UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE PRE-14C

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

| Check the appropriate box: |

| |

| ☒ |

Preliminary Information Statement |

| ☐ |

Confidential, For Use of the Commission Only (as Permitted by Rule 14c-5(d)(2) |

| ☐ |

Definitive Information Statement |

WB Burgers Asia, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No fee required |

| |

|

| ☐ |

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

|

| (1) |

Title of each class of securities to which transaction applies: |

| |

|

| (2) |

Aggregate number of securities to which transaction applies: |

| |

|

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

| (4) |

Proposed maximum aggregate value of transaction: |

| |

|

| (5) |

Total fee paid: |

| |

|

| ☐ |

Fee paid previously with preliminary materials: |

| |

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

| (1) |

Amount previously paid: |

| |

|

| (2) |

Form, Schedule or Registration Statement No.: |

| |

|

| (3) |

Filing Party: |

| |

|

| (4) |

Date Filed: |

THIS

INFORMATION STATEMENT IS BEING PROVIDED TO

YOU

BY THE BOARD OF DIRECTORS OF WB Burgers Asia, INC.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED

NOT TO SEND US A PROXY

WB Burgers Asia, Inc.

3F

K’s Minamiaoyama

6-6-20

Minamiaoyama, Minato-ku,

Tokyo

107-0062, Japan

+81-90-6002-4978

Notice

of Action by Written Consent of Stockholders to be Effective December __, 2023 or as soon as practicable thereafter.

To the Holders of Common Stock of WB Burgers Asia, Inc.:

WB Burgers Asia, Inc., a Nevada Corporation,

(the “Company”), hereby notifies our stockholders of record on November 6, 2023, that stockholders holding approximately 78.50%

of the voting power have approved, by written consent in lieu of a special meeting on November 3, 2023, the following proposal(s):

Proposal(s): To conduct a 100 to 1 Reverse Stock Split, effecting only the outstanding Common Shares of the Company. Accordingly, the

Company will file a Certificate of Change (the “Certificate”) pursuant to Nevada Revised Statutes (“NRS”)

Section 78.209 with the Secretary of State of the State of Nevada on December ___, 2023, or as soon as practicable thereafter, which

is at least 20 calendar days following the date the Company first mailed the Information Statement to its stockholders.

In

connection with the Reverse Stock Split detailed herein, the Company will file with the Financial Industry Regulatory Authority (FINRA)

an Over-The-Counter (OTC) Corporate Action for the Reverse Stock Split to be processed by FINRA and published on the FINRA Daily List.

This

Information Statement is first being mailed to our stockholders of record as of the close of business on November 6, 2023. The actions

contemplated herein will not be effective prior to December ___, 2023, a date which is meant to allow sufficient time to accommodate at

least 20 days after the date on which our definitive Information Statement is first mailed to our stockholders of record. You are urged

to read the Information Statement in its entirety for a description of the action taken by the majority stockholders of the Company.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

The action(s) to be effective at least 20 days after

the mailing of this Information Statement are:

Proposal(s):

To conduct a 100 to 1 Reverse Stock Split, effecting only the outstanding Common Shares of the Company. Accordingly, the Company

will file a Certificate of Change (the “Certificate”) pursuant to Nevada Revised Statutes (“NRS”) Section 78.209

with the Secretary of State of the State of Nevada on December ___, 2023, or as soon as practicable thereafter, which is at least 20

calendar days following the date the Company first mailed the Information Statement to its stockholders.

In

connection with the Reverse Stock Split detailed herein, the Company will file with the Financial Industry Regulatory Authority (FINRA)

an Over-The-Counter (OTC) Corporate Action for the Reverse Stock Split to be processed by FINRA and published on the FINRA Daily List.

Pursuant

to the proposed action, there is to be no change in the quantity of our authorized shares of Common or Preferred Stock.

