- Financial Assets Division Reports

110% Growth in Operating Income for First Nine Months of 2023

-

Heritage Global Inc. (NASDAQ: HGBL) (“Heritage Global,” “HG” or

“the Company”), an asset services company specializing in financial

and industrial asset transactions, today reported financial results

for the third quarter and nine months ended September 30, 2023.

Heritage Global Chief Executive Officer Ross Dove commented, “We

had another solid quarter, as we continue to capitalize on the

opportunities we are seeing in our Industrial and Financial Asset

divisions. As we have previously mentioned, our business is

benefitting from strong tailwinds related to the challenging

economy, with an increased volume of assets coming to market as

consumer debt reaches record levels and companies downsize

operations.

“At Heritage Global Capital (HGC), the high volume of

charged-off portfolios drove strong growth in our loan activity,

and we closed the quarter with a loan book of $36 million,

representing a solid increase from the previous balance of $30

million at the end of the second quarter. Meanwhile, as consumer

collection rates revert back to pre-pandemic (and stimulus) levels,

we have increased the Company’s non-cash credit loss reserve by

$0.9 million, primarily to address a request to amend the existing

credit agreements with our largest borrower. Collections on the

balance of our loan portfolio, overall, are meeting or exceeding

minimum target levels. Overall, reported operating income was $2.8

million for the third quarter and earnings per share was $0.05,

after the impact of the reserve. Excluding the non-cash reserve,

consolidated net operating income was approximately $3.6 million

and earnings per share was $0.07.”

Third Quarter and First Nine Months 2023 Summary of Financial

Results:

($ in thousands, except per share

amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022

Operating income

$

2,769

$

3,474

$

9,764

$

7,973

Net income

$

1,977

$

2,300

$

7,585

$

5,523

Net income per share – diluted

$

0.05

$

0.06

$

0.20

$

0.15

(Non-GAAP Financial Measures) (1)

EBITDA

$

2,901

$

3,608

$

10,137

$

8,373

Adjusted EBITDA

$

3,076

$

3,778

$

10,719

$

8,757

(1)

EBITDA and Adjusted EBITDA are commonly

used non-GAAP financial measures utilized by management as a

supplemental tool to evaluate the underlying operating performance

of the Company on an ongoing basis and should be considered

together with Heritage Global’s GAAP financial measures.

Definitions and disclosures regarding non-GAAP financial

information including reconciliations are included at the end of

the press release.

“The fundamentals underlying our Financial Assets business

remain strong. Consumer debt has grown to historic levels which, in

turn, is driving significant growth in charged-off credit cards and

non-performing loans. Our Financial Assets division, which achieved

net operating income growth of 110% for the first nine months of

2023, is well positioned to continue to take advantage of the

macroeconomic tailwinds. In the short term, consumer repayment

speeds are slowing to more historical levels and we are working

together with our lending partners and borrowers to prudently

manage this transition, as needed. Long term, we believe the flow

of distressed financial assets is only going to increase and we

have built the relationships and have the right team in place to

secure additional brokerage contracts and specialty lending

opportunities as they come to market.

“Increased asset flow is also evident in our pipeline and

calendar for upcoming industrial auctions, as more businesses make

the decision to downsize operations with the corresponding closure

of operating facilities and offices, and more buyers are seeking

high quality used equipment. Our auction business has a longer

sales cycle as it is typically a few months from the time our

partners announce closures to their readiness to auction assets and

with our visibility today, we are optimistic about the strength of

our pipeline through the remainder of the year and beyond.

“We are focused on continuing the momentum we have built to date

in 2023 to deliver a strong close to the year. We take a long-term

view of our business and remain confident that with our solid

foundation, industry leading team and longstanding partnerships, we

are ideally suited to maximize the many opportunities we are seeing

to drive continued growth as we expand our leadership position and

market reach,” Mr. Dove concluded.

Third Quarter 2023 Highlights:

- The Company achieved operating income of $2.8 million for the

third quarter of 2023, as compared to operating income of $3.5

million in the third quarter of 2022. Excluding adjustments related

to the non-cash reserve, operating income was $3.6 million.

- Net income totaled $2.0 million, or $0.05 diluted earnings per

share for the third quarter of 2023, as compared to net income of

$2.3 million, or $0.06 diluted earnings per share in the prior-year

quarter. Excluding adjustments related to the non-cash reserve, net

income totaled $2.6 million and diluted earnings per share was

$0.07.

- EBITDA totaled $2.9 million in the third quarter of 2023 versus

EBITDA of $3.6 million in the third quarter of 2022 and Adjusted

EBITDA was $3.1 million compared to $3.8 million in the prior-year

quarter.

