UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 Under

the

Securities Exchange Act of 1934

For

the month of November 2023

Commission

File Number: 001-38304

DOGNESS

(INTERNATIONAL) CORPORATION

(Registrant’s

name)

No.

16 N. Dongke Road, Tongsha Industrial Zone

Dongguan,

Guangdong

People’s

Republic of China 523217

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXPLANATORY

NOTE

On

November 6, 2023, Dogness (International) Corporation, a British Virgin Islands company (the “Company”), announced (i) a

share consolidation of the Company’s issued and outstanding Class A common shares (“Class A Shares”) at the

ratio of one-for-twenty (the “Share Consolidation”) and (ii) an amendment of the Company’s Memorandum and Articles

of Association (the “Amended and Restated M&A”) to change its authorized shares from 90,931,000 Class A Shares with $0.002

par value per share and 19,069,000 Class B common shares (“Class B Shares”) with $0.002 par value per share to an unlimited

number of authorized Class A Shares and Class B Shares, each without par value.

Reason

for the Share Consolidation

The

Share Consolidation was effected to enable the Company to meet the NASDAQ continued listing standards relating to the minimum bid price.

Effects

of the Share Consolidation

Effective

Date; Symbol; CUSIP Number. The Share Consolidation will become effective on November 7, 2023 and will be reflected with the

NASDAQ Capital Market and in the marketplace at the open of business on November 7, 2023 (the “Effective Date”), whereupon

the Class A Shares will begin trading on a split-adjusted basis. In connection with the Share Consolidation, the Company’s Class

A Shares will be listed for trading on NASDAQ Capital Market under the same symbol “DOGZ” but will trade under a new CUSIP

Number, G2788T111.

Split

Adjustment; No Fractional Shares. On the Effective Date, the total number of the Company’s Class A Shares held by each

shareholder will be converted automatically into the number of whole Class A Shares equal to (i) the number of issued and outstanding

Class A Shares held by such shareholder immediately prior to the Share Consolidation, divided by (ii) twenty (20).

No

fractional Class A Shares will be issued to any shareholders in connection with the Share Consolidation. The Company will purchase, redeem

or otherwise acquire at market value any fractional shares. No change will occur with respect to the issued and outstanding Class B Shares.

Non-Certificated

Shares; Certificated Shares. Shareholders who are holding their Class A Shares in electronic form at brokerage firms do not have

to take any action as the effect of the Share Consolidation will automatically be reflected in their brokerage accounts.

Shareholders

holding paper certificates may (but are not required to) send the certificates to the Company’s transfer agent, Transhare Corporation,

at the address given below. The transfer agent will issue a new share certificate reflecting the terms of the Share Consolidation to

each requesting shareholder. Please contact Transhare Corporation for further information, related costs and procedures before sending

any certificates.

Transhare

Corporation

17755

North US Highway 19 Suite 140

Clearwater,

FL 33764

Tel:

(303) 662-1112

British

Virgin Islands Filing. The Share Consolidation was effected by the Company’s filing of the Amended and Restated Memorandum

and Articles of Association (“Amended and Restated M&A”) with the Registrar of Corporate Affairs in the British Virgin

Islands on October 18, 2023. A copy of the Amended and Restated M&A is attached hereto as Exhibit 3.1 and incorporated herein by

reference.

Authorized

Shares. At the time the Share Consolidation is effective, the number of shares the Company is authorized to issue will change

from 110,000,000 shares divided into: (i) 90,931,000 Class A shares, each with a par value of US$0.002 and (ii) 19,069,000 Class B shares,

each with a par value of US$0.002 to an unlimited number of Class A Shares of no par value each and an unlimited number of Class B Shares

of no par value each.

Capitalization.

Immediately prior to the Effective Date, there were 31,055,259 Class A Shares outstanding. As a result of the Share Consolidation, there

are approximately 1,552,763 Class A Shares outstanding (subject to redemptions of fractional shares). Before and after the Share Consolidation,

the outstanding Class B Shares remaining the same as 9,069,000 shares.

