Siemens Sees Slower Revenue Growth, With Automation Demand Still Recovering -- 2nd Update

November 16 2023 - 3:46AM

Dow Jones News

By Giulia Petroni

Siemens anticipates a slowdown in revenue growth next year, with

global demand for automation products not expected to pick up again

until the second half.

The German industrial conglomerate said Thursday that it is

targeting revenue growth of between 4% and 8% on a comparable

basis, compared with 11% growth in the current year. Revenue at the

digital industries division, which sells automation equipment and

software to industrial customers globally, should grow by up to 3%

or stagnate, with demand in the automation businesses still

recovering, especially in China.

"We expect fiscal 2024 to be more of a 'transitional year'

before accelerated growth picks up again," Chief Financial Officer

Ralf Thomas said. "For the first half, we anticipate a soft

economic development with sluggish demand, especially in China and

Germany, and with destocking in key countries. We assume that

improving trends will begin to materialize in the second half."

Thomas added that muted growth momentum in the next quarters is

also the result of fading effects from price inflation and a softer

investment climate due to higher interest rates.

Earnings per share--before purchase price allocation accounting

and excluding the effects of investments in Siemens Energy--are

seen at between 10.40 and 11 euros ($11.28 and $11.93) in fiscal

2024.

In the fourth quarter ended Sept. 30, Siemens's net profit came

to EUR1.72 billion, down from EUR2.70 billion in the year-earlier

period. In fiscal 2023, net profit soared to EUR7.95 billion from

EUR3.72 billion.

Quarterly revenue grew 4% to EUR21.39 billion, while orders came

in broadly flat at EUR21.80 billion. On a comparable basis, revenue

and orders increased 10% and 6% in the quarter, respectively.

"Our customers and distributors continued destocking their

inventories in all key countries, particularly in China," Chief

Executive Roland Busch said.

In the digital industries segment, orders declined 14% on year

in the quarter, dragged by the short-cycle automation businesses,

with market conditions softening across regions and continued

destocking. The company assumes orders at its automation business

bottomed out in the quarter.

Siemens said free cash flow exceeded EUR10 billion in the year,

and that it will lift its dividend to EUR4.70 a share from EUR4.25

in 2022. That translates into a dividend yield of 3.5% based on the

closing share price of EUR135.66 at the end of September.

The company also said it will start an upgraded share buyback

program of up to EUR6 billion for up to five years as soon as it

completes the current program.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

November 16, 2023 03:31 ET (08:31 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

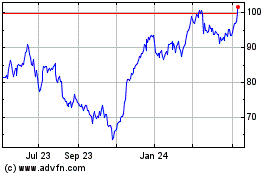

Siemens (PK) (USOTC:SIEGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

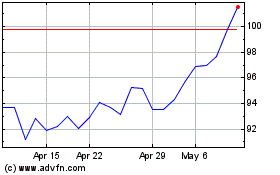

Siemens (PK) (USOTC:SIEGY)

Historical Stock Chart

From Apr 2023 to Apr 2024