The information in this

preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. A registration statement relating

to these securities has been declared effective by the Securities and Exchange Commission. This preliminary prospectus supplement and

the accompanying prospectus are not an offer to sell these securities and we are not soliciting an offer to buy these securities in any

state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 30,

2023

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-273431

PRELIMINARY Prospectus Supplement

(To Prospectus dated August 3, 2023)

Shares

![[dlpn_424b002.gif]](https://www.sec.gov/Archives/edgar/data/1282224/000107997323001500/image_001.gif)

Dolphin Entertainment, Inc.

Common Stock

————————————————————

We are offering of shares of our

common stock, par value $0.015 per share, at a public offering price of $ per share pursuant to this prospectus supplement and the accompanying

prospectus.

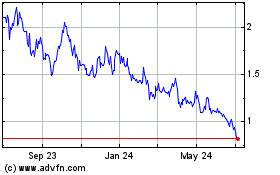

Our common stock is listed on

The Nasdaq Capital Market under the symbol “DLPN.” On October 27, 2023, the last reported sale price of our common stock was

$1.54 per share.

In offering securities by means

of this prospectus supplement and the accompanying base prospectus, we are relying on General Instruction I.B.6 of Form S-3, which limits

the amount of securities we can sell pursuant to the registration statement to one-third of the market value of our common stock held

by non-affiliates, or our public float, in any 12-month period. On the date of this prospectus supplement, our public float was $21,377,050

based on the closing sale price of our common stock of $1.54 on October 27, 2023. During the prior 12 calendar month period that ends

on and includes the date of this prospectus supplement, we have not issued any shares of common stock pursuant to General Instruction

I.B.6 of Form S-3 and accordingly we may sell up to approximately $7,054,426 of shares of common stock hereunder.

Investing

in our common stock involves a high degree of risk. See the risks described in the “Risk Factors” section

on page S-3 of this prospectus supplement, and in the documents incorporated by reference into this prospectus supplement and the base

prospectus, respectively.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offense.

————————————————————

| |

|

Per Share |

|

|

Total |

|

| Public offering price |

|

$ |

[ ] |

|

|

$ |

[ ] |

|

| Underwriting discounts and commissions (1) |

|

$ |

[ ] |

|

|

$ |

[ ] |

|

| Proceeds, before expenses, to us (2) |

|

$ |

[ ] |

|

|

$ |

[ ] |

|

———————

| (1) |

For additional information about the expenses for which we have agreed to reimburse the underwriters in connection with this offering, see “Underwriting” on page S-[ ] of this prospectus supplement. |

| (2) |

If the underwriters exercise the option in full, the total underwriting discount payable by us will be $________, and the total proceeds to us, before expenses, will be $________, |

We

have granted the underwriters the right to purchase up to an additional __________ shares of common stock. The underwriters may exercise

this right at any time, in whole or in part, within 45 days following the date of this prospectus supplement.

The underwriters expect to deliver the shares of common

stock on or about November __, 2023, subject to customary closing conditions.

Sole Book Runner

MAXIM GROUP LLC

The date of this prospectus

supplement is October [ ], 2023.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

All references to the terms “Dolphin,”

the “Company,” “we,” “us” or “our” in this prospectus supplement refer to Dolphin Entertainment,

Inc., a Florida corporation, and its consolidated subsidiaries, unless the context requires otherwise.

This prospectus supplement, the

accompanying prospectus and the documents incorporated in each by reference include important information about us, the shares being offered

and other information you should know before investing in our common stock. To the extent there is a conflict between the information

contained in this prospectus supplement, on the one hand, and the information contained in any document incorporated by reference into

this prospectus supplement that was filed with the SEC before the date of this prospectus supplement, on the other hand, you should rely

on the information in this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement

in another document having a later date - for example, a document incorporated by reference in this prospectus supplement - the statement

in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations

and prospects may have changed since the earlier date.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into

this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on this prospectus

supplement, the accompanying prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus

supplement and the accompanying prospectus. We have not authorized anyone to provide you with information that is in addition to or different

from that contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not offering to sell

these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or

incorporated by reference in this prospectus supplement is accurate as of any date other than as of the date of this prospectus supplement

or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus

supplement or any sale of our common stock. Our business, financial condition, liquidity, results of operations and prospects may have

changed since those dates. You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference,

and any free writing prospectus that we may authorize for use in connection with this offering, in their entirety before making an investment

decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus

titled “Where You Can Find Additional Information” and “Incorporation of Information by Reference”.

| |

PROSPECTUS SUPPLEMENT SUMMARY

The following summary of our business highlights

some of the information contained elsewhere in or incorporated by reference into this prospectus supplement or the accompanying prospectus.

Because this is only a summary, however, it does not contain all of the information that may be important to you. You should carefully

read this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein,

which are described under “Incorporation of Certain Information by Reference” in this prospectus supplement and under “Incorporation

of Certain Information by Reference” in the accompanying prospectus. You should also carefully consider the matters discussed in

the section in this prospectus supplement entitled “Risk Factors” and in the accompanying prospectus, in our Annual Report

on Form 10-K for the year ended December 31, 2022 and in other documents incorporated herein by reference.

Our Company

Overview

We are a leading independent entertainment

marketing and premium content production company. Through our subsidiaries, 42West, The Door, Shore Fire, The Digital Department, Special

Projects and Viewpoint, we provide expert strategic marketing and publicity services to many of the top brands, both individual and corporate,

in the entertainment, hospitality and music industries. 42West (film and television), The Door (culinary, hospitality and consumer products),

and Shore Fire (music) are each recognized global leaders in the PR and marketing services for the industries they serve. The Digital

Department was formed from the combination of two of our subsidiaries, Be Social and Socialyte, and provides best-in-class influencer

marketing capabilities. Special Projects is one of the entertainment industry’s leading talent booking and celebrity live event

company. Viewpoint adds full-service creative branding and production capabilities to our marketing group. Dolphin’s legacy content

production business, founded by our Emmy-nominated Chief Executive Officer, Bill O’Dowd, has produced multiple feature films and

award-winning digital series, primarily aimed at family and young adult markets. Our Common Stock trades on The Nasdaq Capital Market

under the symbol “DLPN”.

We have established an acquisition

strategy based on identifying and acquiring companies that complement our existing entertainment publicity and marketing services and

content production businesses. We believe that complementary businesses can create synergistic opportunities and bolster profits and cash

flow.

We have also established an investment

strategy, “Dolphin Ventures,” based upon identifying opportunities to develop internally owned assets, or acquire ownership

stakes in others’ assets, in the categories of entertainment content, live events and consumer products. We believe these categories

represent the types of assets wherein our expertise and relationships in entertainment marketing most influences the likelihood of success.

