false

0001054102

0001054102

2023-11-08

2023-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 8, 2023

INTERPACE

BIOSCIENCES, INC.

(Exact

name of Registrant as specified in its charter)

| delaware |

|

0-24249 |

|

22-2919486 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

Waterview

Plaza, Suite 310

2001

Route 46,

Parsippany,

NJ 07054

(Address,

including zip code, of Principal Executive Offices)

(855)

776-6419

Registrant’s

telephone number, including area code

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

November 8, 2023, Interpace Biosciences, Inc. issued a press release announcing its results of operations and financial condition for

the quarter ended September 30, 2023. The full text of the press release is set forth as Exhibit 99.1 attached hereto and is incorporated

herein by reference.

The

information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any registration statement or other document

filed under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Interpace Biosciences, Inc. |

| |

|

|

| |

By: |

/s/ Thomas

W. Burnell |

| |

Name: |

Thomas W. Burnell |

| |

Title: |

President and Chief Executive Officer |

Date:

November 8, 2023

Exhibit

99.1

Interpace

Biosciences Announces Record Third Quarter 2023 Financial and Business Results

| |

● |

Q3

Revenue of $9.1 million; an 11% increase year-over-year |

| |

|

|

| |

● |

Q3

Test volume up 11% year-over-year |

| |

|

|

| |

● |

Q3

Reimbursement improvement up 11% year-over-year, driven by additional commercial contracts and collection initiatives |

PARSIPPANY,

NJ, November 8, 2023 (GLOBE NEWSWIRE) — Interpace Biosciences, Inc. (“Interpace” or the “Company”)

(OTCQX: IDXG) today announced financial results for the third quarter ended September 30, 2023 and provided a business and financial

update.

Third

quarter Net Revenue was $9.1 million, a $0.9 million increase over third quarter 2022. Loss from continuing operations in the third quarter

of 2023 was $0.5 million, an improvement of $0.7 million from the prior-year quarter’s loss of $1.3 million. On an adjusted basis,

EDITDA was $0.4 million in Q3 and $2.9 million for YTD 2023. Net of previously reported one-time charges, YTD adjusted EBITDA is $3.9

million vs a YTD 2022 loss of $1.8 million.

Q3

represented the 3rd consecutive quarter of double-digit volume and revenue growth in 2023 compared to 2022, according to Chris

McCarthy, Chief Financial Officer. Tom Burnell, President and CEO, added, “in part due to expansion of test utilization by physicians,

the execution of new and re-negotiated commercial contracts, as well as overall price improvement, the cash position of the Company allowed

for the full re-payment of $2.5 million that was outstanding on the Company’s Line of Credit with Comerica Bank.” Additionally,

Burnell said, “in an effort to continue to improve the Company’s balance sheet, we fully satisfied the $3 million Terminal

Payment owed to BroadOak Capital Partners as part of our long-term debt agreement.” The Company was also able to re-negotiate the

terms of the LTD, significantly reducing the cost of capital. Finally, Burnell added, “the resiliency of our team is second-to-none.

They have endured restructuring, reimbursement challenges, and the shedding of non-performing assets all while optimizing operational

efficiency and overall growth of superior molecular diagnostics for assessing the risk of pancreatic and thyroid cancers.” The

Company announced that it expects full-year 2023 revenue to exceed $40 million.

Third

Quarter and 2023 Financial Performance

For

the Third Quarter of 2023 as Compared to the Third Quarter of 2022

| |

● |

Net

Revenue was $9.1 million, an increase of 11% from $8.2 million for the prior-year quarter |

| |

|

|

| |

● |

Gross

Profit percentage was 55% compared to 58% for the prior-year quarter |

| |

|

|

| |

● |

Operating

loss was $(0.02) million vs an operating loss of $(0.8) million in the prior-year quarter |

| |

|

|

| |

● |

A

loss from continuing operations was $(0.5) million vs a loss from continuing operations of $(1.3) million in the prior-year quarter |

| |

|

|

| |

● |

Adjusted

EBITDA was $0.4 million vs $0.1 million in the prior-year quarter |

| |

|

|

| |

● |

Q3

2023 cash collections totaled $9.8 million vs $7.6 million for Q3 2022 |

| |

|

|

| |

● |

September

30, 2023 cash balance of $5.0 million |

For

the Nine Months Ended September 30, 2023 as Compared to the Nine Months Ended September 30, 2022

