Form 8-K - Current report

October 06 2023 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 28, 2023

Pacific Coast Oil Trust

(Exact name of registrant as specified in its charter)

| Delaware |

1-35532 |

80-6216242 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

|

The Bank of New York Mellon Trust Company, N.A.

601 Travis, Floor 16

Houston, Texas |

77002 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (512) 236-6555

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

None

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

As previously disclosed, on March 31, 2023,

Pacific Coast Energy Company LP (“PCEC”) submitted a demand for arbitration against The Bank of New York Mellon Trust Company,

N.A. (the “Trustee”), as trustee of Pacific Coast Oil Trust (the “Trust”), seeking, among other things, (1) an

order compelling the Trustee to commence the process of dissolving the Trust pursuant to the provisions of the Amended and Restated Trust

Agreement of the Trust, dated as of May 8, 2012 (the “Trust Agreement”), (2) a declaration that the Conveyance of

Net Profits Interests and Overriding Royalty Interest (the “Conveyance”) permits the legal fees and costs that PCEC, as operator,

incurred in defending the litigation and arbitration proceedings with Evergreen Capital Management LLC (“Evergreen”) to be

deducted from the proceeds from the net profits interests held by the Trust (the “Net Profits Interests”), and (3) a

declaration that the Trust must repay, with interest, the legal fees and costs that PCEC paid on behalf of the Trust to defend claims

against the Trustee in the Evergreen proceedings or, alternatively, that PCEC may deduct such legal fees and costs from the proceeds from

the Net Profits Interests.

On September 28, 2023, the arbitration panel

issued its Partial Final Award, in which the panel found as follows:

| · | The Trustee is not required to immediately commence the marketing and sale of the Trust’s assets; |

| · | PCEC is entitled to deduct from the net profits its own legal fees and the Trustee’s legal fees paid by PCEC in connection with

the Evergreen proceedings; and |

| · | PCEC is not entitled to reimbursement of such legal fees from the proceeds of the sale of the Trust’s assets. |

In light of the arbitration panel’s finding

that the Trustee is not required to immediately commence the marketing of the Trust’s assets, the Trustee plans to continue to work

with PCEC and the Trust’s independent auditor to complete the Trust’s financial statements and its filings with the Securities

and Exchange Commission and will make them available to unitholders as soon as possible, at which point the Trustee expects to commence

the marketing and sale process.

Meanwhile, because the Partial Final Award confirmed

PCEC’s right to deduct from the net profits its own legal fees and the Trustee’s legal fees paid by PCEC in connection with

the Evergreen proceedings, which total approximately $5 million in the aggregate, the existing net profits deficit is expected to increase

to approximately $10 million. PCEC has indicated to the Trustee that PCEC continues to incur fees and expenses related to Evergreen’s

appeal of its loss in the litigation and arbitration and will continue to deduct those amounts under the monthly net profits interest

calculation as provided in the Conveyance (the “NPI Calculation”), which could result in further increases to the net profits

deficit.

Only proceeds otherwise payable to the Trust pursuant

to the monthly NPI Calculation are used to reduce the net profits deficit. Proceeds from a sale of the Trust’s assets would be used

to repay amounts outstanding under the promissory note with PCEC and to pay the expenses of the Trust, including any estimated future

remaining expenses, with any remaining net proceeds to be distributed to the Trust unitholders.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Pacific Coast Oil Trust |

| |

|

|

By: The Bank of New York Mellon Trust Company, N.A., as Trustee |

| |

|

| Date: October 6, 2023 |

By: |

/s/ Sarah

Newell |

| |

|

Sarah Newell |

|

|

Vice President |

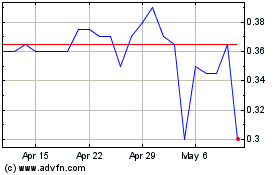

Pacific Coast Oil (CE) (USOTC:ROYTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pacific Coast Oil (CE) (USOTC:ROYTL)

Historical Stock Chart

From Apr 2023 to Apr 2024