UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 13, 2023

INVO

BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39701 |

|

20-4036208 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

5582

Broadcast Court

Sarasota,

Florida 34240

(Address

of principal executive offices)

(Zip

Code)

Registrant’s

telephone number, including area code: (978) 878-9505

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☒ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Common

Stock, $0.0001 par value |

|

INVO |

|

The

Nasdaq Stock Market LLC |

| (Title

of Each Class) |

|

(Trading

Symbol) |

|

(Name

of Each Exchange on Which Registered) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (CFR §240.12b-2 of this chapter). Emerging growth company

☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

INVO

Bioscience, Inc., a Nevada corporation (the “Company”) intends to commence an exchange offer to all holders of the

Company’s common stock purchase warrants dated August 8, 2023 (the “Warrants”) to exchange shares of

INVO’s common stock for each warrant tendered.

INVO

expects to file a Schedule TO on or before November 23, 2023, at which time INVO will commence an exchange offer for the warrants that

will be open for no less than 20 business days and will expire two trading days after INVO’s closing of the

previously announced proposed merger with NAYA Biosciences, Inc., a Delaware corporation (“NAYA”).

Under

the terms of the proposed exchange offer, warrant holders will have the opportunity to exchange each warrant held for a number of shares

of common stock equal to the quotient of $2.25 per warrant divided by the closing price of INVO’s common stock on the date of closing

of the proposed merger with NAYA.

These

terms and conditions of the exchange offer will be described in an offer to exchange and related letter of transmittal that will be sent

to INVO’s warrant holders shortly after commencement of the exchange offer. The exchange offer will be subject to the closing of

the merger agreement with NAYA. Tenders of

warrants must be made prior to the expiration of the exchange offer period.

None

of INVO, its board of directors, the warrant agent, or the depositary will make any recommendation to warrant holders as to whether to

tender or refrain from tendering their warrants. Securityholders must make their own decision as to whether to tender their warrants

and, if so, how many warrants to tender.

Pre-Commencement

Communications

This

communication is not an offer to buy or the solicitation of an offer to sell any shares of INVO’s common stock or other securities.

The anticipated exchange offer described in this communication has not yet commenced. The

solicitation and offer to exchange warrants will be made only

pursuant to an offer to exchange, letter of transmittal and related materials that INVO intends to distribute to its stockholders and

file with the Securities and Exchange Commission (the “SEC”). The full details of the exchange offer, including complete

instructions on how to tender warrants, will be included in the offer to exchange, letter of transmittal, and related materials, which

will become available to warrant holders upon commencement of the exchange offer.

Prior

to making any decision with respect to the proposed exchange offer, securityholders should read carefully the information in the offer

to exchange, letter of transmittal, and related materials because they will contain important information, including the various terms

of, and conditions to, the exchange offer. A free copy of the exchange offer documents that will be filed with the SEC may be obtained

when filed from the SEC’s website at www.sec.gov or by calling the information agent (to be identified at the time the offer is

made). Warrant Holders are urged to read these materials, when available, carefully prior to making any decision with respect to the

exchange offer.

Important

Additional Information will be filed with the SEC

This

communication is being made in respect of the proposed transaction between the Company and NAYA (the “Proposed Transaction”).

In connection with the proposed transaction, the Company and NAYA will file relevant materials with the SEC, including a registration

statement on Form S-4 to be filed by the Company that will include a proxy statement of the Company that also constitutes a prospectus

of the Company. A definitive proxy statement/prospectus will be mailed to stockholders of the Company and of NAYA.

This

communication is not a substitute for the registration statement, proxy statement, or prospectus or any other document that the Company

or NAYA (as applicable) may file with the SEC in connection with the Proposed Transaction. INVESTORS AND SECURITY HOLDERS OF THE COMPANY

AND NAYA ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED

OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors

and security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when they become available),

as well as other filings containing important information about the Company or NAYA, without charge at the SEC’s Internet website

(http://www.sec.gov). Copies of the documents filed with the SEC by the Company will be available free of charge under the tab “SEC

Filings” on the “Investors” page of the Company’s internet website at www.invobioscience.com or by contacting

the Company’s Investor Relations Contact at INVO@lythampartners.com. The information included on, or accessible through,

the Company’s or NAYA’s website is not incorporated by reference into this communication.

Participants

in the Solicitation

The

Company, NAYA, their respective directors and certain of their respective executive officers may be deemed to be participants in the

solicitation of proxies in respect of the Proposed Transaction. Information about the directors and executive officers of the Company

is set forth in its annual report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on April 17, 2023,

and its amendment to annual report on Form 10-K, which was filed on April 27, 2023. Information about the directors and executive officers

of NAYA will be set forth in the registration statement on Form S-4 and the definitive proxy statement/prospectus included therein. Additional

information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security

holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they

become available.

