false000160206500016020652023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 7, 2023

___________

VIPER ENERGY, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | | | | |

DE | 001-36505 | 46-5001985 | |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) | |

| 500 West Texas Ave. | | | | |

| Suite 100 | | | | |

Midland, TX | | | 79701 | |

(Address of principal

executive offices) | | | (Zip code) | |

(432) 221-7400

(Registrant's telephone number, including area code)

Viper Energy Partners LP

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

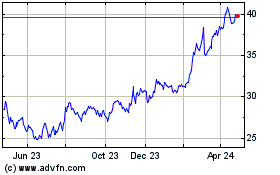

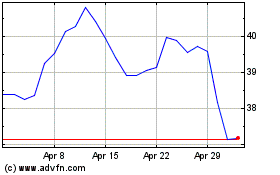

| Class A Common Stock, $0.000001 Par Value | VNOM | The Nasdaq Stock Market LLC |

| | (NASDAQ Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

As previously disclosed in its Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on November 7, 2023 (the “Closing 8-K”), on November 1, 2023 (the "Closing Date"), Viper Energy Partners LP (“Viper”) and its operating subsidiary, Viper Energy Partners LLC (“Viper OpCo” and, together with Viper, the “Buyer Parties”) completed the acquisition (the “Acquisition”) of certain mineral interests, overriding royalty interests, royalty interests and non-participating royalty interests in oil, gas, and other hydrocarbons (the “Assets”) from Royalty Asset Holdings, LP, Royalty Asset Holdings II, LP and Saxum Asset Holdings, LP (collectively, “Sellers,” and affiliates of Warwick Capital Partners and GRP Energy Capital) under the previously reported Purchase and Sale Agreement, dated as of September 4, 2023, by and among the Buyer Parties and the Sellers (the “Purchase and Sale Agreement”). The total consideration for the Acquisition consisted of 9,018,760 common units representing limited partnership interests in Viper (the “Common Units”) (the “Common Unit Consideration”) and $750 million in cash (the “Cash Consideration”). The Cash Consideration for the Acquisition was funded through a combination of (i) cash on hand, (ii) proceeds from Viper’s offering of $400 million in aggregate principal amount of 7.375% Senior Notes due 2031, (iii) $200 million in net proceeds from the issuance of 7,215,007 Common Units to Viper’s parent, Diamondback Energy, Inc. (“Diamondback”), under that certain Common Unit Purchase and Sale Agreement (the “Common Unit Purchase Agreement”) described in Item 1.01 of Viper’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on September 7, 2023 (the “Initial 8-K”) at the same implied valuation per Common Unit as the Common Unit Consideration, and (iv) borrowings under Viper OpCo’s revolving credit facility. The Acquisition has an effective date of October 1, 2023.

This Amendment to Current Report on Form 8-K is being filed to amend and supplement the Initial 8-K, the sole purpose of which is to provide the financial statements and pro forma financial information required by Item 9.01, which were excluded from the Initial 8-K and are filed as exhibits hereto and are incorporated herein by reference. All other items in the Initial remain the same.

Further, as previously disclosed in its Current Report on Form 8-K filed with the SEC on November 2, 2023, Viper filed a Certificate of Conversion with the Secretary of the State of Delaware to convert its legal status from a Delaware limited partnership into a Delaware corporation (the “Conversion”). The Conversion became effective at 12:01 a.m. (Eastern Time) on November 13, 2023 at which time Viper Energy Partners LP converted its legal status from a Delaware limited partnership into a Delaware corporation and changed its name to Viper Energy, Inc.

References in this 8-K/A and the exhibits to this 8-K/A to the “Partnership” refer to Viper Energy Partners LP, the predecessor of Viper Energy, Inc., prior to the Conversion. Additionally, references to “Viper Energy,” “Viper,” “the Company,” “we,” “our,” “us” or like terms refer to (A) following the conversion, Viper Energy, Inc. individually and collectively with Viper OpCo, as the context requires, and (B) before the conversion, the Partnership individually and collectively with Viper OpCo, as the context requires.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Business or Funds Acquired.

The combined financial statements of the Sellers, which comprise the combined balance sheets, the related combined statements of operations, combined statement of partners' capital, and combined statements of cash flows, the related notes to the combined financial statements, and the unaudited supplemental information on oil and natural gas operations for the years ended December 31, 2022 and 2021, are filed as Exhibit 99.1 hereto and incorporated by reference herein.

The unaudited interim combined financial statements of the Sellers, which comprise the combined balance sheets, the related combined statements of operations, combined statement of partners' capital, and combined statements of cash flows, and the related notes to the combined financial statements for the nine months ended September 30, 2023 and 2022, are filed as Exhibit 99.2 hereto and incorporated by reference herein.

(b) Pro Forma Financial Information.

The unaudited pro forma condensed combined financial information of Viper, which comprises the balance sheet as of September 30, 2023, the statements of operations for the nine months ended September 30, 2023 and year ended December 31, 2022, and the related notes thereto, is filed as Exhibit 99.3 hereto and incorporated by reference herein.

(d) Exhibits

| | | | | | | | | | | |

| Number | | Description |

| 23.1* | | |

| 23.2* | | |

| 23.3* | | |

| 99.1* | | |

| 99.2* | | |

| 99.3* | | |

| 99.4* | | |

| 99.5* | | |

104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | VIPER ENERGY, INC. |

| | | | |

| Date: | November 13, 2023 | | | |

| | | | |

| | | By: | /s/ Teresa L. Dick |

| | | Name: | Teresa L. Dick |

| | | Title: | Chief Financial Officer, Executive Vice President and Assistant Secretary |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our report dated November 13, 2023, with respect to the combined financial statements of Royalty Asset Holdings, LP, Royalty Asset Holdings II, LP, and Saxum Asset Holdings, LP included in this current report of Viper Energy, Inc. on Form 8-K/A. We consent to the incorporation by reference of said report in the Registration Statement of Viper Energy Partners LP (now known as Viper Energy, Inc.) on Form S-8 (File No. 333-196971).

/s/ GRANT THORNTON LLP

Oklahoma City, Oklahoma

November 13, 2023

Exhibit 23.2

CONSENT OF DEGLOYER AND MACNAUGHTON

We have issued our reports, each dated October 25, 2023, on estimates of proved reserves, future production and income attributable to certain royalty interests acquired by Viper Energy Partners LP (now known as Viper Energy, Inc.) (“Viper”) from Royalty Asset Holdings, LP, Royalty Asset Holdings II, LP and Saxum Asset Holdings, LP, prepared as of December 31, 2022 and December 31, 2021 (the “Reserve Reports”), included as Exhibit 99.4 and 99.5, respectively, in this Current Report on Form 8-K/A of Viper. As independent petroleum engineers, we hereby consent to (i) the inclusion of the Reserve Reports and the information contained therein and information from our prior reserve reports referenced in this Current Report on Form 8-K/A of Viper (this “Form 8-K/A”) and to all references to our firm in this Form 8-K/A and (ii) the incorporation by reference of the Reserve Reports in the Registration Statement on Form S-8 (File No. 333-196971) (the “S-8 Registration Statement”) and (ii) the use in the S-8 Registration Statement of the information contained in the Reserve Reports.

| | | | | | | | |

| DeGloyer and MacNaughton |

| | |

| /s/ DeGloyer and MacNaughton |

| |

| |

| DEGLOYER AND MACNAUGHTON |

Houston, Texas

November 13, 2023

Exhibit 23.3

CONSENT OF RYDER SCOTT COMPANY, L.P.

