0001757715

Aterian, Inc.

false

--12-31

Q3

2023

0.0001

0.0001

500,000,000

500,000,000

80,752,290

80,752,290

89,132,183

89,132,183

3.1

3

10

1

1

4

3

10

6,902,816

On March 20, 2023, the Company made certain leadership changes in our essential oil business resulting in a change in strategy and outlook for the business which will result in a reduced portfolio offering. This reduction in the portfolio will be impactful to our essential oil business's future revenues and profitability and as a result the Company made revisions to our internal forecasts. The Company concluded that this change was an interim triggering event for the three months ending March 31, 2023 indicating the carrying value of our essential oil business's long-lived assets including trademarks may not be recoverable. Accordingly, the Company performed an interim impairment test of the trademark and assessed the recoverability of the related intangible assets by using level 3 inputs and comparing the carrying value of an asset group to the net undiscounted cash flow expected to be generated. The recoverability test indicated that certain definite-live trademark intangible assets were impaired. The Company concluded the carrying value of the trademark exceeded its estimated fair value which was determined utilizing the relief-from-royalty method to determine discounted projected future cash flows which resulted in an impairment charge. The Company recorded an intangible impairment charge of $16.7 million in the three months ending March 31, 2023 within impairment loss on intangibles on the condensed consolidated statement of operations.

The Company evaluated current economic conditions during 2022, including the impact of the Federal Reserve further increasing the risk-free interest rate, as well as the inflationary pressure on product and labor costs and operational impacts attributable to continued global supply chain disruptions. The Company believed that these conditions were factors in our market capitalization falling below the book value of net assets during the fiscal quarters ending March 31, 2022 and September 30, 2022. Accordingly, the Company concluded a triggering event had occurred in each of these periods and performed interim goodwill impairment analyses. As a result, the Company recorded a goodwill impairment charge of approximately $29.0 million and $90.9 during the three months ended March 31, 2022 and September 30, 2022, respectively. On October 4, 2022, the Company acquired Step and Go, a brand in the health and Wellness category, for $0.7 million. As part of the purchase price allocation of the acquisition, $0.5 million was attributed to goodwill. As our market capitalization was further reduced below net assets as of December 31, 2022, we concluded a triggering event has occurred to test goodwill, an impairment loss on goodwill of $0.5 million was recorded for the three months ended December 31, 2022, which is included in impairment loss on goodwill in the Consolidated Statement of Operations for the year-ended December 31, 2022.

Certain asset groups experienced a significant decrease in sales and contribution margin through September 30, 2022. This was considered an interim triggering event for the three months ended September 30, 2022. Based on the analysis of comparing the undiscounted cash flow to the carrying value of the asset group, one group tested indicated that the assets may not be recoverable. For this asset group, the Company compared the fair value to the carrying amount of the asset group and recorded an intangible impairment charge of $3.1 million for the year-ended December 31, 2022.

00017577152023-01-012023-09-30

xbrli:shares

00017577152023-11-01

thunderdome:item

iso4217:USD

00017577152022-12-31

00017577152023-09-30

iso4217:USDxbrli:shares

00017577152022-07-012022-09-30

00017577152023-07-012023-09-30

00017577152022-01-012022-09-30

0001757715us-gaap:CommonStockMember2022-06-30

0001757715us-gaap:AdditionalPaidInCapitalMember2022-06-30

0001757715us-gaap:RetainedEarningsMember2022-06-30

0001757715us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-30

00017577152022-06-30

0001757715us-gaap:CommonStockMember2022-07-012022-09-30

0001757715us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-30

0001757715us-gaap:RetainedEarningsMember2022-07-012022-09-30

0001757715us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-30

0001757715us-gaap:CommonStockMember2022-09-30

0001757715us-gaap:AdditionalPaidInCapitalMember2022-09-30

0001757715us-gaap:RetainedEarningsMember2022-09-30

0001757715us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-30

00017577152022-09-30

0001757715us-gaap:CommonStockMember2023-06-30

0001757715us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001757715us-gaap:RetainedEarningsMember2023-06-30

0001757715us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

00017577152023-06-30

0001757715us-gaap:CommonStockMember2023-07-012023-09-30

0001757715us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0001757715us-gaap:RetainedEarningsMember2023-07-012023-09-30

0001757715us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-30

0001757715us-gaap:CommonStockMember2023-09-30

0001757715us-gaap:AdditionalPaidInCapitalMember2023-09-30

0001757715us-gaap:RetainedEarningsMember2023-09-30

0001757715us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

0001757715us-gaap:CommonStockMember2021-12-31

0001757715us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001757715us-gaap:RetainedEarningsMember2021-12-31

0001757715us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31

00017577152021-12-31

0001757715us-gaap:CommonStockMember2022-01-012022-09-30

0001757715us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-30

0001757715us-gaap:RetainedEarningsMember2022-01-012022-09-30

0001757715us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-30

0001757715us-gaap:CommonStockMember2022-12-31

0001757715us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001757715us-gaap:RetainedEarningsMember2022-12-31

0001757715us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0001757715us-gaap:CommonStockMember2023-01-012023-09-30

0001757715us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-30

0001757715us-gaap:RetainedEarningsMember2023-01-012023-09-30

0001757715us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-30

xbrli:pure

00017577152023-05-092023-05-09

0001757715us-gaap:OtherNoncurrentAssetsMember2022-12-31

0001757715us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:LetterOfCreditMember2022-12-31

0001757715us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberater:MidcapCreditFacilityMember2022-12-31

0001757715us-gaap:OtherNoncurrentAssetsMember2023-09-30

0001757715us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:LetterOfCreditMember2023-09-30

0001757715us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberater:MidcapCreditFacilityMember2023-09-30

0001757715ater:AccruedLiabilityMember2022-12-31

0001757715ater:AccruedLiabilityMember2023-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMembersrt:NorthAmericaMember2022-07-012022-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMembersrt:NorthAmericaMember2022-07-012022-09-30

0001757715srt:NorthAmericaMember2022-07-012022-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMemberater:OtherThanNorthAmericaMember2022-07-012022-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMemberater:OtherThanNorthAmericaMember2022-07-012022-09-30

0001757715ater:OtherThanNorthAmericaMember2022-07-012022-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMember2022-07-012022-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMember2022-07-012022-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMembersrt:NorthAmericaMember2023-07-012023-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMembersrt:NorthAmericaMember2023-07-012023-09-30

0001757715srt:NorthAmericaMember2023-07-012023-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMemberater:OtherThanNorthAmericaMember2023-07-012023-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMemberater:OtherThanNorthAmericaMember2023-07-012023-09-30

0001757715ater:OtherThanNorthAmericaMember2023-07-012023-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMember2023-07-012023-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMember2023-07-012023-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMembersrt:NorthAmericaMember2022-01-012022-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMembersrt:NorthAmericaMember2022-01-012022-09-30

0001757715srt:NorthAmericaMember2022-01-012022-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMemberater:OtherThanNorthAmericaMember2022-01-012022-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMemberater:OtherThanNorthAmericaMember2022-01-012022-09-30

0001757715ater:OtherThanNorthAmericaMember2022-01-012022-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMember2022-01-012022-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMember2022-01-012022-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMembersrt:NorthAmericaMember2023-01-012023-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMembersrt:NorthAmericaMember2023-01-012023-09-30

0001757715srt:NorthAmericaMember2023-01-012023-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMemberater:OtherThanNorthAmericaMember2023-01-012023-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMemberater:OtherThanNorthAmericaMember2023-01-012023-09-30

