UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: October, 2023

Commission file number: 001-38350

Lithium Americas (Argentina) Corp.

(Translation of Registrant's name into English)

900 West Hastings Street, Suite 300,

Vancouver, British Columbia,

Canada V6C 1E5

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [ ] Form 40-F [X]

EXHIBIT INDEX

# Portions of this exhibit have been redacted in compliance with Items 601(a)(6) or 601(b) of Regulation S-K. The Company agrees to furnish a copy of any omitted schedule or exhibit to the SEC upon its request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Lithium Americas (Argentina) Corp.

|

|

|

(Registrant)

|

|

|

|

|

|

By:

|

"John Kanellitsas"

|

|

|

Name:

|

John Kanellitsas

|

|

|

Title:

|

President and Interim Chief Executive Officer

|

Dated: October 4, 2023

NEWS RELEASE

Lithium Americas Closes Separation

to Create Two Leading Lithium Companies

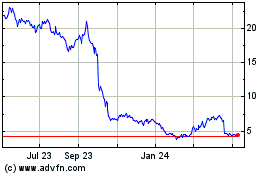

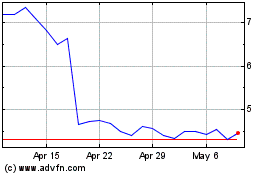

October 3, 2023 - Vancouver, Canada: Lithium Americas Corp. ("Lithium Americas" or the "Company"), now Lithium Americas (Argentina) Corp. ("Lithium Argentina") (TSX: LAAC) (NYSE: LAAC) and a new Lithium Americas Corp. ("Lithium Americas (NewCo)") (TSX: LAC) (NYSE: LAC) today jointly announced the completion of the reorganization of Lithium Americas into two independent publicly traded companies, implemented by way of statutory plan of arrangement (the "Separation").

"We look forward to seeing these two market-leading companies thrive independently," said Jonathan Evans, President and CEO of Lithium Americas (NewCo) and former President and CEO of Lithium Americas. "The Separation offers investors two unique and highly focused pure-play lithium companies with world-class assets in our respective regions of operation."

"I am extremely proud of the Lithium Argentina and Lithium Americas (NewCo) teams for their hard work and dedication in redesigning these companies with the right management teams and resources to flourish independently," said John Kanellitsas, Executive Chairman, President and Interim CEO of Lithium Argentina and former Executive Vice Chair of Lithium Americas. "The closing of this Separation is a pivotal moment in allowing each company to sharpen its focus and pursue independent and unique growth opportunities within the lithium industry."

As of close of trading on Tuesday, October 3, 2023 (the "Effective Date"), common shares of Lithium Americas ("Lithium Americas Shares") have concluded regular-way trading on the Toronto Stock Exchange ("TSX") and New York Stock Exchange ("NYSE") under the symbol "LAC," and Lithium Argentina common shares ("Lithium Argentina Shares") and Lithium Americas (NewCo) common shares ("Lithium Americas (NewCo) Shares") have concluded trading on a "when-issued" basis on the NYSE.

At the start of trading on Wednesday, October 4, 2023, Lithium Argentina Shares and Lithium Americas (NewCo) Shares will commence trading on the TSX and NYSE on a regular-way basis under the ticker symbols "LAAC" and "LAC," respectively.

REGISTERED SHAREHOLDERS

Registered shareholders of Lithium Americas ("LAC Registered Shareholders") are reminded to submit their certificates or direct registration statements ("DR Statements") representing their Lithium Americas Shares with a duly completed letter of transmittal ("Letter of Transmittal") to Computershare Investor Services Inc., as depositary, in order to receive DR Statements representing their Lithium Argentina Shares and Lithium Americas (NewCo) Shares. The Letter of Transmittal is filed on Lithium Argentina's SEDAR profile (www.sedarplus.ca).

LAC Registered Shareholders who fail to submit their certificates or DR Statements and their Letter of Transmittals on or before October 3, 2026, the third anniversary of the Effective Date of the Separation, will cease to have any right or claim against or interest of any kind or nature in Lithium Argentina or Lithium Americas (NewCo). Accordingly, persons who tender certificates or DR Statements for Lithium Americas Shares after October 3, 2026 will not receive any Lithium Argentina Shares or Lithium Americas (NewCo) Shares, will not own any interest in Lithium Argentina or Lithium Americas (NewCo) and will not be paid any cash or other compensation in lieu thereof.

GM TRANSACTION - LITHIUM AMERICAS (NEWCO)

Upon completion of the Separation, General Motors Holdings LLC ("GM") executed a second tranche subscription agreement (pursuant to which GM will, subject to the fulfillment of certain conditions precedent, purchase US$329,852,134.38 in Lithium Americas (NewCo) Shares). GM also executed an investor rights agreement with Lithium Americas (NewCo) and GM's offtake agreement with the Company was assigned to Lithium Americas (NewCo). The second tranche alternative exercise warrants previously issued to GM by the Company and the second tranche subscription agreement between GM and the Company are no longer effective in accordance with the terms of those agreements. GM is the largest shareholder of both Lithium Americas (NewCo) and Lithium Argentina with approximately 9.4% of the shares of each company.

CONVERTIBLE NOTES - LITHIUM ARGENTINA

The Separation constitutes a Make-Whole Fundamental Change as defined in the indenture, dated December 6, 2021 (the "Indenture"), between the Company (now Lithium Argentina) and Computershare Trust Company N.A., governing the Company's 1.75% Convertible Senior Notes due 2027 (the "Notes"). The effective date (as defined in the Indenture) of such Make-Whole Fundamental Change is October 3, 2023. In addition, the Separation will result in an adjustment to the conversion rate of the Notes. Notices will be sent to the Depository Trust Company ("DTC") as the holder of the Notes and filed on SEDAR and EDGAR regarding (i) the number of additional Lithium Argentina Shares by which the conversion rate of the Notes may be increased per US$1,000 principal amount of Notes with respect to conversions occurring in connection with such Make-Whole Fundamental Change being nil, as the last reported sale prices of the Company's common shares over the five trading day period ending on, and including, the trading day immediately preceding the applicable effective date Make-Whole Fundamental Change, was less than US$34.89, and (ii) the adjustment to the conversion rate for the Notes as a result of the Separation.

|

ABOUT LITHIUM ARGENTINA

Lithium Argentina owns a 44.8% interest in the Caucharí-Olaroz project located in Jujuy, Argentina. The company is focused on advancing its Caucharí-Olaroz project toward full production capacity and exploring regional growth opportunities in the Pastos Grandes basin with its Pastos Grandes and Sal de la Puna projects (100% and 65% owned, respectively).

Lithium Argentina contact:

Kelly O'Brien, VP Investor Relations and ESG

Telephone: +54-11-52630616

Email: ir@lithium-argentina.com

Website: www.lithium-argentina.com

|

|

ABOUT LITHIUM AMERICAS (NEWCO)

Lithium Americas (NewCo) owns the Thacker Pass project located in Nevada, which hosts the largest known Measured and Indicated lithium resource in the United States. The company is focused on advancing construction at Thacker Pass; construction commenced in early 2023. Thacker Pass is expected to employ over 1,000 workers during construction and create 500 permanent jobs during operations over its 40-year mine life.

