Table of Contents

As filed with the Securities and Exchange Commission

on October 13, 2023.

Registration No. 333-274582

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

___________________________

Pre-Effective Amendment No. 1

to the

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

_____________________________

SONOMA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

(State or other jurisdiction of incorporation or

organization)

|

| 2834 |

| (Primary Standard Industrial Classification Code Number) |

| |

| 68-0423298 |

| (I.R.S. Employer Identification Number) |

| |

|

5445 Conestoga Court, Suite 150

Boulder, CO 80301

(800) 759-9305 |

|

(Address, including zip code, and telephone number,

including area code, of registrant’s principal

executive offices) |

| |

|

Amy Trombly

Chief Executive Officer

5445 Conestoga Court, Suite 150

Boulder, CO 80301

(800) 759-9305 |

(Name, address, including zip code, and telephone number,

including area code, of agent for service) |

| |

| ___________________________ |

with copies to:

|

Andrew J. Merken, Esq.

Burns & Levinson LLP

125 High Street

Boston, MA 02110

Phone: (617) 345-3740

Fax: (617) 345-3299 |

|

Leslie Marlow, Esq.

Patrick J. Egan, Esq.

Hank Gracin, Esq.

Blank Rome LLP

1271 Avenue of the Americas

New York, NY 10020

Phone: (212) 885-5000

Fax: (212) 885-5001 |

Approximate date of commencement of proposed sale

to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box: ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| Emerging growth company ☐ |

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The information in this prospectus is not complete

and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission

is declared effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities

in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER

13, 2023.

Up to 6,666,666 Shares of Common Stock

SONOMA PHARMACEUTICALS, INC.

We are offering on a best efforts basis up

to 6,666,666 shares of our common stock, $0.0001 par value per share (the “Common Stock”), based on an assumed public offering

price of $0.75 per share, which is equal to the closing price of our shares of Common Stock on the Nasdaq Capital Market on October

9, 2023. See “Description of Securities” in this prospectus for more information. We refer to the securities

offered by this prospectus as the “Securities.”

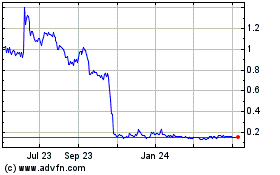

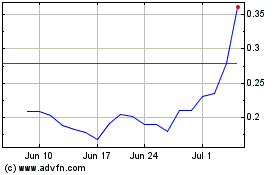

Our common stock is traded on the Nasdaq Capital

Market under the symbol “SNOA.” On October 9, 2023, the last reported sale price for our common stock was $0.75 per share.

The offering will terminate on November 15,

2023, unless completed sooner or unless we decide to terminate the offering (which we may do at any time in our discretion) prior to

that date. We expect that this offering will end two (2) trading days after we first enter into a securities purchase agreement and we

will deliver all securities issued in connection with this offering delivery versus payment/receipt versus payment upon our receipt of

investor funds. Accordingly, neither we nor the placement agent have made any arrangements to place investor funds in an escrow account

or trust account since the placement agent will not receive investor funds in connection with the sale of the securities offered hereunder.

We have engaged Maxim Group LLC as our exclusive

placement agent (the “placement agent”) to use its reasonable best efforts to solicit offers to purchase the Securities in

this offering. The placement agent has no obligation to purchase any of the Securities from us or to arrange for the purchase or sale

of any specific number or dollar amount of the Securities. Because there is no minimum offering amount required as a condition to closing

in this offering the actual public offering amount, placement agent’s fee, and proceeds to us, if any, are not presently determinable

and may be substantially less than the total maximum offering amounts set forth above and throughout this prospectus. We have agreed to

pay the placement agent the placement agent fees set forth in the table below. See “Plan of Distribution” in this prospectus

for more information.

The final public offering price of the securities

sold in this offering will be determined between us, the placement agent, and the investors in the offering and may be at a discount to

the current market price of our common stock. Therefore, the recent market price used throughout this prospectus will not be indicative

of the actual public offering price.

We are a “smaller reporting company” under applicable

federal securities laws and are subject to reduced public company reporting requirements. Investing in our securities involves a high

degree of risk. See the section entitled “Risk Factors” beginning on page 5.

| |

|

|

Per Share |

|

Total |

| |

|

|

|

|

|

| Public offering price |

|

$ |

|

$ |

|

| Placement agent fees(1) |

|

$ |

|

$ |

|

| Proceeds, before expenses, to us |

|

$ |

|

$ |

|

| (1) | | Represents a cash fee equal to 8.0% of the aggregate purchase price paid by investors in this

offering. Does not include certain out-of-pocket expenses of the placement agent that are reimbursable by us. See “Plan

of Distribution” beginning on page 9 of this prospectus for a description of the compensation to be received by the

placement agent. |

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

We anticipate that the delivery of the shares

of our Common Stock against payment therefor will be made on or before ,

2023.

Maxim Group LLC

Subject to completion, the date of this prospectus

is October 13, 2023.

TABLE OF CONTENTS

You should rely only on the information incorporated

by reference or provided in this prospectus, any prospectus supplement and the registration statement. We have not, and the placement

agent has not, authorized anyone else to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We are not making an offer to sell these securities in any state where the offer or sale is not

permitted. You should assume that the information in this prospectus and any prospectus supplement, or incorporated by reference, is accurate

only as of the dates of those documents. Our business, financial condition, results of operations and prospects may have changed since

those dates.

ABOUT THIS PROSPECTUS

We incorporate by reference

important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions

under “Where You Can Find More Information.” You should carefully read this prospectus before deciding to invest in our securities.

We have not, and the placement

agent has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus

or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and

can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell

only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained

in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or

any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. To

the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in

any document filed with the Securities and Exchange Commission (the “SEC”) before the date of this prospectus and incorporated

by reference herein, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated

by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the

document having the later date modifies or supersedes the earlier statement.

Unless otherwise indicated,

all information contained or incorporated by reference in this prospectus concerning our industry in general or any portion thereof, including

information regarding our general expectations and market opportunity, is based on management’s estimates using internal data, data

from industry related publications, consumer research and marketing studies or other externally obtained data.

For investors outside the

United States: We have not, and the placement agent has not, done anything that would permit this offering or possession or distribution

of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the

United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the

offering of the securities and the distribution of this prospectus outside the United States.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus

is a part and in any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement,

including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus and the

information incorporated by reference into this prospectus contain references to our trademarks and to trademarks belonging to other entities.

