false

0001589061

0001589061

2023-10-12

2023-10-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 12, 2023

GYRODYNE, LLC

(Exact name of Registrant as Specified in its Charter)

|

New York

|

001-37547

|

46-3838291

|

|

(State or other jurisdiction

|

(Commission File

|

(I.R.S. Employer

|

|

of incorporation)

|

Number)

|

Identification No.)

|

One Flowerfield

Suite 24

St. James, New York 11780

(Address of principal executive

offices) (Zip Code)

(631) 584-5400

Registrant’s telephone number,

including area code

N/A

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares of Limited

Liability Company Interests

|

GYRO

|

Nasdaq Capital Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

Gary Fitlin, President, Chief Executive Officer, Chief Financial Officer and Treasurer of Gyrodyne, LLC (the “Company”), presented remarks at the Company’s 2023 Annual Shareholders Meeting held on October 12, 2023 (the “2023 Annual Meeting”). The text of Mr. Fitlin’s remarks is attached hereto as Exhibit 99.1, which is incorporated herein by reference.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934.

Item 9.01. Exhibits

(d) Exhibit:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date:

|

October 12, 2023

|

By:

|

GYRODYNE, LLC

/s/ Gary Fitlin

|

| |

|

Name:

|

Gary Fitlin

|

| |

|

Title:

|

President, Chief Executive Officer, Chief Financial Officer and Treasurer

|

Exhibit 99.1

President, CEO, CFO and Treasurer Remarks

Thank you very much Paul.

Thank you everyone for joining us today.

Our goal remains completing the entitlement process, selling our properties, and making liquidating distributions as soon as possible.

Last year, the shareholders spoke, and we responded. After receiving a disappointing vote last year on our slate of directors and executive pay, we conducted a formal shareholder outreach campaign consisting of one-on-one meetings with shareholders owning over 60% of our shares in the aggregate. Based on feedback we received, we made changes to our bonus plan to create better alignment with shareholders and moved our directors out of the bonus plan and into the new stock plan that you, our shareholders, are voting on today. We are grateful for the shareholder feedback and look forward to continued engagement.

Our estimated NAV and timeline to complete our liquidation continues to be severely impacted by escalating interest rates, the slow pace of government approvals and the Article 78 proceeding. If that wasn’t enough, 2023 began with two regional bank failures the fallout of which continues to be felt through tighter credit standards and a significant reduction in real estate transactions. These factors have resulted in developers deferring investments on projects other than those that are shovel ready or already under contract and pose significant risks to both the current real estate value of our properties, the timeline for the completion of their sales and the liquidation of the Company.

Before going further, I sincerely want to thank our team of employees, directors and advisors for their relentless focus on the mission of maximizing future distributions to our shareholders while simultaneously deferring much of their respective director fees and advisory fees. I recognize in particular the contributions of Phil Palmedo, who retired from our Board earlier this year after 27 years of extraordinary and dedicated service to the Company to facilitate in part, at considerable personal expense to himself, the implementation of the proposed Restricted Stock Plan. I also want to welcome Jan Loeb to our Board. He brings a level of experience and knowledge that will be of great benefit to the liquidation of the Company.

What has happened since our last Annual Meeting?

During late 2022, we amended our application to reflect a larger medical use footprint in lieu of the residential component when it became abundantly clear that the Town of Cortlandt had changed course and was unlikely to support a multi-family residential component on our property thus delaying the Medical Office District approval. This was both a surprise and a disappointment as we had been led to believe that the Town fully supported our mixed-use plan which provided the maximum post entitled values to the Company. In March 2023, the Cortlandt Town Board adopted a Medical Oriented District with our property receiving the medical oriented district designation from the Town Board and entitlements for up to 150,000 square feet of medical office and 4,000 square feet of retail use. The property is now positioned for sale at post entitled values. Based on the approvals which are now finalized, we believe the Town will allow a buyer to pursue site plan approval without further delays. The extent of the value ultimately achievable will probably be contingent, to a certain extent, on the associated demand stemming from our neighbor in Cortlandt, the New York Presbyterian Hudson Valley Medical Center, and the anticipated costs of construction and the interest rates.

Moving on to Smithtown

On March 30, 2022, the Smithtown Planning Board voted unanimously to adopt the Findings Statement and granted preliminary approval of our subdivision application. We are now pursuing final technical approvals which we anticipate will be received in late 2023 or early 2024.

On April 26, 2022, certain parties commenced an Article 78 proceeding seeking to annul the Planning Board’s findings statement and preliminary approval of the subdivision plan. Gyrodyne and the Town of Smithtown then filed motions to dismiss in June 2022. Earlier this year, the judge overseeing the Article 78 proceeding retired and the case was reassigned to a new judge. The case was recently reassigned again to another new judge. Our motion to dismiss the case made in June of 2022 has yet to be decided. The Article 78 proceeding when finally heard, and if appealed could take years to run its course. Nevertheless, the Company remains focused on securing final subdivision approval and consummating the sale of the Flowerfield property by year-end 2024.

We are fortunate to have Joe Clasen of Robinson & Cole and Tim Shea of Certilman Balin helping us to protect entitlements granted by the Town of Smithtown. Mr. Clasen is no stranger to Gyrodyne; he was the attorney who won a $167.5 million condemnation award for our predecessor Gyrodyne Company of America on top of the original payment from the State of NY of $26,315,000.

…which is a good segue to our operations and financial update.

