0000065596

false

0000065596

2023-11-11

2023-11-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 11, 2023

Siebert Financial Corp.

(Exact name of registrant as specified in its charter)

| New York |

|

0-5703 |

|

11-1796714 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

| 653 Collins Avenue, Miami Beach, FL |

|

33139 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (212) 644-2400

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock - $0.01 par value |

|

SIEB |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On

November 13, 2023, Siebert Financial Corp. (the "Company") issued a press release announcing financial results for the three

months ended September 30, 2023. A copy of such release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

by reference herein.

Pursuant

to General Instruction B.2 of Current Report on Form 8-K, the information contained in, or incorporated into, Item 2.02, including the

press release attached as Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as

amended, or the Exchange Act, except as shall be expressly set forth by specific reference to such filing.

Item 8.01 Other Events.

On November 11, 2023, Siebert

delivered a notice (the “Notice”) to Kakaopay Corporation (“Kakaopay”) stating that a material adverse effect

has occurred with respect to Kakaopay in light of, among other events, Korean authorities taking action against Kakaopay, its parent company,

Kakao Corp., and their affiliates, and Kakao Corp.’s recent announcement that it will establish an independent compliance committee

for Kakao Corp. and its subsidiaries to address what it described as the current crisis at Kakao Corp. and its subsidiaries. Siebert is

considering its rights and obligations under the stock purchase agreement (the “Second Share Purchase Agreement”) pursuant

to which Siebert agreed to issue to Kakaopay an additional 25,756,470 shares of Siebert’s common stock at a per share price of $2.35,

including evaluating whether and under what circumstances the stock purchase agreement might be terminated, and has reserved all of its

rights and remedies, including Siebert’s right to assert that Kakaopay has materially breached a number of covenants in the stock

purchase agreement. On November 12, 2023, Kakaopay delivered a letter in response to the Notice that expressed Kakaopay’s disagreement

with the statements in the Notice.

As

a result of the foregoing, Siebert has incurred and may incur additional legal expenses evaluating these matters, the amount of which

is uncertain as of the date hereof.

Forward-Looking Statements

For

purposes of this Current Report on Form 8-K (“Report”), the terms “Siebert,” “Company,” “we,”

“us” and “our” refer to Siebert Financial Corp., its wholly-owned and majority-owned subsidiaries collectively,

unless the context otherwise requires.

The

statements contained throughout this Report, including any documents incorporated by reference, that are not historical facts, including

statements about our beliefs and expectations, are “forward-looking statements” within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Forward-looking statements include statements preceded by, followed by or that include the words “may,”

“could,” “would,” “should,” “believe,” “expect,” “anticipate,”

“plan,” “estimate,” “target,” “project,” “intend” and similar words or expressions.

In addition, any statements that refer to expectations, projections, or other characterizations of future events or circumstances are

forward-looking statements.

These

forward-looking statements, which reflect our beliefs, objectives, and expectations as of the date hereof, are based on the best judgement

of management. All forward-looking statements speak only as of the date on which they are made. Such forward-looking statements are subject

to certain risks, uncertainties and assumptions relating to factors that could cause actual results to differ materially from those anticipated

in such statements, including, without limitation, the following: economic, social and political conditions, global economic downturns

resulting from extraordinary events; securities industry risks; interest rate risks; liquidity risks; credit risk with clients and counterparties;

risk of liability for errors in clearing functions; systemic risk; systems failures, delays and capacity constraints; network security

risks; competition; reliance on external service providers; new laws and regulations affecting our business; net capital requirements;

extensive regulation, regulatory uncertainties and legal matters; failure to maintain relationships with employees, customers, business

partners or governmental entities; the inability to achieve synergies or to implement integration plans; the closing conditions relating

to the Second Tranche Purchase Agreement with Kakaopay may not be satisfied and the transactions contemplated by the Second Tranche Purchase

Agreement may not be consummated; and other consequences associated with risks and uncertainties detailed in Part I, Item 1A - Risk

Factors of our Annual Report on Form 10-K for the year ended December 31, 2022, (“2022 Form 10-K”), and our filings with

the SEC.

We

caution that the foregoing list of factors is not exclusive, and new factors may emerge, or changes to the foregoing factors may occur,

that could impact our business. We undertake no obligation to publicly update or revise these statements, whether as a result of new information,

future events or otherwise, except to the extent required by the federal securities laws.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following

exhibit is furnished with this Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Dated: November 13, 2023 |

SIEBERT FINANCIAL CORP. |

| |

|

| |

By |

/s/ John J. Gebbia |

| |

|

John J. Gebbia |

| |

|

Chief Executive Officer |

| |

|

(Principal executive officer) |

| |

|

| |

By |

/s/ Andrew H. Reich |

| |

|

Andrew H. Reich |

| |

|

Executive Vice President, Chief Operating Officer, |

| |

|

Chief Financial Officer, and Secretary |

| |

|

(Principal financial and accounting officer) |

3

Exhibit 99.1

Siebert Reports Third Quarter 2023 Financial

Results

NEW YORK, NY – November 13, 2023 –

Siebert Financial Corp. (NASDAQ: SIEB) (“Siebert”), a diversified provider of financial services, today reported

financial results for the third quarter ended September 30, 2023.

