000128985012/312023Q3false00012898502023-01-012023-09-3000012898502023-10-25xbrli:shares00012898502023-09-30iso4217:USD00012898502022-12-310001289850us-gaap:PreferredNonConvertibleStockMember2023-09-300001289850us-gaap:PreferredNonConvertibleStockMember2022-12-310001289850us-gaap:ConvertiblePreferredStockMember2023-09-300001289850us-gaap:ConvertiblePreferredStockMember2022-12-31iso4217:USDxbrli:shares00012898502023-07-012023-09-3000012898502022-07-012022-09-3000012898502022-01-012022-09-300001289850us-gaap:PreferredStockMemberus-gaap:ConvertiblePreferredStockMember2022-12-310001289850us-gaap:CommonStockMember2022-12-310001289850us-gaap:AdditionalPaidInCapitalMember2022-12-310001289850us-gaap:RetainedEarningsMember2022-12-310001289850us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100012898502023-01-012023-03-310001289850us-gaap:CommonStockMember2023-01-012023-03-310001289850us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001289850us-gaap:RetainedEarningsMember2023-01-012023-03-310001289850us-gaap:PreferredStockMemberus-gaap:ConvertiblePreferredStockMember2023-03-310001289850us-gaap:CommonStockMember2023-03-310001289850us-gaap:AdditionalPaidInCapitalMember2023-03-310001289850us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001289850us-gaap:RetainedEarningsMember2023-03-3100012898502023-03-310001289850us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-3000012898502023-04-012023-06-300001289850us-gaap:CommonStockMember2023-04-012023-06-300001289850us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001289850us-gaap:RetainedEarningsMember2023-04-012023-06-300001289850us-gaap:PreferredStockMemberus-gaap:ConvertiblePreferredStockMember2023-06-300001289850us-gaap:CommonStockMember2023-06-300001289850us-gaap:AdditionalPaidInCapitalMember2023-06-300001289850us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001289850us-gaap:RetainedEarningsMember2023-06-3000012898502023-06-300001289850us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001289850us-gaap:CommonStockMember2023-07-012023-09-300001289850us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001289850us-gaap:RetainedEarningsMember2023-07-012023-09-300001289850us-gaap:PreferredStockMemberus-gaap:ConvertiblePreferredStockMember2023-09-300001289850us-gaap:CommonStockMember2023-09-300001289850us-gaap:AdditionalPaidInCapitalMember2023-09-300001289850us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001289850us-gaap:RetainedEarningsMember2023-09-300001289850us-gaap:PreferredStockMemberus-gaap:ConvertiblePreferredStockMember2021-12-310001289850us-gaap:CommonStockMember2021-12-310001289850us-gaap:AdditionalPaidInCapitalMember2021-12-310001289850us-gaap:RetainedEarningsMember2021-12-3100012898502021-12-310001289850us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-3100012898502022-01-012022-03-310001289850us-gaap:CommonStockMember2022-01-012022-03-310001289850us-gaap:RetainedEarningsMember2022-01-012022-03-310001289850us-gaap:PreferredStockMemberus-gaap:ConvertiblePreferredStockMember2022-03-310001289850us-gaap:CommonStockMember2022-03-310001289850us-gaap:AdditionalPaidInCapitalMember2022-03-310001289850us-gaap:RetainedEarningsMember2022-03-3100012898502022-03-310001289850us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-3000012898502022-04-012022-06-300001289850us-gaap:CommonStockMember2022-04-012022-06-300001289850us-gaap:RetainedEarningsMember2022-04-012022-06-300001289850us-gaap:PreferredStockMemberus-gaap:ConvertiblePreferredStockMember2022-06-300001289850us-gaap:CommonStockMember2022-06-300001289850us-gaap:AdditionalPaidInCapitalMember2022-06-300001289850us-gaap:RetainedEarningsMember2022-06-3000012898502022-06-300001289850us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001289850us-gaap:CommonStockMember2022-07-012022-09-300001289850us-gaap:RetainedEarningsMember2022-07-012022-09-300001289850us-gaap:PreferredStockMemberus-gaap:ConvertiblePreferredStockMember2022-09-300001289850us-gaap:CommonStockMember2022-09-300001289850us-gaap:AdditionalPaidInCapitalMember2022-09-300001289850us-gaap:RetainedEarningsMember2022-09-3000012898502022-09-300001289850nuro:FromHeldToMaturitySecuritiesMemberus-gaap:MoneyMarketFundsMember2023-09-300001289850nuro:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-30xbrli:pure0001289850nuro:CustomerTwoMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-300001289850nuro:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-07-012022-09-300001289850nuro:CustomerTwoMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-07-012022-09-300001289850nuro:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001289850nuro:CustomerTwoMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001289850nuro:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-09-300001289850nuro:CustomerOneMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-09-300001289850us-gaap:AccountsReceivableMembernuro:CustomerTwoMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-09-300001289850us-gaap:AccountsReceivableMembernuro:CustomerThreeMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-09-300001289850nuro:CustomerOneMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001289850us-gaap:AccountsReceivableMembernuro:CustomerTwoMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001289850us-gaap:AccountingStandardsUpdate201613Member2023-01-010001289850us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001289850us-gaap:EmployeeStockOptionMember2022-01-012022-09-300001289850us-gaap:RestrictedStockMember2023-01-012023-09-300001289850us-gaap:RestrictedStockMember2022-01-012022-09-300001289850us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001289850us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-300001289850us-gaap:ConvertiblePreferredStockMember2023-01-012023-09-300001289850us-gaap:ConvertiblePreferredStockMember2022-01-012022-09-300001289850us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-09-300001289850us-gaap:CommercialPaperMember2023-09-300001289850us-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001289850us-gaap:CorporateDebtSecuritiesMember2022-12-310001289850us-gaap:CommercialPaperMember2022-12-310001289850us-gaap:MoneyMarketFundsMember2023-09-300001289850us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-09-300001289850us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-09-300001289850us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-09-300001289850us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Member2023-09-300001289850us-gaap:FairValueInputsLevel1Member2023-09-300001289850us-gaap:FairValueInputsLevel2Member2023-09-300001289850us-gaap:MoneyMarketFundsMember2022-12-310001289850us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2022-12-310001289850us-gaap:FairValueInputsLevel1Member2022-12-310001289850nuro:WoburnLeaseMembernuro:MonthlyRentMember2018-06-012018-06-010001289850nuro:WoburnLeaseMember2018-06-0100012898502022-01-012022-06-300001289850us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2022-12-310001289850us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2023-09-3000012898502022-10-012022-10-1900012898502023-05-012023-05-310001289850nuro:AtTheMarketOfferingProgramMemberus-gaap:CommonStockMember2023-06-012023-06-300001289850us-gaap:CommonStockMember2023-06-012023-06-3000012898502023-06-012023-06-300001289850nuro:AtTheMarketOfferingProgramMemberus-gaap:CommonStockMember2023-07-012023-07-3100012898502023-07-012023-07-3100012898502023-08-012023-08-310001289850us-gaap:RestrictedStockMember2023-09-300001289850us-gaap:RestrictedStockUnitsRSUMember2023-09-300001289850us-gaap:RestrictedStockMember2022-12-310001289850us-gaap:RestrictedStockUnitsRSUMember2022-12-310001289850nuro:AtTheMarketOfferingProgramMemberus-gaap:CommonStockMember2022-01-012022-01-310001289850us-gaap:CommonStockMember2022-01-012022-01-310001289850us-gaap:CommonStockMember2022-04-012022-04-300001289850nuro:ManagementIncentiveCompensationMemberus-gaap:CommonStockMember2022-04-012022-04-3000012898502022-05-012022-05-310001289850us-gaap:CommonStockMember2022-06-012022-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission File Number 001-33351

_________________________________________________

NEUROMETRIX, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 04-3308180 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) | |

| | |

4B Gill Street Woburn, Massachusetts | 01801 |

| (Address of principal executive offices) | (Zip Code) |

(781) 890-9989

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock, $0.0001 par value per share | NURO | The Nasdaq Stock Market LLC |

| Preferred Stock Purchase Rights | | |

| | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | Accelerated filer | | Non-accelerated filer | | Smaller reporting company | | Emerging growth company |

| ☐ | | ☐ | | ☒ | | ☒ | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 8,591,374 shares of common stock, par value $0.0001 per share, were outstanding as of October 25, 2023.