| |

● |

Net

Revenue was $29.9 million, an increase of 27% from $23.5 million for the prior year |

| |

|

|

| |

● |

Gross

Profit percentage was 59% compared to 56% for the prior-year quarter, and improved 5% vs 2022 |

| |

|

|

| |

● |

Income

from continuing operations was $0.3 million vs a loss from continuing operations of $(4.5) million in the prior year |

| |

|

|

| |

● |

Adjusted

EBITDA was $2.9 million vs $(1.8) million loss in the prior year |

About

Interpace Biosciences

Interpace

Biosciences is an emerging leader in enabling personalized medicine, offering specialized services along the therapeutic value chain

from early diagnosis and prognostic planning to targeted therapeutic applications.

Clinical

services, through Interpace Diagnostics, provide clinically useful molecular diagnostic tests and bioinformatics and pathology services

for evaluating risk of cancer by leveraging the latest technology in personalized medicine for improved patient diagnosis and management.

Interpace has five commercialized molecular tests and one test in a clinical evaluation program (CEP): PancraGEN® for

the diagnosis and prognosis of pancreatic cancer from pancreatic cysts; PanDNA®, a “molecular only” version

of PancraGEN that provides physicians a snapshot of a limited number of factors; ThyGeNEXT® for the diagnosis of thyroid

cancer from thyroid nodules utilizing a next-generation sequencing assay; ThyraMIR®v2, used in combination with ThyGeNEXT®,

for the diagnosis of thyroid cancer utilizing a proprietary microRNA pairwise expression profiler along with algorithmic classification;

and RespriDX®, that differentiates lung cancer of primary versus metastatic origin. In addition, BarreGEN®,

a molecular-based assay that helps resolve the risk of progression of Barrett’s Esophagus to esophageal cancer, is currently in

a CEP, whereby we gather information from physicians using BarreGEN to assist us in gathering clinical evidence relative to the safety

and performance of the test and also providing data that will potentially support payer reimbursement.

For

more information, please visit Interpace Biosciences’ website at www.interpace.com.

Forward-looking

Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995, relating to the Company’s future financial

and operating performance. The Company has attempted to identify forward-looking statements by terminology including “believes,”

“estimates,” “anticipates,” “expects,” “plans,” “projects,” “intends,”

“potential,” “may,” “could,” “might,” “will,” “should,” “approximately”

or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. These statements are

based on current expectations, assumptions and uncertainties involving judgments about, among other things, future economic, competitive

and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which

are beyond the Company’s control. These statements also involve known and unknown risks, uncertainties and other factors that may

cause the Company’s actual results to be materially different from those expressed or implied by any forward-looking statements,

including, but not limited to, the reimbursement of the Company’s tests being subject to review by CMS, the Company’s ability

to continue to perform, bill and receive reimbursement for our PancraGEN® molecular test under the existing local coverage

determination (“LCD”), given that such LCD is currently under review by Novitas Solutions, Inc., the Company’s Medicare

administrative contractor, the possibility that the Company’s estimates of future revenue, cash flows and adjusted EBITDA may prove

to be materially inaccurate, the Company’s history of operating losses, the Company’s ability to adequately finance its business

and seek alternative sources of financing, the Company’s ability to repay borrowings with Comerica Bank and BroadOak, the Company’s

dependence on sales and reimbursements from its clinical services, the Company’s ability to retain or secure reimbursement including

its reliance on third parties to process and transmit claims to payers and the adverse impact of any delay, data loss, or other disruption

in processing or transmitting such claims, the Company’s revenue recognition being based in part on estimates for future collections

which estimates may prove to be incorrect, and the possible removal of the Company’s common stock from trading on the OTCQX®.

Additionally,

all forward-looking statements are subject to the “Risk Factors” detailed from time to time in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2022, as amended, Current Reports on Form 8-K and Quarterly Reports on Form

10-Q filed with the Securities and Exchange Commission. Because of these and other risks, uncertainties and assumptions, undue reliance

should not be placed on these forward-looking statements. In addition, these statements speak only as of the date of this press release

and, except as may be required by law, the Company undertakes no obligation to revise or update publicly any forward-looking statements

for any reason.

Contacts:

Investor

Relations

Interpace

Biosciences, Inc.