As

described in this Information Statement, the Majority Stockholders, collectively representing approximately 78.50% of the voting

power of the Company, as well as the Board of Directors, approved the aforementioned Proposals by written consent in lieu of a

meeting by the Directors and Shareholders holding the majority of the voting power of the Company.

This is not a notice of a meeting of stockholders

and no stockholders’ meeting will be held to consider the matters described herein. This Information Statement is being furnished

to you solely for the purpose of informing stockholders of the matters described herein pursuant to Section 14(c) of the Exchange Act

and the regulations promulgated thereunder, including Regulation 14C.

ACCORDINGLY, WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE REQUESTED NOT TO SEND US A PROXY. NO PROXY CARD HAS BEEN ENCLOSED WITH THIS INFORMATION.

This Information Statement will serve as written notice

to stockholders of the Company pursuant to the Nevada Revised Statutes.

| By Order of the Board of Directors. |

|

| November ___, 2023 |

/s/ Koichi Ishizuka |

| |

Koichi Ishizuka |

| |

Chief Executive Officer; Director |

INFORMATION

STATEMENT REGARDING

ACTION

TAKEN BY WRITTEN CONSENT OF

THE

MAJORITY SHAREHOLDERS

IN

LIEU OF A SPECIAL MEETING

WE

ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

WB Burgers Asia, Inc.

3F

K’s Minamiaoyama

6-6-20

Minamiaoyama, Minato-ku,

Tokyo

107-0062, Japan

+81-90-6002-4978

INFORMATION STATEMENT

GENERAL INFORMATION

This Information Statement has been filed with

the Securities and Exchange Commission (the “SEC”) and is being sent, pursuant to Section 14C of the Exchange

Act, to the holders of record as of November 6, 2023 (the “Record Date”) of Common Stock, $0.0001 par value (the

“Common Stock”), of WB Burgers Asia, Inc. a Nevada corporation (the “Company,”

“we,” “our” or “us”), to notify holders of our Common Stock of

the following:

Stockholders holding approximately 78.50%

of the voting power have approved, by written consent in lieu of a special meeting on November 3, 2023, the following proposal(s):

Proposal(s):

To conduct a 100 to 1 Reverse Stock Split, effecting only the outstanding Common Shares of the Company. Accordingly, the Company will

file a Certificate of Change (the “Certificate”) pursuant to Nevada Revised Statutes (“NRS”) Section 78.209 with

the Secretary of State of the State of Nevada on December ___, 2023, or as soon as practicable thereafter, which is at least 20 calendar

days following the date the Company first mailed the Information Statement to its stockholders.

In

connection with the Reverse Stock Split detailed herein, the Company will file with the Financial Industry Regulatory Authority (FINRA)

an Over-The-Counter (OTC) Corporate Action for the Reverse Stock Split to be processed by FINRA and published on the FINRA Daily List.

Pursuant

to the proposed action, there is to be no change in the quantity of our authorized shares of Common or Preferred Stock.

We

anticipate that we will file an 8-K with the Securities and Exchange Commission after completion of our FINRA corporate action that

may include, amongst other details, our new CUSIP number for our Common Stock and other pertinent information. The legal date of the

Certificate of Change we will file with the Nevada Secretary of State in connection with our Reverse Stock Split may not be the same

exact date as the FINRA effective date of our Reverse Stock Split.

This

Information Statement is first being mailed to our stockholders of record as of the close of business on November 6, 2023. The actions

contemplated herein will not be effective prior to December ___, 2023, a date which is meant to allow sufficient time to accommodate at

least 20 days after the date on which our definitive Information Statement is first mailed to our stockholders of record. You are urged

to read the Information Statement in its entirety for a description of the action taken by the majority stockholders of the Company.

The

reverse stock split will be effected by the Company filing a Certificate of Change (the “Certificate”) pursuant to

Nevada Revised Statutes (“NRS”) Section 78.209 with the Secretary of State of the State of Nevada on December __, 2023,

or as soon as practicable thereafter. The Certificate is not effective until the Effective Date. Under Nevada law, no amendment to the Company’s Articles of

Incorporation is required in connection with the reverse stock split.

