false

0001434524

0001434524

2023-11-14

2023-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 14, 2023

CLEARSIGN TECHNOLOGIES CORPORATION

(Exact name of registrant as specified in Charter)

| Delaware |

|

001-35521 |

|

26-2056298 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File No.) |

|

(IRS Employee

Identification No.) |

8023 E. 63rd Place, Suite 101

Tulsa,

Oklahoma 74133

(Address of Principal Executive Offices)

(918) 236-6461

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2 below).

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13(e)-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which

registered |

| Common Stock |

|

CLIR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth

company ¨ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results

of Operations and Financial Condition.

To

the extent required, the information set forth below in Item 7.01 of this Current Report on Form 8-K is incorporated herein by reference

in its entirety.

Item 7.01 Regulation FD Disclosure.

On

November 14, 2023, ClearSign Technologies Corporation (the “Company”) issued a press release announcing the results of

operations for the quarter ended September 30, 2023 (the “Third Quarter Results”). The press release is included as Exhibit 99.1

to this Current Report on Form 8-K and is incorporated by reference in its entirety into this Item 7.01.

Also

on November 14, 2023, the Company held a conference call discussing the Third Quarter Results and other business related information.

A transcript of this conference call is attached as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated by reference

in its entirety into this Item 7.01.

The

information furnished with this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act,

except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 15, 2023

| |

CLEARSIGN TECHNOLOGIES CORPORATION |

| |

|

|

| |

|

|

| |

By: |

/s/ Colin James Deller |

| |

Name: |

Colin James Deller |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

ClearSign Technologies Corporation Provides

Third Quarter 2023 Update

TULSA, Okla., November 14, 2023 -- ClearSign Technologies Corporation

(Nasdaq: CLIR) ("ClearSign" or the "Company"), an emerging leader in industrial combustion and sensing technologies

that improve energy, operational efficiency and safety while dramatically reducing emissions, today provides an update on operations for

the third quarter ended September 30, 2023.

“We are pleased to start putting our initial commercial orders

into operation, and meaningfully expanding our operational reference list as we do so,” said Jim Deller, Ph.D., Chief Executive

Officer of ClearSign. “Our first commercial boiler burner installation was started up last week, our Texas chemicals burner is installed

and awaiting start up, and burners for our two fast track refinery heaters are scheduled to start up next month and early in the new year.”

“On top of this, we rolled out new branding of our boiler burner line with Rogue. The new market segmentation and flexibility in

this product line attained through this refreshed branding has already shown promise, and we are encouraged by the growing opportunities

in both of our product lines,” concluded Dr. Deller.

Recent strategic and operational highlights during and subsequent to

the end of the third quarter 2023 include:

Marketing

re-Lauch of Boiler Burner Products: The Company has launched and branded the boiler product line to Rogue NZN (Near Zero NOx),

Rogue S5 and Rogue S9. These product lines are targeted and segmented to address prospective customers’ different needs and requirements.

Hired

Matthew Martin as Chief Technology Officer: Mr. Martin is an established industry veteran who is well respected throughout

the fired equipment and combustion industry. Mr. Martin’s focus will be to further develop and grow ClearSign’s business

in the rapidly evolving global energy industry. Mr. Martin will leverage his experience in product positioning to identify opportunities

for business growth and look to broaden the applications of the unique ClearSign Core technology into new markets and verticals.

Completed

Successful Phase 1 Testing of Ultra-Low NOx 100% Hydrogen Burner and Awarded Phase 2 SBIR Grant for $1.65M: With this completion

of the Phase 1 work, the Company submitted a follow-up proposal with testing data and documented industry support to continue the development

work with a Phase 2 grant. Subsequently, the Company was awarded a Phase 2 government grant through the SBIR program with the DOE to further

the development and commercialization of a ClearSign Core™ Ultra Low NOx burner fueled with 100% hydrogen.

Announced

the Collaboration and Support from SoCalGas for its Flexible Hydrogen Fueled Ultra Low NOx Process Burner Project: SoCalGas

will promote the introduction and field demonstration of the hydrogen capable ClearSign Core burner technology in Southern California,

as well as provide an additional $500,000 to fund to the project which is designed to help decarbonize hard-to-electrify industries,

which is entering its commercialization phase.

The Company recognized approximately $85 thousand in revenue during

the three months ended September 30, 2023, as compared to zero revenue for the same period of 2022.

Cash, cash equivalents and short-term investments were approximately

$7.2 million as of September 30, 2023.

There were 38,565,836 shares of the Company’s common stock issued

and outstanding as of September 30, 2023.

The Company will be hosting a call at 5:00 PM ET today.

Investors interested in participating on the live call can dial 1-866-372-4653 within the U.S. or 1-412-902-4217 from abroad. Investors

can also access the call online through a listen-only webcast at https://app.webinar.net/dWz7ApJRlBv or on the investor

relations section of the Company's website at http://ir.clearsign.com/overview.