(855)-776-6419

Info@Interpace.com

INTERPACE

BIOSCIENCES, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited,

in thousands, except per share data)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue, net | |

$ | 9,078 | | |

$ | 8,189 | | |

$ | 29,931 | | |

$ | 23,506 | |

| Cost of revenue | |

| 4,124 | | |

| 3,457 | | |

| 12,163 | | |

| 10,286 | |

| Gross Profit | |

| 4,954 | | |

| 4,732 | | |

| 17,768 | | |

| 13,220 | |

| | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 2,498 | | |

| 2,236 | | |

| 7,444 | | |

| 6,987 | |

| Research and development | |

| 149 | | |

| 191 | | |

| 484 | | |

| 626 | |

| General and administrative | |

| 2,124 | | |

| 2,767 | | |

| 7,515 | | |

| 8,636 | |

| Acquisition amortization expense | |

| 199 | | |

| 318 | | |

| 834 | | |

| 953 | |

| Change in fair value of contingent consideration | |

| - | | |

| - | | |

| - | | |

| (311 | ) |

| Total operating expenses | |

| 4,970 | | |

| 5,512 | | |

| 16,277 | | |

| 16,891 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating (loss) income | |

| (16 | ) | |

| (780 | ) | |

| 1,491 | | |

| (3,671 | ) |

| Interest accretion expense | |

| (26 | ) | |

| (38 | ) | |

| (92 | ) | |

| (123 | ) |

| Note payable interest | |

| (230 | ) | |

| (230 | ) | |

| (682 | ) | |

| (620 | ) |

| Other expense, net | |

| (252 | ) | |

| (217 | ) | |

| (408 | ) | |

| (20 | ) |

| (Loss) income from continuing operations before tax | |

| (524 | ) | |

| (1,265 | ) | |

| 309 | | |

| (4,434 | ) |

| Provision (benefit) for income taxes | |

| 4 | | |

| (11 | ) | |

| 12 | | |

| 24 | |

| (Loss) income from continuing operations | |

| (528 | ) | |

| (1,254 | ) | |

| 297 | | |

| (4,458 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from discontinued operations, net of tax | |

| (86 | ) | |

| (12,954 | ) | |

| (385 | ) | |

| (15,936 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (614 | ) | |

$ | (14,208 | ) | |

$ | (88 | ) | |

$ | (20,394 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic (loss) income per share of common stock: | |

| | | |

| | | |

| | | |

| | |

| From continuing operations | |

$ | (0.12 | ) | |

$ | (0.30 | ) | |

$ | 0.07 | | |

$ | (1.05 | ) |

| From discontinued operations | |

| (0.02 | ) | |

| (3.05 | ) | |

| (0.09 | ) | |

| (3.77 | ) |

| Net loss per basic share of common stock | |

$ | (0.14 | ) | |

$ | (3.35 | ) | |

$ | (0.02 | ) | |

$ | (4.82 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted (loss) income per share of common stock: | |

| | | |

| | | |

| | | |

| | |

| From continuing operations | |

$ | (0.12 | ) | |

$ | (0.30 | ) | |

$ | 0.07 | | |

$ | (1.05 | ) |

| From discontinued operations | |

| (0.02 | ) | |

| (3.05 | ) | |

| (0.09 | ) | |

| (3.77 | ) |

| Net loss per diluted share of common stock | |

$ | (0.14 | ) | |

$ | (3.35 | ) | |

$ | (0.02 | ) | |

$ | (4.82 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Weighted average number of common shares and

common share equivalents outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic | |

| 4,319 | | |

| 4,242 | | |

| 4,313 | | |

| 4,227 | |

| Diluted | |

| 4,319 | | |

| 4,242 | | |

| 4,355 | | |

| 4,227 | |

Selected

Balance Sheet Data (Unaudited)

($

in thousands)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| Cash and cash equivalents | |

$ | 5,032 | | |

$ | 4,828 | |

| | |

| | | |

| | |

| Total current assets | |

| 11,438 | | |

| 12,154 | |

| Total current liabilities | |

| 12,324 | | |

| 14,283 | |

| | |

| | | |

| | |

| Total assets | |

| 14,250 | | |

| 15,979 | |

| Total liabilities | |

| 30,394 | | |

| 32,515 | |

| Total stockholders’ deficit | |

| (62,680 | ) | |

| (63,072 | ) |

Selected

Cash Flow Data (Unaudited)