Under the NRS, stockholders are not entitled to dissenters’ rights with respect to the Reverse Stock Split.

This Information Statement is being

furnished for informational purposes only.

Our

Board of Directors is not soliciting your proxy or consent in connection with the aforementioned Reverse Stock Split or

Proposals. You are urged to read this Information Statement carefully and in its entirety for a description of the corporate action

taken by the Majority Stockholders and Board of Directors.

The

entire cost of furnishing this Information Statement will be borne by the Company.

We will commence mailing the notice to the holders

of Common Stock on or about November ___, 2023.

PLEASE NOTE THAT THIS IS NOT A REQUEST FOR YOUR

VOTE OR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF CERTAIN ACTIONS TAKEN BY THE MAJORITY STOCKHOLDERS.

DESCRIPTION

OF CAPITAL STOCK

We have authorized capital stock consisting of 5,000,000,000

shares of Common Stock, $0.0001 par value per share (“Common Stock”) and 200,000,000 shares of Preferred Stock, $0.0001 par

value per share (“Preferred Stock”). Of the shares of our Preferred Stock, 1,000,000 are designated as Series A Preferred

Stock, having voting rights whereas every one share of Series A Preferred Stock has voting rights equivalent to 1,000 shares of Common

Stock.

As of the date of this filing,

we have 2,072,642,444 shares of Common Stock and 0 shares of Preferred Stock issued and outstanding.

Common Stock

Holders of shares of Common Stock

shall be entitled to cast one vote for each share held at all stockholders' meetings for all purposes, including the election of directors.

The Common Stock does not have cumulative voting rights. No holder of shares of stock of any class or series shall be entitled as a matter

of right to subscribe for or purchase or receive any part of any new or additional issue of shares of stock of any class or series, or

of securities convertible into shares of stock of any class or series, whether now hereafter authorized or whether issued for money, for

consideration other than money, or by way of dividend.

Preferred Stock

Two hundred million (200,000,000)

shares are designated as preferred stock at $0.0001 par value (the “Preferred Stock”). One million (1,000,000) shares of Preferred

Stock shall be designated as Series A Preferred Stock. Every share of Series A Preferred Stock may be converted into one thousand (1,000)

shares of Common Stock at the discretion of the holder(s) of Series A Preferred Stock., and every vote of Series A Preferred Stock shall

have voting rights equal to 1,000 votes of Common Stock.

The Preferred Stock of the Corporation

shall be issuable by authority of the Board of Director(s) of the Corporation in one or more classes or one or more series within any

class and such classes or series shall have such voting powers, full or limited, or no voting powers, and such designations, preferences,

limitations or restrictions as the Board of Directors of the Corporation may determine, from time to time. The authority of the Board

of Directors with respect to each class or series shall include all designation rights conferred by Nevada Laws upon directors, including,

but not limited to, determination of the following:

(a) The number of shares constituting

of that class or series and the distinctive designation of that class or series;

(b) The dividend rate on the share

of that class or series, whether dividends shall be cumulative, and, if so, from which date or dates, and the relative rights or priorities,

if any, of payment of dividends on shares of that class or series;

(c) Whether the shares of that

class or series shall have conversion privileges, and, if so, the terms and conditions of such privileges, including provision for adjustment

of conversion rate(s) in relation to such events as the Board of Directors shall determine;

(d) Whether the shares of that

class or series shall be redeemable, and, if so, the terms and conditions of such redemption, including the date or dates upon or after

which amount they shall be redeemable, and the amount per share payable in case of redemption, which amount may vary under different conditions

and at different redemption dates;

(e) Whether there shall be a sinking

fund for the redemption or purchase of shares of that class or series, and, if so, the terms and amount of such sinking fund;

(f) The rights of the shares of

that class or series in the event of voluntary or involuntary liquidation, dissolution or winding up of the Corporation, and the relative

rights of priority, if any, of payment of shares of that class or series; and

(g) Any other relative rights,

preferences and limitations of that class or series now or hereafter permitted by law.

