Preliminary

Offering Circular, Dated [*], 2023

AN

OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION.

INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR

MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR

SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE

IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE

MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION

OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

American

Rebel Holdings, Inc.

909

18th Avenue South, Suite A

Nashville,

Tennessee 37212

833-267-3235

www.americanrebel.com

BEST

EFFORTS OFFERING OF UP TO 2,666,666 SHARES OF

SERIES

C REDEEMABLE CONVERTIBLE PREFERRED STOCK

American

Rebel Holdings, Inc., which we refer to as “our company,” “we,” “our” and “us,” is offering

up to 2,666,666 shares of series C redeemable convertible preferred stock, par value $0.001 per share, which we refer to as the Series

C Preferred Stock, at an offering price of $7.50 per share, for a maximum offering amount of $19,999,995. There is a minimum initial

investment amount per investor of $300.00 for the Series C Preferred Stock and any additional purchases must be made in increments of

at least $7.50.

The

Series C Preferred Stock being offered will rank, as to dividend rights and rights upon our liquidation, dissolution, or winding up,

senior to our Common Stock. Holders of our Series C Preferred Stock will be entitled to receive cumulative dividends in the amount of

$0.16 per share each quarter; provided that upon an event of default (generally defined as our failure to pay dividends when due or to

redeem shares when requested by a holder), such amount shall be increased to $0.225 per quarter. The liquidation preference for each

share of our Series C Preferred Stock is $7.50. Upon a liquidation, dissolution or winding up of our company, holders of shares of our

Series C Preferred Stock will be entitled to receive the liquidation preference with respect to their shares plus an amount equal to

any accrued but unpaid dividends (whether or not declared) to, but not including, the date of payment with respect to such shares. Commencing

on the fifth anniversary of the initial closing of this offering and continuing indefinitely thereafter, we shall have a right to call

for redemption the outstanding shares of our Series C Preferred Stock at a call price equal to 150% of the original issue price of our

Series C Preferred Stock, and correspondingly, each holder of shares of our Series C Preferred Stock shall have a right to put the shares

of Series C Preferred Stock held by such holder back to us at a put price equal to 150% of the original issue purchase price of such

shares. The Series C Preferred Stock will have no voting rights (except for certain matters) and each share of the Series C Preferred

Stock is convertible into five (5) shares of our Common Stock at the option of the holder. The shares of Common Stock underlying the

Series C Preferred Stock will be registered following this offering. See “Description of Securities” beginning on

page 71 for additional details.

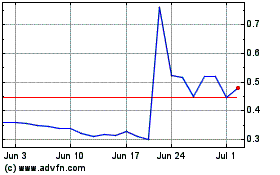

There

is no existing public trading market for the Series C Preferred Stock. Our common stock, $0.001

par value per share (the “Common Stock”) and certain existing warrants are traded on the Nasdaq Capital Market (which

we sometimes refer to as “Nasdaq”) under the symbols “AREB” and “AREBW,” respectively. On [*], 2023,

the closing price of our Common Stock as reported on the Nasdaq Capital Market was $[*] per share. Unless

otherwise noted and other than in our financial statements and the notes thereto, the share and per share information in this offering

circular reflects a reverse stock split of the outstanding Common Stock of the Company at a 1-for-25 ratio, which was effectuated on

June 27, 2023.

The

offering price of the Series C Preferred Stock may not reflect the market price of our Series C Preferred Stock after this offering.

We

intend to apply to have our Series C Preferred Stock listed on the Nasdaq Capital Market under the symbol “AREBP” after the

final closing of this offering. We intend to list our Series C Preferred Stock on the Nasdaq Capital Market following Nasdaq’s

certification of the Form 8-A of the Company to be filed after, and to begin trading within 120 days after, the final closing of this

offering. The listing of the Company’s Series C Preferred Stock on the Nasdaq Capital Market is not a condition of the Company’s

proceeding with this offering, and no assurance can be given that our application to list on Nasdaq Capital Market will be approved or

that an active trading market for our Series C Preferred will develop. Our Series C Preferred Stock is not currently listed or quoted

on any exchange.

This

offering is being conducted on a “best efforts” basis pursuant to Regulation A of Section 3(6) of the Securities Act of 1933,

as amended, or the Securities Act, for Tier 2 offerings. This offering will terminate at the earliest of: (1) the date at which the maximum

amount of offered shares has been sold, (2) the date which is one year after this offering is qualified by the U.S. Securities and Exchange

Commission, or the Commission, and (3) the date on which this offering is earlier terminated by us in our sole discretion.

Digital

Offering, LLC is a broker-dealer registered with the Commission and members of the Financial Industry Regulatory Authority, or

FINRA, and the Securities Investor Protection Corporation, or SIPC, which we refer to as the lead selling agent or managing broker-dealer,

is the lead selling agent for this offering. The lead selling agent is selling our shares in this offering on a best-efforts basis and

is not required to sell any specific number or dollar amount of shares offered by this offering circular but will use their best efforts

to sell such shares.

We

may undertake one or more closings on a rolling basis. Until we complete a closing, the proceeds for this offering will be kept in an

escrow account maintained at Wilmington Trust, National Association (“Wilmington Trust”). At each closing, the proceeds will

be distributed to us and the associated Series C Preferred Stock will be issued to the investors. If there are no closings or if funds

remain in the escrow account upon termination of this offering without any corresponding closing, the funds so deposited for this offering

will be promptly returned to investors, without deduction and without interest. See “Plan of Distribution.”

| | |

Price to Public(1) | | |

Selling Agent Commissions(2) | | |

Proceeds to issuer(1) | |

| Per Share | |

$ | 7.50 | | |

$ | 0.6375 | | |

$ | 6.8625 | |

| Total Maximum | |

$ | 19,999,995 | | |

$ | 1,699,999.58 | | |

$ | 18,299,995.40 | |

| |

1. |

Per

Share price represents the offering price for one share of Series C Preferred Stock. |

| |

2. |

The

Company has engaged Digital Offering, LLC (“Digital Offering”) to act as lead selling agent to offer the shares of our

Series C Redeemable Convertible Preferred Stock, par value $0.001 (the “Series C Preferred Stock”) to prospective investors

in this offering on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be received

by the Company in this offering. In addition, the lead selling agent may engage one or more sub-agents or selected dealers to assist

in its marketing efforts. Digital Offering is not purchasing the shares of Series C Preferred Stock offered by us and is not required

to sell any specific number or dollar amount of shares in this offering before a closing occurs. The Company will pay a cash commission

of 8.5% to Digital Offering on sales of the shares of Series C Preferred Stock. See “Plan of Distribution” on page

78 for details of compensation payable to the lead selling agent in connection with the offering. |

| |

3. |

Before

deducting expenses of the offering, which are estimated to be approximately $___,000. See the section captioned “Plan of Distribution”

for details regarding the compensation payable in connection with this offering. This amount represents the proceeds of the offering

to us, which will be used as set out in the section captioned “Use of Proceeds.” |

Our

business and an investment in our Series C Preferred Stock involve significant risks. See “Risk Factors” beginning on page

13 of this offering circular to read about factors that you should consider before making an investment decision. You should also consider

the risk factors described or referred to in any documents incorporated by reference in this offering circular, before investing in these

securities.

