0001045742false00010457422023-07-202023-07-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | |

Date of Report (Date of earliest event reported): July 20, 2023 |

Live Ventures Incorporated

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Nevada | 001-33937 | 85-0206668 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | | |

325 E. Warm Springs Road, Suite 102 | |

Las Vegas, Nevada | | 89119 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

Registrant’s Telephone Number, Including Area Code: (702) 997-5968 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading

Symbol(s) | |

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | LIVE | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note.

Live Ventures Incorporated (the “Company” or “Live Ventures”) hereby amends and supplements the Current Report on Form 8-K originally filed with the Securities and Exchange Commission on July 26, 2023 to include the information required by Item 9.01(a) and Item 9.01(b) of Form 8-K in connection with the acquisition by the Company of 100% of the issued and outstanding equity interests of Precision Metal Works, Inc. (a Kentucky entity) (“PMW”) pursuant to a Stock Purchase Agreement dated July 20, 2023.

Item 9.01 Financial Statements and Exhibits

(a)Financial Statements of Business Acquired.

The audited balance sheet of PMW as of December 31, 2022 and the audited consolidated statements of operations, changes in equity, and cash flows for the year there ended, and the notes thereto, are attached hereto as Exhibit 99.1.

(b)Pro Forma Financial Information.

The unaudited pro forma condensed combined financial statements for the year ended September 30, 2022 and the nine months ended June 30, 2023 for Live Ventures are hereby filed as Exhibit 99.2 to this Current Report on Form 8-K/A and incorporated herein by reference. Such unaudited pro forma condensed combined financial statements are not necessarily indicative of the financial position that actually would have existed or the operating results that actually would have been achieved if the adjustments set forth therein had been in effect as of the dates and for the periods indicated or that may be achieved in future periods and should be read in conjunction with the historical financial statements of Live Ventures and PMW.

(c)Exhibits.

The following exhibits are attached hereto:

| | | | | | | | |

Exhibit Number | | Description |

| 23.1 | | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Date File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, we have duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| LIVE VENTURES INCORPORATED |

| | |

| By: | /s/ Jon Isaac |

| | Name: Jon Isaac |

| | Title: Chief Executive Officer |

Dated: October 5, 2023

Exhibit 23.1

CONSENT OF INDEPENDENT AUDITORS

We hereby consent to the incorporation by reference in the Registration Statements on Form S-3 (File No. 333-270836) and Form S-8 (File No. 333-198205) of Live Ventures Incorporated of our report dated October 4, 2023, with respect to our audit of the financial statements of Precision Metal Works., Inc. as of and for the year ended December 31, 2022, which appears on this Form 8-K/A.

/s/ Frazier & Deeter, LLC Atlanta, Georgia

October 4, 2023

PRECISION METAL WORKS, INC.

FINANCIAL STATEMENTS

YEAR ENDED DECEMBER 31, 2022

CONTENTS

Independent Auditor's Report 1

Financial Statements as of and for the year ended December 31, 2022

Balance Sheet 3

Statement of Operations 5

Statement of Stockholders' Equity 6

Statement of Cash Flows 7

Notes to Financial Statements 8

INDEPENDENT AUDITOR’S REPORT

To the Board of Directors

Precision Metal Works, Inc.

Las Vegas, NV

Opinion

We have audited the financial statements of Precision Metal Works, Inc. (the Company), which comprise the balance sheet as of December 31, 2022, and the related statements of operations, stockholder's equity and cash flows for the year then ended, and the related notes to the financial statements.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of Precision Metal Works, Inc. as of December 31, 2022, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Emphasis of Matter - Change in Accounting Principle

As discussed in Note 1 to the financial statements, the Company adopted the new lease accounting standards applicable under Financial Accounting Standards Board Accounting Standards Codification 842, Leases, effective January 1, 2022, utilizing the modified retrospective approach. Our opinion is not modified with respect to this matter.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair

presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern within one year after the date that the financial statements are available to be issued.

Auditor's Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

•Exercise professional judgment and maintain professional skepticism throughout the audit.

•Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

•Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. Accordingly, no such opinion is expressed.

•Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

•Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified during the audit.

/s/ Frazier & Deeter, LLC

October 4, 2023

PRECISION METAL WORKS, INC.

BALANCE SHEET

ASSETS

Current assets

Cash $ 84,122

Accounts receivable, net of allowance for doubtful

accounts of $187,579 12,998,671

Employee Retention Credit receivable 3,460,078

Contract assets 120,962

Inventories 7,098,630

Other 686,619

Total current assets 24,449,082

Operating lease right-of-use assets, net 5,983,251

Property, plant, and equipment, net 10,391,850

Other assets 181,161

Total assets $ 41,005,344

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities

Accounts payable $ 10,727,741

Accrued expenses 970,572

Contract liabilities 333,102

Current portion of operating lease liabilities 662,376

Current maturities of long-term debt 1,262,992

Current portion of financing lease liabilities/

obligations under capital leases 110,958

Total current liabilities 14,067,741

Revolving line-of-credit 5,178,240

Operating lease liabilities, net of current portion 5,369,693

Long-term debt, net of current maturities and debt issuance costs 5,077,814

Financing lease liabilities/obligations under capital leases, net

of current portion/obligations 216,695

Net deferred tax liability 738,973

Commitments and contingencies

Stockholders' equity

Class A preferred stock, no par value;