The webcast will be archived on the Company's investor relations website

for at least 90 days and a telephonic playback of the conference call will be available by calling 1-877-344-7529 within the U.S. or 1-412-317-0088

from abroad. Conference ID #4731576. The telephonic playback will be available for 7 days after the conference call.

About ClearSign Technologies Corporation

ClearSign Technologies Corporation designs and develops products and

technologies for the purpose of improving key performance characteristics of industrial and commercial systems, including operational

performance, energy efficiency, emission reduction, safety and overall cost-effectiveness. Our patented technologies, embedded in established

OEM products as ClearSign Core™ and ClearSign Eye™ and other sensing configurations, enhance the performance of combustion

systems and fuel safety systems in a broad range of markets, including the energy (upstream oil production and down-stream refining),

commercial/industrial boiler, chemical, petrochemical, transport and power industries. For more information, please visit www.clearsign.com.

Cautionary note on forward-looking statements

All

statements in this press release that are not based on historical fact are “forward-looking statements.” You can find many

(but not all) of these statements by looking for words such as “approximates,” “believes,” “hopes,”

“expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,”

“would,” “should,” “could,” “may,” “will” or other similar expressions. While

management has based any forward-looking statements included in this press release on its current expectations on the Company’s

strategy, plans, intentions, performance, or future occurrences or results, the information on which such expectations were based may

change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks,

uncertainties and other factors, many of which are outside of our control, that could cause actual results to materially differ from such

statements. Such risks, uncertainties and other factors include, but are not limited to, our ability to successfully deliver, install,

and meet the performance obligations of our burners in the California and Texas market, and any other markets we may sell our products

in; our ability to further expand the sale of ultra-low NOx process and boiler burners; our ability to successfully perform engineering

orders; our ability to successfully develop our 100% hydrogen burner with the Phase 2 grant funding; general business and economic conditions;

the performance of management and our employees; our ability to obtain financing, competition; whether our technology will be accepted

and adopted and other factors identified in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission

and available at www.sec.gov and other factors that are detailed in our periodic and current reports available for review

at www.sec.gov. Furthermore, we operate in a competitive environment where new and unanticipated risks may arise. Accordingly,

investors should not place any reliance on forward-looking statements as a prediction of actual results. We disclaim any intention to,

and, except as may be required by law, undertake no obligation to, update or revise forward-looking statements to reflect events or circumstances

that subsequently occur or of which we hereafter become aware.

For further information:

Investor Relations:

Matthew Selinger

Firm IR Group for ClearSign

+1 415-572-8152

mselinger@firmirgroup.com

Exhibit 99.2

[CLIR] ClearSign Technologies

Q3 2023 Earnings Conference Call

Tuesday, November 14, 2023, 5:00 PM ET.

Officers and Speakers

Matthew Selinger, Firm IR Group

Brent Hinds, Chief Financial Officer

Jim Deller, Chief Executive Officer

Analysts

Eric Gruskin, Private Investor

Robert Kecseg, Las Colinas Capital Management

Jeff Feinglas, Private Investor

Brad Van Dooker, Private Investor

Presentation

Operator: Good day, and welcome to the ClearSign Technologies Third

Quarter 2023 Conference Call. (Operator Instructions). After today's presentation, there will be an opportunity to ask questions. (Operator

Instructions). Please also note that this event is being recorded today.

I would now like to turn the conference over to Matthew Selinger of

Firm IR Group. Please go ahead, sir.

Matthew Selinger: Good afternoon, and thank you, operator. Welcome,

everyone, to the ClearSign Technologies Corporation Third Quarter 2023 Results Conference Call. During this conference call, the company

will make forward-looking statements. Any statement that is not a statement of historical fact is a forward-looking statement. This includes

remarks about the company's projections, expectations, plans, beliefs and prospects. These statements are based on judgments and analysis

as of the date of this conference call, and are subject to numerous important risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking statements.

The risks and uncertainties associated with the forward-looking statements

made in this conference call include, but are not limited to, whether field testing and sales of ClearSign's products will be successfully

completed, whether ClearSign will be successful in expanding the market for its products, and other risks that are described in ClearSign's

public periodic filings with the SEC, including the discussion in the Risk Factors section of the 2022 Annual Report on Form 10-K

and a quarterly report on Form 10-Q for the quarterly period ended September 30, 2023.

Except as required by law, ClearSign assumes no responsibility to update

these forward-looking statements to reflect future events or actual outcomes, and does not intend to do so.

On the call with me today are Jim Deller, ClearSign's Chief Executive

Officer, and Brent Hinds, ClearSign's Chief Financial Officer.

So at this point in the call, I would like to turn the call over

to CFO Brent Hinds. Brent, please go ahead,

Brent Hinds: Thank you, Matthew, and thank you to everyone for joining

us here today. Before I begin, I'd like to note that our financial results on Form 10-Q were filed with the SEC earlier today

after the market close.