NeuroMetrix, Inc.

Form 10-Q

Quarterly Period Ended September 30, 2023

TABLE OF CONTENTS

| | | | | | | | |

| |

| | | |

| Item 1. | | |

| | | |

| | Balance Sheets as of September 30, 2023 (unaudited) and December 31, 2022 | |

| | | |

| | Statements of Operations (unaudited) for the Quarters and Nine Months Ended September 30, 2023 and 2022 | |

| | |

| Statements of Comprehensive Loss (unaudited) for the Quarters and Nine Months Ended September 30, 2023 and 2022 | 2 |

| | | |

| Statements of Changes in Stockholders' Equity (unaudited) for the Quarters and Nine Months Ended September 30, 2023 and 2022 | |

| | |

| | Statements of Cash Flows (unaudited) for the Nine Months Ended September 30, 2023 and 2022 | 4 |

| | | |

| | | |

| | | |

| Item 2. | | 11 |

| | | |

| Item 3. | | 17 |

| | | |

| Item 4. | | 18 |

| | | |

| |

| | | |

| Item 1. | | 19 |

| | | |

| Item 1A. | | 19 |

| | | |

| Item 2. | | 20 |

| | | |

| Item 3. | | 20 |

| | | |

| Item 4. | | 20 |

| | | |

| Item 5. | | 20 |

| | | |

| Item 6. | | 21 |

| | | |

| 22 |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

NeuroMetrix, Inc.

Balance Sheets

| | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| (Unaudited) | | |

| Assets | | | |

| Current assets: | | | |

Cash and cash equivalents | $ | 1,460,553 | | | $ | 4,335,020 | |

| Held-to-maturity securities | — | | | 16,864,707 | |

| Available-for-sale securities | 16,177,122 | | | — | |

Accounts receivable, net | 614,381 | | | 646,771 | |

Inventories | 1,666,609 | | | 1,614,987 | |

| | | |

Prepaid expenses and other current assets | 786,978 | | | 645,502 | |

Total current assets | 20,705,643 | | | 24,106,987 | |

| | | |

| Fixed assets, net | 272,838 | | | 165,619 | |

| Right of use asset | 281,891 | | | 370,609 | |

| Other long-term assets | 26,400 | | | 26,400 | |

Total assets | $ | 21,286,772 | | | $ | 24,669,615 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| | | |

Accounts payable | $ | 225,474 | | | $ | 368,082 | |

| | | |

Accrued expenses and compensation | 886,501 | | | 589,939 | |

| | | |

Lease obligation, current | 148,391 | | | 148,391 | |

Total current liabilities | 1,260,366 | | | 1,106,412 | |

| | | |

Lease obligation, net of current portion | 122,870 | | | 207,516 | |

Total liabilities | 1,383,236 | | | 1,313,928 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Stockholders’ equity: | | | |

Preferred stock | — | | | — | |

Convertible preferred stock | 1 | | | 1 | |

Common stock, $0.0001 par value; 25,000,000 shares authorized at September 30, 2023 and December 31, 2022; 8,588,455 and 7,771,938 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 859 | | | 777 | |

Additional paid-in capital | 228,155,613 | | | 226,934,775 | |

| Accumulated other comprehensive income | 206,869 | | | — | |

Accumulated deficit | (208,459,806) | | | (203,579,866) | |

Total stockholders’ equity | 19,903,536 | | | 23,355,687 | |

Total liabilities and stockholders’ equity | $ | 21,286,772 | | | $ | 24,669,615 | |

The accompanying notes are an integral part of these interim financial statements.

NeuroMetrix, Inc.

Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Quarters Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Revenues | $ | 1,203,164 | | | $ | 1,968,003 | | | $ | 4,583,679 | | | $ | 6,408,695 | |

| | | | | | | |

| Cost of revenues | 421,382 | | | 693,571 | | | 1,484,240 | | | 1,888,566 | |

| | | | | | | |

Gross profit | 781,782 | | | 1,274,432 | | | 3,099,439 | | | 4,520,129 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

Research and development | 592,654 | | | 1,074,954 | | | 2,045,588 | | | 2,701,330 | |

Sales and marketing | 943,795 | | | 810,209 | | | 2,504,630 | | | 2,235,646 | |

General and administrative | 1,206,231 | | | 1,102,260 | | | 3,843,643 | | | 3,468,452 | |

| | | | | | | |

Total operating expenses | 2,742,680 | | | 2,987,423 | | | 8,393,861 | | | 8,405,428 | |

| | | | | | | |

Loss from operations | (1,960,898) | | | (1,712,991) | | | (5,294,422) | | | (3,885,299) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Interest income | 25,378 | | | 106,737 | | | 247,699 | | | 160,560 | |

| Other income | 166,783 | | | — | | | 166,783 | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss | $ | (1,768,737) | | | $ | (1,606,254) | | | $ | (4,879,940) | | | $ | (3,724,739) | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss per common share applicable to common stockholders, basic and diluted | $ | (0.21) | | | $ | (0.23) | | | $ | (0.61) | | | $ | (0.53) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Statements of Comprehensive Loss

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Quarters Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net loss | $ | (1,768,737) | | | $ | (1,606,254) | | | $ | (4,879,940) | | | $ | (3,724,739) | |

| | | | | | | |

| Other comprehensive income: | | | | | | | |

| | | | | | | |

| Unrealized gain on available-for-sale securities | 204,931 | | | — | | | 373,652 | | | — | |

| | | | | | | |

| Reclassification of realized gain on available-for-sale securities to other income | (166,783) | | | — | | | (166,783) | | | — | |

| | | | | | | |

| Comprehensive loss | $ | (1,730,589) | | | $ | (1,606,254) | | | $ | (4,673,071) | | | $ | (3,724,739) | |

The accompanying notes are an integral part of these interim financial statements.

NeuroMetrix, Inc.

Statements of Changes in Stockholders' Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Series B Convertible Preferred Stock | | Common

Stock | | Additional

Paid-In

Capital | | | | Accumulated

Deficit | | Total |

| Number of

Shares | | Amount | | Number of

Shares | | Amount | | | Accumulated Other Comprehensive Income | | |

| Balance at December 31, 2022 | 200 | | | 1 | | | 7,675,682 | | | $ | 777 | | | $ | 226,934,775 | | | $ | — | | | $ | (203,579,866) | | | $ | 23,355,687 | |

| Stock-based compensation expense | — | | | — | | | — | | | — | | | 165,361 | | | — | | | — | | | 165,361 | |

| Vesting of restricted stock under equity plan | — | | | — | | | 19,512 | | | 1 | | | (1) | | | — | | | — | | | — | |

| Unrealized gain on available-for-sale securities | — | | | — | | | — | | | — | | | — | | | 65,874 | | | — | | | 65,874 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | (1,574,174) | | | (1,574,174) | |

| Balance at March 31, 2023 | 200 | | | 1 | | | 7,695,194 | | | 778 | | | 227,100,135 | | | 65,874 | | | (205,154,040) | | | 22,012,748 | |

| Stock-based compensation expense | — | | | — | | | — | | | — | | | 132,745 | | | — | | | — | | | 132,745 | |

| Issuance of common stock under at the market offering | — | | | — | | | 725,291 | | | 73 | | | 691,332 | | | — | | | — | | | 691,405 | |

