As

filed with the Securities and Exchange Commission on October 19, 2023

Registration

No. 333-274581

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment No. 3

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

SONNET

BIOTHERAPEUTICS HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

20-2932652 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S

Employer

Identification

Number) |

100

Overlook Center, Suite 102

Princeton,

New Jersey 08540

Telephone:

609-375-2227

(Address,

including zip code, and telephone number,

including

area code, of registrant’s principal executive offices)

Pankaj

Mohan, Ph.D.

CEO

and Chairman

Sonnet

BioTherapeutics Holdings, Inc.

100

Overlook Center, Suite 102

Princeton,

New Jersey 08540

Telephone:

(609) 375-2227

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

Please send copies of all communications to:

Steven

M. Skolnick, Esq.

Alexander

E. Dinur, Esq.

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, NY 10020

Telephone: (212) 262-6700 |

|

Joseph

Lucosky, Esq.

Lucosky

Brookman LLP

101

Wood Avenue South, 5th Floor

Woodbridge,

NJ 08830

Telephone:

(732) 395-4400 |

Approximate

date of commencement of proposed sale to the public:

As

soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐

|

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒

|

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED OCTOBER 19, 2023

PRELIMINARY

PROSPECTUS

4,016,064

Shares of Common Stock

4,016,064

Pre-Funded Warrants to Purchase up to 4,016,064

Shares of Common Stock

8,032,128

Common Warrants to Purchase up to 8,032,128

Shares of Common Stock

120,481

Underwriter Warrants to Purchase up to 120,481

Shares of Common Stock

4,016,064

Shares of Common Stock issuable upon exercise

of the Pre-Funded Warrants

8,032,128

Shares of Common Stock issuable upon exercise

of the Common Warrants

120,481

Shares of Common Stock issuable upon exercise

of the Underwriter Warrants

We

are offering 4,016,064 shares of our common stock and common warrants to purchase an aggregate of 8,032,128 shares of our

common stock (and the shares of common stock that are issuable from time to time upon exercise of the common warrants). We are also offering

to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with

its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our

outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser

so chooses, pre-funded warrants to purchase shares of our common stock, in lieu of shares of common stock that would otherwise result

in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common

stock. Each pre-funded warrant will be exercisable for one share of our common stock. The purchase price of each pre-funded warrant and

accompanying common warrant will be equal to the price at which a share of common stock and accompanying common warrant are sold to the

public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants

will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. This offering

also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering. Each share of common

stock and pre-funded warrant is being sold together with a common warrant to purchase two shares of our common stock at an exercise

price of $ per share (representing 100% of the price at which a share of common stock and accompanying common warrant are sold to the

public in this offering). The common warrants will be exercisable immediately and will expire five years from the date of issuance. For

each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because

we will issue a common warrant to purchase two shares of our common stock for each share of our common stock and for each pre-funded

warrant to purchase one share of our common stock sold in this offering, the number of common warrants sold in this offering will not

change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold. The shares of common stock

and pre-funded warrants, and the accompanying common warrants, can only be purchased together in this offering but will be issued separately

and will be immediately separable upon issuance.

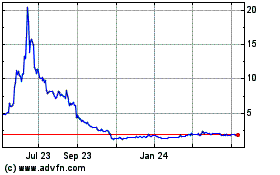

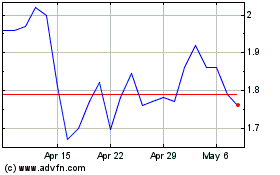

Our

common stock is listed on The Nasdaq Capital Market under the symbol “SONN.” On October 18, 2023, the last reported

sale price of our common stock on The Nasdaq Capital Market was $2.47 per share. There is no established public trading market

for the pre-funded warrants or common warrants, and we do not expect a market to develop. In addition, we do not intend to apply

for a listing of the pre-funded warrants or common warrants on any national securities exchange. Without an active trading market,

the liquidity of the pre-funded warrants or common warrants will be limited.

The

public offering price per share of common stock and accompanying common warrant and any pre-funded warrant and accompanying common warrant,

as the case may be, will be determined by us at the time of pricing, may be at a discount to the current market price, and the recent

market price used throughout this prospectus may not be indicative of the final offering price.

You

should read this prospectus, together with additional information described under the headings “Information Incorporated by Reference”

and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus and in the documents

incorporated by reference into this prospectus for a discussion of risks that should be considered in connection with an investment in

our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | |

Per Share and

Accompanying

Common

Warrant | | |

Per Pre- Funded

Warrant and Accompanying Common

Warrant | | |

Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Underwriting discounts and commissions (1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds to us, before expenses | |

$ | | | |

$ | | | |

$ | | |

(1)

See “Underwriting” for additional information regarding underwriting compensation.

The

delivery of the securities offered hereby to purchasers is expected to be made on or about _________, 2023.

Joint

Book-Running Managers

| Chardan |

Ladenburg Thalmann |

The

date of this prospectus is __________, 2023.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus

as well as additional information described under “Information Incorporated by Reference,” before deciding to invest in our

securities.

Neither

we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained

or incorporated by reference in this prospectus filed with the Securities and Exchange Commission (the “SEC”). We take no

responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The underwriters

are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The information

contained in this prospectus, or any document incorporated by reference in this prospectus, is accurate only as of the date of those

respective documents, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition,

results of operations and prospects may have changed since that date.

The

information incorporated by reference or provided in this prospectus contains statistical data and estimates, including those relating

to market size and competitive position of the markets in which we participate, that we obtained from our own internal estimates and

research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications,

studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal

company research is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions

have been verified by any independent source.

For

investors outside the United States (“U.S.”): We and the underwriters have not done anything that would permit this offering

or the possession or distribution of this prospectus in any jurisdiction where action for those purposes is required, other than in the

U.S. Persons outside the U.S. who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offering of the securities and the distribution of this prospectus outside of the U.S.