We are in various stages of internal development and outside conversations on a wide range of opportunities within Dolphin Ventures. We

intend to enter into additional investments during 2024, but there is no assurance that we will be successful in doing so, whether in

2024 or at all.

We operate in two reportable segments:

our entertainment publicity and marketing segment and our content production segment. The entertainment publicity and marketing segment

is composed of 42West, The Door, Shore Fire, The Digital Department, Special Projects and Viewpoint and provides clients with diversified

services, including public relations, entertainment content marketing, strategic communications, social media marketing, talent booking,

live event production, creative branding, and the production of promotional video content. The content production segment is composed

of Dolphin Films, Inc. (“Dolphin Films”) and Dolphin Digital Studios, which produce and distribute feature films and digital

content. The activities of our Content Production segment also include all corporate overhead activities.

Our Company Background

We

were originally incorporated in the State of Nevada on March 7, 1995, and we subsequently domesticated in the State of Florida on

December 4, 2014. Effective July 6, 2017, we changed our name from Dolphin Digital Media, Inc. to Dolphin Entertainment, Inc. Our

principal executive offices are located at 150 Alhambra Circle, Suite 1200, Coral Gables, Florida 33134. We also have offices located

at 600 3rd Avenue, 23rd Floor, New York, New York, 10016

and 1840 Century Park East, Suite 200, Los Angeles, California 90067. Our telephone number is (305) 774-0407 and our website address

is www.dolphinentertainment.com. Neither our website nor any information contained on, or accessible through, our website

is part of this prospectus supplement. |

|

| |

|

|

| The Offering |

| Common stock offered by us |

shares. |

| |

|

| Offering Price |

$ per share. |

| |

|

| Shares of common stock to be outstanding immediately after this offering(1) |

shares of common stock. (or shares of common stock if the underwriters

exercise their option to purchase additional shares in full) |

| |

|

Over-allotment option |

We have granted the underwriters an option to purchase up to an additional

shares of our common stock. This option is exercisable, in whole or in part, for a period of 45 days from the

date of this prospectus supplement |

| |

|

| Use of proceeds |

We intend to use the net proceeds from this offering for general corporate purposes, including working capital. We may also use a portion of the net proceeds to acquire or invest in complementary businesses. See “Use of Proceeds” for additional information. |

| |

|

| Risk factors |

Investing in our securities involves risks. You should read carefully the “Risk Factors” section of this prospectus supplement, the accompanying prospectus and in the documents incorporated by reference herein and therein for a discussion of factors that you should carefully consider before deciding to invest in our securities. |

| |

|

| Common stock symbol |

Our common stock is listed on the Nasdaq Capital Market under the symbol “DLPN.” |

———————

| (1) | | The number of shares of our common stock outstanding is based

on 14,208,361 shares outstanding as of October 27, 2023, which assumes

no exercise of the underwriters’ option to purchase additional shares and excludes: |

| • | | As of June 30, 2023, 20,000 shares of our common stock issuable

upon the exercise of outstanding warrants at an exercise price of $3.91 per share; |

| • | | shares of our common stock issuable upon the conversion of

50,000 shares of Series C Convertible Preferred Stock outstanding; |

| • | | 1,857,189 shares of our common stock reserved for future issuance

under our 2017 Equity Incentive Plan; |

| • | | Up to 2,332,877 shares of our common stock issuable upon the

conversion of eleven convertible promissory notes outstanding. One of the convertible promissory notes has a fixed conversion price of

$3.91 per share. The other ten convertible promissory notes have conversion prices based on a 90-day trailing trading average share price

but cannot be converted for less than $2.00 per share for five of the convertible promissory notes and $2.50 for five of the convertible

promissory notes. |

RISK FACTORS

Investing in our common stock involves a high degree

of risk. You should consider carefully the risks and uncertainties described below, the risks described under the heading “Risk

Factors” in Item 1A of Part I of our Annual Report on Form 10-K for the year ended December 31, 2022 and in the accompanying prospectus

and other information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus, including

our audited consolidated financial statements and the related notes, before you decide whether to purchase our common stock. If any of

the following risks actually occur, our business, financial condition, results of operations, cash flow and prospects could be materially

and adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment

in our common stock.

Risks Related to this Offering and our Common Stock

Management will have broad discretion as to the use of the net proceeds

from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion as to the

application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of this offering,

as described in “Use of Proceeds”. Our shareholders may not agree with the manner in which our management chooses to allocate

and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase our market

value.

You will experience immediate and substantial dilution.

The public offering price for

the common stock offered pursuant to this prospectus supplement is substantially higher than the net tangible book value of each outstanding

share of our common stock. Purchasers of common stock in this offering will experience immediate and substantial dilution on a book value

basis. Following this offering, there will be an immediate increase in net tangible book value of approximately $ per share to

our existing shareholders, and an immediate dilution of $ per share to investors purchasing shares in this offering, based on

an public offering price of $ per share. If the holders of outstanding options or other securities convertible into our

common stock exercise those options or other such securities at prices below the public offering price, you will incur further dilution.

Please see the section in the prospectus supplement entitled “Dilution” for a more detailed discussion of the dilution you

will incur in this offering. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price

per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or

other securities in the future could have rights superior to existing stockholders, including investors who purchase shares of common

stock in this offering. The price per share at which we sell additional shares of our common stock or securities convertible into common

stock in future transactions, may be higher or lower than the price per share in this offering. As a result, purchasers of the shares

we sell, as well as our existing stockholders, will experience significant dilution if we sell at prices significantly below the price

at which they invested.

We may require additional funding through further issuances of shares

of our common stock, which may negatively affect the market price of our common stock.

To operate our business, we may need to raise additional

capital through sales of our common stock or securities exercisable for or convertible into shares of our common stock. Future sales of

our common stock, or securities exercisable for or convertible into shares of our common stock, including shares of our common stock issued

upon exercise of warrants, could adversely affect the prevailing market price of our common stock and our ability to raise capital in

the future.