| Issuance of common stock under employee stock purchase plan | — | | | — | | | 10,526 | | | 1 | | | 8,714 | | | — | | | — | | | 8,715 | |

| Vesting of restricted stock under equity plan | — | | | — | | | 72,121 | | | 6 | | | (6) | | | — | | | — | | | — | |

| Unrealized gain on available-for-sale securities | — | | | — | | | — | | | — | | | — | | | 102,847 | | | — | | | 102,847 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | (1,537,029) | | | (1,537,029) | |

| Balance at June 30, 2023 | 200 | | | 1 | | | 8,503,132 | | | 858 | | | 227,932,920 | | | 168,721 | | | (206,691,069) | | | 21,411,431 | |

| Stock-based compensation expense | — | | | — | | | — | | | — | | | 221,268 | | | — | | | — | | | 221,268 | |

| Issuance of common stock under at the market offering | — | | | — | | | 1,470 | | | — | | | 1,426 | | | — | | | — | | | 1,426 | |

| Vesting of restricted stock under equity plan | — | | | — | | | 22,561 | | | 1 | | | (1) | | | — | | | — | | | — | |

| Unrealized gain on available-for-sale securities | — | | | — | | | — | | | — | | | — | | | 204,931 | | | — | | | 204,931 | |

| Realized gain on available-for-sale securities | — | | | — | | | — | | | — | | | — | | | (166,783) | | | — | | | (166,783) | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | (1,768,737) | | | (1,768,737) | |

| Balance at September 30, 2023 | 200 | | | 1 | | | 8,527,163 | | | 859 | | | 228,155,613 | | | 206,869 | | | (208,459,806) | | | 19,903,536 | |

| | | | | | | | | | | | | | | |

| Series B Convertible Preferred Stock | | Common

Stock | | Additional

Paid-In

Capital | | Accumulated Other Comprehensive Income | | Accumulated

Deficit | | Total |

| Number of

Shares | | Amount | | Number of

Shares | | Amount | | | | |

| Balance at December 31, 2021 | 200 | | | $ | 1 | | | 6,650,480 | | | $ | 668 | | | $ | 222,378,374 | | | $ | — | | | $ | (199,163,257) | | | $ | 23,215,786 | |

| Stock-based compensation expense | — | | | — | | | — | | | — | | | 37,632 | | | — | | | — | | | 37,632 | |

| Issuance of common stock under at the market offering | — | | | — | | | 292,500 | | | 29 | | | 1,943,023 | | | — | | | — | | | 1,943,052 | |

| Vesting of restricted stock under equity plan | — | | | — | | | 1,759 | | | 3 | | | (3) | | | — | | | — | | | — | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | (958,562) | | | (958,562) | |

| Balance at March 31, 2022 | 200 | | | 1 | | | 6,944,739 | | | 700 | | | 224,359,026 | | | — | | | (200,121,819) | | | 24,237,908 | |

| Stock-based compensation expense | — | | | — | | | — | | | — | | | 109,340 | | | — | | | — | | | 109,340 | |

| | | | | | | | | | | | | | | |

| Issuance of common stock under employee stock purchase plan | — | | | — | | | 2,503 | | | — | | | 7,829 | | | — | | | — | | | 7,829 | |

| Issuance of common stock to settle compensation obligation | — | | | — | | | 50,213 | | | 5 | | | 215,412 | | | — | | | — | | | 215,417 | |

| Vesting of restricted stock under equity plan | — | | | — | | | 3,120 | | | 7 | | | (7) | | | — | | | — | | | — | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | (1,159,923) | | | (1,159,923) | |

| | | | | | | | | | | | | | | |

| Balance at June 30, 2022 | 200 | | | 1 | | | 7,000,575 | | | $ | 712 | | | 224,691,600 | | | — | | | (201,281,742) | | | 23,410,571 | |

| Stock-based compensation expense | — | | | — | | | — | | | — | | | 161,951 | | | — | | | — | | | 161,951 | |

| | | | | | | | | | | | | | | |

| Vesting of restricted stock under equity plan | — | | | — | | | 16,578 | | | 1 | | | (1) | | | — | | | — | | | — | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | (1,606,254) | | | (1,606,254) | |

| Balance at September 30, 2022 | 200 | | | $ | 1 | | | 7,017,153 | | | $ | 713 | | | $ | 224,853,550 | | | $ | — | | | $ | (202,887,996) | | | $ | 21,966,268 | |

The accompanying notes are an integral part of these interim financial statements.

NeuroMetrix, Inc.

Statements of Cash Flows

(Unaudited) | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (4,879,940) | | | $ | (3,724,739) | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | |

Depreciation | 30,957 | | | 39,170 | |

Stock-based compensation | 519,374 | | | 308,923 | |

| Issuance of common stock to settle compensation obligations | — | | | 26,019 | |

| Inventory provision charged to cost of revenue | 63,420 | | | — | |

| Loss on disposal of fixed assets | — | | | 6875 | |

| Amortization of premiums and discounts on securities | (135,293) | | | (133,278) | |

| Realized gain on available-for-sale securities | (166,783) | | | — | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 32,390 | | | (391,641) | |

| Inventories | (115,042) | | | (350,686) | |

| | | |

| Prepaid expenses and other current and long-term assets | (197,404) | | | (383,310) | |

| Accounts payable | (142,608) | | | 255,343 | |

| Accrued expenses and compensation | 356,562 | | | 540,902 | |

| | | |

| Net cash used in operating activities | (4,634,367) | | | (3,806,422) | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases of held-to-maturity securities | — | | | (18,921,376) | |

| Purchases of available-for-sale securities | (22,898,470) | | | — | |

| Proceeds from maturities of held-to-maturity securities | 17,000,000 | | | — | |

| Proceeds from maturities of available-for-sale securities | 7,095,000 | | | — | |

| Purchases of fixed assets | (138,176) | | | (23,182) | |

| Net cash used in investing activities | 1,058,354 | | | (18,944,558) | |

| | | |

| Cash flows from financing activities: | | | |

| Net proceeds from issuance of stock | 701,546 | | | 1,950,881 | |

| | | |

| | | |

| Net cash provided by financing activities | 701,546 | | | 1,950,881 | |

| | | |

| Net decrease in cash and cash equivalents | (2,874,467) | | | (20,800,099) | |

| Cash and cash equivalents, beginning of period | 4,335,020 | | | 22,572,104 | |

| Cash and cash equivalents, end of period | $ | 1,460,553 | | | $ | 1,772,005 | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of these interim financial statements.

NeuroMetrix, Inc.

Notes to Unaudited Financial Statements

September 30, 2023

1.Business and Basis of Presentation

Our Business-An Overview

NeuroMetrix, Inc. (the "Company" or "NeuroMetrix") develops and commercializes health care products that utilize non-invasive neurostimulation. Revenues are derived from the sale of medical devices and after-market consumable products and accessories. The Company’s products are sold in the United States and select overseas markets. They are cleared by the U.S. Food and Drug Administration ("FDA") and regulators in foreign jurisdictions where appropriate. The Company has two primary products. DPNCheck® is a point-of-care test for diabetic peripheral neuropathy, which is the most common long-term complication of Type 2 diabetes. Quell is an app-enabled, wearable device for lower extremity chronic pain and for the symptoms of fibromyalgia.

The Company held cash, cash equivalents and securities totaling $17.6 million as of September 30, 2023. The Company believes that its present balance of cash resources and securities coupled with cash inflows from product sales will enable the Company to fund its operations for at least the next twelve months from the date of issuance of the financial statements. Actual cash requirements could differ from management's projections for many reasons, including changes the Company may make to its business strategy, commercial challenges, regulatory developments, changes to research and development programs, supply chain issues, staffing challenges and other items affecting the Company's projected uses of cash.