CAUTIONARY

NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided

by the Private Securities Litigation Reform Act of 1995. All statements contained in this prospectus other than statements of historical

fact, including statements regarding our strategy, future operations, future financial position, liquidity, future revenue, projected

expenses, results of operations, expectations concerning the timing and our ability to commence and subsequently report data from planned

non-clinical studies and clinical trials, prospects, plans and objectives of management are forward-looking statements. The words “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“plan,” “expect,” “predict,” “potential,” “opportunity,” “goals,”

or “should,” and similar expressions are intended to identify forward-looking statements. Such statements are based on management’s

current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected

in the forward-looking statements as a result of many factors.

We

based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe

may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives,

and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those

described in “Risk Factors” in this prospectus, and under a similar heading in any other annual, periodic or current report

incorporated by reference into this prospectus or that we may file with the SEC in the future. Moreover, we operate in a very competitive

and rapidly changing environment. New risks emerge quickly and from time to time. It is not possible for our management to predict all

risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks,

uncertainties and assumptions, the future events and trends discussed in this prospectus, may not occur and actual results could differ

materially and adversely from those anticipated or implied in the forward-looking statements. We undertake no obligation to revise or

publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties,

readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in

their entirety by this cautionary statement.

You

should also read carefully the factors described in the “Risk Factors” section of this prospectus, and under a similar heading

in any other annual, periodic or current report incorporated by reference into this prospectus, to better understand the risks and uncertainties

inherent in our business and underlying any forward-looking statements. You are advised to consult any further disclosures we make on

related subjects in our future public filings.

PROSPECTUS

SUMMARY

This

summary highlights information about our company, this offering and information contained in greater detail in other parts of this prospectus

or incorporated by reference into this prospectus from our filings with the SEC listed in the section entitled “Information Incorporated

by Reference.” Because it is only a summary, it does not contain all of the information that you should consider before purchasing

our securities in this offering and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information

appearing elsewhere or incorporated by reference into this prospectus. You should read the entire prospectus, the registration statement

of which this prospectus is a part, and the information incorporated by reference into this prospectus in their entirety, including the

“Risk Factors” and our financial statements and the related notes incorporated by reference into this prospectus, before

purchasing our securities in this offering.

Except

as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “the Company,” “we,”

“us” and “our” refer to Sonnet BioTherapeutics Holdings, Inc. and our consolidated subsidiaries.

On

August 31, 2023, we effected a reverse stock split of our issued and outstanding common stock, par value $0.0001 per share, at a ratio

of 1-for-22 and on September 16, 2022, we effected a reverse stock split of our issued and outstanding common stock at a ratio of 1-for-14.

All of our historical share and per share information related to issued and outstanding common stock and outstanding options and warrants

exercisable for common stock included in this prospectus have been adjusted, on a retroactive basis, to reflect the reverse stock splits.

The information dated before August 31, 2023 incorporated by reference into this prospectus has not been adjusted to reflect the reverse

stock splits. See “Corporate Information.”

Corporate

Overview

Sonnet

BioTherapeutics Holdings, Inc. (“we,” “us,” “our” or the “Company”), is a clinical stage,

oncology-focused biotechnology company with a proprietary platform for innovating biologic medicines of single- or bi-specific action.

Known as FHAB™ (Fully Human Albumin Binding), the technology utilizes a fully human single chain antibody fragment that

binds to and “hitch-hikes” on human serum albumin for transport to target tissues. We designed the construct to improve drug

accumulation in specific tissues, as well as to extend the duration of activity in the body. FHAB development candidates are

produced in a mammalian cell culture, which enables glycosylation, thereby reducing the risk of immunogenicity. We believe our FHAB

technology, for which we received a U.S. patent in June 2021, is a distinguishing feature of our biopharmaceutical platform that is well

suited for future drug development across a range of human disease areas, including in oncology, autoimmune, pathogenic, inflammatory,

and hematological conditions.

Recent

Developments

Registered

Direct Offering and Private Placement

On

June 28, 2023, we entered into a securities purchase agreement with certain investors pursuant to which we agreed

to sell and issue, in (i) a registered direct offering (the “RD Offering”), an aggregate of (a) 166,363 shares of common

stock at a purchase price of $9.90 per share and accompanying Private Warrant, and (b) 60,909 pre-funded warrants (the “Pre-Funded

Warrants”) to purchase up to an aggregate of 60,909 shares of common stock (the “Pre-Funded Warrant Shares”) at a purchase

price of $9.8978 per Pre-Funded Warrant and accompanying Private Warrant and (ii) in a concurrent private placement (the “Private

Placement” and together with the RD Offering, the “June 2023 Offering”), Private Warrants to purchase up to 227,272

shares of common stock. The Private Warrants will be exercisable as of December 30, 2023 at an exercise price of $14.8478 per share and

will expire three and one-half years from the date of issuance. The closing of the issuance and sale of these securities was consummated

on June 30, 2023. The gross proceeds from the offering, prior to deducting offering expenses and placement agent fees and expenses payable

by us, was approximately $2.25 million.

Pursuant

to a placement agency agreement dated as of June 28, 2023, we engaged Chardan Capital Markets, LLC (“Chardan”) to act as

our exclusive placement agent in connection with the June 2023 Offering. We paid to Chardan (i) a cash fee equal to 8.0% of the aggregate

gross proceeds of the June 2023 Offering, excluding the proceeds, if any, from the exercise of the Private Warrants and (ii) a non-accountable

expense allowance of 0.5% of the aggregate gross proceeds of the June 2023 Offering, and (iii) reimbursed Chardan for certain expenses

and legal fees up to $35,000. In addition, we issued to Chardan or its designees, PA Warrants to purchase up to 6,818 shares of common

stock. The PA Warrants will be exercisable as of December 30, 2023 and have a term of exercise equal to three and a half years from the

date of issuance, with an exercise price of $14.8478 per share.

Corporate

Information

We

were organized on October 21, 1999, under the name Tulvine Systems, Inc., under the laws of the State of Delaware. On April 25, 2005,

Tulvine Systems, Inc. formed a wholly owned subsidiary, Chanticleer Holdings, Inc., and on May 2, 2005, Tulvine Systems, Inc. merged

with, and changed its name to, Chanticleer Holdings, Inc. On April 1, 2020, we completed our business combination with Sonnet BioTherapeutics,

Inc. (“Sonnet”), in accordance with the terms of the Agreement and Plan of Merger, dated as of October 10, 2019, as amended,

by and among us, Sonnet and Biosub Inc., a wholly-owned subsidiary of the Company (“Merger Sub”) (the “Merger Agreement”),

pursuant to which Merger Sub merged with and into Sonnet, with Sonnet surviving as a wholly owned subsidiary of us (the “Merger”).