0001757715ater:OtherThanNorthAmericaMember2023-01-012023-09-30

0001757715us-gaap:SalesChannelDirectlyToConsumerMember2023-01-012023-09-30

0001757715us-gaap:SalesChannelThroughIntermediaryMember2023-01-012023-09-30

0001757715ater:HeatingCoolingAndAirQualityMember2022-07-012022-09-30

0001757715ater:HeatingCoolingAndAirQualityMember2023-07-012023-09-30

0001757715ater:KitchenAppliancesMember2022-07-012022-09-30

0001757715ater:KitchenAppliancesMember2023-07-012023-09-30

0001757715ater:HealthAndBeautyMember2022-07-012022-09-30

0001757715ater:HealthAndBeautyMember2023-07-012023-09-30

0001757715ater:PersonalProtectiveEquipmentMember2022-07-012022-09-30

0001757715ater:PersonalProtectiveEquipmentMember2023-07-012023-09-30

0001757715ater:CookwareKitchenToolsAndGadgetsMember2022-07-012022-09-30

0001757715ater:CookwareKitchenToolsAndGadgetsMember2023-07-012023-09-30

0001757715ater:HomeOfficeMember2022-07-012022-09-30

0001757715ater:HomeOfficeMember2023-07-012023-09-30

0001757715ater:HousewaresMember2022-07-012022-09-30

0001757715ater:HousewaresMember2023-07-012023-09-30

0001757715ater:EssentialOilsAndRelatedAccessoriesMember2022-07-012022-09-30

0001757715ater:EssentialOilsAndRelatedAccessoriesMember2023-07-012023-09-30

0001757715us-gaap:ProductAndServiceOtherMember2022-07-012022-09-30

0001757715us-gaap:ProductAndServiceOtherMember2023-07-012023-09-30

0001757715ater:HeatingCoolingAndAirQualityMember2022-01-012022-09-30

0001757715ater:HeatingCoolingAndAirQualityMember2023-01-012023-09-30

0001757715ater:KitchenAppliancesMember2022-01-012022-09-30

0001757715ater:KitchenAppliancesMember2023-01-012023-09-30

0001757715ater:HealthAndBeautyMember2022-01-012022-09-30

0001757715ater:HealthAndBeautyMember2023-01-012023-09-30

0001757715ater:PersonalProtectiveEquipmentMember2022-01-012022-09-30

0001757715ater:PersonalProtectiveEquipmentMember2023-01-012023-09-30

0001757715ater:CookwareKitchenToolsAndGadgetsMember2022-01-012022-09-30

0001757715ater:CookwareKitchenToolsAndGadgetsMember2023-01-012023-09-30

0001757715ater:HomeOfficeMember2022-01-012022-09-30

0001757715ater:HomeOfficeMember2023-01-012023-09-30

0001757715ater:HousewaresMember2022-01-012022-09-30

0001757715ater:HousewaresMember2023-01-012023-09-30

0001757715ater:EssentialOilsAndRelatedAccessoriesMember2022-01-012022-09-30

0001757715ater:EssentialOilsAndRelatedAccessoriesMember2023-01-012023-09-30

0001757715us-gaap:ProductAndServiceOtherMember2022-01-012022-09-30

0001757715us-gaap:ProductAndServiceOtherMember2023-01-012023-09-30

00017577152023-01-012023-03-31

0001757715ater:PaperBusinessAndKitchenApplianceBusinessMember2023-04-012023-06-30

0001757715us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2022-12-31

0001757715us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2022-12-31

0001757715us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2022-12-31

0001757715us-gaap:FairValueInputsLevel1Memberater:RestrictedCashMember2022-12-31

0001757715us-gaap:FairValueInputsLevel2Memberater:RestrictedCashMember2022-12-31

0001757715us-gaap:FairValueInputsLevel3Memberater:RestrictedCashMember2022-12-31

0001757715us-gaap:FairValueInputsLevel1Memberater:WarrantLiabilityMember2022-12-31

0001757715us-gaap:FairValueInputsLevel2Memberater:WarrantLiabilityMember2022-12-31

0001757715us-gaap:FairValueInputsLevel3Memberater:WarrantLiabilityMember2022-12-31

0001757715us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2023-09-30

0001757715us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2023-09-30

0001757715us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2023-09-30

0001757715us-gaap:FairValueInputsLevel1Memberater:RestrictedCashMember2023-09-30

0001757715us-gaap:FairValueInputsLevel2Memberater:RestrictedCashMember2023-09-30

0001757715us-gaap:FairValueInputsLevel3Memberater:RestrictedCashMember2023-09-30

0001757715us-gaap:FairValueInputsLevel1Memberater:WarrantLiabilityMember2023-09-30

0001757715us-gaap:FairValueInputsLevel2Memberater:WarrantLiabilityMember2023-09-30

0001757715us-gaap:FairValueInputsLevel3Memberater:WarrantLiabilityMember2023-09-30

0001757715ater:WarrantLiabilityMember2021-12-31

0001757715ater:WarrantLiabilityMember2022-01-012022-12-31

0001757715ater:WarrantLiabilityMember2022-12-31

0001757715ater:WarrantLiabilityMember2023-01-012023-09-30

0001757715ater:WarrantLiabilityMember2023-09-30

utr:Y

0001757715us-gaap:LineOfCreditMemberater:MidcapCreditFacilityMember2021-12-222021-12-22

0001757715us-gaap:LineOfCreditMemberater:MidcapCreditFacilityMember2021-12-22

0001757715ater:MidcapWarrantMember2021-12-22

0001757715ater:TerminatedNotesMember2021-12-22

0001757715us-gaap:LineOfCreditMemberater:MidcapCreditFacilityMemberater:TermSecuredOvernightFinancingRateMember2021-12-222021-12-22

0001757715us-gaap:LineOfCreditMemberater:MidcapCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2021-12-222021-12-22

0001757715ater:MidcapCreditFacilityMember2022-12-31

0001757715ater:MidcapCreditFacilityMember2023-09-30

0001757715ater:SecuritiesPurchaseAgreementMember2022-03-012022-03-01

0001757715ater:SecuritiesPurchaseAgreementMember2022-03-01

0001757715ater:PrefundedWarrantsMemberater:SecuritiesPurchaseAgreementMember2022-03-01

0001757715ater:CommonStockWarrantsMemberater:SecuritiesPurchaseAgreementMember2022-03-01

00017577152022-03-01

0001757715ater:RegisteredDirectOfferingMemberater:SeptemberPurchaseAgreementsMember2022-09-292022-09-29

0001757715ater:RegisteredDirectOfferingMemberater:SeptemberPurchaseAgreementsMember2022-09-29

0001757715ater:RegisteredDirectOfferingMemberater:AccreditedPurchasersMemberater:SeptemberPurchaseAgreementsMember2022-09-292022-09-29

0001757715ater:CommonStockWarrantsMemberater:RegisteredDirectOfferingMemberater:AccreditedPurchasersMemberater:SeptemberPurchaseAgreementsMember2022-09-29

0001757715ater:RegisteredDirectOfferingMemberater:InsidersMemberater:SeptemberPurchaseAgreementsMember2022-09-292022-09-29

0001757715ater:CommonStockWarrantsMemberater:RegisteredDirectOfferingMemberater:InsidersMemberater:SeptemberPurchaseAgreementsMember2022-09-29

0001757715ater:RegisteredDirectOfferingMemberater:SeptemberPurchaseAgreementsMember2022-10-042022-10-04

0001757715ater:RegisteredDirectOfferingMemberater:SeptemberPurchaseAgreementsMember2022-07-012022-09-30

0001757715ater:Aterian2014EquityIncentivePlanMember2023-09-30

0001757715ater:Aterian2018EquityIncentivePlanMember2023-09-30

0001757715us-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-09-30

0001757715ater:VestingOnFirstAnniversaryMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-09-30

0001757715ater:VestingOnProRataBasisOverRemainingPeriodMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-09-30

0001757715us-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-012023-09-30

0001757715ater:VestingOnFirstAnniversaryMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-012023-09-30

