0001762303false00017623032023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 09, 2023 |

AVITA Medical, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39059 |

85-1021707 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

28159 Avenue Stanford Suite 220 |

|

Valencia, California |

|

91355 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 661 367-9170 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

RCEL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, AVITA Medical, Inc. issued a press release announcing its financial results for the quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in this report, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

AVITA Medical, Inc. |

|

|

|

|

Date: |

November 09, 2023 |

By: |

/s/ Donna Shiroma |

|

|

|

Donna Shiroma

General Counsel |

Exhibit 99.1

AVITA Medical Reports Third Quarter Financial Results with 51% Revenue Growth over the Same Period the Prior Year

VALENCIA, Calif., November 9, 2023 — AVITA Medical, Inc. (NASDAQ: RCEL, ASX: AVH) (the “Company”), a regenerative medicine company leading the development and commercialization of first-in-class devices and autologous cellular therapies for skin restoration, today reported financial results for the third quarter September 30, 2023.

Financial Highlights and Recent Updates

•Commercial revenue of $13.5 million, an approximately 51% increase compared to $9.0 million for the same period in 2022

•Gross margin of 84.5% for the quarter

•Announced international expansion plan; engaged first European distribution partner, PolyMedics Innovations GmbH, to lead expansion into Germany, Austria, and Switzerland

•In October, secured a debt financing facility for up to $90.0 million, of which $40.0 million was borrowed at closing. Together with the cash on hand of $60.1 million as of September 30, 2023, the Company believes it has sufficient capital to meet its goals and to reach profitability during 2025.

“We continue to execute our growth strategy, paving the way to profitability,” said Jim Corbett, Chief Executive Officer of AVITA. “We are diligently working through supplemental in-house testing to support the FDA’s review of our PMA supplement for RECELL GO. Once complete, we expect to submit a response to the FDA’s open questions on February 28, 2024. Under the Breakthrough Device program, we anticipate FDA approval on May 30, 2024, which positions us for a launch the following day.”

Future Milestones

•Expect FDA real-time review of the PMA Supplement for RECELL GO™ to resume on March 1, 2024, day 91 of the 180-day review cycle, with FDA approval anticipated on May 30, 2024

•Reaffirming high growth potential of full-thickness skin defect indication, which presents a market 10 times the size of original burns market

•Plan to actively identify new international distributor partnerships, including Australia, Japan, and European Union, over the next 6 to 12 months

•Expect full enrollment of post-market study, TONE, by end of February 2024

•Initiating health care economics study to capture longitudinal healthcare costs of vitiligo patients

•Expect initial reimbursement coverage for vitiligo in Q3 2025

•Expect to reach profitability in 2025

“We have achieved significant commercial revenue growth rates for the last three quarters of 40%, 42% and 51%, respectively, over the same periods in the previous year,” said David O’Toole, Chief Financial Officer of AVITA Medical. “Further, we remain confident that our cash reserves position us to achieve our goals and reach profitability in 2025.”

Page 1

Financial Guidance

•Commercial revenue for the fourth quarter 2023 is expected to be in the range of $15.3 to $16.3 million, reflecting a lower bound of 64% and upper bound of 73% growth over the same period in the prior year

•Commercial revenue for the full year 2023 is expected to be in the range of $51 to $53 million, reflecting a lower bound of 50% and upper bound of 56% growth over the same period in the prior year

•Gross margin for the full year 2023 expected to be in the range of 83% to 85%

Third Quarter 2023 Financial Results

Our commercial revenue, which excludes Biomedical Advanced Research and Development Authority (BARDA) revenue, increased by 51% to $13.5 million in the three-months ended September 30, 2023, compared to $9.0 million in the same period in 2022. Total revenue, which includes BARDA revenue, increased by 50% to $13.6 million compared to $9.1 million in the same period in 2022.

Gross profit margin increased by 1.3% to 84.5% compared to 83.2% for the third quarter of 2022. The increase was largely driven by higher production associated with our increase in revenues and lower shipping costs.

Total operating expenses for the quarter were $21.0 million, compared to $14.2 million in the same period in 2022. The increase in operating expenses is primarily attributable to an increase of $5.1 million in sales and marketing costs. The increase in sales and marketing costs is a result of the expansion of our commercial organization in preparation of the commercial launch of full-thickness skin defects that happened in the second quarter. In addition, the increase in operating expenses included an increase of $0.6 million in R&D costs, and an increase of $1.1 million in G&A costs, primarily due to an increase in stock compensation expense.

Net loss was $8.7 million, or a loss of $0.34 per basic and diluted share, compared to a net loss of $5.6 million, or a loss of $0.22 per basic and diluted share, in the same period in 2022.

As of September 30, 2023, the Company had approximately $60.1 million in cash, cash equivalents, and marketable securities.