Under the terms of the Merger Agreement, we issued shares of common stock to Sonnet’s stockholders at an exchange rate of 0.106572

shares for each share of Sonnet common stock outstanding immediately prior to the Merger. In connection with the Merger, we changed our

name from “Chanticleer Holdings, Inc.” to “Sonnet BioTherapeutics Holdings, Inc.,” and the business conducted

by us became the business conducted by Sonnet.

On

August 31, 2023, we effected a reverse stock split of our issued and outstanding common stock, par value $0.0001 per share, at a ratio

of 1-for-22 (the “2023 Reverse Stock Split”), and on September 16, 2022, we effected a reverse stock split of our issued

and outstanding common stock at a ratio of 1-for-14 (the “2022 Reverse Stock Split” and, together with the 2023 Reverse Stock

Split, the “Reverse Stock Splits”). Shares of common stock underlying outstanding stock options and other equity instruments

convertible into common stock were proportionately reduced and the respective exercise prices, if applicable, were proportionately increased

in accordance with the terms of the agreements governing such securities in connection with the Reverse Stock Splits. No fractional shares

were issued in connection with the Reverse Stock Splits. Stockholders who would otherwise be entitled to a fractional share of common

stock instead receive a proportional cash payment. All of our historical share and per share information related to issued and outstanding

common stock and outstanding options and warrants exercisable for common stock included in this prospectus have been adjusted, on a retroactive

basis, to reflect the Reverse Stock Splits. The information dated before August 31, 2023 incorporated by reference into this prospectus

has not been adjusted to reflect the 2023 Reverse Stock Split.

Our

principal executive offices are located at 100 Overlook Center, Suite 102, Princeton, New Jersey 08540, and our telephone number is (609)

375-2227. Our website is www.sonnetbio.com. Our website and the information contained on, or that can be accessed through, our website

shall not be deemed to be incorporated by reference in, and are not considered part of, this prospectus supplement or the accompanying

prospectus. You should not rely on any such information in making your decision whether to purchase our common stock.

The

Offering

| Common

Stock to be Offered |

|

4,016,064

shares, based on the sale of our common stock

at an assumed combined public offering price of $2.49 per share of common stock and accompanying common warrant, which is

the last reported sale price of our common stock on October 17, 2023, and assuming no sale of any pre-funded warrants. |

| |

|

|

| Pre-funded

Warrants to be Offered |

|

We

are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser,

together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser,

9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if such

purchasers so choose, pre-funded warrants to purchase shares of common stock, in lieu of shares of common stock that would otherwise

result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding

common stock. Each pre-funded warrant will be exercisable for one share of our common stock. The purchase price of each pre-funded

warrant and accompanying common warrant will equal the price at which the share of common stock and accompanying common warrant are

being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share.

The pre-funded warrants will be exercisable immediately and may be exercised at any time until all of the pre-funded warrants are

exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold

in this offering. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on

a one-for-one basis. Because we will issue a common warrant to purchase two shares of our common stock for each share of our

common stock and for each pre-funded warrant to purchase one share of our common stock sold in this offering, the number of common

warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded

warrants sold. |

| |

|

|

| Common

Warrants to be Offered |

|

Common

warrants to purchase an aggregate of 8,032,128 shares of our common stock, based on the sale of our common stock at an assumed

combined public offering price of $2.49 per share of common stock and accompanying common warrant, which is the last reported

sale price of our common stock on The Nasdaq Capital Market on October 17, 2023. Each share of our common stock and each pre-funded

warrant to purchase one share of our common stock is being sold together with a common warrant to purchase two shares of our

common stock. Each common warrant will have an exercise price of $

per share (representing 100% of the price at which a share of common stock and accompanying common warrant are sold to the public

in this offering), will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The shares

of common stock and pre-funded warrants, and the accompanying common warrants, as the case may be, can only be purchased together

in this offering but will be issued separately and will be immediately separable upon issuance. This prospectus also relates to the

offering of the shares of common stock issuable upon exercise of the common warrants. |

| Common

Stock to be Outstanding Immediately After this Offering (1) |

|

5,766,490

shares, assuming none of the common warrants

issued in this offering are exercised, and based on the sale of our common stock at an assumed combined public offering price of

$2.49 per share of common stock, which is the last reported sale price of our common stock on The Nasdaq Capital Market on

October 17, 2023, and no sale of any pre-funded warrants. |

| |

|

|

| Underwriter

Warrants to be Offered |

|

We

have agreed to issue to the underwriters warrants (the “underwriter warrants”) to purchase up to

shares of common stock (representing 3% of the aggregate number of shares sold in this offering, including upon any exercise

of the underwriters’ option to purchase additional shares of common stock, and including the number of shares of common stock

underlying the pre-funded warrants), at an exercise price of $ per share

(representing 125% of the price at which a share of common stock and accompanying common warrant are sold to the public in this offering).

The underwriter warrants will be exercisable immediately and for five years from the date of commencement of sales in this offering.

The issuance of the underwriter warrants and the shares issuable upon exercise of the underwriter warrants are registered on the

registration statement of which this prospectus forms a part. |

| |

|

|

| Use

of Proceeds |

|

We

estimate that the net proceeds from this offering will be approximately $8.8 million, based

on an assumed combined public offering price of $2.49 per share of common stock and

accompanying common warrant, which was the last reported sales price of our common stock

on The Nasdaq Capital Market on October 17, 2023, and assuming no sale of any pre-funded

warrants, after deducting estimated underwriting discounts and commissions and estimated

offering expenses payable by us, and excluding the proceeds, if any, from the exercise of

the common warrants in this offering.