1,500,000 shares authorized and issued; 1,272,487

shares outstanding 4,485,934

Class B preferred stock, no par value; 500,000 shares

authorized and issued; 0 shares outstanding -

Class A common stock, no par value; 14,878,000 shares

authorized and issued; 14,080,683 shares outstanding 5,088,364

Class B common stock, no par value; 3,000,000 shares

authorized and issued; 1,997,721 shares outstanding 241,584

Class C common stock, no par value; 2,233,000 shares

authorized; 1,233,000 shares issued and outstanding 33,291

Retained earnings 1,713,838

Treasury stock, at cost; 227,513 shares of Class A

preferred stock; 500,000 shares of Class B preferred

stock; 797,317 shares of Class A common stock; and

1,002,279 shares of Class B common stock (1,206,823)

Total stockholders' equity 10,356,188

Total liabilities and stockholders' equity $ 41,005,344

PRECISION METAL WORKS, INC.

STATEMENT OF OPERATIONS

| | |

| Year ended December 31, 2022 |

Revenue

Net product sales $ 81,698,925

Net tooling sales 1,254,151

Total revenue 82,953,076

Cost of goods sold 77,548,385

Gross profit 5,404,691

Selling, general, and administrative expenses 3,127,696

Income from operations 2,276,995

Other income (expense)

Loss on sale of equipment (21,354)

Interest expense (537,654)

Other expense, net (559,008)

Income before tax expense 1,717,987

Income tax expense 477,986

Net income $ 1,240,001

PRECISION METAL WORKS, INC.

STATEMENT OF STOCKHOLDERS' EQUITY

| | |

| Year ended December 31, 2022 |

Retained Total

Class A Class B Class A Class B Class C Earnings Total

Preferred Stock Preferred Stock Common Stock Common Stock Common Stock Treasury Stock (Accumulated Stockholders’

Shares Amount Shares Amount Shares Amount Shares Amount Shares Amount Shares Amount Deficit) Equity

Balance as of

January 1, 2022 1,499,105 $ 5,284,275 500,000 $ 98,791 13,938,634 $ 5,100,606 2,596,694 $ 262,099 1,233,000 $ 33,291 1,343,567 $ (72,113) $ (982,233) $ 9,724,716

Cumulative effect

due to change in

accounting

principle, net of

income taxes - - - - - - - - - - - - 526,181 526,181

Shares issued - - - - 747,500 - - - - - (747,500) - - -

Shares forfeited

to treasury - - - - (85,000) - - - - - 85,000 - - -

Shares redeemed

to treasury (226,618) (798,341) (500,000) (98,791) (520,451) (12,242) (598,973) (20,515) - - 1,846,042 (1,134,710) 929,889 (1,134,710)

Net income - - - - - - - - - - - - 1,240,001 1,240,001

Balance as of

December 31, 2022 1,272,487 $ 4,485,934 - $ - 14,080,683 $ 5,088,364 1,997,721 $ 241,584 1,233,000 $ 33,291 2,527,109 $ (1,206,823) $ 1,713,838 $ 10,356,188

PRECISION METAL WORKS, INC.

STATEMENT OF CASH FLOWS

| | |

| Year ended December 31, 2022 |

Cash flows from operating activities

Net income $ 1,240,001

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation and amortization 897,689

Change in allowance for doubtful accounts 100,000

Change in allowance for obsolete inventories (385,931)

Deferred income taxes 444,748

Loss on sale of equipment 21,354

Changes in operating assets and liabilities:

Accounts receivable (5,241,928)

Employee Retention Credit receivable 64,324

Contract assets (8,689)

Inventories 691,911

Other assets (375,804)

Accounts payable 5,917,652

Accrued expenses (1,456,919)

Contract liabilities (120,745)

Operating lease right-of-use assets and liabilities 48,818

Net cash provided by operating activities 1,836,481

Cash flows from investing activities

Proceeds from sale of equipment 20,000

Purchases of property, plant, and equipment (2,555,975)

Net cash used in investing activities (2,535,975)

Cash flows from financing activities

Net borrowings under revolving line-of-credit 1,181,421

Issuance of long-term debt 1,795,042

Payments on long-term debt (998,611)

Payments on financing lease liabilities/obligations under

capital leases (97,752)

Redemption of stock (1,134,710)

Net cash provided by financing activities 745,390

Net increase in cash 45,896

Cash at beginning of year 38,226

Cash at end of year $ 84,122

PRECISION METAL WORKS, INC.

NOTES TO FINANCIAL STATEMENTS

| | |

| Year ended December 31, 2022 |

1. Nature of business and summary of significant accounting policies

Nature of business – Precision Metal Works, Inc. (the Company) manufactures and sells stamped metal component parts to customers throughout North America.

Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Fair value measurements – The Company applies the Fair Value Measurements topic of the Accounting Standards Codification (ASC) which requires companies to determine fair value based on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. The Fair Value Measurement topic emphasizes that fair value is a market-based measurement, not an entity-specific measurement, and applies in conjunction with other ASC topics that require or permit fair value measurements and disclosures. Impacted assets and liabilities are measured and disclosed in one of three categories based on the significance and source of the inputs to their valuation. The hierarchy consists of three broad levels: Level 1, Level 2, and Level 3. Level 1 inputs have the highest priority and consist of observable unadjusted quoted prices for identical assets or liabilities in active markets that the Company has the ability to access. Level 2 inputs include: a) quoted prices for similar assets or liabilities in active markets; b) quoted prices for identical or similar assets or liabilities in inactive markets; c) inputs other than quoted prices that are observable for the asset or liability; and d) inputs that are derived principally from or corroborated by observable market data by correlation or other means. Level 3 inputs have the lowest priority, are unobservable, and include judgments about the assumptions that market participants would use in pricing the asset or liability.