Options and Warrants

None.

Convertible Notes

None.

Dividend Policy

We have not paid any cash dividends

to shareholders. The declaration of any future cash dividends is at the discretion of our board of directors and depends upon our earnings,

if any, our capital requirements and financial position, general economic conditions, and other pertinent conditions. It is our

present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Holders

As of the date of this information statement, we have approximately 224 shareholders of record.

Transfer Agent

Our transfer agent is Olde Monmouth

Stock Transfer Co., Inc. Their mailing address is 200 Memorial Parkway Atlantic Highlands, NJ 07716.

VOTING SECURITIES

As

of the date of this Information Statement, our voting securities consist of our shares of our Common Stock, par value $0.0001 per

share (“Common Stock”) of which 2,072,642,444 shares of Common Stock are issued and outstanding. At this time we have

no shares of Preferred Stock issued and outstanding.

Our

Certificate of Change, which needs to be filed with the Nevada Secretary of State to effectuate our Reverse Stock Split, requires

the affirmative consent of our majority shareholders, which has been obtained by White Knight Co., Ltd., which is owned and

controlled by Koichi Ishizuka, as well as Koichi Ishizuka individually. Collectively, White Knight Co., Ltd. and Koichi Ishizuka beneficially own approximately 78.50% of the issued and outstanding shares of our Common

Stock.

White

Knight Co., Ltd., controlled entirely by Koichi Ishizuka, Koichi Ishizuka individually, and our Board of Directors, consisting solely of Koichi

Ishizuka, have approved the proposed action(s) herein.

Koichi

Ishizuka, through both his direct and indirect ownership of the Company, has the power to pass the proposed corporate actions

detailed herein without the concurrence of any of our other stockholders.

This

Information Statement will be mailed on or about November __, 2023 to stockholders of record as of the Record Date and is being

delivered to inform you of the corporate action described herein before such action takes effect in accordance with Rule 14c-2 of

the Securities Exchange Act of 1934.

The

entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians,

fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our voting securities held of record

by them, and we will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

Dissenters’

Rights of Appraisal

No dissenters’ or appraisal rights are available

to the Company’s stockholders as of the Record Date under Nevada law, the Restated Certificate of Incorporation, or the bylaws of

the Company in connection with the Actions.

ACTIONS TO BE TAKEN

On November 3, 2023, the Board, along with White

Knight Co., Ltd. and Koichi Ishizuka, “the Consenting Stockholders”, as well as our Board of Directors, consisting

solely of Koichi Ishizuka, approved the following proposal(s):

Proposal(s):

To conduct a 100 to 1 Reverse Stock Split, effecting only the outstanding Common Shares of the Company. Accordingly, the Company will

file a Certificate of Change (the “Certificate”) pursuant to Nevada Revised Statutes (“NRS”) Section 78.209 with

the Secretary of State of the State of Nevada on December ___, 2023, or as soon as practicable thereafter, which is at least 20 calendar

days following the date the Company first mailed the Information Statement to its stockholders.

In

connection with the Reverse Stock Split detailed herein, the Company will file with the Financial Industry Regulatory Authority (FINRA)

an Over-The-Counter (OTC) Corporate Action for the Reverse Stock Split to be processed by FINRA and published on the FINRA Daily List.

Pursuant

to the proposed action, there is to be no change in the quantity of our authorized shares of Common or Preferred Stock.

Purpose

of the Reverse Stock Split

The

Company’s Board of Directors, consisting solely of Koichi Ishizuka, and our Majority Shareholders, comprised of White Knight

Co., Ltd., which is owned and controlled by Koichi Ishizuka, as well as Koichi Ishizuka individually, believe that the Reverse Stock

Split is in the best interests of the Company and its shareholders.