We

currently intend to use the net proceeds from this offering for research and development, including clinical trials, working capital

and general corporate purposes. See “Use of Proceeds” for additional information. |

| Risk

Factors |

|

An

investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus

and the other information included and incorporated by reference in this prospectus for a discussion of the risk factors you should

carefully consider before deciding to invest in our securities. |

| |

|

|

| National

Securities Exchange Listing |

|

Our

common stock is listed on The Nasdaq Capital Market under the symbol “SONN.” There is no established public trading market

for the pre-funded warrants or common warrants, and we do not expect a market to develop. In addition, we do not intend to apply

to list the pre-funded warrants or common warrants on any national securities exchange or other nationally recognized trading system.

Without an active trading market, the liquidity of the pre-funded warrants or common warrants will be limited. |

(1)

The number of shares of our common stock that will be outstanding immediately after this offering is based on 1,750,426 shares of common

stock outstanding as of October 17, 2023, and assumes the sale and issuance by us of 4,016,064 shares of common stock (and

no sale of any pre-funded warrants) in this offering and excludes:

●

2,326 shares of common stock underlying restricted stock units outstanding as of October 17, 2023;

●

14,480 shares of common stock reserved for future issuance under the 2020 Omnibus Equity Incentive Plan as of October 17, 2023;

●

730,333 shares of common stock issuable upon the exercise of warrants outstanding as of October 17, 2023, with a weighted average

exercise price of $115.60 per share;

●

shares of common stock issuable upon the exercise of the pre-funded warrants issued in this offering, if any;

●

up to 8,032,128 shares of common stock issuable upon the exercise of the common warrants issued in this offering; and

●

120,481 shares of common stock issuable upon the exercise of the underwriter warrants issued in this offering.

Unless

otherwise indicated, this prospectus reflects and assumes no issuances or exercises of any other outstanding shares, options or warrants

after October 17, 2023.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. We urge you to carefully consider all of the information contained in this prospectus

and other information which may be incorporated by reference in this prospectus as provided under “Information Incorporated by

Reference.” In particular, you should consider the risk factors below, together with those under the heading “Risk Factors”

in our most recent Annual Report on Form 10-K, which is incorporated by reference into this prospectus, as those risk factors are amended

or supplemented by our subsequent filings with the SEC. These risks and uncertainties are not the only risks and uncertainties we face.

Additional risks and uncertainties not currently known to us, or that we currently view as immaterial, may also impair our business.

If any of the risks or uncertainties described below or in our SEC filings or any additional risks and uncertainties actually occur,

our business, financial condition, results of operations and cash flow could be materially and adversely affected. As a result, you could

lose all or part of your investment.

RISKS

RELATED TO THIS OFFERING

If

you purchase shares of common stock in this offering, you will experience immediate and substantial dilution in your investment. You

will experience further dilution if we issue additional equity or equity-linked securities in the future.

Because the price per share of our common stock being

offered is substantially higher than the as adjusted net tangible book value per share of our common stock, you will suffer immediate

and substantial dilution with respect to the net tangible book value of the common stock you purchase in this offering. Based on an assumed

combined public offering price of $2.49 per share of common stock and accompanying common warrant being sold in this offering,

and our as adjusted net tangible book value as of June 30, 2023 of $2.12 per share, if you purchase shares of common stock in

this offering, you will suffer immediate and substantial dilution of $0.37 per share with respect to the as adjusted net tangible

book value of the common stock. See the section entitled “Dilution” for a more detailed discussion of the dilution you will

incur if you purchase common stock in this offering.

If

we issue additional shares of common stock, or securities convertible into or exchangeable or exercisable for shares of common stock,

our stockholders, including investors who purchase shares of common stock and/or pre-funded warrants and accompanying common warrants

in this offering, will experience additional dilution, and any such issuances may result in downward pressure on the price of our common

stock. We also cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that

is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities

in the future could have rights superior to existing stockholders.

Future

sales of substantial amounts of our common stock or securities convertible into or exchangeable or exercisable for shares of common stock,

either by us or by our existing stockholders, or the possibility that such sales could occur, could adversely affect the market price

of our common stock.

Future

sales in the public market of shares of our common stock or securities convertible into or exchangeable or exercisable for shares of

common stock, including shares referred to in the foregoing risk factor, shares held by our existing stockholders or shares issued upon

exercise of our outstanding stock options or warrants, or the perception by the market that these sales could occur, could lower the

market price of our common stock or make it difficult for us to raise additional capital.

There

is no public market for the pre-funded warrants or common warrants being offered in this offering.

There

is no established public trading market for the pre-funded warrants or common warrants being offered in this offering, and we do not

expect a market to develop. In addition, we do not intend to apply to list the pre-funded warrants or common warrants on any securities

exchange or nationally recognized trading system, including The Nasdaq Capital Market. Without an active market, the liquidity of the

pre-funded warrants and common warrants will be limited.

Holders

of pre-funded warrants and common warrants purchased in this offering will have no rights as common stockholders until such holders exercise

such warrants and acquire our common stock.

Until

holders of pre-funded warrants or common warrants acquire shares of our common stock upon exercise of such warrants, holders of pre-funded

warrants or common warrants will have no rights with respect to the shares of our common stock underlying such warrants. Upon exercise

of the pre-funded warrants or common warrants, the holders will be entitled to exercise the rights of a common stockholder only as to

matters for which the record date occurs after the exercise date.

We

will have broad discretion in the use of our existing cash and cash equivalents, including the proceeds from this offering, and may invest

or spend our cash in ways with which you do not agree and in ways that may not increase the value of your investment.

We

will have broad discretion over the use of our cash and cash equivalents, including the proceeds from this offering. You may not agree

with our decisions, and our use of cash may not yield any return on your investment. We intend to use the net proceeds from this offering

for research and development, including clinical trials, working capital and general corporate purposes. Our failure to apply the net

proceeds from this offering effectively could compromise our ability to pursue our growth strategy and we might not be able to yield

a significant return, if any, on our investment of these net proceeds. You will not have the opportunity to influence our decisions on

how to use our net proceeds from this offering.

USE

OF PROCEEDS

We

estimate that we will receive net proceeds of approximately $8.8 million from the sale of the securities offered by us in this offering,

based on an assumed combined public offering price of $2.49 per share and accompanying common warrant, which was the last reported

sales price of our common stock on The Nasdaq Capital Market on October 17, 2023, after deducting the estimated underwriting discounts

and commissions and estimated offering expenses payable by us, excluding the proceeds, if any, from the exercise of the common warrants

issued in this offering.

