0001833197

false

0001833197

2023-10-20

2023-10-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest

event reported): October 20, 2023

| LATHAM GROUP, INC. |

| (Exact name of registrant as specified in its charter) |

| |

|

|

| Delaware |

001-40358 |

83-2797583 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| |

|

|

|

787 Watervliet Shaker Road

Latham, NY 12110 |

| (Address of principal executive offices) (Zip Code) |

| |

| (800) 833-3800 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which

registered |

| Common stock, par value $0.0001 per share |

|

SWIM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers. |

Appointment of Chief Financial Officer – Oliver Gloe

On October 20, 2023, the Board of Directors (the “Board”)

of Latham Group, Inc. (the “Company”) appointed Oliver C. Gloe, age 49, as Vice President, Finance of the Company and Latham

Pool Products, Inc., a subsidiary of the Company (collectively, the “Latham Companies”), effective from October 30, 2023 until

November 12, 2023, and Chief Financial Officer of the Latham Companies, effective November 13, 2023.

From May 2022 to March 2023, Mr. Gloe served as the Chief Financial

Officer of the Outdoors & Security business unit of Fortune Brands Innovations (NYSE: FBIN), a home, security and commercial building

products company. In such capacity, he led the financial operations of a $2.5 Billion business, including refining and implementing its

growth strategy, driving continuous improvement and developing the finance organization. Previously, from February 2020 to September 2021,

Mr. Gloe was the Chief Financial Officer of the Global Operations business unit of Stanley Black & Decker (NYSE: SWK), a global manufacturer

of tools and outdoor operating manufacturing facilities. In this role, Mr. Gloe was responsible for the transformation of global operations

to improve customer focus, advance digitalization, increase return on invested capital and improve leverage of scale. From July 2013 to

December 2020, Mr. Gloe held various finance roles at The Goodyear Tire & Rubber Company (Nasdaq: GT), a global tire manufacturing

company, including as Vice President Finance, Americas from July 2018 to December 2020. Previously, Mr. Gloe served as Chief Financial

Officer, Europe and Mediterranean, of General Cable, a global cable manufacturing company, from 2011 to 2013. From 2000 until 2011, Mr.

Gloe held various finance and financial planning roles at Hexion Specialty Chemicals, a global producer of adhesives and coating materials.

Mr. Gloe holds a Bachelor of Business Administration degree in finance from European University in Montreux, Switzerland and his Master

of Business Administration degree in finance and international management from Thunderbird, American Graduate School of International

Management in Phoenix, Arizona.

There are no arrangements or

understandings between Mr. Gloe and any other persons pursuant to which he was selected as Chief Financial Officer of the Company. Mr.

Gloe has no familial relationships with any executive officer or director of the Company. Further, there have been no transactions in

which the Company has participated and in which Mr. Gloe had a direct or indirect material interest that would be required to be disclosed

under Item 404(a) of Regulation S-K.

Offer Letter and Related Matters – Oliver Gloe

On October 20, 2023, Latham Pool Products, Inc. entered into an offer

letter with Mr. Gloe (the “Gloe Offer Letter”). The Gloe Offer Letter sets forth specified compensation and benefits of Mr.

Gloe, including (i) an annual base salary of $420,000, (ii) a target cash bonus of 60% of base salary (pro-rated for 2023), subject to

the Company’s Management Incentive Bonus Plan, (iii) a target long-term equity incentive of 150% of base salary, (iv) a one-time

relocation expense reimbursement of up to $150,000, and (v) 70% of COBRA premium payments until Mr. Gloe is on the Company’s benefits.

Mr. Gloe also is eligible for other customary employee benefits for similarly situated executives.