Solely for convenience, trademarks and trade names referred to in this prospectus and the information incorporated by reference into this

prospectus, including logos, artwork, and other visual displays, may appear without the ® or TM symbols, but such references are not

intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the

applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or

trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

The Sonoma Pharmaceuticals

logo and other trademarks or service marks of Sonoma Pharmaceuticals, Inc. appearing in this prospectus are the property of Sonoma Pharmaceuticals,

Inc. All other brand names or trademarks appearing in this prospectus are the property of their respective owners. Solely for convenience,

the trademarks and trade names in this prospectus may be referred to without the ® or TM symbols, but such references should not be

construed as any indicator that their respective owners will not assert their rights thereto. We do not intend our use or display of other

companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

When used in this prospectus, the words “expect,”

“believe,” “anticipate,” “estimate,” “may,” “could,” “intend,”

and similar expressions are intended to identify forward-looking statements. These statements are subject to known and unknown risks and

uncertainties that could cause actual results to differ materially from those projected or otherwise implied by the forward-looking statements.

These forward-looking statements speak only as of the date of this prospectus. Given these risks and uncertainties, you should not place

undue reliance on these forward-looking statements.

These forward-looking statements may include,

but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections of results of

operations or of financial condition, expected capital needs and expenses, statements relating to the research, development, completion

and use of our device, and all statements (other than statements of historical facts) that address activities, events or developments

that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements are not guarantees

of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments

made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments

and other factors they believe to be appropriate.

Important factors that could cause actual results,

developments and business decisions to differ materially from those anticipated in these forward-looking statements include, among other

things:

| |

● |

our expectations regarding future revenues and profitability; |

| |

● |

our expectations regarding future growth; |

| |

● |

our expectations concerning future product research, development, clinical trial and commercialization activities and related costs; |

| |

● |

our expectations regarding product development timelines; |

| |

● |

our ability to successfully commercialize and market our product candidates in development, if approved; |

| |

● |

matters relating to the manufacture of our commercial products; |

| |

● |

our strategies and opportunities; |

| |

● |

the potential market size, opportunity and growth potential for our product candidates, if approved; |

| |

● |

anticipated trends in our markets; |

| |

● |

anticipated dates for commencement or completion of clinical trials; |

| |

● |

our expectations concerning regulatory matters concerning our product candidates, including the timing of anticipated regulatory filings; |

| |

● |

our liquidity needs and need for future funding and working capital; |

| |

● |

our need to raise additional capital and our ability to obtain sufficient funding to support our planned activities; |

| |

● |

our expectations regarding future expense, profit, cash flow, or balance sheet items or any other guidance regarding future periods; |

| |

● |

the accuracy of our estimates regarding expenses, capital requirements and needs for additional financing; |

| |

● |

our ability to continue as a going concern; |

| |

● |

the impact of the health emergencies or global geopolitical events on our business; |

| |

● |

the success, safety and efficacy of our drug products; |

| |

● |

accounting principles; |

| |

● |

the potential outcome of any litigation or legal proceedings; |

| |

● |

the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology; |

| |

● |

the volatility of the price of our common stock; |

| |

● |

our financial performance; and |

| |

● |

other factors described from time to time in documents that we file with the SEC. |

Such statements are not historical facts, but

are based on our current expectations and projections about future events. They are subject to risks and uncertainties, known and unknown,

that could cause actual results and developments to differ materially from those expressed or implied in such statements.

These statements are only current predictions

and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results,

levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. We

discuss many of these risks in this prospectus in greater detail under the heading “Risk Factors” and elsewhere in this prospectus.

You should not rely upon forward-looking statements as predictions of future events.

Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as a result of new

information, future events or otherwise, after the date of this prospectus.

We will continue to file annual, quarterly and

current reports, proxy statements and other information with the SEC. Forward-looking statements speak only as of the dates specified

in such filings. Except as expressly required under federal securities laws and the rules and regulations of the SEC, we do not undertake

any obligation to update any forward-looking statements to reflect events or circumstances arising after any such date, whether as a result

of new information or future events or otherwise. You should not place undue reliance on the forward-looking statements included in this

prospectus or that may be made elsewhere from time to time by us, or on our behalf. All forward-looking statements attributable to us

are expressly qualified by these cautionary statements.

PROSPECTUS SUMMARY

This summary highlights information contained

elsewhere in this prospectus or incorporated by reference. This summary does not contain all of the information you should consider before

buying shares of our Securities. You should read the entire prospectus carefully, especially the risks of investing in our Securities

that we describe under “Risk Factors” and our consolidated financial statements appearing in our annual

and periodic reports incorporated in this prospectus by reference, before deciding to invest in our securities. Unless the context requires

otherwise, references to “Sonoma,” “the Company,” “the Registrant,” “we,” “our”

and “us” refer to Sonoma Pharmaceuticals, Inc.

Company Overview

Sonoma Pharmaceuticals is a global scientific

healthcare company that pioneered the use of hypochlorous acid (HOCl) in the specialty pharmaceutical

sector with over 20 years of experience developing and manufacturing HOCl products. We develop safe and effective solutions that provide

fast relief and are free from side effects and other limitations. Our primary focus is developing innovative solutions for dermatological

conditions, wound care, eye care, oral care, podiatry, animal health care and non-toxic disinfectants. We believe our products, which

are sold throughout the United States and internationally, have improved patient outcomes for millions of patients by treating and reducing

certain skin diseases including acne, atopic dermatitis, scarring, infections, itch, pain and harmful inflammatory responses, without

a single report of serious adverse effect.

We have 21 U.S. FDA clearances as 510(k) medical

devices, CE marks for over 39 products, and extensive worldwide regulatory clearances. We have a pharmaceutical-grade manufacturing facility

in Guadalajara, Mexico, and a robust and diverse international partner network selling into over 55 countries. Our core strategy is to

work with partners both in the United States and around the world to market and distribute our products, and in some cases we also market

and sell our own direct-to-consumer and office dispense products.

