false000130525300013052532023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________

FORM 8-K

_________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2023

_________________________________________________

EIGER BIOPHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

_________________________________________________

| | | | | | | | |

| Delaware | 001-36183 | 33-0971591 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

Eiger BioPharmaceuticals, Inc.

2155 Park Blvd.

Palo Alto, California 94306

(Address of principal executive offices, including zip code)

(650) 272-6138

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

_________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 | | EIGR | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On November 9, 2023, Eiger BioPharmaceuticals, Inc. reported its financial results for the quarter ended September 30, 2023. A copy of the press release titled “Eiger BioPharmaceuticals Reports Third Quarter 2023 Financial Results and Provides Business Update,” is furnished pursuant to Item 2.02 as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in this Item 2.02 and in the press release attached as Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of Section 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information in this Item 2.02 and in the press release attached as Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Eiger BioPharmaceuticals, Inc., whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Eiger BioPharmaceuticals, Inc. |

| | |

| Dated: November 9, 2023 | | |

| | |

| By: | /s/ David Apelian |

| | David Apelian

Chief Executive Officer |

Eiger BioPharmaceuticals Reports Third Quarter 2023 Financial Results and Provides Business Update

•Resources prioritized to advance avexitide in hyperinsulinemic hypoglycemia indications

•Phase 3 LIMT-2 study of peginterferon lambda in chronic hepatitis delta discontinued due to safety findings

•Company’s cash runway expected to extend into the third quarter of 2024

Palo Alto, Calif., November 9, 2023 -- Eiger BioPharmaceuticals, Inc. (Nasdaq:EIGR), a commercial-stage biopharmaceutical company focused on the development of innovative therapies for rare metabolic diseases, today reported financial results for the third quarter 2023 and provided a business update.

“As we disclosed in June 2023, we continue to seek financial resources to advance avexitide in post-bariatric hypoglycemia, or PBH, where we see the highest revenue potential, have demonstrated proof-of-concept in Phase 2 clinical trials, and have FDA alignment on Phase 3 endpoints, sample size, and study design,” said David Apelian, MD, PhD, MBA, CEO of Eiger.

Business Highlights

Avexitide for Post-Bariatric Hypoglycemia (PBH)

•A large orphan disease with a growing population; caused by complications in bariatric surgery

•Prevalence of approximately 180,000 in the US and approximately half that in the EU

•Avexitide is the only drug in development for PBH with Breakthrough Therapy designation from FDA

•FDA alignment on pivotal Phase 3 study endpoints, sample size, and design

Avexitide for Congenital Hyperinsulinism (HI)

•An ultra-rare, life-threatening, pediatric disorder of persistent hypoglycemia that results in irreversible brain damage in up to 50% of children

•Breakthrough Therapy designation from FDA

•Rare Pediatric Disease designation

Zokinvy® (lonafarnib) for Progeria and Processing-Deficient Progeroid Laminopathies

•Achieved net revenue of $3.2 million in Q3 2023

Corporate

•43% reduction in workforce to-date and reductions in out-of-pocket spend related to the Company's hepatitis delta development program are expected to extend the Company’s cash runway into the third quarter of 2024

Cash Position

•$39.4 million in cash, cash equivalents and short-term securities as of September 30, 2023

Third Quarter 2023 Financial Results

Total revenue was $3.2 million for the third quarter of 2023, as compared to $4.0 million for the same period in 2022. The decrease was primarily driven by a decrease in U.S. sales. It was partially offset by an increase in sales in France under the Company’s Temporary Authorizations for Use for Zokinvy®, compared to no such sales for the same period in 2022.

Cost of sales decreased by $1.1 million in the third quarter 2023 compared to the same period in 2022. The decrease was primarily due to a non-conforming batch of inventory that was written off during the three months ended September 30, 2022.

Research and development expenses were $14.6 million for the third quarter of 2023, as compared to $22.2 million for the same period in 2022. The decrease was primarily attributed to a decrease in clinical and contract manufacturing expenditures due to a decline in manufacturing costs for peginterferon lambda and avexitide, a decrease in compensation and personnel related expense due to a decrease in headcount, and a decrease in outside services across programs including consulting and advisory services due to a decline in spending on the Company's peginterferon lambda program.

Selling, general and administrative expenses were $5.5 million for the third quarter of 2023, as compared to $7.0 million for the same period in 2022. The decrease was primarily due to a decrease in compensation and personnel related expense, including stock-based compensation, and a decrease in outside services, including consulting, advisory and accounting services.

Total operating expenses include non-cash expenses of $1.4 million for the third quarter of 2023, as compared to $4.0 million for the same period in 2022. The decrease was primarily due to a change in amortization of premiums and discounts on debt securities due to current market and economic conditions and a decrease in compensation and personnel related expense including stock-based compensation, due to a decrease in headcount.

The Company reported a net loss of $18.0 million, or $0.41 per share basis for the third quarter of 2023. This compares to a net loss of $27.1 million, or $0.62 per share basis for the same period in 2022.

Cash, cash equivalents, and short-term debt securities as of September 30, 2023 totaled $39.4 million, as compared to $98.9 million as of December 31, 2022.

As of September 30, 2023, the Company had 44,384,684 common shares outstanding.

About Eiger

Eiger is a commercial-stage biopharmaceutical company focused on the development of innovative therapies for rare metabolic diseases. Eiger’s lead product candidate, avexitide, is a well characterized, first-in-class GLP-1 antagonist being developed for the treatment of post-bariatric hypoglycemia (PBH) and congenital hyperinsulinism (HI). Avexitide is the only drug in development for PBH with Breakthrough Therapy designation from the FDA.

