false

0000278165

0000278165

2023-11-13

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 13, 2023

OMNIQ

CORP.

(Exact

name of registrant as specified in charter)

| Delaware |

|

001-40768 |

|

20-3454263 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

1865

West 2100 South, Salt Lake City, UT 84119

(Address

of Principal Executive Offices) (Zip Code)

(714)

899-4800

(Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name or Former Address, If Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

OMQS |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure

On

November 13, 2023, OmniQ Corp. (the “Company”) issued a press release. A copy of the press release is attached hereto and

incorporated herein by reference in its entirety as Exhibit 99.1.

Item

9.01 Financial statements and Exhibits

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 13, 2023

| |

OMNIQ

Corp. |

| |

|

|

| |

By: |

/s/

Shai S. Lustgarten |

| |

|

Shai

S. Lustgarten |

| |

|

President

and CEO |

Exhibit

99.1

OMNIQ

ANNOUNCES Q3 2023 REVENUE OF $17.5 MILLION AND INCREASED GROSS PROFIT to 23%.

SALT

LAKE CITY, November 13th, 2023 (GLOBE NEWSWIRE) — OMNIQ Corp. (NASDAQ: OMQS) (“OMNIQ” or the “Company”),

a provider of Artificial Intelligence (AI) and IoT – based solutions announces Q3 2023 revenue of $17.5M and Gross Profit of $4M.

| |

●

|

Q3

2023 Revenue of $17.5 Million a 35% decrease vs Q3 2022 impacted by temporary delay of several large orders mainly related to the

supply chain line of products. |

| |

|

|

| |

●

|

9

months 2023 Revenue of $65.8 Million a 15% decrease versus 9-month 2022 |

| |

|

|

| |

●

|

Gross

margin for the three months ended September 30, 2023, sequentially increased to 23% as compared to 19% in in Q2 2023 and 21% in Q1

2023. Driven by higher portion of Revenue with higher profitability margins. |

| |

|

|

| |

●

|

Gross

margin for Q3 2023 improved to 23% as compared with 22% in Q3 2022. |

| |

|

|

| |

●

|

AI

Machine Vision 9-month 2023 Revenue increased by 35% vs 9-month 2022 driven by strong customer demand across Homeland Security, Public

Safety and Automation of Parking. |

| |

|

|

| |

●

|

Company

continues the process of improving efficiencies initiated this year, resulting in approximately $2m decrease in Sales and G&A

expenses for Q3 and $3.5M decrease for the 9 months ended September 30, 2023, as compared to the same periods of 2022. |

| |

|

|

| |

●

|

The

Company continues to take additional measures to achieve profitability and positive cash flow. |

Additional

Q3 2023 and recent events:

| |

●

|

Received

a purchase order from the Israel Train Company to deploy its AI-based Machine Vision system creating smarter and safer stations,

|

| |

|

|

| |

●

|

Extended

partnership with TripShot to provide AI based unique frictionless parking solution with a major technology company, |

| |

|

|

| |

●

|

Selected

for an approximate $50 million project to modernize the supply chain for one of the largest US food and drug chains, |

| |

|

|

| |

●

|

AI

based Machine Vision equipment selected to be deployed at the El Salvador International Airport, |

| |

|

|

| |

●

|

Announced

a technological breakthrough winning MOD performance competition for in-car Face Detection to its Machine Vision AI solution. The

feature is being requested by major security authorities and attracted immediate interest, |

| |

|

|

| |

●

|

Awarded

multiyear IoT equipment supply contract for Israel’s largest and newest logistics center, |

| |

|

|

| |

●

|

Announces

termination of definitive agreement to acquire Tadiran Telecom, |

| |

|

|

| |

●

|

Announces

closing of public offering raising approximately $3 million strengthening its financial profile. |

“In

the Q3, our Supply Chain product sales were impacted mainly by a delay in receiving large purchase orders tied to awarded projects, now

expected to ship significant amounts during Q4.” CEO Shai Lustgarten stated, “As we progress through Q4, we anticipate positive

effects on future profitability from our ongoing cost-cutting initiatives.

Over

the nine-month period, we achieved consistent growth in our Patented AI-Based technology for public safety, border control, and parking

automation. Sales in our Dangot division, providing IoT solutions for hospitals, restaurants, logistic centers, and retailers, continued

to grow. Demonstrating financial responsibility, SG&A expenses decreased by $2 million in Q3 and by $3.5 million in the nine months

ending September 30, 2023, aligning with our goal of achieving positive EBITDA”

Lustgarten

concluded, ‘We’re taking decisive actions to position for profitable growth as Supply Chain sales recover, and we’re

enhancing customer relationships through our innovative AI and IoT solutions.”‘

Third

Quarter 2023 Financial Results

OMNIQ

reported revenue of $17.5 million for the quarter ended September30, 2023, a decrease of 35% from $27 million in the third quarter of

2022. Our Gross Margin in the 3rd quarter was 23% compared to a Gross Margin of 22% in the same period in 2022. Total operating expenses

for the quarter were $6.6 million, a decrease of 23% from $8.6 M in the third quarter of 2022.