Lithium Americas (NewCo) contact:

Virginia Morgan, VP Investor Relations and ESG

Telephone: 778-726-4070

Email: ir@lithiumamericas.com

Website: www.lithiumamericas.com

|

FORWARD-LOOKING INFORMATION

Certain statements in this release constitute "forward-looking statements" within the meaning of applicable United States securities legislation and "forward-looking information" under applicable Canadian securities legislation (collectively, "forward-looking statements"). Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, events, performance or achievements of the Separation and of Lithium Americas (NewCo) / Lithium Argentina (collectively the "Entities" and individually, an "Entity"), its projects, or industry results, to be materially different from any future results, events, performance or achievements expressed or implied by such forward-looking statements. Such statements can be identified by the use of words such as "may," "would," "could," "will," "intend," "expect," "believe," "plan," "anticipate," "estimate," "schedule," "forecast," "predict" and other similar terminology, or state that certain actions, events or results "may," "could," "would," "might" or "will" be taken, occur or be achieved. These statements reflect the Entity's current expectations regarding future events, financial or operating performance and results, and speak only as of the date of this release. Such statements include without limitation, statements with respect to the expected benefits of the Separation for each business and the Entity's shareholders and other stakeholders, the strategic advantages, future opportunities and focus of each business and expectations regarding the status of development of the Entity's projects, and expectation for the completion of the second tranche investment by GM; statements with respect to expectations around Thacker Pass supporting North American supply chain, the number of workers it will employ and its expected mine life.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance, events or results and will not necessarily be accurate indicators of whether or not such events or results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to, the performance, the operations and financial condition of Lithium Americas (NewCo) and Lithium Argentina as separately traded public companies, including the reduced geographical and property portfolio diversification resulting from the Separation; the impact of the Separation on the trading prices for, and market for trading in, the shares of the Entities; the potential for significant tax liability for a violation of the tax-deferred spinoff rules applicable in Canada and the United States; uncertainties with realizing the potential benefits of the Separation; risks with respect to Lithium Americas (NewCo) not meeting the conditions with respect to GM's second tranche investment and other risks with respect to any delays in completing such transaction; risks associated with mining project development, achieving anticipated milestones and budgets as planned, and meeting expected timelines; risks inherent in litigation or rulings that are adverse for an Entity or its projects; maintaining local community support in the regions where an Entity's projects are located; changing social perceptions and their impact on project development and litigation; ongoing global supply chain disruptions and their impact on developing an Entity's projects; availability of personnel, supplies and equipment; the impact of inflation or changing economic conditions on an Entity, its projects and their feasibility; any impacts of COVID-19 or an escalation thereof on the business of an Entity; unanticipated changes in market price for an Entity's shares; changes to an Entity's current and future business plans and the strategic alternatives available to the Entity; industry and stock market conditions generally; demand, supply and pricing for lithium; and general economic and political conditions in Canada, the United States, Argentina and other jurisdictions where an Entity conducts business. Additional information about certain of these assumptions and risks and uncertainties is contained in the Entity's filings with securities regulators, including the Company's management information circular dated June 16, 2023 available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

Although the forward-looking statements contained in this release are based upon what management of the applicable Entity believes are reasonable assumptions as of the date hereof, there can be no assurance that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, none of the Entities assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this release.

LITHIUM AMERICAS (ARGENTINA) CORP.

LITHIUM AMERICAS CORP.

NOTICE OF CHANGE IN CORPORATE STRUCTURE

Pursuant to Section 4.9 of National Instrument 51-102

1. Names of the Parties to the Transaction

Lithium Americas (Argentina) Corp. ("Lithium Argentina"), formerly Lithium Americas Corp. ("Former LAC")

Lithium Americas Corp. ("Lithium Americas (Newco)"), formerly 1397468 B.C. Ltd. ("Spinco")

2. Effective Date of the Transaction

October 3, 2023.

3. Description of the Transaction

On October 3, 2023, Former LAC was reorganized into two independent companies (the "Separation"), Lithium Argentina and Lithium Americas (Newco), by way of a plan of arrangement under the Business Corporations Act (British Columbia) (the "Arrangement"). Pursuant to the Arrangement, the North American business of Former LAC, which includes Former LAC's ownership and rights in the Thacker Pass lithium project, its investment in Green Technology Metals Limited and Ascend Elements Inc., among other things, was transferred to Lithium Americas (Newco).

In connection with the Arrangement, holders of common shares of Former LAC ("Former LAC Shares") will be entitled to receive one common share of Lithium Argentina and one common share of Lithium Americas (Newco) for every Former LAC Share held immediately before the effective time of the Arrangement.

In connection with the Arrangement, the name of Lithium Argentina was changed from "Lithium Americas Corp." to "Lithium Americas (Argentina) Corp." and the name of Lithium Americas (Newco) was changed from "1397468 B.C. Ltd." to "Lithium Americas Corp.".

For additional information relating to the Arrangement, please refer to the management information circular of Former LAC dated June 16, 2023 (the "Circular"), which is available on the SEDAR+ profile of Lithium Argentina at www.sedarplus.ca.

4. Name of each Party that Ceased to be a Reporting Issuer subsequent to Event and of each Continuing Entity

Lithium Argentina will continue to be a reporting issuer in British Columbia, Alberta, Manitoba, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nova Scotia, Nunavut, Ontario, Prince Edward Island, Québec, Saskatchewan, Yukon (collectively, the "Reporting Jurisdictions").

As a result of the completion of the Arrangement, Lithium Americas (Newco) became a reporting issuer in all of the Reporting Jurisdictions, except Ontario where it will become a reporting issuer once its shares are listed and posted for trading on the Toronto Stock Exchange, which is expected to occur on October 4, 2023.

- 2 -

5. The date of Lithium Americas (Newco)'s First Financial Year-End after the Transaction

Lithium Americas (Newco)'s first financial year-end will be December 31, 2023.

6. Periods for Filing Interim Financial Statements and Annual Financial Statements after the Transaction, if Section 4.9(a) or 4.9(b)(ii) of NI 51-102 applies

Lithium Americas (Newco) will be required to file interim financial statements for the period from incorporation on January 23, 2023 to June 30, 2023. Lithium Americas (Newco) will also be required to file interim financial statements from period from July 1, 2023 to September 30, 2023. Lithium Americas (Newco) will then be required to file the year-end financial statements for the period from incorporation to December 31, 2023.

7. Documents Filed in respect of the Transaction if Section 4.9(a) or 4.9(b)(ii) of NI 51- 102 applies

The following documents describing the Arrangement were filed on SEDAR+ and are available under Lithium Argentina's profile at www.sedarplus.ca:

1. News release dated November 3, 2022 announcing the intention of Former LAC to proceed with the Separation;

2. News release dated May 15, 2023 announcing board approval of the Arrangement;

3. Notice to trustee and holders of convertible notes of Former LAC ("Noteholders") dated May 19, 2023, regarding events resulting in conversion rate adjustment;

4. Material change report dated May 25, 2023 with respect to board approval of the Arrangement;

5. Amended and restated notice to trustee and Noteholders dated May 30, 2023, regarding events resulting in conversion rate adjustment;

6. Amended and restated arrangement agreement between Former LAC and Spinco dated June 14, 2023 detailing the Arrangement (the "Arrangement Agreement");

7. Circular;

8. News release dated June 26, 2023 announcing the filing of the Circular in connection with the Separation and the annual general and special meeting of LAC;

9. News release dated July 31, 2023 announcing shareholder approval of the Arrangement, among other things;

10. Notice to trustee and Noteholders dated August 18, 2023 of event triggering right to convert;

11. News release dated September 28 announcing the expected effective date of the Arrangement and other matters;

12. Amended Notice to trustee and Noteholders dated October 2, 2023;

13. Notice of Make-Whole Fundamental Change to Noteholders dated October 3, 2023; and

- 3 -

14. News release dated October 3, 2023 with respect to the closing of the Arrangement.

The following documents describing the Arrangement were filed on SEDAR+ and are available under Lithium Americas (Newco)'s profile at www.sedarplus.ca:

1. Arrangement Agreement; and

2. News release dated October 3, 2023 with respect to the closing of the Arrangement.

Dated: October 3, 2023

LITHIUM AMERICAS (ARGENTINA) CORP.

SECOND AMENDED AND RESTATED EQUITY INCENTIVE PLAN

(as amended by the Board on May 15, 2023)

PART 1

PURPOSE

1.1 Purpose

The purpose of this Plan is to secure for the Company and its shareholders the benefits inherent in share ownership by the employees and directors of the Company and its affiliates who, in the judgment of the Board, will be largely responsible for its future growth and success. It is generally recognized that equity incentive plans of the nature provided for herein aid in retaining and encouraging employees and directors of exceptional ability because of the opportunity offered them to acquire a proprietary interest in the Company.