Unaudited Interim Financial Statements

The accompanying unaudited financial statements as of September 30, 2023 have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X. The accompanying balance sheet as of December 31, 2022 has been derived from the audited balance sheet as of December 31, 2022 included in the Company's Form 10-K referenced below and does not include all disclosures required by GAAP. In the opinion of management, the financial statements include all normal and recurring adjustments considered necessary for a fair presentation of the Company’s financial position and operating results. Operating results for the three and nine months ended September 30, 2023 are not necessarily indicative of the results that may be expected for the year ending December 31, 2023 or any other period. These financial statements and notes should be read in conjunction with the financial statements for the year ended December 31, 2022 included in the Company’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, (the "SEC"), on March 22, 2023 (File No. 001-33351).

Prior period reclassifications

We classify money market funds within cash and cash equivalents. Money market funds in the amount of $81,751 which were reported within held-to-maturity ("HTM") securities at December 31, 2022 have been reclassified into cash and cash equivalents to conform with the current presentation.

Revenues

Revenues include product sales, net of estimated returns. Revenue is measured as the amount of consideration the Company expects to receive in exchange for product transferred. Revenue is recognized at the point in time when contractual performance obligations have been satisfied and control of the product has been transferred to the customer. The Company typically has a single product delivery performance obligation. Accrued product returns using the most likely amount method are estimated based on historical data and evaluation of current information and variable consideration is not constrained.

Accounts receivable are recorded at the amount the Company expects to collect, net of the allowance for doubtful accounts receivable. The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses based on customer past payment history, product usage activity, recent customer communications and, if appropriate, assessment of the future credit losses for receivables with similar characteristics. Individual customer balances which are over 60 days past due are reviewed individually for collectability. The Company does not have any off-balance sheet credit exposure related to its customers. Allowance for doubtful accounts was $25,000 as of September 30, 2023 and December 31, 2022.

In the quarters ended September 30, 2023 and 2022, two customers accounted for 28% and 13% of total revenues during 2023, and two customers accounted for 22% and 10% of total revenues during 2022. In the nine-month periods ended September 30, 2023 and 2022, two customers accounted for 26% and 10% of revenues during 2023 and one customer accounted for 34% of revenues during 2022. As of September 30, 2023, three customers represented 32%, 26% and 12% of receivables and two customers represented 17% and 14% of receivables as of December 31, 2022.

Cash and Cash Equivalents

Cash and cash equivalents include bank demand deposits and money market funds that invest primarily in U.S. government securities.

Securities

The Company invests in highly liquid, marketable debt securities with high credit ratings and typically with maturities of two years or less. Individual securities are designated by the Company as either HTM or “available-for-sale” ("AFS") at the point of investment. Securities classified as short-term have maturities of less than one year. As of September 30, 2023, all marketable securities held by the Company are classified as available for sale and had remaining contractual maturities of one year or less.

HTM securities are valued on an amortized cost basis and reviewed to determine if an allowance for credit losses should be recorded in the statements of operations. AFS securities are valued at fair value. Unrealized gains and losses on AFS securities are included as a component of accumulated other comprehensive income in the balance sheets and statements of stockholders’ equity and a component of total comprehensive loss in the statements of comprehensive income loss. An AFS security is impaired if its fair value is less than amortized cost. Unrealized losses are evaluated to determine if the impairment is credit-related or non credit-related. Credit-related impairment is recognized as an allowance on the balance sheet with a corresponding adjustment to earnings, and a non credit-related impairment is recognized in other comprehensive income (loss). For certain types of securities, such as U.S. Treasuries, the Company generally expects zero credit losses. No allowance for credit losses was recorded on its securities portfolio as of September 30, 2023.

Fair Value

The Company follows the provisions of Financial Accounting Standards Board (the "FASB") Accounting Standards Codification ("ASC") Topic 820-10, Fair Value Measurements and Disclosures ("ASC 820-10"), which defines fair value, establishes a framework for measuring fair value in GAAP and requires certain disclosures about fair value measurements. Fair value is defined as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability.

As a basis for considering such assumptions, ASC 820-10 established a three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value as follows: Level 1 observable inputs such as quoted prices in active markets; Level 2 inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and Level 3 unobservable inputs for which there are little or no market data, which require the Company to develop its own assumptions. The hierarchy requires the Company to use observable market data, when available, and to minimize the use of unobservable inputs when determining fair value (See Note 5).

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make significant estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during reporting periods. Actual results could differ from those estimates.

Recent Accounting Pronouncements

Accounting Standards Updates ("ASUs") issued by the FASB are evaluated for their applicability. ASUs not included in the disclosures in this report were assessed and determined to be either not applicable or not expected to have a material impact on our financial statements.

Recently adopted accounting pronouncement

In June 2016, the FASB issued ASU 2016-13, Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Instruments. The guidance in ASU 2016-13 replaces the incurred loss impairment methodology under current GAAP. The new impairment requires immediate recognition of estimated credit losses expected to occur for most financial assets and certain other instruments. It applies to all entities. For trade receivables, loans and HTM debt securities, entities are required to estimate lifetime expected credit losses. Trading and AFS debt securities are required to be recorded at fair value. SEC small reporting companies were required to adopt this new guidance in fiscal years beginning on or after December 15, 2022. The Company adopted this guidance on a prospective basis as of January 1, 2023 and had no material impact on the financial statements.

2. Comprehensive Loss

For the quarter and nine months ended September 30, 2023, the Company had comprehensive income of 38,148 and 206,869, respectively for net unrealized gains on AFS securities, in addition to net loss in the statement of operations. There were no components of comprehensive income (loss) for the quarter and nine months ended September 30, 2022 other than net loss itself.

3. Net Loss Per Common Share

Basic and dilutive net loss per common share were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarters Ended September 30, | | Nine Months Ended September 30, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Net loss applicable to common stockholders | $ | (1,768,737) | | | $ | (1,606,254) | | | $ | (4,879,940) | | | $ | (3,724,739) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Weighted average number of common shares outstanding, basic and dilutive | 8,520,025 | | | 7,011,438 | | | 8,034,711 | | | 6,962,732 | | | | | |

| | | | | | | | | | | |

| Net loss per common share applicable to common stockholders, basic and diluted | $ | (0.21) | | | $ | (0.23) | | | $ | (0.61) | | | $ | (0.53) | | | | | |

| | | | | | | | | | | |

Shares underlying the following securities were excluded from the calculation of diluted net loss per common share because their effect was anti-dilutive for each of the periods presented:

| | | | | | | | | | | | | | | |

| | | September 30, |

| | | | | | 2023 | | 2022 |

| Options | | | | | 520,299 | | | 525,468 | |

| Unvested restricted stock awards | | | | | 61,292 | | | 106,550 | |

| Unvested restricted stock units | | | | | 301,647 | | | 207,233 | |

| Convertible preferred stock | | | | | 62 | | | 62 | |

| Total | | | | | 883,300 | | | 839,313 | |

4. Securities

The Company's marketable debt securities are classified as either AFS or HTM pursuant to ASC 320 - Investments - Debt Securities. The following table summarizes the valuations and unrealized gains and losses of AFS securities which are recorded at estimated fair value as of September 30, 2023. The Company held no AFS securities as of December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 |

| | | Gross Unrealized | | | | |

| Available-for-sale securities | Cost | | Gains | | Losses | | Credit Losses | | Estimated Fair Value |

| U.S. government bonds | $ | 4,393,086 | | | $ | 54,844 | | | $ | — | | | $ | — | | | $ | 4,447,930 | |

| | | | | | | | | |

| Commercial paper | 11,577,167 | | | 152,025 | | | — | | | — | | | 11,729,192 | |

| Total | $ | 15,970,253 | | | $ | 206,869 | | | $ | — | | | $ | — | | | $ | 16,177,122 | |

HTM securities are valued at amortized cost. The Company held no HTM securities as of September 30, 2023. The following tables summarize the valuations of HTM securities as of December 31, 2022.

| | | | | | | | | | | | | | | | | |

| | December 31, 2022 |

| Held-to-maturity securities | Amortized Cost | | Credit Losses | | Estimated Fair Value |

| U.S. government bonds | $ | 3,457,651 | | | $ | — | | | $ | 3,456,580 | |

| Corporate bonds | 4,011,569 | | | — | | | 3,950,380 | |

| Commercial paper | 9,395,487 | | | — | | | 9,387,914 | |

| Total | $ | 16,864,707 | | | $ | — | | | $ | 16,794,874 | |

The Company evaluates all HTM and AFS securities for impairment at each reporting period. It determined that changes in the fair value of its securities at September 30, 2023 resulted primarily from interest rate fluctuations subsequent to the purchase date of the securities. There was no deterioration in the credit worthiness of the issuers and no credit losses were recorded as of September 30, 2023.

