US index futures are trading higher in Wednesday’s pre-market,

reflecting a perceived easing of concerns about interest rates

following comments from Federal Reserve members the previous day,

as well as substantial stimulus measures announced by China.

Investors are keeping an eye on the release of the Federal Open

Market Committee minutes and developments in the Israel

conflict.

At 06:50 AM, Dow Jones (DOWI:DJI) futures rose 73 points or

0.22%. S&P 500 futures gained 0.23%, and Nasdaq-100 futures

climbed 0.32%. The yield on 10-year Treasury bonds was at

4.558%.

In the commodities market, November West Texas Intermediate

crude oil fell 0.35% to $85.67 per barrel. Brent crude oil for

December dropped 0.26% to near $87.42 per barrel. Iron ore with 62%

concentration traded on the Dalian Exchange rose 1.04% to $113.29

per ton.

On Wednesday’s economic agenda, investors are awaiting the

weekly mortgage rate at 7:00 AM, while the September Producer Price

Index (PPI) is scheduled for release at 8:30 AM, with an expected

monthly increase of 0.30%. Like in previous days, speeches by Fed

members are planned. At 10:15 AM, Fed Governor Christopher Waller

will speak, and Raphael Bostic, President of the Atlanta Fed, will

address at 12:15 PM. At 1:00 PM, another U.S. Treasury auction is

scheduled. Yesterday, the government placed $46 billion in the

three-year Treasury auction at a stop-out yield of 4.740%.

At 2:00 PM, the minutes of the latest Federal Open Market

Committee (FOMC) meeting from September, in which the central bank

kept the interest rate in the range of 5.25% to 5.50%, will be

released. Despite the pause in the monetary tightening cycle, the

Fed’s decision significantly impacted the markets due to its

tougher stance on inflation. Finally, at 4:00 PM, the American

Petroleum Institute (API) will release the weekly crude oil

inventory report.

In Asia, markets closed higher, driven by news that the Chinese

government is considering issuing at least $137 billion in

additional sovereign debt to fund infrastructure projects as part

of its efforts to achieve 5% growth this year. Evergrande, which

had been a major source of uncertainty for investors, saw a strong

afternoon surge in Hong Kong, closing the session with a gain of

more than 22%. Other real estate companies also recorded

significant gains on the day.

Although the conflict between the Hamas terrorist group and

Israel has not had a significant impact on the markets, investors

continue to monitor it closely. Some analysts suggest that markets

may be underestimating the risks of this conflict, as geopolitical

escalation could have significant effects on the commodities

market, particularly oil. This has led Brent crude oil prices to

fluctuate in recent days due to concerns about the global oil

supply imbalance.

In the European market, which started the day on a positive

note, the highlight is the final reading of inflation in Germany,

which rose by 0.3% in September, exceeding consensus expectations

of a similar magnitude increase. These data indicate the resilience

of the largest economy in Europe, suggesting that restrictive

measures are having an effect, with inflation remaining in line

with projections for the second consecutive month.

At Tuesday’s close, the Dow Jones closed up 134.65 points or

0.40% at 33,739.30 points. The S&P 500 rose 22.58 points

or 0.52% to 4,358.24, and the Nasdaq Composite advanced 78.60

points or 0.58% to 13,562.84. As Federal Reserve officials

hinted at the possibility of halting interest rate hikes, markets

reacted positively, with stocks rising and Treasury yields

falling. Shares of US-listed Chinese companies also posted

gains following news about a possible economic stimulus in

China. Treasury yields fell more than 10 basis points during

the session, reflecting a greater than 60% probability that the Fed

will not make further rate hikes in December. Dollar continued to

weaken. At the same time, geopolitical concerns persisted due to

the conflict between Israel and Hamas, which affected natural gas

prices in Europe due to suspicions of sabotage in the Baltic Sea

pipelines.

Ahead of Wednesday’s corporate earnings, investors will be

watching the report from Richardson Electronics (NASDAQ:RELL).