($

in thousands)

| | |

For the Nine Months Ended | |

| | |

September 30, | |

| | |

2023 | | |

2022 | |

| Net loss | |

$ | (88 | ) | |

$ | (20,394 | ) |

| | |

| | | |

| | |

| Net cash provided (used in) operating activities | |

$ | 2,649 | | |

$ | (7,416 | ) |

| Net cash provided by investing activities | |

| 55 | | |

| 7,305 | |

| Net cash (used in) provided by financing activities | |

| (2,500 | ) | |

| 3,106 | |

| Change in cash, cash equivalents and restricted cash | |

| 204 | | |

| 2,995 | |

| Cash, cash equivalents and restricted cash – beginning | |

| 4,828 | | |

| 3,314 | |

| Cash, cash equivalents and restricted cash – ending | |

$ | 5,032 | | |

$ | 6,309 | |

Reconciliation

of Adjusted EBITDA (Unaudited)

($

in thousands)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| (Loss) income from continuing operations (GAAP Basis) | |

$ | (528 | ) | |

$ | (1,254 | ) | |

$ | 297 | | |

$ | (4,458 | ) |

| Depreciation and amortization | |

| 241 | | |

| 353 | | |

| 954 | | |

| 1,076 | |

| Stock-based compensation | |

| 152 | | |

| 501 | | |

| 501 | | |

| 1,110 | |

| Tax expense (benefit) | |

| 4 | | |

| (11 | ) | |

| 12 | | |

| 24 | |

| Interest accretion expense | |

| 26 | | |

| 38 | | |

| 92 | | |

| 123 | |

| Note payable interest | |

| 230 | | |

| 230 | | |

| 682 | | |

| 620 | |

| Mark to market on warrant liability | |

| - | | |

| (3 | ) | |

| - | | |

| (71 | ) |

| Change in fair value of note payable | |

| 259 | | |

| 206 | | |

| 400 | | |

| 46 | |

| Change in fair value of contingent consideration | |

| - | | |

| - | | |

| - | | |

| (311 | ) |

| Adjusted EBITDA | |

$ | 384 | | |

$ | 60 | | |

$ | 2,938 | | |

$ | (1,841 | ) |

Non-GAAP

Financial Measures

In

addition to the United States generally accepted accounting principles, or GAAP, results provided throughout this document, we have provided

certain non-GAAP financial measures to help evaluate the results of our performance. We believe that these non-GAAP financial measures,

when presented in conjunction with comparable GAAP financial measures, are useful to both management and investors in analyzing our ongoing

business and operating performance. We believe that providing the non-GAAP information to investors, in addition to the GAAP presentation,

allows investors to view our financial results in the way that management views financial results.

In

this document, we discuss Adjusted EBITDA, a non-GAAP financial measure. Adjusted EBITDA is a metric used by management to measure cash

flow of the ongoing business. Adjusted EBITDA is defined as income or loss from continuing operations, plus depreciation and amortization,

non-cash stock based compensation and ESPP plans, interest and taxes, and other non-cash expenses including change in fair values of

notes payable, contingent consideration and warrant liability. The table above includes a reconciliation of this non-GAAP financial measure

to the most directly comparable GAAP financial measure.

v3.23.3

Cover

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity File Number |

0-24249

|

| Entity Registrant Name |

INTERPACE

BIOSCIENCES, INC.

|

| Entity Central Index Key |

0001054102

|

| Entity Tax Identification Number |

22-2919486

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Waterview

Plaza

|

| Entity Address, Address Line Two |

Suite 310

|

| Entity Address, Address Line Three |

2001

Route 46

|

| Entity Address, City or Town |

Parsippany

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07054

|

| City Area Code |

(855)

|

| Local Phone Number |

776-6419

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

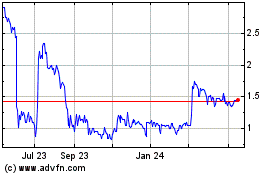

Interpace Biosciences (QX) (USOTC:IDXG)

Historical Stock Chart

From Mar 2024 to Apr 2024

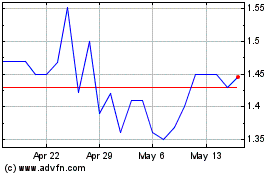

Interpace Biosciences (QX) (USOTC:IDXG)

Historical Stock Chart

From Apr 2023 to Apr 2024