Our key business channels and products include:

Dermatology

In the United States, we sell over-the-counter

dermatology products including:

| · | Regenacyn® Advanced Scar Gel, which is clinically

proven to improve the overall appearance of scars while reducing pain, itch, redness, and inflammation |

| · | Reliefacyn® Advanced Itch-Burn-Rash-Pain

Relief Hydrogel, for the alleviation of red bumps, rashes, shallow skin fissures, peeling, and symptoms of eczema/atopic dermatitis |

| · | Rejuvacyn® Advanced Skin Repair Cooling Mist,

for management of minor skin irritations following cosmetic procedures as well as daily skin health and hydration |

We also sell a line of prescription strength office

dispense products exclusively for skin care professionals, including:

| · | Regenacyn® Plus Scar Gel |

| · | Reliefacyn® Plus Advanced

Itch-Burn-Rash-Pain Relief Hydrogel |

| · | Rejuvacyn® Plus Skin Repair

Cooling Mist |

We sell a pediatric dermatology and wound care

product for over-the-counter use, PediacynTM All Natural Skin Care & First Aid For Children. Our consumer products are

available through Amazon.com, our website and third-party distributors.

We partner with EMC Pharma, LLC to sell our prescription

dermatology products in the United States. We sell dermatology products in Europe and Asia through a distributor network.

First Aid and Wound Care

In the United States, we sell our Microcyn®

technology wound care products directly to hospitals, physicians, nurses, and other healthcare practitioners and indirectly through non-exclusive

distribution arrangements. In Europe and the Middle East, we sell our wound care products through a diverse network of distributors.

Microcyn® OTC Wound and Skin Cleanser, our direct to consumer over-the-counter wound care product in the United States, is available

without a prescription through Amazon.com, our online store and third-party distributors.

In June 2023, we announced a new application

of our HOCl technology for intraoperative pulse lavage irrigation treatment, which can replace commonly used IV bags in a variety of surgical

procedures. It is expected to be ready for commercial use in Europe in September 2023, and we anticipate commercial launch in the U.S.

in 2024.

Eye Care

In the United States, we sell Ocucyn® Eyelid

& Eyelash Cleanser directly to consumers on Amazon.com, through our online store, and through third party distributors. Our prescription

product Acuicyn™ is an antimicrobial prescription solution for the treatment of blepharitis and the daily hygiene of eyelids and

lashes and helps manage red, itchy, crusty and inflamed eyes, and is sold by our partner EMC Pharma through its distribution network.

In international markets we rely on distribution

partners to sell our eye products, which are sold under private labels in Italy, Germany, Spain, Portugal, France, the United Kingdom,

and parts of Asia.

Oral, Dental and Nasal Care

We sell oral, dental, and nasal products around

the world, including:

| · | Endocyn®, a biocompatible root canal irrigant

sold through U.S.-based distributors |

| · | Microdacyn60® Oral Care, which treats mouth

and throat infections and thrush |

| · | Sinudox Hypotonic Nasal Hygiene, which clears

and cleans a blocked nose, stuffy nose and sinuses by ancillary ingredients that may have a local antimicrobial effect and is sold through

Amazon in Europe. In other parts of the world, we partner with distributors to sell Sinudox. |

Podiatry

PodiacynTM Advanced Everyday Foot Care

is sold direct to consumers for over-the-counter use in the United States and intended for management of foot odors, infections, and irritations,

as well as daily foot health and hygiene. Podiacyn is available through Amazon.com, our online store and third-party distributors.

Animal Health Care

In the U.S. and Canada, we partner with Manna

Pro Products, LLC to distribute non-prescription MicrocynAH® products to national pet-store retail chains, farm animal specialty stores.

MicrocynAH is intended for the safe and rapid treatment of a variety of animal afflictions including cuts, burns, lacerations, rashes,

hot spots, rain rot, post-surgical sites, pink eye symptoms and wounds to the outer ear of any animal. For the Asian and European markets,

we partner with Petagon, Limited to sell MicrocynAH.

We also sell a line of animal health products

exclusively for veterinarians, MicrocynVS®, intended for the management of wound, skin, ear and eye afflictions in all animal species.

Surface Disinfectants

Nanocyn® Disinfectant & Sanitizer is a

medical-grade surface disinfectant solution used in hospitals worldwide to protect doctors and patients. We sell Nanocyn through our partner

MicroSafe, in Europe, the Middle East and Australia. In April of 2022, MicroSafe secured the EPA approval for Nanocyn® Disinfectant

& Sanitizer to be sold in the United States as a surface disinfectant. Nanocyn is included on the EPA’s lists for use against

COVID-19, Ebola virus, Mpox, SARS-CoV-2, MRSA, Salmonella, Norovirus, Poliovirus, and as a fungicide.

Corporate Information

We were initially incorporated as Micromed Laboratories,

Inc. in 1999 under the laws of the State of California. We changed our name to Oculus Innovative Sciences, Inc. in 2001. In December 2006

we reincorporated under the laws of the State of Delaware, and in December 2016 we changed our name to Sonoma Pharmaceuticals, Inc. Our

principal executive offices are located at 5445 Conestoga Court, Suite 150, Boulder, Colorado 80301. We have two active wholly owned subsidiaries:

Oculus Technologies of Mexico, S.A. de C.V., and Sonoma Pharmaceuticals Netherlands, B.V. Our fiscal year end is March 31. Our corporate

telephone number is (800) 759-9305.

Risk Factors

Investing in our securities involves a high degree

of risk. This prospectus contains a discussion of risks applicable to an investment in the securities offered. Prior to making a decision

about investing in our securities, you should carefully consider the specific factors discussed in the section entitles “Risk Factors” together with all of the other information contained in this prospectus or appearing or incorporated by reference in

this prospectus.

Summary of the Offering

| Issuer |

Sonoma Pharmaceuticals, Inc., a Delaware corporation |

| |

|

| Securities offered |

Common stock, par value $0.0001 per share |

| |

|

| Common stock offered by us |

Up

to 6,666,666 shares of Common Stock |

| |

|

| Common stock outstanding prior to this offering |

5,177,889 shares |

| |

|

| Common stock to be outstanding after this offering |

11,844,555 shares |

| |

|

| Use of proceeds |

We intend to use the net

proceeds from this offering for working capital and general corporate purposes. See “Use

of Proceeds” on page 9 of this

prospectus. |

| |

|

| Risk factors |

Investment in our Common

Stock involves a high degree of risk. See “Risk Factors” on page 5 of this prospectus,

as well as the other information included in or incorporated by reference in this prospectus, for factors to consider before deciding

to purchase our securities. |

| |

|

| Reasonable best efforts |

We have agreed to offer

and sell the Securities offered hereby to the purchasers through the placement agent. The placement agent is not required to buy or

sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit

offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page

9 of this prospectus. |

| |

|

| Nasdaq Capital Market stock symbol |

SNOA |

RISK FACTORS

Investing in the Securities involves a high

degree of risk. Before investing in the Securities, you should carefully consider the risks described below, together with all of the

other information contained in this prospectus or appearing or incorporated by reference in this prospectus. Some of these factors relate

principally to our business and the industry in which we operate. Other factors relate principally to your investment in the Securities.