1.2 Available Awards

Awards that may be granted under this Plan include:

(a) Options;

(b) Deferred Share Units; and

(c) Restricted Share Rights (time based or in the form of Performance Share Units).

PART 2

INTERPRETATION

2.1 Definitions

(a) "Affiliate" has the meaning set forth in the BCA.

(b) "Arrangement Deferred Share Units" means Deferred Share Units issued as part of the Plan of Arrangement in partial exchange for Outstanding Deferred Share Units.

(c) "Arrangement Departing Participant" has such meaning ascribed thereto in Section 9.2 of this Plan.

(d) "Arrangement Effective Date" means the Effective Date as such term is defined in the Plan of Arrangement.

(e) "Arrangement Effective Time" means the Effective Time as such term is defined in the Plan of Arrangement.

(f) "Arrangement Restricted Share Rights" means Restricted Share Rights issued as part of the Plan of Arrangement in partial exchange for Outstanding Restricted Share Rights.

(g) "Award" means any right granted under this Plan, including Options, Restricted Share Rights and Deferred Share Units.

(h) "BCA" means the Business Corporations Act (British Columbia).

(i) "Blackout Period" means a period in which the trading of Shares or other securities of the Company is restricted under the Company's Corporate Disclosure, Confidentiality and Securities Trading Policy, or under any similar policy of the Company then in effect.

(j) "Board" means the board of directors of the Company.

(k) "Cashless Surrender Right" has the meaning set forth in Section 3.5 of this Plan.

(l) "CEO" means the Chief Executive Officer of the Company.

(m) "Change of Control" means, for greater certainty except for any transaction under the Plan of Arrangement, the occurrence and completion of any one or more of the following events:

(A) the Company shall not be the surviving entity in a merger, amalgamation or other reorganization (or survives only as a subsidiary of an entity other than a previously wholly-owned subsidiary of the Company);

(B) the Company shall sell or otherwise transfer, including by way of the grant of a leasehold interest or joint venture interest (or one or more subsidiaries of the Company shall sell or otherwise transfer, including without limitation by way of the grant of a leasehold interest or joint venture interest) property or assets (i) aggregating more than 50% of the consolidated assets (measured by either book value or fair market value) of the Company and its subsidiaries as at the end of the most recently completed financial year of the Company or (ii) which during the most recently completed financial year of the Company generated, or during the then current financial year of the Company are expected to generate, more than 50% of the consolidated operating income or cash flow of the Company and its subsidiaries, to any other person or persons (other than one or more Designated Affiliates of the Company), in which case the Change of Control shall be deemed to occur on the date of transfer of the assets representing one dollar more than 50% of the consolidated assets in the case of clause (i) or 50% of the consolidated operating income or cash flow in the case of clause (ii), as the case may be;

(C) the Company is to be dissolved and liquidated;

(D) any person, entity or group of persons or entities acting jointly or in concert acquires or gains ownership or control (including, without limitation, the power to vote) more than 50% of the Company's outstanding voting securities; or

(E) as a result of or in connection with: (i) the contested election of directors, or; (ii) a consolidation, merger, amalgamation, arrangement or other reorganization or acquisitions involving the Company or any of its Affiliates and another corporation or other entity in office immediately preceding such election or appointment, the nominees named in the most recent management information circular of the Company for election to the Board shall not constitute a majority of the Board (unless in the case of (ii) such election or appointment is approved by 50% or more of the Board prior to the completion of such transaction).

For the purposes of the foregoing, "voting securities" means Shares and any other shares entitled to vote for the election of directors and shall include any securities, whether or not issued by the Company, which are not shares entitled to vote for the election of directors but are convertible into or exchangeable for shares which are entitled to vote for the election of directors, including any options or rights to purchase such shares or securities.

(n) "Code" means the United States Internal Revenue Code of 1986, as amended, and any applicable United States Treasury Regulations and other binding guidance thereunder.

(o) "Committee" has the meaning attributed thereto in Section 8.1.

(p) "Company" means Lithium Americas Corp. (and from and after the completion of the Plan of Arrangement the same corporation as renamed pursuant to the Plan of Arrangement, if applicable), a company existing under the BCA and its successors.

(q) "Deferred Payment Date" for a Participant means the date after the Restricted Period which is the earlier of (i) the date which the Participant has elected to defer receipt of Shares underlying the Restricted Share Rights in accordance with Section 4.4 of this Plan; and (ii) the Participant's Separation Date.

(r) "Deferred Share Unit" means the agreement by the Company to pay, and the right of the Participant to receive, a Deferred Share Unit Payment for each Deferred Share Unit held, evidenced by way of book-keeping entry in the books of the Company and administered pursuant to this Plan.

(s) "Deferred Share Unit Grant Letter" has the meaning ascribed thereto in Section 5.2 of this Plan.

(t) "Deferred Share Unit Payment" means, subject to any adjustment in accordance with Section 5.5 of this Plan, the issuance to a Participant of one previously unissued Share for each whole Deferred Share Unit credited to such Participant.

(u) "Delegated Options" has the meaning ascribed thereto in Section 3.3 of this Plan.

(v) "Designated Affiliate" means affiliates of the Company designated by the Committee from time to time for purposes of this Plan.

(w) "Director Retirement" in respect of a Participant, means the Participant ceasing to hold any directorships with the Company, any Designated Affiliate and any entity related to the Company for purposes of the Income Tax Act (Canada) after attaining a stipulated age in accordance with the Company's normal retirement policy, or earlier with the Company's consent.

(x) "Director Separation Date" means the date that a Participant ceases to hold any directorships with the Company and any Designated Affiliate due to a Director Retirement or Director Termination and also ceases to serve as an employee or consultant with the Company, any Designated Affiliate and any entity related to the Company for the purposes of the Income Tax Act (Canada).

(y) "Director Termination" means the removal of, resignation or failure to re-elect the Eligible Director (excluding a Director Retirement) as a director of the Company, a Designated Affiliate and any entity related to the Company for purposes of the Income Tax Act (Canada).

(z) "Eligible Directors" means the directors of the Company or any Designated Affiliate who are, as such, eligible for participation in this Plan.

(aa) "Eligible Employees" means employees (including employees who are officers and directors) of the Company or any Designated Affiliate thereof, whether or not they have a written employment contract with Company, determined by the Committee as employees eligible for participation in this Plan. Eligible Employees shall include Service Providers eligible for participation in this Plan as determined by the Committee.

(bb) "Fair Market Value" means, with respect to a Share subject to an Award, the volume weighted average price of the Shares on the New York Stock Exchange (or the Toronto Stock Exchange if the Company is not then listed on the New York Stock Exchange) for the five (5) days on which Shares were traded immediately preceding the date in respect of which Fair Market Value is to be determined or, if the Shares are not, as at that date listed on the New York Stock Exchange or the Toronto Stock Exchange, on such other exchange or exchanges on which the Shares are listed on that date. If the Shares are not listed and posted for trading on an exchange on such day, the Fair Market Value shall be such price per Share as the Board, acting in good faith, may determine.

(cc) "Form S-8" means the Form S-8 registration statement promulgated under the U.S. Securities Act.

(dd) "Good Reason" in respect of an employee or officer of the Company or any of its Affiliates, means a material adverse change imposed by the Company or an Affiliate (as the case may be), without the consent of such employee or officer, as applicable, in position, responsibilities, salary, benefits, perquisites, as they exist immediately prior to the Change of Control, or a material diminution of title imposed by the Company or the Affiliate (as the case may be), as it exists immediately prior to the Change of Control, and includes other events defined as "Good Reason" under any employment agreement of such employee or officer with the Company or its Affiliate.

(ee) "Insider" has the meaning set out in the TSX Company Manual.

(ff) "Option" means an option to purchase Shares granted under the terms of this Plan.