With that, I'd like to give an overview of the financials for

the third quarter of 2023. The company recognized $85,000 in revenue during the third quarter of 2023 compared to $324,000 for the comparable

period in 2022. Revenues recognized year-to-date in 2023 were $1.1 million compared to $324,000 for the same period in 2022. The increase

in year-over-year revenues were driven in large part by our two ongoing California process burner refinery projects.

Now I'd like to shift our focus from revenue to cash. Our net cash

used in operations for the quarter-ended September 30, 2023, was approximately $1.3 million compared to approximately $900,000 for

the same period in 2022. This $400,000 year-over-year increase was driven by project execution costs related to our California refinery

projects.

As noted in prior conference calls, many of our contracts are set up

so as to allow us to collect meaningful amounts of cash before we recognize revenues. As we continue to work through these contracts,

we will hit contract milestones in the coming months that will allow us to collect more cash from our customers.

Now turning focus from cash to the income statement. Our net loss for

the third quarter in 2023 was approximately $1.3 million, which is essentially the same for the comparable period in 2022. Our year-to-date

net loss for 2023 was approximately $4.2 million, which is approximately a $200,000 decrease year-over-year compared to the prior year.

This year-over-year decrease was predominantly due to our change in gross profit, which improved due to sales volume.

As of September 30, 2023, we have $7.2 million in cash and cash

equivalents, with 38.6 million shares of common stock outstanding.

And with that, I'd like to turn the call over to our CEO, Jim

Deller. Jim?

Jim Deller: Thank you, Brent, for the financial overview. As always, I'd

like to thank everyone for joining us on the call today and your interest in ClearSign. On today's call, I will review our business

segments, changing our usual order, and I will start with boiler burners first this time. And at the end of this, I will touch on

China since boiler burners are our main product line there. Following that, I'll move on to process burners, which will include both

what I will call typical process applications and also an update on high hydrogen projects and developments.

Before I start, I have a couple of more general items I'd like

to address. Firstly, I want to personally extend my thanks to Board member, Gary DiElsi, who has just stepped down. Gary called me

early Thursday last week to pass on his regrets that he has had some unavoidable time commitments arise, and unfortunately, he will not

be able to continue his service to ClearSign as a Director. On behalf of myself and the other Directors, I want to pass my gratitude

for his engagement and advisory and help. And we do wish him the best in the future.

The second item is to make you aware of some work completed by a third

party that will be of interest. This report was published by the consulting company ICF for the California State Gas Emerging Technologies

or GET Program, titled Market Assessment of Emerging Ultra-Low NOx Burner Technologies dated August 11, 2023. And that gives a comparison

of the latest burner technologies and features ClearSign prominently, both our process burner and boiler burner technologies. Our boiler

burners are also identified under the Rogue brand name.

So a few quotes to report findings include, "Unlike other burner

manufacturers who have tweaked a regular burner to get ultra-low-NOx levels, ClearSign's burner has been purposely developed to be ultra-low-NOx

from the beginning, and therefore, have tremendous operational flexibility." And then in a section reviewing the ClearSign Rogue

boiler burner, the quote, "This boiler burner using the ClearSign core technology has exceptional flexibility for controlling NOx

emissions." During the site visits, we were able to tweak the burner to operate close to sub-1 PPM NOx. We have put a link to this

report on the home page of our website.

Now turning to our product lines, I will start with boiler burners

first, as said on this call, because we have completed some significant work behind the scenes and want to give this some extra attention.

We have previously discussed our first three boiler burner sales, two into California and one into Texas. These are meaningful as they

will be our first commercial deployments in the field. We actually have four deployments. As for the first sale, we deployed the 500 horsepower

rental boilers from our partner, California Boiler. This rental boiler was set up, and some of you may have seen our posting on LinkedIn

regarding this.

The first boiler burner sale was for a global medical and business

waste services company, and was in conjunction with our partner, California Boiler, into the San Joaquin Valley Air Pollution Control

District of California. This burner was shipped down to California, is now installed and after some delays outside of the scope of ClearSign

or California Boiler, finally started up last week. This unit is now in operation.

Formal third-party verification of the NOx performance has not yet

been completed, But our preliminary numbers indicate that less than 4 parts per million are being achieved, and we have the capability

to reduce this further if needed.

The second boiler burner sold into the California market was to a national

provider of recycling services to the food production and restaurant industries, and will be installed in combination with a new boiler.

This was sold as a package with our partner, California Boiler, into the San Joaquin Valley Air Pollution Control District of California.

The installation is part of recycling plant upgrade that will increase energy efficiency for one of this customer's nationwide sites.

The new burner and new boiler are both shipped and in California awaiting

installation. This new boiler and burner is part of an upgrade of this customer's operations. And it's our understanding that the new

building into which this boiler will be installed is currently under construction.