Generally,

no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income

or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your

investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information

on investing, we encourage you to refer to www.investor.gov.

This

offering will terminate at the earliest of: (1) the date at which the maximum offering amount has been received by the Company, (2) one

year from the date upon which the Commission qualifies the offering statement of which this offering circular forms a part, and (3) the

date at which the offering is earlier terminated by the Company in its sole discretion. This offering is being conducted on a best-efforts

basis. The Company intends to undertake one or more closings in this offering on a rolling basis. After the closing, funds tendered by

investors will be made available to the Company.

THE

UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE

TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE

SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT

DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY,

NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME

OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT

DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING,

WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This

offering circular follows the disclosure format of Part I of Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form

1-A.

The

approximate date of commencement of proposed sale to the public is [*], 2023.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

offering circular and the documents incorporated by reference herein contain, in addition to historical information, certain “forward-looking

statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended, or the Exchange Act, that include information relating to future events, future financial performance, strategies, expectations,

competitive environment, regulation and availability of resources. These forward-looking statements are not historical facts but rather

are based on current expectations, estimates and projections. We may use words such as “may,” “could,” “should,”

“anticipate,” “expect,” “project,” “position,” “intend,” “target,”

“plan,” “seek,” “believe,” “foresee,” “outlook,” “estimate” and

variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future

performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to

predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include

the following:

| |

● |

our ability to efficiently

manage and repay our debt obligations; |

| |

● |

we recently consummated

the purchase of our safe manufacturer and sales organizations, and future acquisitions and operations of new manufacturing facilities

and/or sales organizations might prove unsuccessful and could fail; |

| |

● |

our inability to raise

additional financing for working capital, especially related to purchasing critical inventory; |

| |

● |

our ability to generate

sufficient revenue in our targeted markets to support operations; |

| |

● |

significant dilution resulting

from our financing activities: |

| |

● |

actions and initiatives

taken by both current and potential competitors; |

| |

● |

shortages of components

and materials, as well as supply chain disruptions, may delay or reduce our sales and increase our costs, thereby harming our results

of operations; |

| |

● |

we do not have long-term

purchase commitments from our customers, and their ability to cancel, reduce, or delay orders could reduce our revenue and increase

our costs; |

| |

● |

our success depends on

our ability to introduce new products that track customer preferences; |

| |

● |

if we are unable to protect

our intellectual property, we may lose a competitive advantage or incur substantial litigation costs to protect our rights; |

| |

● |

as a significant portion

of our revenues are derived by demand for our safes and the personal security products for firearms storage, we depend on the availability

and regulation of ammunition and firearm storage; |

| |

● |

as we continue to integrate

the recent purchase of our safe manufacturer and sales organization, any compromised operational capacity may affect our ability

to meet the demand for our safes, which in turn may affect our generation of revenue; |

| |

● |

our future operating results; |

| |

● |

our ability to diversify

our operations; |

| |

● |

our inability to effectively

meet our short- and long-term obligations; |

| |

● |

the fact that our accounting

policies and methods are fundamental to how we report our financial condition and results of operations, and they may require management

to make estimates about matters that are inherently uncertain; |

| |

● |

given our limited corporate

history it is difficult to evaluate our business and future prospects and increases the risks associated with an investment in our

securities; |

| |

● |

adverse state or federal

legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to existing operations; |

| |

● |

changes in generally accepted

accounting policies in the United States (“U.S. GAAP”) or in the legal, regulatory and legislative environments in the

markets in which we operate; |

| |

● |

deterioration in general

or global economic, market and political conditions; |

| |

● |

inability to efficiently

manage our operations; |

| |

● |

inability to achieve future

operating results; |

| |

● |

the unavailability of funds

for capital expenditures; |

| |

● |

our ability to recruit

and hire key employees; |

| |

● |

the global impact of COVID-19

on the United States economy and our operations; |

| |

● |

the inability of management

to effectively implement our strategies and business plans; |

| |

● |

our business prospects; |

| |

● |

any contractual arrangements

and relationships with third parties; |

| |

● |

the dependence of our future

success on the general economy; |

| |

● |

any possible financings;

and |

| |

● |

the adequacy of our cash

resources and working capital. |

Because

the factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking

statements made by us, you should not place undue reliance on any such forward-looking statements. New factors emerge from time to time,

and their emergence is impossible for us to predict. In addition, we cannot assess the impact of each factor on our business or the extent

to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements.

The

specific discussions herein about our company include financial projections and future estimates and expectations about our company’s

business. The projections, estimates and expectations are presented in this offering circular only as a guide about future possibilities

and do not represent actual amounts or assured events. All the projections and estimates are based exclusively on our company management’s

own assessment of its business, the industry in which it works and the economy at large and other operational factors, including capital

resources and liquidity, financial condition, fulfillment of contracts and opportunities. The actual results may differ significantly

from the projections.

Market

and Industry Data

The

market and industry data used in this report are based on independent industry publications, customers, trade or business organizations,

reports by market research firms and other published statistical information from third parties (collectively, the “Third Party

Information”), as well as information based on management’s good faith estimates, which we derive from our review of internal

information and independent sources. Such Third Party Information generally states that the information contained therein or provided

by such sources has been obtained from sources believed to be reliable.

TABLE

OF CONTENTS

Please

read this offering circular carefully. It describes our business, our financial condition and results of operations. We have prepared

this offering circular so that you will have the information necessary to make an informed investment decision.

You

should rely only on the information contained in this offering circular. We have not, and the lead selling agent has not, authorized

anyone to provide you with any information other than that contained in this offering circular. We are offering to sell, and seeking

offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. The information in this offering

circular is accurate only as of the date of this offering circular, regardless of the time of delivery of this offering circular or any

sale of the securities covered hereby. Our business, financial condition, results of operations and prospects may have changed since

that date. We are not, and the lead selling agent is not, making an offer of these securities in any jurisdiction where the offer is

not permitted.

For

investors outside the United States: We have not, and the lead selling agent has not, taken any action that would permit this offering

or possession or distribution of this offering circular in any jurisdiction where action for that purpose is required, other than in

the United States. Persons outside the United States who come into possession of this offering circular must inform themselves about,

and observe any restrictions relating to, the offering of the securities covered hereby or the distribution of this offering circular

outside the United States.

This

offering circular includes statistical and other industry and market data that we obtained from industry publications and research, surveys

and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their

information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such

information. We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable.

