false

--12-31

0001648087

0001648087

2023-10-31

2023-10-31

0001648087

AREB:CommonStock0.001ParValueMember

2023-10-31

2023-10-31

0001648087

AREB:CommonStockPurchaseWarrantsMember

2023-10-31

2023-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) October 31, 2023

AMERICAN

REBEL HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-41267 |

|

47-3892903 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

909

18th Avenue South, Suite A

Nashville,

Tennessee |

|

37212 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (833) 267-3235

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

AREB |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

AREBW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Amended

and Restated Series A Convertible Preferred Stock

Effective

October 31, 2023, the holders of shares of Series A Convertible Preferred Stock, upon the recommendation of the Registrant’s board

of directors, approved amending and restating the certificate of designation of the Registrant’s Series A Convertible Preferred

Stock to increase the number of shares from 100,000 to 150,000 and allow for the conversion of the Series A Preferred Stock under certain

circumstances and vesting requirements set forth in the amended and restated certificate. The amended and restated certificate of designation

is attached hereto as Exhibit 4.1.

Articles

– Designating Series C Convertible Cumulative Preferred Stock

On

November 3, 2023, the Registrant’s board of directors approved the designation of a new Series C Convertible Cumulative Preferred

Stock (the “Series C Designation”). The rights, preferences, restrictions and other matters relating to the Series C Convertible

Cumulative Preferred Stock (the “Series C Preferred Stock”) are described in greater detail below.

Series

C Preferred Stock

The

Series C Designation was filed by the Registrant with the Secretary of State of Nevada on November 3, 2023 (and effective on November

6, 2023) and designated 3,100,000 shares of Series C Preferred Stock, $0.001 par value per share. The Series C Preferred Stock has the

following rights:

Ranking.

The Series C Preferred Stock ranks, as to dividend rights and rights upon liquidation, dissolution, or winding up, junior to the Registrant’s

Series A Preferred Stock and senior to its Common Stock and Series B Preferred Stock. The terms of the Series C Preferred Stock do not

limit the Registrant’s ability to (i) incur indebtedness or (ii) issue additional equity securities that are equal or junior in

rank to the shares of its Series C Preferred Stock as to distribution rights and rights upon liquidation, dissolution or winding up.

Stated

Value. Each share of Series C Preferred Stock has an initial stated value of $7.50, subject to appropriate adjustment in relation

to certain events, such as recapitalizations, stock dividends, stock splits, stock combinations, reclassifications or similar events

affecting the Series C Preferred Stock.

Dividend

Rate and Payment Dates. Dividends on the Series C Preferred Stock are cumulative and payable quarterly in arrears to all holders

of record on the applicable record date. Holders of Series C Preferred Stock are entitled to receive cumulative quarterly dividends at

a per annum rate of 8.53% of the stated value (or $0.16 per share per quarter based on the liquidation preference per share); provided

that upon an event of default (generally defined as the Registrant’s failure to pay dividends when due or to redeem shares when

requested by a holder), such amount shall be increased to $0.225 per quarter, which is equivalent to the annual rate of 12% of the $7.50

liquidation preference per share. In the Registrant’s sole discretion, dividends may be paid in cash or in kind in the form of

Common Stock equal to the closing price of Common Stock on the last day of the quarter. Dividends on each share begin accruing on, and

are cumulative from, the date of issuance and regardless of whether the Board declares and pays such dividends. Dividends on shares of

Series C Preferred Stock will continue to accrue even if any of the Registrant’s agreements prohibit the current payment of dividends

or it does not have earnings.

Liquidation

Preference. Upon a liquidation, dissolution or winding up of the Registrant, holders of shares of Series C Preferred Stock are

entitled to receive, before any payment or distribution is made to the holders of Common Stock or Series B Preferred Stock and on a junior

basis with holders of Series A Preferred Stock, a liquidation preference equal to the stated value per share, plus accrued but unpaid

dividends thereon (whether or not declared).

Company

Call Option. The Registrant may redeem the shares of Series C Preferred Stock, in whole or in part at any time after the fifth

anniversary of the initial closing of offering selling such shares and continuing indefinitely thereafter, at the Registrant’s

option, for cash, at $11.25 per share of Series C Preferred Stock, plus any accrued and unpaid dividends.

Stockholder

Put Option. Once per calendar quarter beginning any time after the fifth-year anniversary of date of issuance, a Holder of record

of shares of Series C Preferred Stock may elect to cause the Registrant to redeem all or any portion of their shares of Series C Preferred

Stock for an amount equal to $11.25 per share plus any accrued and unpaid dividends, which amount may be settled by delivery of cash

or shares of Common Stock, at the option of the holder. If the holder elects settlement in shares of Common Stock, the Registrant will

deliver such number of shares of Common Stock equal to $11.25 per share of Series C Preferred Stock to be redeemed plus any accrued and

unpaid dividends corresponding to the redeemed shares, divided by $2.25 per share (subject to pro rata adjustment in connection with

any stock splits, stock dividends, or similar changes to the Registrant’s capitalization occurring after the date of this Certificate),

with any fraction rounded up to the next whole share of Common Stock. A holder making such election shall provide written notice thereof

to the Registrant specifying the name and address of the holder, the number of shares to be redeemed and whether settlement shall be

in cash or shares of Common Stock. The Registrant shall redeem the specified shares of Series C Preferred Stock for shares of Common

Stock no later than ten (10) days, or for cash no later than 365 days, following receipt of such notice.

