false

0001535955

0001535955

2023-11-08

2023-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

November 8, 2023

LIPOCINE

INC.

(Exact name of registrant as specified in its charter)

Commission File No. 001-36357

| Delaware |

|

99-0370688 |

|

(State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification Number) |

675 Arapeen Drive, Suite 202

Salt Lake City, Utah 84108

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code: (801) 994-7383

Former name or

former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4© under the Exchange Act (17 CFR 240.13©(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

LPCN |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On November 8, 2023, the Company issued a press

release announcing financial and operational results for the quarter ended September 30, 2023. The press release is filed as Exhibit 99.1

and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

The following exhibits are filed with this report:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

|

LIPOCINE INC. |

| |

|

|

|

|

| Date: |

November 8, 2023 |

|

By: |

/s/ Mahesh V. Patel |

| |

|

|

|

Mahesh V. Patel |

| |

|

|

|

President and Chief Executive Officer |

Exhibit 99.1

Lipocine Announces Financial Results for the

Third Quarter Ended September 30, 2023

SALT LAKE CITY, November 8, 2023 — Lipocine

Inc. (NASDAQ: LPCN), a biopharmaceutical company focused on treating Central Nervous System (CNS) disorders by leveraging its proprietary

platform to develop differentiated products, today announced financial results for the third quarter and nine months ended September 30,

2023, and provided a corporate update.

Clinical Program Highlights

Neuroactive Steroids

| ● |

On October 18, Lipocine completed a successful meeting with the FDA on LPCN 1154, which is in development for postpartum depression (PPD). The FDA agreed on Lipocone’s proposal for a 505(b)(2) NDA filing based on a single pivotal study comparing exposure of LPCN 1154 with the approved IV infusion of brexanolone |

| |

○ |

Lipocine anticipates initiating the pivotal study program in Q1 2024 with the LPCN 1154 “to be marketed” formulation |

| |

○ |

Top line results from the study are expected by Q2 2024, with a goal of filing a New Drug Application (NDA) in 2024 |

| |

○ |

If approved, LPCN 1154, has the potential to be a differentiated preferred treatment option for PPD with rapid and high remission/response rates with short treatment duration |

LPCN 1148 in liver cirrhosis

| ● |

In July, Lipocine announced positive topline results from its Phase 2 proof-of-concept (“POC”) study evaluating LPCN 1148 in cirrhosis |

| |

○ |

Study met primary endpoint: treatment with LPCN 1148 increased L3 skeletal muscle index (L3-SMI) relative to placebo (P <0.01) |

| |

○ |

Fewer hepatic encephalopathy (HE) events of grade >1 in the LPCN 1148 treatment arm relative to placebo (P < 0.05) |

| |

○ |

More patients on LPCN 1148 reported symptom improvement compared to placebo (P < 0.05) |

| |

○ |

LPCN 1148 was well-tolerated, with AE rates and severities similar to placebo |

| |

○ |

Lipocine plans to meet with the FDA to discuss the development path to NDA filing |

Quarter Ended September 30, 2023 Financial

Results

Lipocine reported a net loss of $6.7 million,

or ($1.27) per diluted share, for the three months ended September 30, 2023, compared with a net loss of $2.4 million or ($0.52) per diluted

share, in the three months ended September 30, 2022.

During the three months ended September 30, 2023,

the Company recognized a non-cash minimum guaranteed royalties revenue reversal of variable consideration revenue of $3.1 million related

to the termination of the Antares License Agreement. The reversal of revenue is due to the fact that Lipoocine will not receive anticipated

royalties that were previously recorded for the Antares License Agreement due to the termination of the agreement.

