0001829966

false

--09-30

0001829966

2023-09-29

2023-09-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 29, 2023

___________________________

EBET, Inc.

(Exact name of registrant as specified in its

charter)

___________________________

| Nevada |

001-40334 |

85-3201309 |

|

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

3960

Howard Hughes Parkway, Suite 500, Las

Vegas, NV 89169

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code: (888) 411-2726

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

___________________________

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading

Symbols(s) |

Name

of each exchange on which registered |

| Common stock, par value $0.001 per share |

EBET |

The NASDAQ Stock Market LLC |

| Item 1.01. | Entry into a Material Definitive Agreement. |

Amended

Forbearance Agreement

On

November 29, 2021, EBET, Inc. (the “Company”) and the subsidiaries of the Company (the “Guarantors”) entered a

credit agreement (the “Credit Agreement”) with CP BF Lending, LLC (“Lender”), pursuant to which the Lender agreed

to make a single loan to the Company in the original amount of $30,000,000 (the “Loan”). The Loan required the Company to

maintain certain minimum liquidity and other financial and other covenants. As previously disclosed, the Company has received multiple

waivers from the Lender in the past with respect to such covenants with the final waiver expiring on June 30, 2023.

On

June 30, 2023, the Company, the subsidiaries of the Company and the Lender entered into a forbearance agreement (the “Forbearance

Agreement”). Pursuant to the Forbearance Agreement, the Company acknowledged, among other items, that, as June 30, 2023, it was

in default under the Credit Agreement, the Lender had the right to accelerate the Loan, and the Lender had the right to impose the default

rate of interest under the Credit Agreement. Pursuant to the Forbearance Agreement, the Lender agreed to forbear from exercising its rights

and remedies against the Company and the Guarantors under the Credit Documents until September 15, 2023 (the “Forbearance Date”).

On September 15, 2023, the Company, the subsidiaries of the Company and the Lender entered into an amendment number 1 to the Forbearance

Agreement (the “Forbearance Amendment No. 1”). The Forbearance Amendment No. 1 extended the Forbearance Date from September

15, 2023 until October 31, 2023.

On

October 1, 2023, the Company, the subsidiaries of the Company and the Lender entered into an amendment number 2 to the Forbearance Agreement

(the “Forbearance Amendment No. 2”). The Forbearance Amendment No. 2 extended the Forbearance Date from October 31, 2023 until

June 30, 2025, and provides that instead of interest being payable monthly in cash, such interest shall accrue in arrears and can be added

to the outstanding principal balance of the Loan. The interest rate on the Loan and the Revolving Loan was increased to 16.5% per annum.

The Forbearance Amendment No. 2 further adds that the Company’s suspension from trading or failure to be listed on the Nasdaq Capital

Market for more than 30 calendar days will constitute a Termination Event under the Forbearance Agreement as amended. Pursuant to Forbearance

Amendment No. 2, the Company agreed that to the extent it receives net proceeds from or in connection with a judgment, settlement or other

in or out of court resolution of a commercial tort claim, the Company will: (i) make a prepayment on the Loan or the Revolving Loan (discussed

below) of 100% of such net proceeds; and (ii) make an additional payment to the Lender equal to 5% of any such net proceeds (prior to

the payments set forth in subsection (i)) in excess of $50.0 million. Upon the execution of the Forbearance Amendment No. 2, the principal

amount of the Loan is $26,384,634.66.

Revolving

Loan

In

connection with the Forbearance Agreement, the Lender agreed to provide the Company with a revolving loan in the amount not to exceed

$2.0 million (the “Revolving Loan”), with any advances under the Revolving Loan to be made in the sole discretion of the Lender.