(gg) "Option Period" means the period during which an Option is outstanding.

(hh) "Option Shares" has the meaning set forth in Section 3.5 of this Plan.

(ii) "Optionee" means an Eligible Employee or Eligible Director to whom an Option has been granted under the terms of this Plan.

(jj) "Outstanding Deferred Share Units" means Deferred Share Units outstanding immediately prior to the Arrangement Effective Time which, as part of the Plan of Arrangement, were exchanged for Arrangement Deferred Share Units and cancelled.

(kk) "Outstanding Restricted Share Rights" means Restricted Share Rights outstanding immediately prior to the Arrangement Effective Time which, as part of the Plan of Arrangement, were exchanged for Arrangement Restricted Share Rights and cancelled.

(ll) "Participant" means an Eligible Employee or Eligible Director who participates in this Plan.

(mm) "Performance Share Units" means Restricted Share Rights that are subject to performance conditions and/or multipliers and designated as such in accordance with Section 4.1 of this Plan.

(nn) "Plan" means this second amended and restated equity incentive plan, as it may be further amended and restated from time to time.

(oo) "Plan of Arrangement" means the plan of arrangement proposed under section 288 of the BCA which has become effective in accordance with the terms of an amended and restated arrangement agreement between the Company and Spinco dated June 14, 2023.

(pp) "Restricted Period" means any period of time that a Restricted Share Right is not vested and the Participant holding such Restricted Share Right remains ineligible to receive the relevant Shares, determined by the Board in its absolute discretion, however, such period of time may be reduced or eliminated from time to time and at any time and for any reason as determined by the Board, including, but not limited to, circumstances involving death or disability of a Participant.

(qq) "Restricted Share Right" or "Restricted Share Units" has such meaning as ascribed to such term at Section 4.1 of this Plan.

(rr) "Restricted Share Right Grant Letter" has the meaning ascribed to such term in Section 4.2 of this Plan.

(ss) "Retirement" in respect of an Eligible Employee, means the Eligible Employee ceasing to hold any employment with the Company or any Designated Affiliate after attaining a stipulated age in accordance with the Company's normal retirement policy, or earlier with the Company's consent.

(tt) "Separation Date" means the date that a Participant ceases to be an Eligible Director or Eligible Employee.

(uu) "Service Provider" means any person or company engaged by the Company or a Designated Affiliate to provide services for an initial, renewable or extended period of 12 months or more and that complies with the definition of "consultant" or "advisor" as set forth in Form S-8.

(vv) "Shares" means the common shares of the Company.

(ww) "Specified Employee" means a U.S. Taxpayer who meets the definition of "specified employee", as defined in Section 409A(a)(2)(B)(i) of the Internal Revenue Code.

(xx) "Spinco" means, prior to the completion of the Plan of Arrangement, 1397468 B.C. Ltd. (and from and after the completion of the Plan of Arrangement the same corporation as renamed pursuant to the Plan of Arrangement), a corporation incorporated under the BCA and its successors.

(yy) "Spinco Designated Affiliate" means affiliates of Spinco designated by the board of directors of Spinco or the committee of the board of directors of Spinco authorized to administer the Spinco Equity Incentive Plan in accordance with its terms.

(zz) "Spinco Equity Incentive Plan" has the meaning ascribed thereto in the Plan of Arrangement.

(aaa) "Spinco Service Provider" has such meaning as ascribed to such term at Section 9.2 of this Plan.

(bbb) "Termination" means the termination of the employment (or consulting services) of an Eligible Employee with or without cause by the Company or a Designated Affiliate or the cessation of employment (or consulting services) of the Eligible Employee with the Company or a Designated Affiliate as a result of resignation or otherwise, other than the Retirement of the Eligible Employee.

(ccc) "Triggering Event" means (i) in the case of a director of the Company, the Director Termination of such director; (ii) in the case of an employee of the Company or any of its Affiliates, the termination of the employment of the employee without cause, as the context requires by the Company or the Affiliate or in the case of an officer of the Company or any of its Affiliates, the removal of or failure to re-elect or re-appoint the individual without cause as an officer of the Company or an Affiliate thereof; (iii) in the case of an employee or an officer of the Company or any of its Affiliates, his or her resignation following the occurrence of a Good Reason; (iv) in the case of a Service Provider, the termination of the services of the Service Provider by the Company or any of its Affiliates.

(ddd) "U.S. Securities Act" means the United States Securities Act of 1933, as amended.

(eee) "US Taxpayer" means a Participant who is a US citizen, US permanent resident or other person who is subject to taxation on their income under the United States Internal Revenue Code of 1986.

2.2 Interpretation

(a) This Plan is created under and is to be governed, construed and administered in accordance with the laws of the Province of British Columbia and the federal laws of Canada applicable therein.

(b) Whenever the Board or Committee is to exercise discretion in the administration of the terms and conditions of this Plan, the term "discretion" means the sole and absolute discretion of the Board or Committee.

(c) As used herein, the terms "Part" or "Section" mean and refer to the specified Part or Section of this Plan, respectively.

(d) Where the word "including" or "includes" is used in this Plan, it means "including (or includes) without limitation".

(e) Words importing the singular include the plural and vice versa and words importing any gender include any other gender.

(f) Unless otherwise specified, all references to money amounts are to Canadian dollars.

PART 3

STOCK OPTIONS

3.1 Participation

The Company may from time to time grant Options to Participants pursuant to this Plan.

3.2 Price

The exercise price per Share of any Option shall be not less than one hundred per cent (100%) of the Fair Market Value of the Share on the date of grant.

3.3 Grant of Options

The Board, on the recommendation of the Committee, may at any time authorize the granting of Options to such Participants as it may select for the number of Shares that it shall designate, subject to the provisions of this Plan. The Board may also, by way of Board resolution, delegate to the CEO the authority to grant any of a designated number of Options (such number to be specified by the Board in the aforementioned resolution) to Eligible Employees, other than Eligible Employees who are officers or directors of the Company (such Options, the "Delegated Options"). The date of grant of an Option shall be (i) the date such grant was approved by the Committee for recommendation to the Board, provided the Board approves such grant; or (ii) for a grant of an Option not approved by the Committee for recommendation to the Board, the date such grant was approved by the Board; or (iii) in respect of Delegated Options, the date such grant is made by the CEO. Notwithstanding the foregoing, the Board may authorize the grant of Options at any time with such grant to be effective at a later date and the corresponding determination of the exercise price to be done at such date to accommodate any Blackout Period or such other circumstances where such delayed grant is deemed appropriate, and the date of grant of such Options shall then be the effective date of the grant.

Each Option granted to a Participant shall be evidenced by a stock option grant letter or agreement with terms and conditions consistent with this Plan and as approved by the Board on the recommendation of the Committee, or, in respect of Delegated Options, by the CEO (and in all cases which terms and conditions need not be the same in each case and may be changed from time to time, subject to Section 7.8 of this Plan, and the approval of any material changes by the Toronto Stock Exchange or such other exchange or exchanges on which the Shares are then traded).

3.4 Terms of Options

The Option Period shall be five (5) years from the date such Option is granted, or such greater or lesser duration as the Board, on the recommendation of the Committee, or in the case of Delegated Options, the CEO, may determine at the date of grant, and may thereafter be reduced with respect to any such Option as provided in Section 3.6 hereof covering termination of employment or death of the Optionee; provided, however, that at any time the expiry date of the Option Period in respect of any outstanding Option under this Plan should be determined to occur either during a Blackout Period or within ten (10) business days following the expiry of the Blackout Period, the expiry date of such Option Period shall be deemed to be the date that is the tenth (10th) business day following the expiry of the Blackout Period.