For additional information about Eiger and its clinical programs, please visit www.eigerbio.com.

Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts, including statements regarding our future financial condition, timing for and outcomes of clinical results, prospective products, preclinical and clinical pipelines, regulatory objectives, business strategy and plans and objectives for future operations, are forward-looking statements. Forward-looking statements are our current statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our ability to secure additional capital, the timing of our ongoing and planned clinical development; our capability to provide sufficient quantities of any of our products or product candidates for studies or to meet anticipated full-scale commercial demands; our ability to identify, pursue and enter into partnering opportunities for our virology assets; the sufficiency of our cash, cash equivalents and investments to fund our operations into the third quarter of 2024, including the scope and impact of any savings from our workforce reduction and cash conservation efforts; the revenue potential of avexitide in post-bariatric hypoglycemia and congenital hyperinsulinism; our ability to finance, independently or through collaborations, the continued advancement of our development pipeline; and the potential for success of any of our products or product candidates. Various important factors could cause actual results or events to differ materially from the forward-looking statements that Eiger makes, including additional applicable risks and uncertainties described in the “Risk Factors” section in Eiger’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 and Eiger's subsequent filings with the SEC. The forward-looking statements contained in this press release are based on information currently available to Eiger and speak only as of the date on which they are made. Eiger does not undertake and specifically disclaims any obligation to update any forward-looking statements, whether as a result of any new information, future events, changed circumstances or otherwise.

Investors:

Sylvia Wheeler

Wheelhouse Life Science Advisors

swheeler@wheelhouselsa.com

Media:

Aljanae Reynolds

Wheelhouse Life Science Advisors

areynolds@wheelhouselsa.com

Eiger BioPharmaceuticals Inc.

Condensed Consolidated Balance Sheets

(in thousands)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022(1) |

| (Unaudited) | | |

ASSETS | | | |

Cash and cash equivalents | $ | 27,501 | | | $ | 25,798 | |

Short-term debt securities | 11,920 | | | 73,150 | |

Accounts receivable, net | 1,321 | | | 1,749 | |

Inventories, net | 1,105 | | | 2,853 | |

Prepaid expenses and other current assets | 12,777 | | | 13,985 | |

Total current assets | 54,624 | | | 117,535 | |

Property and equipment, net | 677 | | | 696 | |

Operating lease right-of-use assets | 209 | | | 561 | |

Other assets | 144 | | | 1,347 | |

Total assets | $ | 55,654 | | | $ | 120,139 | |

LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | | | |

Current liabilities | 16,524 | | | $ | 25,121 | |

Other liabilities | 40,734 | | | 39,708 | |

Stockholders’ (deficit) equity | (1,604) | | | 55,310 | |

Total liabilities and stockholders’(deficit) equity | $ | 55,654 | | | $ | 120,139 | |

(1)Derived from the audited financial statements, included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

Eiger BioPharmaceuticals Inc.

Condensed Consolidated Statements of Operations Financial Data

(in thousands, except per share and share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, (unaudited) | | Nine Months Ended September 30, (unaudited) |

| 2023 | | 2022 | | 2023 | | 2022 |

Product revenue, net | $ | 3,209 | | | $ | 4,024 | | | $ | 11,720 | | | $ | 10,038 | |

| Other revenue | — | | | — | | | 250 | | | 750 | |

| Total revenue | 3,209 | | | 4,024 | | | 11,970 | | | 10,788 | |

Costs and operating expenses: | | | | | | | |

Cost of sales | 115 | | | 1,231 | | | (77) | | | 1,492 | |

Research and development(1) | 14,568 | | | 22,198 | | | 50,717 | | | 56,761 | |

Selling, general and administrative(1) | 5,454 | | | 6,964 | | | 20,502 | | | 20,804 | |

Total operating expenses | 20,137 | | | 30,393 | | | 71,142 | | | 79,057 | |

Loss from operations | (16,928) | | | (26,369) | | | (59,172) | | | (68,269) | |

Interest expense | (1,412) | | | (1,092) | | | (4,040) | | | (2,912) | |

Interest income | 485 | | | 347 | | | 1,856 | | | 613 | |

Other (expense) income, net | (175) | | | 3 | | | (149) | | | (1,044) | |

Loss before provision for taxes | (18,030) | | | (27,111) | | | (61,505) | | | (71,612) | |

Provision for income taxes | — | | | — | | | 4 | | | 26 | |

Net loss | $ | (18,030) | | | $ | (27,111) | | | $ | (61,509) | | | $ | (71,638) | |

Net loss per common share: | | | | | | | |

Basic and diluted | $ | (0.41) | | | $ | (0.62) | | | $ | (1.39) | | | $ | (1.76) | |

Weighted-average common shares outstanding: | | | | | | | |

Basic and diluted | 44,320,164 | | | 44,010,553 | | | 44,254,711 | | | 40,806,581 | |

(1)Includes stock-based compensation expense of:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

Research and development | $ | 650 | | | $ | 856 | | | $ | 2,001 | | | $ | 2,301 | |

General and administrative | 388 | | | 1,366 | | | 2,324 | | | 4,176 | |

Total stock-based compensation expense | $ | 1,038 | | | $ | 2,222 | | | $ | 4,325 | | | $ | 6,477 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

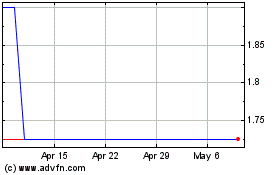

Eiger BioPharmaceuticals (NASDAQ:EIGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eiger BioPharmaceuticals (NASDAQ:EIGR)

Historical Stock Chart

From Apr 2023 to Apr 2024