5. Fair Value Measurements

The following tables set forth the Company’s financial instruments that were measured at fair value:

| | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 |

| | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | |

| Money market funds | $ | 827,002 | | | $ | 827,002 | | | $ | — | | | $ | — | |

| U.S. government bonds | 4,447,930 | | | 4,447,930 | | | — | | | — | |

| Commercial paper | 11,729,192 | | | — | | | 11,729,192 | | | — | |

| Total | $ | 17,004,124 | | | $ | 5,274,932 | | | $ | 11,729,192 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2022 |

| | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | |

| Money market funds | $ | 1,551,027 | | | $ | 1,551,027 | | | $ | — | | | $ | — | |

| Total | $ | 1,551,027 | | | $ | 1,551,027 | | | $ | — | | | $ | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The Company's accounts receivable, accounts payable, and accrued expenses are valued at cost which approximates fair value.

6. Inventories

Inventories consist of the following:

| | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| Purchased components | $ | 1,245,623 | | | $ | 982,129 | |

| | | |

| Finished goods | 420,986 | | | 632,858 | |

| | $ | 1,666,609 | | | $ | 1,614,987 | |

The company recorded a charge of $63,420 in the nine months ended September 30, 2023 to reduce the carrying value of inventory to net realizable value.

7. Accrued Expenses and Compensation

Accrued expenses and compensation consist of the following:

| | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| Professional services | $ | 335,201 | | | $ | 155,000 | |

| Compensation | 329,559 | | | 249,224 | |

| Clinical | $ | 43,524 | | | $ | — | |

| Warranty | 10,300 | | | 16,700 | |

| Sales tax | 128,986 | | | 131,621 | |

| Other | 38,931 | | | 37,394 | |

| | $ | 886,501 | | | $ | 589,939 | |

8. Operating Leases

The Company's lease on its Woburn, Massachusetts corporate office and manufacturing facility extends through September 2025 with a monthly base rent of $13,846 and a 5-year extension option. The Company's lease on its former corporate office in Waltham, Massachusetts (the "Waltham Lease") expired in February 2022. In the first quarter of 2022, a $60,000 reduction in rent expense was recorded upon return of the facility to the lessor. The letter of credit issued by a bank in favor of the Waltham facility was released. For the six months ended June 30, 2022, the Company recorded sublet income on the Waltham Lease totaling $22,795 within operating expenses on the Company's Statement of Operations.

Future minimum lease payments under this non-cancellable operating lease as of September 30, 2023 are as follows: | | | | | | | | |

| | |

| | |

| | |

| | |

| 2023 | | 41,446 | |

| 2024 | | 165,785 | |

| 2025 | | 117,431 | |

| Total minimum lease payments | | $ | 324,662 | |

| | |

Discount rate, 15% | | $ | 53,401 | |

| Lease obligation, current portion | | 148,391 | |

| Lease obligation, net of current portion | | 122,870 | |

| | $ | 324,662 | |

Total recorded rent expense was $49,232 and $46,102, for the quarters ended September 30, 2023 and 2022, respectively. Total recorded rent expense was $147,696 and $116,959 for the nine months ended September 30, 2023 and 2022, respectively. The Company records rent expense on its facility lease on a straight-line basis over the lease term. The remaining operating lease term was two years as of September 30, 2023.

9. Stockholders’ Equity

Preferred stock and convertible preferred stock consist of the following:

| | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

Preferred stock, $0.001 par value; 5,000,000 shares authorized at September 30, 2023 and December 31, 2022; no shares issued and outstanding at September 30, 2023 and December 31, 2022 | $ | — | | | $ | — | |

Series B convertible preferred stock, $0.001 par value; 147,000 shares designated at September 30, 2023 and December 31, 2022; 200 shares issued and outstanding at September 30, 2023 and December 31, 2022 | $ | 1 | | | $ | 1 | |

| | | |

| | | |

| | | |

2023 Equity Activity

In May 2023, the Company issued 12,500 restricted stock units under its 2022 Equity Incentive Plan with a value of $12,625.

In June 2023, the Company issued 725,291 shares of its common stock, under an at-the-market ("ATM") program for net proceeds of $691,405 and issued 10,526 shares of fully vested common stock with a value of $8,715 pursuant to the Company's Employee Stock Purchase Plan.

In July 2023, the Company issued 1,470 shares of its common stock, under ATM program for net proceeds of $1,426 and issued 24,500 restricted stock units under its 2004 Stock Option Plan with a value of $22,883.

In August 2023, the Company issued 172,660 restricted stock units with a value of $240,000 as long term incentives ("LTI") to its directors under its 2022 Equity Incentive Plan.

As of September 30, 2023, the Company has 61,292 restricted stock awards and 301,647 restricted stock units that remain unvested. At December 31, 2022, the Company had 96,250 restricted stock awards and 194,731 restricted stock units that were unvested.

2022 Equity Activity

In January 2022, the Company issued 292,500 shares of common stock under an ATM equity offering program with net proceeds of $1,943,052 and issued 20,000 restricted stock awards under its 2004 Stock Option Plan with a value of $104,200.

In April 2022, the Company issued 76,000 shares of restricted common stock under its 2022 Equity Incentive Plan with a value of $326,000 to employees as LTI and issued 50,213 shares of fully vested common stock with a value of $215,417 in settlement of management incentive compensation.

In May 2022, the Company issued 161,764 restricted stock units with a value of $550,000 as LTI to its management and directors under its 2022 Equity Incentive Plan.

In June 2022, the Company issued 2,503 shares of fully vested common stock with a value of $7,829 pursuant to the Company's Employee Stock Purchase Plan.

For the quarter ended September 30, 2022, the Company issued 57,972 restricted stock units with a value of $202,008 under its 2022 Equity Incentive Plan.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion of our financial condition and results of operations in conjunction with our financial statements and the accompanying notes to those financial statements included elsewhere in this Quarterly Report on Form 10-Q. This discussion contains forward-looking statements that involve risks and uncertainties. For a description of factors that may cause our actual results to differ materially from those anticipated in these forward-looking statements, please refer to the below section of this Quarterly Report on Form 10-Q titled “Cautionary Note Regarding Forward-Looking Statements.” Unless the context otherwise requires, all references to “we”, “us”, the “Company”, or “NeuroMetrix” in this Quarterly Report on Form 10-Q refer to NeuroMetrix, Inc.

Business Overview

NeuroMetrix is a commercial stage neurotechnology company based in Woburn, Massachusetts. The Company’s mission is to improve individual and population health through the development of innovative medical devices and technology solutions for pain syndromes and neurological disorders. Our core expertise in biomedical engineering has been refined over two decades of designing, building and marketing medical devices that stimulate nerves and analyze nerve response for diagnostic and therapeutic purposes. We are fully integrated with in-house capabilities spanning research and development, regulatory affairs and compliance, sales and marketing, customer support, manufacturing, and product fulfillment. We hold extensive, proprietary intellectual property.