BARDA income consisted of funding from the Biomedical Advanced Research and Development Authority, under the Assistant Secretary for Preparedness and Response, within the U.S. Department of Health and Human Services, under ongoing USG Contract No. HHSO100201500028C.

Webcast and Conference Call Information

The Company will host a conference call to discuss the third quarter financial results and, recent business highlights on Thursday, November 9, 2023, at 1:30 p.m. Pacific Time. To access the live call via telephone, please register in advance using the link here. Upon registering, each participant will receive an email confirmation with dial-in numbers and a unique personal PIN that can be used to join the call. A simultaneous webcast of the call will be available via the Company’s website at https://ir.avitamedical.com.

About AVITA Medical, Inc.

AVITA Medical® is a regenerative medicine company leading the development and commercialization of devices and autologous cellular therapies for skin restoration. The RECELL® System technology platform, approved by the FDA for the treatment of thermal burn wounds and full-thickness skin defects and for repigmentation of stable depigmented vitiligo lesions, harnesses the regenerative properties of a patient’s own skin to create Spray-On Skin™ cells. Delivered at the point-of-care, RECELL enables improved clinical outcomes. RECELL is the catalyst of a new treatment paradigm and AVITA Medical is leveraging its proven and differentiated capabilities to develop first-in-class cellular therapies for multiple indications.

In international markets, our products are approved under the RECELL System brand to promote skin healing in a wide range of applications including burns, full-thickness skin defects, and vitiligo. The RECELL System is TGA-registered in Australia, received CE-mark approval in Europe and has PMDA approval in Japan.

To learn more, visit www.avitamedical.com.

Page 2

Forward-Looking Statements

This press release includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “intend,” “could,” “may,” “will,” “believe,” “estimate,” “look forward,” “forecast,” “goal,” “target,” “project,” “continue,” “outlook,” “guidance,” “future,” other words of similar meaning and the use of future dates. Forward-looking statements in this press release include, but are not limited to, statements concerning, among other things, our ongoing clinical trials and product development activities, regulatory approval of our products, the potential for future growth in our business, and our ability to achieve our key strategic, operational, and financial goal. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Each forward-looking statement contained in this press release is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Applicable risks and uncertainties include, among others, the timing and realization of regulatory approvals of our products; physician acceptance, endorsement, and use of our products; failure to achieve the anticipated benefits from approval of our products; the effect of regulatory actions; product liability claims; risks associated with international operations and expansion; and other business effects, including the effects of industry, economic or political conditions outside of the company’s control. Investors should not place considerable reliance on the forward-looking statements contained in this press release. Investors are encouraged to read our publicly available filings for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this release, and we undertake no obligation to update or revise any of these statements.

Investor & Media Contact:

Jessica Ekeberg

Phone +1-661-904-9269

invesotr@avitamedical.com

media@avitamedical.com

Authorized for release by the Chief Financial Officer of AVITA Medical, Inc.

Page 3

AVITA MEDICAL, INC.

Consolidated Balance Sheets

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

50,854 |

|

|

$ |

18,164 |

|

Marketable securities |

|

|

9,264 |

|

|

|

61,178 |

|

Accounts receivable, net |

|

|

5,875 |

|

|

|

3,515 |

|

BARDA receivables |

|

|

201 |

|

|

|

898 |

|

Prepaids and other current assets |

|

|

3,356 |

|

|

|

1,578 |

|

Inventory |

|

|

4,377 |

|

|

|

2,125 |

|

Total current assets |

|

|

73,927 |

|

|

|

87,458 |

|

Marketable securities long-term |

|

|

- |

|

|

|

6,930 |

|

Plant and equipment, net |

|

|

1,862 |

|

|

|

1,200 |

|

Operating lease right-of-use assets |

|

|

2,607 |

|

|

|

851 |

|

Corporate-owned life insurance ("COLI") asset |

|

|

1,923 |

|

|

|

1,238 |

|

Intangible assets, net |

|

|

459 |

|

|

|

465 |

|

Other long-term assets |

|

|

236 |

|

|

|

122 |

|

Total assets |

|

$ |

81,014 |

|

|

$ |

98,264 |

|

LIABILITIES, NON-QUALIFIED DEFERRED COMPENSATION PLAN SHARE AWARDS AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