We are ultimately responsible for all disclosure included in this offering circular.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the offering

statement of which this offering circular is a part were made solely for the benefit of the parties to such agreement, including, in

some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Except

as otherwise indicated by the context, references in this offering circular to “Company,” “American Rebel Holdings,”

“American Rebel,” “we,” “us” and “our” are references to American Rebel Holdings, Inc.

and its operating subsidiaries, American Rebel, Inc., Champion Safe Co., Inc., Superior Safe, LLC, Safe Guard Security Products, LLC

and Champion Safe De Mexico, S.A. de C.V. All references to “USD” or United States Dollar refer to the legal currency of

the United States of America.

WE

HAVE NOT AUTHORIZED ANY DEALER, SALESPERSON OR OTHER PERSON TO GIVE ANY INFORMATION OR REPRESENT ANYTHING NOT CONTAINED IN THIS OFFERING

CIRCULAR. YOU SHOULD NOT RELY ON ANY UNAUTHORIZED INFORMATION. THIS OFFEIRNG CIRCULAR IS NOT AN OFFER TO SELL OR BUY ANY SECURITIES IN

ANY STATE OR OTHER JURISDICTION IN WHICH IT IS UNLAWFUL. THE INFORMATION IN THIS OFFERING CIRCULAR IS CURRENT AS OF THE DATE ON THE COVER.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR.

SUMMARY

This

summary highlights selected information contained elsewhere in this offering circular. This summary is not complete and does not contain

all the information that you should consider before deciding whether to invest in our securities. You should carefully read the entire

offering circular, including the risks associated with an investment in our company discussed in the “Risk Factors” section

of this offering circular, before making an investment decision.

Our

Company

Corporate

Summary

The

Company is setting out to establish itself as “America’s Patriotic Brand.” American Rebel is a lifestyle

brand that we believe presents our customers the opportunity to express their values with the products they buy. We currently operate

primarily as a designer, manufacturer and marketer of branded safes and personal security and self-defense products. American Rebel acquired

Champion Safe Company, Inc., a Utah corporation (“Champion Safe”), and its associated entities on July 29, 2022. This acquisition

dramatically grew the Company’s revenues and built a solid base to position the Company for future growth. Additionally, the Company

designs and produces branded apparel and accessories. On August 9, 2023, the Company entered into a Master Brewing Agreement (the “Brewing

Agreement”) with Associated Brewing Company, a Minnesota limited liability company (“Associated Brewing”). Under the

terms of the Brewing Agreement, Associated Brewing has been appointed as the exclusive producer and seller of American Rebel branded

spirits, with the initial product being American Rebel Light Beer (“American Rebel Beer”). American Rebel Beer plans to launch

regionally in early 2024. The beer industry in the United States is a more than $110 billion dollar market. We believe there

is a substantial opportunity to enter the beer market at this time to present our customers with a beer they can support that aligns

with their values.

We

believe American Rebel is boldly positioning itself as “America’s Patriotic Brand” in a time when national spirit and

American values are being rekindled and redefined. The typical American Rebel customer loves their family, their country and their community.

We believe the time is right for American Rebel Beer, we believe we have the right expertise, and we believe we have the right brand.

We believe recent trends have revealed that beer consumers want to express their values through their choice of beer. We believe that

American Rebel Beer will have a receptive target audience for our product. American Rebel Light Beer will be the first product introduced

on a regional basis, with plans to launch in early 2024. Consumers are already registering their email addresses at www.AmericanRebelBeer.com

to be notified when American Rebel Beer is available in their local market. We are also offering our American Rebel Beer can cooler

as a free incentive to visit our website.

Our

safes have an established legacy of quality and craftsmanship since Champion Safe was founded in 1999 . We believe that

when it comes to their homes, consumers place a premium on their security and privacy. Our products are designed to offer our customers

convenient, efficient and secure home and personal safes from a provider that they can trust. We are committed to offering products of

enduring quality that allow customers to keep their valuable belongings protected and to express their patriotism and style, which is

synonymous with the American Rebel brand.

Our

safes and personal security products are constructed primarily of U.S.-made steel. We believe our products are designed to safely store

firearms, as well as store our customers’ priceless keepsakes, family heirlooms and treasured memories and other valuables, and

we aim to make our products accessible at various price points for home and office use. We believe our products are designed for safety,

quality, reliability, features and performance.

To

enhance the strength of our brand and drive product demand, we work with our manufacturing facilities and various suppliers to emphasize

product quality and mechanical development in order to improve the performance and affordability of our products while providing support

to our distribution channel and consumers. We seek to sell products that offer features and benefits of higher-end safes at mid-line

price ranges.

We

believe that safes are becoming a ‘must-have appliance’ in a significant portion of households in the United States. We believe

our current safes provide safety, security, style and peace of mind at competitive prices.

In

addition to branded safes, we offer an assortment of personal security products as well as apparel and accessories for men and women

under the Company’s American Rebel brand. Our backpacks utilize what we believe is a distinctive sandwich-method concealment pocket,

which we refer to as Personal Protection Pocket, to hold firearms in place securely and safely. The concealment pockets on our Freedom

2.0 Concealed Carry Jackets incorporate a silent operation opening and closing with the use of a magnetic closure.

We

believe that we have the potential to continue to create a brand community presence around the core ideals and beliefs of America, in

part through our Chief Executive Officer, Charles A. “Andy” Ross, Jr., who has written, recorded and performs a number of

songs about the American spirit of independence. We believe our customers identify with the values expressed by our Chief Executive Officer

through the “American Rebel” brand.

Through

our growing network of dealers, we promote and sell our products in select regional retailers and local specialty safe, sporting goods,

hunting and firearms stores, as well as online, including our website and e-commerce platforms such as Amazon.com.

American

Rebel is an advocate for the 2nd Amendment and conveys a sense of responsibility to teach and preach good common practices of gun ownership.

American Rebel products keep our customers concealed and safe both inside and outside the home. American Rebel Safes protect our customers’

firearms and valuables from children, theft, fire and natural disasters inside the home; and American Rebel Concealed Carry Products

provide quick and easy access to our customers’ firearms utilizing American Rebel’s Proprietary Protection Pocket in its

backpacks and apparel outside the home. Our concealed carry product releases embrace the “concealed carry lifestyle” with

a focus on personal security and defense.

The

Company’s “concealed carry lifestyle” motto refers to a set of products and a set of ideas around the emotional decision

to carry a gun everywhere a customer goes. The American Rebel brand strategy is similar to the successful Harley-Davidson Motorcycle

philosophy, referenced in this quote from Richard F. Teerlink, Harley’s chairman and former chief executive, “It’s

not hardware; it is a lifestyle, an emotional attachment. That’s what we have to keep marketing to.” As an American icon,

we believe Harley-Davidson Motorcycle has come to symbolize freedom, rugged individualism, excitement and a sense of “bad boy rebellion.”

We believe American Rebel has significant potential for branded products as a lifestyle brand. We believe our Concealed

Carry Product line and Safe line serve a large and growing market segment; but it is important to note we have product opportunities

beyond Concealed Carry Products and Safes. One of these opportunities is American Rebel Beer, offering beer consumers a chance to celebrate

life and celebrate freedom.