Unless otherwise determined from time to time by the Board, on the recommendation of the Committee, or, in respect of Delegated Options, by the CEO, Options shall vest and may be exercised (in each case to the nearest full Share) during the Option Period as follows:

(a) at any time during the first six (6) months of the Option Period, the Optionee may purchase up to 25% of the total number of Shares reserved for issuance pursuant to his or her Option; and

(b) at any time during each additional six (6) month period of the Option Period the Optionee may purchase an additional 25% of the total number of Shares reserved for issuance pursuant to his or her Option plus any Shares not purchased in accordance with the preceding subsection (a) and this subsection (b) until, after the 18th month of the Option Period, 100% of the Option will be exercisable.

Except as set forth in Section 3.6, no Option may be exercised unless the Optionee is at the time of such exercise:

(a) in the case of an Eligible Employee, in the employ (or retained as a Service Provider) of the Company or a Designated Affiliate and shall have been continuously so employed or retained since the grant of the Option; or

(b) in the case of an Eligible Director, a director of the Company or a Designated Affiliate and shall have been such a director continuously since the grant of the Option.

The exercise of any Option will be contingent upon the Optionee having entered into an Option agreement with the Company on such terms and conditions as have been approved by the Board, on the recommendation of the Committee, or, in respect of the Delegated Options, by the CEO, and which in any case incorporates by reference the terms of this Plan. The exercise of any Option will, subject to Section 3.5, also be contingent upon receipt by the Company of cash payment of the full purchase price of the Shares being purchased.

3.5 Cashless Surrender Right

Participants have the right (the "Cashless Surrender Right"), in lieu of the right to exercise an Option, to surrender such Option in whole or in part by notice in writing delivered by the Participant to the Company electing to exercise the Cashless Surrender Right, and, in lieu of receiving the full number of Shares (the "Option Shares") to which such surrendered Option (or portion thereof) relates, to receive the number of Shares, disregarding fractions, which is equal to the quotient obtained by:

(a) subtracting the applicable Option exercise price per Share from the Fair Market Value per Share on the business day immediately prior to the exercise of the Cashless Surrender Right and multiplying the remainder by the number of Option Shares; and

(b) dividing the product obtained under subsection 3.5(a) by the Fair Market Value per Share on the business day immediately prior to the exercise of the Cashless Surrender Right.

If a Participant exercises a Cashless Surrender Right in connection with an Option, it is exercisable only to the extent and on the same conditions that the related Option is exercisable under this Plan.

3.6 Effect of Termination of Employment or Death

If an Optionee:

(a) dies while employed by a Service Provider to, or while a director of, the Company or a Designated Affiliate, any Option held by him or her at the date of death shall become exercisable in whole or in part, but only by the person or persons to whom the Optionee's rights under the Option shall pass by the Optionee's will or applicable laws of descent and distribution. Unless otherwise determined by the Board, on the recommendation of the Committee, all such Options shall be exercisable only to the extent that the Optionee was entitled to exercise the Option at the date of his or her death and only for 12 months after the date of death or prior to the expiration of the Option Period in respect thereof, whichever is sooner; and

(b) ceases to be employed by a Service Provider to, or act as a director of, the Company or a Designated Affiliate for cause, no Option held by such Optionee will, unless otherwise determined by the Board, on the recommendation of the Committee, be exercisable following the date on which such Optionee ceases to be so engaged. If an Optionee ceases to be employed by, a Service Provider to, or act as a director of, the Company or a Designated Affiliate for any reason other than cause then, unless otherwise determined by the Board, on the recommendation of the Committee, any Option held by such Optionee at the effective date thereof shall become exercisable for a period of up to 12 months thereafter or prior to the expiration of the Option Period in respect thereof, whichever is sooner.

3.7 Effect of Change of Control

If a Triggering Event occurs within the 12-month period immediately following a Change of Control pursuant to the provisions of Section 2.1(m)(A), (B), (D) or (E), all outstanding Options shall vest immediately and become exercisable on the date of such Triggering Event.

In the event of a Change of Control pursuant to the provisions of Section 2.1(m)(C), all Options outstanding shall immediately vest and become exercisable on the date of such Change of Control.

The provisions of this Section 3.7 shall be subject to the terms of any employment agreement between the Participant and the Company.

3.8 Effect of Amalgamation or Merger

Subject to Section 3.7, if the Company amalgamates or otherwise completes a plan of arrangement or merges with or into another corporation, any Shares receivable on the exercise of an Option shall be converted into the securities, property or cash which the Participant would have received upon such amalgamation, arrangement or merger if the Participant had exercised his or her Option immediately prior to the record date applicable to such amalgamation, arrangement or merger, and the option price shall be adjusted appropriately by the Board and such adjustment shall be binding for all purposes of this Plan.

PART 4

RESTRICTED SHARE RIGHTS AND PERFORMANCE SHARE UNITS

4.1 Participants

The Board has the right to grant, in its sole and absolute discretion, to any Participant, rights to receive any number of fully paid and non-assessable Shares ("Restricted Share Rights" or "Restricted Share Units") as a discretionary payment in consideration of past services to the Company or as an incentive for future services, subject to this Plan and with such additional provisions and restrictions as the Board may determine. Restricted Share Rights may be granted subject to performance conditions and/or performance multipliers, in which case such Restricted Share Rights may be designated as "Performance Share Units".

4.2 Restricted Share Right Grant Letter

Each grant of a Restricted Share Right under this Plan shall be evidenced by a grant letter or agreement (a "Restricted Share Right Grant Letter") issued to the Participant by the Company. Such Restricted Share Right Grant Letter shall be subject to all applicable terms and conditions of this Plan and may be subject to any other terms and conditions which are not inconsistent with this Plan and which the Board, on the recommendation of the Committee, deems appropriate for inclusion in a Restricted Share Right Grant Letter. The provisions of the various Restricted Share Right Grant Letters issued under this Plan need not be identical.

4.3 Restricted Period

Concurrent with the determination to grant Restricted Share Rights to a Participant, the Board, on the recommendation of the Committee, shall determine the Restricted Period and vesting requirements applicable to such Restricted Share Rights. Vesting of a Restricted Share Right shall be determined at the sole discretion of the Board at the time of grant and shall be specified in the Restricted Share Right Grant Letter. Vesting requirements may be based upon the continued employment or other service of a Participant, and/or to performance conditions to be achieved by the Company or a class of Participants or by a particular Participant on an individual basis, within a Restricted Period, for such Restricted Share Rights to entitle the holder thereof to receive the underlying Shares (and the number of underlying Shares that may be received may be subject to performance multipliers). Upon expiry of the applicable Restricted Period (or on the Deferred Payment Date, as applicable), a Restricted Share Right shall be automatically settled, and without the payment of additional consideration or any other further action on the part of the holder of the Restricted Share Right, the underlying Shares shall be issued to the holder of such Restricted Share Rights, which Restricted Share Rights shall then be cancelled.

4.4 Deferred Payment Date

Participants who are residents of Canada for the purposes of the Income Tax Act (Canada), or who are residents of Argentina, and not, in either case, a US Taxpayer, may elect to defer to receive all or any part of the Shares underlying Restricted Share Rights until one or more Deferred Payment Dates. Any other Participants may not elect a Deferred Payment Date.

4.5 Prior Notice of Deferred Payment Date

Participants who elect to set a Deferred Payment Date must, in respect of each such Deferred Payment Date, give the Company written notice of the Deferred Payment Date(s) not later than thirty (30) days prior to the expiration of the applicable Restricted Period. For certainty, Participants shall not be permitted to give any such notice after the day which is thirty (30) days prior to the expiration of the Restricted Period and a notice once given may not be changed or revoked. For the avoidance of doubt, the foregoing shall not prevent a Participant from electing an additional Deferred Payment Date, provided, however that notice of such election is given by the Participant to the Company not later than thirty (30) days prior to the expiration of the subject Restricted Period.

4.6 Retirement or Termination during Restricted Period

Subject to the terms of any employment agreement or Award agreement between the Company and the Participant, in the event and to the extent of the Retirement or Termination and/or, as applicable, the Director Retirement or Director Termination of a Participant from all such roles with the Company during the Restricted Period, any Restricted Share Rights held by the Participant shall immediately terminate and be of no further force or effect; provided, however, that the Board shall have the absolute discretion to modify the Restricted Share Rights, including to provide that the Restricted Period shall terminate immediately prior to the date of such occurrence or allow the Restricted Share Rights to continue in accordance with their original Restricted Periods.