We have issued our report dated January 5, 2023 on estimates of proved reserves, future production and income attributable to certain royalty interests of Viper Energy Partners LP (now known as Viper Energy, Inc.) (“Viper”), prepared as of December 31, 2022 (the “Reserve Report”), included in Viper’s Annual Report on Form 10-K for the year ended December 31, 2022 (the “Annual Report”). As independent oil and gas consultants, we hereby consent to (i) the inclusion or incorporation by reference of the Reserve Report and the information contained therein and information from our prior reserve reports referenced in this Current Report on Form 8-K/A (this “Form 8-K/A”) and (ii) all references to our firm in this Form 8-K/A.

| | | | | | | | |

| |

| | |

| /s/ Ryder Scott Company, L.P. |

| |

| |

| RYDER SCOTT COMPANY, L.P. |

| TBPELS Firm Registration No. F-1580 |

Houston, Texas

November 13, 2023

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

COMBINED FINANCIAL STATEMENTS

Years Ended December 31, 2022 and 2021

with Report of Independent Auditors

TABLE OF CONTENTS

| | | | | |

| Page |

Report of Independent Certified Public Accountants | |

| Combined Balance Sheets | |

| Combined Statements of Operations | |

| Combined Statements of Partners’ Equity | |

| Combined Statements of Cash Flows | |

| Notes to the Combined Financial Statements | |

REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

Board of Directors and Stockholders

Viper Energy, Inc.

Opinion

We have audited the combined financial statements of Royalty Asset Holdings, LP, Royalty Asset Holdings II, LP and Saxum Asset Holdings, LP (collectively, the “Businesses”), which comprise the combined balance sheets as of December 31, 2022 and 2021, and the related combined statements of operations, changes in partners’ equity, and cash flows for the years then ended, and the related notes to the financial statements.

In our opinion, the accompanying combined financial statements present fairly, in all material respects, the financial position of the Businesses as of December 31, 2022 and 2021, and the results of their operations and their cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for opinion

We conducted our audits of the combined financial statements in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Businesses and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of management for the financial statements

Management is responsible for the preparation and fair presentation of the combined financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of combined financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the combined financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Businesses’ ability to continue as a going concern for one year after the date the financial statements are available to be issued.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the combined financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the combined financial statements.

In performing an audit in accordance with US GAAS, we:

•Exercise professional judgment and maintain professional skepticism throughout the audit.

•Identify and assess the risks of material misstatement of the combined financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

•Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Businesses’ internal control. Accordingly, no such opinion is expressed.

•Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the combined financial statements.

•Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Businesses’ ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/ GRANT THORNTON LLP

Oklahoma City, Oklahoma

November 13, 2023

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

COMBINED BALANCE SHEETS

| | | | | | | | | | | |

| December 31, |

| 2022 | | 2021 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 26,523,350 | | | $ | 25,625,173 | |

| Accounts receivable-oil and gas sales and other | 30,393,393 | | | 23,085,831 | |

| Prepaid expenses and other current assets | 765,488 | | | 593,431 | |

| Total current assets | 57,682,231 | | | 49,304,435 | |

| | | |

| Property: | | | |

| Oil and gas properties | 660,404,232 | | | 612,856,556 | |

| Accumulated depletion | (101,043,279) | | | (70,916,751) | |

| Impairment | (164,532,161) | | | (164,532,161) | |

| Total oil and gas properties, net | 394,828,792 | | | 377,407,644 | |

| Total assets | $ | 452,511,023 | | | $ | 426,712,079 | |

| | | |

| Liabilities and Partner’s equity | | | |

| | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 1,620,000 | | | $ | — | |

| | | |

| Commitments and contingencies (Note 3) | | | |

| | | |

| Partners’ equity | 450,891,023 | | | 426,712,079 | |

| | | |

| Total liabilities and Partner’s equity | $ | 452,511,023 | | | $ | 426,712,079 | |

The accompanying notes form an integral part of these combined financial statements.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

COMBINED STATEMENTS OF OPERATIONS

| | | | | | | | | | | |

| Year Ended December 31, |

| 2022 | | 2021 |

| Revenues | | | |

| Oil and gas sales | $ | 156,930,913 | | | $ | 96,271,733 | |

| Lease bonuses | 3,615,406 | | | 510,152 | |

| Total revenues | 160,546,319 | | | 96,781,885 | |

| Operating expenses | | | |

Production and ad valorem taxes | 10,059,617 | | | 6,380,218 | |

| Depletion | 30,126,528 | | | 23,353,101 | |

| General and administrative | 12,947,795 | | | 8,254,093 | |

| Total operating expenses | 53,133,940 | | | 37,987,412 | |

| | | |

| Income from operations | 107,412,379 | | | 58,794,473 | |

| | | |

| Other income (expense) | | | |

| Other income, net | 645,449 | | | 998,936 | |

| Total other income | 645,449 | | | 998,936 | |

| | | |

| Net income | $ | 108,057,828 | | | $ | 59,793,409 | |

The accompanying notes form an integral part of these combined financial statements.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

COMBINED STATEMENTS OF PARTNERS’ CAPITAL

| | | | | |

| Limited Partners |

| Balance at December 31, 2020 | $ | 360,865,786 | |

| Net income | 59,793,409 | |

| Contributions | 59,834,243 | |

| Distributions | (53,781,359) | |

| Balance at December 31, 2021 | 426,712,079 | |

| Net income | 108,057,828 | |

| Contributions | 45,927,676 | |

| Distributions | (129,806,560) | |

| Balance at December 31, 2022 | $ | 450,891,023 | |

The accompanying notes form an integral part of these combined financial statements.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

COMBINED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | |

| Year Ended December 31, |

| 2022 | | 2021 |

| Cash flows from operating activities: | | | |

| Net income | $ | 108,057,828 | | | $ | 59,793,409 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depletion | 30,126,528 | | | 23,353,101 | |

| Effect of changes in current assets and liabilities: | | | |

| Accounts receivable-oil and gas sales and other | (7,307,562) | | | (9,870,133) | |

| Prepaid expenses and other current assets | (172,057) | | | 75,233 | |

| Accounts payable and accrued expenses | 1,620,000 | | | — | |

| Net cash provided by operating activities | 132,324,737 | | | 73,351,610 | |

| | | |

| Cash flows from investing activities: | | | |

| Acquisition of oil and gas properties | (47,547,676) | | | (84,027,425) | |

| Net cash used in investing activities | (47,547,676) | | | (84,027,425) | |

| | | |

| Cash flows from financing activities: | | | |

| Contributions | 45,927,676 | | | 59,834,243 | |

| Distributions | (129,806,560) | | | (53,781,359) | |

Net cash provided by (used in) financing activities | (83,878,884) | | | 6,052,884 | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 898,177 | | | (4,622,931) | |

| Cash, cash equivalents and restricted cash at beginning of period | 25,625,173 | | | 30,248,104 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 26,523,350 | | | $ | 25,625,173 | |

The accompanying notes form an integral part of these combined financial statements.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS

1.BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business - Royalty Asset Holdings, LLC (“RAH LLC”) was formed as a Texas limited liability company on September 22, 2016. On March 7, 2017, RAH LLC was converted into Royalty Asset Holdings, LP (“RAH LP”), a Texas limited partnership pursuant to the filing of a certificate of conversion with the Secretary of State of the State of Texas and in accordance with the provisions of the Texas Limited Partnership Law.