NeuroMetrix created the market for point-of-care nerve testing and introduced sophisticated wearable technology for chronic pain syndromes. Nearly five million patients have been served with our products. Revenue is derived from the sale of medical devices and after-market consumable products and accessories in the United States and select overseas markets. Products are authorized by the U.S. Food and Drug Administration ("FDA") and regulators in foreign jurisdictions where appropriate. We have two principal product categories:

–Therapeutics – wearable neuromodulation for chronic pain syndromes

–Diagnostics – point-of-care peripheral neuropathy assessment

Chronic pain is a significant public health problem. It is defined by the National Institutes of Health (NIH) as pain lasting more than 12 weeks. This contrasts with acute pain which is a normal bodily response to injury or trauma. Chronic pain conditions include lower extremity pain, low back pain, arthritis, fibromyalgia, neuropathic pain, cancer pain and many others. Chronic pain may be triggered by an injury or there may be an ongoing cause such as disease or illness. There may also be no clear cause. Chronic pain can also lead to other health problems. These can include fatigue, sleep disturbance and mood changes, which cause difficulty in carrying out important activities and contributing to disability and despair. In many cases, chronic pain cannot be cured. Treatment of chronic pain is focused on reducing pain and improving function. The goal is effective pain management.

Chronic pain is estimated to affect nearly 100 million adults in the United States. The most common approach to chronic pain management is pain medication. This includes over-the-counter (“OTC”) internal and external analgesics as well as prescription pain medications, both non-opioid and opioid. The approach to treatment is individualized, drug combinations may be employed, and the results are often inadequate. Side effects, including the potential for addiction, are substantial. Nerve stimulation is a long-established category of treatment for chronic pain. This treatment approach is available through implantable devices which have both surgical and ongoing risks. Non-invasive approaches involving transcutaneous electrical nerve stimulation have achieved limited efficacy in practice due to power limitations, inadequate dosing and low patient adherence. We believe that our Quell wearable technology for chronic pain is designed to address many of these limitations.

Peripheral neuropathies are diseases of the peripheral nerves that affect about 10% of adults in the United States, with the prevalence rising to over 30% among individuals 65 years and older. Peripheral neuropathies are associated with loss of sensation, pain, increased risk of falling, weakness, and other complications. People with peripheral neuropathies often experience a diminished quality of life, poor overall health and higher mortality. The most common specific cause of peripheral neuropathies, accounting for about one-third of cases, is diabetes. The most common long-term complication of diabetes, affecting over 50% of the diabetic population, is diabetic peripheral neuropathy ("DPN"). Early detection of peripheral neuropathies, such as DPN, is important because there are no treatment options once the nerves have degenerated. Today’s diagnostic methods for peripheral neuropathies range from a simple monofilament test for lack of sensory perception in the feet

to a nerve conduction study performed by a specialist. Our DPNCheck nerve conduction technology provides a rapid, low cost, quantitative test for peripheral neuropathies, including DPN. It addresses an important medical need and is particularly effective in screening large populations. DPNCheck has been validated in multiple clinical studies.

Business Strategy

Quell, our wearable neuromodulation technology for chronic pain, has been refined over the past seven years with over 200,000 chronic pain patients and is covered by over 20 U.S. utility patents. Patients control and personalize the technology via a mobile phone app, and their utilization and certain clinical metrics may be tracked in the Quell Health Cloud. The degree of technological sophistication, combined with our extensive consumer experience and the compelling results of clinical studies, has provided us the opportunity to redirect this proven technology away from the commodity-oriented OTC market and into an emerging portfolio of specialized, disease indicated, prescription wearable neurotherapeutics. As a multi-indication platform, the potential addressable market for Quell exceeds 25 million patients in the United.States alone.

The Quell opportunity to pivot from OTC to prescription was confirmed when Quell received FDA Breakthrough Device Designation for a fibromyalgia indication in 2021, followed by a second FDA Breakthrough Device Designation for a chronic Chemotherapy Induced Peripheral Neuropathy (“CIPN”) indication in 2022. A double-blind, randomized, sham-controlled clinical study supported a 2022 Quell Fibromyalgia De Novo submission to FDA. Marketing authorization was granted by FDA as an aid for reducing the symptoms of fibromyalgia in adults with high pain sensitivity. A limited strategic launch of Quell Fibromyalgia was initiated during the last quarter of 2022 to better understand market dynamics and refine the sales fulfillment process. The strategic launch was expanded during the third quarter of 2023 with a direct sales presence in the large markets of Florida, Texas and California.

The University of Rochester School of Medicine and Dentistry reported results of an NIH-funded multi-center randomized sham-controlled trial of Quell for CIPN. The trial results indicated a statistically meaningful reduction in moderate to severe CIPN symptoms of pain and muscular cramping in patients using Quell. The clinical work will support an FDA regulatory submission to market Quell with a CIPN indication planned for late 2023 or early 2024. If approved, commercial launch of Quell for CIPN could occur in late 2024.

Beyond fibromyalgia and CIPN, our Quell indications pipeline includes Chronic Low Back Pain with Pain Hypersensitivity, Chronic Overlapping Pain Conditions, and Painful Diabetic Neuropathy. These initiatives are in varying stages of development of clinical evidence.

Our DPNCheck diagnostic technology for peripheral neuropathies, particularly for diabetic peripheral neuropathy, has been validated in multiple clinical studies over the past decade. This technology was recently updated with the launch of the next-generation DPNCheck device which significantly enhances the user experience, improves testing efficiency, and continues to deliver quantitative results with high sensitivity and specificity.

Historically, our domestic DPNCheck commercial efforts have focused on the Medicare Advantage (“MA”) market sector where patient enrollment during 2023 will likely exceed traditional fee-for-service Medicare patients. This market was disrupted during the first quarter of 2023 when the Centers for Medicare and Medicaid Services ("CMS") announced dramatic policy changes regarding risk adjustment data validation ("RADV") and patient risk factor adjustment coding. RADV changes have been implemented, and risk factor coding changes are being implemented in stages over a three-year period. The coding changes significantly reduce CMS reimbursement payments to MA healthcare providers and, in effect, curtail financial incentives for several aspects of patient screening, including for neuropathy and other health-related issues.

As a result of the CMS changes, we experienced a significant reduction in DPNCheck revenues during the past nine months in comparison with the prior year. It is unlikely that there will be near term revisions to risk factor coding that would be favorable to patients and to our Company. Consequently, we are developing a long-term DPNCheck strategy that will preserve as much as possible of our MA business while identifying meaningful opportunities for growth. Several areas are under consideration, the most prominent of which is a broader focus on large, value-based healthcare providers with a patient constituency beyond MA. Also under consideration is a disease-focused marketing approach which might cover diabetes and related areas such as renal and oncology care.

ADVANCE is our legacy, point-of-care neurodiagnostic technology used primarily for the diagnosis and screening for carpal tunnel syndrome. While ADVANCE devices are no longer sold, we continue to provide consumables and repair services to our customer base of hand surgeons and manufacturers for use in industrial health.