We believe we are truly resetting the bar for boiler burners. This

burner is larger at 1,200 horsepower and is in the size range requiring sub-2.5 part per million NOx emissions, a capability that we believe

is unique to ClearSign burners. All other solutions require the inclusion of an SCR and associated capital costs and ammonia handling

that go with them. It's also worth noting that the new boiler for this site is being supplied by Hearst, the largest manufacturer of 5G

boilers in the United States.

The third boiler burner sale was into Texas, where after California,

we anticipate the Texas Gulf Coast region will be the next large market for us. This sale was to a chemicals company and the first into

the industrial chemicals sector. This is unique in the fact that this is our first application of our boiler burner technology into a

non-boiler heater and very importantly, our first sale to a heater manufacturer, who has included our burner as their chosen solution

to meet their customers' needs. This burner has been installed and actually run, enabling us to collect preliminary NOx data significantly

below the required 5 parts per million permit level.

The unit is not yet in full operation, but we anticipate that it will

be in the coming weeks, and in doing so, will provide a valuable reference for us in this important Texas Gulf Coast region. This installation,

in particular, is receiving significant attention. Specifically, we believe that this opportunity will enable us to quote new heaters

once this burner is fully operational.

Further, this sale is to a heater manufacturer who has also provided

the boiler burner and boiler package to our end-user customer in Texas, who will now have firsthand experience of the efficacy of ClearSign

burners, and the competitive advantage that they provide for them, which we believe will result in even more sales, both for the heater

manufacturer and us. In fact, just this past week, we were asked to quote for two other projects that this customer is chasing.

Over the last couple of months, we've made some significant, albeit

subtle, changes to the marketing and branding of our Rogue burner product line. For those of you who follow us closely, you will start

to see references to Rogue NZN, Rogue S5 and Rogue S9 burners. This is the result of market segmentation and assessing what is needed

to be competitive in different regions. And what I'm excited about is developing an offering that we believe will be competitive throughout

the United States and beyond, significantly expanding the customer base that we can pursue today.

For anyone new, and to avoid confusion, Rogue is the name given to

the boiler burner built with our ClearSign core burner body and the fuel gas controls and equipment, which are provided by Rogue Combustion,

a subsidiary of our partner, California Boiler. Rogue NZN, an abbreviation of Near Zero NOx, is our high-end fully capable burner provided

with NOx emission guarantees at 2.5 parts per million or below, (indiscernible) in boilers over 500 horsepower in the Valley District

of California. And we anticipate other regions of California, including the Los Angeles region, in the future.

In this segment, our competition is a [cathodic] unit back-end cleanup

system, which is a much more capital and operationally-expensive alternative. The S5 version is a simplified ClearSign core burner and

a simpler control system, modified to provide a superior offering in a segment where there are some alternative burners available, albeit

with hit-and-miss results, low operating efficiency and higher maintenance needs. This burner and the sales materials are focused on our

California customers and particularly, 5G boilers smaller than 500 horsepower. The S9 version is targeted at all regions outside of California.

The main difference between the S5 and the S9 is the sales channel

and promotional strategy, as the competitive landscape is different. I appreciate that these distinctions may seem subtle, but this approach

leads to the development of sales channels targeted to these distinctly-different markets and customers.

On our last call, we introduced Tina Unachukwu, who has just joined

us as Director of Customer Relations and Business Development. Tina was instrumental in orchestrating the aforementioned rebranding and

segmentation. Driving changes like this through takes focus, management and experience, and I'm very pleased to have Tina work with us

and with California Boiler to bring this revision into practice together. This has truly been a collaborative project.

While I do not have any actual orders to report today, we already have

seen traction with customers in two states outside of California and Texas, and in addition, have been notified that we have been identified

as the favorite supplier for a new multi-burner project in California.

For some detail, one of the attributes identified in our segmentation

project was the ability to provide a sub-5 ppm or sub-9 ppm burner, and then provide a simple upgrade to enable our customers to comply

with a future 2.5 ppm requirement should that be needed without a major change-out of their equipment. This capability was specifically

referenced in our proposal and also in the feedback asked back to us by this customer when explaining why they selected the ClearSign

Rogue offering. I look forward to letting you know as these opportunities are brought to fruition.

Now a quick update on our work in China. We are in the commissioning

phase of our 500 horsepower demonstration unit there in China. This has admittedly taken longer than we originally anticipated, due to

the time required to get some final components fabricated. But we do believe we are in the final stages and look forward to being able

to coordinate the formal visit from the Chinese officials to demonstrate the burner operating to its full performance range. I anticipate

that this will be around the end of the year or very early 2024.

Please note all boiler burner companies, domestic and foreign, need

to go through this government burner certification process in order to be allowed to sell burners in China.

The regulations in China continue to push the reduction of emissions.