The risks and uncertainties described therein and below are not the only risks we face, but those that we consider to be material. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also materially and adversely affect our business

and operations. If any of the matters included in the following risks were to occur, our business, financial condition, results of operations,

cash flows or prospects could be materially and adversely affected. In such case, you may lose all or part of your investment. Please

also read carefully the section below entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Common Stock

The market price of the Common Stock may

be volatile, and the value of your investment could decline significantly.

The trading price for the Common Stock has been,

and we expect it to continue to be, volatile. The price at which the Common Stock trades depends upon a number of factors, including our

historical and anticipated operating results, our financial situation, announcements of new products by us or our competitors, our ability

or inability to raise the additional capital we may need and the terms on which we raise it, and general market and economic conditions.

Some of these factors are beyond our control. Broad market fluctuations may lower the market price of the Common Stock and affect the

volume of trading in our stock, regardless of our financial condition, results of operations, business or prospects. It is impossible

to assure you that the market price of our shares of Common Stock will not fall in the future.

Our operating results may fluctuate, which

could cause our stock price to decrease.

Fluctuations in our operating results may lead

to fluctuations, including declines, in our share price. Our operating results and our share price may fluctuate from period to period

due to a variety of factors, including:

| |

· |

demand by physicians, other medical staff and patients for our HOCl-based products; |

| |

· |

reimbursement decisions by third-party payors and announcements of those decisions; |

| |

· |

clinical trial results published by others in our industry and publication of results in peer-reviewed journals or the presentation at medical conferences; |

| |

· |

the inclusion or exclusion of our HOCl-based products in large clinical trials conducted by others; |

| |

· |

actual and anticipated fluctuations in our quarterly financial and operating results; |

| |

· |

developments or disputes concerning our intellectual property or other proprietary rights; |

| |

· |

issues in manufacturing our product candidates or products; |

| |

· |

new or less expensive products and services or new technology introduced or offered by our competitors or by us; |

| |

· |

the development and commercialization of product enhancements; |

| |

· |

changes in the regulatory environment; |

| |

· |

delays in establishing new strategic relationships; |

| |

· |

costs associated with collaborations and new product candidates; |

| |

· |

introduction of technological innovations or new commercial products by us or our competitors; |

| |

· |

litigation or public concern about the safety of our product candidates or products; |

| |

· |

changes in recommendations of securities analysts or lack of analyst coverage; |

| |

· |

failure to meet analyst expectations regarding our operating results; |

| |

· |

additions or departures of key personnel; and |

| |

· |

general market conditions. |

Variations in the timing of our future revenues

and expenses could also cause significant fluctuations in our operating results from period to period and may result in unanticipated

earning shortfalls or losses. In addition, The Nasdaq Capital Market, in general, and the market for life sciences companies, in particular,

have experienced significant price and volume fluctuations that have often been unrelated or disproportionate to the operating performance

of those companies.

Anti-takeover provisions in our certificate

of incorporation and bylaws and under Delaware law may make it more difficult for stockholders to change our management and may also make

a takeover difficult.

Our corporate documents and Delaware law contain

provisions that limit the ability of stockholders to change our management and may also enable our management to resist a takeover. These

provisions include:

| |

· |

the ability of our Board of Directors to issue and designate, without stockholder approval, the rights of up to 714,286 shares of convertible preferred stock, which rights could be senior to those of common stock; |

| |

· |

limitations on persons authorized to call a special meeting of stockholders; and |

| |

· |

advance notice procedures required for stockholders to make nominations of candidates for election as directors or to bring matters before meetings of stockholders. |

We are subject to Section 203 of the Delaware

General Corporation Law, which, subject to certain exceptions, prohibits “business combinations” between a publicly held Delaware

corporation and an “interested stockholder,” which is generally defined as a stockholder who became a beneficial owner of

15% or more of a Delaware corporation’s voting stock for a three-year period following the date that such stockholder became an

interested stockholder.

These provisions might discourage, delay or prevent

a change of control in our management. These provisions could also discourage proxy contests and make it more difficult for you and other

stockholders to elect directors and cause us to take other corporate actions. In addition, the existence of these provisions, together

with Delaware law, might hinder or delay an attempted takeover other than through negotiations with our Board of Directors.

Our stockholders may experience substantial

dilution in the value of their investment if we issue additional shares of our capital stock or other securities convertible into common

stock.

Our Restated Certificate of Incorporation, as

amended, allows us to issue up to 24,000,000 shares of our common stock and to issue and designate, without stockholder approval, the

rights of up to 714,286 shares of preferred stock. In the event we issue additional shares of our capital stock, dilution to our stockholders

could result. In addition, if we issue and designate a class of convertible preferred stock, these securities may provide for rights,

preferences or privileges senior to those of holders of our common stock. Additionally, if we issue preferred stock, it may convert into

common stock at a ratio of 1:1 or greater because our Restated Certificate of Incorporation, as amended, allows us to designate a conversion

ratio without limitations.

Shares issuable upon the conversion of warrants

or preferred stock or the exercise of outstanding options may substantially increase the number of shares available for sale in the public

market and depress the price of our common stock.

As of June 30, 2023, we had outstanding warrants

exercisable for an aggregate of 103,000 shares of our common stock at a weighted average exercise price of approximately $9.32 per share.

We also had units convertible into 46,000 shares of common stock at an exercise price of $11.25 per unit. In addition, as of June 30,

2023, options to purchase an aggregate of 547,000 shares of our common stock were outstanding at a weighted average exercise price of

$11.92 per share and a weighted average contractual term of 1.93 years. In addition, 628,547 shares of our common stock were available

on June 30, 2023 for future option grants under our 2016 Equity Incentive Plan and our 2021 Equity Incentive Plan. To the extent any of

these warrants or options are exercised and any additional options are granted and exercised, there will be further dilution to stockholders

and investors. Until the options and warrants expire, these holders will have an opportunity to profit from any increase in the market

price of our common stock without assuming the risks of ownership. Holders of options and warrants may convert or exercise these securities

at a time when we could obtain additional capital on terms more favorable than those provided by the options or warrants. The exercise

of the options and warrants will dilute the voting interest of the owners of presently outstanding shares by adding a substantial number

of additional shares of our common stock.