0001757715ater:VestingOnProRataBasisOverRemainingPeriodMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-012023-09-30

0001757715ater:Aterion2019EquityPlanMember2023-09-30

0001757715us-gaap:RestrictedStockMemberater:Aterion2019EquityPlanMember2023-01-012023-09-30

0001757715ater:InducementEquityIncentivePlanMember2023-09-30

0001757715ater:InducementEquityIncentivePlanMember2023-01-012023-09-30

00017577152022-01-012022-12-31

0001757715us-gaap:RestrictedStockMember2022-12-31

0001757715us-gaap:RestrictedStockMember2023-01-012023-09-30

0001757715us-gaap:RestrictedStockMember2023-09-30

0001757715us-gaap:SellingAndMarketingExpenseMember2022-07-012022-09-30

0001757715us-gaap:SellingAndMarketingExpenseMember2023-07-012023-09-30

0001757715us-gaap:SellingAndMarketingExpenseMember2022-01-012022-09-30

0001757715us-gaap:SellingAndMarketingExpenseMember2023-01-012023-09-30

0001757715us-gaap:ResearchAndDevelopmentExpenseMember2022-07-012022-09-30

0001757715us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-30

0001757715us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-09-30

0001757715us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-30

0001757715us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012022-09-30

0001757715us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-30

0001757715us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-09-30

0001757715us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-30

0001757715ater:MuellerActionMember2021-10-012021-10-30

iso4217:GBP

0001757715ater:EarnoutPaymentDisputeMember2022-02-242022-02-24

0001757715ater:SmashAssetsMember2020-12-012020-12-01

0001757715ater:SmashAssetsMember2020-12-01

0001757715ater:SmashAssetsMemberater:SellersBrokersMember2020-12-012020-12-01

0001757715ater:SmashAssetsMember2023-09-30

0001757715ater:SquattyPottyLlcMember2021-05-05

0001757715ater:SquattyPottyLlcMember2022-12-31

0001757715ater:SmashAssetsMember2021-12-31

0001757715ater:SquattyPottyLlcMember2021-12-31

0001757715ater:SmashAssetsMember2022-01-012022-12-31

0001757715ater:SquattyPottyLlcMember2022-01-012022-12-31

0001757715ater:SmashAssetsMember2022-12-31

00017577152022-01-01

00017577152022-01-012022-03-31

0001757715ater:StepAndGoMember2022-10-042022-10-04

0001757715ater:StepAndGoMember2022-10-04

00017577152022-10-012022-12-31

0001757715us-gaap:TrademarksMember2022-01-01

0001757715us-gaap:TrademarksMember2022-01-012022-12-31

0001757715us-gaap:TrademarksMember2022-12-31

0001757715us-gaap:NoncompeteAgreementsMember2022-01-01

0001757715us-gaap:NoncompeteAgreementsMember2022-01-012022-12-31

0001757715us-gaap:NoncompeteAgreementsMember2022-12-31

0001757715ater:TransitionServicesAgreementMember2022-01-01

0001757715ater:TransitionServicesAgreementMember2022-01-012022-12-31

0001757715ater:TransitionServicesAgreementMember2022-12-31

0001757715us-gaap:CustomerRelationshipsMember2022-01-01

0001757715us-gaap:CustomerRelationshipsMember2022-01-012022-12-31

0001757715us-gaap:CustomerRelationshipsMember2022-12-31

0001757715us-gaap:OtherIntangibleAssetsMember2022-01-01

0001757715us-gaap:OtherIntangibleAssetsMember2022-01-012022-12-31

0001757715us-gaap:OtherIntangibleAssetsMember2022-12-31

0001757715us-gaap:TrademarksMember2023-01-01

0001757715us-gaap:TrademarksMember2023-01-012023-09-30

0001757715us-gaap:TrademarksMember2023-09-30

0001757715us-gaap:NoncompeteAgreementsMember2023-01-01

0001757715us-gaap:NoncompeteAgreementsMember2023-01-012023-09-30

0001757715us-gaap:NoncompeteAgreementsMember2023-09-30

0001757715ater:TransitionServicesAgreementMember2023-01-01

0001757715ater:TransitionServicesAgreementMember2023-01-012023-09-30

0001757715ater:TransitionServicesAgreementMember2023-09-30

0001757715us-gaap:CustomerRelationshipsMember2023-01-01

0001757715us-gaap:CustomerRelationshipsMember2023-01-012023-09-30

0001757715us-gaap:CustomerRelationshipsMember2023-09-30

0001757715us-gaap:OtherIntangibleAssetsMember2023-01-01

0001757715us-gaap:OtherIntangibleAssetsMember2023-01-012023-09-30

0001757715us-gaap:OtherIntangibleAssetsMember2023-09-30

00017577152023-01-01

0001757715us-gaap:EmployeeSeveranceMember2023-07-012023-09-30

0001757715us-gaap:EmployeeSeveranceMember2023-01-012023-09-30

0001757715ater:RetentionBonusSettlementMember2023-07-012023-09-30

0001757715ater:RetentionBonusSettlementMember2023-01-012023-09-30

0001757715us-gaap:ContractTerminationMember2023-07-012023-09-30

0001757715us-gaap:ContractTerminationMember2023-01-012023-09-30

0001757715us-gaap:OtherRestructuringMember2023-07-012023-09-30

0001757715us-gaap:OtherRestructuringMember2023-01-012023-09-30

0001757715us-gaap:EmployeeSeveranceMember2022-12-31

0001757715ater:RetentionBonusSettlementMember2022-12-31

0001757715us-gaap:ContractTerminationMember2022-12-31

0001757715us-gaap:OtherRestructuringMember2022-12-31

0001757715us-gaap:EmployeeSeveranceMember2023-09-30

0001757715ater:RetentionBonusSettlementMember2023-09-30

0001757715us-gaap:ContractTerminationMember2023-09-30

0001757715us-gaap:OtherRestructuringMember2023-09-30

0001757715ater:AccruedExpensesAndOtherCurrentLiabilitiesMember2023-09-30

0001757715us-gaap:OtherLiabilitiesMember2023-09-30

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-38937

Aterian, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | 83-1739858 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer

Identification Number) |

| | | |

| 350 Springfield Avenue, Suite 200 Summit, NJ | | 07901 |

| (Address of principal executive offices) | | (Zip Code) |

(347) 676-1681

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | ATER | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 1, 2023, the registrant had 90,213,264 shares of common stock, $0.0001 par value per share, outstanding.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934 (the "Exchange Act"). Many of these statements can be identified by the use of terminology such as “believes,” “expects,” “intends,” “anticipates,” “plans,” “may,” “will,” “could,” "would,” “projects,” “continues,” “estimates,” “potential,” “opportunity” or the negative versions of these terms and other similar expressions. Our actual results or experience could differ significantly from the forward-looking statements. Factors that could cause or contribute to these differences include those discussed in “Risk Factors,” in Part II, Item 1A of this Quarterly Report on Form 10-Q as well as information provided elsewhere in this Quarterly Report on Form 10-Q and our Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the Securities and Exchange Commission (the SEC) on March 16, 2023. You should carefully consider that information before you make an investment decision.

You should not place undue reliance on these types of forward-looking statements, which speak only as of the date that they were made. These forward-looking statements are based on the beliefs and assumptions of the Company’s management based on information currently available to management and should be considered in connection with any written or oral forward-looking statements that the Company may issue in the future as well as other cautionary statements the Company has made and may make. Except as required by law, the Company does not undertake any obligation to release publicly any revisions to these forward-looking statements after completion of the filing of this Quarterly Report on Form 10-Q to reflect later events or circumstances or the occurrence of unanticipated events.

The discussion of the Company’s financial condition and results of operations should be read in conjunction with the Company’s Condensed Consolidated Financial Statements and the related Notes thereto included in this Quarterly Report on Form 10-Q.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

ATERIAN, INC.