China's National Development and Reform Commission issued guidance in 2023 to accelerate the retrofit of equipment to further improve

energy savings, CO2 and harmful emissions. We continue to have good engagements with the government at local levels. In particular, we

continue to work with administration in [Shenzhen] and promote our joint capabilities with Shuangliang. We have similar engagements in

Tangshan, and in general, have engaged in strategic outreach to major industrial parks in Suzhou, Nantong and Tianjin.

Now, switching to process burdens. The last time we spoke, and at the

start of this quarter, we had just received the award of $1.6 million for the Phase II SBIR grant from the Department of Energy for a

100% hydrogen low NOx burner. This grant follows the previous Phase 1 grant for $250,000, which was for the proof-of-concept work. As

we discussed, the second grant is for up to 2 years and will fund the development and commercialization of a full range of burners that

will enable the control of NOx emissions to the levels required to control ground-level ozone in critical polluted areas. These burners

will coincide with the adoption of the new hydrogen economy and the use of hydrogen fuel for industrial heating.

The anticipated outcome is to achieve reductions in the industrial

emissions of both carbon dioxide and nitrogen oxides, or to enable our customers to transition to hydrogen or hydrogen fuels within the

constraints of their current operating permits.

As we have highlighted previously, the current available solutions

are able to reduce CO2 through the burning of hydrogen in place of hydrocarbon fuels, but the byproduct is much higher NOx. Our novel

burner enables down to zero CO2 by burning pure hydrogen and creates NOx emissions so low, that they compete with SCRs in the low-single-digit

parts per million range.

Phase 1 saw the completion of demonstration of a prototype process

burner to successfully integrate with hydrogen and hydrogen blending, while maintaining NOx below 5 parts per million. Phase II will entail

scaling up the size of the burner from 2 million BTUs per hour up to 8 million BTUs an hour and deploying it in real-world commercial

industrial settings where high heat is required over the next 2 years. The design of the first burner, the second phase is done, and we

are in the process of scheduling for fabrication and testing. This is anticipated for early 2024.

We did mention on the last call that we are seeing interest from additional

parties regarding our hydrogen technology. And on the heels of this, we announced on September 20 a collaboration with Southern California

Gas Company, or so SoCalGas, for additional funding as well as other support for this project. SoCalGas has pledged $500,000 to the project

with the objective of promoting the installation of our hydrogen-capable ClearSign Core burn technology into their client space in Southern

California.

This latter part, the support of the field demonstration, is vital

as they will help us find and select demonstration sites from their client list, so that we can get the technology into the field; and

of course, for SoCalGas, so they can prepare their customers to receive the hydrogen fuels from the infrastructure that SoCalGas is developing

and continue to operate within their environmental permits.

SoCalGas is an exciting partner, as they have focused on clean energy

innovations designed to decarbonize hard-to-electrify sectors of the economy. This is a segment that is the focus of most hydrogen projects,

and in this case, a key component of the efforts to help California achieve net zero by 2045. To that end, SoCalGas is working to develop

Angeles Link, a proposed green hydrogen pipeline system that could deliver hydrogen to the Los Angeles region, a project which could be

the nation's largest green hydrogen pipeline system.

On top of our collaborative focus on a hydrogen fuel process burner,

we have been able to present to them our other existing products in our portfolio like our Ultra-Low NOx boiler burners. In turn, SoCalGas

has set up meetings and made introductions enabling us to present our technology and business to opportunities to not only a significant

number of their customers, but also their peers in other regions and other technology-development organizations largely funded by these

large utilities.

It is an exciting opportunity to be able to leverage our collaborative

relationships with SoCalGas, and get in front of the customers that rely on them for their fuel. We hope to grow and foster this relationship

by bringing products into the market that can help companies like SoCalGas meet their forward-looking mandates by providing their customers

access to our boiler and process heater technology.

Turning to the projects in our pipeline. We have two multi-heater multi-burner

orders that we are processing. The second of these two orders is actually on the tighter schedule. As a quick reminder, this order is

for the burners to fit into two different existing heaters. The order, which we received back in May of this year, includes 13 burners

in total. The factory performance test for the first of these two heaters went very smoothly and was completed mid-October. These burners

are now in the manufacturing process, and they're due to be shipped and installed this year.

The performance test for the second of these heaters is underway this

week, and these burners are scheduled to be installed early after the New Year. And if you recall, due to our contract structures, these

are the events that will trigger significant revenue recognition. We are anxious to get this order completed, because as some of you may

recollect, this order is a repeat order from a customer who was an early adopter of our technology in Southern California.

Additionally, as we have mentioned and is very important, this customer

came back to ClearSign after initiating an alternative option to install a traditional selective catalytic reduction or SCR, NOx control

system, and inherent complexities associated with such a system. We believe that successfully completing this project will make a powerful

statement for ClearSign, significant to both our customer base and also the regional air regulators. One feature of this installation

is that the burners will operate on fuel with a very high concentration of hydrogen. This feature is included in the factory testing protocol.

