false

0001642380

0001642380

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): November 9, 2023

Oncocyte

Corporation

(Exact

name of registrant as specified in its charter)

| California |

|

1-37648 |

|

27-1041563 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

15

Cushing

Irvine,

California 92618

(Address

of principal executive offices) (Zip code)

(949)

409-7600

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Exchange Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common Stock, no par value |

|

OCX |

|

The Nasdaq Stock Market

LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

November 9, 2023, Oncocyte Corporation (“we,” “us,” “our,” the “Company” or “Oncocyte”)

issued a press release announcing our financial results for the three and nine months ended September

30, 2023. A copy of the press release is furnished as Exhibit 99.1, which, in its entirety, is incorporated herein by reference.

The

information in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished and shall not be

deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section. Such information shall not be deemed incorporated by reference into any filing

of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless

of any general incorporation language in such filing, except as otherwise expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ONCOCYTE CORPORATION |

| |

|

| Date: November 9, 2023 |

By: |

/s/

Joshua Riggs |

| |

|

Joshua Riggs |

| |

|

President and Chief Executive Officer |

Exhibit 99.1

ONCOCYTE

REPORTS THIRD QUARTER 2023 FINANCIAL RESULTS

-Launching

First Products in 1H 2024-

-Conference

Call on Thursday, November 9, 2023 at 5:00 a.m. PT / 8:00 a.m. ET-

IRVINE,

Calif., November 9, 2023 — Oncocyte Corporation (Nasdaq: OCX), a precision diagnostics company, today reported financial

results for the third quarter of 2023, ended September 30, 2023.

Third

Quarter and Recent Highlights

| ● | VitaGraft™

Kidney, the Company’s kidney transplant diagnostic test, received a positive coverage

decision from CMS coverage; commercial revenue is expected beginning in 1H 2024. |

| ● | Significant

new clinical data was presented at the European Society of Organ Transplant Conference demonstrating

the VitaGraft assay detects antibody-mediated transplant rejection 10 months sooner than

commonly used monitoring protocols (p<0.001). |

| ● | Cash

burn declined to $3.6 million and is projected to remain below a $5 million quarterly average. |

| ● | $14.2

million in cash, cash equivalents, and marketable securities as of September 30, 2023. |

| ● | VitaGraft

Liver, Oncocyte’s second transplant test, continues under review for CMS coverage at

MolDX. |

Josh

Riggs, CEO of Oncocyte, commented, “Oncocyte received a positive coverage decision from CMS during the third quarter for the Company’s

innovative VitaGraft Kidney. This is the test that was recently demonstrated to detect signs of transplant organ rejection a full 10

months earlier than standard of care methods. Going into next year we expect the startup of revenues from the VitaGraft Kidney test and

our RUO product, GraftAssure.”

“Financially,

we reduced our cash burn to $3.6 million in the third quarter, the lowest level in several years and a reflection of the sharp reductions

in non-revenue related activities that we instituted earlier in the year. Going forward, we expect to maintain this lower level of cash

burn and remain below $5 million on a quarterly basis. With $14.2 million in cash, cash equivalents, and marketable securities, a declining

cash burn, and multiple products nearing commercialization, we believe that Oncocyte is well positioned for growth in 2024 and the years

beyond,” concluded Mr. Riggs.

Third

Quarter 2023 Financial Results

Consolidated

revenue for the third quarter of 2023 was approximately $0.4 million primarily due to increased revenue from Pharma Services. Cost of

revenue was approximately $0.2 million.

Net

consolidated operating loss for the three months ended September 30, 2023, was $6.5 million compared to a net consolidated operating

loss of $1.7 million for the third quarter of 2022, which included a positive non-cash benefit of $6.1 million for change in fair value

of contingent consideration.

Research

and Development expense for the third quarter was $2.2 million compared to $1.5 million in the third quarter of 2022, an increase of

48%, driven by continued focused investment in developing manufacturable versions of assays including DetermaIOTM, VitaGraft,

and DetermaCNITM.

General

and Administrative expense for the third quarter was $2.5 million compared to $5.7 million in the year ago period, a decrease of 56%,

primarily due to decreased stock-based compensation and personnel expenses.