An asset’s or liability’s fair value measurement level within the hierarchy is based on the lowest level of any input that is significant to its fair value measurement. Valuation techniques used maximize the use of observable inputs and minimize the use of unobservable inputs. Management uses specific valuation techniques based on the available inputs to measure the fair values of the Company’s impacted assets and liabilities. When available, management measures fair value using Level 1 inputs because they generally provide the most reliable evidence of fair value.

The valuation methods used by the Company may produce fair value calculations that may not be indicative of net realizable values, or reflective of future fair values. Furthermore, while management believes the valuation methods utilized are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine fair values of certain assets and liabilities could result in different fair value measurements.

Revenue recognition – The Company’s revenue primarily results from the sale of stamped metal component parts under fixed-price contracts with customers. Additionally, the Company enters into fixed-price contracts with the same customers to build tools for the purpose of producing the aforementioned parts.

Revenue is recognized when promised goods or services are transferred to customers in an amount that reflects consideration to which the Company expects to be entitled in exchange for those goods or services utilizing the following five-step process:

Identify the contract(s) with a customer – The Company generally considers a sales contract or agreement with an approved purchase order as a customer contract provided that collection is considered probable, which is assessed on the creditworthiness of the customer as determined by credit checks, payment histories, and/or other circumstances. The Company combines contracts with a customer if contracts have a single commercial substance or contain price dependencies.

Identify the performance obligations in each contract – The Company enters into similar contracts with all customers for product sales with a single performance obligation identified as shipment of the product to the customer. Management evaluates the Company’s tooling contracts to assess the products and services promised in a contract and identifies separate performance obligations for each distinct promise to transfer products and services to the customer. Typically, the Company’s tooling contracts with customers are determined to have a single performance obligation identified as producing a specific tool for the production of specific stamped component parts to the customer. Shipping and handling activities are not considered a performance obligation because they are performed prior to the product’s transfer to the customer. Accordingly, shipping and handling costs are expensed as incurred and included in cost of goods sold on the accompanying statement of operations. The Company provides only an assurance warranty on its product which covers the product’s compliance with agreed-upon specifications. Accordingly, the Company’s assurance warranty is not considered a performance obligation and is accounted for in accordance with ASC Topic 460, Guarantees.

Determine the transaction price – The transaction price for the Company’s contracts with customers are typically fixed with payments anticipated over terms up to 60 days after product shipment. The Company’s contracts with customers do not include significant financing components as the period between the transfer of performance obligation and timing of payments are generally less than one year.

Allocate the transaction price to the performance obligations in each contract – Allocation of the transaction price to performance obligations is not necessary as management has determined the Company’s contracts typically contain a single performance obligation as described above because potential sales returns are determined to be immaterial in the context of a given contract. Sales returns are estimated based on historical sales returns, current trends, and expectations regarding future experience.

Recognize revenue when or as a performance obligation is satisfied – Revenue under product contracts is recognized at a point in time which is generally upon shipment of the product to the customer. Revenue under tooling contracts is recognized over time based on the contract’s progress because the Company’s performance creates an asset that the customer controls. Tooling contract progress is measured using a cost-to-cost input method as management has determined this method best depicts the transfer to the customer. Under the cost-to-cost measure of progress, the extent of progress towards completion is measured based on the ratio of costs incurred to date to the total estimated costs at completion of a performance obligation. Due to uncertainties inherent in the estimation process regarding tooling contracts, it is possible that estimates of costs to complete a performance obligation will be revised in the near term. Changes in total estimated costs, and related progress towards complete satisfaction of a performance obligation are recognized on a cumulative catch-up basis in the period in which the revisions to the estimates are made. When the current estimate of total costs for a performance obligation indicates a loss, a provision for the entire estimated loss on the unsatisfied performance obligation is made in the period in which the loss becomes evident.

The lengths of the Company’s tooling contracts are typically less than twelve months. The operating cycle is the length of each contract. Therefore, related accounts receivable, contract assets, and contract liabilities are reported as current items on the accompanying balance sheet.

Accounts receivable net – Accounts receivable result from contracts with customers and are recognized when the Company’s right to consideration is unconditional. Credit is extended based on an evaluation of the customer’s financial condition, and generally, collateral is not required. Management provides an allowance for doubtful accounts through specific identification of known collection problem accounts based on delinquent status and through utilization of historical trend information. Accounts receivable are considered delinquent based upon invoice or purchase order terms. Accounts are written-off when management has exhausted collection attempts and concludes the amounts are uncollectible.

Inventories – Inventories are stated at the lower of cost (first-in, first-out method), or net realizable value.

Leases – Effective January 1, 2022, the Company recognizes lease right-of-use assets and liabilities related to its leases based on the present value of the future lease payments over the lease term (which includes reasonably certain option periods). The Company utilizes the risk-free discount rate practical expedient available for non-public entities under ASC Topic 842, Leases, at lease commencement to determine present value related to its operating leases. For financing leases, the Company determines present value utilizing a lease’s implicit interest rate (if determinable) or the Company’s incremental borrowing rate for similar financing situations at lease commencement when the lease’s implicit interest rate is not determinable.

