0001779474FALSE00017794742023-10-022023-10-020001779474us-gaap:CommonClassAMember2023-10-022023-10-020001779474us-gaap:WarrantMember2023-10-022023-10-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 2, 2023

WM TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39021 | 98-1605615 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

41 Discovery Irvine, California | | 92618 |

| (Address of principal executive offices) | | (Zip Code) |

(844) 933-3627(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | MAPS | The Nasdaq Global Select Market |

Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share | MAPSW | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Chief Technology Officer Retention Agreement

On October 2, 2023, Ghost Management Group, LLC, an indirect subsidiary of WM Technology, Inc. (the “Company”), entered into a retention bonus agreement with Duncan Grazier, the Chief Technology Officer of the Company (the “Retention Agreement”).

Under the Retention Agreement, Mr. Grazier will be advanced $200,000, subject to any applicable withholdings, on the first regular payroll date after October 1, 2023, further subject to repayment by Mr. Grazier (or a pro-rated portion thereof, as described in the Retention Agreement) if his employment is terminated for “Cause” (as defined in the Retention Agreement) before July 1, 2024.

The foregoing summary description of the Retention Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Retention Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 8.01. Other Events

Amended and Restated Non-Employee Director Compensation Policy

As part of a regular review of the corporate governance practices of the Company and in an effort to continue to attract and retain qualified members of the Board of Directors of the Company (the “Board”), after consultation with compensation experts and upon recommendation of the Compensation Committee of the Board (the “Compensation Committee”), the Board approved an Amended and Restated Non-Employee Director Compensation Policy (the “A&R Non-Employee Director Compensation Policy”), which provides annual cash and equity compensation for non-employee members of the Board (“Outside Directors”), on the terms and conditions contained therein. The A&R Non-Employee Director Compensation Policy is intended to enable the Company to attract qualified Outside Directors, provide them with compensation at a level that is consistent with the Company’s compensation objectives, and in the case of equity-based compensation, align the Outside Directors’ interests with those of the Company’s stockholders. The A&R Non-Employee Director Compensation Policy is effective as of October 1, 2023 (the “Effective Date”).

The foregoing description of the A&R Non-Employee Director Compensation Policy is not complete and is subject to and qualified in its entirety by reference to the A&R Non-Employee Director Compensation Policy, a copy of which is attached hereto as Exhibit 10.2 and is incorporated herein by reference.

Departure of Chief Marketing Officer

September 21, 2023 was the last day of employment for Randa McMinn, the Chief Marketing Officer of the Company. Upon her departure from the Company, Ms. McMann will be eligible to receive certain severance benefits pursuant to the Company’s Severance and Change in Control Plan (the “CIC Plan”), subject to the terms and conditions set forth in the CIC Plan.

Ms. McMinn’s departure was not the result of any disagreement between Ms. McMinn and the Company, its management, board of directors or any committee thereof, or with respect to any matter relating to the Company’s operations, policies or practices.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibits are filed with this Current Report on Form 8-K:

| | | | | | | | |

| Exhibit Number | | Description of Exhibits |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Dated: October 6, 2023 | | |

| | | |

| | | |

| | WM TECHNOLOGY, INC. |

| | | |

| | By: | /s/ Mary Hoitt |

| | | Mary Hoitt |

| | | Interim Chief Financial Officer |

| | | |

Ghost Management Group, LLC

41 Discovery

Irvine, California 92618

October 1, 2023

Duncan Grazier 6210 Colina Pacifica

San Clemente, CA 92673

Re: Retention Bonus Opportunity

Dear Duncan,

Congratulations! Ghost Management Group, LLC (the “Company”) is pleased to offer you the opportunity to receive a cash retention bonus (the “Retention Bonus”) in the gross amount of Two Hundred Thousand Dollars ($200,000) as set forth below in this retention bonus opportunity letter (“Letter”).

To earn the Retention Bonus, you must remain actively employed with the Company through July 1, 2024 (the “Retention Date”). By signing this Letter, you acknowledge and agree that no portion of the Retention Bonus is earned unless and until you have been actively employed with the Company through the Retention Date. The Retention Bonus, however, will be provided to you subject to any applicable withholdings on the first regular payroll date after October 1, 2023, subject to repayment by you if your employment terminates before the Retention Date for any of the disqualifying reasons described below. Please know that by signing this Letter, you acknowledge and agree that your receipt of the Retention Bonus is a bonus that is subject to repayment pursuant to the terms and conditions described in this Letter.