On September 29, 2023, the Lender agreed to increase the maximum available amount of the Revolving Loan to $4.0 million. The Company paid

Lender a fee of $40,000 in connection with the increase. The Revolving Loan carries an interest rate of 16.5% per annum, provided that

upon an occurrence of default the interest rate will increase to the default rate under the Loan. The interest on the Revolving Loan shall

accrue in arrears and can be added to the outstanding principal balance of the Revolving Loan. The Revolving Loan is an Obligation as

defined in the Credit Agreement and as such is secured by the collateral in which the Borrower and the Guarantors have granted liens and

security interests to the Lender in connection with the Loan. All discretionary advances shall terminate automatically and all outstanding

principal together with accrued but unpaid interest and fees shall become immediately due and payable, without notice to or action by

any party, on the earlier of the termination date of the Forbearance Agreement, or the maturity date of the Revolving Note, unless otherwise

extended by the Lender. As of the date of the Forbearance Amendment No. 2, the principal amount of the Revolving Note is $1,690,744.58.

The

summaries of the of Forbearance Agreement, Forbearance Amendment No. 1, Forbearance Amendment No. 2, and the Revolving Loan do not purport

to be complete and are qualified in its entirety by reference to the full text of such agreements, copies of which are attached hereto

as Exhibits 10.1, 10.2, 10.3, and 10.4 and are incorporated herein by reference.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant. |

The information set forth

in Item 2.03 is incorporated by reference into this Item 1.01.

| Item 3.02. | Unregistered Sales of Equity Securities. |

On October 2, 2023, the Company

entered into an amended and restated note conversion option agreement (the “Option Agreement”) with the Lender. Pursuant to

the Option, the Company agreed that Lender have the right to convert any amounts due pursuant to the Loan and the Revolving Loan into

shares of Company common stock at a conversion price of $1.25 per share with respect to the initial $5.0 million and at a conversion price

of $2.50 per share with respect to the remaining amounts. In addition, the Company agreed to file a registration statement registering

the resale of the shares of Company common stock underlying the Loan within 45 days of the date of the Option and to use its commercially

reasonable efforts to cause such registration statement to become effective within 120 days of the date of the Option.

The Option Agreement provides

that the Lender (together with its affiliates) may not convert any portion of the Loan or Revolving Loan during an initial 45-day lockup

or to the extent that the Lender would own more than 9.99% of the Company’s outstanding common stock immediately after exercise,

except that upon prior notice from the Lender to the Company, the Lender may increase or decrease the amount of ownership of outstanding

stock after conversion of the Loan, provided that any modification will not be effective until 61 days following notice to the Company.

Any shares of Company common

stock issued to Lender pursuant to this Option will be issued pursuant to Section 4(a)(2) of the Securities Act and/or Regulation D thereunder.

The

summary of the of Option Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the

Option Agreement, a copy of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

| Item 3.03. |

Material Modifications of Rights of Security Holders. |

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 herein is incorporated by reference into this Item

3.03.

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year. |

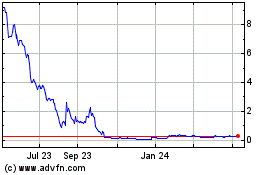

At

the Company’s annual meeting of stockholders completed on July 26, 2023, the stockholders of the Company approved an amendment to

the Company’s amended and restated articles of incorporation (the “Amendment”) to effect the reverse stock split at

a ratio in the range of 1-for-2 to 1-for-30, with such ratio to be determined in the discretion of the Company’s board of directors

and with such reverse stock split to be effected at such time and date, if at all, as determined by the Company’s board of directors

in its sole discretion prior to the one-year anniversary of the annual meeting.

Pursuant

to such authority granted by the Company’s stockholders, the Company’s board of directors approved a one-for-thirty (1:30)

reverse stock split (the “Reverse Stock Split”) of the Company’s common stock and the filing of the Amendment to effectuate

the Reverse Stock Split. The Amendment was filed with the Secretary of State of the State of Nevada and the Reverse Stock Split became

effective in accordance with the terms of the Amendment at 4:01 p.m. Eastern Time on September 29, 2023 (the “Effective Time”).

The Amendment provides that, at the Effective Time, every thirty shares of the Company’s issued and outstanding common stock will

automatically be combined into one issued and outstanding share of common stock, without any change in par value per share, which will

remain $0.001.