Results of Operations

Comparison of Quarters Ended September 30, 2023 and 2022

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended September 30, | | Increase (Decrease) |

| 2023 | | 2022 | | Amount | | Percent |

| | | |

| Revenues | $ | 1,203,164 | | | $ | 1,968,003 | | | $ | (764,839) | | | (38.9) | % |

| Gross profit | 781,782 | | | 1,274,432 | | | $ | (492,650) | | | (38.7) | % |

–% of revenues | 65.0 | % | | 64.8 | % | | | | 0.2 | % |

| Operating expenses | 2,742,680 | | | 2,987,423 | | | $ | (244,743) | | | (8.2) | % |

| Interest income | 25,378 | | | 106,737 | | | $ | (81,359) | | | (76.2) | % |

| Other income | 166,783 | | | — | | | $ | 166,783 | | | 100.0 | % |

| Net loss | $ | (1,768,737) | | | $ | (1,606,254) | | | $ | 162,483 | | | 10.1 | % |

| Net loss per common share | $ | (0.21) | | | $ | (0.23) | | | $ | (0.02) | | | (8.7) | % |

Revenues

Revenues for the third quarter of 2023 decreased by $765 thousand or 38.9% compared to the third quarter of 2022. The revenue decline was primarily attributable to DPNCheck sales made into the MA market. Healthcare providers in that market are experiencing significant reductions in patient reimbursement due to dramatic changes initiated by CMS in early 2023 which reduce and ultimately remove key financial incentives for patient screening, including for neuropathy. The Company has felt the effect of CMS changes as certain key customers have reduced or eliminated patient screening with DPNCheck. Quell sales were also lower in the 2023 third quarter reflecting the strategic transition to prescription indications and away from over-the-counter sales. Quell fibromyalgia is the initial prescription indication with other potential indications in the clinical and development pipeline. The legacy ADVANCE business continues to be managed for cash flow.

Gross Profit

Gross profit for the third quarter of 2023 decreased by $493 thousand or 38.7% compared to the third quarter of 2022. The decline in revenue, particularly DPNCheck, was the largest contributor to the reduction in gross profit. The gross profit rate as a percentage of revenue was approximately flat between the periods.

Operating Expenses

Operating expenses declined in the third quarter of 2023 by $245 thousand or 8.2% compared to the third quarter of 2022. Research and development spending, particularly for consulting services and clinical and development costs was lower by $482 thousand or 44.9% due to the timing of certain engineering projects and clinical trials. Sales and marketing personnel costs increased by $180 thousand or 41.5% with the expansion of the Quell fibromyalgia sales force. General and administrative costs increased by $104 thousand or 9.4% due to higher consulting and professional fees.

Net loss

The net loss in the third quarter of 2023 increased by $162 thousand or 10.1% compared to the third quarter of 2022. The net loss per common share decreased to ($0.21) per common share in the third quarter of 2023 from ($0.23) per common share in the third quarter of 2022.

Comparison of Nine Months Ended September 30, 2023 and 2022

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, | | Increase (Decrease) |

| 2023 | | 2022 | | Amount | | Percent |

| | | |

| Revenues | $ | 4,583,679 | | | $ | 6,408,695 | | | $ | (1,825,016) | | | (28.5) | % |

| Gross profit | $ | 3,099,439 | | | $ | 4,520,129 | | | $ | (1,420,690) | | | (31.4) | % |

–% of revenues | 67.6 | % | | 70.5 | % | | | | (2.9) | % |

| Operating expenses | $ | 8,393,861 | | | $ | 8,405,428 | | | $ | (11,567) | | | (0.1) | % |

| Interest income | 247,699 | | | 160,560 | | | 87,139 | | | 54.3 | % |

| Other income | 166,783 | | | — | | | 166,783 | | | 100.0 | % |

| Net loss | $ | (4,879,940) | | | $ | (3,724,739) | | | $ | 1,155,201 | | | 31.0 | % |

| Net loss per common share | $ | (0.61) | | | $ | (0.53) | | | $ | 0.08 | | | 15.1 | % |

Revenues

Revenues for the nine months ended September 30, 2023 decreased by $1.8 million or 28.5% compared to the nine months ended September 30, 2022. DPNCheck sales, primarily focused on MA, accounted for the majority of revenues in both periods and a decline in these sales was the primary contributor to the revenue decline in the year-to-date 2023 period.

Gross Profit

Gross profit for the nine months ended September 30, 2023 decreased by $1.4 million or 31.4% compared to the corresponding period in 2022. The decline in revenue, particularly DPNCheck revenue, was the largest contributor to the reduction in gross profit. The gross profit rate in the nine months ended September 30, 2023 contracted from the prior year period by 2.9 percentage points primarily due to lower margin Quell fibromyalgia sales which were initiated in 2023.

Operating Expenses

Operating expenses in the nine months ended September 30, 2023 were approximately flat with the corresponding period in 2022. Research and development costs declined by $656 thousand or 24.3% due to project timing. Sales and marketing costs increased by $269 thousand or 12.0% primarily due to increased Quell personnel costs offset by reduced promotional spending. General and administrative costs increased by $375 thousand of 10.8% due to higher personnel costs and professional fees.

Net loss

The net loss for the nine months ended September 30, 2023 increased by $1.2 million or 31% compared to the corresponding period in 2022. Similarly, net loss per common share increased to ($0.61) per common share in the nine months ended September 30, 2023 from ($0.53) per common share in the corresponding period in 2022. The increase in the number of common shares outstanding in the nine months ended September 30, 2023 partially offset the effect of a greater net loss in that period.

Liquidity and Capital Resources

The following table contains certain key performance indicators we believe depict our liquidity and cash flow position:

| | | | | | | | | | | | | | | | | | | | | |

| September 30, | | December 31, | | | | |

| 2023 | | 2022 | | 2022 | | | | |

| | | | |

| Cash and cash equivalents | $ | 1,460,553 | | | $ | 1,772,005 | | | $ | 4,335,020 | | | | | |

| Securities | $ | 16,177,122 | | | $ | 19,054,654 | | | 16,864,707 | | | | | |

| Working capital | $ | 19,445,277 | | | $ | 21,599,577 | | | $ | 23,000,575 | | | | | |

| Current ratio | 16.4 | | | 12.8 | | | 21.8 | | | | | |

| Net debt position | $ | (16,254,439) | | | $ | (18,760,537) | | | $ | (19,885,799) | | | | | |

| Days sales outstanding | 50.9 | | | 28.6 | | | 20.9 | | | | | |

| Inventory turnover | 1.0 | | 2.9 | | | 1.8 | | | | | |

Our primary sources of liquidity are cash and cash equivalents, securities, revenues from the sales of our products, and net proceeds from equity sales. Our expected cash outlays relate to funding operations. We believe that our resources are sufficient to fund our cash requirements over at least the next twelve months from the date of issuance of the financial statements.

As of September 30, 2023, we held $17.6 million in cash, cash equivalents, and securities. Working capital was $19.4 million, and the current ratio of working capital was 16.4. The Company had no term debt or borrowings. Net debt, defined as short and long-term debts (liabilities), less cash and cash equivalents and securities, continues to be negative.

Days sales outstanding ("DSO") reflect our customer payment terms which vary from payment on order to 60 days from shipment date. The increase in DSO to 50.9 on September 30, 2023 in comparison with 28.6 on September 30, 2022 is primarily due to collection delays with two large MA customers who recently implemented new accounts payable systems causing disruption to payment cycles. The Company is currently working with these customers and towards resolution of these delays. The inventory turnover rate declined during the quarter ended September 30, 2023 due to the drop in sales and increase in inventory balances.

Cash Flows

| | | | | | | | | | | | | | | | | |

| Nine months ended September 30, | | |

| | 2023 | | 2022 | | Change |

| | | | |

| Net cash provided by (used in): | | | | | |

Operating activities | $ | (4,634,367) | | | $ | (3,806,422) | | | $ | 827,945 | |

Investing activities | 1,058,354 | | | (18,944,558) | | | (20,002,912) | |

Financing activities | 701,546 | | | 1,950,881 | | | (1,249,335) | |

| Net change in cash and cash equivalents | $ | (2,874,467) | | | $ | (20,800,099) | | | |

Operating Activities

Cash used in operating activities in the nine months ended September 30, 2023 increased by $828 thousand from the comparable period in 2022. This primary contributor to the change in operating cash usage was the higher operating loss of $1,155 thousand partially offset by changes in working capital usage.