The other 20 burner California project is also progressing, but on

a less tight timeline. As we indicated previously, the final witness testing went as planned. At this time, we do not have confirmation

whether the site shutdown, during which these burns will be installed, will be undertaken in 2024 or 2025. It's dependent on our clients'

plans and scheduling. Bear in mind that there are a lot of activities included in these refinery shutdowns, so the planning process is

complex and dependent on many factors. We will be able to invoice and receive payment upon delivery of the burners, and only a small part

of the purchase order will remain until installation.

As we have stated before, the burners used in this witness demonstration

are not part of the final production run, but will not be included in the shipment to California. These burners will be kept for demonstration

purposes for potential customers and stakeholders. We have customer demonstration events planned for the coming months.

Beyond these projects, we do see a growing pipeline and encouragingly,

a growing interest from customers in the Texas Gulf Coast region. As we have said in the past, we very much believe that a lot of the

industry is watching these larger multi-burner orders. And when in the field and operational, we anticipate that being able to refer to

these operational units, will give other customers who may be on the fence, who are not fully considering us at this time, the confidence

that they need to include ClearSign when assessing their options for future burner upgrades, or a more cost-efficient alternative to installing

an SCR.

Most recently, on November 7, just last week, we issued a press

release announcing that Matthew Martin has joined ClearSign as Chief Technology Officer. I want to give some insight into who he is and

his role at ClearSign. I'm sure for anyone in the fire equipment industry, Matthew Martin needs no introduction. But for those who are

not, Matthew is one of the leading and recognized technical experts in this field.

He has spent his entire career in the field of fire equipment and energy

systems, covering the technical development (indiscernible) particularly computer-based modeling and predictions required to do so. He

also has a strong background in assessing the refining and related energy equipment markets and opportunities to deliver value to customers

through improving the technology available.

I have known Matt for over 20 years, and worked with him for most of

that time. His combination of technical excellence and creativity, combined with his market and business acumen, is exceptional. While

at Honeywell, he had the rare distinction of being appointed an engineering fellow in recognition of his extraordinary contributions.

There are more details of his background and accomplishments in the press release for anyone who did not see it. I am very excited to

have Matt join us. It is very encouraging to have someone of his stature in the industry, redirect their career and join us at ClearSign.

We already have a very strong technical team at ClearSign with world-class

talent supporting all our product lines, So I want to talk a little about his new role. Everyone at ClearSign wears multiple hats, and

as you would expect in the company of our size, our working protocol is very collaborative and responsive, as opposed to being formal

and rigid. So Matt's input and expertise will be additive across all our products and projects. But Matt's objective is to focus on the

growth of ClearSign. As an example, taking our Texas chemicals installation, where we have a boiler burner successfully installed in a

new process heater and extrapolating that capability into applications in different types of heaters and other fired equipment and adapting

the burner to operate in more diverse operating regimes.

At a higher level, his objective is to efficiently simulate the customers'

needs, business opportunities and technical possibilities to meaningfully expand that business. And to achieve these outcomes takes focus,

resources and, in particular, talent.

Take a step back and look at ClearSign more generally. The recent additions

of Tina Unachukwu, bringing her considerable sales management and business development talent to ClearSign, and now Matthew Martin, with

his opportunity-focused technical expertise in addition to, I believe, is a truly world-class talent we already have in the team

of ClearSign, provides ClearSign with a very strong capability to expand our offerings beyond the progression of our current low-emission

burner technologies. I'm very optimistic and looking forward to the future opportunities for ClearSign.

Looking forwards, there are key events on our horizon. The most immediate

will be the installations and startups that are so important to our sales growth. We have the 300 horsepower, 5 parts per million burner

in California, commissioned last week, now awaiting independent emissions verification. We have the 500 horsepower boiler burner and a

process heater on a chemicals plant in the Texas Gulf Coast, just waiting on the replacement of a component in the piping system outside

of our supply, and with opportunities to quote several other process burners waiting on that performance verification.

And very significantly, the installation and startup of a 1,200 horsepower

sub-2.5 parts per million boiler burner in the San Joaquin Valley Air Pollution Control District of California. And the installation and

startup of the two process heaters at California Refinery anticipated next month and early 2024. These startups will transform our installed

base and reference list.

We have sales opportunities to progress in both boiler burner and process

burner product lines, and both in and out of California. And I'm particularly eager to develop our opportunities enabled by our recent

boiler burner product line segmentation project.

Longer term, I'm very much looking forward to working with Matthew

Martin, engaging with an extensive industry network, and promoting our products into diversifying opportunities.

With that, I'd like to open up the call for questions. Please,

Operator?

Questions and Answers

Operator: We will now begin the question-and-answer session. (Operator

Instructions). Eric [Gruskin], Private Investor.

