Filed Pursuant to Rule 424(b)(3)

Registration No. 333-275229

PROSPECTUS SUPPLEMENT

(to Prospectus dated November 7, 2023)

Portage Biotech Inc.

9,631,580 Ordinary Shares underlying Warrants

This prospectus supplement is being filed to update and supplement the information

contained in the prospectus dated November 7, 2023 (the “Prospectus”), which forms a part of our Registration Statement on

Form F-1 (Registration No. 333-275229), with the information contained in our current report on Form 6-K, furnished to the Securities

and Exchange Commission on November 13, 2023 (the “November 13, 2023 Form 6-K”). Accordingly, we have attached the November

13, 2023 Form 6-K to this prospectus supplement.

This prospectus supplement updates and supplements the information in the

Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any

amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency

between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Ordinary Shares are listed on The Nasdaq Capital Market (“Nasdaq”)

under the symbol “PRTG”. On November 10, 2023, the closing sale price of our Ordinary Shares as reported on Nasdaq was $1.47.

___________________________

Investing in the securities offered in the Prospectus involves a high

degree of risk. Before making any investment in these securities, you should consider carefully the risks and uncertainties in the section

entitled “Risk Factors” beginning on page 9 of the Prospectus, and in the other documents that are incorporated by reference

into the Prospectus.

Neither the Securities and Exchange Commission nor any state or non-U.S.

regulatory body has approved or disapproved of the securities offered in the Prospectus or passed upon the accuracy or adequacy of the

Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

___________________________

The date of this prospectus supplement is November 13, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE

ACT OF 1934

For the month of November 2023

Commission File Number: 001-40086

Portage Biotech Inc.

(Translation of registrant’s

name into English)

N/A

(Translation of registrant’s

name into English)

British Virgin Islands

(Jurisdiction of incorporation or

organization)

Clarence Thomas Building, P.O.

Box 4649, Road Town, Tortola, British Virgin Islands, VG1110

(Address of principal executive offices)

c/o Portage Development Services

Inc., Ian Walters, 203.221.7378

61 Wilton Road, Westport, Connecticut

06880

(Name, telephone, e-mail and/or facsimile

number and Address of Company Contact Person)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: ☒ Form 20-F ☐ Form

40-F

Exhibits

The following Exhibit is filed with this report:

| Exhibit |

|

Description |

| |

|

|

| 99.1 |

|

Corporate Presentation |

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Portage Biotech, Inc. |

| |

|

|

| Date: November 13, 2023 |

By: |

/s/ Allan Shaw |

| |

Name: |

Allan Shaw |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

1 Corporate Presentation Nasdaq: PRTG November 2023

2 Legal Disclaimer Forward - Looking Information This presentation contains "forward - looking statements" that involve risks and uncertainties . Our actual results could differ materially from those discussed in the forward - looking statements . The statements contained in this presentation that are not purely historical are forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, or the "Securities Act," and Section 21 E of the Securities Exchange Act of 1934 , as amended, or the Exchange Act . Forward - looking statements are often identified by the use of words such as, but not limited to, "anticipate," "believe," "can," "continue," "could," "estimate," "expect," "intend," "may," "plan," "project," "seek," "should," "strategy," "target," "will," "would" and similar expressions or variations intended to identify forward - looking statements . These statements are based on the beliefs and assumptions of our management based on information currently available to management . Such forward - looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward - looking statements . Factors that could cause or contribute to such differences include, but are not limited to the Company's ability to obtain financing in the future to cover its operational costs and progress its plans for clinical development, its estimates regarding its capital requirements, and its ability to continue as a going concern ; the Company's plans and ability to develop and commercialize product candidates and the timing of these development programs ; the Company's clinical development of its product candidates, including the results of current and future clinical trials ; the benefits and risks of the Company's product candidates as compared to others ; the Company's maintenance and establishment of intellectual property rights in its product candidates ; the Company’s estimates of future revenues and profitability ; the Company's estimates of the size of the potential markets for its product candidates ; its selection and licensing of product candidates ; and other factors set forth in “Item 3 - Key Information - Risk Factors” in the Company’s Annual Report on Form 20 - F for the year ended March 31 , 2023 , and those discussed in the Company's other reports filed with the Securities and Exchange Commission from time to time . Except as required by law, we undertake no obligation to update any forward - looking statements to reflect events or circumstances after the date of such statements .