Wall Street Corporate Highlights for Today

Alphabet (NASDAQ:GOOGL) – Sundar Pichai, CEO of

Google, expressed concerns in 2007 about the Google-Apple

agreement, stating that it was bad in terms of optics as it did not

allow choosing a search engine in the Safari browser. This came to

light during the Department of Justice’s antitrust lawsuit against

Google. The emails reveal worries about Google paying Apple

(NASDAQ:AAPL) to be the default search option, raising questions

about competition. In other news, Google and its subsidiary Discord

maintained an exclusive forum to discuss the AI-based chatbot,

Bard, for months. Google employees debate the tool’s effectiveness

and question whether the massive investment in development is worth

it. Despite ongoing improvements, Bard faces criticism for

generating inaccurate information and potentially hazardous advice.

Concerns have also arisen about the working conditions of service

providers training Bard. For now, Google continues to enhance its

chatbot as it seeks to maintain its leadership in the search

market.

AMD (NASDAQ:AMD) – AMD announced plans to

acquire artificial intelligence startup, Nod.ai, as part of its

strategy to strengthen its software capabilities. AMD seeks to

compete with Nvidia (NASDAQ:NVDA) by

investing in essential software for its AI chips. The company

aims to create a unified collection of software for its various

chips, including the integration of technology from Nod.ai, which

makes it easier to deploy AI models tailored to its

chips. Financial details of the acquisition were not

disclosed, and AMD continues to expand its team of engineers in its

AI group. This is the second recent acquisition by AMD, which

maintains its focus on strengthening its portfolio.

Adobe (NASDAQ:ADBE) – Adobe has launched

new imaging technology, including the “Generative Match” feature,

to compete with companies like Midjourney and Stable

Diffusion. This allows users to create images from text and

upload multiple images as a base. Adobe emphasized the legal

protection of generated images and revealed that its customers have

already created three billion images. Additionally, it

introduced tools for vector graphics and templates for

brochures. Prices will remain unchanged following previous

increases in September.

HP Inc. (NYSE:HPQ) – HP Inc. forecast

fiscal 2024 earnings in line with estimates, increasing its annual

dividend by 5% to $1.10 per share due to stabilizing demand for

PCs. Future Ready plan aims to strengthen the core business, expand

services and improve structural costs.

Micron

Technology (NASDAQ:MU), Intel (NASDAQ:INTC)

– Samsung Electronics (USOTC:SSNLF)

reported a quarterly drop in profits, but less sharp than in

previous quarters, possibly signaling a positive outlook for North

American companies like Micron Technology and Intel. Samsung’s

recovery, particularly in chip production, could benefit Micron,

while Intel expects a broader recovery in demand for chips in PCs

and smartphones. Samsung’s results suggest a possible

stabilization in the consumer electronics market, boosting investor

confidence.

Cisco Systems (NASDAQ:CSCO) – Cisco

Systems has named

former PayPal (NASDAQ:PYPL) CEO Dan

Schulman to its board of directors. Schulman is also a member

of other boards, including PayPal, Verizon

Communications (NYSE:VZ) and Cleveland

Clinic. Additionally, Michele Burns, Rod McGeary and Lisa Su,

CEO of Advanced Micro

Devices (NASDAQ:AMD), announced that they will not

seek re-election at Cisco’s 2023 annual meeting.

MGM Resorts (NYSE:MGM) – MGM Resorts

International CEO Bill Hornbuckle chose not to give in to the

ransom demand of hackers who broke into the company’s casino

network. The attack had been underway for several days before

MGM received the ransom note. The company was able to rebuild

its systems and saw no need to respond to the hackers.

Vodafone Group (NASDAQ:VOD) – The UK

Competition and Markets Authority is asking for market feedback on

the potential merger between the UK units of Vodafone and

CK Hutchison

Holdings (TG:A2R88B). The assessment seeks to

determine the impact on competition and investment incentives on

the quality of mobile networks in the country. The proposed

merger to acquire Three UK faces regulatory scrutiny given the

recent strict stance of antitrust authorities in the UK. The

government is also examining security implications, as the

agreement may involve sensitive technologies.

Walt

Disney (NYSE:DIS), Blackstone (NYSE:BX)

– Private equity firm Blackstone has discussed with Walt Disney

about acquiring a stake in its Indian entertainment

division. Disney is seeking partnerships or asset sales in a

competitive Indian market, including digital and TV

businesses. Candle Media, backed by Blackstone and founded by

former Disney executives, led the talks. Other negotiations

include talks with Indian billionaires Gautam Adani and Kalanithi

Maran.