It

is the belief of the Board of Directors, and the Majority Shareholders, that the Reverse Stock Split is in the best interests of the

Company primarily for the following reasons, although these are not necessarily the sole rationale behind this decision:

The

Board of Directors and Majority Shareholders believe that the Reverse Stock Split will improve the marketability and liquidity of

the Common Stock. The Company believes that the increased market price of its Common Stock, expected as a result of implementing the

Reverse Stock Split, may improve the marketability and liquidity of its Common Stock and may encourage interest and trading in its

Common Stock. The Reverse Stock Split could allow a broader range of institutions to invest in Common Stock (namely, funds that are

prohibited from buying stocks whose price is below a certain threshold), potentially increasing the liquidity of its Common Stock.

Because of the trading volatility often associated with low-priced stocks, many brokerage firms and or institutional investors have

internal policies and practices that prohibit them from investing in low-priced stocks. However, the liquidity of the Common Stock

may in fact be adversely affected by the proposed Reverse Stock Split given the reduced number of shares that would be outstanding

after the Reverse Stock Split.

Risks

of the Reverse Stock Split

The

Reverse Stock Split may not have the effect that the Company anticipates, which would prevent the Company from realizing some of the

anticipated benefits of the Reverse Stock Split. The immediate effect of the Reverse Stock Split would be to reduce the number of

shares of outstanding Common Stock and to potentially increase the trading price of the Company’s Common Stock. However, the effect

of any effected Reverse Stock Split upon the market price of the Common Stock cannot be predicted, and the history of reverse stock splits

for companies in similar circumstances sometimes improves stock performance, but in many cases does not. There can be no assurance that

the trading price of the Common Stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares

of the Company’s Common Stock outstanding as a result of the Reverse Stock Split or remain at an increased level for any period.

Also, there is no assurance that the stock price would not decline below the anticipated stock price following the Reverse Stock Split.

The trading price of the Common Stock may change due to a variety of other factors, including’s operating results, other factors

related to the Company’s business and general market conditions. In addition, the fewer number of shares that will be available

to trade will possibly cause the trading market of the Common Stock to become less liquid, which could have an adverse effect on the

price of the Common Stock.

Effects

of the Reverse Stock Split

Reduction

of Shares Held by Individual Stockholders. After the Effective Split Time, each Common Stockholder will own fewer shares of the

Company’s Common Stock. However, the Reverse Stock Split will affect all of the Common Stockholders uniformly and will not

affect any Common Stockholder’s percentage ownership interests in the Company, except to the extent that the Reverse Stock

Split results in any of its stockholders owning a fractional share as described below. Any fractional share shall be rounded up to

the nearest whole share. Further, any stockholder as of the Effective Split Time who owns at least 100 shares will not own less than

100 shares as a result of the Reverse Stock Split.

Authorized

Shares of Common Stock. The Reverse Stock Split, if implemented, would not change the number of authorized shares of the Common

Stock as designated by the Articles. Therefore, because the number of issued and outstanding shares of Common Stock would decrease, the

number of shares remaining available for issuance of Common Stock would increase.

Other

Effects on Outstanding Shares. If the Reverse Stock Split is implemented, the rights and preferences of the outstanding shares of

the Common Stock would remain the same after the Reverse Stock Split. Each share of Common Stock issued pursuant to the Reverse Stock

Split would be fully paid and non-assessable.

STATE

FILING

The

Reverse Stock Split will be effected by the Company filing a Certificate of Change (the “Certificate”) pursuant to

Nevada Revised Statutes (“NRS”) Section 78.209 with the Secretary of State of the State of Nevada on December ___, 2023,

or as soon as practicable thereafter, which is at least 20 calendar days following the date the Company first mailed

the Information Statement to its stockholders.

In

connection with the Reverse Stock Split detailed herein, the Company will file with the Financial Industry Regulatory Authority

(FINRA) an Over-The-Counter (OTC) Corporate Action for the Reverse Stock Split to be processed by FINRA and published on the FINRA

Daily List. As a result of the Reverse Stock Split we anticipate that our ticker symbol may change for a temporary period of time,

with the addition of a “D”. In connection with our Reverse Stock Split we will receive a new CUSIP number.