Pursuant to Gloe Offer Letter and effective October 30, 2023, the Company

will grant various equity awards to Mr. Gloe, each subject to the Latham Group, Inc. 2021 Omnibus Incentive Plan and the applicable form

of award agreement previously approved by the Compensation Committee of the Board for similarly situated executives. The vesting of the

equity awards is subject to continued employment through the applicable vesting dates, and such awards will be settled in shares of the

Company’s common stock. The equity awards include:

| |

· | A sign-on equity award of a number of restricted stock units

with an equivalent value of $100,000 on the date of the grant, with vesting in three equal installments on each of the first three anniversaries

of the date of grant. |

| |

· | A 2023 annual equity award of (i) a number of stock appreciation rights with an equivalent value of $63,000 on the date of the grant,

with vesting in four equal installments on each of the first four anniversaries of the date of grant, and (ii) a number of restricted

stock units with an equivalent value $147,000 on the date of the grant, with vesting in four equal installments on each of the first four

anniversaries of the date of grant. |

Mr. Gloe

is eligible to participate in the Latham Pool Products, Inc. Officer Severance Plan (the “Severance Plan”), which provides

participants with certain payments and benefits (i) following specified termination events and (ii) following specified termination events

subsequent to a change of control of the Company. A summary of the material terms of the Severance Plan is set forth in Item 5.02 of

the Company’s Current Report on Form 8-K filed on July 25, 2023 and is incorporated herein by reference, which is

qualified in its entirety by reference to the full text of the Severance Plan, which is attached hereto as Exhibit 10.1 and is incorporated

herein by reference.

On October 20, 2023, the Company and Mr. Gloe also entered into agreements

relating to confidentiality, non-competition and non-solicitation and binding employment arbitration. Mr. Gloe also will be subject to

the Company’s executive clawback policies.

The foregoing summary of the material terms of the Gloe Offer Letter

is qualified in its entirety by reference to the full text of the Gloe Offer Letter, which is attached hereto as Exhibit 10.2 and is incorporated

herein by reference.

Change in Employment Role – Mark Borseth

In accordance with his employment agreement, as amended, Mark Borseth

will transition from Interim Chief Financial Officer of the Company to Strategic Advisor of the Company, effective November 13, 2023,

and he will serve in such capacity until the end of his employment term, December 31, 2023. Mr. Borseth will no longer be an executive

officer of the Company as of November 13, 2023.

| Item 7.01 |

Regulation FD Disclosure. |

On October 24, 2023, the Company

issued a press release announcing the foregoing matters, which is attached hereto as Exhibit 99 and is incorporated herein by reference.

The information in Item 7.01 of this Current

Report on Form 8-K (including Exhibit 99 furnished herewith) shall not be deemed "filed" for purposes of Section 18 of the Exchange

Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the

Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

|

Description |

| |

|

|

| 10.1* |

|

Latham Pool Products, Inc. Officer Severance Plan (incorporated

by reference to Exhibit 10.3 to Latham Group, Inc.’s Current Report on Form 8-K filed on July 25, 2023 with

the SEC (File No. 001-40358)) |

| |

|

|

| 10.2* |

|

Offer Letter, by and between Oliver C. Gloe and Latham Pool Products, Inc., dated October 20, 2023 |

| |

|

|

| 99 |

|

Press release of Latham Group, Inc., dated October 24, 2023, announcing the appointment of Oliver C. Gloe as Chief Financial Officer |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Indicates management

contract or compensatory plan.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 24, 2023

| |

LATHAM GROUP, INC. |

| |

|

|

| |

By: |

/s/ Scott M. Rajeski |

| |

Name: |

Scott M. Rajeski |

| |

Title: |

Chief Executive Officer and President |

Exhibit 10.2

October 16, 2023

Oliver C. Gloe

[Address]

Dear Oliver:

On behalf of Latham Pool Products, Inc.

(“Latham” or the “Company”), I am pleased to extend this formal contingent offer of employment effective October

30, 2023, as Vice President, Finance, until November 13, 2023 when you will be named Latham’s Chief Financial Officer (CFO), reporting

in both positions to Scott Rajeski, Chief Executive Officer. Your continued employment is at-will, for no set period of time, and may

be terminated for any reason at any time by either you or the Company.