Eric Gruskin: Good day, Dr. Deller. You talked a lot about process

burners and boiler burners, but can you also talk about the prospects for the fire tube product, the flame cameras, and the new hydrogen

fuel burners? And perhaps you could rank those in terms of sales capacity?

Jim Deller: Certainly. And I can give some more color around those

and some clarification. So I'll start the boiler burners. You mentioned the fire tube. The fire tube is the smaller range of the boiler

products. Basically, the boilers or the boilers that we address fit into two types. There's water tube, which tend to be the larger end

of the range, and the fire tube boilers, which are typically on the smaller end of the range, and they are the main focus of our sales

at this time. The boiler burner products are sold in collaboration with our partner, California Burner or Boiler, and branded as the Rogue

burner. And those are actually the subject of the segmentation project that I referenced that we worked with California Boiler.

So in terms of the immediate sales opportunities, I think that

has to be the one that I would focus on most from the outside. The response we have to that segmentation project and making these products

relevant to now all areas of the United States, both within California and outside. And the response that we've seen to date in the very

short time since our project was rolled out, definitely made that a major focus for us. We have two major product lines; one is that boiler

burner line and the second is the process burners.

The immediate startups that I referenced, the one that was started

last week, there's another just waiting on one component down in Texas. It's actually in a process heater and a much larger boiler burner

due to be started up around the end of the year. Those are all of that fire tube boiler burner product line.

And then the indications we've got from customers following the segmentation

of ClearSign being favorably seen amongst the other bidders for other projects in California also resulting from that segmentation. So

of those who mentioned, I really would focus on the fire tube boiler burners, longer term -- and obviously, we're all watching the

(indiscernible) economy and the development of the hydrogen pipelines and the introduction of hydrogen into fuel gas systems, and that

has got enormous potential.

And just to try to emphasize that, one, of course, is the customer

is burning hydrogen and needing equipment to burn hydrogen. But what may be the bigger influence for us is whenever you add hydrogen to

a typical fuel gas, even in a smaller percentage range in the region of 15% to 20%, has been discussed, that has a very large influence

on the NOx created. You may put the NOx up by 40% to doubling the NOx, so if a client is operating currently just under their NOx permit,

introducing the hydrogen in that fuel gas is going to put them over their permit levels and require them to address that.

And we really believe the most efficient way to address that is to

put in a new, much lower NOx-creating burner, which we have and we are promoting as the ClearSign products. That is the focus of not just

the project we mentioned with the SBIR grant, but also the reasons for promoting the ClearSign boiler burners.

The last topic you mentioned was the ClearSign sensor. I know you (indiscernible)

what we have is a sensing technology that's unique. Our biggest prospects for that -- we have a partner company called Narion based out

in Seattle. And Narion was the recipient of a government grant recently, which we announced, of $250,000 to develop a sensor that will

control the steam flow to industrial flares. That's a very big -- a big need in that market and Narion is also pursuing many other opportunities.

These are longer range and further out, but I really believe there's great potential in the work that Narion is completing as well.

Eric Gruskin: Okay. Thank you very much.

Operator: (Operator Instructions). Robert Kecseg with Las Colinas Capital

Management.

Robert Kecseg: I was wondering about the cash flow and the dilution

with the $7 million that's shown on the balance sheet at the end of the quarter, and the anticipation of these orders flowing some cash

in. Do you believe that we'll get into the next calendar year before you need any more public financing?

Brent Hinds: Yes, thank you for the questions. Our balance sheet, we

thought, is healthy right now, we're comfortable with it. We have projects that we're working on and cash coming in from those projects,

and cash to come from those projects.

Robert Kecseg: Yes.

Jim Deller: Bob, just to add some color to that, right, I know

everyone's watching the revenue. But specifically, the projects that drive the revenue are exactly the ones we're talking about. The revenue

is recognized on significant milestones, but typical milestones will be the -- by the delivery and the startup of burners. We've got the

three boiler burners we talked about today, and also the testing of the installation of the process burners. There are some significant

projects that are happening in these next few months that will trigger the milestones typical to lead to the revenue recognition.

Robert Kecseg: Good, good. So that'll give us some runway to go. That

sounds good. Okay. Thank you.

Operator: Jeff Feinglas, a Private Investor.

Jeff Feinglas: Jim, I was hoping you could expand a bit on China,

and specifically, you mentioned the prospects of relatively soon getting certification for the 5G boiler. But what are the next steps

after that as far as sales? Maybe it's too speculative at this point, but could you speak on that?

Jim Deller: Hey, Jeff, yes. So certainly, I can; I appreciate

the question. I would just preface this, but obviously at this time, I will tell you what I see, but this is very speculative. As

I mentioned, we are in the process of completing the run-in soon to be followed by the government certification of the 500-horsepower

5G boiler burner in California. But Jeff, I know you've been following, but for those that haven't, one of our key strengths in China

is our partnership with what may be their biggest 5G boiler manufacturer in China called Shuangliang. This is a truly enormous company,

and their interest in ClearSign, and what we've agreed through our alliance with them, is to provide what we're calling an integrated

boiler burner package into the Chinese market. So we have a truly national-scale Chinese boiler manufacturer developing a product, incorporating

the ClearSign burner to achieve the new low NOx requirements that are being rolled out by the Chinese government.