Prior to the filing of the certificate of conversion, Royalty Asset Holdings GP, LLC (“RAH GP”), a Texas limited liability company and Brigadier Royalty Warehouse, LLC (“BRW”), a Texas limited liability company owned 0.1% and 99.9% equity interest in RAH LLC respectively. On March 7, 2017, RAH GP was appointed as the sole general partner and BRW was appointed as the sole limited partner of RAH LP. Effective as of April 1, 2017, BRW assigned to Warwick Royalty and Mineral Master Fund LP (“WRMF”) a Delaware limited partnership, all of BRW’s equity interests in and to each of RAH GP and RAH LP.

Royalty Asset Holdings II, LP (“RAH II LP”), a Delaware limited partnership was formed on February 11, 2019, by Warwick Royalty and Mineral Fund II GP Limited (“WRMF II GP”), a Cayman Islands exempted limited company, as the sole general partner, and Brigadier Royalty Warehouse II, LLC (“BRW II”), a Delaware limited liability company, as the sole limited partner. Effective as of April 18, 2019, BRW II assigned to Warwick Royalty and Mineral Master Fund II LP (“WRMF II”), a Delaware limited partnership, all BRW II’s equity interests in RAH II LP.

Saxum Asset Holdings, LP (“Saxum LP”) was formed on April 15, 2020, by Warwick Royalty and Mineral Fund III GP Limited, a Cayman Islands exempted company as the sole general partner (“WRMF III GP”) and Warwick Royalty and Mineral Master Fund III LP (“WRMF III”), a Delaware limited partnership, as the sole limited partner to Saxum LP.

RAH LP, RAH II LP and Saxum LP together are known as the Limited Partners.

RAH LP, RAH II LP and Saxum LP (together the “Businesses”) were formed to seek and acquire both producing and nonproducing mineral interests, royalty interests, overriding royalty interests, net profit interests, and production payments, in each case, in the United States.

The General Partners and the Businesses have delegated, subject to its responsibility and supervision, day-to-day investment management of the Partnership’s assets to GRP Royalty Holdings LLC, a Texas limited liability company and their affiliates, GRP RAH I Holdings LLC, GRP RAH II Holdings LLC and GRP Saxum Holdings, LLC, all of which are Delaware limited liability company (together the “Manager”).

Basis of Presentation - The accompanying combined financial statements and related notes thereto were prepared in conformity with accounting principles generally accepted in the United States of America. All intercompany balances and transactions have been eliminated in combination.

Use of Estimates in the Preparation of Financial Statements - Management is required to make certain estimates and assumptions in the preparation of the combined financial statements that affect the reported amounts of assets, liabilities, and the disclosure of contingent assets and liabilities at the date of the combined financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The impact of oil and gas prices has a significant impact on estimates made by management. Changes in the value of these commodities has a direct impact on the economic limits of estimated oil and gas reserves. These economic limits have significant effects upon predicted reserve values. These estimates are the basis for the calculation of depletion for the oil and gas properties and the assessment as to whether an impairment of such properties is required.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS - (CONTINUED)

Further, these estimates and other factors, including those outside of the Businesses’ control, such as the impact of sustained lower commodity prices, can potentially impact operators' current and future development plans (including the impact to undeveloped oil & gas properties), which could have a significant adverse impact to the Businesses’ financial condition, results of operations and cash flows.

The Businesses’ oil, natural gas, and natural gas liquid reserves represent estimated quantities of oil and gas which, using geological and engineering data, are estimated with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. There are numerous uncertainties inherent in estimating oil and gas reserves and their values including many factors beyond the Businesses’ control. Accordingly, reserve estimates are different from the future quantities of oil and gas that are ultimately recovered.

Cash - Cash includes cash on hand.

Accrued Revenue Recognized on Production Income Basis - Production estimates are made based upon internal estimated ultimate recovery curves in the routine course of business if publicly available data does not exist for new Proved Developed Producing (PDP) wells.

Revenue from Contracts with Customers

Oil and Gas Sales

Revenues from oil, natural gas and natural gas liquids are generally recognized when control of the product is transferred to the purchaser, which is the point where performance obligations are satisfied based on the Businesses’ percentage ownership share of the revenue, net of any deductions for gathering and transportation. All the Businesses’ oil and gas sales are made under contracts between the operators of the properties in which the Businesses hold interest and their respective customers. The Businesses' contract is with the operator of the oil and gas properties; however, we have concluded that the substance of the transactions between the Businesses and the end customer results in the Businesses being the principal within the context of Accounting Standards Codification 606, Revenue from Contracts with Customers, "ASC 606". The Businesses' performance obligations are satisfied at the point in time the product is delivered by the operator to the purchaser of the hydrocarbons. Accordingly, the Businesses' contracts do not give rise to contract assets or liabilities.

The Businesses typically receive payment for oil and gas sales within 60 days, unless the product being sold is related to a newly drilled well, in which case, payment may be received up to six months beyond the date of first production. Contracts for the sale of oil, natural gas and natural gas liquids are industry standard contracts that include variable consideration based upon a monthly index and may include provisions related to gravity, price differentials, discounts and other adjustments and deductions. As each unit of production represents a separate performance obligation, the consideration is variable as it relates to oil and gas prices, and the variability is resolved as each unit of production is delivered to the purchaser, variable consideration does not need to be estimated. Additionally, the Businesses' right to royalties does not originate until production occurs and, therefore, is not considered to exist beyond each day's production. Therefore, there are no unsatisfied performance obligations at the end of the period.

Lease Bonus Revenue

The Businesses earn revenue from lease bonuses. Lease bonus revenue is generated by leasing the Businesses’ mineral interests to exploration and production companies. A lease agreement represents a contract with a customer (in this case the operator of oil and gas properties) and generally transfers the rights to any oil, natural gas and natural gas liquids discovered, grants the Businesses a right to a specified royalty interest and requires that drilling and completion operations commence within a specified time frame. The Businesses recognize lease bonus revenue when the lease agreement has been executed, payment has been received, and the Businesses have no obligation to refund the payment. At the time the Businesses execute the lease agreement, the Businesses expect to receive payment of the lease bonus within a short time frame, but in no case more than one year. As such, the

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS - (CONTINUED)

Businesses have not adjusted the expected amount of revenue for the effects of any significant financing component per the practical expedient in ASC 606.

Prior-Period Performance Obligations

The Businesses derive revenue from the sale of oil, natural gas and natural gas liquids produced from properties in which they own a royalty or overriding royalty interest, which is recognized based on the Businesses’ pro-rata interest. Revenue is recorded and receivables are accrued in the month production is delivered to the purchaser, at which time ownership of the oil and gas is transferred to the purchaser. The Businesses accrue revenue based on estimated production dates of the wells associated with the Businesses’ mineral and overriding royalty interests, along with estimates of pricing for the production. In certain instances, statements are received from operators which provide information with respect to actual revenues to be received after year end, which are incorporated into the accrued revenue analysis.

The difference between the Businesses' estimates and the actual amounts received for oil and gas sales is recorded in the month that payment is received. For the years ended December 31, 2022 and 2021, revenues recognized relating to performance obligations satisfied in prior periods were immaterial.