Net

loss for the quarter was $4.3 million, or a loss of $.55 per basic share, compared with a loss of $3.8 million, or a loss of $.52 per

basic share, for the third quarter of last year.

Adjusted

EBITDA (adjusted Earnings Before Interest, Taxes, Depreciation and Amortization) for the third quarter of 2023 amounted to a loss of

$1.5 million compared with an adjusted EBITDA loss of $516 thousand in the third quarter of 2022.

Cash

balance at September 30, 2022 was $408 thousand compared with $1.3 million at December 31, 2022.

Nine

Months ending September 30, 2023, Financial Results

OMNIQ

reported revenue of $65.7 million for the nine months ended September 30, 2023, a decrease of 15% from $77.5 million in the first nine

months of 2022. Our Gross Margin for the first nine months of 2023 was 21%, compared to a Gross Margin of 23% for the same period in

2022. Total operating expenses for the nine months ended September 30, 2023 were $20.8 million, compared with $24.2 million in the same

period of 2022 a decrease of 14%.

Net

loss for the nine months ended September 30, 2023 was $11.7 million, or a loss of $1.50 per basic share, compared with a loss of $9.6

million, or a loss of $1.29 per basic share, for the first nine months of last year.

Adjusted

EBITDA (adjusted Earnings Before Interest, Taxes, Depreciation and Amortization) for the nine months ended September 30, 2023 amounted

to a loss of $3.8 million compared with an adjusted EBITDA loss of $1.5 million in the same period of 2022.

Earnings

Call Details

To

participate in this event, dial approximately 5 to 10 minutes before the beginning of the call.

Event

Date: November 14th - 8:30 AM Eastern Time

Toll

Free: 877-545-0523

International:

973-528-0016

Participant

Access Code: 697773

Event

Link: Webcast URL: https://www.webcaster4.com/Webcast/Page/2310/49470

Replay

Number:

Toll

Free: 877-481-4010

International:

919-882-2331

Replay

Passcode: 49470

Replay

will be available on the company website at www.omniq.com under the investor tab.

About

omniQ Corp.

omniQ

Corp. (Nasdaq: OMQS) provides computerized and machine vision image processing solutions that use patented and proprietary AI technology

to deliver data collection, real-time surveillance and monitoring for supply chain management, homeland security, public safety, traffic

& parking management, and access control applications. The technology and services provided by the Company help clients move people,

assets, and data safely and securely through airports, warehouses, schools, national borders, and many other applications and environments.

omniQ’s

customers include government agencies and leading Fortune 500 companies from several sectors, including manufacturing, retail, distribution,

food and beverage, transportation and logistics, healthcare, and oil, gas, and chemicals. Since 2014, annual revenues have grown to more

than $50 million from clients in the USA and abroad.

The

Company currently addresses several billion-dollar markets, including the Global Safe City market, forecast to grow to $67.1 billion

by 2028, and the Ticketless Safe Parking market, forecast to grow to $33.5 billion by 2023 and the fast casual restaurant sector expected

to reach $209 billion by 2027.

For

more information, visit www.omniq.com .

Information

about Forward-Looking Statements

“Safe

Harbor” Statement under the Private Securities Litigation Reform Act of 1995. Statements in this press release relating to plans,

strategies, economic performance and trends, projections of results of specific activities or investments, and other statements that

are not descriptions of historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

This

release contains “forward-looking statements” that include information relating to future events and future financial and

operating performance. The words “anticipate”, “may,” “would,” “will,” “expect,”

“estimate,” “can,” “believe,” “potential” and similar expressions and variations thereof

are intended to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance

or results, and will not necessarily be accurate indications of the times at, or by, which that performance or those results will be

achieved. Forward-looking statements are based on information available at the time they are made and/or management’s good faith

belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance

or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could

cause these differences include, but are not limited to: fluctuations in demand for the Company’s products particularly during

the current health crisis , the introduction of new products, the Company’s ability to maintain customer and strategic business

relationships, the impact of competitive products and pricing, growth in targeted markets, the adequacy of the Company’s liquidity

and financial strength to support its growth, the Company’s ability to manage credit and debt structures from vendors, debt holders

and secured lenders, the Company’s ability to successfully integrate its acquisitions, and other information that may be detailed

from time-to-time in omniQ Corp.’s filings with the United States Securities and Exchange Commission. Examples of such forward

looking statements in this release include, among others, statements regarding revenue growth, driving sales, operational and financial

initiatives, cost reduction and profitability, and simplification of operations. For a more detailed description of the risk factors

and uncertainties affecting omniQ Corp., please refer to the Company’s recent Securities and Exchange Commission filings, which

are available at https://www.sec.gov. omniQ Corp. undertakes no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise, unless otherwise required by law.