For leases commencing in 2022 and thereafter, the Company has elected to account for lease and non-lease components as single lease components.

The Company has also elected, for all underlying classes of assets, to not recognize lease right-of-use assets and liabilities for short-term leases that have a lease term of twelve months or less at lease commencement, and do not include an option to purchase the underlying asset that the Company is reasonably certain to exercise. The Company recognizes lease costs associated with any short-term leases on a straight-line basis over the related lease terms.

Property, plant, and equipment – Net property, plant, and equipment is stated at cost less accumulated depreciation and amortization. Property, plant, and equipment is depreciated and amortized utilizing the straight-line method over the assets’ estimated useful lives ranging from three to fifteen years excluding leasehold improvements. Leasehold improvements are amortized over the estimated lives of the related assets or the related lease term defined above, whichever is shorter. Straight-line and accelerated methods are utilized for income tax purposes. Total depreciation and amortization expense related to property, plant, and equipment totals $857,613 for the year ended December 31, 2022.

Long-lived assets – The recoverability of property, plant, and equipment and lease right-of-use assets is assessed by management whenever events or circumstances indicate that an asset, or group of related assets, may be impaired. Among the factors management continually evaluates are unfavorable changes in the Company’s relative market share and market competitive environment, and the Company’s current period and forecasted operating results and cash flows. Recoverability is measured by a comparison of the carrying amount of an asset, or group of related assets, to estimated undiscounted future cash flows expected to be generated by the asset, or group of related assets. If the carrying amount of an asset, or group of related assets, exceeds its estimated future undiscounted cash flows, an impairment charge is recognized for the amount by which the carrying amount of the asset, or group of related assets, exceeds the related fair value. Fair value is determined through discounted cash flow analysis and relies on Level 3 inputs. Although management believes the estimates and assumptions used to evaluate the fair values of long-lived assets are reasonable, the use of different methodologies or assumptions to perform the evaluations could result in different fair value determinations. No asset impairment loss related to long-lived assets has been recognized for the year ended December 31, 2022.

Debt issuance costs – Debt issuance costs are capitalized and netted against long-term debt on the accompanying balance sheet, and amortized as interest expense utilizing the effective interest method over the life of the related debt agreement.

Self-insurance medical claims – Self-insurance medical claims represent an estimate for both reported claims not yet paid, and claims incurred but not yet reported to the Company under a self-insurance plan for employee medical insurance. The Company estimates the liability related to claims incurred but not yet reported utilizing assumptions regarding the plan’s historical loss experience and loss limits defined in the plan.

Income taxes – The Company recognizes deferred tax assets and liabilities for the expected future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases using enacted tax laws and rates expected to apply to taxable income in the years in which the temporary differences are expected to be recovered or settled. The measurement of deferred tax assets is reduced by a valuation allowance if, based upon available evidence, management determines it is more likely than not that some or all of the deferred tax assets will not be realized. In estimating future tax consequences, management generally considers all expected future events other than enactments of changes in tax laws or rates. The effect on deferred tax assets and liabilities of a change in tax laws or rates is recognized in the period that includes the enactment date.

GAAP requires management to evaluate tax positions taken by the Company and recognize a tax liability (or asset) if the Company has taken uncertain tax positions that more likely than not would not be sustained upon examination by taxing authorities. Management has analyzed the tax positions taken by the Company and has concluded that as of December 31, 2022, there are no uncertain positions taken, or expected to be taken, that would require recognition of a tax liability (or asset), or disclosure in the financial statements.

Subsequent events – Management has evaluated subsequent events through October 4, 2023, the date which the financial statements were available for issue.

New accounting pronouncements – In February 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-02, Leases, which creates ASC Topic 842, Leases. ASU 2016-02 requires recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under ASC Topic 840, Leases, initially measured at the present value of the related lease payments. When measuring assets and liabilities arising from a lease, a lessee includes payments to

be made in optional periods only if the lessee is reasonably certain to exercise an option to extend the lease, or not to exercise an option to terminate the lease. Similarly, optional payments to purchase the underlying asset are included in the measurement of lease assets and lease liabilities only if the lessee is reasonably certain to exercise that purchase option. ASU 2016-02 also requires a lessee to exclude most variable lease payments in measuring lease assets and lease liabilities, other than those that depend on an index or rate, or are in substance fixed payments. ASU 2016-02 requires recognition of a single lease cost (for

non-finance leases), calculated so the cost of the lease is allocated over the lease term on a generally straight-line basis. For leases with a term of twelve months or less, a lessee is permitted to make an accounting policy election by class of underlying asset not to recognize lease assets and lease liabilities. If a lessee makes this election, it recognizes lease expense for such leases generally on a straight-line basis over the lease term. Further, ASU 2016-02 requires all cash payments related to leases to be included within the operating activities in the statement of cash flows. ASU 2016-02 requires disclosures to supplement the amounts recorded in the financial statements to enable users of financial statements to understand more about the nature of an entity’s leasing activities. Under ASU 2016-02, an entity may elect to continue to account for leases that commence

