UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number 000-51138

GRAVITY CO., LTD.

————————————————————————————————————

(Translation of registrant’s name into English)

14F, 396 World Cup buk-ro, Mapo-gu, Seoul 121-795, Korea

————————————————————————————————————

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F þ Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

GRAVITY REPORTS THIRD QUARTER OF 2023 RESULTS AND BUSINESS UPDATES

Seoul, South Korea – November 13, 2023 – GRAVITY Co., Ltd. (NasdaqGM: GRVY) (“Gravity” or “Company”), a developer and publisher of online and mobile games based in South Korea, today announced its unaudited financial results for the third quarter ended September 30, 2023, prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and business updates.

THIRD QUARTER 2023 HIGHLIGHTS

•Total revenues were KRW 176,145 million (US$ 130,685 thousand), representing a 26.3% decrease from the second quarter ended June 30, 2023 (“QoQ”) and a 72.1% increase from the third quarter ended September 30, 2022 (“YoY”).

•Operating profit was KRW 37,917 million (US$ 28,131 thousand), representing a 28.1% decrease QoQ and a 78.3% increase YoY.

•Profit before income tax expenses was KRW 41,208 million (US$ 30,572 thousand), representing a 25.2% decrease QoQ and a 68.8% increase YoY.

•Net profit attributable to parent company was KRW 28,961 million (US$ 21,486 thousand), representing a 35.7% decrease QoQ and an 80.2% increase YoY.

REVIEW OF THIRD QUARTER 2023 FINANCIAL RESULTS

Revenues

Online game revenues for the third quarter of 2023 were KRW 17,316 million (US$ 12,847 thousand), representing an 1.7% increase QoQ from KRW 17,025 million and a 10.1% decrease YoY from KRW 19,271 million. The increase QoQ was mainly attributable to increased revenues from Ragnarok Online in Taiwan. Such increase was partially offset by decreased revenue from Ragnarok Online in Japan. The decrease YoY was largely due to decreased revenues from Ragnarok Online in Taiwan, Korea, Philippines, Singapore and Malaysia.

Mobile game revenues were KRW 155,467 million (US$ 115,344 thousand) for the third quarter of 2023, representing a 28.9% decrease QoQ from KRW 218,687 million and a 95.7% increase YoY from KRW 79,443 million. The decrease QoQ was resulted by decreased revenues from Ragnarok Origin in Southeast Asia, Taiwan, Hong Kong and Macau and Ragnarok X: Next Generation in Korea. The increase YoY was mainly due to initial revenue from Ragnarok Origin in Southeast Asia launched in April 6, 2023 and Ragnarok X: Next Generation in Korea launched in January 5, 2023. This increase was partially offset by decreased revenues from Ragnarok X: Next Generation in Southeast Asia, Ragnarok Monster's Arena and Ragnarok M: Eternal Love in Southeast Asia.

Other revenues were KRW 3,362 million (US$ 2,494 thousand) for the third quarter of 2023, representing a 5.7% increase QoQ from KRW 3,182 million and an 8.2% decrease YoY from KRW 3,663 million.

Cost of Revenue

Cost of revenue was KRW 117,834 million (US$ 87,423 thousand) for the third quarter of 2023, representing a 30.0% decrease QoQ from KRW 168,309 million and a 97.0% increase YoY from KRW 59,829 million. The decrease QoQ was mainly due to decreased commission paid for mobile game services related to Ragnarok Origin in Southeast Asia , Taiwan, Hong Kong and Macau and Ragnarok X: Next Generation in Korea. The increase YoY was primarily due to increased commission paid for mobile game services related to Ragnarok Origin in Southeast Asia launched in April 6,2023 and Ragnarok X: Next Generation in Korea launched in January 5, 2023.

