 5,464,287 | | |

| 65,772 | |

| Total liabilities | |

| 6,045,764 | | |

| 5,964,890 | | |

| 71,797 | |

| Total equity and liabilities | |

| 6,765,083 | | |

| 13,904,081 | | |

| 167,357 | |

Yatra

Online, Inc.

UNAUDITED

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR SIX MONTHS ENDED SEPTEMBER 30, 2023

(Amount

in INR thousands, except per share data and number of shares)

| | |

Attributable to shareholders of the Parent Company | | |

| | |

| |

| | |

Equity

share capital | | |

Equity

share premium | | |

Treasury

shares | | |

Accumulated deficit | | |

Other

capital reserve | | |

Foreign currency translation reserve | | |

Total | | |

Non controlling interest | | |

Total Equity | |

| Balance as at April 1, 2023 | |

| 850 | | |

| 20,388,799 | | |

| (11,219 | ) | |

| (19,921,095 | ) | |

| 281,394 | | |

| (31,034 | ) | |

| 707,695 | | |

| 11,624 | | |

| 719,319 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss for the period | |

| | | |

| | | |

| | | |

| (294,190 | ) | |

| | | |

| | | |

| (294,190 | ) | |

| (2,616 | ) | |

| (296,806 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation differences | |

| | | |

| | | |

| | | |

| - | | |

| | | |

| (14,168 | ) | |

| (14,168 | ) | |

| - | | |

| (14,168 | ) |

| Re-measurement gain on defined benefit plan | |

| | | |

| | | |

| | | |

| (641 | ) | |

| | | |

| - | | |

| (641 | ) | |

| (330 | ) | |

| (971 | ) |

| Total other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (641 | ) | |

| - | | |

| (14,168 | ) | |

| (14,809 | ) | |

| (330 | ) | |

| (15,139 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (294,831 | ) | |

| - | | |

| (14,168 | ) | |

| (308,999 | ) | |

| (2,946 | ) | |

| (311,945 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share based payments | |

| - | | |

| - | | |

| - | | |

| 5,988 | | |

| 115,690 | | |

| - | | |

| 121,678 | | |

| - | | |

| 121,678 | |

| Exercise of options | |

| 4 | | |

| 75,718 | | |

| - | | |

| - | | |

| (75,722 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

Change in non-controlling

interest* | |

| - | | |

| - | | |

| - | | |

| 5,197,745 | | |

| - | | |

| - | | |

| 5,197,745 | | |

| 2,212,394 | | |

| 7,410,139 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total contribution by owners | |

| 4 | | |

| 75,718 | | |

| - | | |

| 5,203,733 | | |

| 39,968 | | |

| - | | |

| 5,319,423 | | |

| 2,212,394 | | |

| 7,531,817 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as at September 30, 2023 | |

| 854 | | |

| 20,464,517 | | |

| (11,219 | ) | |

| (15,012,193 | ) | |

| 321,362 | | |

| (45,202 | ) | |

| 5,718,119 | | |

| 2,221,072 | | |

| 7,939,191 | |

* Pursuant to fresh issue of shares by Indian

subsidiary and sale of shares of Indian subsidiary by THCL as part of the Indian IPO, non-controlling interest share has increased from

1.41% to 35.54%. The Company has opted to allocate the transaction cost incurred to non-controlling interest, in accordance with IFRS

10.

Yatra

Online, Inc.

UNAUDITED

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR SIX MONTHS ENDED SEPTEMBER 30, 2023

(Amount

in thousands, except per share data and number of shares)