before the effective date in accordance with ASC Topic 840, Leases, unless the lease is modified, except that lessees are required to recognize a lease asset and a lease liability for all operating leases based on the present value of the remaining minimum rental payments that are tracked and disclosed under ASC Topic 840, Leases. ASU 2016-02 and other related new lease standards under ASC Topic 842, Leases, are effective for years beginning after December 15, 2021. The Company adopted ASU 2016-02 and the other new lease standards effective January 1, 2022, under the modified retrospective approach. The Company also elected the package of practical expedients, which permits the Company to not reassess (a) whether any expired or existing contracts are or contain leases, (b) the lease classification for any expired leases, and (c) any initial direct costs for any existing leases as of the effective date. Also, the Company did not elect the hindsight practical expedient, which permits entities to use hindsight in determining the lease term and assessing impairment. The adoption of the new lease standards resulted in recognition of operating lease right-of-use assets and liabilities totaling approximately $6,372,000, and recognition of the unamortized portion of a deferred gain related to a prior year sale lease-back transaction, net of deferred income taxes, resulting in an increase to retained earnings totaling approximately $526,000 as of January 1, 2022.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments – Credit Losses, which amends ASC Topic 326. ASU 2016-13 requires a financial asset (including receivables) measured at amortized cost basis to be presented at the net amount expected to be collected. Thus, the statement of operations will reflect the measurement of credit losses for newly recognized financial assets as well as the expected increases or decreases of expected credit losses that have taken place during the period. ASU 2016-13 is effective for

years beginning after December 15, 2022. Early application is permitted. The Company’s management has not determined the impact, if any, the adoption of ASU 2016-13 may have on the Company’s future financial statements.

In December 2019, the FASB issued ASU 2019-12, Simplifying the Accounting for Income Taxes, which amends ASC Topic 740, Income Taxes. ASU 2019-12 removes certain exceptions to the general principles of accounting for income taxes and improves consistent application of and simplification of GAAP for certain areas of accounting for income taxes. The Company adopted ASU 2019-12 effective January 1, 2022. The adoption of ASU 2019-12 had no impact on the Company’s financial statements.

2. Contract balances

The timing of revenue recognition related to the Company’s tooling contracts often differs from the timing of billing to customers. A contract asset occurs when revenue recognized to date under a tooling contract is in excess of amounts billed to date under the contract. A contract liability occurs when amounts billed to date under a tooling contract exceed revenue recognized to date under the contract.

Contract balances as of December 31, 2022 consist of the following:

Costs incurred on uncompleted contracts $ 3,546,255

Estimated earnings thereon 617,222

Total costs incurred and estimated

earnings thereon 4,163,477

Less billings to date 4,375,617

Net billings in excess of costs and estimated

earnings on uncompleted contracts $ 212,140

As of December 31, 2022, the Company has remaining performance obligations totaling approximately $630,000. Remaining performance obligations represent revenue to be realized from uncompleted tooling contracts awarded to the Company as of December 31, 2022 whose cancellation is not anticipated. Management anticipates revenue from these remaining performance obligations to be recognized during the year ending December 31, 2023.

3. Inventories

Inventories as of December 31, 2022 consist of the following:

Finished goods $ 2,986,953

Work in progress 1,311,142

Raw materials 2,012,474

Small tools, dies, and supplies 1,362,645 Reserve (574,584)

Total inventories $ 7,098,630

4. Property, plant, and equipment, net

Property, plant and equipment, including both owned assets and assets subject to financing lease liabilities/capital leases, consist of the following as of December 31, 2022:

Building $ 2,511,569

Land 220,000

Leasehold improvements 899,534

Machinery and equipment 18,427,122

Office equipment 737,155

Vehicles 100,786

Construction in progress 1,850,871

Total property, plant, and equipment 24,747,037

Less accumulated depreciation 14,355,187

Property, plant, and equipment, net $ 10,391,850

5. Debt

The Company has a credit and security agreement with a financial institution covering a revolving line-of-credit and two term loans. The agreement contains certain restrictive covenants which require the Company to meet certain minimum financial targets and ratios. The agreement also places certain restrictions on capital expenditures, dividends, and consulting fees to Company owners and directors. Debt under the credit and security agreement is collateralized by substantially all Company assets.

The revolving line-of-credit expires in May 2025 and has a maximum borrowing capacity of $8.5 million subject to certain borrowing base restrictions. The borrowing base advances are restricted to 85% of eligible accounts receivable plus the lesser of $3 million or 50% of eligible inventory. The revolving line-of-credit bears interest at a variable rate defined by the financial institution (7.5% as of December 31, 2022). The Company is charged 0.375% for unused borrowing capacity.

The term loans bear interest at the financial institution’s prime lending rate plus 0.25% (7.75% as of December 31, 2022). The larger term note requires the Company to make prepayments upon meeting certain excess cash flow criteria as defined in the loan agreement. The accompanying balance sheet does not contain any scheduled 2023 principal payment reduction as a current liability as it is not determinable that the Company will be required to make these payments.

During 2022, the Company was issued a note payable from a financial institution for installation of certain equipment. The note payable bears interest at the financial institution’s

SOFR rate plus 2.5% (6.32% as of December 31, 2022), allows borrowings up to $4.3 million, is collateralized by certain equipment, and will be converted to a term loan upon completion of the installation.

The Company has a mortgage note payable bearing interest at 4%.The note contains a prepayment penalty through 2024, matures in November 2039, and is collateralized by a building utilized as one of the Company’s operating facilities.