As

a result of the Reverse Stock Split, the number of shares of common stock outstanding will be reduced from approximately 448.2 million

shares as of September 29, 2023 to approximately 14.9 million shares, and the number of authorized shares of common stock will remain

at 500 million shares. As a result of the Reverse Stock Split, proportionate adjustments will be made to the per share exercise price

and/or the number of shares issuable upon the exercise or vesting of all outstanding stock options and warrants, which will result in

a proportional decrease in the number of shares of the Company’s common stock reserved for issuance upon exercise or vesting of

such stock options and warrants, and a proportional increase in the exercise price of all such stock options and warrants. In addition,

the number of shares reserved for issuance under the Company’s equity compensation plan immediately prior to the Effective Time

will be reduced proportionately.

No

fractional shares will be issued as a result of the Reverse Stock Split. Stockholders of record who would otherwise be entitled to receive

a fractional share will be entitled to the rounding up of the fractional share to the nearest whole number. The Reverse Stock Split became

effective at 4:01 p.m., Eastern Time, on September 29, 2023, and the Company’s common stock is expected to begin trading on a Reverse

Stock Split-adjusted basis on The Nasdaq Capital Market at the open of the markets on October 2, 2023. The trading symbol for the common

stock will remain “EBET.” The Company’s post-Reverse Stock Split common stock has a new CUSIP number (CUSIP No. 278700

208), but the par value and other terms of the common stock are not affected by the Reverse Stock Split.

The

summary of the of Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment,

a copy of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

On

September 29, 2023, the Company issued a press release to announce that today it filed a certificate of amendment to its articles of incorporation

with the Secretary of State of the State of Nevada to effect a 1-for-30 reverse stock split of its common stock. A copy of the press release

is attached to this report as Exhibit 99.1 and is incorporated by reference herein.

The table below sets forth the impact of the Reverse

Stock Split on the Company’s net loss per common share – basic and diluted; weighted average common shares outstanding –

basic and diluted; and shares issued and outstanding, for the years ended September 30, 2022 and 2021; the three months ended June 30,

2023 and 2022; and the nine months ended June 30, 2023 and 2022:

| | |

PRE SPLIT | | |

POST SPLIT | |

| | |

FISCAL YEAR ENDED | | |

FISCAL YEAR ENDED | |

| | |

September 30, 2022 | | |

September 30, 2021 | | |

September 30, 2022 | | |

September 30, 2021 | |

| | |

| | |

| | |

| | |

| |

| Net loss available to common shareholders | |

$ | (46,178,194 | ) | |

$ | (15,200,024 | ) | |

$ | (46,178,194 | ) | |

$ | (15,200,024 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| 14,839,645 | | |

| 11,397,739 | | |

| 494,655 | | |

| 379,925 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | (3.11 | ) | |

$ | (1.33 | ) | |

$ | (93.35 | ) | |

$ | (40.01 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| PRE SPLIT | | |

| POST SPLIT |

| | |

| 3 MONTHS ENDED | | |

| 3 MONTHS ENDED | |

| | |

| June 30, 2023 | | |

| June 30, 2022 | | |

| June 30, 2023 | | |

| June 30, 2022 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss available to common shareholders | |

$ | (44,722,672 | ) | |

$ | (10,394,942 | ) | |

$ | (44,722,672 | ) | |

$ | (10,394,942 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| 25,908,005 | | |

| 14,842,497 | | |

| 863,600 | | |

| 494,750 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | (1.73 | ) | |

$ | (0.70 | ) | |

$ | (51.79 | ) | |

$ | (21.01 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| PRE SPLIT | | |

| POST SPLIT | |

| | |

| 9 MONTHS ENDED | | |

| 9 MONTHS ENDED | |

| | |

| June 30, 2023 | | |

| June 30, 2022 | | |

| June 30, 2023 | | |

| June 30, 2022 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss available to common shareholders | |