Your annual rate of pay is $420,000.00

which equates to $16,153.85 biweekly on our normal pay schedule. This position is classified

as salaried (exempt) and ineligible for overtime.

As a full-time employee

of Latham, you will be eligible for certain employee benefits, at your election, in the Company’s employee benefit programs, which

currently include group medical, dental, and vision insurance, disability insurance, life insurance, flexible spending accounts, and

the Company-sponsored 401(k) plan, among other employee benefits. These employee benefits are subject to the terms and conditions of

any applicable plan documents or other Company policies. Such employee benefits are provided on the first day of the month following

60 days of employment. Therefore, if you commence employment on October 30, 2023, you must have your selections completed by December

29, 2023 and such employee benefits will be effective January 1, 2024. Our 401(k) plan has an automatic enrollment feature, as well as

a company match. You will be notified via mail about the plan when the automatic enrollment begins. Should you choose to opt out, visit

www.401K.com or call Fidelity at 1- 800-835-5097. The Company reserves the right to add to,

amend, or discontinue any employee benefit(s) at any time. Please do not hesitate to ask if you have questions about any employee benefits

after reviewing the materials provided to you.

As a special consideration with this offer

of employment, Latham will reimburse you for out-of-pocket COBRA premiums for the months of November and December 2023, at a 70% rate,

as a bridge to your eligibility onto our plan effective January 1, 2024.

In addition to your

base salary, you are eligible to participate in the Company’s annual Management Incentive Bonus (MIB) program at Tier 1B (60% of

base pay) effective November 1, 2023. Your 2023 bonus, if earned, is based on plan achievement level which is determined in Q1 2024, subject

to Compensation Committee approval and will be pro-rated based on your eligibility date of November 1, 2023 through December 31, 2023.

The current year’s MIB program details are contained in the Appendix to this offer letter. The MIB program is subject to change

each year as will be reflected in an updated Appendix. Participation in the MIB is governed by a separate plan document, including and

subject to any clawback provision therein. Any payment under this plan is separate from your base salary and any other employee benefit

program.

You are eligible for a Company-provided

mobile phone to use for business purposes. If you prefer to use your personal mobile phone for company business, you may choose that alternative.

Please note that the Company does not reimburse for personal cell phone use.

The Company will reimburse you for reasonable

expenses incurred in connection with the performance of your duties, subject to Company’s policies and, to the extent applicable,

the Board’s approved annual budget. You will receive a copy of our expense reimbursement and travel policies as part of your onboarding.

As an executive officer of the Company,

you are eligible for participation in Latham Group, Inc.’s annual equity incentive program. Your current position eligibility in

the annual award program (with an annual issuance generally in March) has a target of 150% of annual base salary ($630,000.00

value) which may be subject to change if the Compensation Committee implements plan design changes. Your equity award for the 2023

plan year will be pro-rated for four months ($210,000.00 value) and consists of 70% Restricted Stock

Units (RSUs) and 30% Stock Appreciation Rights (SARs) scheduled to vest in 25% increments on each anniversary of the grant date over a

four-year period. As a special consideration with this offer of employment, you will also receive a $100,000.00

sign-on equity grant in the form of RSUs scheduled to vest in 33% increments on each anniversary of the grant date over a three-year

period. The vesting for all awards is subject to your continued employment. The foregoing equity awards will be subject to the terms of

the Latham’s equity plan, as well as the award agreements approved by the Compensation Committee, each in effect as of the grant

date and used for similarly situated executives.

As your RSU award

and SAR award vests, you will receive shares of SWIM stock. The value of your vested shares from the vested shares is based on the fair

market value of Latham’s stock at market close on the date of vesting. Your SAR award agreement will explain how a SAR may be exercised

once vested.