Operating Expenses

Operating expenses were KRW 20,394 million (US$ 15,131 thousand) for the third quarter of 2023, representing a 14.0% increase QoQ from KRW 17,884 million and a 4.2% decrease YoY from KRW 21,277 million. The increase QoQ was mainly due to increased commission paid for payment gateway fees related to Ragnarok Online in Taiwan, increased R&D expense and increased advertising expenses for White Chord launched in Japan on August 29, 2023, Ragnarok Landverse launched in Southeast Asia (Thailand and Indonesia excluded), Middle East, India, Africa and Oceania on September 20, 2023 and Ragnarok 20 Heroes launched in Korea on October 12, 2023. The decrease YoY was mainly due to decreased advertising expenses for Ragnarok Monster's Arena in Thailand and Korea, Ragnarok Origin in North America and Korea and Ragnarok Online in Korea.

Profit Before Income Tax Expenses

Profit before income tax expenses was KRW 41,208 million (US$ 30,572 thousand) for the third quarter of 2023 compared with profit before income tax expense of KRW 55,097 million for the second quarter of 2023 and profit before income tax expenses of KRW 24,410 million for the third quarter of 2022.

Net Profit

As a result of the foregoing factors, Gravity recorded a net profit attributable to parent company of KRW 28,961 million (US$ 21,486 thousand) for the third quarter of 2023 compared with net profit attributable to parent company of KRW 45,016 million for the second quarter of 2023 and a net profit attributable to parent company of KRW 16,076 million for the third quarter of 2022.

Liquidity

The balance of cash and cash equivalents and short-term financial instruments was KRW 443,835 million (US$ 329,289 thousand) as of September 30, 2023.

Note: For convenience purposes only, the KRW amounts have been expressed in U.S. dollars at the exchange rate of KRW 1,347.86 to US$ 1.00, the noon buying rate in effect on September 30, 2023 as quoted by the Federal Reserve Bank of New York.

GRAVITY BUSINESS UPDATES

Ragnarok Online IP-based Games

•Ragnarok Origin, an MMORPG mobile and PC game

Ragnarok Origin officially received a foreign version number from Chinese government on August 29, 2023, and is preparing to be launched in China in the first quarter of 2024. Also, the global version of this game is being prepared to be launched in Central, South America, etc. in the first quarter of 2024.

•Ragnarok X: Next Generation, an MMORPG mobile and PC game

Ragnarok X: Next Generation is preparing to be launched in China and the publisher of the game is Beihai Leyou Technology Co. Ltd, an affiliate of ZLONGAME.

•Ragnarok Begins, an Action Side-scrolling MMORPG mobile and PC game

Ragnarok Begins started its second CBT on November 1, 2023 and is preparing to be launched in South Korea in December 2023.

•Ragnarok V: Returns, a 3D MMORPG mobile and PC game

Ragnarok V: Returns will open its second CBT in South Korea and the first CBT in Thailand in the first half of 2024.

•Ragnarok 20 Heroes, an Action RPG mobile game

Ragnarok 20 Heroes launched in Korea on October 12, 2023.

Ragnarok Online IP-based Blockchain Games

•Ragnarok Landverse, an MMORPG blockchain PC game

Ragnarok Landverse launched in Southeast Asia (Thailand and Indonesia excluded), Middle East, India, Africa and Oceania on September 20, 2023.

•Ragnarok Poring Merge NFT, a Time Effective RPG blockchain mobile game

Ragnarok Poring Merge NFT is being prepared to be launched in Global in the first quarter of 2024.

Other IP-based games

•Wetory, a 3D Action Adventure Rogue-Like PC and console game

Wetory was released in global on October 26, 2023. The game was developed by PepperStons, a Korean game developer. and published by Gravity.

Investor Presentation

Gravity issued an investor presentation. The presentation contains the Company’s recent business updates, results of the third quarter in 2023 and Gravity’s business plan. The presentation can be found on the Company’s website under the IR Archives section at http://www.gravity.co.kr/en/ir/pds/list.asp. Korean and Japanese versions of the presentation are also provided on the website.