$ | (59,386,657 | ) | |

$ | (32,968,127 | ) | |

$ | (59,386,657 | ) | |

$ | (32,968,127 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| 21,896,714 | | |

| 14,267,461 | | |

| 729,890 | | |

| 475,582 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | (2.71 | ) | |

$ | (2.31 | ) | |

$ | (81.36 | ) | |

$ | (69.32 | ) |

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

| 3.1 |

Amendment to EBET, Inc. Articles of Incorporation |

| 10.1 * |

Forbearance Agreement dated June 30, 2023 between EBET, Inc., certain subsidiaries of EBET, Inc., and CP BF Lending, LLC (incorporated by reference to Exhibit 10.1 of the Form 8-K filed July 3, 2023) |

| 10.2 * |

Forbearance Agreement Amendment No. 1 dated September 15, 2023 between EBET, Inc., certain subsidiaries of EBET, Inc., and CP BF Lending, LLC (incorporated by reference to Exhibit 10.2 of the Form 8-K filed September 19, 2023) |

| 10.3* |

Forbearance Agreement Amendment No. 2 dated October 2, 2023 between EBET, Inc., certain subsidiaries of EBET, Inc., and CP BF Lending, LLC |

| 10.4 |

Form of Revolving Note issuable by EBET, Inc. to CP BF Lending, LLC (incorporated by reference to Exhibit 10.2 of the Form 8-K filed July 3, 2023) |

| 10.5 |

Amended and Restated Note Conversion Option Agreement dated October 2, 2023 between EBET, Inc. and CP BF Lending, LLC |

| 99.1 |

Press release dated September 29, 2023 |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Schedules

and exhibits omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company will furnish a copy of any omitted schedule or exhibit

to the SEC upon request.

SIGNATURE

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

EBET, INC. |

| |

|

| |

|

| Date: October 2, 2023 |

|

| |

By: /s/

Matthew

Lourie |

| |

Matthew Lourie |

| |

Chief Financial Officer |

Exhibit 3.1

Business Number E9336362020 - 8 Filed in the Office of Secretary of State State Of Nevada Filing Number 20233517259 Filed On 9/28/2023 12:19:00 PM Number of Pages 3

Do cuSi gn Env e lop e ID: 112FDC86 - 050 6 - 461D - 9289 - 7D162E0EE849 FRANCISCO V. AGUILAR Secretary of State 202 North Carson Street Carson City, Nevada 89701 - 4201 (775) 684 - 5708 Website: www.nvsos.gov 4 T 5 C c 6 ( Profit Corporation: Certificate of Amendment (PuRsuANTTO NRs 78 .3 80 & 78 .3 85 / 78 . 390) Certificate to Accompany Restated Articles or Amended and Restated Articles (PuRsuANT TO NRs 78.403) Officer's Statement (PuRsuANT TO NRs 80 . 030 Date : [ September 29, 2023 Time: 1 1 :01 P.M. (PT) (must not be later than 90 days after the certificate is filed) . Effective Date and ime: (Optional) Changes to takes the following effect: D The entity name has been amended . D The registered agent has been changed. (attach Certificate of Acceptance from new registered agent) D The purpose of the entity has been amended. [8] The authorized shares have been amended. D The directors, managers or general partners have been amended . D IRS tax language has been added. D Articles have been added. D Articles have been deleted. D Other. The articles have been amended as follows : (provide article numbers , if available) , See attached Exhibit A. (attach additional page(s) i f necessary) . Information Being hanged: (Domestic orporations only) J Chief Executive Officer Signature of Officer or Authorized Signer Title J Chief Financial Officer Signature of Officer or Authorized Signer Title * If any proposed amendment would alter or change any preference or any relative or other right g i ven to any class or series of outstanding shares , then the amendment must be approved by the vote , in addition to the affirmative vote otherwise required , of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof. . Signature: Required) Please include any required or optional information in space below: (attach additional page(s) if necessary) This form must be accompanied by appropriate fees . Page 2 of 2 Revised : 12 /15/2022

Exhibit A

ANNEX A

TO THE CERTIFICATE OF AMENDMENT

OF THE AMENDED AND RESTATED ARTICLES OF INCORPORATION OF

EBET,INC.