In the event your employment is terminated by the Company without “Cause” (as such term is defined in this Letter), prior to the Retention Date, then you will be entitled to retain the Retention Bonus payment in full. However, if you voluntarily terminate your employment with the Company or alternatively your employment is terminated by the Company for Cause before the Retention Date then you will not have earned the Retention Bonus and you will be required to repay to the Company a prorated amount of the Retention Bonus based on the ratio of (x) nine minus the number of full months of your employment with the Company, commencing as of October 1, 2023, to (y) nine months. By signing this Letter, you agree that in the event you are required to repay the Retention Bonus to the Company, you hereby authorize the Company to deduct from your final paycheck up to the full amount of the Retention Bonus owed, unless you are a non-exempt employee and the total amount to be deducted results in your final paycheck being less than the minimum wage for that pay period. In addition, if any amount of the Retention Bonus which you are required to repay to the Company remains unpaid by you after deduction, if any, is made from your final paycheck, or if the Company is unable to or chooses not to deduct all or part of the Retention Bonus from your final paycheck, you hereby agree to repay to the Company the remaining balance owed within ten (10) calendar days after the termination of your employment. You further agree that if you fail to repay the owed amount of the Retention Bonus within ten (10) calendar days after the termination of your employment, and if the Company resorts to litigation to obtain such repayment, you shall be liable to the Company for all of its litigation costs and expenses, including attorneys’ fees and interest at the applicable legal rate.

The Retention Bonus payment will be subject to any applicable withholdings. If you are a non-exempt employee subject to state and federal overtime laws, and you have earned the Retention Bonus, you will be paid any overtime owed on the Retention Bonus by the end of the next full pay period after the Retention Date.

Duncan Grazier October 1, 2023

Page 2 of 2

For purposes of this Letter only, the term “Cause,” as it concerns you, shall be defined as follows: (a) refusal or failure to competently perform your assigned duties and responsibilities; (b) misconduct including, but not limited to, any violation of any of the Company’s policies or procedures; (c) conviction of or plea of nolo contendere to a felony or any crime involving moral turpitude; (d) failure to comply with any of the Company’s lawful directives; (e) violation of any law, rule or regulation; (f) taking of any improper action or failure to take proper action that has had or could reasonably be expected to have a material adverse effect on the Company; (g) dishonesty, bad faith, gross negligence, or willful or reckless disregard of your job duties; and/or (h) engagement in a competitive business practice or business that is otherwise materially adverse to the Company.

Nothing in this Letter changes or alters your status with the Company, which continues to be “at-will” employment. Accordingly, the Company or you may terminate your employment with the Company at any time and for any reason, with or without cause or notice.

This Letter supersedes any agreement concerning the subject matter set forth herein and may be amended only by a written agreement signed by you and a duly authorized officer of the Company. This Letter will be governed by the internal substantive laws, but not the choice of law rules, of the State of California. You may not sell or assign your right to receive the Retention Bonus or pledge it as security for a loan or otherwise, and your creditors cannot garnish, attach, or levy on it prior to its payment. Any successor to the Company will assume the obligations under this Letter and agree expressly to perform the obligations under this Letter in the same manner and to the same extent as the Company would be required to perform such obligations in the absence of a succession. If any provision of this Letter becomes or is declared by a court of competent jurisdiction to be illegal, unenforceable, or void, this Letter will continue in full force and effect without such provision.

To accept this Letter, please date and sign this Letter below where indicated. By signing below, you acknowledge and agree that this Letter is a legally enforceable contract between you and the Company. If you do not accept this Letter by October 4, 2023, this Letter will not become effective.

Regards,

Brian Camire General Counsel

By signing this Letter, I acknowledge that I have read this Letter carefully and understand its terms, and that I enter into this Letter knowingly and voluntarily; and I agree to and accept all of the terms set forth in this Letter.

Agreed and Accepted:

Dated: Oct-02 , 2023 Duncan Grazier

_______________________

WM Technology, Inc.

Amended and Restated

Non-Employee Director Compensation Policy

Approved and Adopted by the Board of Directors: October 1, 2023 Effective October 1, 2023

The purpose of this Non-Employee Director Compensation Policy (the “Policy”) of WM Technology, Inc., a Delaware corporation (the “Company”), is to provide a total compensation package that enables the Company to attract and retain, on a long-term basis, high-caliber directors who are not employees or officers of the Company or its subsidiaries (“Outside Directors”). An Outside Director may decline all or any portion of his or her compensation by giving notice to the Company prior to the date cash may be paid or equity awards are to be granted, as the case may be.