In recent years, we've seen a shift in China, and the regulations are

being rolled out now in the heavily-industrialized regions of China; whereas previously, the focus was on the northern regions, especially

around Beijing, where the air was notoriously bad and focused on the district heating. That is still in place, but this new development

is in the industrial cities. In the call, I mentioned Shenzhen and Suzhou, Nantong and Tianjin; these are all very large industrial

regions within China. These industrial regions are heavily populated with 5G boilers, and they are not a seasonal heating. This is industrial

heating that's used year-round.

The local governments are driving the NOx levels down in these regions.

And being able to partner with a Chinese company like Shuangliang, which is very prominent within the Chinese market; and then along with

them, the outreach to the local governments in those areas and to the industrial parks. And to me, it's a really exciting opportunity.

I don't have any details to report, but that is the path that we're following and the sales pursuits that we are undertaking as we complete

the certification of this larger 500 horsepower boiler burner.

Jeff Feinglas: All right. Thank you on that; thank you for that, appreciate

it.

Operator: Brad [Van Dooker], a Private Investor.

Brad Van Dooker: Hi, Dr. Deller. My question is, as a long-term

investor, is the market cap of the company and the fact that the stock prices remain really low, and we can't seem to turn the corner

on it or maintain anything with it. What are your thoughts on getting the stock price up, the shares up and the interest up, where investment

is up?

Jim Deller: Brad, I really can't comment on the share price and

what people pay, that's not really in our control. But we're obviously in control of the progress of the company and the news that flows

out. I can reinforce [my side], and hopefully, for everyone, the absolute importance of getting the reference projects out into the market,

and having the equipment in the field for our customers to see and to give them confidence in placing those orders. And I know I've said

that before, but let me give you a bit of color.

Just this past week, we started up the 300-horsepower 5G boiler project

in California. In that same week, we have already had one customer contact our sales team with California Boiler, and go and visit that

boiler to look at it as a reference in preparation for them making plans for their NOx control equipment in California. So it's absolutely

critical to get this equipment out. We have two boilers starting up in California this year, or the big one may be rolling slightly into

next year. We've got one down in Texas that we have process burner quotes, or requests for quote, been waiting to come to us on that burner

startup. And in addition, the heater manufacturer who manufactured that heater has already come back to us and asked for quotes for two

more burners for projects that they are chasing.

So when you ask -- I know everyone is looking forwards and looking

at the development. I just cannot stress from my perspective, how important getting these units out into the field are. And then it's

absolutely our job to leverage that, right, to do (indiscernible) like we have for the segmentation to get, right, people like Tina and

Matt on board, and to really focus on the growth of ClearSign, so we can leverage that installed base and finally show the world what

ClearSign products can do.

Brad Van Dooker: Yes, I can remember when the boilers first came

out, that there was -- I think you quoted in the 50s, the number of inquiries into it, but we didn't have any out and installed. So do

you think now that we're getting installation, that we'll start seeing things come across the finish line with orders?

Jim Deller: I truly believe so, Brad. And based on what we've seen

just this past few months, both with the segmentation project that I talked about, and the targeting and the interest in that, and then

just -- right, just seeing people want to see the equipment installed. Just an example is the reference that I quoted this past week of

the customer immediately coming and asking to see the 300-horsepower burner in operation up. And to my background, my previous background

in the process burner industry, where the clients always ask what was your reference list. So for us to finally be putting our references

together, I believe, is absolutely key for us.

Brad Van Dooker: Okay. Thank you. I think the encouraging thing for

me is that I have not seen a failure in a product that, once it's been installed, that a customer has had to withdraw or anything. Everything

has been successful. So I think as an investor and a long-term believer in the company, it's just frustration that things aren't picking

up faster, but I understand patience. Thank you.

Operator: And this concludes our question-and-answer session. I'd like

to turn the conference back over to Jim Deller for any closing remarks.

Jim Deller: Thank you, everyone, as always, for your interest and taking

the time to participate today. We look forward to updating you regarding our developments and speaking with you on our next earnings call.

Operator: The conference has now concluded. Thank you for attending

today's presentation. You may now disconnect your lines.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

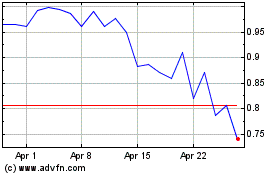

ClearSign Technologies (NASDAQ:CLIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ClearSign Technologies (NASDAQ:CLIR)

Historical Stock Chart

From Apr 2023 to Apr 2024