A new section 8.13(a) is added to the Amended and Restated Articles of Incorporation of EBET, Inc. as follows:

At 1:01 p.m. PST on September 29, 2023 (the “Effective

Time”) every 30 (the “Reverse Split Factor”) outstanding shares of Common Stock shall without further action by

the corporation or the holder thereof be combined into and automatically become one share of Common Stock (the “Reverse Stock

Split”); provided, however, no fractional shares of Common Stock shall be issued in connection with the Reverse Stock Split,

and instead, the Corporation shall issue one full share of post-Reverse Stock Split Common Stock to any stockholder who would have

been entitled to receive a fractional share of Common Stock as a result of the Reverse Stock Split.

Exhibit 10.3

EXECUTION

FORBEARANCE AGREEMENT AMENDMENT NO. 2

among

EBET, INC. F/K/A ESPORTS TECHNOLOGIES, INC.

as the Borrower,

the SUBSIDIARIES OF THE BORROWER,

as Guarantors

and

CP BF LENDING, LLC,

as Lender

Dated as of October 1, 2023

This FORBEARANCE AGREEMENT

AMENDMENT NO. 2 (this “Agreement”) is entered into as of October 1, 2023 by and between EBET, INC. f/k/a ESPORTS

TECHNOLOGIES, INC., a Nevada corporation (the “Borrower”), the Guarantors, and CP BF LENDING, LLC, a Delaware

limited liability company (the “Lender”).

WHEREAS, the Lender and

the Borrower are parties to that certain Credit Agreement dated as of November 29, 2021 as amended from time to time, (the “Credit

Agreement”) whereby the Lender advanced a term loan to the Borrower in the original principal amount of THIRTY MILLION DOLLARS

and 00/100 CENTS (US$30,000,000.00) (the “Loan” as defined in the Credit Agreement) and a discretionary Revolving

Loan to the Borrower in the original principal amount of up to FOUR MILLION DOLLARS and 00/100 CENTS (US$4,000,000.00) which Loan,

Revolving Loan and other Obligations under the Credit Agreement have been unconditionally guaranteed by the Guarantors;

WHEREAS, the Lender,

the Borrower and the Guarantors have entered into a Forbearance Agreement dated as of June 30, 2023 as amended by Forbearance Agreement

Amendment No. 1 dated as of September 15, 2023 (the “Forbearance Agreement”), whereby the Borrower and the Guarantors

acknowledged the existence of certain Specified Events of Default and acknowledged and confirmed certain other matters referenced in the

Forbearance Agreement, and in consideration therefore, the Lender agreed to enter into the Forbearance Agreement and to forbear from exercising

its rights and remedies during the Forbearance Period;

WHEREAS, on February

13, 2023, via electronic mail, a copy of which is attached hereto as Exhibit A and incorporated herein and as amended thereafter

on April 28, 2023 in the Fifteenth Limited Waiver Agreement, on May 12, 2023 in the Sixteenth Limited Waiver Agreement, on May 26, 2023

in the Seventeenth Limited Waiver Agreement, on June 9, 2023 in the Eighteenth Limited Waiver Agreement, on June 20, 2023 in the Nineteenth

Limited Waiver Agreement, on June 30, 2023 and September 15, 2023 in the Forbearance Agreement (the “2/13 Email”),

Lender agreed on a limited basis to defer the ongoing requirement to provide Aspire Excess Cash Flow Certificates for the period of time

provided for therein and on the terms and conditions contained therein;

WHEREAS, the Lender and

the Borrower have entered into an Amended and Restated Note Conversion Agreement dated as of October 1, 2023 whereby the Lender and the

Borrower have agreed that Lender may from time to time convert certain amounts of its Loan and Revolving Loan into Capital Stock of the

Borrower;