The

foregoing discussion assumes no sale of pre-funded warrants, which if sold, would reduce the number of shares of common stock that we

are offering on a one-for-one basis.

We

currently intend to use the net proceeds from this offering for research and development, including clinical trials, working capital

and general corporate purposes. See “Risk Factors” for a discussion of certain risks that may affect our intended use of

the net proceeds from this offering.

Our

expected use of net proceeds from this offering represents our current intentions based upon our present plans and business condition.

As of the date of this prospectus, we cannot currently allocate specific percentages of the net proceeds that we may use for the purposes

specified above, and we cannot predict with certainty all of the particular uses for the net proceeds to be received upon the completion

of this offering, or the amounts that we will actually spend on the uses set forth above. The amounts and timing of our actual use of

the net proceeds will vary depending on numerous factors, including our ability to obtain additional financing, the progress, cost and

results of our preclinical and clinical development programs, and whether we are able to enter into future licensing or collaboration

arrangements.

Pending

the use of the net proceeds from this offering, we intend to invest the net proceeds in investment-grade, interest-bearing instruments,

certificates of deposit or direct or guaranteed obligations of the U.S.

A $0.50 increase or decrease in the assumed public

offering price of $2.49 per share would increase or decrease the net proceeds to us from this offering by approximately $1.9

million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and

after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

Similarly, a 0.5 million share increase or decrease

in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase or decrease the net proceeds

to us by approximately $1.2 million, based on the assumed public offering price of $2.49 per share remaining the same, and after

deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

DILUTION

If

you invest in our securities, your ownership interest will be diluted to the extent of the difference between the public offering price

per share of our common stock and the as adjusted net tangible book value per share of our common stock immediately after the closing

of this offering.

Our

historical net tangible book value as of June 30, 2023 was $3.4 million, or $1.96 per share of common stock. Our historical net

tangible book value is the amount of our total tangible assets less our liabilities. Historical net tangible book value per common share

is our historical net tangible book value divided by the number of shares of common stock outstanding as of June 30, 2023.

After giving effect to the sale of 4,016,064

shares of common stock and the accompanying common warrants in this offering at an assumed combined public offering price of $2.49

per share and accompanying common warrant, which was the last reported sale price of our common stock on The Nasdaq Capital Market

on October 17, 2023, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable

by us, excluding the proceeds, if any, from the exercise of the common warrants issued in this offering, and assuming no sale of pre-funded

warrants in this offering, our as adjusted net tangible book value as of June 30, 2023 would be $12.2 million, or $2.12 per share

of common stock. This amount represents an immediate increase in net tangible book value of $0.16 per share to our existing stockholders

and an immediate dilution of $0.37 per share to investors participating in this offering. We determine dilution per share to investors

participating in this offering by subtracting as adjusted net tangible book value per share after this offering from the assumed combined

public offering price per share paid by investors participating in this offering.

The

following table illustrates this dilution on a per share basis to new investors:

| Assumed combined public offering price per share and accompanying common warrant | |

| | | $ |

2.49 |

|

| Historical net tangible book value per share as of June 30, 2023 | |

$ | 1.96 | |

|

|

|

| Increase in net tangible book value per share attributable to this offering | |

| 0.16 | |

|

|

|

| Net tangible book value per share after giving effect to this offering | |

| | |

|

2.12 |

|

| Dilution per share to new investors in this offering | |

| | | $ |

0.37 |

|

Each $0.50 increase or decrease in the assumed combined

public offering price of $2.49 per share and accompanying common warrant, which was the last reported sale price of our common

stock on The Nasdaq Capital Market on October 17, 2023, would increase or decrease the as adjusted net tangible book value per

share by $0.32 per share and the dilution per share to investors participating in this offering by $0.18 per share, respectively,

assuming that the number of shares and/or pre-funded warrants offered by us, as set forth on the cover page of this prospectus, remains

the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We may also increase or decrease the number of shares

we are offering. An increase of 0.5 million in the number of shares offered by us, as set forth on the cover page of this prospectus,

would increase the as adjusted net tangible book value per share by approximately $0.02 and decrease the dilution per share to

new investors participating in this offering by approximately $0.02, based on an assumed combined public offering price of $2.49

per share and accompanying common warrant, which was the last reported sale price of our common stock on The Nasdaq Capital Market

on October 17, 2023, remaining the same and after deducting estimated underwriting discounts and commissions and estimated offering

expenses payable by us. A reduction of 0.5 million in the number of shares offered by us, as set forth on the cover page of this prospectus,

would decrease the as adjusted net tangible book value per share after this offering by approximately $0.02 and increase the dilution

per share to new investors participating in this offering by approximately $0.02, based on an assumed combined public offering

price of $2.49 per share and accompanying common warrant, which was the last reported sale price of our common stock on The Nasdaq

Capital Market on October 17, 2023, remaining the same and after deducting estimated underwriting discounts and commissions and

estimated offering expenses payable by us.

The

table and discussion above is based on 1,744,984 shares of common stock outstanding as of June 30, 2023 and excludes:

●

2,326 shares of common stock underlying unvested restricted stock units outstanding as of June 30, 2023;

●

5,516 shares of common stock subject to restricted stock awards granted as of June 30, 2023 but not yet issued;

●

14,480 shares of common stock reserved for future issuance under the 2020 Omnibus Equity Incentive Plan as of June 30, 2023;

●

730,333 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2023, with a weighted average exercise

price of $115.60 per share;

●

shares of common stock issuable upon the exercise of the pre-funded warrants issued in this offering;

●

shares of common stock issuable upon the exercise of the common warrants issued in this offering; and

●

shares of common stock issuable upon the exercise of the underwriter warrants issued in this offering.

The

information discussed above is illustrative only and will adjust based on the actual public offering price, the actual number of shares

and common warrants that we offer in this offering, and other terms of this offering determined at pricing. Except as indicated otherwise,

the discussion and table above assume (i) no sale of pre-funded warrants, which, if sold, would reduce the number of shares of common

stock that we are offering on a one-for-one basis and (ii) no exercise of common warrants accompanying the shares of common stock sold in this offering.