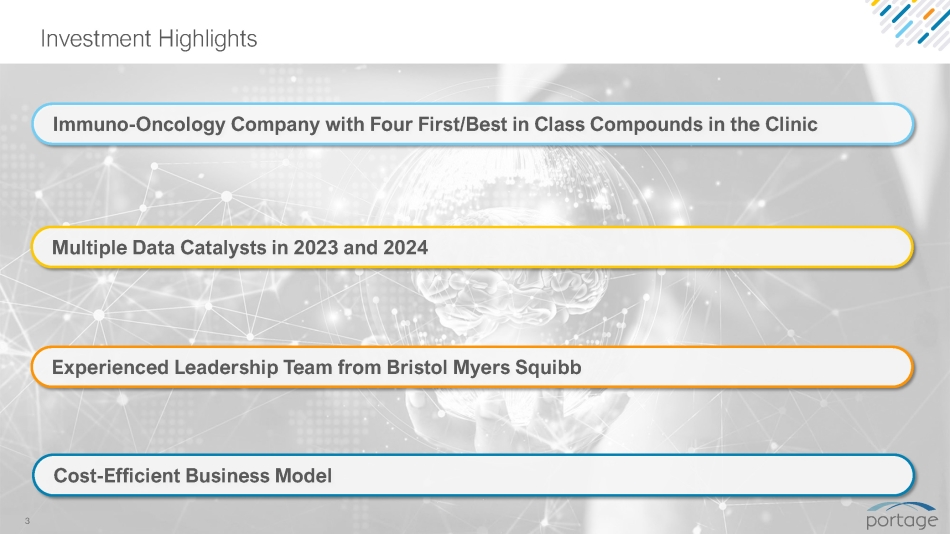

3 Immuno - Oncology Company with Four First/Best in Class Compounds in the Clinic Investment Highlights Cost - Efficient Business Model Multiple Data Catalysts in 2023 and 2024 Experienced Leadership Team from Bristol Myers Squibb

4 Allan Shaw CFO Justin Fairchild VP Clin Dev Proven Leadership with Oncology and Financing Expertise Board of Directors Gregory Bailey, MD Rob Glassman, MD Linda M. Kozick Jim Mellon Mark Simon Ian Walters, MD CEO, Chairman Rob Kramer, PhD CSO Steve Innaimo VP PM & Operations Brian Wiley CBO Steven Mintz St. Germain Capital Corp Over 10 Oncology Approvals, Several Billion $ Exits

5 Our Formula for Success De - Risked Development Structured to Create Significant Value Strong Academic & Industry Network First/Best in Class I/O Agents Potential for Large Returns • Compounds with broad targets, single agent activity • Address ~70 - 80% of patients that don’t respond • Randomized studies early • Enrich patient population when possible • Active CRADA with National Cancer Institute • Programs vetted with Big Pharma companies likely to transact • >$35B market growth to >$100B • Data catalysts create meaningful inflections • Partner with large oncology - focused companies • Retain IP exclusivity

6 Nine Phase 1b/2 Data Catalysts Anticipated to Drive Value iNKT Engager Platform Adenosine Plat Final Data Interim Data # of PTS STAGE INDICATION ASSET Q1 2024 ASCO 2023 18 Phase 1 Melanoma + NSCLC PORT - 2 13 Phase 1^ Solid Tumors PORT - 3 IST ASCO 2025 SITC 2024 10 Phase 2* Refractory Melanoma PORT - 2 ᬚ SITC 2025 SITC 2024 30 Phase 2* Front line PD - L1 + NSCLC PORT - 2+ Keytruda ® ᬛ SITC 2025 SITC 2024 10 Phase 2* PD - L1 – NSCLC 2 nd /3 rd line PORT - 2+ Keytruda ® ᬜ SITC 2025 ASCO 2025 15 Phase 2* PD - L1 + NSCLC 2 nd line PORT - 2+ Keytruda ® ᬝ Final Data Interim Data # of PTS STAGE INDICATION ASSET SITC 2024 ASCO 2024 21 - 27 Phase 1a A2A exp Solid Tumors PORT - 6 (A2A) ASCO 2025 SITC 2024 18 Phase 1a* A2B exp Solid Tumors PORT - 7 (A2B) for m SITC 2025 SITC 2024 20 Phase 1b* A2B exp Solid Tumors PORT - 6 (A2A) ᬞ ASCO 2026 SITC 2025 20 Phase 1b* A2A exp Solid Tumors PORT - 7 (A2B) ᬟ SITC 2025 SITC 2024 20 Phase 1b* A2A exp Solid Tumors PORT - 6 (A2A) + CPI ᬠ ASCO 2026 SITC 2025 20 Phase 1b* A2B exp Solid Tumors PORT - 7 (A2B) + CPI ᬡ ASCO 2026 SITC 2025 20 Phase 1b* BM enriched PORT 6/7 (A2A/2B) +CPI ᬢ * Planned based on data and available liquidity ^ Investigator sponsored trial

iNKT Engagers PORT - 2, PORT - 3 Activating the innate, adaptive immune system and correcting the tumor microenvironment