Recent

Events

American

Rebel Beer

On

August 9, 2023, the Company entered into a Master Brewing Agreement with Associated Brewing. Under the terms of the Brewing Agreement,

Associated Brewing has been appointed as the exclusive producer and seller of American Rebel branded spirits, with the initial product

being American Rebel Light Beer. American Rebel Light Beer will launch regionally in early 2024.

Acquisition

of Champion Entities

On

June 29, 2022, the Company entered into a stock and membership interest purchase agreement with Champion Safe, Superior Safe, LLC (“Superior

Safe”), Safe Guard Security Products, LLC (“Safe Guard”), Champion Safe De Mexico, S.A. de C.V. (“Champion Safe

Mexico” and, together with Champion Safe, Superior Safe, Safe Guard, and Champion Safe Mexico, collectively, the “Champion

Entities”) and Mr. Ray Crosby (“Seller”) (the “Champion Purchase Agreement”), pursuant to which the Company

agreed to acquire all of the issued and outstanding capital stock and membership interests of the Champion Entities from the Seller.

This transaction was completed on July 29, 2022. We have included the Champion Entities assets and liabilities as of that date and the

subsequent financial activity through the date of this offering circular in our consolidated financial statements which consist of the

consolidated balance sheets, consolidated statement of operations, consolidated statement of stockholders’ equity (deficit) and

consolidated statement of cash flows (the “Consolidated Financial Statements”). The Champion Entities have been integrated

with our existing operations and are under the control of our management team.

The

closing contemplated by the Champion Purchase Agreement occurred on July 29, 2022. Under the terms of the Champion Purchase Agreement,

the Company paid the Seller (i) cash consideration in the amount of $9,150,000, along with (ii) cash deposits previously paid of $350,000,

and (iii) reimbursement to the Seller for $397,420 of agreed upon acquisitions and equipment purchases completed by the Seller and the

Champion Entities since June 30, 2021.

Our

Competition

Safes

- The North American safe industry is dominated by a small number of companies. We compete primarily on the quality, safety, reliability,

features, performance, brand awareness, and price of our products. Our primary competitors include companies such as Liberty Safe, Fort

Knox Security Products, American Security, Sturdy Safe Company, Homeland Security Safes, SentrySafe, as well as certain other domestic

manufacturers, as well as certain China-based manufactured safes. Safes manufactured in China, including Steelwater and Alpha-Guardian,

were subject to import tariffs initiated under the administration of former U.S President Donald Trump and continued during the first

half of the current administration. We believe that given the current substantial uncertainty related to the supply chain and delivery

of international goods, we have a competitive advantage because our safes are not manufactured overseas. Our higher end safes and vault

doors are made in the USA in our Provo, UT manufacturing facility, which we believe resonates with our customer base. Our middle and

value line safes are made with USA made steel in our manufacturing facility in Nogales, Mexico. We believe the combination of having

all our safes made with USA made steel along with our higher end safes and vault doors being made in America put the Company in a strong

position against our competitors because we do not rely on importing safes from China and US-made steel is the strongest steel available.

Chinese imports are less appealing due to rising raw material and labor costs in China as well as the ever-present risk that tariffs

could be reinstated at any time.

Beer

- The Beer industry in the United States is highly competitive due to large domestic and international brewers and the increasing

number of craft brewers in this category who distribute similar products that have similar pricing and target beer drinkers. The two

largest brewers in the United States, AB InBev and Molson Coors, participate actively in mass appeal beer offerings as well as the high

end and beyond beer categories, through numerous hard seltzers, flavored malt beverages, and spirit ready to drink packaged beverages,

or RTDs, from existing beer brands or new brands, importing and distributing import brands, and with their own domestic specialty beers,

either by developing new brands or by acquiring, in whole or part, existing brands. Imported beers, such as Corona®, Heineken®,

Modelo Especial® and Stella Artois®, continue to compete aggressively in the United States and have gained market share over

the last ten years. All of these companies have substantially greater financial resources, marketing strength and distribution networks

than the Company. We believe our brand positioning will present opportunities for us to compete in this crowded marketplace. American

Rebel won’t be all things to all people; but we do believe we can be important to a large potential market.

Our

Competitive Strengths

We

believe we are progressing toward long-term, sustainable growth, and our business has, and our future success will be driven by, the

following competitive strengths:

●

Powerful Brand Identity – We believe we have developed a distinctive brand that sets us apart from our competitors. This has contributed

significantly to the success of our business. Our brand is predicated on patriotism and quintessential American character: protecting

our loved ones and expressing one’s values and beliefs. We strive to equip our safes with technologically advanced features, improved

designs and accessory benefits that offer customers advanced security to provide the peace of mind they need. Our beer offerings are

formulated for the mass appeal beer market and our can will boldly proclaim the drinker’s values as we believe the beer consumer

has an almost unlimited number of options, but actually very few beer choices that clearly convey the drinker’s values. Maintaining,

protecting and enhancing the “American Rebel” brand is critical to expanding our loyal enthusiasts base, network of dealers,

distributors and other partners. Through our beer, our safes, and branded apparel and accessories, we seek to further enhance our connection

with the American Rebel community and share the values of patriotism and safety for which our Company stands for. We strive to continue

to meet their need for our safes and our success will depend largely on our ability to maintain customer trust, become a gun safe storage

leader and continue to provide high-quality safes. Introducing American Rebel Beer will further expand our brand identity due to the

size and potential customer base available to us in the beer market.

●

Beverage Operations – We believe that our agreement with Associated Brewing provides an operational advantage for American Rebel

Beer. Associated Brewing is a premier beverage partner that provides turn-key operational support for American Rebel Beer. Associated

Brewing’s resources and expertise jump-start American Rebel’s entry into the beer market providing a base of initial scale

for the Company to utilize to enter this new market.

●

Safe Product Design and Development – Our current safe models rely on time-tested features, such as Four-Way Active Boltworks,

pinning the door shut on all four sides (compared to Three-Way Bolt works, which is prevalent in many of our competitors’ safes),

and benefits that would not often be available in our price point, including 12-gauge and heavier US-made steel. The sleek exterior of

our American Rebel safes has garnered attention and earned the moniker from our dealers as the “safe with an attitude.” When

we set out to enter the safe market, we wanted to offer a safe that we would want to buy, one that would get our attention and provide

excellent value for the cost. Our Champion and Superior safes draw on decades of exemplary craftsmanship and dependability. Champion

Safe – Built Up to a Standard, Not Down to a Price.

●

Focus on Safe Product Performance – Since the introduction of our first safes, we have maintained a singular focus on creating

a full range of safe, quality, reliable safes that were designed to help our customers keep their family and valuables safe at all times.