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING INFORMATION

This prospectus supplement contains

“forward-looking statements” and information within the meaning of Section 27A of the Securities Act of 1933, as amended,

or the “Securities Act”, and Section 21E of the Securities Exchange Act of 1934, as amended, or the “Exchange Act”,

which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited

to, statements about our plans, objectives, representations and intentions and are not historical facts and typically are identified by

use of terms such as “may,” “should,” “could,” “expect,” “plan,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “continue,” “will,”

“would” and similar words, although some forward-looking statements are expressed differently. You should be aware that the

forward-looking statements included herein represent management’s current judgment and expectations, but our actual results, events

and performance could differ materially from those in the forward-looking statements. We discuss our known material risks under Item 1.A

“Risk Factors” contained in our Company’s Annual Report on Form 10-K for the year ended December 31, 2022. Many factors

could cause our actual results to differ materially from the forward-looking statements. In addition, we cannot assess the impact of each

factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from

those contained in any forward-looking statements.

Any forward-looking statement

made by us in this prospectus supplement is based only on information currently available to us and speaks only as of the date on which

it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from

time to time, whether as a result of new information, future developments or otherwise.

USE OF PROCEEDS

We estimate that the net proceeds

from this offering, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, will

be approximately $ (or approximately $ if the underwriters’ over-allotment option is exercised in full).

We will retain broad discretion over the use of the

net proceeds to us from the sale of our securities under this prospectus supplement. We currently expect to use the net proceeds that

we receive from this offering for working capital and other general corporate purposes. We may also use a portion of the net proceeds

to acquire or invest in complementary businesses. We are currently pursuing opportunities. The consummation of this offering is not conditioned

upon the consummation of any such acquisition or investment. The expected use of net proceeds of this offering represents our current

intentions based on our present plans and business conditions. We cannot specify with certainty all of the particular uses for the net

proceeds to be received upon the closing of this offering.

DILUTION

If you invest in the common stock being offered by

this prospectus, you will suffer immediate and substantial dilution in the net tangible book value per share of common stock. Our net

tangible deficit as of June 30, 2023 was approximately $5.6 million, or approximately $0.40 per share. Net tangible deficit per share

represents our total tangible assets less total tangible liabilities, divided by the number of shares of common stock outstanding as of

June 30, 2023.

Dilution in net tangible book

value per share represents the difference between the public offering price per share paid by purchasers in this offering and the net

tangible book value per share of our common stock immediately after this offering. After giving effect to the sale by us of shares in

this offering, assuming all shares are sold, at a public offering price of $ per share, after deducting estimated offering expenses

payable by us, our net tangible book value as of June 30, 2023 would have been approximately $ million, or approximately $

per share of common stock. This represents an immediate increase of $ in net tangible book value per share to our existing shareholders

and an immediate dilution of $ per share to purchasers of securities in this offering. The following table illustrates this per

share dilution:

| Public offering price per share |

|

$ |

[ ] |

|

| Net tangible book value deficit per share as of June 30, 2023 |

|

$ |

(0.40 |

) |

| Increase in net tangible book value per share attributable to new investors |

|

$ |

[ ] |

|

| Adjusted net tangible book value deficit per share as of June 30, 2023, after giving effect to the offering |

|

$ |

([ ] |

) |

| Dilution per share to new investors in the offering |

|

$ |

[ ] |

|

The above discussion and table assume no exercise of the underwriter’s option to purchase additional

shares and do not include the

following:

| |

|

|

| |

· |

As of June 30, 2023, 20,000 shares of our common stock issuable upon the exercise of outstanding warrants at an exercise price of $3.91 per share; |

| |

· |

shares of our common stock issuable upon the conversion of 50,000 shares of Series C Convertible Preferred Stock outstanding; |

| |

· |

1,857,189 shares of our common stock reserved for future issuance under our 2017 Equity Incentive Plan; |

| · | Up to 2,332,877 shares of our common stock issuable upon the conversion of eleven convertible promissory

notes outstanding. One of the convertible promissory notes has a fixed conversion price of $3.91 per share. The other ten convertible

promissory notes have conversion prices based on a 90-day trailing trading average share price but cannot be converted for less than $2.00

per share for five of the convertible promissory notes and $2.50 for five of the convertible promissory notes. |

CAPITALIZATION

The following table sets forth our consolidated cash

and cash equivalents and capitalization as of June 30, 2023. Such information is set forth on the following basis:

| |

|

|

| |

· |

on an actual basis; and |

| |

· |

on a pro forma as adjusted basis, giving effect to the sale of the shares in this offering at a public offering price of $_____ per share, after deducting estimated underwriting discounts and commissions and estimated offering expenses. |

You should read this table together with the section

of this prospectus supplement entitled “Use of Proceeds” and with the financial statements and related notes and the other

information that we incorporated by reference into this prospectus supplement and the accompanying prospectus, including our Annual Report

on Form 10-K and Quarterly Reports on Form 10-Q that we file from time to time with the SEC.

| | |

As

of June 30, 2023 | |

| | |

Actual | | |

As Adjusted | |

| Cash and cash equivalents | |

$ | 7,001,403 | | |

$ | — | |

| Restricted cash | |

| 1,127,960 | | |

| | |

| Accounts receivable: | |

| | | |

| | |

| Trade, net of allowance of $1,003,898 | |

$ | 5,614,202 | | |

| | |

| Other receivables | |

$ | 3,312,398 | | |

| | |

| Notes receivable | |

$ | 4,630,416 | | |

| | |

| Current Assets | |

$ | 22,524,981 | | |

| | |

| Total Assets | |

$ | 65,819,617 | | |

| | |

| Total liabilities | |

$ | 39,715,129 | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, Series C, $0.001 par value, 50,000 authorized, 50,000 shares issued and outstanding as of June 30, 2023. | |

| 1,000 | | |

| — | |

| Common stock, $0.015 par value, 200,000,000 shares authorized, 13,868,003 shares issued and outstanding as of June 30, 2023. | |

| 208,020 | | |

| | |

| Additional paid-in capital | |

$ | 146,038,511 | | |

| | |

| Accumulated Deficit | |

$ | (120,143,043 | ) | |

| | |

| Total Stockholders’ Equity | |

$ | 26,104,488 | | |

| | |

| Total Liabilities and Stockholders’ Equity | |

$ | 65,819,617 | | |

| | |

The calculation in the table above does not include

the following as of June 30, 2023:

| |

|

|

| |

· |

20,000 shares of our common stock issuable upon the exercise of outstanding warrants at an exercise price of $3.91 per share; |

| |

· |

shares of our common stock issuable upon the conversion of 50,000 shares of Series C Convertible Preferred Stock outstanding; |

| |

· |

1,857,189 shares of our common stock reserved for future issuance under our 2017 Equity Incentive Plan; |

| |

· |

Up to 2,332,877 shares of our common stock issuable upon the conversion of eleven convertible promissory notes outstanding. One of the convertible promissory notes has a fixed conversion price of $3.91 per share. The other ten convertible promissory notes have conversion prices based on a 90-day trailing trading average share price but cannot be converted for less than $2.00 per share for five of the convertible promissory notes and $2.50 for five of the convertible promissory notes. |

UNDERWRITING

We have entered into an underwriting

agreement with Maxim Group LLC (the “Representative”), as representative of the underwriters listed below, dated [●],

2023. Subject to the terms and conditions of the underwriting agreement, we have agreed to sell to each underwriter named below, and each

underwriter below has severally agreed to purchase, at the public offering price less the underwriting discounts set forth on the cover

page of this prospectus, the number of shares listed next to its name in the following table:

| Underwriter |

|

Number of

Shares |

|

|

| Maxim Group LLC |

|

|

|

|

|

| |

|

|

|

|

|

The underwriters are committed

to purchase all of the shares offered by us other than those covered by the over-allotment option described below, if they purchase any

shares. The obligations of the underwriters may be terminated upon the occurrence of certain events specified in the underwriting agreement.