4.7 Retirement or Termination after Restricted Period

In the event and to the extent of the Retirement or Termination and/or, as applicable, the Director Retirement or Director Termination of the Participant from all such roles with the Company following the Restricted Period and prior to a Deferred Payment Date, the Participant shall be entitled to receive, and the Company shall issue forthwith, Shares in satisfaction of the Restricted Share Rights then held by the Participant.

4.8 Death or Disability of Participant

In the event of the death or total disability of a Participant, any Shares represented by Restricted Share Rights held by the Participant shall be immediately issued by the Company to the Participant or legal representative of the Participant.

4.9 Payment of Dividends

Subject to the absolute discretion of the Board, in the event that a dividend (other than a stock dividend) is declared and paid by the Company on the Shares, a Participant may be credited with additional Restricted Share Rights. The number of such additional Restricted Share Rights, if any, will be calculated by dividing (a) the total amount of the dividends that would have been paid to the Participant if the Restricted Share Rights (including Restricted Share Rights in which the Restricted Period has expired but the Shares have not been issued due to a Deferred Payment Date) in the Participant's account on the dividend record date had been outstanding Shares (and the Participant held no other Shares) by (b) the Fair Market Value of the Shares on the date on which such dividends were paid. If the foregoing results in a fractional Restricted Share Right, the fraction shall be disregarded. Any additional Restricted Share Rights awarded pursuant to this Section will be subject to the same terms, including the time of settlement, as the Restricted Share Rights to which they relate.

4.10 Change of Control

If a Triggering Event occurs within the 12-month period immediately following a Change of Control pursuant to the provisions of Section 2.1(m)(A), (B), (D) or (E), all outstanding Restricted Share Right Rights shall vest immediately and be settled by the issuance of Shares notwithstanding the Restricted Period and any Deferred Payment Date.

In the event of a Change of Control pursuant to the provisions of Section 2.1(m)(C), all Restricted Shares Rights outstanding shall immediately vest and be settled by the issuance of Shares notwithstanding the Restricted Period and any Deferred Payment Date.

Notwithstanding any provision of this Plan, in the event of a Change of Control, all Arrangement Restricted Share Rights outstanding held by Arrangement Departing Participants shall vest immediately and be settled by the issuance of Shares notwithstanding the Restricted Period and any Deferred Payment Date.

The provisions of this Section 4.10 shall be subject to the terms of any employment agreement between the Participant and the Company.

4.11 Settlement Basis for Performance Share Units

In respect of Performance Share Units that are accelerated as a result of a Change of Control or the total disability or death of a Participant, unless the Board determines otherwise and subject to any employment agreement or Award agreement between the Company and the Participant, (i) in respect of any performance measurement periods that are completed on or prior to the Change of Control, total disability or death of a Participant, the proportion of Performance Share Units equivalent to the performance measurement periods completed shall be settled by applying a performance multiplier calculated based on the actual performance in respect to such completed periods, and (ii) in respect of any performance measurement periods that are not completed on or prior to the Change of Control, total disability or death of a Participant, the equivalent proportion of Performance Share Units in respect to such periods shall be settled by applying a performance multiplier of one Share for each Performance Share Unit.

PART 5

DEFERRED SHARE UNITS

5.1 Deferred Share Unit Grants

The Board may from time to time determine to grant Deferred Share Units to one or more Eligible Directors in a lump sum amount or on regular intervals, based on such formulas or criteria as the Board may from time to time determine. Deferred Share Units will be credited to the Eligible Director's account when designated by the Board.

5.2 Deferred Share Unit Grant Letter

Each grant of a Deferred Share Unit under this Plan shall be evidenced by a grant letter or agreement (a "Deferred Share Unit Grant Letter") issued to the Eligible Director by the Company. Such Deferred Share Unit Grant Letter shall be subject to all applicable terms and conditions of this Plan and may be subject to any other terms and conditions which are not inconsistent with this Plan and which the Board deems appropriate for inclusion in a Deferred Share Unit Grant Letter. The provisions of Deferred Share Unit Grant Letters issued under this Plan need not be identical.

5.3 Redemption of Deferred Share Units and Issuance of Deferred Shares

The Deferred Share Units held by each Eligible Director who is not a US Taxpayer shall be redeemed automatically and with no further action by the Eligible Director on the 20th business day following the Separation Date for that Eligible Director. For US Taxpayers, Deferred Share Units held by an Eligible Director who is a Specified Employee will be automatically redeemed with no further action by the Eligible Director on the date that is six (6) months following the Separation Date for the Eligible Director, or if earlier, upon such Eligible Director's death. Upon redemption, the former Eligible Director shall be entitled to receive and the Company shall issue, subject to the limitations set forth in Section 7.1 of this Plan, the number of Shares issued from treasury equal to the number of Deferred Share Units in the Eligible Director's account, subject to any applicable deductions and withholdings. In the event a Separation Date occurs during a year and Deferred Share Units have been granted to such Eligible Director for that entire year, the Eligible Director will only be entitled to a pro-rated Deferred Share Unit Payment in respect of such Deferred Share Units based on the number of days that he or she was an Eligible Director in such year.

No amount will be paid to, or in respect of, an Eligible Director under this Plan or pursuant to any other arrangement, and no other additional Deferred Share Units will be granted to compensate for a downward fluctuation in the value of the Shares of the Company nor will any other benefit be conferred upon, or in respect of, an Eligible Director for such purpose.

5.4 Death of Participant

In the event of the death of an Eligible Director, the Deferred Share Units shall be redeemed automatically and with no further action on the 20th business day following the death of an Eligible Director.

5.5 Payment of Dividends

Subject to the absolute discretion of the Board, in the event that a dividend (other than a stock dividend) is declared and paid by the Company on the Shares, an Eligible Director may be credited with additional Deferred Share Units. The number of such additional Deferred Share Units, if any, will be calculated by dividing (a) the total amount of the dividends that would have been paid to the Eligible Director if the Deferred Share Units in the Eligible Director's account on the dividend record date had been outstanding Shares (and the Eligible Director held no other Shares), by (b) the Fair Market Value of the Shares on the date on which such dividends were paid. If the foregoing results in a fractional Deferred Share Unit, the fraction shall be disregarded. Any additional Deferred Share Units awarded pursuant to this Section will be subject to the same terms, including the time of settlement, as the Deferred Share Units to which they relate.

PART 6

WITHHOLDING TAXES

6.1 Withholding Taxes

The Company or any Designated Affiliate may take such steps as are considered necessary or appropriate for the withholding of any taxes or other amounts which the Company or any Designated Affiliate is required by any law or regulation of any governmental authority whatsoever to withhold in connection with any Award including, without limiting the generality of the foregoing, the withholding of all or any portion of any payment or the withholding of the issue of any Shares to be issued under this Plan, until such time as the Participant has paid the Company or any Designated Affiliate for any amount which the Company or Designated Affiliate is required to withhold by law with respect to such taxes or other amounts. Without limitation to the foregoing, the Board may adopt administrative rules under this Plan, which provide for the automatic sale of Shares (or a portion thereof) in the market upon the issuance of such Shares under this Plan on behalf of the Participant to satisfy withholding obligations under an Award.

PART 7

GENERAL

7.1 Number of Shares

The aggregate number of Shares that may be issued under this Plan (together with any other securities-based compensation arrangements of the Company in effect from time to time) shall not exceed 14,400,737 Shares, such Shares to be allocated among Awards and Participants in amounts and at such times as may be determined by the Board from time to time. In addition, the aggregate number of Shares that may be issued and issuable under this Plan (when combined with all of the Company's other security-based compensation arrangements, as applicable),

(a) to Insiders shall not exceed 10% of the Company's outstanding issue from time to time;

(b) to Insiders within any one-year period shall not exceed 10% of the Company's outstanding issue from time to time; and

(c) to any one Insider and his or her associates or Affiliates within any one-year period shall not exceed 5% of the Company's outstanding issue from time to time.