We incorporate advanced features into our safes that are designed to improve strength and durability. Key elements of our current model

safes’ performance include:

Double

Plate Steel Door - 4 ½” Thick

Reinforced

Door Edge – 7/16” Thick

Double-Steel

Door Casement

Steel

Walls – 11-Gauge

Diameter

Door Bolts – 1 ¼” Thick

Four-Way

Active Boltworks – AR-50(14), AR-40(12), AR-30(10), AR-20(10), AR-15(8), AR-12(8)

Diamond-Embedded

Armor Plate

*

Double Plate Steel Door is formed from two U.S.-made steel plates with fire insulation sandwiched inside. Thicker steel is placed on

the outside of the door while the inner steel provides additional door rigidity and attachment for the locking mechanism and bolt works.

The door edge is reinforced with up to four layers of laminated steel. Pursuant to industry-standard strength tests performed, this exclusive

design offers up to 16 times greater door strength and rigidity than the “thin metal bent to look thick” doors.

*

Double-Steel Door Casement is formed from two or more layers of steel and is welded around the perimeter of the door opening. Pursuant

to industry-standard strength tests performed, it more than quadruples the strength of the door opening and provides a more secure and

pry-resistant door mounting. Our manufacturer installs a Double-Steel Door Casement™ on our safes. We believe the reinforced door

casement feature provides important security as the safe door is often a target for break-in attempts.

*

Diamond-Embedded Armor Plate Industrial diamond is bonded to a tungsten steel alloy hard plate. Diamond is harder than either a cobalt

or carbide drill. If drilling is attempted the diamond removes the cutting edge from the drill, thus dulling the drill bit to where it

will not cut.

●

Trusted Brand – We believe that we have trusted brands with both retailers and consumers for delivering reliable, secure safe solutions.

●

Customer Satisfaction – We believe we have established a reputation for delivering high-quality safes and personal security products

in a timely manner, in accordance with regulatory requirements and our retailers’ delivery requirements and supporting our products

with a consistent merchandising and marketing message. We also believe that our high level of service, combined with strong consumer

demand for our products and our focused distribution strategy, produces substantial customer satisfaction and loyalty. We also believe

we have cultivated an emotional connection with the brand which symbolizes a lifestyle of freedom, rugged individualism, excitement and

a sense of bad boy rebellion.

●

Proven Management Team - Our founder and Chief Executive Officer, Charles A. “Andy” Ross, Jr., has led the expansion and

focus on the select product line we offer today. We believe that Mr. Ross had, and continues to have, an immediate and positive impact

on our brand, products, team members, and customers. Under Mr. Ross’s leadership, we believe that we have built a strong brand

and strengthened the management team. We are refocusing on the profitability of our products, reinforcing the quality of safes to engage

customers and drive sales. We believe our management team possesses an appropriate mix of skills, broad range of professional experience,

and leadership designed to drive board performance and properly oversee the interests of the Company, including our long-term corporate

strategy. We believe our management team also reflects a balanced approach to tenure that will allow the Board to benefit from a mix

of newer members who bring fresh perspectives and seasoned directors who bring continuity and a deep understanding of our complex business.

Associated Brewing provides expertise in the beverage industry which is anticipated to increase our efficiency in our American Rebel

Beer launch, and they are very excited about the American Rebel brand, marketing abilities and market opportunity. Associated Brewing

and their affiliate copackers have significant capacity to supply American Rebel Beer.

Our

Growth Strategy

Our

goal is to enhance our position as a designer, producer and marketer of premium safes and personal security products. In addition, we

recently announced we are entering the beverage business, through the introduction of American Rebel Beer. We have established plans

to grow our business by focusing on three key areas: (1) organic growth and expansion in existing markets; (2) targeted strategic acquisitions

that increase our on-premise and online product offerings, distributor and retail footprint and/or have the ability to increase and improve

our manufacturing capabilities and output, and (3) expanding the scope of our operation activities to new applications and new business

categories.

We

have developed what we believe is a multi-pronged growth strategy, as described below, to help us capitalize on a sizable opportunity.

Through methodical sales and marketing efforts, we believe we have implemented several key initiatives we can use to grow our business

more effectively. We believe we made significant progress in 2023 in the largest growing segment of the safe industry, sales to first-time

buyers. We also intend to opportunistically pursue the strategies described below to continue our upward trajectory and enhance stockholder

value. Key elements of our strategy to achieve this goal are as follows:

Organic

Growth and Expansion in Existing Markets - Build our Core Business

The

cornerstone of our business has historically been our safe product offerings. We are focused on continuing to develop our home, office

and personal safe product lines. We are investing in adding what we believe are distinctive and advanced technological solutions for

our safes and protective product lines.

We

are working to increase floor space dedicated to our safes and strengthen our online presence in order to expand our reach to new enthusiasts

and build our devoted American Rebel community. We intend to continue to endeavor to create and provide retailers and customers with

what we believe are responsible, safe, reliable and stylish products, and we expect to concentrate on tailoring our supply and distribution

logistics in response to the specific demands of our customers. We pledge to our customers to fight to protect their privacy just as

we would fight to protect our own privacy. Customers purchase our safes with an expectation of security and privacy and we have to live

up to their trust placed in us and fight for them.

Additionally,

our Concealed Carry Product line and Safe line serve a large market segment. We believe that interest in safes increases, as well

as in our complimentary concealed carry backpacks and apparel as a byproduct, when interest of the general population in firearms increases.

To this extent, the Federal Bureau of Investigation’s National Instant Criminal Background Check System (NICS), which we believe

serves as a proxy for gun sales since a background check is generally needed to purchase a firearm, reported a record number of background

checks in 2020, 39,695,315. The prior annual record for background checks was 2019’s 28,369,750. In 2021, there were 38,876,673

background checks conducted, similar to that of 2020’s annual record which was 40% higher than the previous annual record in 2019.

Background checks in 2023 are continuing on a pace to exceed the 2019 totals as well. While we do not expect this increase in background

checks to necessarily translate to an equivalent number of additional safes purchased, we do believe it might be an indicator of the

increased demand in the safe market. In addition, certain states (such as Massachusetts, California, New York and Connecticut) are starting

to legislate new storage requirements in respect of firearms, which is expected to have a positive impact on the sale of safes. We have

also recognized a growth in first-time gun buyers and their propensity to purchase a gun safe simultaneously with their first-time gun

purchase. The previous trend was that gun buyers would wait to purchase a gun safe until multiple firearms were owned.

We

continue to strive to strengthen our relationships and our brand awareness with our current distributors, dealers, manufacturers, specialty

retailers and consumers and to attract other distributors, dealers, and retailers. We believe that the success of our efforts depends

on the distinctive features, quality, and performance of our products; continued manufacturing capabilities and meeting demand for our

safes; the effectiveness of our marketing and merchandising programs; and the dedicated customer support.

In

addition, we seek to improve customer satisfaction and loyalty by offering distinctive, high-quality products on a timely and cost-attractive

basis and by offering efficient customer service. We regard the features, quality, and performance of our products as the most important

components of our customer satisfaction and loyalty efforts, but we also rely on customer service and support for growing our business.