In furtherance of the purpose stated above, all Outside Directors who serve as a member of the Board of Directors (the “Board”) shall receive, as compensation for services provided to the Company, (a) the cash retainers set forth below and (b) a grant of restricted stock units as set forth below.

1.Cash Retainers

Outside Directors are eligible to receive the annual cash retainers in the amounts and subject to the terms and conditions as set forth below. All payments shall be made in arrears on the last business day of each fiscal quarter in which the Outside Director’s service occurred. All annual cash retainers are vested upon payment.

If an Outside Director joins the Board or a committee of the Board at a time other than effective as of the first day of a fiscal quarter, each annual retainer set forth below will be prorated based on days served in the applicable fiscal year, with the prorated amount paid for the first fiscal quarter in which the Outside Director provides the service, and regular full quarterly payments thereafter.

All retainers set forth below are effective as of January 1, 2023.

(a)Annual Retainer for Board Membership: $50,000 for general availability and participation in meetings and conference calls of our Board.

(b)Additional Annual Retainers for Committee Membership:

Audit Committee Chairperson: $20,000

Audit Committee member (other than Chairperson): $10,000

Compensation Committee Chairperson: $15,000

Compensation Committee member (other than Chairperson): $7,500 Nominating and Corporate Governance Committee Chairperson: $10,000

Nominating and Corporate Governance Committee member (other than Chairperson): $5,000

Technology Committee Chairperson: $15,000

Technology Committee member (other than Chairperson): $7,500

(c)Additional Annual Retainer for Chairperson of our Board of Directors (if an Outside Director): $60,000

(d)Additional Annual Retainer for Lead Independent Director: $25,000 for serving as lead independent director of our Board of Directors.

(e)Additional Meeting Fees for each Director: Any Outside Director who attends more than eight (8) meetings of (i) the Board plus (ii) any ad hoc or special committee meetings not named in I.(b) above during any calendar year will receive an additional $1,000 for each meeting attended in the calendar year in excess of eight (8). Any Outside Director who attends more than eight (8) meetings of any Committee named in I.(b) above on which that Outside Director serves during any calendar year will receive $1,000 for each meeting of that Committee attended in the calendar year in excess of eight (8).

2.Equity Retainers

(a)New Director Grants. Without any further action of the Board or Compensation Committee of the Board, each Outside Director who is elected or appointed for the first time to be an Outside Director will automatically, upon the date of his or her initial election or appointment to be an Outside Director (the “Commencement Date”), receive an initial, one-time grant of restricted stock units (the “New Director Grant”) with an aggregate value of approximately (i) $200,000 multiplied by the ratio of (A) the number of calendar months between the Commencement Date and the first anniversary of the date of the Company’s most recent annual meeting of the Company’s stockholders, rounded up to the nearest whole number (which in no circumstance will be greater than 12), and (B) 12, plus (ii) $200,000 multiplied by the number of whole calendar years remaining on the Outside Director’s term. The portion of the grant described in clause (i) of the prior sentence will vest on the date of the next annual meeting of the Company’s Stockholders (the “First Meeting Date”) and the portion of the grant described in clause (ii) of the prior sentence, if any, will vest in equal annual installments on the date of each annual meeting of the Company’s stockholders (an “Annual Meeting Date”) following the First Meeting Date that is part of the Outside Directors initial term. The New Director Grant may only be granted once to any Outside Director.

(b)Initial Term Grants. On the date that this Policy is adopted and approved by the Board, each Outside Director who is then in office will automatically receive a one-time grant of restricted stock units (each, an “Initial Term Grant”) with an aggregate value of approximately

$200,000 multiplied by the number of whole calendar years remaining on the Outside Director’s term. Each Initial Term Grant will vest in equal annual installments on the date of each remaining Annual Meeting Date following the First Meeting Date subsequent to the effectiveness of the Initial Term Grant that is part of the Outside Directors current term. The Initial Term Grant may only be granted once to any Outside Director.

(c)Renewal Term Grants. Without any further action of the Board or Compensation Committee of the Board, at the close of business on each Annual Meeting Date, each Outside Director who is re-elected by the Company’s stockholders to continue as a member of the Board on such Annual Meeting Date will receive a grant of restricted stock units on the Annual Meeting Date (the “Renewal Term Grant”) with an aggregate value of approximately $600,000, that vests in three equal annual installments over the next three Annual Meeting Dates.