Restrictions

on Redemption and Repurchase. The Registrant is not be obligated to redeem or repurchase shares of Series C Preferred Stock if

it is restricted by applicable law or its articles of incorporation from making such redemption or repurchase or to the extent any such

redemption or repurchase would cause or constitute a default under any borrowing agreements to which it or any of its subsidiaries are

a party or otherwise bound. In addition, the Registrant has no obligation to redeem shares in connection with a redemption request made

by a holder if it determines, as of the redemption date, that it does not have sufficient funds available to fund that redemption. In

this regard, the Registrant will have complete discretion under the certificate of designation for the Series C Preferred Stock to determine

whether it is in possession of “sufficient funds” to fund a redemption request. Redemptions will be limited to five percent

(5%) of the total outstanding shares of Series C Preferred Stock per quarter. To the extent the Registrant is unable to complete redemptions

it may have earlier agreed to make, the Registrant will complete those redemptions promptly after it becomes able to do so, with all

such deferred redemptions being satisfied on a first come, first served, basis.

Voting

Rights. The Series C Preferred Stock has no voting rights relative to matters submitted to a vote of the Registrant’s stockholders

(other than as required by law). The Registrant may not authorize or issue any class or series of equity securities ranking senior to

the Series C Preferred Stock as to dividends or distributions upon liquidation (including securities convertible into or exchangeable

for any such senior securities) or amend its articles of incorporation (whether by merger, consolidation, or otherwise) to materially

and adversely change the terms of the Series C Preferred Stock without the affirmative vote of at least two-thirds of the votes entitled

to be cast on such matter by holders of the Registrant’s outstanding shares of Series C Preferred Stock, voting together as a class.

Further

Issuances. The Registrant will not be required to redeem shares of Series C Preferred Stock at any time except as otherwise described

above under the captions “Company Call Option” and “Stockholder Put Option.” Accordingly, the shares of Series

C Preferred Stock will remain outstanding indefinitely, unless the Registrant decides, at its option, to exercise its call right, or

the holder of the Series C Preferred Stock exercises their put right. The shares of Series C Preferred Stock will not be subject to any

sinking fund.

Conversion

Rights. Each share of Series C Preferred Stock shall be convertible into shares of Common Stock at a price per share of $1.50

(1 share of Series C Preferred Stock converts into 5 shares of Common Stock), at the option of the holder thereof, at any time following

the issuance date of such share of Series C Preferred Stock and on or prior to the fifth (5th) day prior to a redemption date,

if any, as may have been fixed in any redemption notice with respect to the shares of Series C Preferred Stock, at the Registrant’s

office or any transfer agent for such stock.

The

foregoing description of the Series C Preferred Stock and Series C Designation, does not purport to be complete and is qualified in its

entirety by reference to the Series C Designation, a copy of which is incorporated by reference as Exhibit 4.2 to this Current Report

on Form 8-K and incorporated in this Item 5.03 in its entirety by reference.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

AMERICAN REBEL HOLDINGS, INC. |

| |

|

|

| Date:

November 6, 2023 |

By: |

/s/

Charles A. Ross, Jr. |

| |

|

Charles

A. Ross, Jr. |

| |

|

Chief

Executive Officer |

Exhibit

4.1

Exhibit 4.2

v3.23.3

Cover

|

Oct. 31, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 31, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-41267

|

| Entity Registrant Name |

AMERICAN

REBEL HOLDINGS, INC.

|

| Entity Central Index Key |

0001648087

|

| Entity Tax Identification Number |

47-3892903

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

909

18th Avenue South

|

| Entity Address, Address Line Two |

Suite A

|

| Entity Address, City or Town |

Nashville

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37212

|

| City Area Code |

(833)

|

| Local Phone Number |

267-3235

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock 0. 001 Par Value [Member] |

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

AREB

|

| Security Exchange Name |

NASDAQ

|

| Common Stock Purchase Warrants [Member] |

|

| Title of 12(b) Security |

Common

Stock Purchase Warrants

|

| Trading Symbol |

AREBW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AREB_CommonStock0.001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AREB_CommonStockPurchaseWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

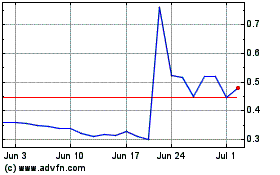

American Rebel (NASDAQ:AREB)

Historical Stock Chart

From Apr 2024 to May 2024

American Rebel (NASDAQ:AREB)

Historical Stock Chart

From May 2023 to May 2024