Furthermore, pursuant to the underwriting agreement, the underwriters’ obligations are subject to customary conditions, representations

and warranties contained in the underwriting agreement, such as receipt by the underwriters of officers’ certificates and legal

opinions.

We have agreed to indemnify the

underwriters against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the underwriters

may be required to make in respect thereof.

The underwriters are offering

the shares, subject to prior sale, when, as and if issued to and accepted by it, subject to approval of legal matters by its counsel and

other conditions specified in the underwriting agreement. The underwriters reserve the right to withdraw, cancel or modify offers to the

public and to reject orders in whole or in part.

Over-Allotment Option

We have granted a 45-day option

to the Representative, exercisable one or more times in whole or in part, to purchase up to __________ additional shares of common stock,

less the underwriting discounts and commissions, to cover over-allotments, if any.

Discounts

The following table shows the

per Share and total underwriting discounts and commissions to be paid to the underwriter. Such amounts are shown assuming both no exercise

and full exercise of the underwriters’ option to purchase additional shares.

| |

|

|

|

|

Total |

|

| |

|

Per

Share |

|

|

Without

Option |

|

|

With

Option |

|

| Public offering price |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Underwriting discounts and commissions |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Proceeds, before expenses, to us |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

The underwriters propose to offer

the shares offered by us to the public at the public offering price set forth on the cover of this prospectus. In addition, the underwriters

may offer some of the shares to other securities dealers at such price less a concession of $__________ per share. If all of the shares

offered by us are not sold at the public offering price, the Representative may change the offering price and other selling terms by means

of a supplement to this prospectus.

The estimated offering expenses

payable by us, exclusive of the underwriting discounts and commissions, are approximately $__________. This amount includes the Representative’s

accountable expenses, including legal fees for Representative’s legal counsel, that we have agreed to pay at the closing of the

offering in an aggregate amount of up to $75,000.

Discretionary Accounts

The underwriters do not intend

to confirm sales of the securities offered hereby to any accounts over which it has discretionary authority.

Other Compensation

Within twelve (12) months following

either the expiration of our engagement of the Representative or the consummation of the offering, if we complete any financing of equity,

equity-linked, convertible or debt or other capital raising activity with any of the investors that were previously unknown to the Company

and contacted or introduced by the Representative, the Representative will be entitled to compensation as set forth in this section.

Upon the closing of the offering

contemplated hereby, and for a period of twelve (12) months from such closing, the Company grants the Representative the right of first

refusal to act as co-lead managing underwriter and co-book runner, placement agent with at least 50% of the economics, or sales agent

with at least 50% of the economics, for any and all future public or private equity, equity-linked or debt (excluding commercial bank

debt) offerings for which the Company retains the service of an underwriter, agent, advisor, finder or other person or entity in connection

with such offering during such twelve (12) month period of the Company, or any successor to or any subsidiary of the Company.

Electronic Offer, Sale and Distribution of Shares

A prospectus in electronic format

may be made available on the websites maintained by the underwriters or selling group members. The Representative may agree to allocate

a number of securities to the selling group members for sale to its online brokerage account holders. Internet distributions will be allocated

by the underwriters and selling group members that will make internet distributions on the same basis as other allocations. Other than

the prospectus in electronic format, the information on these websites is not part of, nor incorporated by reference into, this prospectus

or the registration statement of which this prospectus forms a part, has not been approved or endorsed by us, and should not be relied

upon by investors.

Stabilization

In connection with this offering,

the underwriters may engage in stabilizing transactions, over-allotment transactions, syndicate-covering transactions, penalty bids and

purchases to cover positions created by short sales.

| |

● |

Stabilizing transactions permit bids to purchase securities so long as the stabilizing bids do not exceed a specified maximum, and are engaged in for the purpose of preventing or retarding a decline in the market price of the securities while the offering is in progress. |

| |

● |

Over-allotment transactions involve sales by the underwriters of securities in excess of the number of securities the underwriters are obligated to purchase. This creates a syndicate short position which may be either a covered short position or a naked short position. In a covered short position, the number of securities over-allotted by the underwriters is not greater than the number of securities that they may purchase in the over-allotment option. In a naked short position, the number of securities involved is greater than the number of securities in the over-allotment option. The underwriters may close out any short position by exercising their over-allotment option and/or purchasing securities in the open market. |

| |

● |

Syndicate covering transactions involve purchases of securities in the open market after the distribution has been completed in order to cover syndicate short positions. In determining the source of the securities to close out the short position, the underwriters will consider, among other things, the price of securities available for purchase in the open market as compared with the price at which they may purchase securities through exercise of the over-allotment option. If the underwriters sell more securities than could be covered by exercise of the over-allotment option and, therefore, have a naked short position, the position can be closed out only by buying securities in the open market. A naked short position is more likely to be created if the underwriters is concerned that after pricing there could be downward pressure on the price of the securities in the open market that could adversely affect investors who purchase in the offering. |

| |

● |

Penalty bids permit the Representative to reclaim a selling concession from a syndicate member when the securities originally sold by that syndicate member are purchased in stabilizing or syndicate covering transactions to cover syndicate short positions. |

These stabilizing transactions,

over-allotment transactions, syndicate covering transactions and penalty bids may have the effect of raising or maintaining the market

price of our securities or preventing or retarding a decline in the market price of our securities. As a result, the price of our securities

in the open market may be higher than it would otherwise be in the absence of these transactions. Neither we nor the underwriters make

any representation or prediction as to the effect that the transactions described above may have on the price of our securities. These

transactions may be effected on the Nasdaq Capital Market, in the over-the-counter market or otherwise and, if commenced, may be discontinued

at any time.