Contact

ir@omniq.com

OMNIQ

CORP.

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

As of | |

| (In thousands, except share and per share data) | |

September 30, 2023 | | |

December 31, 2022 | |

| | |

(UNAUDITED) | | |

| |

| ASSETS | |

| | |

| |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 408 | | |

$ | 1,311 | |

| Accounts receivable, net | |

| 18,472 | | |

| 23,893 | |

| Inventory | |

| 6,044 | | |

| 8,726 | |

| Prepaid expenses | |

| 787 | | |

| 1,268 | |

| Other current assets | |

| 33 | | |

| 473 | |

| Total current assets | |

| 25,744 | | |

| 35,671 | |

| | |

| | | |

| | |

| Property and equipment, net of accumulated depreciation of $1,084 and $1,030 respectively | |

| 1,263 | | |

| 1,086 | |

| Goodwill | |

| 16,363 | | |

| 16,542 | |

| Trade name, net of accumulated amortization of $4,768 and $4,458, respectively | |

| 1,364 | | |

| 1,826 | |

| Customer relationships, net of accumulated amortization of $11,161 and $10,762, respectively | |

| 3,898 | | |

| 4,967 | |

| Other intangibles, net of accumulated amortization of $1,569 and $1,541, respectively | |

| 532 | | |

| 675 | |

| Right of use lease asset | |

| 2,490 | | |

| 2,300 | |

| Other assets | |

| 1,399 | | |

| 1,744 | |

| Total Assets | |

| 53,053 | | |

| 64,811 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 53,406 | | |

$ | 54,736 | |

| Line of credit | |

| 2,660 | | |

| 1,971 | |

| Accrued payroll and sales tax | |

| 1,653 | | |

| 2,633 | |

| Notes payable, related parties – current portion | |

| - | | |

| 293 | |

| Notes payable – current portion | |

| 8,828 | | |

| 11,572 | |

| Lease liability – current portion | |

| 1,007 | | |

| 942 | |

| Other current liabilities | |

| 1,390 | | |

| 1,394 | |

| Total current liabilities | |

| 68,944 | | |

| 73,541 | |

| | |

| | | |

| | |

| Long term liabilities | |

| | | |

| | |

| Notes payable, related party, less current portion | |

| - | | |

| - | |

| Accrued interest and accrued liabilities, related party | |

| 73 | | |

| 72 | |

| Notes payable, less current portion | |

| 1,427 | | |

| 55 | |

| Lease liability | |

| 1,519 | | |

| 1,404 | |

| Other long term liabilities | |

| 282 | | |

| 265 | |

| Total liabilities | |

| 72,245 | | |

| 75,337 | |

| | |

| | | |

| | |

| Stockholders’ equity (deficit) | |

| | | |

| | |

| Series A Preferred stock; $0.001 par value; 2,000,000 shares designated, 0 shares issued and outstanding | |

| - | | |

| - | |

| Series B Preferred stock; $0.001 par value; 1 share designated, 0 shares issued and outstanding | |

| - | | |

| - | |

| Series C Preferred stock; $0.001 par value; 3,000,000 shares designated, 502,000 shares issued and 544,500 outstanding, respectively | |

| 1 | | |

| 1 | |

| Common stock; $0.001 par value; 15,000,000 shares authorized; 7,893,067 and 7,714,780 shares issued and outstanding, respectively. | |

| 8 | | |

| 8 | |

| Additional paid-in capital | |

| 75,523 | | |

| 73,714 | |

| Accumulated (deficit) | |

| (96,162 | ) | |

| (84,460 | ) |

| Cumulative Translation Adjustment | |

| 1,438 | | |

| 211 | |

| Total OmniQ stockholders’ equity (deficit) | |

| (19,192 | ) | |

| (10,526 | ) |

| | |

| | | |

| | |

| Total liabilities and equity (deficit) | |

$ | 53,053 | | |

$ | 64,811 | |

OMNIQ

CORP.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| | |

For the three months ending | | |

For the Nine months ended | |

| | |

September 30, | | |

September 30, | |

| (In thousands, except share and per share data) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

| | |

| | |

| | |

| |

| Total Revenues | |

$ | 17,480 | | |

$ | 27,008 | | |

$ | 65,748 | | |

$ | 77,539 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 13,471 | | |

| 21,032 | | |

| 52,131 | | |

| 59,449 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 4,009 | | |

| 5,976 | | |

| 13,617 | | |

| 18,090 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Research & Development | |