DESCRIPTION

OF CAPITAL STOCK

Our

authorized capital stock consists of:

●

125,000,000 shares of common stock, par value $0.0001 per share; and

●

5,000,000 shares of preferred stock, par value $0.0001 per share, of which, as of the date of this prospectus, none of which shares have

been designated.

As

of close of business on October 17, 2023, 1,750,426 shares of common stock were issued and outstanding and no shares of preferred

stock were issued and outstanding.

The

additional shares of our authorized stock available for issuance may be issued at times and under circumstances so as to have a dilutive

effect on earnings per share and on the equity ownership of the holders of our common stock. The ability of our board of directors to

issue additional shares of stock could enhance the board’s ability to negotiate on behalf of the stockholders in a takeover situation

but could also be used by the board to make a change-in-control more difficult, thereby denying stockholders the potential to sell their

shares at a premium and entrenching current management. The following description is a summary of the material provisions of our capital

stock. You should refer to our Certificate of Incorporation, as amended (the “Certificate of Incorporation”) and Amended

and Restated Bylaws (the “Bylaws”), both of which are on file with the SEC as exhibits to previous SEC filings, for additional

information. The summary below is qualified by provisions of applicable law.

Common

Stock

Holders

of our common stock are each entitled to cast one vote for each share held of record on all matters presented to stockholders. Cumulative

voting is not allowed; the holders of a majority of our outstanding shares of common stock may elect all directors. Holders of our common

stock are entitled to receive such dividends as may be declared by our board out of funds legally available and, in the event of liquidation,

to share pro rata in any distribution of our assets after payment of liabilities. Our directors are not obligated to declare a dividend.

It is not anticipated that we will pau dividends in the foreseeable future. Holders of our do not have preemptive rights to subscribe

to any additional shares we may issue in the future. There are no conversion, redemption, sinking fund or similar provisions regarding

the common stock. All outstanding shares of common stock are fully paid and nonassessable.

The

rights, preferences and privileges of holders of common stock are subject to the rights of the holders of any outstanding shares of preferred

stock.

Preferred

Stock

We

are authorized to issue up to 5,000,000 shares of preferred stock, all of which are undesignated. Our board of directors has the authority

to issue preferred stock in one or more classes or series and to fix the designations, powers, preferences and rights, and the qualifications,

limitations or restrictions thereof, including dividend rights, conversion right, voting rights, terms of redemption, liquidation preferences

and the number of shares constituting any class or series, without further vote or action by the stockholders. Although we have no present

plans to issue any other shares of preferred stock, the issuance of shares of preferred stock, or the issuance of rights to purchase

such shares, could decrease the amount of earnings and assets available for distribution to the holders of common stock, could adversely

affect the rights and powers, including voting rights, of the common stock, and could have the effect of delaying, deterring or preventing

a change of control of us or an unsolicited acquisition proposal. The preferred stock may provide for an adjustment of the conversion

price in the event of an issuance or deemed issuance at a price less than the applicable conversion price, subject to certain exceptions.

If

we offer a specific series of preferred stock under this prospectus, we will describe the terms of the preferred stock in the prospectus

supplement for such offering and will file a copy of the certificate establishing the terms of the preferred stock with the SEC. To the

extent required, this description will include:

●

the title and stated value;

●

the number of shares offered, the liquidation preference per share and the purchase price;

●

the dividend rate(s), period(s) and/or payment date(s), or method(s) of calculation for such dividends;

●

whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate;

●

the procedures for any auction and remarketing, if any;

●

the provisions for a sinking fund, if any;

●

the provisions for redemption, if applicable;

●

any listing of the preferred stock on any securities exchange or market;

●

whether the preferred stock will be convertible into our common stock, and, if applicable, the conversion price (or how it will be calculated)

and conversion period;

●

whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price (or how it will be calculated)

and exchange period;

●

voting rights, if any, of the preferred stock;

●

a discussion of any material and/or special U.S. federal income tax considerations applicable to the preferred stock;

●

the relative ranking and preferences of the preferred stock as to dividend rights and rights upon liquidation, dissolution or winding

up of our affairs; and

●

any material limitations on issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred

stock as to dividend rights and rights upon liquidation, dissolution or winding up of our affairs.

Anti-takeover

Effects of Delaware Law and our Certificate of Incorporation and Bylaws

Our

Certificate of Incorporation and Bylaws contain provisions that could have the effect of discouraging potential acquisition proposals

or tender offers or delaying or preventing a change of control. These provisions are as follows:

●

they provide that special meetings of stockholders may be called by the President, the board of directors or at the request by stockholders

of record owning at least thirty-three and one-third (33 1/3%) percent of the issued and outstanding voting shares of our common stock;

●

they do not include a provision for cumulative voting in the election of directors. Under cumulative voting, a minority stockholder holding

a sufficient number of shares may be able to ensure the election of one or more directors. The absence of cumulative voting may have

the effect of limiting the ability of minority stockholders to effect changes in our board of directors; and

●

they allow us to issue, without stockholder approval, up to 5,000,000 shares of preferred stock that could adversely affect the rights

and powers of the holders of our common stock.

We

are subject to the provisions of Section 203 of the Delaware General Corporation Law, an anti-takeover law. Subject to certain exceptions,

the statute prohibits a publicly held Delaware corporation from engaging in a “business combination” with an “interested

stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder

unless:

●

prior to such date, the board of directors of the corporation approved either the business combination or the transaction which resulted

in the stockholder becoming an interested stockholder;

●

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder

owned at least eighty-five percent 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding

for purposes of determining the number of shares outstanding those shares owned (1) by persons who are directors and also officers and

(2) by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject

to the plan will be tendered in a tender or exchange offer; or

●

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting

of stockholders, and not by written consent, by the affirmative vote of at least sixty-six and two-thirds percent 66 2/3% of the outstanding

voting stock that is not owned by the interested stockholder.

Generally,

for purposes of Section 203, a “business combination” includes a merger, asset or stock sale, or other transaction resulting

in a financial benefit to the interested stockholder. An “interested stockholder” is a person who, together with affiliates

and associates, owns or, within three (3) years prior to the determination of interested stockholder status, owned fifteen percent (15%)

or more of a corporation’s outstanding voting securities.