Passive Market Making

In connection with this offering,

the underwriters and selling group members may engage in passive market making transactions in our securities in accordance with Rule

103 of Regulation M under the Exchange Act, during a period before the commencement of offers or sales of the shares and extending through

the completion of the distribution. In general, a passive market maker must display its bid at a price not in excess of the highest independent

bid of that security. However, if all independent bids are lowered below the passive market maker’s bid, then that bid must then

be lowered when specified purchase limits are exceeded. Passive market making may stabilize the market price of the securities at a level

above that which might otherwise prevail in the open market and, if commenced, may be discontinued at any time.

Certain Relationships

The underwriters and their affiliates

have provided, or may in the future provide, various investment banking, commercial banking, financial advisory, brokerage or other services

to us and our affiliates for which services they have received, and may in the future receive, customary fees and expense reimbursement.

The underwriters and their affiliates

may, from time to time, engage in transactions with and perform services for us in the ordinary course of its business for which they

may receive customary fees and reimbursements of expenses. In the ordinary course of their various business activities, the underwriters

and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative

securities) and financial instruments (including bank loans) for their own accounts and for the accounts of their customers and such investment

and securities activities may involve securities and/or instruments of our Company. The underwriters and their affiliates may also make

investment recommendations and/or publish or express independent research views in respect of such securities or instruments and may at

any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Selling Restrictions

European Economic Area

Notice to prospective investors in the European Economic

Area

In relation to each Member State

of the European Economic Area (each a “Relevant Member State”), no shares have been offered or will be offered pursuant to

the offering to the public in that Relevant Member State prior to the publication of a prospectus in relation to the shares which has

been approved by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member State

and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Regulation, except that it

may make an offer to the public in that Relevant Member State of any shares at any time under the following exemptions under the Prospectus

Regulation:

| |

a) |

to any legal entity which is a qualified investor as defined under the Prospectus Regulation; |

| |

b) |

to fewer than 150 natural or legal persons (other than qualified investors as defined under the Prospectus Regulation), subject to obtaining the prior consent of the representatives; or |

| |

c) |

in any other circumstances falling within Article 1(4) of the Prospectus Regulation, |

provided that no such offer of the shares shall require

the issuer or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or supplement a prospectus pursuant

to Article 23 of the Prospectus Regulation.

For the purposes of this provision,

the expression an “offer to the public” in relation to the shares in any Relevant Member State means the communication in

any form and by any means of sufficient information on the terms of the offer and any shares to be offered so as to enable an investor

to decide to purchase or subscribe for any shares, and the expression “Prospectus Regulation” means Regulation (EU) 2017/1129.

United Kingdom

Notice to prospective investors in United Kingdom

In relation to the United Kingdom,

no shares have been offered or will be offered pursuant to the offering to the public in the United Kingdom prior to the publication of

a prospectus in relation to the shares that has been approved by the Financial Conduct Authority, except that offers of shares may be

made to the public in the United Kingdom at any time under the following exemptions under the UK Prospectus Regulation:

| |

a) |

to any legal entity which is a qualified investor as defined under Article 2 of the UK Prospectus Regulation; |

| |

b) |

to fewer than 150 natural or legal persons (other than qualified investors as defined under Article 2 of the UK Prospectus Regulation), subject to obtaining the prior consent of the representatives; or |

| |

c) |

in any other circumstances falling within Section 86 of the Financial Services and Markets Act 2000 (the “FSMA”), |

provided that no such offer of shares shall require

the issuer or any underwriter to publish a prospectus pursuant to Section 85 of the FSMA or supplement a prospectus pursuant to Article

23 of the UK Prospectus Regulation.

For the purposes of this provision,

the expression an “offer to the public” in relation to the shares in the United Kingdom means the communication in any form

and by any means of sufficient information on the terms of the offer and any shares to be offered so as to enable an investor to decide

to purchase or subscribe for any shares and the expression “UK Prospectus Regulation” means Regulation (EU) 2017/1129 as it

forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018.

In addition, this prospectus is

only being distributed to, and is only directed at, and any investment or investment activity to which this prospectus relates is available

only to, and will be engaged in only with, persons who are outside the United Kingdom or persons in the United Kingdom (i) having professional

experience in matters relating to investments who fall within the definition of “investment professionals” in Article 19(5)

of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (ii) who are high net worth

entities falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”).

Persons who are not relevant persons should not take any action on the basis of this prospectus and should not act or rely on it.

Israel

Notice to prospective investors in Israel

In the State of Israel this prospectus

shall not be regarded as an offer to the public to purchase shares under the Israeli Securities Law, 5728—1968, which requires a

prospectus to be published and authorized by the Israel Securities Authority, if it complies with certain provisions of Section 15 of

the Israeli Securities Law, 5728–1968, including, inter alia, if: (i) the offer is made, distributed or directed to not more than

35 investors, subject to certain conditions (the “Addressed Investors”) or (ii) the offer is made, distributed or directed

to certain qualified investors defined in the First Addendum of the Israeli Securities Law, 5728—1968, subject to certain conditions

(the “Qualified Investors”). The Qualified Investors shall not be taken into account in the count of the Addressed Investors

and may be offered to purchase securities in addition to the 35 Addressed Investors. The issuer has not and will not take any action that

would require it to publish a prospectus in accordance with and subject to the Israeli Securities Law, 5728—1968. We have not and

will not distribute this prospectus or make, distribute or direct an offer to subscribe for our shares to any person within the State

of Israel, other than to Qualified Investors and up to 35 Addressed Investors.

Qualified Investors may have to

submit written evidence that they meet the definitions set out in of the First Addendum to the Israeli Securities Law, 5728—1968.

In particular, we may request, as a condition to be offered shares, that each Qualified Investor will represent, warrant and certify to

us and/or to anyone acting on our behalf: (i) that it is an investor falling within one of the categories listed in the First Addendum

to the Israeli Securities Law, 5728—1968; (ii) which of the categories listed in the First Addendum to the Israeli Securities Law,

5728—1968 regarding Qualified Investors is applicable to it; (iii) that it will abide by all provisions set forth in the Israeli

Securities Law, 5728—1968 and the regulations promulgated thereunder in connection with the offer to be issued shares; (iv) that

the shares that it will be issued are, subject to exemptions available under the Israeli Securities Law, 5728—1968: (a) for its

own account; (b) for investment purposes only; and (c) not issued with a view to resale within the State of Israel, other than in accordance

with the provisions of the Israeli Securities Law, 5728—1968; and (v) that it is willing to provide further evidence of its Qualified

Investor status. Addressed Investors may have to submit written evidence in respect of their identity and may have to sign and submit

a declaration containing, inter alia, the Addressed Investor’s name, address and passport number or Israeli identification number.