We have filed several registration statements

with the SEC, so that substantially all of the shares of our common stock which are issuable upon the exercise of outstanding warrants

and options may be sold in the public market. The sale of our common stock issued or issuable upon the exercise of the warrants and options

described above, or the perception that such sales could occur, may adversely affect the market price of our common stock.

Our failure to maintain compliance with

Nasdaq’s continued listing requirements could result in the delisting of our common stock.

On September 22, 2023, we received a letter

from The Nasdaq Stock Market LLC (“Nasdaq”) indicating that we are not in compliance with Nasdaq Listing Rule 5550(a)(2),

which requires companies listed on The Nasdaq Stock Market to maintain a minimum bid price of $1 per share for continued listing. Nasdaq’s

letter has no immediate impact on the listing of our common stock, which will continue to be listed and traded on Nasdaq, subject to

our compliance with the other continued listing requirements. Nasdaq has granted us a period of 180 calendar days, or until March 20,

2024, to regain compliance with the rule. We may regain compliance at any time during this compliance period if the minimum bid price

for our common stock is at least $1 for a minimum of ten consecutive business days.

Until Nasdaq has reached a final determination

that we have regained compliance with all of the applicable continued listing requirements, there can be no assurances regarding the

continued listing of our common stock or warrants on Nasdaq. The delisting of our common stock and warrants from Nasdaq would have a

material adverse effect on our access to capital markets, and any limitation on market liquidity or reduction in the price of its common

stock as a result of that delisting would adversely affect our ability to raise capital on terms acceptable to the Company, if at all.

Risks Related to this Offering

We will have broad discretion in how we

use the proceeds, and we may use the proceeds in ways in which you and other stockholders may disagree.

We intend to use the net proceeds from this offering

for general corporate purposes, new product launches and working capital. Our management will have broad discretion in the application

of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the

value of our common stock. The failure by management to apply these funds effectively could result in financial losses that could have

a material adverse effect on our business or cause the price of our common stock to decline.

This is a best efforts offering, no minimum amount of Securities

is required to be sold, and we may not raise the amount of capital we believe is required for our business plans.

The placement agent has agreed to use its reasonable

best efforts to solicit offers to purchase the Securities being offered in this offering. The placement agent has no obligation to buy

any of the Securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the Securities. There

is no required minimum number of Securities or amount of proceeds that must be sold as a condition to completion of this offering. Because

there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement agent

fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth above. We may

sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors

in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to fund for our operations

as described in the “Use of Proceeds” section herein. Thus, we may not raise the amount of capital we believe is required

for our operations and may need to raise additional funds, which may not be available or available on terms acceptable to us.

Purchasers in this offering may suffer immediate

and substantial dilution in the net tangible book value per share of our common stock.

Because the price per share of Common Stock in

this offering may be substantially higher than the net tangible book value per share of Common Stock as of June 30, 2023, investors in

this offering may suffer immediate and substantial dilution in the net tangible book value per share of Common Stock. The shares in this

offering will be sold at market prices which may fluctuate substantially. After giving effect to the sale of 6,666,666 shares

of Common Stock at a price of $0.75 per share, and after deducting the placement agent fees and estimated offering expenses payable

by us, you would not experience any immediate dilution. However, if a new investor purchases shares to be sold in this offering at a

per share price above the adjusted net tangible book value per share of our common stock, you could suffer immediate and substantial

dilution. See the section entitled “Dilution” below for a more detailed illustration of the dilution

you would incur if you participate in this offering. In In addition, upon the exercise of any of our outstanding options or warrants,

investors will incur further dilution.

USE OF PROCEEDS

We estimate that the net proceeds to us from

the sale of shares of Common Stock in this offering, after deducting placement agent fees and estimated offering expenses payable by

us, will be approximately $4.45 million, based on a public offering price of $0.75 per share, the closing sale price of our Common

Stock on the Nasdaq Capital Market on October 9, 2023. However, because this is a best efforts offering and there is no minimum

offering amount required as a condition to the closing of this offering, the actual offering amount, the placement agent’s fees

and net proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth on the cover page

of this prospectus.

We intend to use the net proceeds from the sale

of the Securities offered by this prospectus for general corporate purposes. General corporate purposes may include additions to working

capital, research and development, financing of capital expenditures, and future acquisitions and strategic investment opportunities.

PLAN OF DISTRIBUTION

Maxim Group LLC is acting as our exclusive placement

agent to solicit offers to purchase the securities offered by this prospectus. We and the placement agent intend to enter into a placement

agency agreement with respect to the shares of Common Stock being offered hereby. The placement agent is not purchasing or selling any

securities, nor is it required to arrange for the purchase and sale of any specific number or dollar amount of securities, other than

to use its “reasonable best efforts” to arrange for the sale of the securities by us. Therefore, we may not sell the entire

amount of Securities being offered. There is no minimum amount of proceeds that is a condition to closing of this offering. We will enter

into one or more securities purchase agreements directly with the investors, at each investor’s option, who purchase our securities

in this offering. Investors who do not enter into a securities purchase agreement shall rely solely on this prospectus in connection with

the purchase of our securities in this offering. The placement agent may engage one or more subagents or selected dealers in connection

with this offering.

The placement agency agreement will provide that

the placement agent’s obligations are subject to conditions contained in the placement agency agreement and the securities purchase

agreement, as applicable.

We will deliver the shares of Common Stock being

issued to the investors upon receipt of investor funds for the purchase of the shares of Common Stock offered pursuant to this prospectus.

We anticipate that the initial delivery of the shares of Common Stock being offered pursuant to this prospectus on or about ________,

2023.

Placement Agent Fees, Commissions and Expenses

Upon the closing of this offering, we will pay

the placement agent a cash transaction fee equal to 8.0% of the aggregate gross cash proceeds to us from the sale of the Securities in

the offering. Pursuant to the placement agency agreement, we will agree to reimburse the placement agent for its expenses in connection

with the offering payable by us, in an aggregate amount not to exceed $75,000.

