UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October 2023

Commission File Number: 001-36059

Controladora Vuela Compañía de Aviación,

S.A.B. de C.V.

(Name of Registrant)

Av. Antonio Dovalí Jaime No. 70, 13 Floor,

Tower B

Colonia Zedec Santa Fe

United Mexican States, Mexico City 01210

+(52) 55-5261-6400

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x Form

40-F o

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): £

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): £

EXPLANATORY NOTE

On October 10, 2023, Controladora Vuela Compañía de Aviación,

S.A.B. de C.V. (NYSE: VLRS) issued a press release titled “Volaris Reports September 2023 Traffic Results: 3% YoY Demand Growth

with an 84% Load Factor

Updating Full-Year 2023 Guidance” A copy of this press release is

attached to this Form 6-K as Exhibit 99.1

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. |

| |

|

| Date: October 10, 2023 |

By: |

/s/ Enrique J. Beltranena Mejicano |

| |

Name: |

Enrique J. Beltranena Mejicano |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

By: |

/s/ Jaime E. Pous Fernández |

| |

Name: |

Jaime E. Pous Fernández |

| |

Title: |

Chief Financial Officer |

EXHIBIT INDEX

Volaris Reports September

2023 Traffic Results:

3% YoY Demand Growth with an 84% Load Factor

Updating Full-Year 2023 Guidance

Mexico City, Mexico, October 10, 2023 –

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (NYSE: VLRS and BMV: VOLAR) (“Volaris”

or “the Company”), the ultra-low-cost carrier (ULCC) serving Mexico, the United States, Central, and South America, reports

its September 2023 preliminary traffic results.

In September 2023, Volaris’ capacity

(measured in ASMs) increased by 7.5% year-over-year, while demand (measured in RPMs) increased by 3.1%; the result was a load factor decrease

of 3.6 pp YoY to 83.8%. Volaris transported 2.5 million passengers during the month, a 0.6% decrease compared to September 2022. Demand

(measured in RPMs) in the Mexican domestic market decreased by 4.6%, while in the international market, demand increased by 22.4%.

During the third quarter of 2023, the average

economic fuel cost was $3.16 per gallon, an increase of 17% compared to the second quarter of 2023.

Enrique Beltranena, Volaris’

President and CEO, said: “On July 25th, 2023, RTX Corporation, the parent company of

Pratt & Whitney (“P&W”), requested accelerated inspections of GTF engines. The accelerated inspection program will

include engines in our fleet. The Volaris team is actively executing plans to mitigate the engine inspection impact, including a project

to optimize our route network. We anticipate our growth rate will slow while we work through the required engine shop visits.

We will continue to modify

our plans as we get more detail from P&W, but based on the current information we have, we expect Total Operating Revenues for the

full-year of 2023 to reach approximately $3.2 billion and CASM ex-fuel to be $4.8 cents, in line with prior guidance. However, we now

forecast an EBITDAR margin for 2023 of approximately 26%, given the continuing volatility in jet fuel prices and the effect on ASM production

as we work through the engine issues and its projected impact on our network and profitability."

| |

Sep 2023 |

Sep 2022 |

Variance |

YTD Sep 2023 |

YTD Sep 2022 |

Variance |

| RPMs (million, scheduled & charter) |

|

|

|

|

|

|

| Domestic |

1,706 |

1,788 |

-4.6% |

17,065 |

15,792 |

8.1% |

| International |

874 |

714 |

22.4% |

8,096 |

6,099 |

32.7% |

| Total |

2,580 |

2,503 |

3.1% |

25,161 |

21,891 |

14.9% |

| ASMs (million, scheduled & charter) |

|

|

|

|

|

|

| Domestic |

1,947 |

1,985 |

-1.9% |

19,798 |

18,033 |

9.8% |

| International |

1,132 |

879 |

28.8% |

9,690 |

7,744 |

25.1% |

| Total |

3,079 |

2,864 |

7.5% |

29,488 |

25,777 |

14.4% |

| Load Factor (%, scheduled, RPMs/ASMs) |

|

|

|

|

|

|

| Domestic |

87.6% |

90.1% |

(2.5) pp |

86.2% |

87.6% |

(1.4) pp |

| International |

77.2% |

81.2% |

(4.0) pp |

83.6% |

78.8% |

4.8 pp |

| Total |

83.8% |

87.4% |

(3.6) pp |

85.3% |

84.9% |

0.4 pp |

| Passengers (thousand, scheduled & charter) |

|

|

|

|

|

|

| Domestic |

1,951 |

2,075 |

-6.0% |

19,683 |

18,297 |

7.6% |

| International |

598 |

489 |

22.3% |

5,566 |

4,279 |

30.1% |

| Total |

2,549 |

2,564 |

-0.6% |

25,250 |

22,576 |

11.8% |

The information included in this

report has not been audited and does not provide information on the company’s future performance. Volaris’ future performance

depends on many factors. It cannot be inferred that any period’s performance or its comparison year over year will indicate a similar

performance in the future.