No

Offer or Solicitation

This

communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of

an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, solicitation, or sale of securities

in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section

10 of the U.S. Securities Act of 1933, as amended.

Forward-Looking

Statements

This

communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context,

forward-looking statements often address future business and financial events, conditions, expectations, plans or ambitions, and

often contain words such as “expect,” “anticipate,” “intend,” “plan,”

“believe,” “seek,” “see,” “will,” “would,” “target,” similar

expressions, and variations or negatives of these words, but not all forward-looking statements include such words. Forward-looking

statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of

the Proposed Transaction and the anticipated benefits thereof. All such forward-looking statements are based upon current plans,

estimates, expectations, and ambitions that are subject to risks, uncertainties, and assumptions, many of which are beyond the

control of the Company and NAYA, that could cause actual results to differ materially from those expressed in such forward-looking

statements. Important risk factors that may cause such a difference include, but are not limited to, the following: the completion

of the Proposed Transaction on anticipated terms and timing, or at all, including obtaining regulatory approvals that may be

required on anticipated terms, Company stockholder approval, and NAYA stockholder approval; anticipated tax treatment, unforeseen

liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial

condition, losses, future prospects, business, and management strategies for the management, expansion, and growth of the combined

company’s operations and other conditions to the completion of the Proposed Transaction, including the possibility that any of

the anticipated benefits of the Proposed Transaction will not be realized or will not be realized within the expected time period;

the ability of the Company and NAYA to integrate the business successfully and to achieve anticipated synergies and value creation;

potential litigation relating to the Proposed Transaction that could be instituted against the Company, NAYA, or their respective

directors; the risk that disruptions from the Proposed Transaction will harm the Company’s or NAYA’s business, including

current plans and operations and that management’s time and attention will be diverted on transaction-related issues;

potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Proposed

Transaction; legislative, regulatory and economic developments, including regulatory implementation of the Inflation Reduction Act,

and other regulatory actions targeting public companies in the biotech industry and changes in local, national, or international

laws, regulations, and policies affecting the Company and NAYA; potential business uncertainty, including the outcome of commercial

negotiations and changes to existing business relationships during the pendency of the Proposed Transaction that could affect the

Company’s and/or NAYA’s financial performance and operating results; certain restrictions during the pendency of the

Proposed Transaction that may impact the Company’s or NAYA’s ability to pursue certain business opportunities or

strategic transactions or otherwise operate its business; acts of terrorism or outbreak of war, hostilities, civil unrest, attacks

against the Company or NAYA, and other political or security disturbances; dilution caused by the Company’s issuance of

additional shares of Company common stock in connection with the Proposed Transaction; the possibility that the transaction may be

more expensive to complete than anticipated, including as a result of unexpected factors or events; the impacts of pandemics or

other public health crises, including the effects of government responses on people and economies; changes in technical or operating

conditions, including unforeseen technical difficulties; those risks described in Item 1A of the Company’s Annual Report on

Form 10-K, filed with the SEC on April 17, 2023; and those risks that will be described in the registration statement on Form S-4

and accompanying prospectus available from the sources indicated above.

These

risks, as well as other risks associated with the Proposed Transaction, will be more fully discussed in the proxy statement/prospectus

that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the Proposed Transaction.

While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 will be,

considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the realization of forward-looking statements. We caution you not to place undue

reliance on any of these forward-looking statements as they are not guarantees of future performance

or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition

and liquidity, and the development of new markets or market segments in which we operate, may differ materially from those made in or

suggested by the forward-looking statements contained in this communication. Neither the Company nor NAYA assumes any obligation to publicly

provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise,

should circumstances change, except as otherwise required by securities and other applicable laws. Neither future distribution of this

communication nor the continued availability of this communication in archive form on the Company’s or NAYA’s website should

be deemed to constitute an update or re-affirmation of these statements as of any future date.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits

| Exhibit |

|

Description |

| |

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 13, 2023

| |

INVO

BIOSCIENCE, INC. |

| |

|

|

| |

By: |

/s/

Steven Shum |

| |

|

Steven

Shum |

| |

|

Chief

Executive Officer |

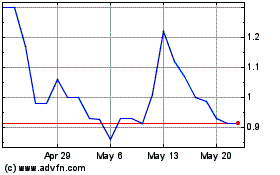

INVO BioScience (NASDAQ:INVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

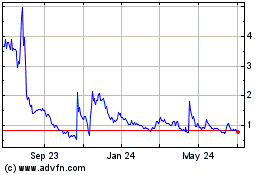

INVO BioScience (NASDAQ:INVO)

Historical Stock Chart

From Apr 2023 to Apr 2024