Research and development expenses were $2.9 million

during the three months ended September 30, 2023, as compared with $2.1 million in the three months ended September 30, 2022. The increase

in research and development expenses was a result of an increase in costs related to the LPCN 1154 clinical studies, an increase in TLANDO

manufacturing related costs, and an increase in personnel related costs, offset by a decrease in LPCN 1111 scale up costs in 2022, a decrease

in contract research organization expense related to the LPCN 1148 Phase 2 POC study in male subjects with cirrhosis, a decrease in contract

research organization expense and outside consulting costs related to the completion of the LPCN 1144 LiFT study in 2022, and a decrease

in LPCN 1107 PK and food effect studies and other research and development costs in 2022.

General and administrative expenses were $1.0

million during the three months ended September 30, 2023, as compared to $0.8 million in the three months ended September 30, 2022. The

increase in expenses is mainly due to increases in business development expenses, and an increase in professional services and legal fees.

These increases were offset by a decrease in corporate insurance expense.

As of September 30, 2023, Lipocine had $23.8 million

of unrestricted cash, cash equivalents and marketable investment securities compared to $32.5 million at December 31, 2022.

Nine Months Ended September 30, 2023 Financial

Results

Lipocine reported a net loss of $14.1 million,

or ($2.72) per diluted share, for the nine months ended September 30, 2023, compared with a net loss of $8.5 million or ($1.72) per diluted

share, in the nine months ended September 30, 2022.

The Company recognized a non-cash minimum guaranteed

royalties revenue reversal of variable consideration revenue of $3.1 million related to the termination of the Antares License Agreement

during the nine months ended September 30, 2023. The reversal of variable consideration revenue is offset by license revenue of approximately

$55,000 for payments received from Spriaso, a related party, under a licensing agreement for the cough and cold field during the nine

months ended September 30, 2023. The Company recognized revenue related to a non-refundable cash fee of $500,000 received from Antares

for consideration of a 90-day extension for Antares to exercise its option to license LPCN 1111 during the nine months ended September

30, 2022.

Research and development expenses were $8.5 million

and $6.9 million, respectively, for the nine months ended September 30, 2023, and 2022. The increase was due to an increase in costs related

to the LPCN 1154 clinical studies, an increase in TLANDO manufacturing related costs, an increase in contract research organization expense

related to the LPCN 1148 Phase 2 POC study in male subjects with cirrhosis, and an increase in personnel salaries and benefits. These

increases were offset by a decrease related to LPCN 1111 scale up costs in 2022, a decrease in contract research organization expense

and outside consulting costs related to the completion of our LPCN 1144 LiFT study, a decrease related to the completion of our LPCN 1107

PK and food effect studies and a decrease in other research and development activities.

General and administrative expenses were $3.8

million and $3.2 million, respectively, for the nine months ended September 30, 2023, and 2022. The increase consisted of an increase

in business development expenses, an increase in professional and legal fees and an increase in other general and administrative expenses.

These increases were offset by decrease resulting from a decrease in corporate insurance expense and a decrease in various other consulting

fees.

For more information on Lipocine’s financial

results for the three and nine months ended September 30, 2023, refer to Form 10Q filed with the SEC.

About Lipocine

Lipocine is a biopharmaceutical

company leveraging its proprietary technology platform to augment therapeutics through effective oral delivery to develop products for

CNS disorders. Lipocine has drug candidates in development as well as drug candidates for which we are exploring partnering. Our drug

candidates represent enablement of differentiated, patient friendly oral delivery options for favorable benefit to risk profile which

target large addressable markets with significant unmet medical needs.

Lipocine’s

clinical development candidates include: LPCN 1154, oral brexanolone, for the potential treatment of postpartum depression, LPCN 2101

for the potential treatment of epilepsy and LPCN 1148, a novel androgen receptor agonist prodrug for oral administration targeted for

the management of symptoms associated with liver cirrhosis. Lipocine is exploring partnering opportunities for LPCN 1107, our candidate

for prevention of preterm birth, LPCN1154, for rapid relief of postpartum depression, LPCN 1148, for the management of decompensated

cirrhosis, LPCN 1144, our candidate for treatment of non-cirrhotic NASH, and LPCN 1111, a once-a-day therapy candidate for testosterone

replacement therapy (TRT). TLANDO, a novel oral prodrug of testosterone containing testosterone undecanoate developed by Lipocine, is

approved by the FDA for conditions associated with a deficiency of endogenous testosterone, also known as hypogonadism, in adult males.