Furthermore,

we intend to continue improving our business operations, including research and development, component sourcing, production processes,

marketing programs, and customer support. Thus, we are continuing our efforts to enhance our production by increasing daily production

quantities through equipment acquisitions, expanded shifts and process improvements, increased operational availability of our equipment,

reduced equipment down times, and increased overall efficiency.

We

believe that by enhancing our brand recognition, our market share might grow correspondingly. Champion Safe and its legacy of nearly

25 years of craftsmanship and quality position its products as viable alternatives to Liberty Safe product. Firearm industry sources

estimate that 70 million to 80 million people in the United States own an aggregate of more than 400 million firearms, creating a large

potential market for our safes and personal security products. We are focusing on the premium segment of the market through the quality,

distinctiveness, and performance of our products; the effectiveness of our marketing and merchandising efforts; and the attractiveness

of our competitive pricing strategies.

Targeted

Strategic Acquisitions for Long-term Growth

We

are consistently evaluating and considering acquisition opportunities that fit our overall growth strategy as part of our corporate mission

to accelerate long-term value for our stockholders and create integrated value chains.

Expand

into New Business Categories

We

recently entered into an agreement to introduce American Rebel Beer as a new product offering, which is anticipated to launch regionally

in early 2024. The Company has strived to be innovative, building products around its brand, and is committed to becoming a leading innovator

in the industries in which it competes. To that end, the Company plans to continually test new alcohol beverages and may sell them under

various brand labels for evaluation of drinker interest. The Company will also continue to consider new markets for its safe products

and new product applications. The Company has already identified opportunities in the cannabis industry to lock inventory after hours

as well as locking cabinets for tools and automotive parts in garages. Also, Champion Safe has focused on the middle and premium segments

of the safe market. We believe introducing a value line series will grow customer and dealer loyalty to our brands as nearly 60% of current

safe industry sales are going to value line products. We believe our value line product will have features and benefits other value line

safes won’t offer and that our value line safe will be a better product.

Our

Risks and Challenges

Our

prospects should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by similar companies.

Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others,

the following:

| |

● |

we recently consummated

the purchase of our safe manufacturer and sales organizations, and future acquisitions and operations of new manufacturing facilities

and/or sales organizations might prove unsuccessful and could fail; |

| |

● |

our success depends on

our ability to introduce new products that track customer preferences; |

| |

|

|

| |

● |

We face substantial risks

relating to our planned entry into the beer and alcoholic beverage market; |

| |

|

|

| |

● |

we may be unsuccessful

introducing new products, thereby increasing our expenditures without corresponding increases in our revenues; |

| |

|

|

| |

● |

if we are unable to protect

our intellectual property, we may lose a competitive advantage or incur substantial litigation costs to protect our rights; |

| |

|

|

| |

● |

as a significant portion

of our revenues are derived by demand for our safes and the personal security products for firearms storage, we depend on the availability

and regulation of ammunition and firearm storage; |

| |

|

|

| |

● |

as we continue to integrate

the recent purchase of our safe manufacturer and sales organization, any compromised operational capacity may affect our ability

to meet the demand for our safes, which in turn may affect our generation of revenue; |

| |

|

|

| |

● |

shortages of components

and materials, as well as supply chain disruptions, may delay or reduce our sales and increase our costs, thereby harming our results

of operations; |

| |

|

|

| |

● |

we do not have long-term

purchase commitments from our customers, and their ability to cancel, reduce, or delay orders could reduce our revenue and increase

our costs; |

| |

|

|

| |

● |

our inability to effectively

meet our short- and long-term obligations; |

| |

|

|

| |

● |

given our limited corporate

history it is difficult to evaluate our business and future prospects and increases the risks associated with an investment in our

securities; |

| |

|

|

| |

● |

our inability to raise

additional financing for working capital; |

| |

|

|

| |

● |

our ability to generate

sufficient revenue in our targeted markets to support operations; |

| |

|

|

| |

● |

significant dilution resulting

from our financing activities; |

| |

|

|

| |

● |

the actions and initiatives

taken by both current and potential competitors; |

| |

|

|

| |

● |

our ability to diversify

our operations; |

| |

|

|

| |

● |

the fact that our accounting

policies and methods are fundamental to how we report our financial condition and results of operations, and they may require management

to make estimates about matters that are inherently uncertain; |

| |

|

|

| |

● |

changes in U.S. GAAP or

in the legal, regulatory and legislative environments in the markets in which we operate; |

| |

|

|

| |

● |

the deterioration in general

of global economic, market and political conditions; |

| |

|

|

| |

● |

the inability to efficiently

manage our operations; |

| |

|

|

| |

● |

the inability to achieve

future operating results; |

| |

|

|

| |

● |

the unavailability of funds

for capital expenditures; |

| |

|

|

| |

● |

the inability of management

to effectively implement our strategies and business plans; and |

In

addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition, and results of

operations. You should consider the risks discussed in “Risk Factors” and elsewhere in this offering circular before investing

in our Series C Preferred Stock.

Corporate

Information

Our

principal executive offices are located at 909 18th Avenue South, Suite A, Nashville, Tennessee. Our telephone number is (833)

267-3235. Our website addresses are www.americanrebel.com, www.championsafe.com, www.superiorsafe.com and www.americanrebelbeer.com.

Information available on our websites is not incorporated by reference in and is not deemed a part of this offering circular. Investors

should not rely on any such information in deciding whether to purchase our Series C Preferred Stock.

The

Offering

Securities

being

offered: |

|

Up

to 2,666,666 shares of Series C Convertible Cumulative Preferred Stock (“Series C Preferred Stock”) at an offering price

of $7.50 per share, for a maximum offering amount of $19,999,995. |

Terms

of Series C Preferred Stock:

|

|

● |

Ranking

- The Series C Preferred Stock ranks, as to dividend rights and rights upon our liquidation, dissolution, or winding up,

senior to our Common Stock and our Series B Preferred Stock (as defined below) and junior to our Series A Preferred Stock (as

defined below). The terms of the Series C Preferred Stock will not limit our ability to (i) incur indebtedness or (ii) issue

additional equity securities that are equal or junior in rank to the shares of our Series C Preferred Stock as to distribution rights

and rights upon our liquidation, dissolution or winding up. |

| |

|

|

|

| |

|

● |

Dividend

Rate and Payment Dates - Dividends on the Series C Preferred Stock being offered will be cumulative and payable quarterly

in arrears to all holders of record on the applicable record date. Holders of our Series C Preferred Stock will be entitled to receive

cumulative dividends in the amount of $0.16 per share each quarter, which is equivalent to the annual rate of 8.53% of the $7.50

liquidation preference per share described below; provided that upon an event of default (generally defined as our failure to pay

dividends when due or to redeem shares when requested by a holder), such amount shall be increased to $0.225 per quarter, which is

equivalent to the annual rate of 12% of the $7.50 liquidation preference per share described below. Dividends on shares of our Series

C Preferred Stock will continue to accrue even if any of our agreements prohibit the current payment of dividends or we do not have

earnings. Dividends may be paid in cash or in kind in the form of Common Stock of the Company equal to the closing price of Common