The

Company continues to meet all other listing standards, and the Company issued a press release announcing the foregoing matters on November

6, 2023.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Dogness

(International) Corporation |

| |

|

|

| Date:

November 6, 2023 |

By:

|

/s/

Silong Chen |

| |

Name:

|

Silong

Chen |

| |

Title:

|

Chief

Executive Officer |

| |

|

(Principal

Executive Officer) and Duly Authorized |

| |

|

Officer |

Exhibit

3.1

Exhibit

99.1

Dogness

(International) Corporation Announces 1-for-20 Class A Common Share Consolidation

PLANO,

Texas, November 6, 2023– Dogness (International) Corporation (NASDAQ: DOGZ) (“Dogness” or the “Company”),

a developer and manufacturer of a comprehensive line of Dogness-branded, OEM and private label pet products, announced today that the

Company’s board of directors approved on October 18, 2023 to amend its Memorandum and Articles of Association. This amendment will

result in a change to the Company’s authorized shares and par value and effect a share consolidation of the Company’s issued

and outstanding Class A common shares (“Class A Shares”) at the ratio of 1-for-20 with the marketplace effective date

of November 7, 2023.

The

objective of the share consolidation is to enable the Company to regain compliance with Nasdaq Marketplace Rule 5550(a)(2) and maintain

its listing on Nasdaq. The Company continues to meet all other listing standards.

Beginning

with the opening of trading on November 7, 2023, the Company’s Class A Shares will trade on the Nasdaq Capital Market on a split-adjusted

basis, under the same symbol “DOGZ” but under a new CUSIP Number, G2788T111.

As

a result of the share consolidation, each twenty Class A Shares outstanding will automatically combine and convert to one issued and

outstanding common share without any action on the part of the shareholders. No fractional Class A Shares will be issued to any shareholders

in connection with the share consolidation, and such fractional shares will be redeemed by the Company.

At

the time the Share Consolidation is effective, the number of shares the Company is authorized to issue will change from 110,000,000 shares

divided into: (i) 90,931,000 Class A shares, each with a par value of US$0.002 and (ii) 19,069,000 Class B shares, each with a par value

of US$0.002 to an unlimited number of Class A Shares of no par value each and an unlimited number of Class B Shares of no par value each.

The share consolidation will reduce the number of Class A Shares outstanding from 31,055,259 to approximately 1,552,763 (subject to the

redemption of the fractional shares). Both before and after the Share Consolidation, the outstanding number of Class B

Shares is 9,069,000 shares.

About

Dogness

Dogness

(International) Corporation was founded in 2003 from the belief that dogs and cats are important, well-loved family members. Through

its smart products, hygiene products, health and wellness products, and leash products, Dogness’ technology simplifies pet lifestyles

and enhances the relationship between pets and pet caregivers. The Company ensures industry-leading quality through its fully integrated

vertical supply chain and world-class research and development capabilities, which has resulted in over 200 patents and patents pending.

Dogness products reach families worldwide through global chain stores and distributors. For more information, please visit: ir.dogness.com.

Forward

Looking Statements

No

statement made in this press release should be interpreted as an offer to purchase or sell any security. Such an offer can only be made

in accordance with the Securities Act of 1933, as amended, and applicable state securities laws. Certain statements in this press release

concerning our future growth prospects are forward-looking statements regarding our future business expectations intended to qualify

for the “safe harbor” under the Private Securities Litigation Reform Act of 1995, which involve a number of risks and uncertainties

that could cause actual results to differ materially from those in such forward-looking statements. The risks and uncertainties relating

to these statements include, but are not limited to, risks and uncertainties regarding lingering effects of the Covid-19 pandemic on

our customers’ businesses and end purchasers’ disposable income, our ability to raise capital on any particular terms, fulfillment

of customer orders, fluctuations in earnings, fluctuations in foreign exchange rates, our ability to manage growth, our ability to realize

revenue from expanded operation and acquired assets in China and the U.S., our ability to attract and retain highly skilled professionals,

client concentration, industry segment concentration, reduced demand for technology in our key focus areas, our ability to successfully

complete and integrate potential acquisitions, and unauthorized use of our intellectual property and general economic conditions affecting

our industry. Additional risks that could affect our future operating results are more fully described in our United States Securities

and Exchange Commission filings. These filings are available at www.sec.gov. Dogness may, from time to time, make additional written

and oral forward-looking statements, including statements contained in the Company’s filings with the Securities and Exchange Commission

and our reports to shareholders. In addition, please note that any forward-looking statements contained herein are based on assumptions

that we believe to be reasonable as of the date of this press release. The Company does not undertake to update any forward-looking statements

that may be made from time to time by or on behalf of the Company unless it is required by law.

For

more information, please contact:

Wealth

Financial Services LLC

Connie

Kang, Partner

Email:

ckang@wealthfsllc.com

Tel:

+86 1381 185 7742 (CN)

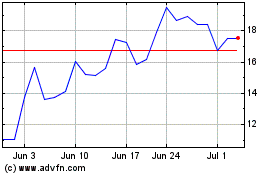

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Apr 2023 to Apr 2024