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands, except share and per share data)

| | | December 31, 2022 | | | September 30, 2023 | |

| ASSETS | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash | | $ | 43,574 | | | $ | 27,955 | |

| Accounts receivable, net | | | 4,515 | | | | 3,271 | |

| Inventory | | | 43,666 | | | | 31,493 | |

| Prepaid and other current assets | | | 8,261 | | | | 5,963 | |

| Total current assets | | | 100,016 | | | | 68,682 | |

| Property and equipment, net | | | 853 | | | | 792 | |

| Other intangibles, net | | | 54,757 | | | | 12,016 | |

| Other non-current assets | | | 813 | | | | 541 | |

| Total assets | | $ | 156,439 | | | $ | 82,031 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| Current Liabilities: | | | | | | | | |

| Credit facility | | $ | 21,053 | | | $ | 14,182 | |

| Accounts payable | | | 16,035 | | | | 12,464 | |

| Seller notes | | | 1,693 | | | | 1,196 | |

| Accrued and other current liabilities | | | 14,254 | | | | 10,740 | |

| Total current liabilities | | | 53,035 | | | | 38,582 | |

| Other liabilities | | | 1,452 | | | | 1,540 | |

| Total liabilities | | | 54,487 | | | | 40,122 | |

| Commitments and contingencies (Note 9) | | | | | | | | |

| Stockholders' equity: | | | | | | | | |

| Common stock, $0.0001 par value, 500,000,000 shares authorized and 80,752,290 and 89,132,183 shares outstanding at December 31, 2022 and September 30, 2023, respectively | | | 8 | | | | 9 | |

| Additional paid-in capital | | | 728,339 | | | | 735,110 | |

| Accumulated deficit | | | (625,251 | ) | | | (692,108 | ) |

| Accumulated other comprehensive loss | | | (1,144 | ) | | | (1,102 | ) |

| Total stockholders’ equity | | | 101,952 | | | | 41,909 | |

| Total liabilities and stockholders' equity | | $ | 156,439 | | | $ | 82,031 | |

The accompanying notes are an integral part of these unaudited Condensed Consolidated Financial Statements.

ATERIAN, INC.

Condensed Consolidated Statements of Operations

(Unaudited)

(in thousands, except share and per share data)

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2022 | | | 2023 | | | 2022 | | | 2023 | |

| Net revenue | | $ | 66,326 | | | $ | 39,668 | | | $ | 166,268 | | | $ | 109,811 | |

| Cost of good sold | | | 36,135 | | | | 20,085 | | | | 81,118 | | | | 56,236 | |

| Gross profit | | | 30,191 | | | | 19,583 | | | | 85,150 | | | | 53,575 | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Sales and distribution | | | 33,792 | | | | 20,921 | | | | 88,632 | | | | 61,704 | |

| Research and development | | | 1,706 | | | | 852 | | | | 4,582 | | | | 3,808 | |

| General and administrative | | | 10,369 | | | | 4,326 | | | | 29,481 | | | | 16,566 | |

| Impairment loss on goodwill | | | 90,921 | | | | — | | | | 119,941 | | | | — | |

| Impairment loss on intangibles | | | 3,118 | | | | — | | | | 3,118 | | | | 39,445 | |

| Change in fair value of contingent earn-out liabilities | | | (774 | ) | | | — | | | | (5,240 | ) | | | — | |

| Total operating expenses | | | 139,132 | | | | 26,099 | | | | 240,514 | | | | 121,523 | |

| Operating loss | | | (108,941 | ) | | | (6,516 | ) | | | (155,364 | ) | | | (67,948 | ) |

| Interest expense, net | | | 904 | | | | 359 | | | | 2,043 | | | | 1,076 | |

| Gain on extinguishment of seller note | | | — | | | | — | | | | (2,012 | ) | | | — | |

| Loss on initial issuance of equity | | | 12,834 | | | | — | | | | 18,669 | | | | — | |

| Change in fair value of warrant liability | | | (5,528 | ) | | | (567 | ) | | | 2,365 | | | | (2,410 | ) |

| Other (income) expense, net | | | (174 | ) | | | (128 | ) | | | (199 | ) | | | 101 | |

| Loss before income taxes | | | (116,977 | ) | | | (6,180 | ) | | | (176,230 | ) | | | (66,715 | ) |

| Provision (benefit) for income taxes | | | (75 | ) | | | 90 | | | | (243 | ) | | | 142 | |

| Net loss | | $ | (116,902 | ) | | $ | (6,270 | ) | | $ | (175,987 | ) | | $ | (66,857 | ) |

| Net loss per share, basic and diluted | | $ | (1.81 | ) | | $ | (0.08 | ) | | $ | (2.78 | ) | | $ | (0.86 | ) |

| Weighted-average number of shares outstanding, basic and diluted | | | 64,648,650 | | | | 79,022,467 | | | | 63,397,196 | | | | 77,801,774 | |

The accompanying notes are an integral part of these unaudited Condensed Consolidated Financial Statements.

ATERIAN, INC.

Condensed Consolidated Statements of Comprehensive Loss

(Unaudited)

(in thousands)

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2022 | | | 2023 | | | 2022 | | | 2023 | |

| Net loss | | $ | (116,902 | ) | | $ | (6,270 | ) | | $ | (175,987 | ) | | $ | (66,857 | ) |

| Other comprehensive loss: | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustments | | | (485 | ) | | | (213 | ) | | | (1,087 | ) | | | 42 | |

| Other comprehensive loss | | | (485 | ) | | | (213 | ) | | | (1,087 | ) | | | 42 | |

| Comprehensive loss | | $ | (117,387 | ) | | $ | (6,483 | ) | | $ | (177,074 | ) | | $ | (66,815 | ) |

The accompanying notes are an integral part of these unaudited Condensed Consolidated Financial Statements.

ATERIAN, INC.

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

(in thousands, except share and per share data)

| |

|

Three Months Ended September 30, 2022 |

|

| |

|

Common Stock |

|

|

Additional Paid-in |

|

|

Accumulated |

|

|

Accumulated Other Comprehensive |

|

|

Total Stockholders’ |

|

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Loss |

|

|

Equity |

|

| BALANCE—July 1, 2022 |

|

|

69,219,384 |

|

|

$ |

7 |

|

|

$ |

689,955 |

|

|

$ |

(488,044 |

) |

|

$ |

(1,070 |

) |

|

$ |

200,848 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(116,902 |

) |

|

|

— |

|

|

|

(116,902 |

) |

| Issuance of shares of restricted common stock |

|

|

329,968 |

|

|

|

- |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Forfeiture of shares of restricted common stock |

|

|

(31,965 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Issuance of common stock |

|

|

23,362 |

|

|

|

— |

|

|

|

43 |

|

|

|

— |

|

|

|

— |

|

|

|

43 |

|

| Loss on initial issuance of equity |

|

|

— |

|

|

|

— |

|

|

|

12,834 |

|

|

|

— |

|

|

|

— |

|

|

|

12,834 |

|

| Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

2,943 |

|

|

|

— |

|

|

|

— |

|

|

|

2,943 |

|

| Other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(485 |

) |

|

|

(485 |

) |

| BALANCE—September 30, 2022 |

|

|

69,540,749 |

|

|

$ |

7 |

|

|

$ |

705,775 |

|

|

$ |

(604,946 |

) |

|

$ |

(1,555 |

) |

|

$ |

99,281 |

|

| |

|

Three Months Ended September 30, 2023 |

|

| |

|

Common Stock |

|

|

Additional Paid-in |

|

|

Accumulated |

|

|

Accumulated Other Comprehensive |

|

|

Total Stockholders’ |

|

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Loss |

|

|

Equity |

|

| BALANCE—July 1, 2023 |

|

|

88,014,844 |

|

|

$ |

9 |

|

|

$ |

733,878 |

|

|

$ |

(685,838 |

) |

|

$ |

(889 |

) |

|

$ |

47,160 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6,270 |

) |

|

|

— |

|

|

|

(6,270 |

) |

| Issuance of shares of restricted common stock |

|

|

3,959,679 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Forfeiture of shares of restricted common stock |

|

|

(2,842,340 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

1,232 |

|

|

|

— |

|

|

|

— |

|

|

|

1,232 |

|

| Other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(213 |

) |

|

|

(213 |

) |

| BALANCE—September 30, 2023 |

|

|

89,132,183 |

|

|

$ |

9 |

|

|

$ |

735,110 |

|

|

$ |

(692,108 |

) |

|

$ |

(1,102 |

) |

|

$ |

41,909 |

|

ATERIAN, INC.