Canada.

The securities may be sold in

Canada only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument

45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined

in National Instrument 31 103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the

securities must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable

securities laws.

Securities legislation in certain

provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus supplement (including

any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser

within the time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser should refer

to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights

or consult with a legal advisor.

Pursuant to section 3A.3 of National

Instrument 33 105 Underwriting Conflicts (NI 33 105), the placement agent is not required to comply with the disclosure requirements of

NI 33-105 regarding conflicts of interest in connection with this offering.

LEGAL MATTERS

The validity of the securities

offered hereby will be passed upon by K&L Gates LLP, Miami, Florida. Ellenoff Grossman & Schole LLP, New York, New York, is acting

as counsel for the underwriters in connection with this offering.

EXPERTS

The audited consolidated financial

statements as of December 31, 2022 and for the year ended December 31, 2022, incorporated by reference in this prospectus and elsewhere

in the registration statement have been so incorporated by reference in reliance upon the report of Grant Thornton LLP, independent registered

public accountants, upon the authority of said firm as experts in accounting and auditing.

The consolidated financial statements of Dolphin Entertainment,

Inc. as of December 31, 2021, and for the year ended December 31, 2021 incorporated by reference in this prospectus and in the registration

statement have been incorporated in reliance on the report of BDO USA LLP, n/k/a BDO USA, P.A., independent registered public accounting

firm, given on authority of said firm as experts in auditing and accounting.

The financial statements of Socialyte LLC and its subsidiary

as of and for the years ended December 31, 2021 and 2020 incorporated by reference in this prospectus and in the registration statement

have been audited by Aprio, LLP, independent auditors, as stated in their report, which is incorporated herein by reference.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy

statements and other information with the SEC. Through our website at www.dolphinentertainment.com, you may access, free of charge,

our filings, as soon as reasonably practical after we electronically file them with or furnish them to the SEC. The information contained

on, or accessible through, our website is not incorporated by reference in, and is not a part of this prospectus or any accompanying prospectus

supplement. You also may read and copy any document we file with the SEC at the SEC’s public reference room at 100 F Street, N.E.,

Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Our SEC filings are

also available to the public from the SEC’s website at www.sec.gov.

This prospectus supplement is part of a registration

statement on Form S-3 that we filed with the SEC to register the securities to be offered hereby. This prospectus supplement does not

contain all of the information included in the registration statement, including certain exhibits and schedules. You may obtain the registration

statement and exhibits to the registration statement from the SEC at the address listed above or from the SEC’s website listed above.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference the information

we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information

that we incorporate by reference is considered to be part of this prospectus supplement. Information that we file with the SEC in the

future and incorporate by reference in this prospectus supplement automatically updates and supersedes previously filed information as

applicable.

We incorporate by reference into this prospectus supplement

the following documents filed by us with the SEC, other than any portion of any such documents that is not deemed “filed”

under the Exchange Act in accordance with the Exchange Act and applicable SEC rules:

| |

· |

our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 31, 2023, as amended by that Annual Report on Form 10-K/A for the year ended December 31, 2022 filed with the SEC on May 1, 2023; |

| |

· |

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023 filed with the SEC on May 15, 2023 and August 14, 2023, respectively; |

| |

· |

our Definitive Proxy Statement on Schedule 14A, filed with the SEC on September 1, 2022; |

| |

· |

our Current Reports on Form

8-K filed with the SEC on January

13, 2023, January

30, 2023 and October 6, 2023; |

| |

· |

a description of our common stock contained in Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2020, including any amendment or reports filed for the purpose of updating this description; and |

| |

· |

any document filed in the future with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement and until this offering is completed. |

This prospectus supplement does not, however, incorporate

by reference any documents or portions thereof, whether specifically listed above or furnished by us in the future, that are not deemed

“filed” with the SEC, including information “furnished” pursuant to Items 2.02, 7.01 and 9.01 of Form 8-K.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent

that a statement contained herein or in any subsequently filed document that is also incorporated by reference herein modifies or replaces

such statement. Any statements so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part

of this prospectus.

Any information incorporated by reference herein is

available to you without charge upon written or oral request. If you would like a copy of any of this information, please submit your

request to us at the following address:

Dolphin Entertainment, Inc.

Attn: Mirta A. Negrini

150 Alhambra Circle, Suite 1200

Coral Gables, FL 33134

(305) 774-0407

PROSPECTUS

Dolphin Entertainment, Inc.

$100,000,000 of Common Stock

Dolphin Entertainment, Inc., a Florida corporation

(“us”, “we”, “our”, or the “Company”) may offer and sell from

time to time, in one or more series or issuances and on terms that we will determine at the time of the offering, shares of our common

stock, par value $0.015 per share (“Common Stock”) described in this prospectus, up to an aggregate amount of $100,000,000.

This prospectus provides you with a general description

of the securities offered. Each time we offer and sell securities, we will file a prospectus supplement to this prospectus that contains

specific information about the offering and, if applicable, the amounts, prices and terms of the securities. Such supplements may also

add, update or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus

supplement before you invest in any of our securities. This prospectus may not be used to consummate sales of securities unless accompanied

by a prospectus supplement.

We may offer and sell the securities described in

this prospectus and any prospectus supplement directly to our stockholders or to other purchasers or through agents on our behalf or through

underwriters or dealers as designated from time to time. If any agents or underwriters are involved in the sale of any of these securities,

the applicable prospectus supplement will provide the names of the agents or underwriters and any applicable fees, commission or discounts.

Our Common Stock is currently quoted on The Nasdaq

Capital Market under the symbol “DLPN”. On July 24, 2023, the last reported sale price of our Common Stock on The Nasdaq Capital

Market was $2.16 per share.

As of July 24, 2023, our public float, which is equal

to the aggregate market value of our outstanding voting and non-voting common stock held by non-affiliates, was approximately $27,099,396,

based on 14,025,158 shares of outstanding common stock, of which approximately 12,546,017 shares were held by non-affiliates, and a closing

sale price of our common stock of $2.16 on that date. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities

in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public

float remains below $75.0 million.

Investing in our securities involves a high degree

of risk. See the section entitled “Risk Factors” on page 2 of this prospectus

and in the documents we filed with the Securities and Exchange Commission that are incorporated in this prospectus by reference for certain

risks and uncertainties you should consider.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

This prospectus is dated August 3,

2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus of Dolphin Entertainment, Inc., a

Florida corporation (collectively with all of its subsidiaries, the “Company”, or “we”, “us”, or “our”)

is a part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (“SEC”) utilizing

a “shelf” registration process. Under this shelf registration process, we may, from time to time, sell the securities described

in this prospectus in one or more offerings up to a total dollar amount of $100,000,000 as described in this prospectus.