Stock on the last day of the quarter at the Company’s discretion. |

| |

|

|

|

| |

|

● |

Liquidation

Preference - The liquidation preference for each share of our Series C Preferred Stock is $7.50. Upon a liquidation, dissolution

or winding up of our company, holders of shares of our Series C Preferred Stock will be entitled to receive the liquidation preference

with respect to their shares plus an amount equal to any accrued but unpaid dividends (whether or not declared) to, but not including,

the date of payment with respect to such shares. |

| |

|

|

|

| |

|

● |

Conversion

– At any time our Series C Preferred Stock is convertible into 5 (five) shares of our Common Stock at the option of

the holder. The shares underlying the Series C Preferred Stock will be registered following this offering. |

| |

|

|

|

| |

|

● |

Company

Call and Stockholder Put Options - Commencing on the fifth anniversary of the initial closing of this offering and continuing

indefinitely thereafter, we shall have a right to call for redemption the outstanding shares of our Series C Preferred Stock at a

call price equal to 150% of the original issue price of our Series C Preferred Stock, and correspondingly, each holder of shares

of our Series C Preferred Stock shall have a right to put the shares of Series C Preferred Stock held by such holder back to us at

a put price equal to 150% of the original issue purchase price of such shares. Such price will be $11.25 per share. |

| |

|

|

|

| |

|

● |

Further

Issuances - The shares of our Series C Preferred Stock have no maturity date, and we will not be required to redeem shares

of our Series C Preferred Stock at any time except as otherwise described above under the caption “Company Call and Stockholder

Put Options.” Accordingly, the shares of our Series C Preferred Stock will remain outstanding indefinitely, unless we decide,

at our option, to exercise our call right, the holder of the Series C Preferred Stock exercises his put right. |

| |

|

|

|

| |

|

● |

Voting

Rights - We may not authorize or issue any class or series of equity securities ranking senior to the Series C Preferred

Stock as to dividends or distributions upon liquidation (including securities convertible into or exchangeable for any such senior

securities) or amend our articles of incorporation (whether by merger, consolidation, or otherwise) to materially and adversely change

the terms of the Series C Preferred Stock without the affirmative vote of at least two-thirds of the votes entitled to be cast on

such matter by holders of our outstanding shares of Series C Preferred Stock, voting together as a class. Otherwise, holders of the

shares of our Series C Preferred Stock will not have any voting rights. |

| Investor Perks: |

|

Investment

Level |

|

Perks(1) |

| |

|

$300-524 |

|

1 American Rebel Hat |

| |

|

|

|

2 American Rebel Koozies |

| |

|

|

|

1 American Rebel T-shirt |

| |

|

|

|

|

| |

|

$525-1,004 |

|

1 American Rebel Hat |

| |

|

|

|

2 American Rebel Koozies |

| |

|

|

|

1 American Rebel T-shirt |

| |

|

|

|

1 American Rebel Tank Top |

| |

|

|

|

1 Andy Ross Album |

| |

|

|

|

|

| |

|

$1,005-2,504 |

|

1 American Rebel Hat |

| |

|

|

|

4 American Rebel Koozies |

| |

|

|

|

2 American Rebel T-shirt |

| |

|

|

|

2 American Rebel Tank Top |

| |

|

|

|

1 Andy Ross Album |

| |

|

|

|

1 American Rebel Hoodie |

| |

|

|

|

|

| |

|

$2,505-5,024 |

|

1 American Rebel Hat |

| |

|

|

|

4 American Rebel Koozies |

| |

|

|

|

2 American Rebel T-shirt |

| |

|

|

|

2 American Rebel Tank Top |

| |

|

|

|

1 Andy Ross Album |

| |

|

|

|

2 American Rebel Hoodie |

| |

|

|

|

1 Commemorative Plaque |

| |

|

|

|

|

| |

|

$5,025-10,004 |

|

1 American Rebel Hat |

| |

|

|

|

4 American Rebel Koozies |

| |

|

|

|

2 American Rebel T-shirt |

| |

|

|

|

2 American Rebel Tank Top |

| |

|

|

|

1 Andy Ross Album |

| |

|

|

|

2 American Rebel Hoodie |

| |

|

|

|

1 Commemorative Plaque |

| |

|

|

|

1 We The People Guitar |

| |

|

|

|

|

| |

|

$10,005-25,004 |

|

1 American Rebel Hat |

| |

|

|

|

4 American Rebel Koozies |

| |

|

|

|

2 American Rebel T-shirt |

| |

|

|

|

2 American Rebel Tank Top |

| |

|

|

|

1 Andy Ross Album |

| |

|

|

|

2 American Rebel Hoodie |

| |

|

|

|

1 Commemorative Platinum Plaque |

| |

|

|

|

1 We The People Guitar |

| |

|

|

|

2 VIP Invitations to our Kick-Off

Party in Nashville, TN |

| |

|

|

|

|

| |

|

$25,005+ |

|

1 American Rebel Hat |

| |

|

|

|

4 American Rebel Koozies |

| |

|

|

|

2 American Rebel T-shirt |

| |

|

|

|

2 American Rebel Tank Top |

| |

|

|

|

1 Andy Ross Album |

| |

|

|

|

2 American Rebel Hoodie |

| |

|

|

|

1 Commemorative Platinum Plaque |

| |

|

|

|

1 We The People Guitar |

| |

|

|

|

2 $1,000 Event and Accommodations

Vouchers to our Kick-Off Party in Nashville, TN |

(1) Subject to change at the Company’s sole option.

Conversion

to

Common: |

|

Each

holder of the Series C Preferred Stock is entitled to convert any portion of the outstanding shares of Series C Preferred Stock held

by such holder into validly issued, fully paid and non-assessable shares of our Common Stock. Each share of the Series C Preferred

Stock is convertible into our Common Stock at the conversion rate of 1 share of Series C Preferred Stock to 5 shares of Common Stock

at $1.50 per share, subject to vesting requirements and adjustment in the event of certain stock dividends and distributions, stock

splits, stock combinations, reclassifications or similar events affecting our Common Stock. Should the Company issue a redemption

notice any conversion of Series C Preferred Stock initiated after the redemption notice date shall occur on or prior to the fifth

(5th) day prior to the redemption date, as may have been fixed in any redemption notice with respect to the Existing Series

C Preferred Stock shares, at the office of the Company or any transfer agent for such stock. |

| |

|

|

| Selling

Agent; Best Efforts Offering: |

|

We

have engaged Digital Offering to serve as our lead selling agent to assist in the placement of our Series C Preferred Stock in this

offering on a “best efforts” basis. In addition, Digital Offering may engage one or more sub-agents or selected dealers

to assist in its marketing efforts. The Selling Agents are not required to sell any specific number or dollar amount of Series C