Investing Activities

Investing activities in the nine months periods ended September 30 2023 reflected a reduction of $1.1 million in portfolio investments as resources were shifted to support operations. During the nine months period ended September 30, 2022 the Company deployed cash of approximately $18.9 million to purchase investment grade securities. The cash invested in portfolio

assets is for the short term and, while it is not forecasted to be essential to the Company’s near-term operations requirements, provides a cushion if necessary.

Financing Activities

Equity sales in the nine months periods ended September 30, 2023 and 2022 contributed $702 thousand and $1.9 million, respectively. Shares of our common stock were sold to investors pursuant to the Company's ATM facility.

On October 22, 2021, we entered into an At Market Issuance Sales Agreement (the “ATM Sales Agreement”) with Ladenburg Thalmann & Co. Inc. (the “Sales Agent”), pursuant to which we can offer and sell, from time to time at our sole discretion, shares of our common stock having an aggregate offering price of up to $25 million through the Sales Agent in an “at the market offering.” The Sales Agent will receive a commission of 3.0% of the gross proceeds of any common stock sold under the ATM Sales Agreement. On August 31, 2022, Amendment 1 was filed which limited the amount of common stock we may offer and sell up to $7.6 million due to Securities and Exchange Commission ("SEC") limitations. During the nine months ended September 30, 2023, we sold 726,761 shares of our common stock, net of banker, audit and legal fees, for proceeds of $692,831 pursuant to the ATM Sales Agreement.

We continue to maintain an effective shelf registration statement covering the sales of shares of our common stock and other securities, giving us the opportunity to raise funding when needed or otherwise considered appropriate at prices and on terms to be determined at the time of any such offerings. Pursuant to the instructions to Form S-3, we have the ability to sell shares under the shelf registration statement, during any 12-month period, in an amount less than or equal to one-third of the aggregate market value of our common stock held by non-affiliates. If we raise additional funds by issuing equity or debt securities, either through the sale of securities pursuant to a registration statement or by other means, our existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders.

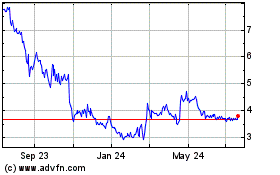

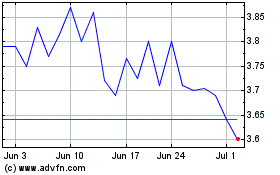

On August 8, 2023, we received a notice from the Listing Qualifications Department of the Nasdaq Stock Market indicating that, for the last 30 consecutive business days, the bid price for our common stock had closed below the minimum $1.00 per share required for continued inclusion in the Nasdaq Capital Market under Nasdaq Listing Rule 5550(a)(2). The notification letter states that pursuant to Nasdaq Listing Rule 5810(c)(3)(A), the Company will be afforded 180 calendar days, or until February 5, 2024, to regain compliance with the minimum bid price requirement. In order to regain compliance, shares of the Company’s common stock must maintain a minimum bid closing price of at least $1.00 per share for a minimum of 10 consecutive business days. If we do not regain compliance by February 5, 2024, Nasdaq will provide written notification to us that our common stock will be delisted. At that time, we may appeal Nasdaq’s delisting determination to a Nasdaq Listing Qualifications Panel. Alternatively, we may be eligible for an additional 180-day grace period if we satisfy all of the requirements, other than the minimum bid price requirement, for listing on The Nasdaq Capital Market set forth in Nasdaq Listing Rule 5505. The notification letter has no effect at this time on the listing of our common stock on the Nasdaq Capital Market. We intend to actively monitor the bid price for our common stock between now and February 5, 2024.

Critical Accounting Polices and Estimates

The discussion and analysis of our financial condition and results of operations are based upon our unaudited financial statements, which have been prepared in accordance with generally accepted accounting principles for interim financial information. The preparation of these unaudited financial statements requires us to make estimates and assumptions about future events that affect the amounts reported in our financial statements. Actual results may differ from these estimates. The critical accounting policies and the significant judgments and estimates used in the preparation of our unaudited financial statements for the three and nine months ended September 30, 2023, were consistent with those discussed in our Annual Report on Form 10-K for the year ended December 31, 2022.

Recent Developments

At a special meeting of stockholders held on October 19, 2023, our stockholders approved a reverse stock split, if needed in the discretion of our Board of Directors, to regain compliance with the Nasdaq minimum bid price requirement as discussed above, at a ratio between 1:2 and 1:8, inclusive. On October 25, 2023, the closing price of our common stock was $0.67 per share.

Cautionary Note Regarding Forward-Looking Statements

The statements contained in this Quarterly Report on Form 10-Q, including under the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of this Quarterly Report, include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), including, without limitation, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future, such as our estimates regarding anticipated operating losses, future revenues and projected expenses, our future liquidity and our expectations regarding our needs for and ability to raise additional capital; our ability to maintain the listing of our common stock on the Nasdaq Capital Market; our ability to manage our expenses effectively and raise the funds needed to continue our business; our belief that there are unmet needs and our estimates regarding the addressable market for the management of chronic pain and in the diagnosis and treatment of diabetic neuropathy; our expectations surrounding our commercialized neurostimulation and neuropathy diagnostic products; our expected timing and our plans to develop and commercialize our products; our ability to meet our proposed timelines for the commercial availability of our products; our ability to obtain and maintain regulatory approval of our existing products and any future products we may develop; regulatory and legislative developments in the United States and foreign countries; the performance of our third-party manufacturers; our ability to obtain and maintain intellectual property protection for our products; the successful development of our sales and marketing capabilities; the size and growth of the potential markets for our products and our ability to serve those markets; our estimate of our customer returns of our products; the rate and degree of market acceptance of any future products; our reliance on key scientific management or personnel; the payment and reimbursement methods used by private or government third party payers; and other factors discussed elsewhere in this Quarterly Report on Form 10-Q. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plan” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this quarterly report are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section titled “Risk Factors” in our Annual Report on Form 10-K. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

We do not use derivative financial instruments in our investment portfolio and have no foreign exchange contracts. Our financial instruments consist of cash and cash equivalents and available for sale debt securities. We consider investments that, when purchased, have a remaining maturity of 90 days or less to be cash equivalents. The primary objectives of our investment strategy are to preserve principal, maintain proper liquidity to meet operating needs, and maximize yields. To minimize our exposure to an adverse shift in interest rates, we invest mainly in cash equivalents and investments with a maturity of twelve months or less and we maintain an average maturity of twelve months or less. We do not believe that a notional or hypothetical 10% change in interest rate percentages would have a material impact on the fair value of our investment portfolio or our interest income.

Item 4. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures. Our principal executive officer and principal financial officer, after evaluating the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of September 30, 2023, have concluded that, based on such evaluation, our disclosure controls and procedures were effective to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

(b) Changes in Internal Controls. In connection with our evaluation of the Company’s internal controls over financial reporting during 2022, we identified a control deficiency in inventory accounting which represented a material weakness in our controls over financial reporting as of December 31, 2022. Specifically, our controls were not designed or implemented to ensure the proper review and determination of inventory costing, and the valuation of inventory net realizable value. The Company has taken steps to remediate the material weakness in inventory accounting controls by expanding its period-end closing process to require that the Corporate Controller perform and document a review of inventory costing and also prepare an analysis of inventory net realizable value, which analysis is required to be reviewed and approved by the Chief Financial Officer. This change in internal controls was implemented during the closing process for the first quarter of 2023 and was maintained in each quarterly closing thereafter.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

While we are not currently a party to any material legal proceedings, we could become subject to legal proceedings in the ordinary course of business. We are not aware of and do not expect any such potential issues. However, should they occur, we would not expect them to have a significant impact on our financial position.

Item 1A. Risk Factors