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

(in thousands, except share and per share data)

| |

|

Nine Months Ended September 30, 2022 |

|

| |

|

Common Stock |

|

|

Additional Paid-in |

|

|

Accumulated |

|

|

Accumulated Other Comprehensive |

|

|

Total Stockholders’ |

|

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Loss |

|

|

Equity |

|

| BALANCE—January 1, 2022 |

|

|

55,090,237 |

|

|

$ |

5 |

|

|

$ |

653,650 |

|

|

$ |

(428,959 |

) |

|

$ |

(468 |

) |

|

$ |

224,228 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(175,987 |

) |

|

|

— |

|

|

|

(175,987 |

) |

| Issuance of shares of restricted common stock |

|

|

4,350,642 |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

| Forfeiture of shares of restricted common stock |

|

|

(233,561 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Exercise of prefunded warrants |

|

|

3,013,850 |

|

|

|

— |

|

|

|

15,039 |

|

|

|

— |

|

|

|

— |

|

|

|

15,039 |

|

| Issuance of common stock settlement of seller note |

|

|

292,887 |

|

|

|

— |

|

|

|

767 |

|

|

|

|

|

|

|

|

|

|

|

767 |

|

| Issuance of common stock, net of issuance costs |

|

|

7,003,332 |

|

|

|

1 |

|

|

|

27,006 |

|

|

|

|

|

|

|

|

|

|

|

27,007 |

|

| Issuance of warrants in connection with offering |

|

|

— |

|

|

|

— |

|

|

|

(18,982 |

) |

|

|

— |

|

|

|

— |

|

|

|

(18,982 |

) |

| Issuance of common stock |

|

|

23,362 |

|

|

|

|

|

|

|

43 |

|

|

|

|

|

|

|

|

|

|

|

43 |

|

| Loss on initial issuance of equity |

|

|

— |

|

|

|

|

|

|

|

18,669 |

|

|

|

|

|

|

|

|

|

|

|

18,669 |

|

| Issuance of warrants to contractors |

|

|

|

|

|

|

|

|

|

|

1,137 |

|

|

|

|

|

|

|

|

|

|

|

1,137 |

|

| Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

8,446 |

|

|

|

— |

|

|

|

— |

|

|

|

8,446 |

|

| Other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,087 |

) |

|

|

(1,087 |

) |

| BALANCE—September 30, 2022 |

|

|

69,540,749 |

|

|

$ |

7 |

|

|

$ |

705,775 |

|

|

$ |

(604,946 |

) |

|

$ |

(1,555 |

) |

|

$ |

99,281 |

|

| |

|

Nine Months Ended September 30, 2023 |

|

| |

|

Common Stock |

|

|

Additional Paid-in |

|

|

Accumulated |

|

|

Accumulated Other Comprehensive |

|

|

Total Stockholders’ |

|

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Loss |

|

|

Equity |

|

| BALANCE—January 1, 2023 |

|

|

80,752,290 |

|

|

$ |

8 |

|

|

$ |

728,339 |

|

|

$ |

(625,251 |

) |

|

$ |

(1,144 |

) |

|

$ |

101,952 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(66,857 |

) |

|

|

— |

|

|

|

(66,857 |

) |

| Issuance of shares of restricted common stock |

|

|

12,050,644 |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

| Forfeiture of shares of restricted common stock |

|

|

(3,970,751 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Issuance of common stock |

|

|

300,000 |

|

|

|

— |

|

|

|

290 |

|

|

|

— |

|

|

|

— |

|

|

|

290 |

|

| Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

6,481 |

|

|

|

— |

|

|

|

— |

|

|

|

6,481 |

|

| Other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

42 |

|

|

|

42 |

|

| BALANCE—September 30, 2023 |

|

|

89,132,183 |

|

|

$ |

9 |

|

|

$ |

735,110 |

|

|

$ |

(692,108 |

) |

|

$ |

(1,102 |

) |

|

$ |

41,909 |

|

The accompanying notes are an integral part of these unaudited Condensed Consolidated Financial Statements.

ATERIAN, INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

| | | Nine Months Ended September 30, | |

| | | 2022 | | | 2023 | |

| OPERATING ACTIVITIES: | | | | | | | | |

| Net loss | | $ | (175,987 | ) | | $ | (66,857 | ) |

| Adjustments to reconcile net loss to net cash used by operating activities: | | | | | | | | |

| Depreciation and amortization | | | 5,763 | | | | 3,416 | |

| Provision for sales returns | | | 134 | | | | (215 | ) |

| Amortization of deferred financing cost and debt discounts | | | 321 | | | | 321 | |

| Issuance of common stock | | | 43 | | | | — | |

| Stock-based compensation | | | 11,854 | | | | 6,771 | |

| Gain from decrease of contingent earn-out liability fair value | | | (5,240 | ) | | | — | |

| Change in inventory provisions | | | — | | | | 213 | |

| Loss (gain) in connection with the change in warrant fair value | | | 2,365 | | | | (2,410 | ) |

| Gain in connection with settlement of note payable | | | (2,012 | ) | | | — | |

| Loss on initial issuance of equity | | | 18,669 | | | | — | |

| Impairment loss on goodwill | | | 119,941 | | | | — | |

| Impairment loss on intangibles | | | 3,118 | | | | 39,445 | |

| Allowance for doubtful accounts and other | | | 219 | | | | 59 | |

| Changes in assets and liabilities: | | | | | | | | |

| Accounts receivable | | | 5,326 | | | | 1,186 | |

| Inventory | | | 2,588 | | | | 11,960 | |

| Prepaid and other current assets | | | 3,351 | | | | 1,942 | |

| Accounts payable, accrued and other liabilities | | | (9,994 | ) | | | (4,289 | ) |

| Cash used in operating activities | | | (19,541 | ) | | | (8,458 | ) |

| INVESTING ACTIVITIES: | | | | | | | | |

| Purchase of fixed assets | | | (29 | ) | | | (80 | ) |

| Purchase of Step and Go assets | | | — | | | | (125 | ) |

| Cash used in investing activities | | | (29 | ) | | | (205 | ) |

| FINANCING ACTIVITIES: | | | | | | | | |

| Proceeds from equity offering, net of issuance costs | | | 27,007 | | | | — | |

| Repayments on note payable to Smash | | | (2,868 | ) | | | (518 | ) |

| Payment of Squatty Potty earn-out | | | (3,983 | ) | | | — | |

| Borrowings from MidCap credit facilities | | | 107,678 | | | | 63,978 | |

| Repayments for MidCap credit facilities | | | (116,924 | ) | | | (71,165 | ) |

| Insurance obligation payments | | | (1,778 | ) | | | (788 | ) |

| Insurance financing proceeds | | | 2,099 | | | | 986 | |

| Cash provided (used) by financing activities | | | 11,231 | | | | (7,507 | ) |

| Foreign currency effect on cash, cash equivalents, and restricted cash | | | (936 | ) | | | 42 | |

| Net change in cash and restricted cash for the year | | | (9,275 | ) | | | (16,128 | ) |