The Businesses' oil, natural gas and natural gas liquids receivables are related to revenues due from operators of properties in which the Businesses owns mineral or overriding royalty interests. Although diversified amongst several producers, collectability of receivables is largely dependent upon the general economic conditions of the industry. All receivables are reviewed periodically, and balances are written off when, in the judgement of management, the receivable becomes uncollectible. Historically, the Businesses have not experienced significant issues with collectability and have determined no allowance for uncollectible accounts is necessary at December 31, 2022 and 2021.

Disaggregation of Revenue

The following table disaggregates the Businesses' total oil and gas sales by product type net of any deductions for gathering and transportation.

| | | | | | | | | | | |

| For the Years Ended December 31, |

| 2022 | | 2021 |

| Oil sales | $ | 121,133,976 | | | $ | 73,051,880 | |

| Gas sales | 18,626,238 | | | 11,620,247 | |

| Natural gas liquids sales | 17,170,699 | | | 11,599,606 | |

| Oil and gas sales | $ | 156,930,913 | | | $ | 96,271,733 | |

Concentrations of Credit Risk - The Businesses regularly have cash in a single financial institution which exceeds federal depository insurance limits. The Businesses place such deposits with high credit quality institutions and have not experienced any credit losses. The Businesses are also subject to credit risk related to oil and gas receivables due from operators related to the sale of hydrocarbons produced from properties in which the Businesses own a mineral or overriding royalty interest. For the years ended December 31, 2022 and 2021, one purchaser accounted for more than 10% of royalty income each year.

Fair Value of Financial Instruments - The Businesses' financial instruments consist of cash, accounts receivable, prepayments, other current assets, accounts payables and accrued expenses. The carrying values of these financial instruments are considered to be representative of their fair market values, due to the short-term maturity of these instruments.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS - (CONTINUED)

Accounting for Oil and Gas Operations - The Businesses use the full cost method of accounting for oil and gas properties. Under this method, all costs related to the acquisition, exploration and development of oil and gas properties are capitalized to the full cost pool. The Businesses' oil and gas properties are comprised of only mineral and overriding royalty interests. As such, the Businesses have not incurred any exploration or development costs.

All acquisitions of mineral and royalty interests are considered asset acquisitions in accordance with the guidance in Accounting Standards Codification 805 – Business Combinations. For asset acquisitions, the purchase price (which includes costs incurred for the acquisition) is allocated to the individual assets acquired and liabilities assumed based on their relative fair values. In substantially all of the acquisitions completed by the Businesses during the years ended December 31, 2022 and 2021, the fair value of the proved properties acquired exceeded the purchase price. As such, the purchase price for each acquisition was fully allocated to proved properties. Proceeds from the disposition of oil and gas properties are accounted for as adjustments to the full cost pool, with no gain or loss recognized unless the adjustment would significantly alter the relationship between capitalized costs and proved reserves.

Proved reserves are those quantities of petroleum that, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be commercially recoverable from a given date forward from known reservoirs and under defined economic conditions, operating methods, and government regulations. Fair values of acquired proved properties were estimated using associated future net cash flows prepared by the Businesses’ internal reservoir engineers, which include significant inputs such as anticipated production of proved reserves and other relevant data.

Depletion of capitalized costs of oil and gas properties is provided for using the units of production method based upon estimates of proved oil and gas reserves. In calculating depletion, the volume of proved oil and gas reserves and production is converted into a common unit of measure at the energy equivalent conversion rate of six thousand cubic feet of natural gas to one barrel of oil. Depletion expense for the years ended December 31, 2022 and 2021 was $30,126,528 or $12.80 per barrel of oil equivalent and $23,353,101 or $11.65 per barrel of oil equivalent, respectively.

In accordance with the full cost method of accounting, the net capitalized costs of oil and gas properties are subject to a ceiling. The cost center ceiling is defined as the sum of (a) estimated future net revenues from proved reserves, discounted at 10% per annum based on the trailing 12-month unweighted arithmetic average of the commodity prices posted on the first day of each month in the respective year, adjusted for existing contract provisions; (b) the cost of properties not being amortized, if any; and (c) the lower of cost or fair market value of unproved properties included in the cost being amortized.

If the net book value exceeds the ceiling, the book balance of the properties is written down to the ceiling via an impairment charge. No ceiling test impairment was recorded for the year ended December 31, 2022 and 2021. The businesses recorded an impairment expense of $164,532,161 as a result of the decline in commodity prices for the year ended December 31, 2020.

Income Taxes - All the Businesses are disregarded for U.S. income tax purposes. As such, they are neither subject to taxation nor required to submit tax returns. All the assets and liabilities of the Businesses are treated as owned directly by the respective limited partners. Further, the Businesses are passive entities for Texas franchise tax purposes, so they are not subject to tax in the state.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS - (CONTINUED)

Recently Issued Accounting Standards

Adoption of ASU 2016-02

In February 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2016-02, Leases. The FASB issued the guidance to increase the transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. This is required for all leases that have a term longer than one year. ASU 2016-02 does not apply to leases of mineral rights to explore for or use crude oil and natural gas. For non-public entities, ASU 2016-02 is effective for financial statements issued for fiscal years beginning after December 15, 2021. Adoption of the accounting standard did not have a material impact on the combined financial statements or related disclosures.

Accounting Standards Not Yet Adopted

In June 2016, the FASB issued ASU 2016-13, Financial Instruments-Credit Losses. In May 2019, ASU 2016-13 was subsequently amended by ASU 2019-04, Codification Improvements to Topic 326, Financial Instruments-Credit Losses and ASU 2019-05, Financial Instruments-Credit Losses (Topic 326): Targeted Transition Relief. ASU 2016-13, as amended, applies to trade receivables, financial assets and certain other instruments that are not measured at fair value through net income. This ASU will replace the currently required incurred loss approach with an expected loss model for instruments measured at amortized cost and is effective for financial statements issued for fiscal years beginning after December 15, 2022, including interim periods in those fiscal years. Adoption of this accounting standard is not expected to have a material impact on the combined financial statements or related disclosures.

There are no other accounting standards applicable to the Businesses that would have a material effect on the Businesses' combined financial statements and disclosures that have been issued but not yet adopted by the Businesses as of December 31, 2022, and through the filing date of this report.

2. ACQUISITIONS OF ASSETS

2022 Acquisitions

During the year ended December 31, 2022, in individually insignificant transactions, the Businesses acquired, from unrelated third party sellers, mineral and royalty interests representing 1,920 net royalty acres in the Permian Basin for an aggregate net purchase price of approximately $47.5 million, including certain customary post-closing adjustments. The Businesses funded the acquisitions through capital contributions from Partners.

2021 Acquisitions

During the year ended December 31, 2021, in individually insignificant transactions, the Businesses acquired, from unrelated third party sellers, mineral and royalty interests representing 5,430 net royalty acres in the Permian Basin for an aggregate net purchase price of approximately $84.0 million, including certain customary post-closing adjustments. The Businesses funded the acquisitions through capital contributions from Partners.

3. COMMITMENTS AND CONTINGENCIES

The Businesses may from time to time be involved in various legal actions arising in the normal course of business or from activities associated with properties prior to their acquisition by the Businesses. In the opinion of management, the Businesses’ liability, if any, in these pending actions would not have a material adverse effect on the financial position, results of operations or cash flows of the Businesses.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS - (CONTINUED)

4. PARTNERS’ CAPITAL

Capitalization and Distributions - The General Partners of the Businesses may from time to time call capital, and the limited partners will contribute capital to the Businesses in accordance with their respective Partnership Interests.