3.General

All grants of equity retainer awards to Outside Directors pursuant to this Policy will be automatic and nondiscretionary and will be made in accordance with the following provisions:

(a)Plan. The grants of equity retainer awards to Outside Directors will be made pursuant to the Company’s 2021 Equity Incentive Plan (the “Plan”).

(b)Value. For purposes of this Policy, the number of restricted stock units granted to an Outside Director hereunder shall be calculated by dividing the target value of such award by the volume weighted average price of the Common Stock (as defined in the Plan) during the 60 trading day period ending on the day prior to the effective date of the grant (or, if that end date isn’t a trading day, the trading day prior). If the value of each grant of restricted stock units is denominated in dollars, the number of shares of restricted stock units that are granted pursuant to each award shall be rounded down to the nearest whole share.

(c)Revisions. The Board and/or the Compensation Committee in its discretion may change and otherwise revise the terms of awards to be granted under this Policy, including, without limitation, the number of shares subject thereto, for awards of the same or different type granted on or after the date the Board and/or the Compensation Committee determines to make any such change or revision.

(d)Vesting; Change in Control Acceleration. All vesting is subject to the Outside Director’s Continuous Service (as defined in the Plan) through the applicable vesting date. Notwithstanding the foregoing vesting schedule, for each Outside Director who remains in Continuous Service with the Company until immediately prior to the closing of a Change in Control (as defined in the Plan) (the “Closing”):

i.The portion of each New Director Grant held by such Outside Director that, if the Change in Control had not occurred, would have vested at each of the next two Annual Meeting Dates following the Closing date

will, immediately prior to the Closing, accelerate and become vested;

ii.The portion of each Initial Term Grant held by such Outside Director that, if the Change in Control had not occurred, would have vested at the next Annual Meeting Date following the Closing date will, immediately prior to the Closing, accelerate and become vested; and

iii.The portion of each Renewal Term Grant held by such Outside Director that, if the Change in Control had not occurred, would have vested at the next Annual Meeting Date following the Closing date will, immediately prior to the Closing, accelerate and become vested.

(e)Remaining Terms. The remaining terms and conditions of each restricted stock unit, including transferability, will be as set forth in the Company’s standard restricted stock unit award agreement, in the applicable form adopted from time to time by the Board or the Compensation Committee of the Board.

4.Expenses

The Company will reimburse all reasonable out-of-pocket travel expenses incurred by Outside Directors in attending meetings of the Board or any Committee thereof; provided, that the Outside Director timely submits to the Company appropriate documentation substantiating such expenses in accordance with the Company’s travel and expense policy, as in effect from time to time.

5.Maximum Annual Compensation

The aggregate value of all compensation granted or paid, as applicable, to any individual for service as an Outside Director with respect to any calendar year, including equity awards granted and cash fees paid by the Company to such Outside Director, will not exceed (i) $750,000 in total value or (ii) in the event such Outside Director is first appointed or elected to the Board during any calendar year, $1,000,000 in total value, in each case calculating the value of any equity awards based on the grant date fair value of such equity awards for financial reporting purposes (or such other limit as may be set forth in Section 3(d) of the Plan or any similar provision of a successor plan).

6.Administration

The Board, or Compensation Committee of the Board, will administer the Policy. The Board or the Compensation Committee of the Board will have the sole discretion and authority to administer, interpret, amend and terminate the Policy, and the decisions of the Board or the Compensation Committee of the Board will be final and binding on all persons having an interest in the Policy.

v3.23.3

Cover Page

|

Oct. 02, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 02, 2023

|

| Entity Registrant Name |

WM TECHNOLOGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39021

|

| Entity Tax Identification Number |

98-1605615

|

| Entity Address, Address Line One |

41 Discovery

|

| Entity Address, City or Town |

Irvine

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92618

|

| City Area Code |

844

|

| Local Phone Number |

933-3627

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001779474

|

| Amendment Flag |

false

|

| Class A Common Stock, $0.0001 par value per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

MAPS

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

MAPSW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

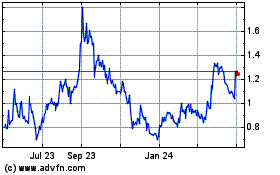

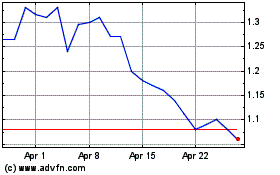

WM Technology (NASDAQ:MAPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

WM Technology (NASDAQ:MAPS)

Historical Stock Chart

From Apr 2023 to Apr 2024