WHEREAS, the Borrower

and the Guarantors have requested that the Lender extend the Forbearance Period, and Lender has agreed, subject to the terms of this Agreement

and provided that no Default or Event of Default that is not otherwise designated as a Specified Event of Default has occurred prior to

the date of this Agreement;

WHEREAS, Lender

and the Credit Parties further wish to set forth their mutual acknowledgements, confirmations and agreements in this Agreement subject

to the understanding that except as modified in this Agreement, nothing in this Agreement constitutes or will constitute a modification,

amendment or other change to the terms of the Credit Documents previously executed between the Lender and the Credit Parties, and that

this Agreement may not, in any circumstance, be regarded as a moratorium or novation of any obligations of the Credit Parties.

NOW, THEREFORE,

in consideration of the foregoing and the mutual covenants herein contained, and for other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the Lender and the Credit Parties hereby agree as follows:

1. Defined Terms. Capitalized

terms used herein and not otherwise defined in the recitals shall have the meanings ascribed to them in the Credit Documents.

2. Borrower Acknowledgements.

a. Defaults.

Borrower and Guarantors acknowledge that the Specified Events of Default identified on the list attached hereto as Exhibit B hereto

have occurred or will occur during the term of this Agreement and that the Specified Events of Default in existence as of the date of

this Agreement are continuing.

b. Credit Documents.

The Credit Documents and all other agreements, instruments and other documents executed in connection with or relating to the Obligations

or the Collateral are legal, valid, binding and enforceable against Borrower and Guarantors in accordance with their terms. The terms

of the Credit Documents as in effect immediately prior to the effectiveness of this Agreement remain unchanged, except as modified by

this Agreement.

c. No Lending

Obligations. As a result of the Specified Events of Default, the Lender has no obligation to make loans or otherwise extend credit

to Borrower, except as expressly contemplated under the Forbearance Agreement, and that any extensions of credit made during the Forbearance

Period (as defined below) are to be made in the sole discretion of the Lender and shall not constitute a waiver of any of Lender’s

rights under the Credit Documents.

d. Right to Accelerate

Obligations. As a result of the Specified Events of Default, the Lender has the immediate right to accelerate the maturity and demand

immediate payment of the Obligations.

e. Default Notice.

To the extent a notice of default is required by the Credit Documents to be provided to the Borrower and the Guarantors, the Borrower

and the Guarantors acknowledge that this Agreement shall constitute such notice under the Credit Documents. The Borrower and the Guarantors

further acknowledge that such notice is received timely and properly, that the Lender reserves all rights and remedies available to it

under the Credit Documents and at law. The Borrower and the Guarantors hereby waive any rights to receive further notice solely in connection

with the Specified Events of Default. All applicable cure periods relating to the Specified Events of Default are waived by the Borrower

and the Guarantors.

f. Default Interest

Rate. By reason of the Specified Events of Default, the Lender has the right, as of the Effective Date (as defined below), to impose

the default rate of interest under Section 2.4(c) of the Credit Agreement commencing from the date of the occurrence of the initial Specified

Event of Default.

g. No Waiver

of Defaults. Neither this Agreement, nor any actions taken in accordance with this Agreement or the Credit Documents, including the

Lender’s willingness to extend credit to the Borrower pursuant to the terms of this Agreement, shall be construed as a waiver of

or consent to the Specified Events of Default or any other existing or future defaults under the Credit Documents, as to which the Lender’s

rights shall remain reserved.

h. Preservation

of Rights and Remedies. Upon expiration of the Forbearance Period, all of the Lender’s rights and remedies under the Credit

Documents and at law and in equity shall be available without restriction or modification, as if the forbearance had not occurred.

i. Lender Conduct.

The Lender has fully and timely performed all of its obligations and duties in compliance with the Credit Documents and applicable law,

and has acted in good faith under the circumstances.

j. Request to

Forbear. The Borrower and the Guarantors have requested the Lender’s forbearance as provided herein, which shall inure to their

direct and substantial benefit.