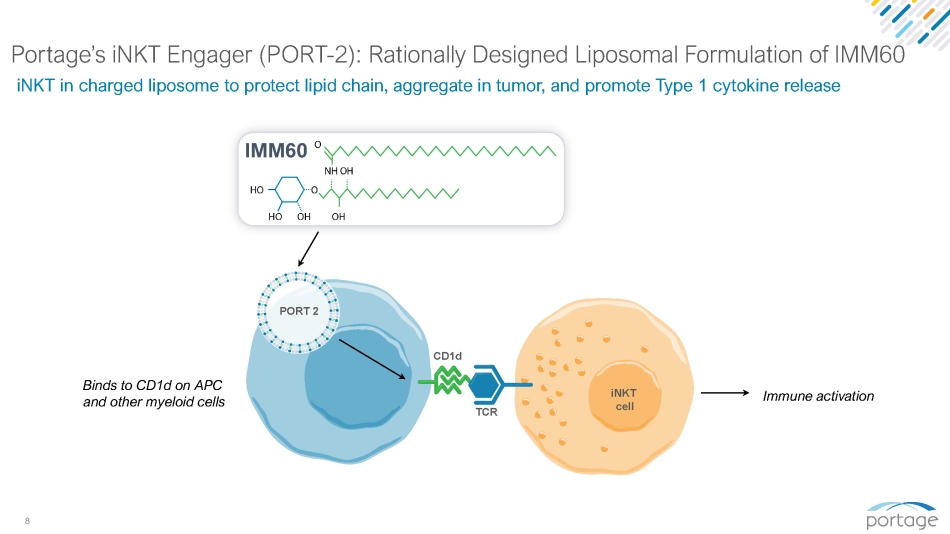

8 Portage’s iNKT Engager (PORT - 2): Rationally Designed Liposomal Formulation of IMM60 iNKT cell iNKT in charged liposome to protect lipid chain, aggregate in tumor, and promote Type 1 cytokine release IMM60 Binds to CD1d on APC and other myeloid cells TCR CD1d PORT 2 Immune activation

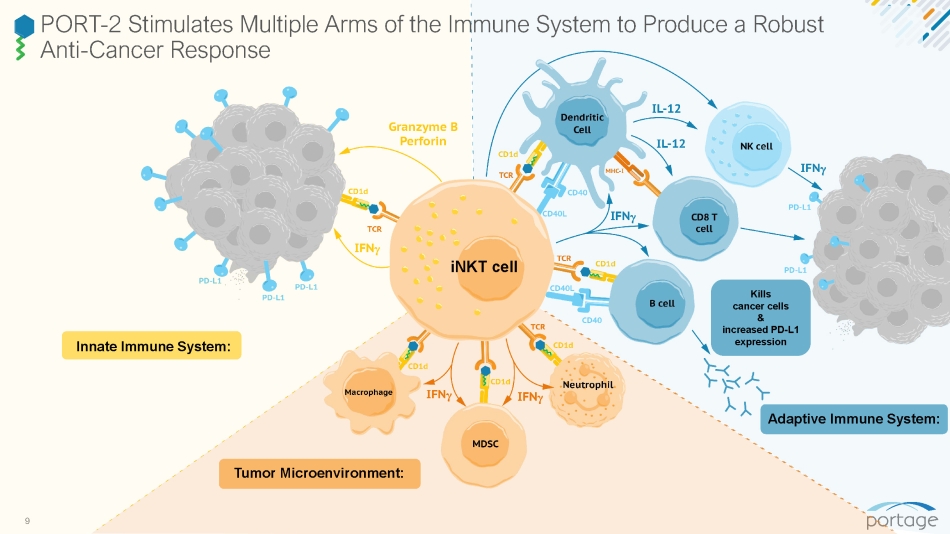

9 Innate Immune System: Adaptive Immune System: Tumor Microenvironment: Kills cancer cells & increased PD - L1 expression iNKT cell PORT - 2 Stimulates Multiple Arms of the Immune System to Produce a Robust Anti - Cancer Response