During the years ended December 31, 2022 and 2021, the Businesses made aggregate distributions to their limited partners of $129,806,560 and $53,781,359, respectively.

The limited partners shall not be entitled to (a) withdraw from the Businesses except upon the assignment by the limited partner of all of the limited partner’s interest in the Businesses, or (b) the return of the limited partner’s capital contributions except to the extent, if any, that distributions made pursuant to the express terms of the limited partnership agreement may be considered as such by law or upon dissolution and liquidation of the Businesses, and then only to the extent expressly provided for in the limited partnership agreement and as permitted by applicable law.

Except upon liquidation, all distributions of cash or property of the Businesses to the Partners is made in accordance with their Partnership Interests. The timing of all distributions of the Businesses’ income and capital is at the sole discretion of the General Partner. No Partner is entitled to withdraw any part of its capital contributions or its capital account or to receive any distribution from the Businesses, except as provided in the limited partnership agreement.

Dissolution, Liquidation, and Terminations - The Businesses shall dissolve upon the happening of one of the following events: (a) any event which, in the opinion of the General Partner, would make it in the best interests of the Businesses to be dissolved; (b) the bankruptcy of the General Partner; or (c) the occurrence of any other event under the agreement that causes the dissolution of a limited partnership (unless the Partners elect to continue the Businesses within 90 days of such event in accordance with the agreement, if permissible under the circumstances).

Upon dissolution, the General Partner shall proceed diligently to wind up the business and affairs of the Businesses, allocate income and loss among the limited partners and distribute its properties and assets, if any. Distributions to limited partners upon the liquidation of the Businesses will be made pro rata in accordance with the Partners’ Partnership Interests. Subject to the preceding sentence, the manner in which the Businesses is liquidated will be within the sole and absolute discretion of the General Partner.

5. RELATED PARTY TRANSACTIONS

Parties are considered to be related if one party has the ability to control the other party or exercise significant influence over the other party in making financial and operational decisions or if two entities are under common control. Related party transactions in the Partnership are discussed below.

Service Fee

The Manager is entitled to a monthly service fee of $135,000 from each of the Businesses. In addition, the Businesses pay the Manager a quarterly incentive payment (“MIP”) which is calculated by the General Partner as of the end of each calendar quarter during the year in an amount equal to 5% of the net cash flows realized by each Business during the calendar quarter.

The services fee and MIP paid out for the years ended December 31, 2022 and 2021 were $11,378,480 and $7,719,570, respectively.

6. SUBSEQUENT EVENTS

Subsequent events have been evaluated through November 13, 2023, the date the combined financial statements were issued. Subsequent to December 31, 2022 and up to November 13, 2023, the Businesses made distributions of $116,949,510. No additional subsequent events of a material nature have been identified that require recognition or disclosure.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS - (CONTINUED)

7. SUPPLEMENTAL INFORMATION ON OIL AND NATURAL GAS OPERATIONS (UNAUDITED)

Proved Oil and Gas Reserve Quantities

Proved oil and natural gas reserve estimates and their associated future net cash flows for the Businesses were estimated by independent reserve engineers, DeGolyer and MacNaughton Corp, as of December 31, 2022 and 2021. Proved reserves were estimated in accordance with guidelines established by the SEC, which require that reserve estimates be prepared under existing economic and operating conditions based upon the 12-month unweighted arithmetic average of the first-day-of-the-month prices for the 12-month period prior to the end of the reporting period.

The SEC has defined proved reserves as the estimated quantities of oil, NGL and natural gas that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. There are numerous uncertainties inherent in estimating quantities of proved oil and natural gas reserves. Oil and natural gas reserve engineering is a subjective process of estimating underground accumulations of oil and natural gas that cannot be precisely measured and the accuracy of any reserve estimate is a function of the quality of available data and of engineering and geological interpretation and judgment. Results of drilling, testing and production subsequent to the date of the estimate may justify revision of such estimate. Accordingly, reserve estimates are often different from the quantities of oil and natural gas that are ultimately recovered.

The following table presents changes in the estimated quantities of proved reserves for the years ended December 31, 2022 and 2021.

| | | | | | | | | | | | | | | | | | | | | | | |

| Oil

(MBbls) | | Natural Gas

(MMcf) | | Natural Gas Liquids

(MBbls) | | Total (MBOE) |

| (In thousands) | |

| Proved Developed and Undeveloped Reserves: | | | | | | | |

| As of December 31, 2020 | 13,136 | | | 56,735 | | | 8,351 | | | 30,943 | |

| Purchase of reserves in place | 1,350 | | | 4,124 | | | 688 | | | 2,725 | |

| Extensions and discoveries | 235 | | | 1,166 | | | 153 | | | 582 | |

| Revisions of previous estimates | (32) | | | 598 | | | 69 | | | 137 | |

| | | | | | | |

| Production | (1,123) | | | (2,997) | | | (381) | | | (2,004) | |

| As of December 31, 2021 | 13,566 | | | 59,626 | | | 8,880 | | | 32,383 | |

| Purchase of reserves in place | 263 | | | 1,785 | | | 303 | | | 864 | |

| Extensions and discoveries | 56 | | | 273 | | | 34 | | | 136 | |

| Revisions of previous estimates | 52 | | | (776) | | | (102) | | | (179) | |

| | | | | | | |

| Production | (1,316) | | | (3,266) | | | (494) | | | (2,354) | |

| As of December 31, 2022 | 12,621 | | | 57,642 | | | 8,621 | | | 30,850 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Proved Developed Reserves: | | | | | | | |

| | | | | | | |

| December 31, 2021 | 6,146 | | | 32,774 | | | 4,559 | | | 16,167 | |

| December 31, 2022 | 7,126 | | | 35,007 | | | 4,961 | | | 17,922 | |

| | | | | | | |

| Proved Undeveloped Reserves: | | | | | | | |

| December 31, 2021 | 7,420 | | | 26,852 | | | 4,321 | | | 16,216 | |

| December 31, 2022 | 5,495 | | | 22,635 | | | 3,660 | | | 12,928 | |

Revisions represent changes in previous reserves estimates, either upward or downward, resulting from new information normally obtained from development drilling and production history or resulting from a change in economic factors, such as commodity prices, operating costs or development costs.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS - (CONTINUED)

For the year ending December 31, 2021, the Businesses’ positive revisions of 137 MBoe of previously estimated quantities consisted of price and performance revisions of proved developed producing wells. Extensions and discoveries of 582 MBoe resulted primarily from the addition of 67 new wells and from 105 new proved undeveloped locations added.

For the year ending December 31, 2022, the Businesses’ negative revisions of 179 MBoe of previously estimated quantities consisted of performance revisions of proved developed producing wells. Extensions and discoveries of 136 MBoe resulted primarily from the addition of 40 new wells and from 46 new proved undeveloped locations added.

Standardized Measure of Discounted Future Net Cash Flows

The standardized measure of discounted future net cash flows should not be viewed as realistic estimates of future cash flows, nor should the “standardized measure” be interpreted as representing current value of proved reserves to the Businesses. Material revisions to estimates of proved reserves may occur in the future; development and production of the reserves may not occur in the periods assumed; actual prices realized are expected to vary significantly from those used; and actual costs may vary.