The registration statement of which this prospectus

is a part provides additional information about us and the securities offered under this prospectus. The registration statement, including

the exhibits and the documents incorporated herein by reference, can be read on the SEC website or at the SEC offices mentioned under

the heading “Where You Can Find More Information.”

We will provide a prospectus supplement containing

specific information about the amounts, prices and terms of the securities for a particular offering. The prospectus supplement may add,

update or change information in this prospectus. If the information in the prospectus is inconsistent with a prospectus supplement, you

should rely on the information in that prospectus supplement. You should read both this prospectus and, if applicable, any prospectus

supplement.

You should rely only on the information contained

or incorporated by reference in this prospectus and in any prospectus supplement. We have not authorized any other person to provide you

with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making

offers to sell or solicitations to buy the securities in any jurisdiction in which an offer or solicitation is not authorized or in which

the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

You should not assume that the information in this prospectus or any prospectus supplement, as well as the information we file or previously

filed with the SEC that we incorporate by reference in this prospectus or any prospectus supplement, is accurate as of any date other

than the date of such document. Our business, financial condition, results of operations and prospects may have changed since those dates.

PROSPECTUS

SUMMARY

The items in the following summary are described

in more detail later in this prospectus. This summary does not contain all of the information you should consider. Before investing in

our securities, you should read the entire prospectus carefully, including the “Risk Factors” beginning on page 2

and in the documents we filed with the Securities and Exchange Commission that are incorporated in this prospectus

by reference and the financial statements incorporated by reference.

Overview

We are a leading independent entertainment

marketing and premium content production company. Through our subsidiaries, 42West, The Door, Shore Fire, Viewpoint, Be Social, B/HI,

and Socialyte, we provide expert strategic marketing and publicity services to many of the top brands, both individual and corporate,

in the entertainment, hospitality and music industries. 42West, The Door, and Shore Fire are each recognized global leaders in the PR

and marketing services for the industries they serve. Viewpoint adds full-service creative branding and production capabilities to our

marketing group and Be Social and Socialyte provide influencer marketing capabilities through their roster of highly engaged social media

influencers. Dolphin’s legacy content production business, founded by our Emmy-nominated Chief Executive Officer, Bill O’Dowd,

has produced multiple feature films and award-winning digital series, primarily aimed at family and young adult markets. Our Common Stock

trades on The Nasdaq Capital Market under the symbol “DLPN”.

We have established an acquisition

strategy based on identifying and acquiring companies that complement our existing entertainment publicity and marketing services and

content production businesses. We believe that complementary businesses, such as live event production, can create synergistic opportunities

and bolster profits and cash flow. We have identified potential acquisition targets and are in various stages of discussion with such

targets.

We have also established an investment

strategy, “Dolphin 2.0,” based upon identifying opportunities to develop internally owned assets, or acquire ownership stakes

in others’ assets, in the categories of entertainment content, live events and consumer products. We believe these categories represent

the types of assets wherein our expertise and relationships in entertainment marketing most influences the likelihood of success. We are

in various stages of internal development and outside conversations on a wide range of opportunities within Dolphin 2.0. We intend to

enter into additional investments during 2023, but there is no assurance that we will be successful in doing so, whether in 2023 or at

all.

We operate in two reportable segments:

our entertainment publicity and marketing segment and our content production segment. The entertainment publicity and marketing segment

is composed of 42West, The Door, Shore Fire, Viewpoint, Be Social, B/HI and Socialyte and provides clients with diversified services,

including public relations, entertainment content marketing, strategic communications, social media marketing, creative branding, and

the production of promotional video content. The content production segment is composed of Dolphin Films, Inc. (“Dolphin Films”)

and Dolphin Digital Studios, which produce and distribute feature films and digital content. The activities of our Content Production

segment also include all corporate overhead activities.

Our Company

We

were originally incorporated in the State of Nevada on March 7, 1995, and we subsequently domesticated in the State of Florida on December

4, 2014. Effective July 6, 2017, we changed our name from Dolphin Digital Media, Inc. to Dolphin Entertainment, Inc. Our corporate headquarters

is located at 150 Alhambra Circle, Suite 1200, Coral Gables, Florida 33134. We also have offices located at 600 3rd Avenue, 23rd Floor,

New York, NY, 10016, 37 West 17th Street, 5th

Floor, New York, NY, 10011, 1840 Century Park East, Suite 700, Los Angeles, California 90067, and 12 Court

Street, Suite 1800, Brooklyn, NY 11201. Our telephone number is (305) 774-0407 and our website address is www.dolphinentertainment.com.

Neither our website nor any information contained on, or accessible through, our website is part of this prospectus.

RISK FACTORS

An investment in our Common Stock

involves significant risks. You should carefully consider the risk factors contained in our filings with the SEC, as well as all of the

information contained in any prospectus supplement, free writing prospectus and amendments thereto, before you decide to invest in our

Common Stock. Our business, prospects, financial condition and results of operations may be materially and adversely affected as a result

of any of such risks. The value of our Common Stock could decline as a result of any of these risks. You could lose all or part of your

investment in our Common Stock. Some of our statements in sections entitled “Risk Factors” are forward-looking statements.

You should also consider the risks, uncertainties and assumptions discussed under “Part I—Item 1A—Risk Factors”

of our most recent Annual Report on Form 10-K and in “Part II—Item 1A—Risk Factors” in our most recent Quarterly

Report on Form 10-Q filed subsequent to such Form 10-K that are incorporated herein by reference, as may be amended, supplemented or superseded

from time to time by other reports we file with the SEC in the future. The risks and uncertainties we have described are not the only

ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business,

prospects, financial condition and results of operations.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking

statements” and information within the meaning of Section 27A of the Securities Act of 1933, as amended, or the “Securities

Act”, and Section 21E of the Securities Exchange Act of 1934, as amended, or the “Exchange Act”, which are subject to

the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements

about our plans, objectives, representations and intentions and are not historical facts and typically are identified by use of terms

such as “may,” “should,” “could,” “expect,” “plan,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “continue,” “will,”

“would” and similar words, although some forward-looking statements are expressed differently. You should be aware that the

forward-looking statements included herein represent management’s current judgment and expectations, but our actual results, events

and performance could differ materially from those in the forward-looking statements. We discuss our known material risks under Item 1.A

“Risk Factors” contained in our Company’s Annual Report on Form 10-K for the year ended December 31, 2022. Many factors

could cause our actual results to differ materially from the forward-looking statements. In addition, we cannot assess the impact of each

factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from

those contained in any forward-looking statements.