| Cash and restricted cash at beginning of year | | | 38,315 | | | | 46,629 | |

| Cash and restricted cash at end of year | | $ | 29,040 | | | $ | 30,501 | |

| RECONCILIATION OF CASH AND RESTRICTED CASH: | | | | | | | | |

| Cash | | | 25,997 | | | | 27,955 | |

| Restricted Cash—Prepaid and other current assets | | | 2,914 | | | | 2,417 | |

| Restricted cash—Other non-current assets | | | 129 | | | | 129 | |

| TOTAL CASH AND RESTRICTED CASH | | $ | 29,040 | | | $ | 30,501 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | | | | | | | | |

| Cash paid for interest | | $ | 1,409 | | | $ | 1,457 | |

| Cash paid for taxes | | $ | 58 | | | $ | 90 | |

| NON-CASH INVESTING AND FINANCING ACTIVITIES: | | | | | | | | |

| Non-cash consideration paid to contractors | | $ | 1,137 | | | $ | 321 | |

| Fair value of warrants issued in connection with equity offering | | $ | 18,982 | | | $ | — | |

| Issuance of common stock related to exercise of warrants | | $ | 767 | | | $ | — | |

| Issuance of common stock | | $ | 43 | | | $ | — | |

| Exercise of prefunded warrants | | $ | 15,039 | | | $ | — | |

The accompanying notes are an integral part of these unaudited Condensed Consolidated Financial Statements.

Aterian, Inc.

Notes to Condensed Consolidated Financial Statements

For the Three and Nine Months Ended September 30, 2022 and 2023 (Unaudited)

(In thousands, except share and per share data)

| 1. | ORGANIZATION AND DESCRIPTION OF BUSINESS |

Aterian, Inc. is a technology-enabled consumer products company that predominantly operates through online retail channels such as Amazon and Walmart. The Company operates its owned brands, which were either incubated or purchased, selling products in multiple categories, including home and kitchen appliances, kitchenware, cooling and air quality appliances (dehumidifiers, humidifiers and air conditioners), health and beauty products and essential oils.

Headquartered in New Jersey, Aterian also maintains offices in China, Philippines, and Poland.

Liquidity and Going Concern

As an emerging growth company in the early commercialization stage of its lifecycle, we are subject to inherent risks and uncertainties associated with the development of our enterprise. In this regard, substantially all of our efforts to date have been devoted to the development and sale of our products in the marketplace, which includes our investment in organic growth at the expense of short-term profitably, our investment in incremental growth through mergers & acquisitions (“M&A strategy”), our recruitment of management and technical staff, and raising capital to fund the development of our enterprise. As a result of these efforts, we have incurred significant losses and negative cash flows from operations since our inception and expect to continue to incur such losses and negative cash flows for the foreseeable future until such time that we reach a scale of profitability to sustain our operations. We have also experienced declining revenues due to macroeconomic factors, including increased interest rates and reduced consumer discretionary spending, and other factors, and we intend to focus our efforts on a more limited number of products. In addition, our recent financial performance has been adversely impacted by inflationary pressures and reduced consumer spending.

In order to execute our growth strategy, we have historically relied on outside capital through the issuance of equity, debt, and borrowings under financing arrangements (collectively “outside capital”) to fund our cost structure, and we expect to continue to rely on outside capital for the foreseeable future, specifically for our M&A strategy. While we believe we will eventually reach a level of profitability to sustain our operations, there can be no assurance we will be able to achieve such profitability or do so in a manner that does not require our continued reliance on outside capital. Moreover, while we have historically been successful in raising outside capital, there can be no assurance we will be able to continue to obtain outside capital in the future or do so on terms that are acceptable to us.

As of the date the accompanying Condensed Consolidated Financial Statements were issued (the “issuance date”), we evaluated the significance of the following adverse financial conditions in accordance with Accounting Standard Codification 205-40, Going Concern:

• Since our inception, we have incurred significant losses and used cash flows from operations to fund our enterprise. In this regard, during the nine months ended September 30, 2023, we incurred a net loss of $66.9 million and used net cash flows in our operations of $8.5 million. In addition, as of September 30, 2023, we had unrestricted cash and cash equivalents of $28.0 million available to fund our operations and an accumulated deficit of $692.1 million. Our revenue of $109.8 million for the nine months ended September 30, 2023 declined from $166.3 million for the nine months ended September 30, 2022.

• We are required to remain in compliance with certain financial covenants required by the MidCap Credit facility (See Note 6, Credit Facility, Term Loans and Warrants). We were in compliance with these financial covenants as of September 30, 2023, and expect to remain in compliance through at least September 30, 2024. However, with our short history of forecasting our business following the onset of the COVID-19 global pandemic, the current global inflation and related global supply chain disruptions, we can provide no assurances that we will remain in compliance with our financial covenants. Further, absent of our ability to generate cash inflows from our operations or secure additional outside capital, we may be unable to remain in compliance with these financial covenants. In the event we are unable to remain in compliance with these financial covenants (or other non-financial covenants required by the MidCap Credit Facility), and we are unable to secure a waiver or forbearance, MidCap may, at its discretion, exercise any and all of its existing rights and remedies, which may include, among others, accelerating repayment of the outstanding borrowings and/or asserting its rights in the assets securing the loan.

• As of the issuance date, we have no firm commitments to secure additional outside capital from lenders or investors. While we expect to continue to explore raising additional outside capital, specifically to fund our M&A strategy, there can be no assurance we will be able obtain capital or do so on terms that are acceptable to us. Accordingly, absent our ability to generate cash inflows from our operations and/or secure additional outside capital in the near term, we may be unable to meet our obligations as they become due over the next twelve months beyond the issuance date.

• The Company's plan is to continue to closely monitor our operating forecast, to pursue our M&A strategy, to pursue additional sources of outside capital on terms that are acceptable to us, and to secure a waiver or forbearance from MidCap if we are unable to remain in compliance with one or more of the covenants required by the MidCap Credit Facility. Further, the Company is enacting a strategy to reduce the number of SKUs it sells and will no longer be pursuing future sales of SKUs that are either not profitable or not core to the Company’s strategy. If some or all of our plans prove unsuccessful, we may need to implement short-term changes to our operating plan, including but not limited to delaying expenditures, reducing investments in new products, delaying the development of our software, or reducing our sale and distribution infrastructure. We may also need to seek long-term strategic alternatives, such as a significant curtailment of our operations, a sale of certain of our assets, a divestiture of certain product lines, a sale of the entire enterprise to strategic or financial investors, and/or allow our enterprise to become insolvent.

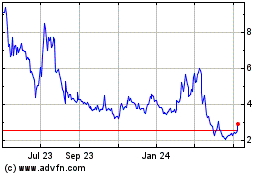

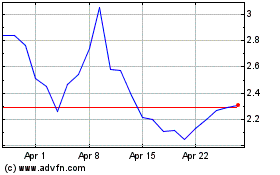

Nasdaq Listing - On April 24, 2023, we received a letter from the Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, based upon the closing bid price of our common stock for the last 30 consecutive business days, the Company is not currently in compliance with the requirement to maintain a minimum bid price of $1.00 per share for continued listing on The Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Notice”). The Bid Price Notice provided a compliance period of 180 calendar days from the date of the Bid Price Notice, or until October 23, 2023, to regain compliance with the minimum closing bid requirement, pursuant to Nasdaq Listing Rule 5810(c)(3)(A). Following a request we made on October 13, 2023, on October 24, 2023, we received a letter from Nasdaq granting the Company an additional 180 days, or until April 22, 2024, to regain compliance with the minimum closing bid requirement (the “Extension Notice”).

The Bid Price Notice has no immediate effect on the continued listing status of our common stock on The Nasdaq Capital Market, and, therefore, our listing remains fully effective.