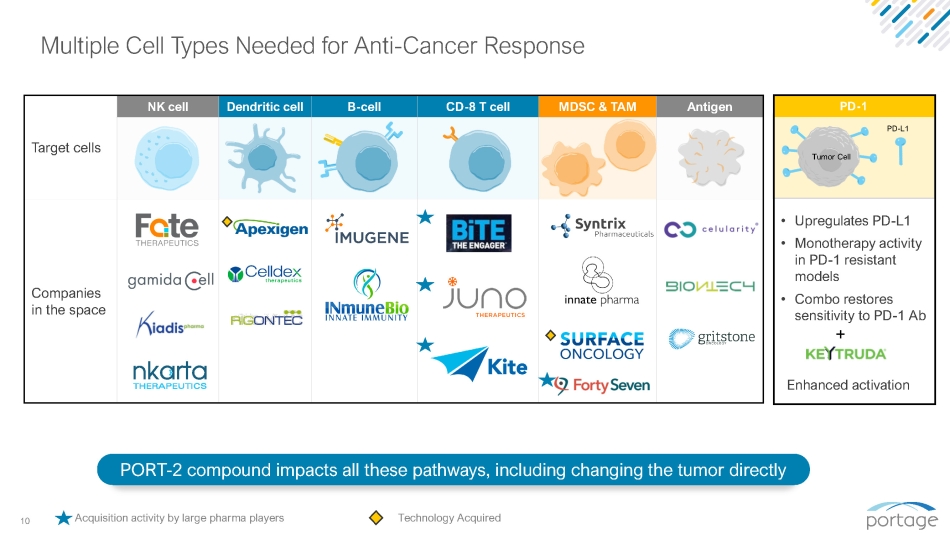

10 Antigen MDSC & TAM CD - 8 T cell B - cell Dendritic cell NK cell Target cells Companies in the space PD - 1 PD - L1 Tumor Cell • Upregulates PD - L1 • Monotherapy activity in PD - 1 resistant models • Combo restores sensitivity to PD - 1 Ab + Enhanced activation Multiple Cell Types Needed for Anti - Cancer Response PORT - 2 compound impacts all these pathways, including changing the tumor directly Acquisition activity by large pharma players Technology Acquired

11 PORT - 2 Demonstrates Robust Pre - Clinical Single Agent Activity Jukes et al Eur. J. Immunol. 2016. 00: 1 – 11 IMM60 (0.5ng/mouse) PORT - 2 Vehicle + anti PD - 1 Vehicle Untreated PORT - 2 shows better response rates vs. anti - PD - 1 in melanoma model B16 melanoma lung metastases

12 SITC 2023 Data Further Supports PORT - 2 Favorable Safety & Tolerability Profile At All Doses Tested to Date Safety • No DLT’s, related SAEs, or G3 - 5 related AEs • Only G1 related AEs have been observed at the highest dose of PORT - 2 • Patient treated with PORT - 2 + pembrolizumab(n=2) experienced only low - grade AEs consistent with the safety profile of pembrolizumab Table 1: Demographics and Baseline Characteristics (n=12) Melanoma: 6 (43) NSCLC 8 (57) Tumor type (%) 63 (41,79) Age (range) 4 (2,7) Median prior therapies (range)* 12 (100) Prior PD - 1* (%) ECOG 0: 9 (64) ECOG 1: 5 (36) Performance status (%) Table 2: Adverse Events related to IMM60 (n=14) Grade 3 - 5 Grade 2 Grade 1 Adverse Event 0 0 1 (7%) Bullous pemphigoid 0 0 1 (7%) Cough 0 0 1 (7%) Diarrhea 0 0 2 (14%) Dizziness 0 0 1 (7%) Dry mouth 0 0 1 (7%) Dyspnea 0 1 (7%) 1 (7%) Fatigue 0 0 1 (7%) Flu - like symptoms 0 0 1 (7%) Hair Loss 0 0 1 (7%) Headache 0 1 (7%) 0 Hypertension 0 0 1 (7%) Hyponatremi a 0 0 1 (7%) Fever 0 0 1 (7%) Nausea 0 0 1 (7%) Pruritus 0 0 2 (14%) AST/ALT elevation 0 0 1 (7%) Vomiting IMM60 in plasma (ng/mL) Exposure • A total of 65 infusions given to 14 patients at doses up to 9 mg/m 2 , with a median of 5 doses per patient • Pk shows long plateau and limited volume of distribution