Your 2023 equity awards and any equity

awards in subsequent plan years will be reflected in a separate Appendix provided to you after Compensation Committee approval of your

awards. Your eligibility for any subsequent equity awards will be based on individual performance in your role and your salary, as well

as other factors in the sole discretion of the Compensation Committee.

Subject to execution of this Offer Letter,

you will be eligible for accelerated vesting under the Severance Plan in the event of a change in control, as defined therein, and subject

to the terms therein.

After the grants have been approved by

the Committee, the grant will be issued to you through E*Trade (or other stock plan administrator elected by the Company.) At the time

that any equity grant is issued, you must have executed the applicable award agreement, which, together with the 2021 Omnibus Equity Incentive

Plan, as amended, will contain the terms and conditions of the awards. In connection with any such award, you will receive a copy of the

2021 Omnibus Equity Incentive Plan, as amended, and the information prospectus covering the award. You will be required to log into your

Latham E*Trade account in order to accept the grant agreement. The award will not become active in your account until after you have accepted

the grant agreement online.

Trading in any shares

of Latham’s stock is always subject to our Securities Trading Policy, which you will receive after your start date, and other applicable

laws and regulations.

Pursuant to our Paid Time Off (PTO)

policy, you will be eligible for five weeks of PTO per year of employment, and we will front-load two weeks of PTO when you begin

employment. You will accrue PTO at a rate of 3.84 hours per week. While you generally have the discretion to take PTO as you see

fit, your use of PTO may be limited by the Company at certain times if it, in its sole discretion, determines that your use of PTO

could adversely affect its business. You will receive a copy of the Company’s Paid Time Off (PTO) policy which provides

additional details about PTO usage. Please also note that as an employee of Latham, you will receive 11 Company-paid holidays each

year. The Company reserves the right to add, amend or discontinue the PTO program.

The Company provides annual performance

reviews for our employees. These reviews normally occur in the fourth quarter. Additionally, annual goals and objectives will be established

for you individually and are generally tied to key performance indicators and strategic initiatives. These goals and objectives are updated

and reviewed by the CEO and the Compensation Committee quarterly. Both the annual performance review and annual goals factor into your

total rewards package. Your compensation is approved annually by the Compensation Committee and is set based on several factors including

individual performance, company performance, market data (including peer group data) and total rewards including short and long-term compensation

awards. Your annual performance review and quarterly goals and objectives results will be a factor considered by the Compensation Committee

when considering a potential base salary or other compensation increase in the future.

At time of hire, a one-time relocation package will

also be provided to you to assist with expenses related to your move to Latham’s headquarters in

Latham, NY by May 1, 2025 (not to exceed $150,000.00). Any payments made to you require 100%

repayment if you voluntarily terminate employment or are terminated for cause within 18 months of hire.

As discussed, your

presence onsite at Latham’s NY headquarters should include a minimum of four days per week. This includes arrival in time for the

Monday Executive Leadership Team (ELT) meetings through Thursday afternoon. Additional business travel will be required for various purposes

including Board meetings, plant visits, investor meetings, conferences and other reasons. Such travel will be covered under the standard

travel and expense reimbursement policy.

Relocation Assistance includes:

| · | Reasonable temporary living expenses for up to 18 months, which includes a hotel or a corporate apartment

and mileage reimbursement for your personal vehicle or rental car fees. Reimbursement is not provided for personal meal or entertainment

expenses during your in- office time, unless those expenses are for business purposes. |

| · | One residence-search trip for you and your significant other up to three days (including airfare, hotel

accommodations, meals, and related expenses (rental car, airport parking fees, etc.). |

| · | Any cost to connect and disconnect utilities because of the move. |

| · | The cost to store your belongings for no more than 30 consecutive days after the move. |

| · | Mileage incurred on your personal vehicle (one time) if you choose to drive your vehicle to your new