If at any time before April 22, 2024, the closing bid price of our common stock closes at or above $1.00 per share for a minimum of 10 consecutive business days, subject to Nasdaq’s discretion to extend this period pursuant to Nasdaq Listing Rule 5810(c)(3)(H) to 20 consecutive business days, Nasdaq will provide written notification that the Company has achieved compliance with the minimum bid price requirement, and the matter would be resolved.

The Company will continue to monitor the closing bid price of its Common Stock and seek to regain compliance with all applicable Nasdaq requirements within the allotted compliance period. If the Company does not regain compliance within the allotted compliance period, Nasdaq will provide notice that the Common Stock will be subject to delisting. The Company would then be entitled to appeal that determination to a Nasdaq hearings panel. There can be no assurance that the Company will regain compliance with the minimum bid price requirement during the compliance period, or maintain compliance with the other Nasdaq listing requirements.

In the future, if our common stock remains below the continued listing standard of $1.00 per share or otherwise fails to satisfy any of the Nasdaq continued listing requirements, and if we are unable to cure such deficiency during any subsequent cure period, our common stock could be delisted from the Nasdaq. If our common stock ultimately were to be delisted for any reason, we could face a number of significant material adverse consequences, including limited availability of market quotations for our common stock; limited news and analyst coverage; decreased ability to obtain additional financing or failure to comply with the covenants with our current lenders; limited liquidity for our stockholders due to thin trading; and the potential loss of confidence by investors, employees and other third parties who we do business with.

Further, we may decide to effect a reverse split of our common stock which could impact the market price for our stock, limit our ability to raise capital or otherwise limit our ability to execute acquisition transactions and there is no assurance that the market price or trading volume for our common stock will not further decline after announcing or effecting such split.

Restructuring - On May 9, 2023, the Company announced a plan to reduce expenses by implementing a reduction in its current workforce impacting approximately 50 employees and 15 contractors, primarily in the Philippines. The Company recognized restructuring charges of $0.4 million and $1.6 million for the three and nine months ended September 30, 2023, respectively.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation—The Condensed Consolidated Financial Statements and accompanying notes have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Unaudited Interim Financial Information—The accompanying interim Condensed Consolidated Financial Statements are unaudited and have been prepared on the same basis as the audited financial statements and, in the opinion of management, reflect all adjustments necessary for the fair presentation of the Company's financial position as of September 30, 2023 and the results of its operations and its cash flows for the periods ended September 30, 2022 and 2023. The financial data and other information disclosed in these notes related to the three and nine months ended September 30, 2022 and 2023 are also unaudited. The results for the three and nine months ended September 30, 2023 are not necessarily indicative of results to be expected for the year ending December 31, 2023, any other interim periods or any future year or period.

Use of Estimates—Preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period covered by the financial statements and accompanying notes. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors, including the current economic environment, and makes adjustments when facts and circumstances dictate. As future events and their effects cannot be determined with precision, actual results could differ from those estimates.

Principles of Consolidation—The Condensed Consolidated Financial Statements include the accounts of the Company and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Restricted Cash—As of December 31, 2022, the Company has classified the following as restricted cash: $0.1 million related to its Chinese subsidiary within “Other Non-current Assets” on the Consolidated Balance Sheets, $2.0 million related to a letter of credit and $0.9 million for cash sweeps account related to the Midcap Credit Facility within "Prepaid and Other Current Assets" on the Consolidated Balance Sheets.

As of September 30, 2023, the Company has classified the following as restricted cash: $0.1 million related to its Chinese subsidiary within “Other Non-current Assets” on the Condensed Consolidated Balance Sheets, $2.0 million related to a letter of credit and $0.4 million for cash sweeps account related to the Midcap Credit Facility within "Prepaid and Other Current Assets" on the Condensed Consolidated Balance Sheets.

Inventory and Cost of Goods Sold—The Company’s inventory consists almost entirely of finished goods. The Company currently records inventory on its balance sheet on a first-in first-out basis, or net realizable value, if it is below the Company’s recorded cost. The Company’s costs include the amounts it pays manufacturers for product, tariffs and duties associated with transporting product across national borders, and freight costs associated with transporting the product from its manufacturers to its warehouses, as applicable. The valuation of our inventory requires us to make judgments, based on available information such as historical data, about the likely method of disposition, such as through sales to individual customers or liquidations, and expected recoverable values of each disposition category. These assumptions about future disposition of inventory are inherently uncertain and changes in our estimates and assumptions may cause us to realize material write-downs in the future.

The “Cost of goods sold” line item in the Condensed Consolidated Statements of Operations consists of the book value of inventory sold to customers during the reporting period. When circumstances dictate that the Company use net realizable value as the basis for recording inventory, it bases its estimates on expected future selling prices less expected disposal costs.

Accounts Receivable—Accounts receivable are stated at historical cost less allowance for doubtful accounts. On a periodic basis, management evaluates its accounts receivable and determines whether to provide an allowance or if any accounts should be written off based on a past history of write-offs, collections and current credit conditions. A receivable is considered past due if the Company has not received payments based on agreed-upon terms. The Company generally does not require any security or collateral to support its receivables. The Company performs ongoing evaluations of its customers and maintains an allowance for bad and doubtful receivables. As of December 31, 2022 and September 30, 2023, the Company had an allowance for doubtful accounts of $0.4 million and $0.3 million.

Revenue Recognition—The Company accounts for revenue in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 606, Revenue from Contracts with Customers (“ASC Topic 606”). The Company derives its revenue from the sale of consumer products. The Company sells its products directly to consumers through online retail channels and through wholesale channels.

For direct-to-consumer sales, the Company considers customer order confirmations to be a contract with the customer. Customer confirmations are executed at the time an order is placed through third-party online channels. For wholesale sales, the Company considers the customer purchase order to be the contract.

For all of the Company’s sales and distribution channels, revenue is recognized when control of the product is transferred to the customer (i.e., when the Company’s performance obligation is satisfied), which typically occurs at shipment date. As a result, the Company has a present and unconditional right to payment and record the amount due from the customer in accounts receivable.

Revenue from consumer product sales is recorded at the net sales price (transaction price), which includes an estimate of future returns based on historical return rates. There is judgment in utilizing historical trends for estimating future returns. The Company’s refund liability for sales returns was $0.6 million at December 31, 2022 and $0.4 million at September 30, 2023, which is included in accrued liabilities and represents the expected value of the refund that will be due to its customers.

The Company evaluated principal versus agent considerations to determine whether it is appropriate to record platform fees paid to Amazon as an expense or as a reduction of revenue. Platform fees are recorded as sales and distribution expenses and are not recorded as a reduction of revenue because it owns and controls all the goods before they are transferred to the customer. The Company can, at any time, direct Amazon, or similarly direct other third-party logistics providers (“Logistics Providers”), to return the Company’s inventory to any location specified by the Company. It is the Company’s responsibility to make customers whole following any returns made by customers directly to Logistic Providers and the Company retains the back-end inventory risk. Further, the Company is subject to credit risk (i.e., credit card charge backs), establishes prices of its products, can determine who fulfills the goods to the customer (Amazon or the Company) and can limit quantities or stop selling the goods at any time. Based on these considerations, the Company is the principal in this arrangement.