We

anticipate that we will file an 8-K with the Securities and Exchange Commission after completion of our FINRA corporate action that may

include, amongst other details, our new CUSIP number for our Common Stock and other pertinent information.

The

legal date of the Certificate of Change we will file with the Nevada Secretary of State in connection with our

Reverse Stock Split may not be the same exact date as the FINRA effective date of our Reverse Stock Split.

See Appendix A for the text

of the Certificate of Change.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following sets forth

information as of November 3, 2023, regarding the number of shares of our Common Stock beneficially owned by (i) each person that we

know beneficially owns more than 5% of our outstanding Common Stock, (ii) each of our directors and named executive officer and (iii)

all of our directors and named executive officer as a group.

Beneficial ownership and percentage ownership are

determined in accordance with the rules of the SEC. Under these rules, beneficial ownership generally includes any shares as to which

the individual or entity has sole or shared voting power or investment power and includes any shares that an individual or entity has

the right to acquire beneficial ownership of within 60 days of November 3, 2023, through the exercise of any option, warrant or similar

right (such instruments being deemed to be “presently exercisable”). In computing the number of shares beneficially owned

by a person and the percentage ownership of that person, shares of our common stock that could be issued upon the exercise of presently

exercisable options and warrants are considered to be outstanding. These shares, however, are not considered outstanding as of November 3, 2023 when computing the percentage ownership of each other person.

The percentage of voting control

held by each listed person and/or entity is based on 2,072,642,444 shares of Common Stock, $0.0001 par value, issued and outstanding

and 0 shares of Preferred Stock, $0.0001 par value, issued and outstanding as of the date of this report.

| Name and Address of Beneficial Owner |

Shares of Common Stock Beneficially Owned |

Common Stock Voting Percentage Beneficially Owned |

Voting Shares Preferred Stock Are Able to Vote |

Preferred Stock Voting Percentage Beneficially Owned |

Total Voting Percentage Beneficially Owned (1) |

| Executive Officers and Directors |

|

|

|

|

|

| Koichi Ishizuka 1 |

101,363,636 |

4.89% |

0 |

0.0% |

4.89% |

| 5% or greater Shareholders (of any class) |

|

|

|

|

|

| White Knight Co., Ltd. 2 |

1,525,575,514 |

73.61% |

0 |

0% |

73.61% |

| Total |

1,626,939,150 |

78.50% |

0 |

0% |

78.50% |

1 The row above for Koichi Ishizuka denotes shares held under

his personal name.

2 White Knight Co., Ltd., is owned entirely by our sole officer

and Director, Koichi Ishizuka.

Note: Collectively, Koichi Ishizuka and White Knight Co., Ltd.

own and control 1,626,939,150 shares of Common Stock as of the date of this Information Statement.

Beneficial ownership has been determined in accordance

with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person

(if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially

owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within 60 days of

the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed

to include the amount of shares beneficially owned by such person by reason of such acquisition rights. As a result, the percentage of

outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at

any particular date.

INTEREST

OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No

director, executive officer, nominee for election as a director, associate of any director, executive officer or nominee, or any

other person, has any substantial interest, direct or indirect, in the Name Change or Proposals detailed herein that are not shared

by all other stockholders.

DELIVERY OF DOCUMENTS TO STOCKHOLDERS

SHARING AN ADDRESS

If hard copies of the materials are requested,

we will send only one Information Statement and other corporate mailings to stockholders who share a single address unless we

received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed

to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of

the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered.

You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address

and (iii) the address to which the Company should direct the additional copy of the Information Statement, to WB Burgers Asia, Inc.,

3F K’s Minamiaoyama 6-6-20, Minamiaoyama, Minato-ku, Tokyo, 107-0062, Japan, Attn: Chief Executive Officer,

Koichi Ishizuka.