residence versus transporting through a moving service. |

| · | Real estate and associated expenses (including attorney and broker fees) involving the sale of your

current residence, if applicable. |

| · | Actual moving expenses (after obtaining at least two quotes) of your household goods and personal effects

from the former residence to the new residence; please note – if there are any unusual items being considered for a move (RV, boat,

more than two vehicles, etc.) we will need to discuss as this may be prohibited according to IRS rules. |

| · | Closing expenses associated with the purchase of a new home in the Capital Region, NY area. |

| · | See IRS Publication 521 for additional information regarding the tax treatment of moving expenses incurred

for work purposes under employer Accountable Plan. Please consult with Latham Human Resources regarding any potential maximum

allowance for certain fees such as closing expenses and broker fees. |

| · | The Company is not responsible for any tax gross-up payments for any of the above payments. |

As a condition of employment, Latham

requires 1) your execution of the enclosed Non-Disclosure, Non- Competition, and Non-Solicitation Agreement, 2) your prompt execution

of the amended Clawback Policy when provided shortly after hire (upon Board approval of the amended policy), and 3) your execution of

the enclosed Mutual and Binding Employment Arbitration Agreement. This offer is contingent on a successful background check which may

include 1) completion of a pre-employment drug screening test that will be at our expense and must be completed before your first day

of employment; 2) your ability to provide proof of your employment eligibility and identity as required under the Immigration Reform and

Control Act of 1986, via the completion of an I-9 form; 3) successful completion of an international background check through the company’s

third party service (Sterling); 4) professional references; and 5) a successful motor vehicle check (MVR) where applicable.

As an employee of Latham, you are subject

to all of the policies and procedures of the Company, including the enclosed Non-Disclosure, Non-Competition, and Non-Solicitation Agreement.

In making this employment offer, Latham has no interest in obtaining the benefit of any trade secrets or confidential information of any

kind from your former employers. Accordingly, Latham requires you not to disclose any trade secrets or confidential information. Latham

also requires you to comply with any existing and/or continuing contractual obligations you may have to any former employers, including

by declining to accept/rescinding your acceptance of this offer of employment if necessary. By signing this letter, you represent that

your employment with Latham shall not breach any agreement you have with any third party and you agree that you will not disclose to Latham

any trade secrets or confidential information of a former employer or third party.

Subject to execution of this Offer

Letter, you will be eligible to participate in the Officer Severance Plan, pursuant and subject to all terms of the Officer Severance

Plan. Please see the attached Plan for more information. Please also see the attached Clawback Policy which has been updated, is pending

Board approval and will require your signature once the amended policy is presented to you post-hire.

Please sign a copy of this letter,

the Non-Disclosure, Non-Competition, and Non-Solicitation Agreement and the Mutual and Binding Employment Arbitration Agreement at your

earliest convenience. Importantly, if you have any questions, please contact me or Melissa Feck.

I anticipate that you will provide many

contributions to our organization as a member of the Executive Leadership Team!

Sincerely,

Scott Rajeski

President and CEO

I acknowledge that I have read and understand

the contents of this offer letter and that no other promises, representations or outside agreements have been made to me on the part of

the Company or its representatives other than those expressly stated herein. I understand this letter is not a contract of employment

and that my employment is at-will, meaning the Company or I may terminate the relationship at any time for any reason, regardless of any

other documents or oral or written statements issued by the Company or its representatives. With this understanding, I accept the Chief

Financial Officer position with the terms as stated above.

| /s/ Oliver Gloe |

10/20/2023 |

| Oliver C. Gloe Signature & Date |

|

Exhibit 99

Latham Group, Inc. Appoints Oliver Gloe

as Chief Financial Officer, effective November 13, 2023

Mark Borseth to Remain Strategic Advisor Through

December 31, 2023

LATHAM, N.Y. – October 24, 2023 – Latham Group, Inc.