Net Revenue by Category. The following table sets forth the Company’s net revenue disaggregated by sales channel and geographic region based on the billing addresses of its customers:

| | | Three Months Ended September 30, 2022 | |

| | | (in thousands) | |

| | | Direct | | | Wholesale/Other | | | Total | |

| North America | | $ | 62,818 | | | $ | 2,530 | | | $ | 65,348 | |

| Other | | | 978 | | | | — | | | | 978 | |

| Total net revenue | | $ | 63,796 | | | $ | 2,530 | | | $ | 66,326 | |

| | | Three Months Ended September 30, 2023 | |

| | | (in thousands) | |

| | | Direct | | | Wholesale/Other | | | Total | |

| North America | | $ | 38,314 | | | $ | 142 | | | $ | 38,456 | |

| Other | | | 1,212 | | | | — | | | | 1,212 | |

| Total net revenue | | $ | 39,526 | | | $ | 142 | | | $ | 39,668 | |

| | | Nine Months Ended September 30, 2022 | |

| | | (in thousands) | |

| | | Direct | | | Wholesale/Other | | | Total | |

| North America | | $ | 158,399 | | | $ | 4,415 | | | $ | 162,814 | |

| Other | | | 3,454 | | | | — | | | | 3,454 | |

| Total net revenue | | $ | 161,853 | | | $ | 4,415 | | | $ | 166,268 | |

| | | Nine Months Ended September 30, 2023 | |

| | | (in thousands) | |

| | | Direct | | | Wholesale/Other | | | Total | |

| North America | | $ | 103,451 | | | $ | 2,454 | | | $ | 105,905 | |

| Other | | | 3,906 | | | | — | | | | 3,906 | |

| Total net revenue | | $ | 107,357 | | | $ | 2,454 | | | $ | 109,811 | |

Net Revenue by Product Categories. The following table sets forth the Company’s net revenue disaggregated by product categories for the three and nine months ended September 30, 2022 and 2023:

| | | Three Months Ended September 30, | |

| | | 2022 | | | 2023 | |

| | | (in thousands) | |

| Heating, cooling and air quality | | $ | 27,179 | | | $ | 15,770 | |

| Kitchen appliances | | | 10,504 | | | | 5,586 | |

| Health and beauty | | | 3,661 | | | | 3,034 | |

| Personal protective equipment | | | 516 | | | | — | |

| Cookware, kitchen tools and gadgets | | | 5,128 | | | | 2,408 | |

| Home office | | | 3,045 | | | | 2,116 | |

| Housewares | | | 8,787 | | | | 6,418 | |

| Essential oils and related accessories | | | 6,262 | | | | 3,935 | |

| Other | | | 1,244 | | | | 401 | |

| Total net revenue | | $ | 66,326 | | | $ | 39,668 | |

| | | Nine Months Ended September 30, | |

| | | 2022 | | | 2023 | |

| | | (in thousands) | |

| Heating, cooling and air quality | | $ | 56,835 | | | $ | 29,512 | |

| Kitchen appliances | | | 27,438 | | | | 18,234 | |

| Health and beauty | | | 12,452 | | | | 11,725 | |

| Personal protective equipment | | | 1,565 | | | | 549 | |

| Cookware, kitchen tools and gadgets | | | 14,229 | | | | 8,315 | |

| Home office | | | 10,077 | | | | 7,410 | |

| Housewares | | | 23,478 | | | | 19,558 | |

| Essential oils and related accessories | | | 17,102 | | | | 12,787 | |

| Other | | | 3,092 | | | | 1,721 | |

| Total net revenue | | $ | 166,268 | | | $ | 109,811 | |

Intangibles—We review long-lived assets for impairment when performance expectations, events, or changes in circumstances indicate that the asset's carrying value may not be recoverable. The evaluation is performed at the lowest level of identifiable cash flows by comparing the carrying value of the asset group to the undiscounted cash flows. If the evaluation indicates that the carrying amount of the assets may not be recoverable, any potential impairment is measured based upon the fair value of the related asset or asset group as determined by an appropriate market appraisal or other valuation technique.

On March 20, 2023, the Company made certain leadership changes in our essential oil business resulting in a change in strategy and outlook for the business resulting in a reduced portfolio offering. This reduction in the portfolio will be impactful to our essential oil business's future revenues and profitability and as a result the Company made revisions to our internal forecasts. The Company concluded that this change was an interim triggering event for the three months ending March 31, 2023 indicating the carrying value of our essential oil business's long-lived assets including trademarks may not be recoverable. Accordingly, the Company performed an interim impairment test of the trademark and assessed the recoverability of the related intangible assets by using level 3 inputs and comparing the carrying value of an asset group to the net undiscounted cash flow expected to be generated. The recoverability test indicated that certain definite-live trademark intangible assets were impaired. The Company concluded the carrying value of the trademark exceeded its estimated fair value which was determined utilizing the relief-from-royalty method to determine discounted projected future cash flows which resulted in an impairment charge. The Company recorded an intangible impairment charge of $16.7 million during the three months ending March 31, 2023 within impairment loss on intangibles on the condensed consolidated statement of operations.

During the three months ended June 30, 2023, the Company had a substantial decrease in its market capitalization, primarily relating to a decrease in share price. Further, the Company continues to see reduced net revenues across its portfolio due primarily to the current macroeconomic environment reducing demand for consumer discretionary goods. Finally, during the three months ending June 30, 2023, the Company implemented a strategy of rationalizing certain less profitable products and reducing its product offering, specifically related to its kitchen appliance products. As a result of this rationalization, along with the reduced demand for its products, the Company has made certain revisions to its internal forecasts for its Paper business and Kitchen appliance business. The Company concluded that these factors were an interim triggering event for the three months ending June 30, 2023 indicating the carrying value of our Paper and Kitchen appliance business’s long-lived assets, including trademarks, may not be recoverable. Accordingly, the Company performed an interim impairment test of the trademark and assessed the recoverability of the related intangible assets by using level 3 inputs and comparing the carrying value of an asset group to the net undiscounted cash flow expected to be generated. The recoverability test indicated that certain definite-live trademark intangible assets were impaired. The Company concluded the carrying value of the trademark exceeded its estimated fair value which was determined utilizing the relief-from-royalty method to determine discounted projected future cash flows which resulted in an impairment charge. The Company recorded an intangible impairment charge of $22.8 million for the Paper business and Kitchen appliance business during the three months ending June 30, 2023 within impairment loss on intangibles on the condensed consolidated statement of operations. There were no triggering events during the three months ended September 30, 2023.

For the nine months ended September 30, 2022 and 2023, total impairment loss on intangibles were approximately$3.1 million and $39.4 million, respectively.

Fair Value of Financial Instruments—The Company’s financial instruments, including net accounts receivable, accounts payable, and accrued and other current liabilities are carried at historical cost. At September 30, 2023, the carrying amounts of these instruments approximated their fair values because of their short-term nature. The Company’s credit facility is carried at amortized cost at December 31, 2022 and September 30, 2023 and the carrying amount approximates fair value as the stated interest rate approximates market rates currently available to the Company. The Company considers the inputs utilized to determine the fair value of the borrowings to be Level 2 inputs.

The fair value of the Prefunded Warrants (as defined in the “Securities Purchase Agreement and Warrants” section of this Quarterly Report) and stock purchase warrants issued in connection with the Company’s common stock offering on March 1, 2022 were measured using the Black-Scholes model. Due to the complexity of the warrants issued, the Company uses an outside expert to assist in providing the mark-to-market fair valuation of the liabilities over the reporting periods in which the original agreement was in effect. Inputs used to determine the estimated fair value of the warrant liabilities include the fair value of the underlying stock at the valuation date, the term of the warrants, and the expected volatility of the underlying stock. The significant unobservable input used in the fair value measurement of the warrant liabilities is the estimated term of the warrants. Upon the issuance of the Prefunded Warrants and stock purchase warrants, the Company evaluated the terms of each warrant to determine the appropriate accounting and classification pursuant to FASB ASC Topic 480, Distinguishing Liabilities from Equity (“ASC 480”), and FASB Accounting Standards Codification Topic 815, Derivatives and Hedging (“ASC 815”). Based on the Company’s evaluation and due to certain terms in the warrant agreements, it concluded the Prefunded Warrants, and the stock purchase warrants should be classified as liability with subsequent remeasurement as long as such warrants continue to be classified as liabilities.