Long-term debt as of December 31, 2022 consists of the following:

Term loan payable; monthly principal

payments of $68,750 plus interest $ 2,406,250

Term loan payable; monthly principal

payments of $7,923 plus interest 213,924

Note payable; interest only payments

through date of conversion to term loan 1,795,043

Mortgage note payable; monthly principal

and interest payments of $13,575 2,002,401

Total long-term debt 6,417,618

Less debt issuance costs 76,812

Long-term debt as reported on the

accompanying balance sheet 6,340,806

Less current maturities 1,262,992

Long-term maturities $ 5,077,814

Aggregate maturities of long-term debt as of December 31, 2022 are as follows for subsequent years:

2023 $ 1,262,992

2024 1,305,258

2025 1,137,174

2026 401,512

2027 423,234

Thereafter 1,887,448

Total long-term debt $ 6,417,618

6. Employee Retention Credits

During 2021, the Company recognized Employee Retention Credits (“ERC’s”) totaling approximately $3,524,402 created under the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act. As of December 31, 2022, the balance of the ERC’s receivable was $3,460,078.

7. Leases

The Company leases two of its operating facilities and certain equipment under non-cancellable operating lease agreements expiring on various dates through 2034. The leases generally obligate the Company for insurance and maintenance on the facilities and equipment. One of the facility leases contains a five-year renewal option. The Company has a non-cancelable sublease agreement for a portion of one of the operating facilities.

Information related to the Companies’ net operating leases as of and for the year ended December 31, 2022 is as follows:

Maturities of operating lease liabilities as of December 31, 2022 for the subsequent years ending December 31 –

Minimum Sublease Net Minimum

Lease Payments Payments Lease Payments

2023 $ 1,043,488 $ (250,680) $ 792,808

2024 629,391 (41,780) 587,611

2025 549,011 - 549,011

2026 556,924 - 556,924

2027 543,490 - 543,490

Thereafter 3,887,187 - 3,887,187

Total lease payments 7,209,491 (292,460) 6,917,031

Less discount 884,962

Present value of operating lease liabilities $ 6,032,069

Cash flow information –

Cash paid during the year included in measurement

of operating lease liabilities, net of $246,680 in

sublease payments received $ 790,993

Lease term and discount rate information –

Weighted average remaining lease term for

operating leases 11.5 years

Weighted average discount rate for

operating leases 2%

8. Preferred and common stock

All preferred and common shares carry identical voting rights. Preferred shares carry specific liquidation rights. In the event of any sale, merger, capital transaction, liquidation, dissolution, or winding-up of the Company, whether voluntary or involuntary, the holders of the preferred shares shall be entitled to receive $1 per preferred share owned. This $1 per share would be paid prior to any allocation of sale proceeds to holders of common shares. If the sale proceeds are insufficient to pay each preferred shareholder $1, preferred shareholders shall receive the entire sale proceeds on a pro rata basis.

Additionally, should any of the aforementioned events occur, the holders of Class A Preferred Stock have the right to convert each share to one share of Class A Common Stock, and the holders of Class B Preferred Stock have the right to convert each share to one share of Class B Common Stock prior to the event's occurrence.

The Company has issued shares of Class A Common Stock to certain employees. The employee shares vest at a rate of 1.6% of total shares issued to each employee for every month of service completed. In the event an employee terminates his or her employment, any non-vested shares are forfeited to the Company.

In prior years, the Company issued shares of Class B Common Stock to its Employee Stock Bonus Plan (the Plan). These shares were fully vested when the Plan was terminated effective May 31, 2022 (see Note 10).

Should a sale or related event (see above) occur prior to full vesting by an employee, and the sale event results in an employee being terminated or not offered a position with similar salary and job responsibilities with the buyer, all shares subject to forfeiture shall immediately vest.

A summary of employee stock is as follows for the year ended December 31, 2022:

Vested Nonvested Total

Shares outstanding as of

January 1, 2022 1,571,757 225,000 1,796,757

Shares issued - 747,500 747,500

Shares vested 259,500 (259,500) -

Shares forfeited to treasury - (85,000) (85,000)

Shares redeemed to treasury (936,469) - (936,469)

Shares outstanding as of

December 31, 2022 894,788 628,000 1,522,788

9. Income taxes

The income tax provision for the year ended December 31, 2022 consists of the following:

Current:

Federal $ 20,322

State and local 12,915

Total current 33,237

Deferred:

Federal $ 308,697

State 136,053

Total deferred 444,750

Income tax provision $ 477,986

The difference between the actual income tax provision and the income tax provision computed by applying the statutory federal income tax rate to income before income tax provision is impacted by state and local income taxes.

As of December 31, 2022, the significant deferred asset (liability) components of net deferred tax liability are as follows:

Net operating loss carryforwards $ 1,990,060

Property, plant, and equipment (1,519,469)

Other 252,036

Valuation allowance (1,461,600)

Net deferred tax liability $ (738,973)

The Company’s valuation allowance did not change during the year ended December 31, 2022.

The Company's federal net operating loss carryforwards of approximately $8.6 million expire at various dates from 2026 through 2039 and federal losses generated in 2020 are available for indefinite carryforward. Of the $8.6 million of federal net operating losses, approximately $8.5 million are subject to limitation as a result of the application of Section 382 of the Internal Revenue Code ("IRC"). Section 382 limits the utilization of federal net operating loss carryforwards following a change of control. The Company has recognized a valuation allowance based upon management’s estimate of the realizability of net deferred tax assets in future periods based on anticipated future earnings and consideration of carryforward utilization per the Internal Revenue Code (IRC) limitations.