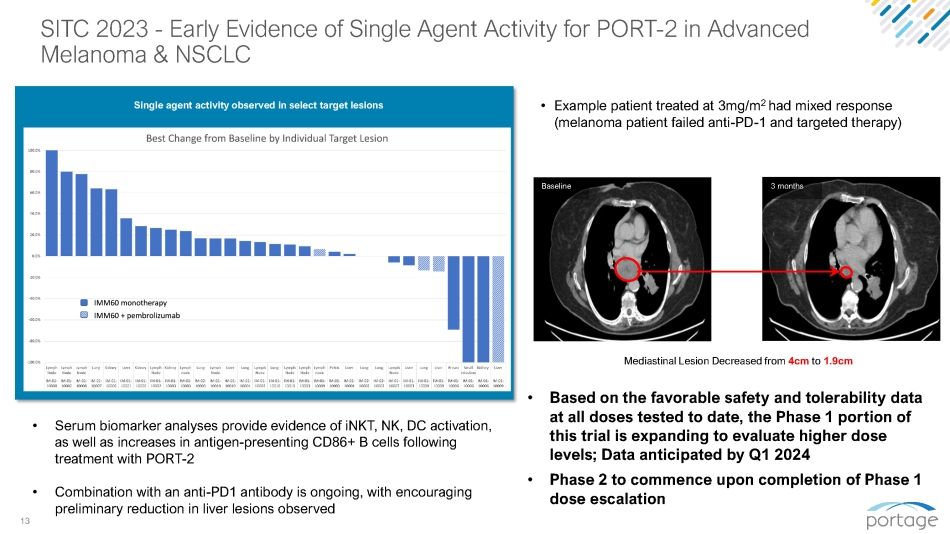

13 SITC 2023 - Early Evidence of Single Agent Activity for PORT - 2 in Advanced Melanoma & NSCLC Single agent activity observed in select target lesions • Serum biomarker analyses provide evidence of iNKT, NK, DC activation, as well as increases in antigen - presenting CD86+ B cells following treatment with PORT - 2 • Combination with an anti - PD1 antibody is ongoing, with encouraging preliminary reduction in liver lesions observed • Based on the favorable safety and tolerability data at all doses tested to date, the Phase 1 portion of this trial is expanding to evaluate higher dose levels; Data anticipated by Q1 2024 • Phase 2 to commence upon completion of Phase 1 dose escalation Baseline 3 months Mediastinal Lesion Decreased from 4cm to 1.9cm • Example patient treated at 3mg/m 2 had mixed response (melanoma patient failed anti - PD - 1 and targeted therapy)

14 Multi - arm study with four parallel development paths = multiple shots on goal IMPORT - 201: Phase 2 Evaluates Front Line NSCLC and Refractory Melanoma* https://www.isrctn.com/ISRCTN80472712 . * Planned depending data and available liquidity PD - 1 q3wk iv infusions n=15 PD - 1 naïve patients PORT - 2 One dose @ MTD n=15 PORT - 2 + PD - 1 6 x iv infusions q3wk @ CMTD n=30 PD - 1 naïve patients Biopsy at 2 - 3wk Pre - Rx Biopsy NSCLC N=60 Progression PD - L1 ≥ 50% PD - L1 <1% PORT - 2 6 x iv infusions q3w @ MTD n=10 PD - 1 refractory Melanoma N=10 ᬛ PORT - 2 + PD - 1 q3wk iv x 5 ᬚ ᬜ ᬝ PORT - 2 + PD - 1 q3wk iv x 6 Clinical Catalysts In collaboration with

Adenosine Portfolio Validated mechanism impacting multiple immune cells Opportunity to modulate adenosine in 4 different ways: PORT - 6 A2AR Antagonist PORT - 7 A2BR Antagonist PORT - 8 A2AR/A2BR Dual Antagonist PORT - 9 Gut - Restricted A2BR Antagonist

16 Leveraging A2A and A2B Alone or in Combo Allows for Customization of Treatment Targeting Adenosine in Cancer Immunotherapy to Enhance T - Cell Function; Virgano, et al; Frontiers in Immunology 2019 modified slightly and used under CC BY 4.0 Macrophage Treg T cell NK Cell Endothelial Cell CAF MDSC Tumor Cell Neutrophil DC Promote adaptive response (A2A and A2B) Correct the TME (A2A and A2B) Decrease proliferation, metastasis and survival (A2A and A2B) Tumor is complex system governed by numerous immune cells