3. Forbearance Period.

Section 3(i) of the Forbearance Agreement is amended to delete the date “October 31, 2023” and to substitute the date “June

30, 2025” in place thereof.

4. Compliance Certificate.

Until such time as further notified by the Lender that the waiver contained in this Section 4 is no longer in effect, the Lender waives

each requirement contained in the Credit Agreement for the delivery to the Lender of a Compliance Certificate, provided, however, that

at all times this waiver is in effect, the Borrower and the Guarantors agree that all changes, modifications, additions, and updates to

Collateral that would have been reported on either an exhibit to a Compliance Certificate or an amendment to the Information Certificate

at any time or times a Compliance Certificate would have been delivered absent this waiver, shall be reported to the Lender no later than

two (2) business days after such changes, modifications, additions, or updates have been made unless such changes, modifications, additions,

or updates required prior consent of the Lender pursuant to the Credit Documents prior to implementation in which case the consent provisions

of the Credit Documents shall control.

5. Conditions Precedent.

This Agreement shall not become effective unless and until the date (the "Effective Date") that each of the following

conditions shall have been satisfied in the Lender’s sole discretion, unless waived in writing by the Lender:

a. Delivery of Documents.

The Borrower and the Guarantors shall deliver or cause to be delivered the following documents, each in substance and form acceptable

to the Lender:

i. a copy of this

Agreement, duly executed by the Borrower and the Guarantors; and

ii. a certificate dated the

date hereof, signed by a duly authorized officer, director or manager of the Borrower and the Guarantors, containing certified copies

of (i) resolutions duly adopted by the board of directors or other applicable authorizing body of the Borrower and the Guarantors, as

applicable, authorizing the execution and delivery of this Agreement and all documents required to be delivered in connection herewith,

and all transactions contemplated herein; (ii) a statement containing the true and correct names, titles and signatures of individuals

or entities authorized to sign such documents and authorize such transactions; (iii) a statement that the Borrower and each Guarantor

is in good standing (or the substantive equivalent in each relevant jurisdiction) in the Borrower’s and each Guarantors’ jurisdiction

of incorporation, organization or formation and in each jurisdiction in which it is qualified as a foreign corporation or other entity

to do business; and (v) and a statement that there have been no modifications to the Borrower’s or any Guarantor’s formation

or governance documents since November 29, 2021 except as contained in the documents attached to the certificate;

b. Professional Fees and

other Expenses. As consideration for the Lender’s agreement to forbear as set forth herein, Borrower shall have paid or reimbursed

Lender for all of all of Lender’s fees and expenses (including fees and expenses of counsel incurred in connection with the drafting

and negotiation of this Agreement).

6. Amendments.

a. The 2/13 Email as amended

is further amended to i) delete the date “October 31, 2023” and to substitute the date “June 27, 2025” in place

thereof, and ii) delete the date “November 23, 2023” and to substitute the date “June 30, 2025” in place thereof.

b. The Pledge and Security Agreement

as amended as of May 26, 2023 (the “Security Agreement”) shall be further amended from time to time by adding at the

end of the existing description in the Description of Claims column on the Commercial Tort Claims schedule any actual litigation matters

as any actions involving such matters are filed and served.

c. Section 11(b)(i) of the Forbearance

Agreement is amended to delete the date “November 28, 2023” and to substitute the date “June 24, 2025” in place

thereof.

d. Section 4 of the Forbearance

Agreement is hereby amended by deleting “or” at the end of subsection “b”, by deleting the “.” at

the end of subsection “c”, by inserting “; or” at the end of subsection “c” and by adding a new subsection

“d” as follows:

“d. The suspension from

trading or failure of the Capital Stock of the Borrower to trade or be listed on the NASDAQ exchange for a period of thirty (30) consecutive

calendar days.”

e. Section 9(k) of the Forbearance

Agreement is hereby amended to add “Section 2.8” in the list of Credit Agreement Sections enumerated in Section 9(k).