Amazon (NASDAQ:AMZN), Walmart (NYSE:WMT), Target (NYSE:TGT)

– Amazon, Walmart, Target and other major US retailers began

discount sales in October in anticipation of Black Friday, one of

the biggest shopping days. Total sales between November and

January are expected to grow 3.5% to 4.6%, reaching up to $1.56

trillion, according to Deloitte. Retailers are adopting flash

sales strategies and exclusive offers to build momentum similar to

the “doorbuster deals” of years past. Inflation worries

shoppers, leading them to look for discounts and coupons. Some

wait for Black Friday and Cyber Monday to buy expensive

electronics.

Walmart (NYSE:WMT) – Walmart plans to

expand its online primary care benefits in 28 U.S. states by

partnering with virtual health services provider Included

Health. Employees will have access to virtual care options,

including digestive health and physical therapy, starting next

year.

Groupon (NASDAQ:GRPN) – Groupon shares

took a big hit on Tuesday after selling a portion of its stake in

SumUp at a much lower-than-expected price. The transaction

involved 9.4% of its stake in SumUp, valuing the company at $4.1

billion, well below the $8.5 billion announced in June 2022. This

reduced the value of Groupon’s stake to $94 million of dollars, a

significant drop. SumUp said small transactions between

existing shareholders often do not reflect the true value of the

company and highlighted its long-term prospects. Groupon

shares are down -2.7% in premarket trading.

Walgreens Boots

Alliance (NASDAQ:WBA) – Walgreens Boots

Alliance has named Tim Wentworth as its new CEO following the

departure of Rosalind Brewer. Wentworth, former CEO

of Cigna (NYSE:CI), will also join the

Board of Directors.

Silk Road Medical (NASDAQ:SILK) – Silk

Road Medical faced a 36.5% drop in Wednesday’s pre-market trading

due to its annual revenue estimate of between $170 million and $174

million, lower than the previous outlook of US$ 180 million to US$

184 million and analysts’ expectations, which predicted around US$

182 million.

Fresenius Medical Care (NYSE:FMS) – The early

shutdown of Novo Nordisk‘s

(NYSE:NVO) clinical trial of semaglutide, a promising drug

against kidney failure, caused an 18.3% drop in Fresenius Medical

Care shares. On the other hand, Novo Nordisk shares rose 2.7%

after the news. Novo Nordisk’s GLP-1 drug, Ozempic, is a

specific treatment for patients with type 2 diabetes. Analysts

indicated that the early cessation of the clinical trial suggests

possible negative impacts on the chronic kidney disease patient

population, an area where GLP-1 drugs -1 may have an effect.

Birkenstock – German premium footwear

maker Birkenstock has set its US IPO at $46 per share, raising

$1.48 billion. Valued at US$9.3 billion after the offering, it

became the fourth company to go public in recent months. The

shares will debut under the ticker “BIRK” on the NYSE.

Tesla (NASDAQ:TSLA) – Tesla has rejected

allegations of health and safety issues at its Berlin gigafactory,

emphasizing its commitment to protecting workers. The company

said it has provided training and safety equipment and that the

factory undergoes regular checks by local authorities.

Xpeng (NYSE:XPEV) – Chinese electric

vehicle maker Xpeng has suspended its vice president Li Feng due to

a corruption investigation. The incident affected a limited

area and did not impact the company’s business or

production. Xpeng has strengthened supply chain management and

investigated some of its employees.

Polestar Automotive (NASDAQ:PSNY) –

Swedish electric vehicle maker Polestar Automotive is looking to

raise $1 billion through various forms, including share sales,

reflecting the challenges faced by EV startups. Its shares

fell 6.9% in premarket trading Wednesday, highlighting the pressure

on companies selling electric vehicles with tight profit

margins.

Thor Industries (NYSE:THO) – Thor

Industries announced a 7% dividend increase, reaching 48 cents per

share. Payment will be made on November 10th to shareholders

registered by November 1st.

General Motors (NYSE:GM) – General Motors

and Canadian union Unifor have reached a tentative agreement

following a 12-hour strike that threatened production of large

trucks. The agreement follows the Ford (NYSE:F) standard

and includes salary increases of up to 25%. Workers still need

to vote to approve the agreement. The strike occurred after GM

refused to match Ford’s contract, and Unifor used the “standards

negotiation” approach.