About GRAVITY Co., Ltd. ---------------------------------------------------

Gravity is a developer and publisher of online and mobile games. Gravity's principal product, Ragnarok Online, is a popular online game in many markets, including Japan and Taiwan, and is currently commercially offered in 91 markets. For more information about Gravity, please visit http://www.gravity.co.kr.

Forward-Looking Statements:

Certain statements in this press release may include, in addition to historical information, “forward-looking statements” within the meaning of the “safe-harbor” provisions of the U.S. Private Securities Litigation Reform Act 1995. Forward-looking statements can generally be identified by the use of forward-looking terminology, such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe”, “project,” or “continue” or the negative thereof or other similar words, although not all forward-looking statements contain these words. Investors should consider the information contained in our submissions and filings with the United States Securities and Exchange Commission (the “SEC”), including our annual report for the fiscal year ended December 31, 2023 on Form 20-F, together with such other documents that we may submit to or file with the SEC from time to time, on Form 6-K. The forward-looking statements speak only as of this press release and we assume no duty to update them to reflect new, changing or unanticipated events or circumstances.

Contact:

Mr. Heung Gon Kim

Chief Financial Officer

Gravity Co., Ltd.

Email: kheung@gravity.co.kr

Ms. Jin Lee

IR Manager

Gravity Co., Ltd.

Email: ir@gravity.co.kr

Telephone: +82-2-2132-7800

Ms. Yiseo Shin

IR Assistant Manager

Gravity Co., Ltd.

Email: ir@gravity.co.kr

Telephone: +82-2-2132-7801

GRAVITY Co., Ltd.

Consolidated Statements of Financial Position

(In millions of KRW and thousands of US$)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of |

| | 31-Dec-22 | | | 30-Sep-23 |

| | KRW | | | US$ | | | KRW | | | US$ |

| | (audited) | | | (unaudited) | | | (unaudited) | | | (unaudited) |

| Assets | | | | | | | | | | | | | | | |

| Current assets: | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | 169,877 | | | | | 126,035 | | | | | 207,220 | | | | | 153,740 | |

| Short-term financial instruments | | | 167,000 | | | | | 123,900 | | | | | 236,615 | | | | | 175,549 | |

| Accounts receivable, net | | | 77,257 | | | | | 57,318 | | | | | 81,046 | | | | | 60,129 | |

| Other receivables, net | | | 140 | | | | | 104 | | | | | 232 | | | | | 172 | |

| Prepaid expenses | | | 3,332 | | | | | 2,472 | | | | | 2,990 | | | | | 2,218 | |

| Other current financial assets | | | 3,370 | | | | | 2,500 | | | | | 4,125 | | | | | 3,060 | |

| Other current assets | | | 791 | | | | | 587 | | | | | 5,749 | | | | | 4,265 | |

| Total current assets | | | 421,767 | | | | | 312,916 | | | | | 537,977 | | | | | 399,133 | |

| Property and equipment, net | | | 8,140 | | | | | 6,039 | | | | | 10,808 | | | | | 8,019 | |

| Intangible assets, net | | | 3,869 | | | | | 2,870 | | | | | 5,029 | | | | | 3,730 | |

| Deferred tax assets | | | 5,660 | | | | | 4,199 | | | | | 5,574 | | | | | 4,135 | |

| Other non-current financial assets | | | 2,176 | | | | | 1,614 | | | | | 1,741 | | | | | 1,292 | |

| Other non-current assets | | | 2,482 | | | | | 1,841 | | | | | 6,204 | | | | | 4,603 | |

| Total assets | | | 444,094 | | | | | 329,479 | | | | | 567,333 | | | | | 420,912 | |

| Liabilities and Equity | | | | | | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | | | | | | |

| Accounts payable | | | 73,549 | | | | | 54,567 | | | | | 76,644 | | | | | 56,863 | |

| Deferred revenue | | | 18,543 | | | | | 13,757 | | | | | 15,976 | | | | | 11,853 | |