If multiple stockholders sharing an address have received

one copy of this Information Statement or any other corporate mailing and would prefer the Company to mail each stockholder a separate

copy of future mailings, you may mail notification to, or call the Company at, its principal executive offices. Additionally, if current

stockholders with a shared address received multiple copies of this Information Statement or other corporate mailings and would prefer

the Company to mail one copy of future mailings to stockholders at the shared address, notification of such request may also be made by

mail or telephone to the Company’s principal executive offices.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING

INFORMATION

This Information Statement may contain

“forward-looking statements” made under the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. The statements include, but are not limited to, statements concerning the effects of the Reverse Stock Split outlined above and statements using terminology such as “expects,” “should,”

“would,” “could,” “intends,” “plans,” “anticipates,”

“believes,” “projects” and “potential.” Such statements reflect the current view of the Company

with respect to future events and are subject to certain risks, uncertainties and assumptions. Known and unknown risks,

uncertainties and other factors could cause actual results to differ materially from those contemplated by the statements.

In evaluating these statements, you should specifically

consider various factors that may cause our actual results to differ materially from any forward-looking statements. You should carefully

review the risks listed, as well as any cautionary language, in this Information Statement and the risk factors detailed under “Risk

Factors” in the documents incorporated by reference in this Information Statement, which provide examples of risks, uncertainties

and events that may cause our actual results to differ materially from any expectations we describe in our forward-looking statements.

There may be other risks that we have not described that may adversely affect our business and financial condition. We disclaim any obligation

to update or revise any of the forward-looking statements contained in this Information Statement. We caution you not to rely upon any

forward-looking statement as representing our views as of any date after the date of this Information Statement. You should carefully

review the information and risk factors set forth in other reports and documents that we file from time to time with the SEC.

ADDITIONAL INFORMATION

We are subject to the disclosure requirements of the

Exchange Act, and in accordance therewith, file reports, information statements and other information, including annual and quarterly

reports on Form 10-K and 10-Q, respectively, with the SEC. Reports and other information filed by the Company can be inspected and copied

at the public reference facilities maintained by the SEC, 100 F Street, N.E., Washington, DC 20549. In addition, the SEC maintains a web

site on the Internet (http://www.sec.gov) that contains reports, information statements and other information regarding issuers

that file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval System.

A copy of any public filing is also available,

at no cost, by writing to WB Burgers Asia, Inc., 3F K’s Minamiaoyama 6-6-20, Minamiaoyama, Minato-ku, Tokyo, 107-0062

Japan, Attn: Chief Executive Officer, Koichi Ishizuka. Any statement contained in a document that is incorporated by

reference will be modified or superseded for all purposes to the extent that a statement contained in this Information Statement (or

in any other document that is subsequently filed with the SEC and incorporated by reference) modifies or is contrary to such

previous statement. Any statement so modified or superseded will not be deemed a part of this Information Statement except as so

modified or superseded.

This Information Statement is provided to the holders

of Common Stock of the Company only for information purposes in connection with the Action, pursuant to and in accordance with Rule 14c-2

of the Exchange Act. Please carefully read this Information Statement.

| |

By Order of the Board of Directors |

| |

|

| November 6, 2023 |

/s/ Koichi Ishizuka |

| |

Koichi Ishizuka |

| |

Chief

Executive Officer, Sole Director |

APPENDIX A

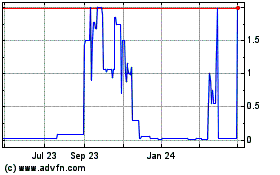

WB Burgers Asia (CE) (USOTC:WBBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

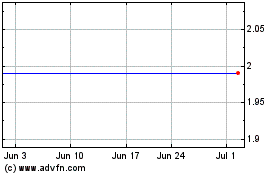

WB Burgers Asia (CE) (USOTC:WBBA)

Historical Stock Chart

From Apr 2023 to Apr 2024