For more information, please visit www.lipocine.com.

Forward-Looking Statements

This release contains “forward-looking statements”

that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and include statements that

are not historical facts regarding our product development efforts, our strategic plans for developing products to treat CNS disorders,

our ability to monetize non-core product candidates, including through entering into partnering arrangements, the application of our proprietary

platform in developing new treatments for CNS disorders, our product candidates and related clinical trials, the achievement of milestones

within and completion of clinical trials, the timing and completion of regulatory reviews, outcomes of clinical trials of our product

candidates, and the potential uses and benefits of our product candidates. Investors are cautioned that all such forward-looking statements

involve risks and uncertainties, including, without limitation, the risks that we may not be successful in developing product candidates

to treat CNS disorders, we may not be able to enter into partnerships or other strategic relationships to monetize our non-core assets,

the FDA will not approve any of our products, risks related to our products, expected product benefits not being realized, clinical and

regulatory expectations and plans not being realized, new regulatory developments and requirements, risks related to the FDA approval

process including the receipt of regulatory approvals, the results and timing of clinical trials, patient acceptance of Lipocine’s

products, the manufacturing and commercialization of Lipocine’s products, and other risks detailed in Lipocine’s filings with

the SEC, including, without limitation, its Form 10-K and other reports on Forms 8-K and 10-Q, all of which can be obtained on the SEC

website at www.sec.gov. Lipocine assumes no obligation to update or revise publicly any forward-looking statements contained in this release,

except as required by law.

For further information:

Krista Fogarty

Phone: (801) 994-7383

kf@lipocine.com

Investors:

PJ Kelleher

Phone: (617) 430-7579

pkelleher@lifesciadvisors.com

LIPOCINE INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited)

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Asset | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,072,706 | | |

$ | 3,148,496 | |

| Marketable investment securities | |

| 19,775,290 | | |

| 29,381,410 | |

| Accrued interest income | |

| 41,061 | | |

| 80,427 | |

| Contract asset - current portion | |

| 130,505 | | |

| 579,428 | |

| Prepaid and other current assets | |

| 594,097 | | |

| 945,319 | |

| | |

| | | |

| | |

| Total current assets | |

| 24,613,659 | | |

| 34,135,080 | |

| | |

| | | |

| | |

| Contract asset - non-current portion | |

| - | | |

| 3,252,500 | |

| Property and equipment, net of accumulated depreciation of $1,174,189 and $1,153,530 respectively | |

| 114,931 | | |

| 131,589 | |

| Other assets | |

| 23,753 | | |

| 23,753 | |

| | |

| | | |

| | |

| Total assets | |

$ | 24,752,343 | | |

$ | 37,542,922 | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,101,068 | | |

$ | 600,388 | |

| Accrued expenses | |

| 1,140,313 | | |

| 1,077,738 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 2,241,381 | | |

| 1,678,126 | |

| | |

| | | |

| | |

| Warrant liability | |

| 29,440 | | |

| 229,856 | |

| | |

| | | |

| | |

| Total liabilities | |

| 2,270,821 | | |

| 1,907,982 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, par value $0.0001 per share, 200,000,000 shares authorized; 5,316,166 and 5,235,166 issued and 5,315,830 and 5,234,830 outstanding | |

| 8,860 | | |

| 8,852 | |

| Additional paid-in capital | |

| 220,022,838 | | |

| 219,112,164 | |

| Treasury stock at cost, 336 shares | |

| (40,712 | ) | |

| (40,712 | ) |

| Accumulated other comprehensive loss | |

| (14,503 | ) | |

| (20,321 | ) |

| Accumulated deficit | |

| (197,494,961 | ) | |

| (183,425,043 | ) |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 22,481,522 | | |

| 35,634,940 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 24,752,343 | | |