17 Difference in A2A Small Molecules 10+ hrs Only asset to demonstrate single agent activity in mouse models Competitive inhibitors won’t block in settings of high adenosine ARCUS CORVUS Potency Selectivity 2.5 hrs Portage’s PORT - 6 is best in class for potency, selectivity and durability* Relative profiles of A2A antagonists based on public profiles Bubble size illustrates how long receptors are occupied In Phase 1, no efficacy at QD 17% ORR at 80mg BID, need longer occupancy Couldn’t escalate due to tox (poor selectivity) * Based on pre - clinical data

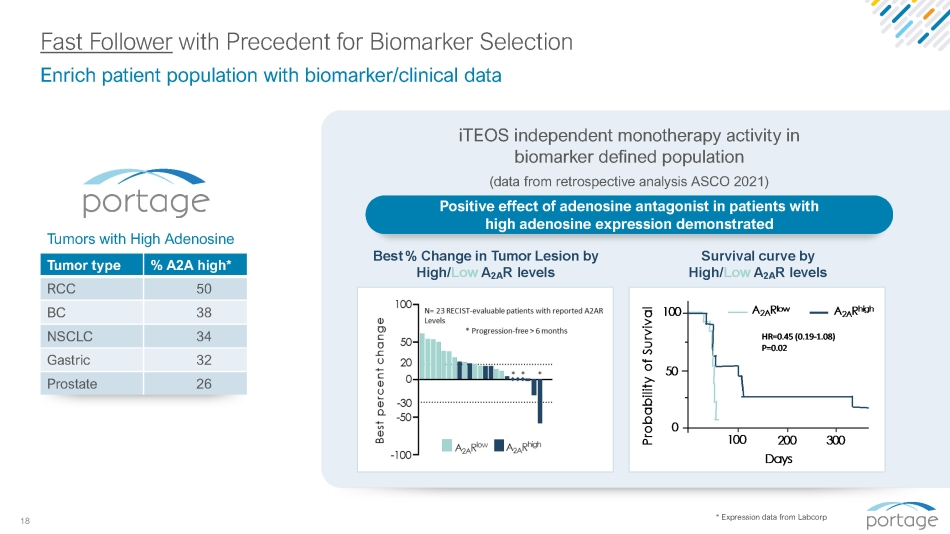

18 Fast Follower with Precedent for Biomarker Selection * Expression data from Labcorp % A2A high* Tumor type 50 RCC 38 BC 34 NSCLC 32 Gastric 26 Prostate Best % Change in Tumor Lesion by High/ Low A 2A R levels Enrich patient population with biomarker/clinical data iTEOS independent monotherapy activity in biomarker defined population (data from retrospective analysis ASCO 2021) Positive effect of adenosine antagonist in patients with high adenosine expression demonstrated Tumors with High Adenosine Survival curve by High/ Low A 2A R levels

19 PORT - 7: Highly Selective and Potent A2B Adenosine Receptor Antagonist High potency and selectivity may provide important safety and efficacy advantages • Activity in 4T1, CT26, and other disease models (asthma, fibrosis, sickle cell) Data on File Binding Affinity Functional Receptor Antagonism receptor Selectivity Ki (nm) Receptor 1 9 A2B >3000x >30,000 A1 >1000x >10,000 A2A >3000x >30,000 A3 Selectivity Ki (nm) Receptor 1 13 A2B 23x 300 A1 138x 1,800 A2A >4,000x 60,000 A3 Portage only company believed to be developing potent/selective A2B inhibitor