In no event will the number of Shares that may be issued to any one Participant pursuant to Awards under this Plan (when combined with all of the Company's other security-based compensation arrangement, as applicable) exceed 5% of the Company's outstanding issue from time to time.

The aggregate number of Options that may be granted under this Plan to any one non-employee director of the Company within any one-year period shall not exceed a maximum value of C$100,000 worth of securities, and together with any Restricted Share Rights and Deferred Share Units granted under this Plan and any securities granted under all other securities-based compensation arrangements, such aggregate value shall not exceed C$150,000 in any on-year period. The calculation of this limitation shall not include however: (i) the initial securities granted under securities-based compensation arrangements to a person who was not previously a director of the Company, upon such person becoming or agreeing to become a director of the Company (however, the aggregate number of securities granted under all securities-based compensation arrangements in this initial grant to any one non-employee director shall not exceed the foregoing maximum values of securities); (ii) the securities granted under securities-based compensation arrangements to a director of the Company who was also an officer of the Company at the time of grant but who subsequently became a non-employee director; and (iii) any securities granted to a non-employee director that is granted in lieu of any director cash fee provided the value of the security awarded has the same value as the cash fee given up in exchange for such security. For greater clarity, in this Plan, securities-based compensation arrangements include securities issued under this Plan and any other compensation arrangements implemented by the Company including stock options, other stock option plans, employee stock purchase plans, stock appreciation right plans, deferred share unit plans, performance share unit plans, restricted share unit plans or any other compensation or incentive mechanism involving the issuance or potential issuance of Shares from treasury, but excludes any compensation arrangement that does not involve the issuance of Shares from treasury and any other compensation arrangements assumed or inherited by the Company in connection with the acquisition of another entity.

For the purposes of this Section 7.1, "outstanding issue" means the total number of Shares, on a non-diluted basis, that are issued and outstanding immediately prior to the date that any Shares are issued or reserved for issuance pursuant to an Award.

For greater clarity, the issuance of Arrangement Restricted Share Rights and Arrangement Deferred Share Units shall not be treated as a new grant of Restricted Share Rights and Deferred Share Units, respectively.

7.2 Lapsed Awards

If Awards are surrendered, terminated or expire without being exercised in whole or in part, new Awards may be granted covering the Shares not issued under such lapsed Awards, subject to any restrictions that may be imposed by the Toronto Stock Exchange.

7.3 Adjustment in Shares Subject to this Plan

If there is any change in the Shares through the declaration of stock dividends of Shares, through any consolidations, subdivisions or reclassification of Shares, or otherwise, the number of Shares available under this Plan, the Shares subject to any Award, and the exercise price of any Option shall be adjusted as determined to be appropriate by the Board, and such adjustment shall be effective and binding for all purposes of this Plan.

7.4 Transferability

Any Awards accruing to any Participant in accordance with the terms and conditions of this Plan shall not be transferable unless specifically provided herein. During the lifetime of a Participant all Awards may only be exercised by the Participant. Awards are non-transferable except by will or by the laws of descent and distribution.

7.5 Employment

Nothing contained in this Plan shall confer upon any Participant any right with respect to employment or continuance of employment with the Company or any Affiliate, or interfere in any way with the right of the Company or any Affiliate to terminate the Participant's employment at any time. Participation in this Plan by a Participant is voluntary.

7.6 Record Keeping

The Company shall maintain a register in which shall be recorded:

(a) the name and address of each Participant;

(b) the number of Awards granted to each Participant and relevant details regarding such Awards; and

(c) such other information as the Board may determine.

7.7 Necessary Approvals

This second amended and restated equity incentive plan of the Corporation continues to be in effect. The amendments adopted by the Board on May 15, 2023 shall become effective on such date, except for Part 9 which shall become effective on the Arrangement Effective Date as contemplated in the Plan of Arrangement, subject in all cases to the approval of (a) the Toronto Stock Exchange and (b) the New York Stock Exchange.

7.8 Amendments to Plan

The Board shall have the power to, at any time and from time to time, either prospectively or retrospectively, amend, suspend or terminate this Plan or any Award granted under this Plan without shareholder approval, including, without limiting the generality of the foregoing: changes of a clerical or grammatical nature, changes regarding the persons eligible to participate in this Plan, changes to the exercise price, vesting, term and termination provisions of the Award, changes to the Cashless Surrender Right provisions, changes to the authority and role of the Board under this Plan, and any other matter relating to this Plan and the Awards that may be granted hereunder, provided however that:

(a) such amendment, suspension or termination is in accordance with applicable laws and the rules of any stock exchange on which the Shares are listed;

(b) no amendment to this Plan or to an Award granted hereunder will have the effect of impairing, derogating from or otherwise adversely affecting the terms of an Award which is outstanding at the time of such amendment without the written consent of the holder of such Award;

(c) the expiry date of an Option Period in respect of an Option shall not be more than ten (10) years from the date of grant of an Option except as expressly provided in Section 3.4;

(d) the Directors shall obtain shareholder approval of:

(i) any amendment to the number of Shares specified in Section 7.1;

(ii) any amendment to the limitations on Shares that may be reserved for issuance, or issued, to Insiders, or remove participation limits on non-employee directors or increase the amounts of participation limits on non-employee directors;

(iii) any amendment that would reduce the exercise price of an outstanding Option other than pursuant to Section 7.3 or permits the cancellation and re-issuance of Options;

(iv) any amendment that would extend the expiry date of the Option Period in respect of any Option granted under this Plan except as expressly contemplated in Section 3.4;

(v) any amendment to permit Options to be transferred other than for normal estate settlement purposes; or

(vi) any amendment to reduce the range of amendments requiring shareholder approval contemplated in this Section.

If this Plan is terminated, the provisions of this Plan and any administrative guidelines and other rules and regulations adopted by the Board and in force on the date of termination will continue in effect as long as any Award or any rights pursuant thereto remain outstanding and, notwithstanding the termination of this Plan, the Board shall remain able to make such amendments to this Plan or the Award as they would have been entitled to make if this Plan were still in effect.

7.9 No Representation or Warranty

The Company makes no representation or warranty as to the future market value of any Shares issued in accordance with the provisions of this Plan.

7.10 Section 409A

It is intended that any payments under the Plan to US Taxpayers shall be exempt from or comply with Section 409A of the Code, and all provisions of the Plan shall be construed and interpreted in a manner consistent with the requirements for avoiding taxes and penalties under Section 409A of the Code.

7.11 Compliance with Applicable Law, etc.

If any provision of this Plan or any agreement entered into pursuant to this Plan contravenes any law or any order, policy, by-law or regulation of any regulatory body or stock exchange having authority over the Company or this Plan, then such provision shall be deemed to be amended to the extent required to bring such provision into compliance therewith.

All Awards and securities which may be acquired pursuant to the exercise of the Awards to be issued pursuant to the Plan will be issued pursuant to the registration requirements of the U.S. Securities Act and applicable state securities laws or an exemption or exclusion from such registration requirements.

7.12 Clawback and Recoupment

All Awards under this Plan shall be subject to forfeiture or other penalties pursuant to any Company clawback policy, as may be adopted or amended from time to time, and such forfeiture and/or penalty conditions or provisions as determined by the Committee.

7.13 Term of the Plan

This Plan shall remain in effect until it is terminated by the Board.

PART 8

ADMINISTRATION OF THIS PLAN

8.1 Administration by the Committee

(a) Unless otherwise determined by the Board, this Plan shall be administered by the Governance, Nomination, Compensation and Leadership Committee (the "Committee") or equivalent committee appointed by the Board and constituted in accordance with such Committee's charter.