The Company is subject to routine income tax audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. Years ended December 31, 2022 through 2019 remain subject to Internal Revenue Service examination; and years ended December 31, 2022 through 2018 remain subject to examination by the Commonwealth of Kentucky.

10. Related party transactions

The Company has a contract with its primary shareholder to manage the Company’s operations. The Company incurred management fees totaling $288,300 during the year ended December 31, 2022.

11. Employee benefit plans

The Company sponsors a defined contribution retirement plan under Section 401(k) of the IRC which covers substantially all Company employees. The plan allows eligible employees to contribute portions of their annual compensation and the Company to match 25% of the first 10% of eligible employee contributions. The Company made matching contributions totaling approximately $81,900 during the year ended December 31, 2022.

The Company sponsored a non-leveraged Employee Stock Bonus Plan (ESBP) (formed as an employee stock ownership plan under the IRC) for the benefit of eligible employees. No contributions were made to the ESBP during the year ended December 31, 2022. All ESBP shares were allocated to eligible employees at the time they were contributed. The ESBP held 598,973 fully-vested shares as of January 1, 2022. Effective May 31, 2022, the Company terminated the ESBP and all shares held by the ESBP were redeemed during the year ended December 31, 2022.

The Company has a self-insured medical coverage plan for eligible employees. Under the plan, participating employees are liable for the first $4,000 (single plan) or $8,000 (family plan) for in-network medical claims and $12,000 (single plan) or $24,000 (family plan) for out-of-network medical claims, and the Company is liable for subsequent claims up to $100,000 per eligible employee. The Company has purchased stop-loss insurance coverage for claims exceeding the plan's stop-loss limitations. The Company recorded expenses

totaling approximately $1,190,000 under the plan for the year ended December 31, 2022. As of December 31, 2022, there is no liability recorded for claims incurred but not recorded as management anticipates stop loss recoveries to exceed claims payable. It is at least reasonably possible that management's estimate of claims incurred but not recorded may change in the near term and such changes could have an adverse impact on the Company's financial condition. The Company has a third party administers the plan.

12. Concentrations, risks, and uncertainties

The Company had sales totaling approximately $69.5 million to three customers for the year ended December 31, 2022. The Company also had receivables totaling approximately $11.3 million to four customers as of December 31, 2022. A reduction in sales to these customers could have significant adverse consequences on the Company’s future operations and financial position.

The Company had payments totaling approximately $7.9 million to one vendor for the year ended December 31, 2022, and had accounts payable of approximately $6.4 million to three vendors as of December 31, 2022.

As of December 31, 2022, the Company has approximately $134,000 held at financial institutions in excess of federally insured limits or not subject to federal insurance.

13. Supplemental disclosures of cash flow information and noncash investing and financing activities

Cash paid during the year ended December 31, 2022 for:

Interest $ 537,654

Income taxes 265,680

Equipment acquired through financing lease liabilities during

the year ended December 31, 2022 346,436

Cumulative effect due to change in accounting

principle impacting deferred gain on sale lease-back,

net of income taxes totaling $184,874 during the year

ended December 31, 2022 526,181

14. Subsequent Events

On July 20, 2023, Precision Metal Works, Inc. was acquired by Live Ventures Incorporated, a Nevada Corporation, for total consideration of approximately $28 million, comprised of a $25 million sales price, with additional consideration of up to $3 million paid in the form of an earn-out.

Exhibit 99.2

Unaudited Pro Forma Condensed Combined Financial Statement of Live Ventures Incorporated as of June 30, 2023, for the year ended September 30, 2022, and for the nine months ended June 30, 2023

Introduction

Precision Metal Works, Inc. Acquisition

On July 20, 2023, the Company acquired Precision Metal Works, Inc. (“PMW”), a Kentucky-based Metal Stamping and Value-Added Manufacturing Company. PMW was acquired for total consideration of approximately $28 million, comprised of a $25 million purchase price, with additional consideration of up to $3 million paid in the form of an earn-out. The purchase price was funded in part by a $2.5 million seller note, borrowings under a credit facility of $14.4 million, and proceeds under a sale-lease back transaction. The acquisition involved no issuance of stock of the Company.

The Purchase Agreement provides for the payment of “Earn-out Payments” of up to an aggregate of $3,000,000 based on the Acquired Company’s financial performance, measured by Adjusted EBITDA (as defined in the Purchase Agreement) relative to the targets for such performance over periods until June 30, 2028.

Additionally, on the Effective Date, the Acquired Company sold two real properties, one located on Allmond Ave., Louisville, Kentucky, and the other located on Commerce Blvd, Frankfort, Kentucky, to Legacy West Kentucky Portfolio, LLC (“Lessor”) for an aggregate purchase price of $14.5 million and leased back each property from Lessor pursuant to a Lease, dated the Effective Date, between Lessor and the Acquired Company (each a “Lease” and, together, the “Leases”); those transactions are referred to herein, collectively, as the “Sale-Leaseback Transactions”. One of the properties in the Sale-Leaseback Transactions was acquired on the Effective Date for $5.1 million in connection with an option of the Acquired Company to purchase that property.

Proforma information

The accompanying unaudited pro forma condensed combined financial information was prepared in accordance with Article 11 of SEC Regulation S-X. The historical consolidated financial information in the unaudited pro forma condensed combined financial information has been adjusted to give effect to pro forma events that are (1) directly attributable to the acquisition, (2) factually supportable and (3) expected to have a continuing impact on the combined results of the Company.