The following table shows the public offering

price, placement agent fees and proceeds, before expenses, to us.

| | |

| Per

Share of

Common Stock | | |

| Total | |

| Public offering price | |

$ | | | |

$ | | |

| Placement agent fees (8.0%) | |

$ | | | |

$ | | |

| Proceeds, before expenses, to us | |

$ | | | |

$ | | |

We estimate that the total expenses of the offering,

including registration, filing and listing fees, printing fees and legal and accounting expenses, but excluding the placement agent commission,

will be approximately $_____, all of which are payable by us.

Indemnification

We have agreed to indemnify the placement agent

against certain liabilities, including liabilities under the Securities Act, and liabilities arising from breaches of representations

and warranties contained in the placement agent agreement and to contribute to payments that the placement agent may be required to make

for these liabilities.

Regulation M

The placement agent may be deemed to be an underwriter

within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale

of the securities sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities

Act. As an underwriter, the placement agent would be required to comply with the requirements of the Securities Act and the Exchange Act,

including, without limitation, Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of

purchases and sales of our securities by the placement agent acting as principal. Under these rules and regulations, the placement agent

(i) may not engage in any stabilization activity in connection with our securities and (ii) may not bid for or purchase any of our securities

or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed

its participation in the distribution.

Determination of Offering Price

The actual public offering price of the shares

of Common Stock we are offering will be determined by negotiations between us, the placement agent and the investors in the offering;

among the factors considered in determining such public offering price are our historical performance and capital structure, prevailing

market conditions, and overall assessment of our business.

Electronic Distribution

A prospectus in electronic format may be made

available on a website maintained by the placement agent. In connection with the offering, the placement agent or selected dealers may

distribute prospectuses electronically. No forms of electronic prospectus other than prospectuses that are printable as Adobe®

PDF will be used in connection with this offering.

Other than the prospectus in electronic format,

the information on the placement agent’s website and any information contained in any other website maintained by the placement

agent is not part of the prospectus or the registration statement of which this prospectus forms a part, has not been approved and/or

endorsed by us or the placement agent in its capacity as placement agent and should not be relied upon by investors.

Lock-Up Agreements and Trading Restrictions

We have agreed, subject to certain exceptions,

not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any shares of our common

stock or other securities convertible into or exercisable or exchangeable for our common stock for a period of six (6) months after this

offering is completed without the prior written consent of the placement agent.

The placement agent may in its sole discretion

and at any time without notice release some or all of the shares subject to lock-up agreements prior to the expiration of the lock-up

period.

Lock-Up Agreements

Our directors and officers have entered into lock-up

agreements. Under these agreements, these individuals agreed, subject to specified exceptions, not to sell or transfer any shares of common

stock or securities convertible into, or exchangeable or exercisable for, common stock during a period ending six (6) months after

the completion of this offering, without first obtaining the written consent of the placement agent. Specifically, these individuals agreed,

in part, subject to certain exceptions, not to:

| |

· |

offer for sale, sell, pledge, or otherwise transfer or dispose of (or enter into any transaction or device that is designed to, or could be expected to, result in the transfer or disposition by any person at any time in the future of) any shares of common stock or securities convertible into or exercisable or exchangeable for common stock; |

| |

|

|

| |

· |

enter into any swap or other derivatives transaction that transfers to another, in whole or in part, any of the economic benefits or risks of ownership of shares of common stock; or |

| |

|

|

| |

· |

make any demand for or exercise any right or cause to be filed a registration statement, including any amendments thereto, with respect to the registration of any of our securities. |

Listing

Our Common Stock is listed on the Nasdaq Stock

Market under the symbol “SNOA”.

Other Relationships

The placement agent and its affiliates have engaged

in, and may in the future engage in, investment banking and other commercial dealings in the ordinary course of business with us or our

affiliates. They have received, or may in the future receive, customary fees and commissions for these transactions. In the course of

its businesses, the placement agent and its affiliates may actively trade our securities or loans for its own account or for the accounts

of customers, and, accordingly, the placement agent and its affiliates may at any time hold long or short positions in such securities

or loans.

Except for services provided in connection with

this offering, and except as set forth in this section, the placement agent has not provided any investment banking or other financial

services during the 180-day period preceding the date of this prospectus and we do not expect to retain the placement agent to perform

any investment banking or other financial services for at least 90 days after the date of this prospectus.

Right of First Refusal

For a period of five (5) months from the Closing

of this Offering, we granted the placement agent the right of first refusal to act as sole managing underwriter and sole book runner,

sole placement agent, or sole sales agent, for any and all future public or private equity, equity-linked or debt (excluding commercial

bank debt and loans against tax credits) offerings for which we retain the service of an underwriter, agent, advisor, finder or other

person or entity in connection with such offering during such five (5) month period.

Other Compensation

We have agreed to the same compensation arrangement

as set forth above, for equity, equity-linked, or debt financing or other capital-raising activity (“Tail Financing”) to

the extent that such financing or capital is provided to us by investors whom the placement agent had contacted, or introduced to us,

during the term of the engagement agreement with the placement agent, if such Tail Financing is consummated at any time within the twelve

(12) month period following the closing of this offering or expiration or termination such placement agency agreement with the placement

agent (other than termination for Cause, as defined in the placement agency agreement).

Selling Restrictions

Notice to Investors in Canada

The securities may be sold in Canada only to purchasers

purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus

Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103

Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the securities must be made in accordance with

an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or

territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus supplement (including any amendment

thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the

time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser should refer to any

applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or

consult with a legal advisor.

Pursuant to section 3A.3 of National Instrument

33-105 Underwriting Conflicts (“NI 33-105”), the placement agent is not required to comply with the disclosure requirements

of NI 33-105 regarding underwriters conflicts of interest in connection with this offering.