| 482 | | |

| 445 | | |

| 1,464 | | |

| 1,436 | |

| Selling, general and administrative | |

| 5,585 | | |

| 7,624 | | |

| 17,667 | | |

| 21,173 | |

| Depreciation | |

| 146 | | |

| 91 | | |

| 349 | | |

| 241 | |

| Amortization | |

| 418 | | |

| 474 | | |

| 1,276 | | |

| 1,326 | |

| Total operating expenses | |

| 6,631 | | |

| 8,634 | | |

| 20,756 | | |

| 24,176 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (2,622 | ) | |

| (2,658 | ) | |

| (7,139 | ) | |

| (6,086 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expenses): | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (898 | ) | |

| (880 | ) | |

| (2,575 | ) | |

| (2,569 | ) |

| Other (expenses) income | |

| (1,000 | ) | |

| (217 | ) | |

| (2,473 | ) | |

| (870 | ) |

| Total other expenses | |

| (1,898 | ) | |

| (1,097 | ) | |

| (5,048 | ) | |

| (3,439 | ) |

| Net Loss Before Income Taxes | |

| (4,520 | ) | |

| (3,755 | ) | |

| (12,187 | ) | |

| (9,525 | ) |

| Provision for Income Taxes | |

| | | |

| | | |

| | | |

| | |

| Current | |

| 215 | | |

| (55 | ) | |

| 509 | | |

| (41 | ) |

| Total Provision for Income Taxes | |

| 215 | | |

| (55 | ) | |

| 509 | | |

| (41 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (4,305 | ) | |

$ | (3,810 | ) | |

$ | (11,678 | ) | |

$ | (9,566 | ) |

| Net income attributable to noncontrolling interest | |

| - | | |

| - | | |

| - | | |

| 67 | |

| Net Loss attributable to OmniQ Corp | |

$ | (4,305 | ) | |

$ | (3,810 | ) | |

$ | (11,678 | ) | |

$ | (9,633 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (4,305 | ) | |

$ | (3,810 | ) | |

$ | (11,678 | ) | |

$ | (9,566 | ) |

| Foreign currency translation adjustment | |

| 260 | | |

| 241 | | |

| 1,227 | | |

| 260 | |

| Comprehensive loss | |

| (4,045 | ) | |

| (3,569 | ) | |

| (10,451 | ) | |

| (9,306 | ) |

| Reconciliation of net loss to net loss attributable to common shareholders | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (4,305 | ) | |

| (3,810 | ) | |

| (11,678 | ) | |

| (9,566 | ) |

| Less: Dividends attributable to non-common stockholders’ of OmniQ Corp | |

| (8 | ) | |

| (149 | ) | |

| (24 | ) | |

| (197 | ) |

| Net income attributable to noncontrolling interest | |

| - | | |

| - | | |

| - | | |

| - | |

| Net loss attributable to common stockholders’ of OmniQ Corp | |

| (4,313 | ) | |

| (3,959 | ) | |

| (11,702 | ) | |

| (9,763 | ) |

| Net (loss) per share - basic attributable to common stockerholders’ of OmniQ Corp | |

$ | (0.55 | ) | |

$ | (0.52 | ) | |

$ | (1.50 | ) | |

$ | (1.29 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding – basic | |

| 7,891,444 | | |

| 7,578,351 | | |

| 7,788,262 | | |

| 7,545,190 | |

OMNIQ

Corp.

RECONCILIATION

OF GAAP MEASURES TO NON-GAAP MEASURES

| | |

Nine Months ended | |

| (In thousands) | |

September 30, | |

| Adjusted EBITDA Calculation | |

2023 | | |

2022 | |

| | |

| | |

| |

| Net loss | |

| (11,678 | ) | |

| (9,763 | ) |

| Depreciation & amortization | |

| 1,625 | | |

| 1,567 | |

| Interest expense | |

| 2,575 | | |

| 2,569 | |

| Income taxes | |

| (509 | ) | |

| 41 | |

| Stock compensation | |

| 1,548 | | |

| 2,811 | |

| Nonrecurring loss events | |

| 2,596 | | |

| 1,293 | |

| Adjusted EBITDA | |

| (3,843 | ) | |

| (1,482 | ) |

| | |

| | | |

| | |

| Total revenues, net | |

| 65,748 | | |

| 77,539 | |

| | |

| | | |

| | |

| Adjusted EBITDA as a % of total revenues, net | |

| (6 | )% | |

| (2 | )% |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

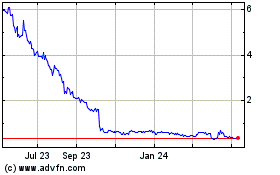

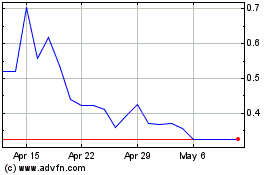

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Mar 2024 to Apr 2024

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Apr 2023 to Apr 2024