- Heritage Global maintains a strong balance sheet, with

stockholders’ equity of $56.4 million as of September 30, 2023,

compared to $48.3 million as of December 31, 2022. Net working

capital was $13.8 million at the end of the third quarter.

- On January 1, 2023, the Company adopted accounting

pronouncement ASC 326 which, among other items, requires a reserve

for potential credit losses. In accordance with the guidance of ASC

326, the Company increased its non-cash credit loss reserve within

its Specialty Lending segment by $0.9 million to $1.4 million, or

3.8% of outstanding balances.

- As of September 30, 2023, the Company’s total balance related

to investments in loans to buyers of charged-off and nonperforming

receivable portfolios was $35.9 million, of which $20.6 million is

classified as Notes Receivable and $15.3 million is classified as

Equity Method Investments.

Third Quarter Conference Call

Management will host a webcast and conference call today,

Thursday, November 9, 2023, at 5:00 pm ET to discuss financial

results for third quarter 2023. Analysts and investors may

participate via conference call using the following dial-in

information:

- 1-877-423-9813 (Domestic)

- 1-201-689-8573 (International)

In addition, individuals can use this link for telephone access

to the call via their web browser. The webcast link is available

here and will be available in the Investor Relations section of the

Company’s website. To listen to a live broadcast, go to the site at

least 10 minutes prior to the scheduled start time in order to

register.

Replay

A replay of the call will be available on the Company’s website

approximately three hours after the call ends through November 23,

2023. To access the replay, dial 1-844-512-2921 (domestic) or

1-412-317-6671 (international). The replay pin number is 13741453.

The replay can also be accessed on the Investor Relations section

of the Company’s website.

About Heritage Global Inc. (“HG”)

Heritage Global Inc. (NASDAQ: HGBL) values and monetizes

industrial & financial assets by providing acquisition,

disposition, valuation, and lending services for surplus and

distressed assets. This aids in facilitating the circular economy

by diverting useful industrial assets from landfills and operating

an ethical supply chain by overseeing post-sale account activity of

financial assets. Specialties consist of acting as an adviser, in

addition to acquiring or brokering turnkey manufacturing

facilities, surplus industrial machinery and equipment, industrial

inventories, real estate, charged-off account receivable

portfolios, through its two business units: Industrial Assets and

Financial Assets.

Definitions and Disclosures Regarding non-GAAP Financial

Information

The Company defines EBITDA as net income/loss plus depreciation

and amortization, interest and other expense, and provision for

income taxes. Adjusted EBITDA reflects EBITDA adjusted further to

eliminate the effects of stock-based compensation. Management uses

EBITDA and Adjusted EBITDA in assessing the Company’s results,

evaluating the Company’s performance and in reaching operating and

strategic decisions. Management believes that the presentation of

EBITDA and Adjusted EBITDA, when considered together with our GAAP

financial statements and the reconciliation to the most directly

comparable GAAP financial measure, is useful in providing investors

a more complete understanding of the factors and trends affecting

the underlying performance of the Company on a historical and

ongoing basis. The Company’s use of EBITDA and Adjusted EBITDA is

not meant to be, and should not be, considered in isolation or as a

substitute for, or superior to, any GAAP financial measure. You

should carefully evaluate the financial information, below, which

reconciles our GAAP reported net income to EBITDA and Adjusted

EBITDA for the periods presented (in thousands).

Forward-Looking Statements

This communication includes forward-looking statements based on

our current expectations and projections about future events. For

these statements, the Company claims the protection of the safe

harbor for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995. While the Company

believes the forward-looking statements contained in this

communication are accurate, these forward-looking statements

represent the Company’s beliefs only as of the date of this

communication, and there are a number of factors that could cause

actual events or results to differ materially from those indicated

by such forward-looking statements, including variability in

magnitude and timing of asset liquidation transactions, the impact

of changes in the U.S. national and global economies, and interest

rate and foreign exchange rate sensitivity, as well as other

factors beyond the Company’s control. Unless required by law, we

undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. In light of these risks, uncertainties and

assumptions, you should not place undue reliance on these

forward-looking statements, which speak only as of the date of this

release. For more details on factors that could affect these

expectations, please see our filings with the Securities and

Exchange Commission.