Sales

and Marketing expense for the third quarter was $0.7 million compared to $0.4 million in the comparable period of 2022, an increase of

76%. The increase was driven by a continued ramp in sales, marketing and commercialization activities related to the recent coverage

decision and expected upcoming launch of VitaGraft Kidney.

For

Oncocyte’s complete financial results for the third quarter ended September 30, 2023, see the Company’s Quarterly Form 10-Q

to be filed with the Securities and Exchange Commission on November 9, 2023.

Webcast

and Conference Call Information

Oncocyte

will host a conference call to discuss the third quarter 2023 financial results prior to market open on Thursday, November 9, 2023 at

5:00 a.m. Pacific Time / 8:00 a.m. Eastern Time. The live call may be accessed via telephone by dialing toll free (888) 550-5422 for

both domestic and international callers. Once dialed in, ask to be joined to the Oncocyte Corporation call.

The

live webinar of the call may be accessed by visiting the “Events & Presentation” section of the Company’s website

at https://investors.oncocyte.com.

About

Oncocyte

Oncocyte

is a precision diagnostics company. The Company’s tests are designed to help provide clarity and confidence to physicians and their

patients. DetermaIO™ is a gene expression test that assesses the tumor microenvironment in order to predict response to immunotherapies.

VitaGraft™ is a blood-based solid organ transplantation monitoring test, and pipeline test DetermaCNI™ is a blood-based monitoring

tool for monitoring therapeutic efficacy. For more information, visit www.oncocyte.com

DetermaIO™,

DetermaCNI™, and VitaGraft™ are trademarks of Oncocyte Corporation.

Forward-Looking

Statements

Any

statements that are not historical fact (including, but not limited to statements that contain words such as “will,” “believes,”

“plans,” “anticipates,” “expects,” “estimates,” “may,” and similar expressions)

are forward-looking statements. These statements include those pertaining to, among other things, expected revenues and commercial launch

of VitaGraft Kidney and GraftAssure in 2024, plans to maintain a cash burn of below $5 million on a quarterly basis, the belief that

Oncocyte is well positioned for growth in 2024 and the years beyond, and other statements about the future expectations, beliefs, goals,

plans, or prospects expressed by management. Forward-looking statements involve risks and uncertainties, including, without limitation,

the potential impact of COVID-19 on Oncocyte or its subsidiaries’ financial and operational results, risks inherent in the development

and/or commercialization of diagnostic tests or products, uncertainty in the results of clinical trials, changes to regulatory oversight

and/or regulatory approvals, the capacity of Oncocyte’s third-party supplied blood sample analytic system to provide consistent

and precise analytic results on a commercial scale, potential interruptions to supply chains, the need and ability to obtain future capital,

maintenance of intellectual property rights in all applicable jurisdictions, obligations to third parties with respect to licensed or

acquired technology and products, the need to obtain third party reimbursement for patients’ use of any diagnostic tests. Oncocyte

or its subsidiaries commercialize in applicable jurisdictions, and risks inherent in strategic transactions such as the potential failure

to realize anticipated benefits, legal, regulatory or political changes in the applicable jurisdictions, accounting and quality controls,

potential greater than estimated allocations of resources to develop and commercialize technologies, or potential failure to maintain

any laboratory accreditation or certification. Actual results may differ materially from the results anticipated in these forward-looking

statements and accordingly such statements should be evaluated together with the many uncertainties that affect the business of Oncocyte,

particularly those mentioned in the “Risk Factors” and other cautionary statements found in Oncocyte’s Securities and

Exchange Commission (SEC) filings, which are available from the SEC’s website. You are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date on which they were made. Oncocyte undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

CONTACT:

Stephanie

Prince

PCG

Advisory

(646)

863-6341

sprince@pcgadvisory.com

-Tables

Follow -

ONCOCYTE

CORPORATION

CONDENSED

CONSOLIDATED BALANCE SHEETS

(In

thousands, except per share data)

