Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

November 03 2023 - 10:09AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

TO

(Amendment

No. 3)

TENDER

OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1) OF THE SECURITIES

EXCHANGE

ACT OF 1934

SIDECHANNEL,

INC.

(Name

of Subject Company (Issuer) and Name of Filing Person (Issuer)

Warrants

to Purchase Common Stock with an Exercise Price of $1.00

Warrants

to Purchase Common Stock with an Exercise Price of $0.36

Warrants

to Purchase Common Stock with an Exercise Price of $0.18

(Title

of Class of Securities)

N/A

(CUSIP

Number of Warrants)

Ryan

Polk

Chief

Financial Officer

SideChannel,

Inc.

146

Main Street, Suite 405

Worcester,

MA 01608

Phone:

(508) 925-0114

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

with

a copy to:

Michael

E. Storck, Esq. Paul J. Schulz, Esq. Lippes Mathias LLP

50

Fountain Plaza, Suite 1700

Buffalo,

New York 14202

(716)

853-5100

CALCULATION

OF FILING FEE

Transaction

valuation* $1.1 million; Amount of filing fee* $112

*

Estimated for purposes of calculating the amount of the filing fee only. SideChannel, Inc. (“SideChannel” or the “Company”)

is offering to holders of certain of its warrants, as more fully described herein, the opportunity to exchange such warrants for shares

of the Company’s common stock, par value $0.001 per share (“Shares” or “Common Stock”) by tendering (i)

six (6) warrants with an exercise price of $0.36 in exchange for one (1) share of our Common Stock, and (ii) four (4) warrants with an

exercise price of $1.00 or $0.18, as the case may be, in exchange for one (1) share of our Common Stock. The amount of the filing fee

assumes that all outstanding warrants that are the subject of the offer will be exchanged and is calculated pursuant to Rule 0-11(b)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The transaction value was determined assuming that

all warrants to purchase SideChannel’s Common Stock eligible to participate in the Offer are exchanged, and that the approximately

12,602,770 shares issued as a result of the Offer have an aggregate value of $1.1 million calculated based on the average of the low

and high trading price on August 16, 2023 which was $0.08.

The

amount of the filing fee, calculated in accordance with Rule 0-11(b) under the Exchange Act, equals $110.20 per million dollars

of the transaction valuation.

| ☐ |

Check

the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was

previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount

Previously Paid: N/A |

Filing

Party: N/A |

| Form

or Registration No.: N/A |

Date

Filed: N/A |

| ☐ |

Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check

the appropriate boxes below to designate any transactions to which the statement relates:

| |

☐ |

third-party

tender offer subject to Rule 14d-1. |

| |

☒ |

issuer

tender offer subject to Rule 13e-4. |

| |

☐ |

going-private

transaction subject to Rule 13e-3. |

| |

☐ |

amendment

to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ☒

SCHEDULE

TO

Amendment

No. 3

This

Amendment No. 3 (this “Amendment”) amends the Tender Offer Statement on (together with any amendments and supplements thereto,

the “Schedule TO”), filed with the Securities and Exchange Commission on August 22, 2023 by SideChannel, Inc., a Delaware

corporation (the “Company” or “SideChannel”).

This

Schedule TO relates to the offer by the Company to holders of certain of the Company’s outstanding warrants (the “Warrants”).

The offer is made upon the terms and subject to the conditions set forth in the Company’s offer to exchange, dated August 21, 2023

(the “Offer to Exchange”), and in the related Offer to Exchange materials which are filed as Exhibits (a)(1)(A), (a)(1)(B),

(a)(1)(C), (a)(1)(D) and (a)(1)(E) to this Schedule TO (which the Offer to Exchange and related Offer to Exchange materials, as amended

or supplemented from time to time, collectively constitute the “Offer Materials”). This was an Offer for all or none of the

Warrants. The Offer was subject to the requirement that all Warrants must be tendered by all eligible holders of the Warrants.

Except

as otherwise set forth in this Amendment, the information set forth in this Schedule TO remains unchanged and is incorporated herein

by reference to the extent relevant to the items in this Amendment. Capitalized terms used but not defined herein have the meanings ascribed

to them in the Schedule TO.

Company

Withdraws Offer to Exchange

The

Offer to Exchange and Items 1 through 9 and 11 through 12 of the Schedule TO, to the extent such items incorporate by reference the information

contained in the Offer to Exchange, are hereby amended by adding the following text thereto:

“On

November 1, 2023, the Expiration Date of the Offer to Exchange, the Company decided to withdraw the Offer to Exchange because it failed

to meet the requirement that all Warrants must be tendered by all eligible holders of the Warrants and chose to not waive this requirement.

The Company is providing Notices of Withdrawal to Warrant holders who had submitted Letters of Transmittal for the Offer to Exchange.

Warrant Holders who submitted a Letter of Transmittal will retain their original warrants and will not receive shares of Common Stock.”

Item

12. Exhibits.

Item

12 of the Schedule TO is hereby amended and supplemented by adding the following exhibits:

*

Filed herewith.

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| SIDECHANNEL,

INC. |

|

|

| |

|

|

| Date:

November 3, 2023 |

By: |

/s/

Ryan Polk |

| |

Name: |

Ryan

Polk |

| |

Title: |

Chief

Financial Officer |

Exhibit

(a)(1)(J)

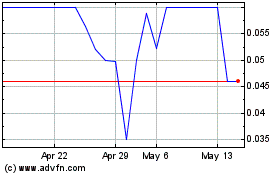

SideChannel (QB) (USOTC:SDCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

SideChannel (QB) (USOTC:SDCH)

Historical Stock Chart

From Apr 2023 to Apr 2024