Third Quarter 2023 Financial Highlights

| ● | Revenue of $18.1 million compared to $14.3 million

in the third quarter of 2022 |

| ● | Net income available to common stockholders of

$2.8 million compared to $1.1 million in the third quarter of 2022 |

| ● | Earnings per share of $0.07 compared to $0.03

in the third quarter of 2022 |

| ● | Total retail customer accounts of 128,727 compared to 122,394 in the third

quarter of 2022 |

| ● | Total retail customer net worth of $14.6 billion,

an improvement compared to $13.5 billion at the end of 2022 |

Recent Business Highlights

| ● | Moved headquarters to Miami Beach in October to solidify presence in this

growing market and build relationships with strategic partners that have expanded their presence to South Florida |

| ● | Signed a five-year lease in the World Financial

Center in New York City, expanding presence in New York and providing savings on occupancy costs |

| ● | Received approval for Fully Paid Securities Lending

in October in order to expand Siebert’s growing securities finance business |

Management Commentary

“Our results this quarter demonstrate the

strength of our business model and the progress we’ve made in building the foundation for future growth,” said John J. Gebbia,

CEO of Siebert. Continuing to invest in our capabilities allows us to meet the evolving needs of investors as we chart the next phase

of our evolution to empower our clients’ success. We enter the fourth quarter with great momentum and a tremendous opportunity for

Siebert to capture opportunities in the current market environment while creating long-term shareholder value.”

Andrew Reich, CFO of Siebert, commented: “We

delivered another quarter of strong results as our business continues to benefit from improved market conditions along with the rise in

interest rates. Revenue grew 26% year-over-year and was driven by higher interest income and revenues related to the mark to market on

our U.S. government securities portfolio, as well as along with higher commission and fee revenue. During the quarter we also delivered

an improvement to both our pretax income and margins as we continue to improve profitability. We continue to benefit from the growth in

capital along with the interest rate environment and expect those trends to continue in the fourth quarter. Looking ahead, we are well-positioned

for sustained growth and have a flexible balance sheet to navigate the remainder of the year while expanding our capabilities and competitive

position.”

Notice to Investors

This communication is provided for informational

purposes only and is neither an offer to sell nor a solicitation of an offer to buy any securities in the United States or elsewhere.

About Siebert Financial Corp.

Siebert is a diversified financial services company

that has been in business and a member of the NYSE since 1967 when Muriel Siebert became the first woman to own a seat on the NYSE and

the first to head one of its member firms.

Siebert operates through its subsidiaries Muriel

Siebert & Co., Inc., Siebert AdvisorNXT, Inc., Park Wilshire Companies, Inc., Rise Financial Services, LLC, Siebert Technologies,

LLC and StockCross Digital Solutions, Ltd. Through these entities, Siebert provides a full range of brokerage and financial advisory services

including securities brokerage, investment advisory and insurance offerings, and corporate stock plan administration solutions. For over

55 years, Siebert has been a company that values its clients, shareholders, and employees. More information is available at www.siebert.com.

Cautionary Note Regarding Forward-Looking Statements

The statements contained in this press release,

that are not historical facts, including statements about our beliefs and expectations, are “forward-looking statements” within

the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements preceded by, followed

by or that include the words “may,” “could,” “would,” “should,” “believe,”

“expect,” “anticipate,” “plan,” “estimate,” “target,” “project,”

“intend” and similar words or expressions. In addition, any statements that refer to expectations, projections, or other characterizations

of future events or circumstances are forward-looking statements.

These forward-looking statements, which reflect

our beliefs, objectives, and expectations as of the date hereof, are based on the best judgement of management. All forward-looking statements

speak only as of the date on which they are made. Such forward-looking statements are subject to certain risks, uncertainties and assumptions

relating to factors that could cause actual results to differ materially from those anticipated in such statements, including, without

limitation, the following: economic, social and political conditions, global economic downturns resulting from extraordinary events; securities

industry risks; interest rate risks; liquidity risks; credit risk with clients and counterparties; risk of liability for errors in clearing

functions; systemic risk; systems failures, delays and capacity constraints; network security risks; competition; reliance on external

service providers; new laws and regulations affecting our business; net capital requirements; extensive regulation, regulatory uncertainties

and legal matters; failure to maintain relationships with employees, customers, business partners or governmental entities; the inability

to achieve synergies or to implement integration plans; the closing conditions relating to the Second Tranche Purchase Agreement with

Kakaopay may not be satisfied and the transactions contemplated by the Second Tranche Purchase Agreement may not be consummated; and other

consequences associated with risks and uncertainties detailed in Part I, Item 1A - Risk Factors of our Annual Report on Form 10-K for

the year ended December 31, 2022, and our filings with the SEC.

We caution that the foregoing list of factors

is not exclusive, and new factors may emerge, or changes to the foregoing factors may occur, that could impact our business. We undertake

no obligation to publicly update or revise these statements, whether as a result of new information, future events or otherwise, except

to the extent required by the federal securities laws.

Investor Relations:

Alex Kovtun and Matt Glover

Gateway Group, Inc.

949-574-3860

sieb@gateway-grp.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

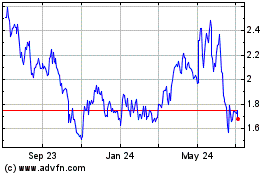

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

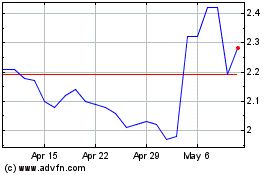

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Apr 2023 to Apr 2024