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 13,783 | | |

$ | 19,993 | |

| Accounts receivable, net of allowance for credit losses of $178 and $154, respectively | |

| 1,882 | | |

| 2,012 | |

| Marketable equity securities | |

| 441 | | |

| 433 | |

| Prepaid expenses and other current assets | |

| 672 | | |

| 977 | |

| Assets held for sale | |

| 139 | | |

| - | |

| Current assets of discontinuing operations | |

| - | | |

| 2,121 | |

| Total current assets | |

| 16,917 | | |

| 25,536 | |

| | |

| | | |

| | |

| NONCURRENT ASSETS | |

| | | |

| | |

| Right-of-use and financing lease assets, net | |

| 1,757 | | |

| 2,088 | |

| Machinery and equipment, net, and construction in progress | |

| 4,076 | | |

| 8,763 | |

| Intangible assets, net | |

| 56,617 | | |

| 61,633 | |

| Restricted cash | |

| 1,700 | | |

| 1,700 | |

| Other noncurrent assets | |

| 520 | | |

| 371 | |

| TOTAL ASSETS | |

$ | 81,587 | | |

$ | 100,091 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 1,136 | | |

$ | 1,253 | |

| Accrued compensation | |

| 1,722 | | |

| 1,771 | |

| Accrued royalties | |

| 1,116 | | |

| 2,022 | |

| Accrued expenses and other current liabilities | |

| 826 | | |

| 1,817 | |

| Accrued severance from acquisition | |

| 2,314 | | |

| 2,314 | |

| Accrued liabilities from acquisition | |

| 109 | | |

| 109 | |

| Right-of-use and financing lease liabilities, current | |

| 720 | | |

| 815 | |

| Current liabilities of discontinuing operations | |

| 90 | | |

| 2,005 | |

| Total current liabilities | |

| 8,033 | | |

| 12,106 | |

| | |

| | | |

| | |

| NONCURRENT LIABILITIES | |

| | | |

| | |

| Right-of-use and financing lease liabilities, noncurrent | |

| 2,354 | | |

| 2,729 | |

| Contingent consideration liabilities | |

| 28,715 | | |

| 45,662 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 39,102 | | |

| 60,497 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Series A Redeemable Convertible Preferred Stock, no par value; stated value

$1,000 per share; 5 and 6 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively; aggregate liquidation

preference of $5,217 and $6,091 as of September 30, 2023 and December 31, 2022, respectively | |

| 4,923 | | |

| 5,302 | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Preferred stock, no par value, 5,000 shares authorized; no shares issued and

outstanding | |

| - | | |

| - | |

Common stock, no par value, 230,000 shares authorized; 8,261 and 5,932 shares

issued and outstanding at

September 30, 2023 and December 31, 2022, respectively | |

| 309,995 | | |

| 294,929 | |

| Accumulated other comprehensive income | |

| 32 | | |

| 39 | |

| Accumulated deficit | |

| (272,465 | ) | |

| (260,676 | ) |

| Total shareholders’ equity | |

| 37,562 | | |

| 34,292 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 81,587 | | |

$ | 100,091 | |

ONCOCYTE

CORPORATION

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In

thousands, except per share data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Net revenue | |