The following table sets forth the standardized measure of discounted future net cash flows attributable to the Business’ proved oil and natural gas reserves as of December 31, 2022, 2021.

| | | | | | | | | | | | | |

| December 31, |

| 2022 | | 2021 | | |

| (In thousands) |

| Future cash inflows | $ | 1,739,907 | | | $ | 1,228,960 | | | |

| Future production taxes | (97,469) | | | (70,750) | | | |

| Future income tax expense | (7,691) | | | (5,491) | | | |

| Future net cash flows | 1,634,747 | | | 1,152,719 | | | |

| 10% discount to reflect timing of cash flows | (779,108) | | | (550,980) | | | |

| Standardized measure of discounted future net cash flows | $ | 855,639 | | | $ | 601,739 | | | |

The following table presents the unweighted arithmetic average first-day-of–the-month prices within the 12-month period prior to the end of the reporting period as adjusted by differentials and other contractual terms for oil, natural gas and natural gas liquids utilized in the computation of future cash inflows.

| | | | | | | | | | | | | |

| December 31, |

| 2022 | | 2021 | | |

| |

| |

| Oil (per Bbl) | $ | 94.02 | | | $ | 66.92 | | | |

| Natural gas (per Mcf) | $ | 5.63 | | | $ | 2.88 | | | |

| Natural gas liquids (per Bbl) | $ | 33.24 | | | $ | 23.62 | | | |

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS - (CONTINUED)

Principal changes in the standardized measure of discounted future net cash flows attributable to the Partnership’s proved reserves are as follows.

| | | | | | | | | | | | | |

| December 31, |

| 2022 | | 2021 | | |

| (In thousands) |

| Standardized measure of discounted future net cash flows at the beginning of the period | $ | 601,739 | | | $ | 315,230 | | | |

| Purchase of minerals in place | 20,346 | | | 60,230 | | | |

| | | | | |

| Sales of oil and natural gas, net of production costs | (146,871) | | | (89,892) | | | |

| Extensions and discoveries | 3,573 | | | 10,820 | | | |

| Net changes in prices and production costs | 336,617 | | | 278,475 | | | |

| Revisions of previous quantity estimates | (2,882) | | | 2,810 | | | |

| Net changes in income taxes | (1,174) | | | (1,345) | | | |

| Accretion of discount | 60,462 | | | 31,677 | | | |

| Net changes in timing of production and other | (16,171) | | | (6,266) | | | |

| Standardized measure of discounted future net cash flows at the end of the period | $ | 855,639 | | | $ | 601,739 | | | |

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

COMBINED FINANCIAL STATEMENTS

For the Nine Months Ended September 30, 2023 and 2022

TABLE OF CONTENTS

| | | | | |

| Page |

| Combined Balance Sheets (unaudited) | |

| Combined Statements of Operations (unaudited) | |

Combined Statements of Partners’ Capital (unaudited) | |

| Combined Statements of Cash Flows (unaudited) | |

| Notes to the Combined Financial Statements (unaudited) | |

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

COMBINED BALANCE SHEETS (UNAUDITED)

| | | | | | | | | | | |

| September 30 | | December 31 |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 30,633,190 | | | $ | 26,523,350 | |

| Accounts receivable-oil and gas sales and other | 16,859,511 | | | 30,393,393 | |

| Prepaid expenses and other current assets | 1,033,141 | | | 765,488 | |

| Total current assets | 48,525,842 | | | 57,682,231 | |

| | | |

| Property: | | | |

| Oil and gas properties | 666,463,108 | | | 660,404,232 | |

| Accumulated depletion | (125,032,364) | | | (101,043,279) | |

| Impairment | (164,532,161) | | | (164,532,161) | |

| Total oil and gas properties, net | 376,898,583 | | | 394,828,792 | |

| Total assets | $ | 425,424,425 | | | $ | 452,511,023 | |

| | | |

| Liabilities and Partner’s equity | | | |

| | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | — | | | $ | 1,620,000 | |

| | | |

| Commitments and contingencies (Note 3) | | | |

| | | |

| Partners’ equity | 425,424,425 | | | 450,891,023 | |

| | | |

| Total liabilities and Partner’s equity | $ | 425,424,425 | | | $ | 452,511,023 | |

The accompanying notes form an integral part of these combined financial statements.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

COMBINED STATEMENTS OF OPERATIONS (UNAUDITED)

| | | | | | | | | | | |

| For the period from January 1, 2023 to September 30, 2023 | | For the period from January 1, 2022 to September 30, 2022 |

| |

| Revenues | | | |

| Oil and gas sales | $ | 91,098,931 | | | $ | 120,024,757 | |

| Lease bonuses | 1,788,093 | | | 2,731,987 | |

| Total revenues | 92,887,024 | | | 122,756,744 | |

| Operating expenses | | | |

Production and ad valorem taxes | 6,180,425 | | | 7,764,671 | |

| Depletion | 23,989,085 | | | 22,670,734 | |

| General and administrative | 10,533,600 | | | 9,313,685 | |

| Total operating expenses | 40,703,110 | | | 39,749,090 | |

| | | |

| Income from operations | 52,183,914 | | | 83,007,654 | |

| | | |

| Other income (expense) | | | |

| Other income, net | 1,818,911 | | | 522,323 | |

| Total other income | 1,818,911 | | | 522,323 | |

| | | |

| Net income | $ | 54,002,825 | | | $ | 83,529,977 | |

The accompanying notes form an integral part of these combined financial statements.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

COMBINED STATEMENTS OF PARTNERS’ CAPITAL (UNAUDITED)

| | | | | |

| Limited Partners |

| For the period from January 1, 2023 to September 30, 2023 |

|

| Balance at January 1, 2023 | $ | 450,891,023 | |

| Net income | 54,002,825 | |

| Contributions | 7,678,876 | |

| Distributions | (87,148,299) | |

| Balance at September 30, 2023 | $ | 425,424,425 | |

| | | | | |

| Limited Partners |

| For the period from January 1, 2022 to September 30, 2022 |

|

| Balance at January 1, 2022 | $ | 426,712,079 | |

| Net income | 83,529,977 | |

| Contributions | 42,892,074 | |

| Distributions | (85,818,073) | |

| Balance at September 30, 2022 | $ | 467,316,057 | |

The accompanying notes form an integral part of these combined financial statements.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

COMBINED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | | | | |

| For the period from January 1, 2023 to September 30, 2023 | | For the period from January 1, 2022 to September 30, 2022 |

|

Cash flows from operating activities: | | | |

| Net income | $ | 54,002,825 | | | $ | 83,529,977 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depletion | 23,989,085 | | | 22,670,734 | |

| Effect of changes in current assets and liabilities: | | | |

| Accounts receivable-oil and gas sales and other | 13,533,882 | | | (4,706,828) | |

| Prepaid expenses and other current assets | (267,653) | | | 293,598 | |

| Accounts payable and accrued expenses | (1,620,000) | | | — | |

| Net cash provided by operating activities | 89,638,139 | | | 101,787,481 | |

| | | |

Cash flows from investing activities: | | | |

| Acquisition of oil and gas properties | (6,058,876) | | | (42,892,076) | |

| Net cash used in investing activities | (6,058,876) | | | (42,892,076) | |

| | | |

Cash flows from financing activities: | | | |

| Contributions | 7,678,876 | | | 42,892,074 | |

| Distributions | (87,148,299) | | | (85,818,073) | |

| Net cash used in financing activities | (79,469,423) | | | (42,925,999) | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 4,109,840 | | | 15,969,406 | |

| Cash, cash equivalents and restricted cash at beginning of period | 26,523,350 | | | 25,625,173 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 30,633,190 | | | $ | 41,594,579 | |

The accompanying notes form an integral part of these combined financial statements.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS (UNAUDITED)

1.BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business - Royalty Asset Holdings, LLC (“RAH LLC”) was formed as a Texas limited liability company on September 22, 2016. On March 7, 2017, RAH LLC was converted into Royalty Asset Holdings, LP (“RAH LP”), a Texas limited partnership pursuant to the filing of a certificate of conversion with the Secretary of State of the State of Texas and in accordance with the provisions of the Texas Limited Partnership Law.