(b) The Committee shall have the power, where consistent with the general purpose and intent of this Plan and subject to the specific provisions of this Plan, to:

(i) adopt and amend rules and regulations relating to the administration of this Plan and make all other determinations necessary or desirable for the administration of this Plan. The interpretation and construction of the provisions of this Plan and related agreements by the Committee shall be final and conclusive. The Committee may correct any defect or supply any omission or reconcile any inconsistency in this Plan or in any related agreement in the manner and to the extent it shall deem expedient to carry this Plan into effect and it shall be the sole and final judge of such expediency; and

(ii) otherwise exercise the powers delegated to the Committee by the Board and under this Plan as set forth herein.

8.2 Board Role

(a) The Board, on the recommendation of the Committee or of its own volition, shall determine and designate from time to time the individuals to whom Awards shall be made, the amounts of the Awards and the other terms and conditions of the Awards. The Board may delegate this authority as it sees fit, including as set forth in Section 3.3.

(b) The Board may delegate any of its responsibilities or powers under this Plan to (i) the Committee, or (ii) the CEO as set forth in Section 3.3.

(c) In the event the Committee or, in respect of the Delegated Options, the CEO, is unable or unwilling to act in respect of a matter involving this Plan, the Board shall fulfill the role of the Committee (or CEO, as the case may be) provided for herein.

PART 9

PLAN OF ARRANGEMENT

9.1 Plan of Arrangement

This second amended and restated equity incentive Plan has been amended to contemplate the Plan of Arrangement. To the extent applicable, it is intended that the Outstanding Restricted Share Rights and the Outstanding Deferred Share Units will be exchanged for Arrangement Restricted Share Rights and Arrangement Deferred Share Units, respectively, pursuant to the Plan of Arrangement on a tax-deferred basis under subsection 7(1.4) of the Income Tax Act (Canada).

9.2 Arrangement Restricted Share Rights

(a) For all purposes under the Plan, the date on which an Arrangement Restricted Share Right is granted for purposes of the Plan shall be deemed to be the date of the grant of the Outstanding Restricted Share Right for which such Arrangement Restricted Share Right was exchanged as part of the Plan of Arrangement and, except as set out herein or in the Plan of Arrangement and with such adjustments as the circumstances require, the Arrangement Restricted Share Right shall be deemed (unless otherwise determined by the Board) to have the same terms and conditions (including vesting and expiration) as the Outstanding Restricted Share Right for which such Arrangement Restricted Share Right was exchanged as part of the Plan of Arrangement.

(b) With respect to Arrangement Restricted Share Rights that replace Performance Share Units, all such Arrangement Restricted Share Rights shall (unless otherwise determined by the Board) be subject to the same time based vesting period as the Performance Share Unit they replace and upon vesting such Arrangement Restricted Share Rights shall be fully satisfied by the issuance of one Share (unless otherwise determined by the Board) irrespective of the applicable performance multiplier to which the Performance Share Unit was subject. Notwithstanding the foregoing, Arrangement Restricted Share Rights that replace Performance Share Units that were fully vested and outstanding prior to the Arrangement Effective Time may be settled by the Company in accordance with the performance multiplier applicable to the Performance Share Units replaced.

(c) In addition, notwithstanding anything contained herein to the contrary, in respect of each person that is a Participant immediately prior to the Arrangement Effective Time that, due to or in connection with the Arrangement, who ceases to be an Eligible Director or an Eligible Employee and becomes a director, officer or employee of Spinco or any Spinco Designated Affiliate, or provides ongoing services for Spinco or any Spinco Designated Affiliate and complies with the definition of "consultant" or "advisor" as set forth in Form S-8 (a "Spinco Service Provider") (each such director, officer, employee or Spinco Service Provider, an "Arrangement Departing Participant"), all Arrangement Restricted Share Rights (other than those issued pursuant to paragraph (b)) issued to such Arrangement Departing Participant that replace Outstanding Restricted Share Rights shall (unless otherwise determined by the Board) immediately vest and the underlying Shares shall be issued to the holder of such Arrangement Restricted Share Rights as soon as practicable by the Company following the Arrangement Effective Date (provided that the Company may establish a schedule for the settlement of Arrangement Restricted Share Rights to ensure the orderly sale of Shares in the markets to satisfy tax withholding obligations), which Arrangement Restricted Share Rights shall then be cancelled.

(d) With respect to Arrangement Restricted Share Rights issued to an Arrangement Departing Participant that are not immediately vested, upon such Arrangement Departing Participant ceasing to be a director, officer or employee of Spinco or any Spinco Designated Affiliates, or a Spinco Service Provider, as applicable, such Arrangement Departing Participant shall be treated for the purposes of this Plan as having ceased to be so employed with the Company and its Designated Affiliates and such Arrangement Departing Participant's Arrangement Restricted Share Rights shall be dealt with in accordance with Section 4.6 of this Plan.

9.3 Arrangement Deferred Share Units

(a) For all purposes under the Plan, the date on which an Arrangement Deferred Share Unit is granted for purposes of the Plan shall be deemed to be the date of the grant of the Outstanding Deferred Share Unit for which such Arrangement Deferred Share Unit was exchanged as part of the Plan of Arrangement and, except as set out herein or in the Plan of Arrangement and with such adjustments as the circumstances require, the Arrangement Deferred Share Unit shall be deemed (unless otherwise determined by the Board) to have the same terms and conditions (including vesting and expiration) as the Outstanding Deferred Share Unit for which such Arrangement Deferred Share Unit was exchanged as part of the Plan of Arrangement.

(b) Notwithstanding anything contained herein to the contrary, (unless otherwise determined by the Board) all Arrangement Deferred Share Units issued to Arrangement Departing Participants shall immediately vest and the underlying Shares shall be issued to the holder of such Arrangement Deferred Share Units as soon as practicable by the Company following the Arrangement Effective Date (provided that the Company may establish a schedule for the settlement of Arrangement Deferred Share Units to ensure the orderly sale of Shares in the markets to satisfy tax withholding obligations), which Arrangement Deferred Share Units shall then be cancelled.

Notice to Holders

LITHIUM AMERICAS (ARGENTINA) CORP.

1.75% Convertible Senior Notes due 2027

CUSIP Nos.: 53680QAA61

NOTE: THIS NOTICE CONTAINS IMPORTANT INFORMATION THAT IS OF INTEREST TO

THE REGISTERED AND BENEFICIAL OWNERS OF THE SUBJECT NOTES. IF

APPLICABLE, ALL DEPOSITORIES, CUSTODIANS, AND OTHER INTERMEDIARIES

RECEIVING THIS NOTICE ARE REQUESTED TO EXPEDITE RE-TRANSMITTAL TO

BENEFICIAL OWNERS OF THE NOTES IN A TIMELY MANNER.

Lithium Americas (Argentina) Corp. (formerly known as Lithium Americas Corp.) ("Corporation") is party to an Indenture dated December 6, 2021 (the "Indenture"), between the Company and Computershare Trust Company N.A., as trustee (the "Trustee"), pursuant to which the Company issued its 1.75% Convertible Senior Notes due 2027 (the "Notes"). Capitalized terms used herein but not otherwise defined shall have the respective meanings given such terms in the Indenture.

On October 3, 2023, the Company implemented by way of a plan of arrangement under the laws of British Columbia (the "Arrangement"), a reorganization resulting in the separation of its North American and Argentine business units into two independent public companies as follows:

-

The Company became an Argentina focused lithium company owning the Company's interest in its Argentine lithium assets, including the near-production Caucharí-Olaroz lithium brine project in Jujuy, Argentina; and

-

The Company created a new North America focused lithium company ("New LAC") owning the Thacker Pass lithium project in Humboldt County, Nevada and the Company's North American investments.

Under the Arrangement, the Company's shareholders retained their proportionate interest in shares of the Company, and received by way of distribution (the "Spin-Off"), newly issued shares of New LAC in proportion to their then-current ownership of the Company. The Spin-Off was also completed on October 3, 2023. As part of the Arrangement, the Company changed its name to Lithium Americas (Argentina) Corp.