| Withholdings | | | 3,201 | | | | | 2,375 | | | | | 3,731 | | | | | 2,768 | |

| Accrued expense | | | 2,041 | | | | | 1,514 | | | | | 1,630 | | | | | 1,209 | |

| Income tax payable | | | 5,469 | | | | | 4,058 | | | | | 14,320 | | | | | 10,624 | |

| Other current liabilities | | | 2,907 | | | | | 2,157 | | | | | 4,197 | | | | | 3,114 | |

| Total current liabilities | | | 105,710 | | | | | 78,428 | | | | | 116,498 | | | | | 86,431 | |

| Long-term account payables | | | 374 | | | | | 277 | | | | | 74 | | | | | 55 | |

| Long-term deferred revenue | | | 30 | | | | | 22 | | | | | 381 | | | | | 283 | |

| Other non-current liabilities | | | 4,968 | | | | | 3,686 | | | | | 3,994 | | | | | 2,962 | |

| Deferred tax liabilities | | | 2,832 | | | | | 2,101 | | | | | 2,833 | | | | | 2,102 | |

| Total liabilities | | | 113,914 | | | | | 84,514 | | | | | 123,780 | | | | | 91,833 | |

| Share capital | | | 3,474 | | | | | 2,577 | | | | | 3,474 | | | | | 2,577 | |

| Capital surplus | | | 27,098 | | | | | 20,104 | | | | | 27,098 | | | | | 20,104 | |

| Other components of equity | | | 2,475 | | | | | 1,837 | | | | | 5,362 | | | | | 3,979 | |

| Retained earnings | | | 296,480 | | | | | 219,963 | | | | | 406,923 | | | | | 301,903 | |

| Equity attributable to owners of the Parent Company | | | 329,527 | | | | | 244,481 | | | | | 442,857 | | | | | 328,563 | |

| Non-controlling interest | | | 653 | | | | | 484 | | | | | 696 | | | | | 516 | |

| Total equity | | | 330,180 | | | | | 244,965 | | | | | 443,553 | | | | | 329,079 | |

| Total liabilities and equity | | | 444,094 | | | | | 329,479 | | | | | 567,333 | | | | | 420,912 | |

* For convenience purposes only, the KRW amounts are expressed in U.S. dollars at the rate of KRW 1,347.86 to US$ 1.00, the noon buying rate in effect on September 30, 2023 as quoted by the Federal Reserve Bank of New York.

GRAVITY Co., Ltd.

Consolidated Statements of Comprehensive Income

(In millions of KRW and thousands of US$ except for share and ADS data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | Nine months ended |

| | | 30-Jun-23 | 30-Sep-22 | 30-Sep-23 | | 30-Sep-22 | | 30-Sep-23 |

| | | (KRW) | | (KRW) | | (KRW) | | (US$) | | (KRW) | | (KRW) | | (US$) |

| | | (unaudited) | | (unaudited) | | (unaudited) | | (unaudited) | | (unaudited) | | (unaudited) | | (unaudited) |

| Revenues: | | | | | | | | | | | | | | | | | | | | | |

| Online games | | | 17,025 | | | 19,271 | | | 17,316 | | | 12,847 | | | 65,545 | | | 57,037 | | | 42,317 |

| Mobile games | | | 218,687 | | | 79,443 | | | 155,467 | | | 115,344 | | | 210,726 | | | 513,148 | | | 380,714 |

| Other revenue | | | 3,182 | | | 3,663 | | | 3,362 | | | 2,494 | | | 11,232 | | | 9,801 | | | 7,270 |

| Total net revenue | | | 238,894 | | | 102,377 | | | 176,145 | | | 130,685 | | | 287,503 | | | 579,986 | | | 430,301 |

| Cost of revenue | | | 168,309 | | | 59,829 | | | 117,834 | | | 87,423 | | | 155,658 | | | 391,628 | | | 290,555 |

| Gross profit | | | 70,585 | | | 42,548 | | | 58,311 | | | 43,262 | | | 131,845 | | | 188,358 | | | 139,746 |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 15,029 | | | 17,624 | | | 17,190 | | | 12,754 | | | 56,473 | | | 45,490 | | | 33,750 |