Prior to the filing of the certificate of conversion, Royalty Asset Holdings GP, LLC (“RAH GP”), a Texas limited liability company and Brigadier Royalty Warehouse, LLC (“BRW”), a Texas limited liability company owned 0.1% and 99.9% equity interest in RAH LLC respectively. On March 7, 2017, RAH GP was appointed as the sole general partner and BRW was appointed as the sole limited partner of RAH LP. Effective as of April 1, 2017, BRW assigned to Warwick Royalty and Mineral Master Fund LP (“WRMF”) a Delaware limited partnership, all of BRW’s equity interests in and to each of RAH GP and RAH LP.

Royalty Asset Holdings II, LP (“RAH II LP”), a Delaware limited partnership was formed on February 11, 2019, by Warwick Royalty and Mineral Fund II GP Limited (“WRMF II GP”), a Cayman Islands exempted limited company, as the sole general partner, and Brigadier Royalty Warehouse II, LLC (“BRW II”), a Delaware limited liability company, as the sole limited partner. Effective as of April 18, 2019, BRW II assigned to Warwick Royalty and Mineral Master Fund II LP (“WRMF II”), a Delaware limited partnership, all BRW II’s equity interests in RAH II LP.

Saxum Asset Holdings, LP (“Saxum LP”) was formed on April 15, 2020, by Warwick Royalty and Mineral Fund III GP Limited, a Cayman Islands exempted company as the sole general partner (“WRMF III GP”) and Warwick Royalty and Mineral Master Fund III LP (“WRMF III”), a Delaware limited partnership, as the sole limited partner to Saxum LP.

RAH LP, RAH II LP and Saxum LP together are known as the Limited Partners.

RAH LP, RAH II LP and Saxum LP (together the “Businesses”) were formed to seek and acquire both producing and nonproducing mineral interests, royalty interests, overriding royalty interests, net profit interests, and production payments, in each case, in the United States.

The general partners of the Businesses (the “General Partners”) and the Businesses have delegated, subject to its responsibility and supervision, day-to-day investment management of the Partnership’s assets to GRP Royalty Holdings LLC, a Texas limited liability company and their affiliates, GRP RAH I Holdings LLC, GRP RAH II Holdings LLC and GRP Saxum Holdings, LLC, all of which are Delaware limited liability companies (together the “Manager”).

Basis of Presentation - The accompanying combined financial statements and related notes thereto were prepared in conformity with accounting principles generally accepted in the United States of America. All intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates in the Preparation of Financial Statements - Management is required to make certain estimates and assumptions in the preparation of the combined financial statements that affect the reported amounts of assets, liabilities, and the disclosure of contingent assets and liabilities at the date of the combined financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The impact of oil and gas prices has a significant impact on estimates made by management. Changes in the value of these commodities has a direct impact on the economic limits of estimated oil and gas reserves. These economic limits have significant effects upon predicted reserve values. These estimates are the basis for the calculation of depletion for the oil and gas properties and the assessment as to whether an impairment of such properties is required. Further, these estimates and other factors, including those outside of the Businesses’ control, such as the impact of sustained lower commodity prices, can potentially impact operators' current and future development plans

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS (UNAUDITED) - (CONTINUED)

(including the impact to undeveloped oil & gas properties), which could have a significant adverse impact to the Businesses’ financial condition, results of operations and cash flows.

The Businesses’ oil, natural gas, and natural gas liquid reserves represent estimated quantities of oil and gas which, using geological and engineering data are estimated with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. There are numerous uncertainties inherent in estimating oil and gas reserves and their values including many factors beyond the Businesses’ control. Accordingly, reserve estimates are different from the future quantities of oil and gas that are ultimately recovered.

Cash - Cash includes cash on hand.

Accrued Revenue Recognized on Production Income Basis

Production estimates are made based upon internal estimated ultimate recovery curves in the routine course of business if publicly available data does not exist for new Proved Developed Producing (PDP) wells.

Revenue from Contracts with Customers

Oil and Gas Sales

Revenues from oil, natural gas and natural gas liquids are generally recognized when control of the product is transferred to the purchaser, which is the point where performance obligations are satisfied based on the Businesses’ percentage ownership share of the revenue, net of any deductions for gathering and transportation. All the Businesses’ oil and gas sales are made under contracts between the operators of the properties in which the Businesses hold interest and their respective customers. The Businesses' contract is with the operator of the oil and gas properties; however, we have concluded that the substance of the transactions between the Businesses and the end customer results in the Businesses being the principal within the context of Accounting Standards Codification 606, Revenue from Contracts with Customers, "ASC 606". The Businesses' performance obligations are satisfied at the point in time the product is delivered by the operator to the purchaser of the hydrocarbons. Accordingly, the Businesses' contracts do not give rise to contract assets or liabilities.

The Businesses typically receive payment for oil and gas sales within 60 days, unless the product being sold is related to a newly drilled well, in which case payment may be received up to six months beyond the date of first production. Contracts for the sale of oil, natural gas and natural gas liquids are industry standard contracts that include variable consideration based upon a monthly index and may include provisions related to gravity, price differentials, discounts and other adjustments and deductions. As each unit of production represents a separate performance obligation, the consideration is variable as it relates to oil and gas prices, and the variability is resolved as each unit of production is delivered to the purchaser, variable consideration does not need to be estimated. Additionally, the Businesses' right to royalties does not originate until production occurs and, therefore, is not considered to exist beyond each day's production. Therefore, there are no unsatisfied performance obligations at the end of the period.

Lease Bonus Revenue

The Businesses earn revenue from lease bonuses. Lease bonus revenue is generated by leasing the Businesses’ mineral interests to exploration and production companies. A lease agreement represents a contract with a customer (in this case the operator of oil and gas properties) and generally transfers the rights to any oil, natural gas and natural gas liquids discovered, grants the Businesses a right to a specified royalty interest and requires that drilling and completion operations commence within a specified time frame. The Businesses recognize lease bonus revenue when the lease agreement has been executed, payment has been received, and the Businesses have no obligation to refund the payment. At the time the Businesses execute the lease agreement, the Businesses expect to receive payment of the lease bonus within a short time frame, but in no case more than one year. As such, the Businesses have not adjusted the expected amount of revenue for the effects of any significant financing component per the practical expedient in ASC 606.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS (UNAUDITED) - (CONTINUED)

Prior-Period Performance Obligations

The Businesses derive revenue from the sale of oil, natural gas and natural gas liquids produced from properties in which they own a royalty or overriding royalty interest, which is recognized based on the Businesses’ pro-rata interest. Revenue is recorded and receivables are accrued in the month production is delivered to the purchaser, at which time ownership of the oil and gas is transferred to the purchaser. The Businesses accrue revenue based on estimated production dates of the wells associated with the Businesses’ mineral and overriding royalty interests, along with estimates of pricing for the production. In certain instances, statements are received from operators which provide information with respect to actual revenues to be received after period end, which are incorporated into the accrued revenue analysis.