Preferred Stock offered by this offering circular but will use their best efforts to sell such shares. See “Plan of Distribution”

for further details. |

| |

|

|

| Securities

issued and outstanding before this offering: |

|

[4,032,920]

shares of Common Stock; 100,000 shares of Series A convertible preferred stock (“Series A Preferred Stock”);

75,143 shares of Series B convertible preferred stock (“Series B Preferred Stock”); warrants

to purchase [*] shares of Common Stock; and no shares of Series C Preferred Stock. |

| |

|

|

| Securities

issued and outstanding after this offering:(1) |

|

[4,032,920]

shares of Common Stock; 100,000 shares of Series A Preferred Stock; 75,143 shares of Series B Preferred

Stock; warrants to purchase [*] shares of Common Stock; and 2,666,666 shares of Series C Preferred Stock if the maximum number

of shares being offered are sold. |

| 1 | The

total number of shares of our capital stock outstanding after this offering is based on 4,032,920

shares of common stock outstanding as of October 31, 2023 and excludes: |

| |

● |

67,723

shares of our common stock reserved for future grants pursuant to our 2021 Long-Term Incentive Plan; and |

Minimum

subscription price: |

|

The

minimum initial investment is per investor is $300.00 and any additional purchases must be made in increments of at least $7.50. |

| |

|

|

| Use

of proceeds: |

|

We

intend to use the net proceeds from this offering to fund acquisitions pursuant to the exercise of existing option agreements with

certain operating businesses, general working capital and for debt repayment. For a discussion, see “Use of Proceeds.” |

| |

|

|

Proposed

listing of

Series C Preferred

Stock |

|

We

intend to apply to list the Series C Preferred Stock on Nasdaq under the symbol “AREBP” after the closing of this offering.

If this application is approved, we expect trading in the Series C Preferred Stock to begin on Nasdaq within 120 days of closing

of the offering, but cannot provide any assurance that a liquid or established trading market for the Series C Preferred Stock will

develop. |

| |

|

|

| Termination

of the offering: |

|

This

offering will terminate at the earliest of: (1) the date at which the maximum amount of offered shares has been sold, (2) the date

which is 365 days after this offering is qualified by the Commission, or (3) the date on which this offering is earlier terminated

by us in our sole discretion. |

| |

|

|

Closings

of the

offering: |

|

We

may undertake one or more closings on a rolling basis. Until we complete a closing, the proceeds

for this offering will be kept in an escrow account maintained at Wilmington Trust (or Enterprise

Bank for investments through DealMaker Securities, LLC). At each closing, the proceeds will

be distributed to us and the associated shares will be issued to the investors.

You

may not subscribe to this offering prior to the date offering statement of which this offering circular forms a part is qualified

by the Commission. Before such date, you may only make non-binding indications of your interest to purchase securities in the offering.

For any subscription agreement received after such date, we have the right review the subscription for completeness, complete anti-money

laundering, know your client and similar background checks and accept the subscription if it is complete and passes such checks or

reject the subscription if it fails any of such checks. If rejected and your funds are held in bank escrow, we will return all funds

to the rejected investor within ten business days. If a closing doesn’t occur or your subscription is rejected and you have

an account with My IPO or another clearing broker, your funds for such subscription will not be debited from My IPO or other clearing

broker and your subscription will be cancelled. The funds will remain in the escrow account pending the completion of anti-money

laundering, know your client and similar background checks. We intend to conduct the initial closing on a date mutually determined

by us and the lead selling agent. In determining when to conduct the initial closing we and the lead selling agent will take into

account the number of investors with funds in escrow that have cleared the requisite background checks and the total amount of funds

held in escrow pending an initial closing (although no minimum amount of funds is required to conduct an initial closing). Upon the

initial closing all funds in escrow will be transferred into our general account.

Following

the initial closing of this offering, we expect to have several subsequent closings of this offering until the maximum offering amount

is raised or the offering is terminated. We expect to have closings on a monthly basis and expect that we will accept all funds subscribed

for each month subject to our working capital and other needs consistent with the use of proceeds described in this offering circular.

Investors should expect to wait approximately one month and no longer than forty-five days before we accept their subscriptions and

they receive the securities subscribed for. An investor’s subscription is binding and irrevocable and investors will not have

the right to withdraw their subscription or receive a return of funds prior to the next closing unless we reject the investor’s

subscription. You will receive a confirmation of your purchase promptly following the closing in which you participate. |

| |

|

|

| Restrictions

on investment amount: |

|

Generally,

no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual

income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that

your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general

information on investing, we encourage you to refer to www.investor.gov. |

| |

|

|

| No

market for Series C Preferred Stock; transferability: |

|

There

is no existing public trading market for the Series C Preferred Stock and we do not anticipate that a secondary market for the stock

will develop. We do not intend to apply for listing of the Series C Preferred Stock on any securities exchange or for quotation in

any automated dealer quotation system or other over-the-counter market until after the final closing. Nevertheless, you will be able

to freely transfer or pledge your shares subject to the availability of applicable exemptions from the registration requirements

of the Securities Act of 1933, as amended. |

| |

|

|

| Current

symbols: |

|

Our

Common Stock and certain existing warrants are traded on the Nasdaq Capital Market under the symbols “AREB” and “AREBW,”

respectively. |

| |

|

|

| Risk

factors: |

|

Investing

in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth

in the “Risk Factors” section beginning on page 13 before deciding to invest in our securities. |

Summary

Financial Data

The

following tables summarize selected financial data regarding our business and should be read in conjunction with our financial statements

and related notes contained elsewhere in this offering circular and the information under “Management’s Discussion and Analysis

of Financial Condition and Results of Operations.”

The

summary consolidated financial data as of December 31, 2022 and 2021 and for the years then ended for our company are derived from our

audited consolidated financial statements included elsewhere in this offering circular. We derived the summary consolidated financial

data as of June 30, 2023 and for the six months ended June 30, 2023 and 2022 from our unaudited consolidated financial statements included

elsewhere in this offering circular, which include all adjustments, consisting of normal recurring adjustments, that our management considers

necessary for a fair presentation of our financial position and results of operations as of the dates and for the periods presented.

Our consolidated financial statements include the accounts of American Rebel Holdings, Inc. and all subsidiaries.

The

summary financial data information is only a summary and should be read in conjunction with the historical financial statements and related

notes contained elsewhere herein. The financial statements contained elsewhere in this offering circular fully represent our financial

condition and operations; however, they are not necessarily indicative of our future performance.

| | |

Six

Months Ended June

30, | | |

Years

Ended December

31, | |

| | |

2023 | | |

2022 | | |

2022 | | |

2021 | |

| | |

(unaudited) | | |

(unaudited) | | |

| | |

| |

| Statements

of Operations Data | |

| | |

| | |

| | |

| |

| Total revenues | |

$ | 8,072,670 | | |

$ | 492,786 | | |

$ | 8,449,800 | | |

$ | 986,826 | |

| Cost of goods sold | |

| 5,774,014 | | |

| 337,797 | | |

| 6,509,382 | | |

| 812,130 | |