Siemens Sees Slower Revenue Growth, With Automation Demand Still Recovering -- Update

November 16 2023 - 2:32AM

Dow Jones News

By Giulia Petroni

Siemens anticipates a slowdown in revenue growth next year, with

global demand for automation products not expected to pick up again

until the second half.

The German industrial conglomerate on Thursday said it is

targeting revenue growth of between 4% and 8% on a comparable

basis, compared with 11% growth in the current year. Revenue at the

digital industries division, which sells automation equipment and

software to industrial customers globally, is expected to grow by

up to 3% or stagnate.

"This is based on the assumption that following destocking by

customers, global demand in the automation businesses, especially

in China, will pick up again in the second half of the fiscal

year," the company said.

Earnings per share--before purchase price allocation accounting

and excluding the effects of investments in Siemens Energy--are

seen at between EUR10.40 and EUR11 in fiscal 2024.

In the fourth quarter ended Sept. 30, Siemens's net profit came

to EUR1.72 billion, down from EUR2.70 billion in the year-earlier

period. In the full year, net profit soared to EUR7.95 billion from

EUR3.72 billion.

Quarterly revenue grew 4% to EUR21.39 billion, while orders came

in broadly flat at EUR21.80 billion. On a comparable basis, revenue

and orders increased 10% and 6% in the quarter, respectively.

Siemens said free cash flow exceeded EUR10 billion in the year,

and that it will lift its dividend to EUR4.70 a share from EUR4.25

in 2022.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

November 16, 2023 02:17 ET (07:17 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

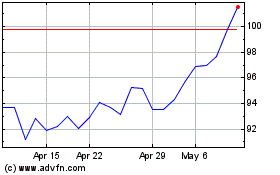

Siemens (PK) (USOTC:SIEGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

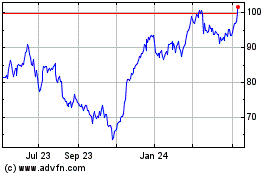

Siemens (PK) (USOTC:SIEGY)

Historical Stock Chart

From Apr 2023 to Apr 2024