Any forward-looking statement

made by us in this prospectus is based only on information currently available to us and speaks only as of the date on which it is made.

We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or otherwise.

USE OF PROCEEDS

We will retain broad discretion

over the use of the net proceeds to us from the sale of our securities under this prospectus. Unless otherwise provided in the applicable

prospectus supplement, we currently expect to use the net proceeds that we receive from this offering for working capital and other general

corporate purposes. We may also use a portion of the net proceeds to acquire or invest in complementary businesses; however, we currently

have no agreements or commitments to complete any such transaction. The expected use of net proceeds of this offering represents our current

intentions based on our present plans and business conditions. We cannot specify with certainty all of the particular uses for the net

proceeds to be received upon the closing of this offering.

DESCRIPTION OF OUR COMMON STOCK

The following description of our

Common Stock is based upon our amended and restated articles of incorporation, as amended, our bylaws and applicable provisions of law,

in each case as currently in effect. This discussion does not purport to be complete and is qualified in its entirety by reference to

our amended and restated articles of incorporation, as amended, and our bylaws, copies of which have

been filed with the SEC as exhibits to the registration statement of which this prospectus forms a part.

Authorized Shares

We are authorized to issue 200,000,000

shares of Common Stock, par value $0.015 per share.

Common Stock

The holders of our Common Stock

are generally entitled to one vote for each share held on all matters submitted to a vote of the shareholders and do not have any cumulative

voting rights. Unless otherwise required by Florida law, once a quorum is present, matters presented to shareholders, except for the election

of directors, will be approved by a majority of the votes cast. The election of directors is determined by a plurality of the votes cast.

Holders of our Common Stock are

entitled to receive dividends if, as and when declared by the Board out of funds legally available for that purpose, subject to preferences

that may apply to any preferred stock that we issue. In the event of our dissolution or liquidation, after satisfaction of all our debts

and liabilities and distributions to the holders of any preferred stock that we issued, or may issue in the future, of amounts to which

they are preferentially entitled, the holders of Common Stock will be entitled to share ratably in the distribution of assets to the shareholders.

There are no cumulative, subscription

or preemptive rights to subscribe for any additional securities which we may issue, and there are no redemption provisions, conversion

provisions or sinking fund provisions applicable to the Common Stock. The rights of holders of Common Stock are subject to the rights,

privileges, preferences and priorities of any class or series of preferred stock.

Our amended and restated articles

of incorporation, as amended and bylaws do not restrict the ability of a holder of our Common Stock to transfer his or her shares of our

Common Stock.

All shares of our Common Stock

will, when issued, be duly authorized, fully paid and nonassessable. The shares to be issued by us in this offering will be when issued

and paid for, validly issued, fully paid and nonassessable.

Preferred Stock

Under our amended and restated

articles of incorporation, as amended, we are authorized to issue up to 10,000,000 shares of preferred stock, par value $0.001 per share,

in one or more series. We are authorized to issue preferred stock with such designation, rights and preferences as may be determined from

time to time by our Board. Accordingly, the Board is empowered, without shareholder approval, to issue preferred stock with dividend,

liquidation, conversion, voting or other rights which could adversely affect the voting power or other rights of the holders of our Common

Stock and, in certain instances, could adversely affect the market price of our Common Stock.

Series C Convertible Preferred Stock

On February 23, 2016, we designated

1,000,000 shares of preferred stock as Series C Convertible Preferred Stock, par value $0.001 per share, which may be issued only to an

“Eligible Series C Preferred Stock Holder” as defined below. As part of the merger consideration in our acquisition of Dolphin

Films, Inc., on March 7, 2016, we issued 1,000,000 shares of Series C Convertible Preferred Stock to Dolphin Entertainment, LLC, an entity

wholly owned by our President, Chairman and Chief Executive Officer, William O’Dowd. Effective July 6, 2017, we amended our articles

of incorporation to reduce the number of Series C Convertible Preferred Stock outstanding in light of our 1-for-20 reverse stock split

from 1,000,000 to 50,000 shares and to clarify the voting rights of the Series C Convertible Preferred Stock as described below.

As of December 31, 2022 and 2021,

the Series C Preferred Stock could be converted into 4,738,940 shares of our common stock. On September 29, 2022, the Company filed an

amendment to its Certificate of Incorporation, approved by the Company’s stockholders on September 27, 2022, to increase the number

of votes per share of common stock the Series C is convertible into from three votes per share to five votes per share. As of December

31, 2022, the holder of the Series C Preferred Stock was entitled to 23,694,700 votes. The holder of Series C Convertible Preferred Stock

is entitled to vote together as a single class on all matters upon which common stockholders are entitled to vote. On November 12, 2020,

we entered into a stock restriction agreement with Dolphin Entertainment, LLC that prohibits the conversion of Series C Convertible Preferred

Stock into Common Stock unless the majority of the independent directors of the board of directors of the Company vote to remove the restriction.

The Stock Restriction Agreement shall terminate upon a Change of Control (as such term is defined in the Stock Restriction Agreement)

of the Company.

The Certificate of Designation

also provides for a liquidation value of $0.001 per share and dividend rights of the Series C on parity with the Company’s Common

Stock.

Anti-Takeover Provisions

As described above, our amended

and restated articles of incorporation, as amended, provide that our Board may issue preferred stock with such designation, rights and

preferences as may be determined from time to time by our Board. Our preferred stock could be issued quickly and utilized, under certain

circumstances, as a method of discouraging, delaying or preventing a change in control of the Company or make removal of management more

difficult. Our amended and restated articles of incorporation, as amended, and our bylaws provide that special meetings may be called

only by a majority vote of the Board or by the holders of not less than 40% of all the shares entitled to vote.

Florida Anti-Takeover Statute

As a Florida corporation, we are

subject to certain anti-takeover provisions that apply to public corporations under Florida law. Pursuant to Section 607.0901 of the Florida

Business Corporation Act, a publicly held Florida corporation may not engage in a broad range of business combinations or other extraordinary

corporate transactions with an interested shareholder without the approval of the holders of two-thirds of the voting shares of the corporation

(excluding shares held by the interested shareholder), unless:

| |

· |

prior to the time that such shareholder became an interested shareholder, the board of directors of the corporation approved either the affiliated transaction or the transaction which resulted in the shareholder becoming an interested shareholder; |

| |

· |