$ | 429 | | |

$ | 67 | | |

$ | 1,189 | | |

$ | 684 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 159 | | |

| 314 | | |

| 593 | | |

| 602 | |

| Cost of revenues – amortization of acquired intangibles | |

| 22 | | |

| 22 | | |

| 66 | | |

| 73 | |

| Gross profit | |

| 248 | | |

| (269 | ) | |

| 530 | | |

| 9 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,185 | | |

| 1,472 | | |

| 6,747 | | |

| 5,923 | |

| Sales and marketing | |

| 713 | | |

| 405 | | |

| 2,213 | | |

| 798 | |

| General and administrative | |

| 2,487 | | |

| 5,702 | | |

| 9,430 | | |

| 16,794 | |

| Change in fair value of contingent consideration | |

| (435 | ) | |

| (6,142 | ) | |

| (16,947 | ) | |

| (17,157 | ) |

| Impairment losses | |

| 1,811 | | |

| - | | |

| 6,761 | | |

| - | |

| Loss on disposal and held for sale assets | |

| - | | |

| - | | |

| 1,283 | | |

| - | |

| Total operating expenses | |

| 6,761 | | |

| 1,437 | | |

| 9,487 | | |

| 6,358 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (6,513 | ) | |

| (1,706 | ) | |

| (8,957 | ) | |

| (6,349 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expenses): | |

| | | |

| | | |

| | | |

| | |

| Interest income (expense), net | |

| 117 | | |

| (14 | ) | |

| 108 | | |

| (65 | ) |

| Unrealized (loss) gain on marketable equity securities | |

| (89 | ) | |

| (160 | ) | |

| 8 | | |

| (485 | ) |

| Other (expenses) income, net | |

| (4 | ) | |

| 62 | | |

| (22 | ) | |

| 304 | |

| Total other income (expenses) | |

| 24 | | |

| (112 | ) | |

| 94 | | |

| (246 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations | |

| (6,489 | ) | |

| (1,818 | ) | |

| (8,863 | ) | |

| (6,595 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from discontinuing operations | |

| - | | |

| (7,515 | ) | |

| (2,926 | ) | |

| (21,329 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (6,489 | ) | |

$ | (9,333 | ) | |

$ | (11,789 | ) | |

$ | (27,924 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Less: dividends and accretion of Series

A

redeemable convertible preferred stock | |

| (198 | ) | |

| (294 | ) | |

| (739 | ) | |

| (294 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to common stockholders | |

$ | (6,687 | ) | |

$ | (9,627 | ) | |

$ | (12,528 | ) | |

$ | (28,218 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss from continuing operations per share: basic and diluted | |

$ | (0.79 | ) | |

$ | (0.31 | ) | |

$ | (1.19 | ) | |

$ | (1.22 | ) |

| Net loss from discontinuing operations per share: basic and diluted | |

$ | - | | |

$ | (1.27 | ) | |

$ | (0.39 | ) | |

$ | (3.94 | ) |

| Net loss attributable to common stockholders per share: basic and diluted | |

$ | (0.81 | ) | |

$ | (1.62 | ) | |

$ | (1.68 | ) | |

$ | (5.22 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding: basic and diluted | |

| 8,256 | | |

| 5,931 | | |

| 7,446 | | |

| 5,408 | |

Oncocyte

Corporation

Reconciliation

of Non-GAAP Financial Measure

Consolidated

Adjusted Loss from Operations

Note:

In addition to financial results determined in accordance with U.S. generally accepted accounting principles (GAAP), this press release

also includes a non-GAAP financial measure (as defined under SEC Regulation G). We believe the adjusted amounts are more representative

of our ongoing performance. The following is a reconciliation of the non-GAAP measure to the most directly comparable GAAP measure:

| | |

For the Three Months Ended | |

| | |

September 30, | | |

June 30, | | |

September 30, | |

| | |

2023 | | |

2023 | | |

2022 | |

| | |

(unaudited) | | |

(unaudited) | | |

(unaudited) | |

| | |

| | |

(In thousands) | | |

| |

| Consolidated GAAP loss from operations | |

$ | (6,513 | ) | |

$ | (8,294 | ) | |

$ | (1,706 | ) |

| Stock-based compensation expense | |

| 608 | | |

| 834 | | |

| 3,181 | |

| Change in fair value of contingent consideration | |

| (435 | ) | |

| 1,795 | | |

| (6,142 | ) |

| Severance charge | |

| (7 | ) | |

| 604 | | |

| 1,046 | |

| Depreciation and amortization expense | |

| 426 | | |

| 457 | | |

| 1,367 | |

| Impairment losses | |

| 1,811 | | |

| - | | |

| - | |

| Consolidated Non-GAAP loss from operations, as adjusted | |

$ | (4,110 | ) | |

$ | (4,604 | ) | |

$ | (2,254 | ) |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

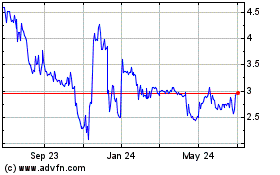

Oncocyte (NASDAQ:OCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

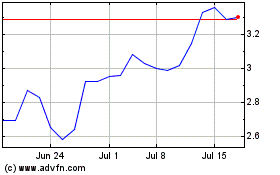

Oncocyte (NASDAQ:OCX)

Historical Stock Chart

From Apr 2023 to Apr 2024