-financial tables follow-

HERITAGE GLOBAL INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(In thousands of US dollars,

except share and per share amounts)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2022

2023

2022

Revenues:

Services revenue

$

9,985

$

7,349

$

30,040

$

16,112

Asset sales

5,566

5,312

15,221

16,971

Total revenues

15,551

12,661

45,261

33,083

Operating costs and expenses:

Cost of services revenue

2,423

2,051

6,570

3,715

Cost of asset sales

3,413

3,015

9,683

12,048

Selling, general and administrative

6,806

5,693

19,546

14,907

Depreciation and amortization

132

134

373

400

Total operating costs and expenses

12,774

10,893

36,172

31,070

Earnings of equity method investments

(8

)

1,706

675

5,960

Operating income

2,769

3,474

9,764

7,973

Interest expense, net

(56

)

(21

)

(225

)

(96

)

Income before income tax expense

2,713

3,453

9,539

7,877

Income tax expense

736

1,153

1,954

2,354

Net income

$

1,977

$

2,300

$

7,585

$

5,523

Weighted average common shares outstanding

– basic

36,742,018

36,084,696

36,675,838

36,014,439

Weighted average common shares outstanding

– diluted

37,647,321

37,221,430

37,605,363

36,872,977

Net income per share – basic

$

0.05

$

0.06

$

0.21

$

0.15

Net income per share – diluted

$

0.05

$

0.06

$

0.20

$

0.15

HERITAGE GLOBAL INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands of US dollars,

except share and per share amounts)

September 30, 2023

December 31, 2022

ASSETS

(unaudited)

Current assets:

Cash and cash equivalents

$

15,578

$

12,667

Accounts receivable, net

2,889

988

Current portion of notes receivable,

net

10,284

4,505

Inventory – equipment

4,446

4,619

Other current assets

681

1,113

Total current assets

33,878

23,892

Non-current portion of notes receivable,

net

10,275

4,245

Equity method investments

16,131

13,973

Right-of-use assets

2,698

2,776

Property and equipment, net

1,728

1,571

Intangible assets, net

3,851

4,144

Goodwill

7,446

7,446

Deferred tax assets

8,363

9,449

Other assets

68

64

Total assets

$

84,438

$

67,560

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable and accrued

liabilities

$

5,808

$

8,924

Payables to sellers

10,184

3,188

Current portion of third party debt

3,303

3,411

Current portion of lease liabilities

783

703

Total current liabilities

20,078

16,226

Non-current portion of third party

debt

5,941

871

Non-current portion of lease

liabilities

2,021

2,164

Total liabilities

28,040

19,261

Stockholders’ equity:

Preferred stock, $10.00 par value,

authorized 10,000,000 shares; issued and outstanding 563 and 565

shares of Series N as of September 30, 2023 and December 31, 2022,

respectively; with liquidation preference over common stockholders

equivalent to $1,000 per share

6

6

Common stock, $0.01 par value, authorized

300,000,000 shares; issued 37,151,924 and 36,932,177 shares as of

September 30, 2023 and December 31, 2022, respectively; and

outstanding 36,908,456 and 36,688,709 shares as September 30, 2023

and December 31, 2022, respectively

372

369

Additional paid-in capital

294,331

293,589

Accumulated deficit

(237,916

)

(245,270

)

Treasury stock at cost, 243,468 shares as

of September 30, 2023 and December 31, 2022

(395

)

(395

)

Total stockholders’ equity

56,398

48,299

Total liabilities and stockholders’

equity

$

84,438

$

67,560

– EBITDA and Adjusted EBITDA (non-GAAP

measures) reconciliation follows –

HERITAGE GLOBAL INC.

Reconciliation of EBITDA and

Adjusted EBITDA (Non-GAAP Measures)

(In thousands of US dollars)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2022

2023

2022

Net income

$

1,977

$

2,300

$

7,585

$

5,523

Add back:

Depreciation and amortization

132

134

373

400

Interest expense, net

56

21

225

96

Income tax expense

736

1,153

1,954

2,354

EBITDA

2,901

3,608

10,137

8,373

Management add back:

Stock based compensation

175

170

582

384

Adjusted EBITDA

$

3,076

$

3,778

$

10,719

$

8,757

HERITAGE GLOBAL INC.

Reconciliation of Credit Loss

Reserve Adjustments, Net

(In thousands of US dollars)

(unaudited)

Three Months Ended September

30,

Actual

Add-back: Credit Loss Reserve

Adjustments, Net

Non-GAAP Financial

Measure

Net operating income

$

2,769

$

841

$

3,610

Net income

$

1,977

$

621

$

2,598

Net income per share - diluted

$

0.05

$

0.02

$

0.07

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231109289514/en/

Investor Relations: John Nesbett/Jennifer Belodeau IMS

Investor Relations 203/972.9200 InvestorRelations@hginc.com

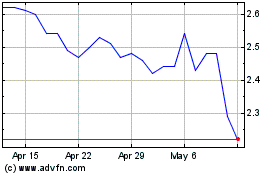

Heritage Global (NASDAQ:HGBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

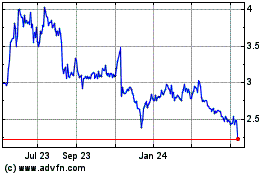

Heritage Global (NASDAQ:HGBL)

Historical Stock Chart

From Apr 2023 to Apr 2024