(“Latham” or “the Company”) (Nasdaq: SWIM), the largest designer, manufacturer and marketer of in-ground residential

swimming pools in North America, Australia and New Zealand, today announced the appointment of Oliver Gloe as Chief Financial Officer

(CFO), effective November 13, 2023. Gloe will join Latham on October 30, 2023 as Vice President, Finance before assuming the

role of CFO.

As CFO, Gloe will oversee Latham’s finance, strategic planning,

investor relations, treasury, tax and accounting reporting functions and report to Latham President and Chief Executive Officer, Scott

Rajeski. Mark Borseth, who currently serves as Interim Chief Financial Officer, will transition to the role of Strategic Advisor to the

Company beginning November 13, 2023 through December 31, 2023.

“Oliver is a highly experienced finance executive with deep operational

expertise in complex manufacturing environments, and I am thrilled to welcome him to Latham,” said Mr. Rajeski. “His

expertise in leading global financial operations and implementing strategies that enhance customer focus and improve leverage of scale

will be invaluable as we continue to execute on our fiberglass conversion opportunity. I would also like to thank Mark for stepping in

to lead our finance organization as we identified a successor to the CFO role. We are incredibly grateful for his leadership and contributions

to strengthening our business throughout his tenure at Latham.”

“I am very excited for the opportunity to join Latham, an industry

leader that is uniquely positioned thanks to its broad portfolio of products and direct-to-homeowner and dealer strategies,” said

Mr. Gloe. “In the coming years, I look forward to leveraging my background in strategic planning and finance within the

manufacturing space to support the Company’s continued efforts to drive the material conversion from concrete to fiberglass pools.”

Gloe brings over 20 years of experience leading finance teams within

global manufacturing companies. He joins Latham after serving with Fortune Brands Innovations as the Chief Financial Officer, Outdoors &

Security, where he led the finance operations of a $2.5 billion revenue business, including refining and implementing its growth strategy,

driving continuous improvement and developing the finance organization. Prior to Fortune Brands Innovations, Gloe served as Chief Financial

Officer Global Operations at Stanley Black & Decker, a global manufacturer of tools and outdoor operating manufacturing facilities

from 2020 to 2021. In this role, he was responsible for the transformation of global operations to improve customer focus, advance digitalization,

increase return on invested capital and improve leverage of scale. From 2013 to 2020, he held various roles at the Goodyear Tire &

Rubber Company, a global tire manufacturing company, including Vice President Finance, Americas and Vice President Finance, Asia Pacific.

Gloe also served as Chief Financial Officer, Europe and Mediterranean, of General Cable, a global cable manufacturing company, from 2011

to 2013. From 2000 until 2011, Mr. Gloe held various finance and financial planning roles at Hexion Specialty Chemicals, a global

producer of adhesives and coating materials. A native of Germany, Gloe holds a Bachelor of Business Administration degree in Finance from

European University in Montreux, Switzerland and a Master of Business Administration degree in Finance and International Management from

Thunderbird School of Global Management in Phoenix, Arizona.

About Latham Group, Inc.

Latham Group, Inc., headquartered in Latham, NY, is the largest

designer, manufacturer, and marketer of in-ground residential swimming pools in North America, Australia, and New Zealand. Latham has

a coast-to-coast operations platform consisting of approximately 2,000 employees across over 30 locations.

Contact:

Nicole Harlowe

Edelman for Latham

latham@edelman.com

646 750 7235

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

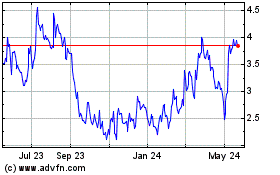

Latham (NASDAQ:SWIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

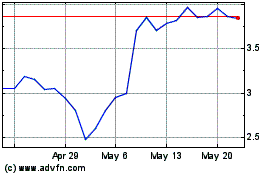

Latham (NASDAQ:SWIM)

Historical Stock Chart

From Apr 2023 to Apr 2024