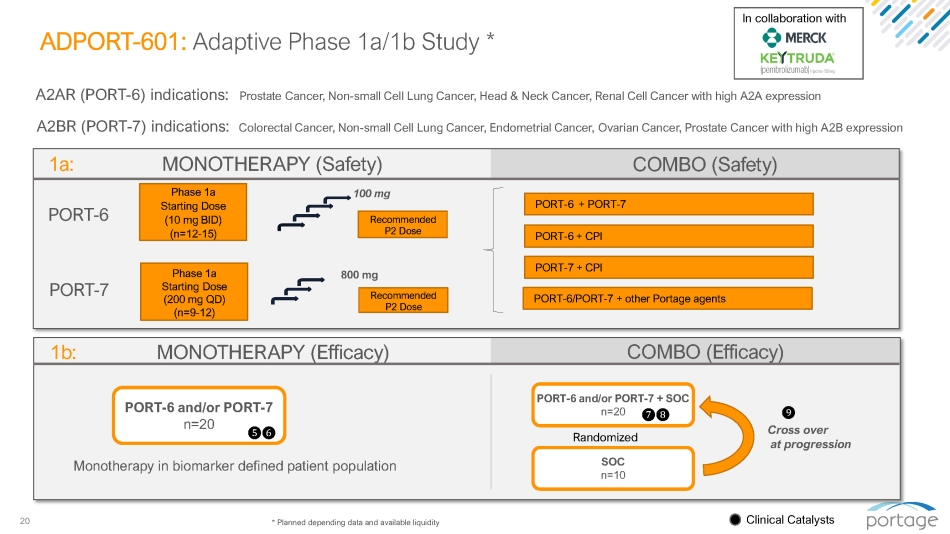

20 ADPORT - 601: Adaptive Phase 1a/1b Study * Phase 1a Starting Dose (10 mg BID) (n=12 - 15) A2AR (PORT - 6) indications: A2BR (PORT - 7) indications: Colorectal Cancer, Non - small Cell Lung Cancer, Endometrial Cancer, Ovarian Cancer, Prostate Cancer with high A2B expression Prostate Cancer, Non - small Cell Lung Cancer, Head & Neck Cancer, Renal Cell Cancer with high A2A expression PORT - 6 1a: MONOTHERAPY (Safety) Phase 1a Starting Dose (200 mg QD) (n=9 - 12) PORT - 7 100 mg 800 mg Recommended P2 Dose Recommended P2 Dose PORT - 6 + PORT - 7 PORT - 6 + CPI PORT - 7 + CPI COMBO (Safety) PORT - 6/PORT - 7 + other Portage agents Clinical Catalysts (Efficacy) COMBO 1b: MONOTHERAPY (Efficacy) ᬢ Cross over at progression PORT - 6 and/or PORT - 7 + SOC n=20 ᬠᬡ Randomized SOC n=10 PORT - 6 and/or PORT - 7 n=20 ᬞᬟ Monotherapy in biomarker defined patient population In collaboration with * Planned depending data and available liquidity

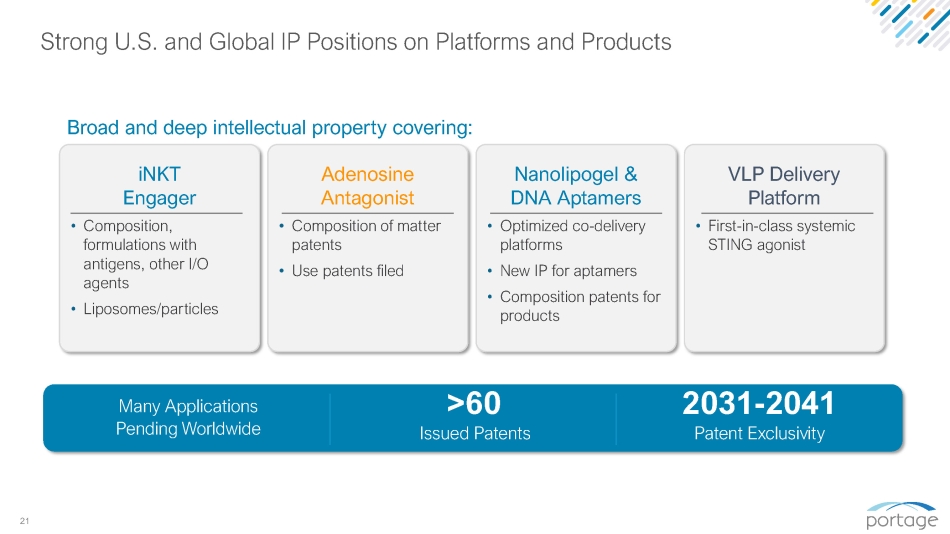

21 iNKT Engager • Composition, formulations with antigens, other I/O agents • Liposomes/particles 2031 - 2041 Patent Exclusivity Many Applications Pending Worldwide Strong U.S. and Global IP Positions on Platforms and Products Broad and deep intellectual property covering: >60 Issued Patents Adenosine Antagonist • Composition of matter patents • Use patents filed Nanolipogel & DNA Aptamers • Optimized co - delivery platforms • New IP for aptamers • Composition patents for products VLP Delivery Platform • First - in - class systemic STING agonist