Potential

Effects of Authorized but Unissued Stock

We

have shares of common stock and preferred stock available for future issuance without stockholder approval. We may utilize these additional

shares for a variety of corporate purposes, including future public offerings to raise additional capital, to facilitate corporate acquisitions

or payment as a dividend on the capital stock.

The

existence of unissued and unreserved common stock and preferred stock may enable our board of directors to issue shares to persons friendly

to current management or to issue preferred stock with terms that could render more difficult or discourage a third-party attempt to

obtain control of us by means of a merger, tender offer, proxy contest or otherwise, thereby protecting the continuity of our management.

In addition, the board of directors has the discretion to determine designations, rights, preferences, privileges and restrictions, including

voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences of each series of preferred stock,

all to the fullest extent permissible under the DGCL and subject to any limitations set forth in our Certificate of Incorporation. The

purpose of authorizing the board of directors to issue preferred stock and to determine the rights and preferences applicable to such

preferred stock is to eliminate delays associated with a stockholder vote on specific issuances. The issuance of preferred stock, while

providing desirable flexibility in connection with possible financings, acquisitions and other corporate purposes, could have the effect

of making it more difficult for a third-party to acquire, or could discourage a third-party from acquiring, a majority of our outstanding

voting stock.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Securities Transfer Corporation. The transfer agent address is Securities Transfer

Corporation, 2901 N Dallas Parkway, Suite 380, Plano, TX 75093, (469) 633-0101.

DESCRIPTION

OF SECURITIES WE ARE OFFERING

We are offering (i) 4,016,064 shares of our

common stock or pre-funded warrants to purchase shares of our common stock and (ii) 8,032,128 common warrants to purchase up to

an aggregate of 8,032,128 shares of our common stock. Each share of common stock or pre-funded warrant is being sold together

with a common warrant to purchase two shares of our common stock. The shares of common stock or pre-funded warrants and accompanying

common warrants will be issued separately. We are also registering the shares of common stock issuable from time to time upon exercise

of the pre-funded warrants and common warrants offered hereby.

Common

Stock

The

material terms and provisions of our common stock are described under the caption “Description of Capital Stock” in this

prospectus.

Pre-Funded

Warrants

The

following summary of certain terms and provisions of pre-funded warrants that are being offered hereby is not complete and is subject

to, and qualified in its entirety by, the provisions of the pre-funded warrant, the form of which will be filed as an exhibit to the

registration statement of which this prospectus forms a part. Prospective investors should carefully review the terms and provisions

of the form of pre-funded warrant for a complete description of the terms and conditions of the pre-funded warrants.

Duration

and Exercise Price. Each pre-funded warrant offered hereby will have an initial exercise price per share equal to $0.0001. The pre-funded

warrants will be immediately exercisable and may be exercised at any time until the pre-funded warrants are exercised in full. The exercise

price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock dividends,

stock splits, reorganizations or similar events affecting our common stock and the exercise price. The pre-funded warrants will be issued

separately from the accompanying common warrants and may be transferred separately immediately thereafter.

Exercisability.

The pre-funded warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed

exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the

case of a cashless exercise as discussed below). Purchasers of the pre-funded warrants in this offering may elect to deliver their exercise

notice following the pricing of the offering and prior to the issuance of the pre-funded warrants at closing to have their pre-funded

warrants exercised immediately upon issuance and receive shares of common stock underlying the pre-funded warrants upon closing of this

offering. A holder (together with its affiliates) may not exercise any portion of the pre-funded warrant to the extent that the holder

would own more than 4.99% of the outstanding common stock immediately after exercise, except that upon at least 61 days’ prior

notice from the holder to us, the holder may increase the amount of ownership of outstanding stock after exercising the holder’s

pre-funded warrants up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise,

as such percentage ownership is determined in accordance with the terms of the pre-funded warrants. Purchasers of pre-funded warrants

in this offering may also elect prior to the issuance of the pre-funded warrants to have the initial exercise limitation set at 9.99%

of our outstanding common stock. No fractional shares of common stock will be issued in connection with the exercise of a pre-funded

warrant. In lieu of fractional shares, we will round down to the next whole share.

Cashless

Exercise. If, at the time a holder exercises its pre-funded warrants, a registration statement registering the issuance of the shares

of common stock underlying the pre-funded warrants under the Securities Act is not then effective or available, then in lieu of making

the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may

elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according

to a formula set forth in the pre-funded warrants.

Transferability.

Subject to applicable laws, a pre-funded warrant may be transferred at the option of the holder upon surrender of the pre-funded

warrant to us together with the appropriate instruments of transfer.

Exchange

Listing. There is no trading market available for the pre-funded warrants on any securities exchange or nationally recognized trading

system. We do not intend to list the pre-funded warrants on any securities exchange or nationally recognized trading system.

Right

as a Stockholder. Except as otherwise provided in the pre-funded warrants or by virtue of such holder’s ownership of shares

of our common stock, the holders of the pre-funded warrants do not have the rights or privileges of holders of our common stock, including

any voting rights, until they exercise their pre-funded warrants.

Fundamental

Transaction. In the event of a fundamental transaction, as described in the pre-funded warrants and generally including any reorganization,

recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our

properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common

stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock, the

holders of the pre-funded warrants will be entitled to receive upon exercise of the pre-funded warrants the kind and amount of securities,

cash or other property that the holders would have received had they exercised the pre-funded warrants immediately prior to such fundamental

transaction.

Common

Warrants

The

following summary of certain terms and provisions of common warrants that are being offered hereby is not complete and is subject to,

and qualified in its entirety by, the provisions of the common warrants, the form of which will be filed as an exhibit to the registration

statement of which this prospectus forms a part. Prospective investors should carefully review the terms and provisions of the form of

common warrants for a complete description of the terms and conditions of the common warrants.