Notice to Investors in the United Kingdom

In relation to each Member State of the European

Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”) an offer to the public of any

securities which are the subject of the offering contemplated by this prospectus may not be made in that Relevant Member State except

that an offer to the public in that Relevant Member State of any such securities may be made at any time under the following exemptions

under the Prospectus Directive, if they have been implemented in that Relevant Member State:

| |

(a) |

to legal entities which are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose corporate purpose is solely to invest in securities; |

| |

(b) |

to any legal entity which has two or more of (1) an average of at least 250 employees during the last financial year; (2) a total balance sheet of more than €43,000,000 and (3) an annual net turnover of more than €50,000,000, as shown in its last annual or consolidated accounts; |

| |

(c) |

by the underwriter to fewer than 100 natural or legal persons (other than qualified investors as defined in the Prospectus Directive); or |

| |

(d) |

in any other circumstances falling within Article 3(2) of the Prospectus Directive, provided that no such offer of these securities shall result in a requirement for the publication by the issuer or the underwriter of a prospectus pursuant to Article 3 of the Prospectus Directive. |

For the purposes of this provision, the expression

an “offer to the public” in relation to any of the securities in any Relevant Member State means the communication in any

form and by any means of sufficient information on the terms of the offer and any such securities to be offered so as to enable an investor

to decide to purchase any such securities, as the same may be varied in that Member State by any measure implementing the Prospectus Directive

in that Member State and the expression” Prospectus Directive” means Directive 2003/71/EC and includes any relevant implementing

measure in each Relevant Member State.

The placement agent has represented, warranted

and agreed that:

| |

(a) |

it has only communicated or caused to be communicated and will only communicate or cause to be communicated any invitation or inducement to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets Act 2000 (the “FSMA”)) received by it in connection with the issue or sale of any of the securities in circumstances in which section 21(1) of the FSMA does not apply to the issuer; and |

| |

(b) |

it has complied with and will comply with all

applicable provisions of the FSMA with respect to anything done by it in relation to the securities in, from or otherwise involving the

United Kingdom.

|

Notice to Investors in the European Economic

Area

In particular, this document does not constitute

an approved prospectus in accordance with European Commission’s Regulation on Prospectuses no. 809/2004 and no such prospectus is

to be prepared and approved in connection with this offering. Accordingly, in relation to each Member State of the European Economic Area

which has implemented the Prospectus Directive (being the Directive of the European Parliament and of the Council 2003/71/EC and including

any relevant implementing measure in each Relevant Member State) (each, a Relevant Member State), with effect from and including the date

on which the Prospectus Directive is implemented in that Relevant Member State (the Relevant Implementation Date) an offer of securities

to the public may not be made in that Relevant Member State prior to the publication of a prospectus in relation to such securities which

has been approved by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member

State and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Directive, except that

it may, with effect from and including the Relevant Implementation Date, make an offer of securities to the public in that Relevant Member

State at any time:

| |

· |

|

to legal entities which are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose corporate purpose is solely to invest in securities; |

| |

· |

|

to any legal entity which has two or more of (1) an average of at least 250 employees during the last financial year; (2) a total balance sheet of more than €43,000,000; and (3) an annual net turnover of more than €50,000,000, as shown in the last annual or consolidated accounts; or |

| |

· |

|

in any other circumstances which do not require the publication by the Issuer of a prospectus pursuant to Article 3 of the Prospectus Directive. |

For the purposes of this provision, the expression

an “offer of securities to the public” in relation to any of the securities in any Relevant Member State means the communication

in any form and by any means of sufficient information on the terms of the offer and the securities to be offered so as to enable an investor

to decide to purchase or subscribe for the securities, as the same may be varied in that Member State by any measure implementing the

Prospectus Directive in that Member State. For these purposes the shares offered hereby are “securities.”

Notice to Investors in Israel

This document does not constitute a prospectus

under the Israeli Securities Law, 5728-1968, or the Securities Law, and has not been filed with or approved by the Israel Securities

Authority. In the State of Israel, this document is being distributed only to, and is directed only at, and any offer of the shares

is directed only at, investors listed in the first addendum (as it may be amended from time to time, the “Addendum”) to the

Israeli Securities Law, consisting primarily of joint investment in trust funds, provident funds, insurance companies, banks, portfolio

managers, investment advisors, members of the Tel Aviv Stock Exchange, underwriters, venture capital funds, entities with equity in excess

of NIS 50 million and “qualified individuals”, each as defined in the Addendum, collectively referred to as qualified

investors (in each case purchasing for their own account or, where permitted under the Addendum, for the accounts of their clients who

are investors listed in the Addendum). Qualified investors will be required to submit written confirmation that they fall within the scope

of the Addendum, are aware of the meaning of same and agree to it.

Notice to Investors in Switzerland

The securities may not be publicly offered in

Switzerland and will not be listed on the SIX Swiss Exchange (the “SIX”) or on any other stock exchange or regulated

trading facility in Switzerland. This document has been prepared without regard to the disclosure standards for issuance prospectuses

under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of

the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this document

nor any other offering or marketing material relating to the securities or the offering may be publicly distributed or otherwise made

publicly available in Switzerland.

Neither this document nor any other offering or

marketing material relating to the offering, or the securities have been or will be filed with or approved by any Swiss regulatory authority.

In particular, this document will not be filed with, and the offer of securities will not be supervised by, the Swiss Financial Market

Supervisory Authority FINMA, and the offer of securities has not been and will not be authorized under the Swiss Federal Act on Collective

Investment Schemes (“CISA”). Accordingly, no public distribution, offering or advertising, as defined in CISA, its implementing

ordinances and notices, and no distribution to any non-qualified investor, as defined in CISA, its implementing ordinances and notices,

shall be undertaken in or from Switzerland, and the investor protection afforded to acquirers of interests in collective investment schemes

under CISA does not extend to acquirers of securities.

Notice to Investors in Australia

No placement document, prospectus, product disclosure

statement or other disclosure document has been lodged with the Australian Securities and Investments Commission, in relation to the offering.

This prospectus does not constitute a prospectus,

product disclosure statement or other disclosure document under the Corporations Act 2001 (the “Corporations Act”) and

does not purport to include the information required for a prospectus, product disclosure statement or other disclosure document under

the Corporations Act.

Any offer in Australia of the securities may only

be made to persons (the Exempt Investors) who are “sophisticated investors” (within the meaning of section 708(8)

of the Corporations Act), “professional investors” (within the meaning of section 708(11) of the Corporations Act) or otherwise

pursuant to one or more exemptions contained in section 708 of the Corporations Act so that it is lawful to offer the securities without

disclosure to investors under Chapter 6D of the Corporations Act.

The securities applied for by Exempt Investors

in Australia must not be offered for sale in Australia in the period of 12 months after the date of allotment under the offering, except

in circumstances where disclosure to investors under Chapter 6D of the Corporations Act would not be required pursuant to an exemption

under section 708 of the Corporations Act or otherwise or where the offer is pursuant to a disclosure document which complies with Chapter

6D of the Corporations Act. Any person acquiring securities must observe such Australian on-sale restrictions.