$ | 37,542,922 | |

LIPOCINE INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

and Comprehensive Loss

(Unaudited)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| License revenue | |

$ | - | | |

$ | - | | |

$ | 54,990 | | |

$ | 500,000 | |

| Minimum guaranteed royalties revenue (reversal of variable

consideration) | |

| (3,121,996 | ) | |

| - | | |

| (3,121,996 | ) | |

| - | |

| Total revenues (reversal of variable consideration), net | |

| (3,121,996 | ) | |

| - | | |

| (3,067,006 | ) | |

| 500,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,878,798 | | |

| 2,100,432 | | |

| 8,500,319 | | |

| 6,886,398 | |

| General and administrative | |

| 1,042,572 | | |

| 798,939 | | |

| 3,770,281 | | |

| 3,172,144 | |

| Total operating expenses | |

| 3,921,370 | | |

| 2,899,371 | | |

| 12,270,600 | | |

| 10,058,542 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (7,043,366 | ) | |

| (2,899,371 | ) | |

| (15,337,606 | ) | |

| (9,558,542 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest and investment income | |

| 317,569 | | |

| 163,966 | | |

| 1,067,561 | | |

| 275,420 | |

| Interest expense | |

| - | | |

| - | | |

| - | | |

| (27,098 | ) |

| Unrealized gain on warrant liability | |

| 74,827 | | |

| 326,240 | | |

| 200,416 | | |

| 531,697 | |

| Gain on litigation settlement liability | |

| - | | |

| - | | |

| - | | |

| 250,000 | |

| Total other income, net | |

| 392,396 | | |

| 490,206 | | |

| 1,267,977 | | |

| 1,030,019 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income tax expense | |

| (6,650,970 | ) | |

| (2,409,165 | ) | |

| (14,069,629 | ) | |

| (8,528,523 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| - | | |

| - | | |

| (200 | ) | |

| (200 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (6,650,970 | ) | |

| (2,409,165 | ) | |

| (14,069,829 | ) | |

| (8,528,723 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Issuance of Series B preferred stock dividend | |

| - | | |

| - | | |

| (89 | ) | |

| - | |

| Net loss attributable to common shareholders | |

$ | (6,650,970 | ) | |

$ | (2,409,165 | ) | |

$ | (14,069,918 | ) | |

$ | (8,528,723 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic loss per share attributable to common stock | |

$ | (1.26 | ) | |

$ | (0.46 | ) | |

$ | (2.68 | ) | |

$ | (1.63 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding, basic | |

| 5,292,058 | | |

| 5,234,576 | | |

| 5,254,116 | | |

| 5,230,619 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted loss per share attributable to common stock | |

$ | (1.27 | ) | |

$ | (0.52 | ) | |

$ | (2.72 | ) | |

$ | (1.72 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding, diluted | |

| 5,292,058 | | |

| 5,250,179 | | |

| 5,254,116 | | |

| 5,260,530 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss: | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (6,650,970 | ) | |

$ | (2,409,165 | ) | |

$ | (14,069,829 | ) | |

$ | (8,528,723 | ) |

| Net unrealized gain (loss) on available-for-sale

securities | |

| 1,309 | | |

| 7,972 | | |

| 5,818 | | |

| (58,919 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss | |

$ | (6,649,661 | ) | |

$ | (2,401,193 | ) | |

$ | (14,064,011 | ) | |

$ | (8,587,642 | ) |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

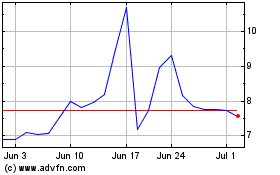

Lipocine (NASDAQ:LPCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lipocine (NASDAQ:LPCN)

Historical Stock Chart

From Apr 2023 to Apr 2024