The difference between the Businesses' estimates and the actual amounts received for oil and gas sales is recorded in the month that payment is received. For the nine month periods ended September 30, 2023 and 2022, revenues recognized relating to performance obligations satisfied in prior periods were immaterial.

The Businesses' oil, natural gas and natural gas liquids receivables are related to revenues due from operators of properties in which the Businesses owns mineral or overriding royalty interests. Although diversified amongst several producers, collectability of receivables is largely dependent upon the general economic conditions of the industry. All receivables are reviewed periodically, and balances are written off when, in the judgement of management, the receivable becomes uncollectible. Historically, the Businesses have not experienced significant issues with collectability and have determined no allowance for uncollectible accounts is necessary at September 30, 2023 and 2022.

Disaggregation of Revenue

The following table disaggregates the Businesses' total oil and gas sales by product type net of any deductions for gathering and transportation.

| | | | | | | | | | | |

| For the Periods Ended September 30, |

| 2023 | | 2022 |

| Oil sales | $ | 76,171,584 | | | $ | 91,531,048 | |

| Gas sales | 5,301,974 | | | 14,753,029 | |

| Natural gas liquids sales | 9,625,373 | | | 13,740,680 | |

| Oil and gas sales | $ | 91,098,931 | | | $ | 120,024,757 | |

Concentrations of Credit Risk - The Businesses regularly have cash in a single financial institution which exceeds federal depository insurance limits. The Businesses place such deposits with high credit quality institutions and have not experienced any credit losses. The Businesses are also subject to credit risk related to oil and gas receivables due from operators related to the sale of hydrocarbons produced from properties in which the Businesses own a mineral or overriding royalty interest. For the periods ended September 30, 2023 and 2022, one purchaser accounted for more than 10% of royalty income each period.

Fair Value of Financial Instruments - The Businesses' financial instruments consist of cash, accounts receivables, prepayments, other current assets, account payables and accrued expenses. The carrying values of these financial instruments are considered to be representative of their fair market value, due to the short-term maturity of these instruments.

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS (UNAUDITED) - (CONTINUED)

Accounting for Oil and Gas Operations - The Businesses use the full cost method of accounting for oil and gas properties. Under this method, all costs related to the acquisition, exploration and development of oil and gas properties are capitalized to the full cost pool. The Businesses' oil and gas properties are comprised of only mineral and overriding royalty interests. As such, the Businesses have not incurred any exploration or development costs.

All acquisitions of mineral and royalty interests are considered asset acquisitions in accordance with the guidance in Accounting Standards Codification 805 – Business Combinations. For asset acquisitions, the purchase price (which includes costs incurred for the acquisition) is allocated to the individual assets acquired and liabilities assumed based on their relative fair values. In substantially all of the acquisitions completed by the Businesses during the periods ended September 30, 2023 and September 30, 2022, the fair value of the proved properties acquired exceeded the purchase price. As such, the purchase price for each acquisition was fully allocated to proved properties. Proceeds from the disposition of oil and gas properties are accounted for as adjustments to the full cost pool, with no gain or loss recognized unless the adjustment would significantly alter the relationship between capitalized costs and proved reserves.

Proved reserves are those quantities of petroleum that, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be commercially recoverable from a given date forward from known reservoirs and under defined economic conditions, operating methods, and government regulations. Fair values of acquired proved properties were estimated using associated future net cash flows prepared by the Businesses’ internal reservoir engineers, which include significant inputs such as anticipated production of proved reserves and other relevant data.

Depletion of capitalized costs of oil and gas properties is provided for using the units of production method based upon estimates of proved oil and gas reserves. In calculating depletion, the volume of proved oil and gas reserves and production is converted into a common unit of measure at the energy equivalent conversion rate of six thousand cubic feet of natural gas to one barrel of oil. Depletion expense for the periods ended September 30, 2023 and 2022 was $23,989,085 or $13.09 per barrel of oil equivalent and $22,670,734 or $13.00 per barrel of oil equivalent, respectively.

In accordance with the full cost method of accounting, the net capitalized costs of oil and gas properties are subject to a ceiling. The cost center ceiling is defined as the sum of (a) estimated future net revenues from proved reserves, discounted at 10% per annum based on the trailing 12-month unweighted arithmetic average of the commodity prices posted on the first day of each month in the respective year, adjusted for existing contract provisions; (b) the cost of properties not being amortized, if any; and (c) the lower of cost or fair market value of unproved properties included in the cost being amortized.

If the net book value exceeds the ceiling, the book balance of the properties is written down to the ceiling via an impairment charge. No ceiling test impairment was recorded for the nine-month periods ended September 30, 2023 and 2022.

Income Taxes - All the Businesses are disregarded for U.S. income tax purposes. As such, they are neither subject to taxation nor required to submit tax returns. All the assets and liabilities of the Businesses are treated as owned directly by the respective limited partners. Further, the Businesses are passive entities for Texas franchise tax purposes, so they are not subject to tax in the state.

Recently Issued Accounting Standards

Adoption of ASU 2016-13

In June 2016, the FASB issued ASU 2016-13, Financial Instruments-Credit Losses. In May 2019, ASU 2016-13 was subsequently amended by ASU 2019-04, Codification Improvements to Topic 326, Financial Instruments-Credit Losses and ASU 2019-05, Financial Instruments-Credit Losses (Topic 326): Targeted

Transition Relief. ASU 2016-13, as amended, applies to trade receivables, financial assets and certain other instruments that are not measured at fair value through net income. This ASU replaces the currently required incurred loss approach with an expected loss model for instruments measured at amortized cost and is effective for financial statements issued for fiscal years beginning after December 15, 2022, including interim periods in those

ROYALTY ASSET HOLDINGS, LP

ROYALTY ASSET HOLDINGS II, LP

SAXUM ASSET HOLDINGS, LP

NOTES TO THE COMBINED FINANCIAL STATEMENTS (UNAUDITED) - (CONTINUED)

fiscal years. Adoption of the accounting standard did not have a material impact on the combined financial statements or related disclosures.

There are no other accounting standards applicable to the Businesses that would have a material effect on the Businesses' combined financial statements and disclosures that have been issued but not yet adopted by the Businesses as of September 30, 2023, and through the filing date of this report.

2. ACQUISITIONS OF ASSETS

2023 Acquisitions

During the nine months ended September 30, 2023, in individually insignificant transactions, the Businesses acquired, from unrelated third party sellers, mineral and royalty interests representing 580 net royalty acres in the Permian Basin for an aggregate net purchase price of approximately $6.1 million, including certain customary post-closing adjustments. The Businesses funded the acquisitions through capital contributions from Partners.

2022 Acquisitions

During the nine months ended September 30, 2022, in individually insignificant transactions, the Businesses acquired, from unrelated third party sellers, mineral and royalty interests representing 1,674 net royalty acres in the Permian Basin for an aggregate net purchase price of approximately $42.9 million, including certain customary post-closing adjustments. The Businesses funded the acquisitions through capital contributions from Partners.

3. COMMITMENTS AND CONTINGENCIES