Chevron (NYSE:CVX) – Chevron and unions

have advanced negotiations over wages and conditions at LNG

facilities in Australia. After the threat of strikes,

negotiations are mediated by the Fair Work Commission. This is

the second round in weeks. Chevron seeks agreement on issues

such as travel and meal reimbursement. The threat of a strike

affected European gas prices.

Exxon

Mobil (NYSE:XOM), Pioneer Natural

Resources (NYSE:PXD) – Exxon Mobil plans to buy

Pioneer Natural Resources for about $58 billion, solidifying its

position in the largest U.S. oil field. Exxon will make a

stock offering valued at more than $250 per Pioneer share, marking

the biggest acquisition of the year and Exxon’s largest since 1998.

Exxon’s planned acquisition dwarfs Shell’s purchase of BG Group in

2016 and strengthens its presence in the global liquefied natural

gas market.

Boeing (NYSE:BA) – Boeing 737 MAX

deliveries have fallen to their lowest level since August 2021 due

to manufacturing issues. Boeing booked orders in September for

224 planes and reported 10 cancellations, but deliveries have

slowed to 15 737 MAX, 10 787 and two 777 planes. Boeing is still

awaiting certification of the 737 MAX 7. Additionally, Boeing

opened a technology and engineering in Brazil, seeking to expand

its global presence and collaborate in the production of

sustainable aviation fuel (SAF). Brazil is considered a leader

in SAF production, and Boeing sees opportunities to develop the

aerospace ecosystem in the country.

Albemarle Corp (NYSE:ALB) – Australian

billionaire Gina Rinehart has acquired a 19.9% stake in lithium

miner Liontown Resources (USOTC:LINRF),

possibly hampering Albemarle’s takeover bid. Hancock

Prospecting, Rinehart’s company, seeks to influence Liontown’s

future as the largest shareholder. Albemarle offered A$3 per

share for Liontown, valuing it at US$4.3 billion.

Honeywell (NASDAQ:HON) – Honeywell

announced a restructuring focused on three business megatrends:

automation, future of aviation and energy transition. The new

structure will include four business lines: Aerospace Technologies,

Industrial Automation, Building Automation and Energy and

Sustainability Solutions. The company expects third-quarter

profit to be at or above its previous estimate of $2.15 to $2.25

per share, driven by demand and U.S. labor shortages. The

reorganization will take effect in the first quarter of 2024.

LPL Financial (NASDAQ:LPLA) – LPL

Financial hired a team from RBC Wealth Management that oversaw $900

million in client assets in York, Pennsylvania. The team led

by Brock R. Hively, Josh P. Smeltzer, Aaron N. Gingrich and Emily

C. Sides joined LPL’s Strategic Wealth Services channel on October

3. The team, called Sides Wealth Advisory Group, chose

independence to build their own practice and take advantage of

LPL’s support services. LPL hired a father-son duo

from Morgan Stanley (NYSE:MS) to its SWS

unit in September.

Deutsche Bank (NYSE:DB) – Strategists at

Deutsche Bank have recommended

an overweight rating on stocks in 2024, arguing

that risks are adequately reflected in the market and are poised to

become opportunities. They predicted weaker growth and

disappointing central bank communications in the third quarter, but

say those risks are already priced in.

Goldman Sachs (NYSE:GS) – Goldman Sachs

warned that the 19% rally in Italian stocks this year leaves them

vulnerable to sovereign debt risks as bond yields

rise. Strategists led by Sharon Bell predict that the spread

between Italian 10-year bond yields and German ones will gradually

widen, putting pressure on Italian banking stocks, Milan’s FTSE MIB

index and European stocks generally. Italy is the world’s

second-largest sovereign issuer in terms of its public debt and

faces concerns about its credit rating. Bell suggests the UK’s

FTSE 100 as a safer alternative.

Block (NYSE:SQ) – Despite the big drop in

Block shares since July, BofA Global Research analyst Jason

Kupferberg sees a buying opportunity due to the payments technology

company’s earnings potential, highlighting cost savings and growth

in gross profit. He maintains a Buy rating with a $71 price

target.

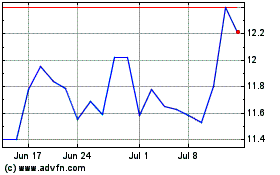

Richardson Electronics (NASDAQ:RELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Richardson Electronics (NASDAQ:RELL)

Historical Stock Chart

From Apr 2023 to Apr 2024