| Research and development | | | 2,852 | | | 3,745 | | | 3,964 | | | 2,941 | | | 9,933 | | | 9,738 | | | 7,225 |

| Others, net | | | 3 | | | | (92) | | | | (760) | | | | (564) | | | | (263) | | | | (806) | | | | (598) | |

| Total operating expenses | | | 17,884 | | | 21,277 | | | 20,394 | | | 15,131 | | | 66,143 | | | 54,422 | | | 40,377 |

| Operating profit | | | 52,701 | | | 21,271 | | | 37,917 | | | 28,131 | | | 65,702 | | | 133,936 | | | 99,369 |

| Finance income(costs): | | | | | | | | | | | | | | | | | | | | | |

| Finance income | | | 4,213 | | | | 5,343 | | | 7,059 | | | 5,237 | | | 11,051 | | | 16,733 | | | 12,415 |

| Finance costs | | | (1,817) | | | | (2,204) | | | | (3,768) | | | | (2,796) | | | | (5,249) | | | | (8,138) | | | | (6,038) | |

| Profit before income tax | | | 55,097 | | | 24,410 | | | 41,208 | | | 30,572 | | | 71,504 | | | 142,531 | | | 105,746 |

| Income tax expense | | | 10,070 | | | 8,312 | | | 12,223 | | | 9,068 | | | 21,663 | | | 32,092 | | | 23,809 |

| Profit for the year | | | 45,027 | | | 16,098 | | | 28,985 | | | 21,504 | | | 49,841 | | | 110,439 | | | 81,937 |

| Profit attributable to: | | | | | | | | | | | | | | | | | | | | | |

| Non-controlling interest | | | 11 | | | | 22 | | | | 24 | | | | 18 | | | | (131) | | | | (4) | | | | (3) | |

| Owners of Parent company | | | 45,016 | | | 16,076 | | | 28,961 | | | 21,486 | | | 49,972 | | | 110,443 | | | 81,940 |

| Earnings per share | | | | | | | | | | | | | | | | | | | | | |

| - Basic and diluted | | | 6,478 | | | | 2,313 | | | 4,168 | | | 3.09 | | | 7,191 | | | 15,894 | | | 11.79 |

| Weighted average number of shares outstanding | | | | | | | | | | | | | | | | | | | | | |

| - Basic and diluted | | | 6,948,900 | | | 6,948,900 | | | 6,948,900 | | | 6,948,900 | | | 6,948,900 | | | 6,948,900 | | | 6,948,900 |

| Earnings per ADS | | | | | | | | | | | | | | | | | | | | | |

| - Basic and diluted | | | 6,478 | | | | 2,313 | | | 4,168 | | | 3.09 | | | 7,191 | | | 15,894 | | | 11.79 |

| | | | | | | | | | | | | | | | | | | | | |

* For convenience, the KRW amounts are expressed in U.S. dollars at the rate of KRW 1,347.86 to US$1.00, the noon buying rate in effect on September 30, 2023 as quoted by the Federal Reserve Bank of New York.

(1) Each ADS represents one common share.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | |

| GRAVITY CO., LTD. |

| | |

| By: | /s/ Heung Gon Kim |

| Name: | Heung Gon Kim |

| Title: | Chief Financial Officer |

Date: November 13, 2023

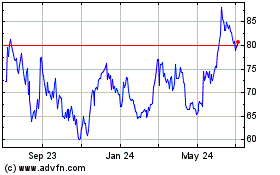

Gravity (NASDAQ:GRVY)

Historical Stock Chart

From Apr 2024 to May 2024

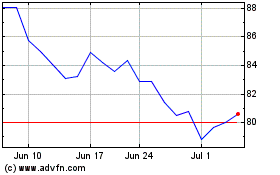

Gravity (NASDAQ:GRVY)

Historical Stock Chart

From May 2023 to May 2024