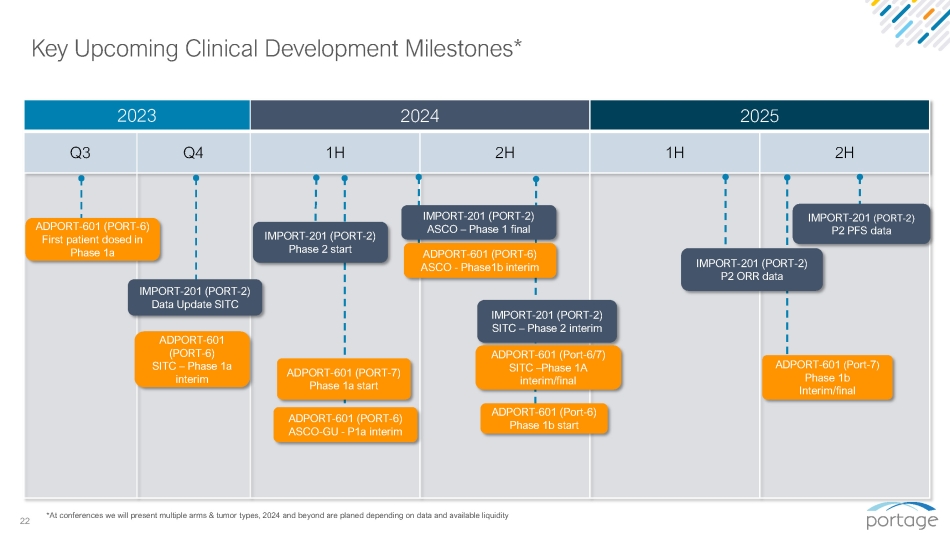

22 2023 2024 2025 Q3 Q4 1H 2H 1H 2H Key Upcoming Clinical Development Milestones* IMPORT - 201 (PORT - 2) Phase 2 start ADPORT - 601 (PORT - 6) First patient dosed in Phase 1a ADPORT - 601 (Port - 6) Phase 1b start IMPORT - 201 (PORT - 2) P2 PFS data *At conferences we will present multiple arms & tumor types, 2024 and beyond are planed depending on data and available liquidity ADPORT - 601 (PORT - 6) SITC – Phase 1a interim IMPORT - 201 (PORT - 2) ASCO – Phase 1 final ADPORT - 601 (PORT - 6) ASCO - Phase1b interim ADPORT - 601 ( Port - 7 ) Phase 1b Interim/final ADPORT - 601 (PORT - 6) ASCO - GU - P1a interim ADPORT - 601 (PORT - 7) Phase 1a start IMPORT - 201 (PORT - 2) SITC – Phase 2 interim ADPORT - 601 (Port - 6/7) SITC – Phase 1A interim/final IMPORT - 201 (PORT - 2) P2 ORR data IMPORT - 201 (PORT - 2) Data Update SITC

+ Pro forma Cash Balance is approximately $13 million, as adjusted, giving effect to $6 million financing, net of expenses, closed on October 3, 2023 (“the Financing”) * Pro forma shares of 20,944,185, as adjusted, giving effect to Financing for 3,157,895 or common stock equivalents and issuance of Series A, B, C Warrants to purchase up to 9,473,685 ordinary shares ^ Portage has right (sole discretion/no obligation), to sell up to $30 million shares over agreement’s 36 - month term based on prevailing market prices at the time of each sale, subject to certain conditions. As of 8/29/23, approximately $28.0 million are available proceeds under the Purchase Agreement, subject to Baby Shelf Rule limitations and contractual lock - up restrictions from Financing. 23 Summary Financial Data ~$7.7 million + Cash Balance (6/30/23) $28.0 million Committed Purchase Lincoln Park Capital Available ^ $ - Debt 17,801,391 * Shares Outstanding (08/29/23) 42.61% Insider Ownership 57.39% Public Float 2,342,160 Options & RSUs Outstanding (6/30/23) $(~2.8 million) Cash Burn During Quarter Ended 6/30/23

24 Novel, Clinical Stage I/O Portfolio with Small Molecule Focus • Manufacturing simplicity, low capital investment • Nine potential phase 1b/2 clinical data reads over next 2 years* Engine for Efficient Drug Development & Commercialization • Expert scientific oversight • Lean structure with financial flexibility Preferred Partner for Pharma in I/O • Deep industry network facilitates engagement with big pharma and biotech • Packaged for commercialization/acquisition Expert Leadership with Track Record of Success • Proven success, more than 10 oncology approvals • Formation of Biohaven Pharmaceuticals, sale to Pfizer Accelerating I/O Development in Untapped Growth Areas * depending data and available liquidity

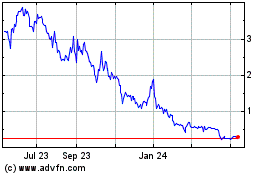

Portage Biotech (NASDAQ:PRTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Portage Biotech (NASDAQ:PRTG)

Historical Stock Chart

From Apr 2023 to Apr 2024