| | |

Six months ended September 30, | |

| | |

2022 | | |

2023 | | |

2023 | |

| | |

INR | | |

INR | | |

USD | |

| | |

| | |

| | |

| |

| Profit/(Loss) before tax | |

| (60,605 | ) | |

| (273,511 | ) | |

| (3,292 | ) |

| Adjustments for non-cash and non-operating items | |

| 173,724 | | |

| 222,866 | | |

| 2,683 | |

| Change in working capital | |

| (898,318 | ) | |

| (122,218 | ) | |

| (1,471 | ) |

| Direct taxes paid (net of refunds) | |

| (61,978 | ) | |

| (59,603 | ) | |

| (717 | ) |

| Net cash flows from/(used in) operating activities | |

| (847,177 | ) | |

| (232,466 | ) | |

| (2,797 | ) |

| Net cash flows (used in) investing activities | |

| 100,167 | | |

| (1,862,084 | ) | |

| (22,413 | ) |

| Net cash flows (used in) financing activities | |

| 265,853 | | |

| 6,399,655 | | |

| 77,030 | |

| Net decrease in cash and cash equivalents | |

| (481,157 | ) | |

| 4,305,105 | | |

| 51,820 | |

| Cash and cash equivalents at the beginning of the period | |

| 800,282 | | |

| 503,601 | | |

| 6,062 | |

| Effect of exchange differences on cash and cash equivalents | |

| (29,749 | ) | |

| (11,557 | ) | |

| (141 | ) |

| Cash and cash equivalents at the end of the period | |

| 289,376 | | |

| 4,797,149 | | |

| 57,741 | |

Yatra

Online, Inc.

OPERATING

DATA

The

following table sets forth certain selected unaudited condensed consolidated financial and other data for the periods indicated:

| | |

For the three months ended September 30, | | |

For the six months ended September 30, | |

| (In thousands except percentages) | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| Quantitative details * | |

| | | |

| | | |

| | | |

| | |

| Air Passengers Booked | |

| 1,266 | | |

| 1,660 | | |

| 2,556 | | |

| 3,485 | |

| Stand-alone Hotel Room Nights Booked | |

| 412 | | |

| 440 | | |

| 997 | | |

| 931 | |

| Packages Passengers Travelled | |

| 5 | | |

| 5 | | |

| 10 | | |

| 11 | |

| Gross Bookings | |

| | | |

| | | |

| | | |

| | |

| Air Ticketing | |

| 13,200,796 | | |

| 14,771,705 | | |

| 28,038,334 | | |

| 31,695,664 | |

| Hotels and Packages | |

| 1,947,481 | | |

| 2,183,857 | | |

| 4,151,792 | | |

| 4,587,999 | |

| Other Services | |

| 745,371 | | |

| 564,710 | | |

| 1,570,738 | | |

| 1,070,985 | |

| Total | |

| 15,893,648 | | |

| 17,520,272 | | |

| 33,760,864 | | |

| 37,354,648 | |

| Adjusted Margin | |

| | | |

| | | |

| | | |

| | |

| Adjusted Margin - Air Ticketing | |

| 1,069,744 | | |

| 1,018,276 | | |

| 1,864,622 | | |

| 2,177,307 | |

| Adjusted Margin - Hotels and Packages | |

| 240,708 | | |

| 278,271 | | |

| 543,361 | | |

| 585,892 | |

| Adjusted Margin - Other Services | |

| 41,053 | | |

| 49,561 | | |

| 92,489 | | |

| 82,288 | |

| Others (Including Other Income) | |

| 164,377 | | |

| 169,115 | | |

| 269,143 | | |

| 323,102 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted Margin %** | |

| | | |

| | | |

| | | |

| | |

| Air Ticketing | |

| 8.1 | % | |

| 6.9 | % | |

| 6.7 | % | |

| 6.9 | % |

| Hotels and Packages | |

| 12.4 | % | |

| 12.7 | % | |

| 13.1 | % | |

| 12.8 | % |

| Other Services | |

| 5.5 | % | |

| 8.8 | % | |

| 5.9 | % | |

| 7.7 | % |

*

Quantitative details are considered on Gross basis.

**

Adjusted Margin % is defined as Adjusted Margin as a percentage of Gross Bookings.

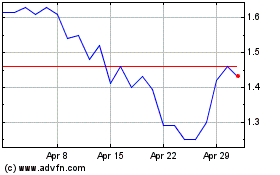

Yatra Online (NASDAQ:YTRA)

Historical Stock Chart

From Apr 2024 to May 2024

Yatra Online (NASDAQ:YTRA)

Historical Stock Chart

From May 2023 to May 2024