Volaris is

updating its full-year 2023 guidance, disclosed in its second-quarter earnings release, to account for the impact of aircraft groundings

as well as higher expected jet fuel prices.

| |

Updated Guidance |

Prior Guidance |

| 2023 Guidance |

|

|

| ASM growth |

~10% |

~13% |

| Total operating revenues |

~$3.2 billion |

$3.2 to $3.4 billion |

| CASM ex fuel |

~$4.8 cents |

$4.7 to $4.8 cents |

| EBITDAR margin |

~26% |

29% to 31% |

| Net debt-EBITDAR ratio |

~3.5x |

~2.8x |

For the full-year 2023,

CAPEX is expected to be approximately $300 million, net of financed fleet predelivery payments. This outlook assumes a full-year average

USD/MXN rate of approximately Ps.17.75 and an average U.S. Gulf Coast jet fuel price of approximately $2.80 per gallon; it also assumes

no significant unexpected disruptions related to COVID-19, macroeconomic factors, or other negative impacts on its business.

The Company's full-year

2023 outlook is based on a number of assumptions, including the foregoing, that are subject to change and may be outside the control of

the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurances that Volaris

will achieve these results.

Glossary

Revenue passenger miles (RPMs): Number

of seats flown by passengers multiplied by the number of miles the seats are flown.

Available seat miles (ASMs): Number of

seats available for passengers multiplied by the number of miles the seats are flown.

Load factor: RPMs divided by ASMs and expressed

as a percentage.

Passengers: The total number of passengers

booked on all flight segments.

Investor

Relations Contact

Ricardo

Martínez / ir@volaris.com

Media

Contact

Israel Álvarez

/ ialvarez@gcya.net

About Volaris:

*Controladora

Vuela Compañía de Aviación, S.A.B. de C.V. (“Volaris” or the “Company”) (NYSE: VLRS and BMV:

VOLAR) is an ultra-low-cost carrier, with point-to-point operations, serving Mexico, the United States, Central, and South America. Volaris

offers low base fares to build its market, providing quality service and extensive customer choice. Since the beginning of operations

in March 2006, Volaris has increased its routes from 5 to more than 245 and its fleet from 4 to 125 aircraft. Volaris offers more than

550 daily flight segments on routes that connect 43 cities in Mexico and 28 cities in the United States, Central, and South America, with

the youngest fleet in Mexico. Volaris targets passengers who are visiting friends and relatives, cost-conscious business and leisure travelers

in Mexico, the United States, Central, and South America. Volaris has received the ESR Award for Social Corporate Responsibility for fourteen

consecutive years. For more information, please visit ir.volaris.com.

Forward-looking Statements

Statements in this release contain

various forward-looking statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of

the US Securities Exchange Act of 1934, as amended, which represent the Company's expectations, beliefs or projections concerning future

events and financial trends affecting the financial condition of our business. When used in this release, the words "expects,"

“intends,” "estimates," “predicts,” "plans," "anticipates," "indicates,"

"believes," "forecast," "guidance," “potential,” "outlook," "may," “continue,”

"will," "should," "seeks," "targets" and similar expressions are intended to identify forward-looking

statements. Similarly, statements that describe the Company's objectives, plans or goals, or actions the Company may take in the future,

are forward-looking statements. Forward-looking statements include, without limitation, statements regarding the Company's full year outlook

and intentions and expectations regarding the delivery schedule of aircraft on order, amount of aircrafts at year end, amount of forward

bookings during the holiday season, ability to maintain the load factor, announced new service routes and customer savings programs. Forward-looking

statements should not be read as a guarantee or assurance of future performance or results and will not necessarily be accurate indications

of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available

at the time those statements are made and/or management’s good faith belief as of that time with respect to future events and are

subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested

by the forward-looking statements. Forward-looking statements are subject to several factors that could cause the Company's actual results

to differ materially from the Company's expectations, including the competitive environment in the airline industry; the Company's ability

to keep costs low; changes in fuel costs; the impact of worldwide economic conditions on customer travel behavior; the Company's ability

to generate non-ticket revenue; and government regulation. Additional information concerning these, and other factors is contained in

the Company's US Securities and Exchange Commission filings. All forward-looking statements attributable to us or persons acting on our

behalf are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as

of the date of this release. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking

statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except

to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will

make additional updates with respect to those or other forward-looking statements.

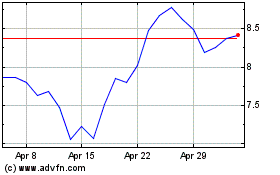

Volaris Aviation (NYSE:VLRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

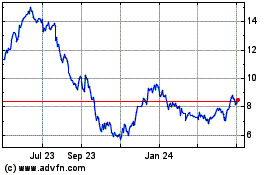

Volaris Aviation (NYSE:VLRS)

Historical Stock Chart

From Apr 2023 to Apr 2024