3,019 |

|

|

|

3,002 |

|

Accrued wages and fringe benefits |

|

|

7,143 |

|

|

|

6,623 |

|

Current non-qualified deferred compensation liability |

|

|

333 |

|

|

|

78 |

|

Other current liabilities |

|

|

1,341 |

|

|

|

990 |

|

Total current liabilities |

|

|

11,836 |

|

|

|

10,693 |

|

Non-qualified deferred compensation liability |

|

|

3,361 |

|

|

|

1,270 |

|

Contract liabilities |

|

|

365 |

|

|

|

698 |

|

Operating lease liabilities, long term |

|

|

1,845 |

|

|

|

306 |

|

Total liabilities |

|

|

17,407 |

|

|

|

12,967 |

|

Non-qualified deferred compensation plan share awards |

|

|

629 |

|

|

|

557 |

|

Commitments and contingencies (Note 12) |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Common stock, $0.0001 par value per share, 200,000,000 shares authorized, 25,550,694 and 25,208,436 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively |

|

|

3 |

|

|

|

3 |

|

Preferred stock, $0.0001 par value per share, 10,000,000 shares authorized, no shares issued or outstanding at September 30, 2023 and December 31, 2022. |

|

|

- |

|

|

|

- |

|

Company common stock held by the non-qualified deferred compensation plan ("NQDC Plan") |

|

|

(1,290 |

) |

|

|

(127 |

) |

Additional paid-in capital |

|

|

347,192 |

|

|

|

339,825 |

|

Accumulated other comprehensive income |

|

|

7,977 |

|

|

|

7,627 |

|

Accumulated deficit |

|

|

(290,904 |

) |

|

|

(262,588 |

) |

Total stockholders' equity |

|

|

62,978 |

|

|

|

84,740 |

|

Total liabilities, non-qualified deferred compensation plan share awards and stockholders' equity |

|

$ |

81,014 |

|

|

$ |

98,264 |

|

|

|

|

|

|

|

|

Page 4

AVITA MEDICAL, INC.

Consolidated Statements of Operations

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three-Months Ended |

|

|

Nine-Months Ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2022 |

|

|

September 30, 2023 |

|

|

September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

13,645 |

|

|

$ |

9,092 |

|

|

$ |

35,948 |

|

|

$ |

24,966 |

|

Cost of sales |

|

|

(2,113 |

) |

|

|

(1,530 |

) |

|

|

(5,984 |

) |

|

|

(4,694 |

) |

Gross profit |

|

|

11,532 |

|

|

|

7,562 |

|

|

|

29,964 |

|

|

|

20,272 |

|

BARDA income |

|

|

212 |

|

|

|

904 |

|

|

|

1,369 |

|

|

|

2,189 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

|

(10,532 |

) |

|

|

(5,411 |

) |

|

|

(27,075 |

) |

|

|

(15,571 |

) |

General and administrative expenses |

|

|

(6,124 |

) |

|

|

(5,004 |

) |

|

|

(20,584 |

) |

|

|

(18,009 |

) |

Research and development expenses |

|

|

(4,394 |

) |

|

|

(3,799 |

) |

|

|

(14,056 |

) |

|

|

(10,478 |

) |

Total operating expenses |

|

|

(21,050 |

) |

|

|

(14,214 |

) |

|

|

(61,715 |

) |

|

|

(44,058 |

) |

Operating loss |

|

|

(9,306 |

) |

|

|

(5,748 |

) |

|

|

(30,382 |

) |

|

|

(21,597 |

) |

Interest expense |

|

|

(10 |

) |

|

|

(6 |

) |

|

|

(21 |

) |

|

|

(10 |

) |

Other income |

|

|

615 |

|

|

|

170 |

|

|

|

2,141 |

|

|

|

307 |

|

Loss before income taxes |

|

|

(8,701 |

) |

|

|

(5,584 |

) |

|

|

(28,262 |

) |

|

|

(21,300 |

) |

Income tax expense |

|

|

(11 |

) |

|

|

(4 |

) |

|

|

(54 |

) |

|

|

(12 |

) |

Net loss |

|

$ |

(8,712 |

) |

|

$ |

(5,588 |

) |

|

$ |

(28,316 |

) |

|

$ |

(21,312 |

) |

Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

$ |

(0.34 |

) |

|

$ |

(0.22 |

) |

|

$ |

(1.12 |

) |

|

$ |

(0.85 |

) |

Weighted-average common shares: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

25,401,754 |

|

|

|

25,006,995 |

|

|

|

25,281,920 |

|

|

|

24,972,331 |

|

Page 5

v3.23.3

Document And Entity Information

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

AVITA Medical, Inc.

|

| Entity Central Index Key |

0001762303

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-39059

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-1021707

|

| Entity Address, Address Line One |

28159 Avenue Stanford

|

| Entity Address, Address Line Two |

Suite 220

|

| Entity Address, City or Town |

Valencia

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91355

|

| City Area Code |

661

|

| Local Phone Number |

367-9170

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

RCEL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

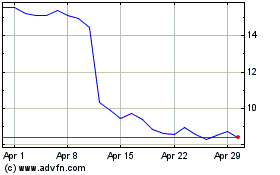

Avita Medical (NASDAQ:RCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avita Medical (NASDAQ:RCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024