This prospectus contains general information only

and does not take account of the investment objectives, financial situation or particular needs of any particular person. It does not

contain any securities recommendations or financial product advice. Before making an investment decision, investors need to consider whether

the information in this prospectus is appropriate to their needs, objectives and circumstances, and, if necessary, seek expert advice

on those matters.

Notice to Investors in the Cayman Islands

No invitation, whether directly or indirectly,

may be made to the public in the Cayman Islands to subscribe for our securities.

Notice to Investors in the People’s Republic

of China

This prospectus may not be circulated or distributed

in the PRC and the shares may not be offered or sold, and will not offer or sell to any person for re-offering or resale directly or indirectly

to any resident of the PRC except pursuant to applicable laws, rules and regulations of the PRC. For the purpose of this paragraph only,

the PRC does not include Taiwan and the special administrative regions of Hong Kong and Macau.

Notice to Investors in Taiwan

The securities have not been and will not be registered

with the Financial Supervisory Commission of Taiwan (“FSCT”) pursuant to relevant securities laws and regulations and may

not be sold, issued or offered within Taiwan through a public offering or in circumstances which constitutes an offer within the meaning

of the Securities and Exchange Act of Taiwan that requires a registration or approval of the FSCT. No person or entity in Taiwan

has been authorized to offer, sell, give advice regarding or otherwise intermediate the offering and sale of the securities in Taiwan.

Notice to Investors in Hong Kong

The contents of this prospectus have not been

reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt

about any of the contents of this prospectus, you should obtain independent professional advice. Please note that (i) our shares

may not be offered or sold in Hong Kong, by means of this prospectus or any document other than to “professional investors”

within the meaning of Part I of Schedule 1 of the Securities and Futures Ordinance (Cap.571, Laws of Hong Kong) (the “SFO”)

and any rules made thereunder, or in other circumstances which do not result in the document being a “prospectus” within

the meaning of the Companies Ordinance (Cap.32, Laws of Hong Kong) (the “CO”) or which do not constitute an offer or invitation

to the public for the purpose of the CO or the SFO, and (ii) no advertisement, invitation or document relating to our shares may

be issued or may be in the possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere) which is

directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under

the securities laws of Hong Kong) other than with respect to the shares which are or are intended to be disposed of only to persons outside

Hong Kong or only to “professional investors” within the meaning of the SFO and any rules made thereunder.

MARKET PRICE AND DIVIDEND POLICY

Our shares of Common Stock are currently quoted

on The Nasdaq Capital Market under the symbol “SNOA”. On October 9, 2023, the last reported sales price of our Common Stock

on Nasdaq was $0.75.

Holders of Record

As of October 6, 2023, we had approximately

294 holders of record of our Common Stock. Because many of our shares of Common Stock are held by brokers and other institutions on behalf

of stockholders, this number is not indicative of the total number of stockholders represented by these stockholders of record.

Dividends

We have not declared or paid dividends to stockholders

since inception and do not plan to pay cash dividends in the foreseeable future. We currently intend to retain earnings, if any, to finance

our growth.

Issuer Purchases of Equity Securities

None.

DILUTION

Purchasers of Common Stock offered by this prospectus

will suffer immediate and substantial dilution in the net tangible book value per share of Common Stock. Our net tangible book value on

June 30, 2023 was approximately $7,242,000, or approximately $1.41 per share of Common Stock based upon 5,141,596 shares outstanding as

of June 30, 2023. Net tangible book value per share is determined by dividing our net tangible book value, which consists of tangible

assets less total liabilities, by the number of shares of Common Stock outstanding on that date.

The shares of Common Stock in this offering

will be sold at market prices which may fluctuate substantially. For purposes of calculating dilution, we have assumed a sale price of

$0.75 per share, which was the closing price of our Common Stock on October 9, 2023.

After giving effect to the sale of our Common

Stock in the aggregate amount of $5,000,000, or 6,666,666 shares, at an assumed offering price of $0.75 per share, and after deducting

placement agent and offering expenses payable by us, our net tangible book value as of June 30, 2023 would have been approximately $11,692,000

or $0.99 per share of Common Stock. This represents an immediate decrease in net tangible book value of $0.42 per share to existing stockholders

and immediate increase in net tangible book value of $0.24 per share to new investors purchasing our Common Stock in this offering at

the public offering price. The following table illustrates this calculation on a per share basis:

| Assumed public offering price

per share |

|

$ |

0.75 |

|

| Net tangible book value per share as of June 30,

2023 |

|

$ |

1.41 |

|

| Decrease in net tangible book value per share attributable

to this offering |

|

$ |

(0.42 |

) |

| |

|

|

|

|

| As adjusted net tangible book value per share as

of June 30, 2023, after giving effect to this offering |

|

$ |

0.99 |

|

| |

|

|

|

|

| Increase in net tangible book value per share to

new investors purchasing our common stock in this offering |

|

$ |

0.24 |

|

An increase of $0.10 per share in the price

at which the shares are sold from the assumed public offering price of $0.75 per share shown in the table above would decrease our as

adjusted net tangible book value per share after the offering to $1.03 per share and result in an increase in net tangible book value

per share to new investors in this offering of $0.20 per share, after deducting placement agent fees and estimated offering expenses

payable by us.

A decrease of $0.10 per share in the price

at which the shares are sold from the assumed public offering price of $0.75 per share shown in the table above would decrease our adjusted

net tangible book value per share after the offering to $0.95 per share and result in an increase in net tangible book value per share

to new investors in this offering of $0.27 per share, after deducting placement agent fees and estimated offering expenses payable by

us.

This information is supplied for illustrative

purposes only and may differ based on the actual offering price and the actual number of shares offered.

The above discussion is based on 5,141,596 shares

of our common stock outstanding as of June 30, 2023, and excludes:

| |

· |

547,000 shares of common stock issuable upon exercise of outstanding stock options, at a weighted average exercise price of $11.92 per share, under our equity incentive plans; |

| |

|

|

| |

· |

31,000 shares of common stock issuable upon exercise/vesting of restricted stock units; |

| |

|

|

| |

· |

628,547 additional shares of common stock reserved for future issuance under our equity incentive plans; |

| |

|

|

| |

· |