The unaudited pro forma condensed combined financial information does not give effect to any operating or revenue synergies that may result from the merger or the costs to achieve any synergies.

The unaudited pro forma condensed combined financial information has been presented for informational purposes only and is not necessarily indicative of what the combined Company's financial position or results of operations would have been had the transactions been completed as of the dates indicated. In addition, the unaudited pro forma condensed combined financial information does not purport to project the future financial position or operating results of the combined Company.

The unaudited pro forma condensed combined financial information contains estimated adjustments, based upon available information and certain assumptions that we believe are reasonable under the circumstances. The assumptions underlying the pro forma adjustments are described in greater detail in the accompanying notes to the unaudited pro forma combined financial information. In many cases, these assumptions were based on preliminary information and estimates.

As of June 30, 2023, proforma total assets, liabilities, and total shareholders’ equity would have been approximately $409.2 million, $306.5 million, and $102.7 million, respectively. If the transaction had occurred on October 1, 2021, the pro forma statement of operations for the year ended September 30, 2022 would have reflected net income of approximately $24.7 million. Pro forma basic and diluted income per share would have remained unchanged at per common share to $7.94 and $7.84, respectively. Additionally, the pro forma statement of operations for the nine months ended June 30, 2023 would have reflected net income of approximately $1.1 million. Pro forma basic and diluted income per share would have decreased by $1.09 and $1.08 per common share, respectively, to income per common share of $0.34.

LIVE VENTURES INCORPORATED

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEETS

JUNE 30, 2023

(dollars in thousands)

LIVE VENTURES INCORPORATED

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2022

(dollars in thousands, except per share amounts)

LIVE VENTURES INCORPORATED

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

NINE MONTHS ENDED JUNE 30, 2023

(dollars in thousands, except per share amounts)

LIVE VENTURES INCORPORATED

NOTES TO THE UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

Note 1. Basis of presentation

The unaudited pro forma condensed combined financial statements are based on Live’s and PMW’s historical financial statements as adjusted to give effect to the acquisition of PMW.

The unaudited pro forma combined statements of operations for the year ended September 30, 2022 gives effect to the PMW acquisition as if it had occurred on October 1, 2021. Live’s fiscal year was October 1, 2021 to September 30, 2022, and the combined proforma statement of operations represents this period.

The unaudited pro forma combined statements of operations for the nine months ended June 30, 2023 gives effect to the PMW acquisition as if it had occurred on October 1, 2022. The statement of operations for “Live Historical” includes proforma financial results for the period of October 1, 2022 to June 30, 2023. The statement of operations for “Precision Metal Works Historical” includes the actual results for PMW for the period of October 1, 2022 to June 30, 2023.

The unaudited pro forma combined balance sheets as of June 30, 2023 give effect to the PMW acquisition as if it had occurred on June 30, 2023.

Note 2. Preliminary purchase price allocation

The following table shows the preliminary allocation of the purchase price for PMW to the acquired identifiable assets, liabilities assumed and pro forma goodwill (dollars in thousands):

Note 3. Pro forma adjustments

The pro forma adjustments are based on our preliminary estimates and assumptions that are subject to change. The following adjustments have been reflected in the unaudited pro forma condensed combined financial information:

Adjustments to the pro forma condensed combined balance sheet

(a)Reflects the step-up in fair value of the acquired inventory.

(b)Reflects the step-up in fair value of the acquired property, plant and equipment based on an independent third-party appraisal, as well as a $5.0 million net impact of a building purchased and buildings subsequently sold and leased back. Under the guidance of ASC 842 (“Leases”), the Company has

determined that the buildings are financing Right-of-Use assets. The Company has made an accounting election to record financing Right-of-Use assets as property, plant and equipment.

(c)Reflects the fair value of operating Right-of-Use assets acquired and operating lease liabilities assumed as required by ASC 842 (“Leases”).

(d)Reflect the fair value of intangible assets acquired based on independent third-party appraisal.

(e)Reflects the preliminary estimate of goodwill, which represents the excess of the purchase price over the fair value of PMW’s identifiable assets acquired and liabilities assumed as presented in Note 2.

(f)Reflects PMW’s current and long-term debt and the seller’s note to finance the acquisition.

(g)Reflects the fair value of the earn-out based on independent third-party appraisal.

(h)Reflects the elimination of PMW’s shareholders’ equity.

(i)Reflects the closing costs paid and expensed by PMW relating to the closing of the acquisition and the sales and leaseback transaction.

Adjustments to the pro forma condensed combined statement of operations

(a)Reflects amortization expense of intangible assets based on the preliminary fair value at acquisition date, and the closing costs paid and expensed by PMW relating to the closing of the acquisition and the sales and leaseback transaction.

(b)Reflects interest expense that would have been incurred as a result of the acquisition financing obtained by the Company.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

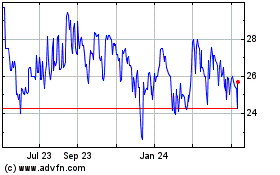

Live Ventures (NASDAQ:LIVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

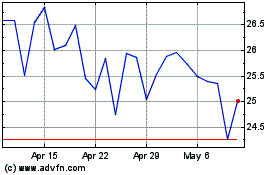

Live Ventures (NASDAQ:LIVE)

Historical Stock Chart

From Apr 2023 to Apr 2024