We continue to believe that our policy of upgrading our tenant base will help mitigate the current challenges and increase liquidating proceeds to our shareholders. The investments we made over the last few years have resulted in approximately 60% of our projected 2023 leasing revenue coming from leases with New York State, Stony Brook University Hospital and its affiliates, and New York Presbyterian Hudson Valley Medical Center, along with various health care providers. The revenue and collections under those leases continue uninterrupted. The balance of our annual leasing revenue comes from small businesses and well-respected community not-for-profit corporations. Net Operating Income for Flowerfield and Cortlandt Manor for 2022 was $957,625 and $371,929, respectively, an increase of 34% and 11%, respectively, over 2021, despite the degradation in the office market which we expect to continue through the liquidation period. Our costs in excess of operating receipts in 2022 of $1.4 million, excluding land development, despite the high inflation rates and higher average outstanding credit, remained flat with 2021. For the first six months of 2023, our costs in excess of operating receipts were approximately $917,000, of which $490,000 is directly attributable to the shareholder activist campaign waged by Star Equity, which we thankfully settled on September 5 through a cooperation agreement.

Through June 30, 2023, the cumulative cost of the activist campaign and associated changes to resolve it was approximately $600,000 and through settlement date may reach approximately $1 million. We are working with insurance coverage counsel to pursue coverage for amounts in excess of the $500,000 insurance deductible under our D&O insurance policy. Approximately $409,000 of the legal fees associated with the proxy contest have been deferred. Offsetting these costs is an estimated $1.1 million to $1.7 million stemming from “ALL” participants agreeing to changes in the bonus plan with the higher amount contingent on the shareholders approving the stock plan today. Under the recent amendment to the Plan, benefits forfeited by two retired directors in the estimated amount of $1,137,108 have been removed from the pool and returned to the Company. Further, the director participants in the Bonus Plan agreed that, prior to the exchange by them of Bonus Plan benefits for shares under the Stock Plan, their estimated Bonus Plan benefits will be reduced by $579,328 from $2,558,493 to $1,979,165, a 22.6% reduction in benefits, contingent on the Stock Plan being approved by the shareholders today.

Let’s move on to the current estimate of the Company’s NAV.

Our second quarter 10-Q reflects an estimated liquidating value of $20.14 per share, a $4.61 per share increase from $15.53 per share reported for the year ended December 31, 2021. The major factor behind the increase was the increase in real estate value of $11,143,500, partially offset by an increase in the estimated costs to complete the liquidation of $4.3 million (net of receipts). The increase in costs is largely comprised of the associated selling costs which are mostly based on the value of the real estate, the estimated litigation costs to defend our entitlements under the Article 78 proceeding and the costs through June 30th, 2023, stemming from the threatened proxy contest. Prior to 2022, we anticipated the need for capital through 2024 and locked into three term loans at fixed rates ranging from 3.75% to 3.85% with maturity dates in 2027 and 2028. As a result of those steps, Gyrodyne’s debt service has been unaffected by the Federal Reserve Interest Rate increases over the last two years. The total principal of the loans outstanding on June 30, 2023 was $9.6 million. The annual debt service is approximately $650,000.

To fortify our cash position to ensure we are operating and selling properties from a position of strength through the duration of the liquidation and thus able to negotiate and enforce purchase agreements and defend our property rights in the Article 78 proceeding, the Company will soon be seeking supplemental funding which we intend to finalize before year-end.

Let us now discuss our sales and marketing efforts.

Our entitlement applications continue to generate interest among potential buyers, despite the Article 78 Proceeding, the interruptions from variants of Covid-19, inflation, and escalating interest rates, and the banking crisis in the first quarter of 2023. We will of course make prompt public disclosure of any definitive agreements we may reach. In summary, although there can’t be assurances and the process is largely in the hands of local officials over whom we have no control, we anticipate the receipt of final entitlements on Flowerfield in late 2023 or early 2024 and the resolution of the Article 78 proceeding no later than the second half of 2024, at the trial court level. We are pursuing our marketing efforts on both Flowerfield and Cortlandt Manor to ensure we enter into sales agreements at post entitled values. As you digest the financial information presented, please remember that the real estate values previously discussed largely reflect the values prior to escalating interest rates and continued inflation. The ultimate value realized is therefore largely dependent on the success of the post pandemic economic recovery, the control of inflation, the stabilization of interest rates, and the speed at which the courts operate and the municipalities act.

Finally, while we still believe final entitlements and subsequent sales of individual properties will maximize distributions to shareholders, we remain open to offers for the properties as is and where is and or for sale of the Company itself.

I thank you very much for your anticipated continuing support.

v3.23.3

Document And Entity Information

|

Oct. 12, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

GYRODYNE, LLC

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 12, 2023

|

| Entity, Incorporation, State or Country Code |

NY

|

| Entity, File Number |

001-37547

|

| Entity, Tax Identification Number |

46-3838291

|

| Entity, Address, Address Line One |

One Flowerfield

|

| Entity, Address, Address Line Two |

Suite 24

|

| Entity, Address, City or Town |

St. James

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

11780

|

| City Area Code |

631

|

| Local Phone Number |

584-5400

|

| Title of 12(b) Security |

Common Shares

|

| Trading Symbol |

GYRO

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001589061

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

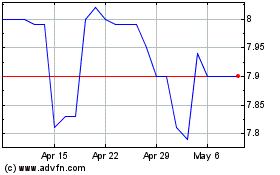

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Apr 2023 to Apr 2024