Duration

and Exercise Price. Each common warrant offered hereby will have an initial exercise price per share equal to $ . The common warrants

will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The exercise price and number

of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits,

reorganizations or similar events affecting our common stock and the exercise price. The common warrants will be issued separately from

the common stock (or pre-funded warrants) and may be transferred separately immediately thereafter. A common warrant to purchase two

shares of our common stock will be issued for every share of common stock (or pre-funded warrant to purchase a share of common stock)

purchased in this offering.

Exercisability.

The common warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise

notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of

a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of the common warrant to

the extent that the holder would own more than 4.99% of the outstanding common stock immediately after exercise, except that upon at

least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding stock after exercising

the holder’s common warrants up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect

to the exercise, as such percentage ownership is determined in accordance with the terms of the common warrants. No fractional shares

of common stock will be issued in connection with the exercise of a common warrant. In lieu of fractional shares, we will round down

to the next whole share.

Cashless

Exercise. If, at the time a holder exercises its common warrants, a registration statement registering the issuance of the shares

of common stock underlying the common warrants under the Securities Act is not then effective or available and an exemption from registration

under the Securities Act is not available for the issuance of such shares, then in lieu of making the cash payment otherwise contemplated

to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise

(either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the common warrants.

Transferability.

Subject to applicable laws, a common warrant may be transferred at the option of the holder upon surrender of the common warrant to us

together with the appropriate instruments of transfer.

Exchange

Listing. There is no established public trading market for the common warrants, and we do not expect a market to develop. In addition,

we do not intend to list the common warrants on any securities exchange or nationally recognized trading system. Without an active trading

market, the liquidity of the common warrants will be limited.

Right

as a Stockholder. Except as otherwise provided in the common warrants or by virtue of such holder’s ownership of shares of

our common stock, the holders of the common warrants do not have the rights or privileges of holders of our common stock, including any

voting rights, until they exercise their common warrants.

Fundamental

Transaction. In the event of a fundamental transaction, as described in the form of common warrant, and generally including any reorganization,

recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our

properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common

stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock, the

holders of the common warrants will be entitled to receive upon exercise of the common warrants the kind and amount of securities, cash

or other property that the holders would have received had they exercised the common warrants immediately prior to such fundamental transaction.

In the event of a Change of Control (as defined in each common warrant) approved by our Board of Directors, the holders of the common

warrants have the right to require us or a successor entity to redeem the common warrants for cash in the amount of the Black-Scholes

Value (as defined in each common warrant) of the unexercised portion of the common warrants on the date of the consummation of the Change

of Control. In the event of a Change of Control which is not approved by our Board of Directors, the holders of the common warrants have

the right to require us or a successor entity to redeem the common warrants for the consideration paid in the Change of Control in the

amount of the Black-Scholes Value of the unexercised portion of the common warrants on the date of the consummation of the Change of

Control.

UNDERWRITING

We

entered into an underwriting agreement with Chardan Capital Markets, LLC (“Chardan”) and Ladenburg Thalmann & Co.

Inc. (“Ladenburg”), as representatives of the several underwriters (the “Representatives”), relating to this offering. Subject

to the terms and conditions of the underwriting agreement, we have agreed to sell to the underwriters and each of the underwriters has

agreed to purchase, severally and not jointly, the number of shares, pre-funded warrants and common warrants set forth opposite its name

in the following table:

| | |

Number of

Shares of

Common Stock | | |

Number of

Pre-Funded

Warrants | | |

Number of

Common

Warrants | |

| Chardan Capital Markets, LLC | |

| | | |

| | | |

| | |

| Ladenburg Thalmann & Co. Inc. | |

| | | |

| | | |

| | |

| TOTAL | |

| | | |

| | | |

| | |

The

underwriters have agreed to purchase all of the shares of common stock and/or pre-funded warrants and accompanying common warrants offered

by us, if any

are purchased. The obligations of the underwriters may be terminated upon the occurrence of certain events specified in the underwriting

agreement. Furthermore, pursuant to the underwriting agreement, the obligations of the underwriters are subject to customary conditions,

representations and warranties contained in the underwriting agreement, such as receipt by the underwriters of officers’ certificates

and legal opinions.

The

underwriters have advised us that they propose initially to offer the shares of common stock and/or pre-funded warrants and accompanying

common warrants to purchase shares of common stock to the public at the public offering price set forth on the cover page of this prospectus

and to dealers at a price less a concession not in excess of $ per share and accompanying common warrant or $ per pre-funded

warrant and accompanying common warrant, based on the combined public offering price per share and accompanying common warrant or pre-funded

warrant and accompanying common warrant. After the shares of common stock and/or pre-funded warrants and accompanying common warrants

are released for sale to the public, the underwriters may change the offering price, the concession, and other selling terms at various

times.

We

have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act and to contribute

to payments the underwriters may be required to make in respect thereof.

The

underwriters are offering the securities in this offering subject to prior sale, when, as and if issued to and accepted by them subject

to approval of legal matters by their counsel and other conditions specified in the underwriting agreement. The underwriters reserve

the right to withdraw, cancel or modify orders to the public, and to reject orders in whole or in part.

Discounts,

Commissions and Reimbursement

The

following table provides information regarding the amount of the discounts and commissions to be paid to the underwriters by us.

| | |

Per Share and Accompanying Common Warrant | | |

Per

Pre-Funded

Warrant and Accompanying Common Warrant | | |

Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Underwriting discounts and commissions (1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds to us, before expenses | |

$ | | | |

$ | | | |

$ | | |

(1)

We have agreed to pay the underwriters a commission of 7% of the gross proceeds of this offering.

The Company has agreed

to pay all reasonable out-of-pocket expenses of the Underwriters relating to this offering, including a maximum of $65,000 for the fees

and disbursements of counsel to the Underwriters. The Company has also agreed to pay to the Representatives,

at the closing of this offering, a non-accountable expense allowance equal to 1% of the gross proceeds of this offering.

We estimate that our

total expenses of the offering, excluding underwriting discounts and commissions, will be approximately $400,000.

Underwriter

Warrants

We have agreed to issue to

the Representatives warrants (the “underwriter warrants”) to purchase up to shares

of common stock (representing 3% of the aggregate number of shares sold in this offering, including the number of shares of common stock

underlying the pre-funded warrants), at an exercise price of $ per share (representing 125% of the price at which a share of common stock