7. Interest. Notwithstanding

anything to the contrary in Section 2.4 (a) and Section 2.4 (b) of the Credit Agreement and in Section 3.2 and Section 4.1 of the Revolving

Note, commencing as of the date hereof, the Loan and the Revolving Loan shall bear interest on the unpaid principal amount thereof through

the date of repayment (whether by acceleration or otherwise) at a rate equal to 16.5% per annum and shall be PIK Interest. All PIK Interest

on the Loan shall accrue in arrears and be added to the outstanding principal balance of the Loan on the first calendar day of each calendar

month, and the principal amount of the Loan shall be increased by such PIK Interest amount for all purposes under the Credit Documents.

All PIK Interest on the Revolving Loan shall accrue in arrears and shall be an advance under the Revolving Loan and added to the outstanding

principal balance of the Revolving Loan on the first calendar day of each calendar month. The principal amount of the Revolving Loan shall

be increased by such PIK Interest amount for all purposes under the Credit Documents but at no time shall the outstanding principal amount

of the Revolving Loan exceed FOUR MILLION DOLLARS and 00/100 CENTS ($4,000,000.00) All accrued but unpaid interest on the Loan

and on the Revolving Loan shall be due and payable in full on the earlier of (i) any date of any prepayment of the Loan or the Revolving

Loan, whether voluntary or mandatory, to the extent accrued on the amount being prepaid, and (ii) the Maturity Date.

8. Covenants.

a. Mandatory Prepayment.

The Borrower agrees that to the extent that it is entitled to receive, and either directly or indirectly through a third party at any

time receives proceeds (net of costs, expenses and other amounts due to any litigation funder approved by the Lender (“Net Proceeds”)),

which Net Proceeds arise from or are in connection with a judgment, settlement or other in or out of court resolution of the Commercial

Tort Claim identified in the Security Agreement as amended by this Agreement, then upon receipt of such Net Proceeds, the Borrower shall

pay or shall cause any third party in possession of the Net Proceeds to pay to the Lender, as a mandatory prepayment under Section 2.8(e)

of the Credit Agreement together with all other amounts due to the Lender at the time a mandatory prepayment is made, one hundred percent

(100%) of the Net Proceeds to be applied to the then existing Loan amount balance due, the Revolving Loan balance due and any other outstanding

Obligations then due to the Lender.

b. Additional Consideration.

As additional consideration for the Lender’s agreement to forbear which additional consideration is fully earned as of the date

hereof, the Borrower agrees that to the extent that it is entitled to receive, and either directly or indirectly through a third party

at any time receives Net Proceeds, then upon receipt of such Net Proceeds, the Borrower shall pay or shall cause any third party in possession

of the Net Proceeds to pay to the Lender an amount equal to five percent (5.0%) of the Net Proceeds amount which is in excess of FIFTY

MILLION DOLLARS and 00/100 CENTS (US$50,000,000.00) (the “Additional Consideration”). The calculation of the Additional

Consideration shall be based upon the full amount of Net Proceeds received prior to any mandatory prepayment made under Section 8(a).

of this Agreement and Section 2.8(e) of the Credit Agreement. Borrower agrees that the Net Proceeds are proceeds of the Commercial Tort

Claim identified in the Security Agreement and the Borrower reaffirms and ratifies its grant of a security interest to the Lender in such

Commercial Tort Claim and the proceeds thereof. For the avoidance of doubt, the Additional Consideration is in addition to all payments

due and owing with respect to the Loan and Revolving Loan and the Borrower is obligated to make such Additional Consideration payment

regardless of whether and when the Loan and/or the Revolving Loan and any other Obligations other than the Additional Consideration have

been paid in full. Payment of the Additional Consideration is a material requirement of Lender in order to induce the Lender to enter

into this Agreement. The Borrower’s obligation to pay the Additional Consideration shall survive the Termination Date, is an “Obligation”

under the Credit Agreement, and the Lender shall not be obligated to release or terminate its security interest in the Net Proceeds until

the Additional Consideration is paid in full.

c. Malta Lien. To the

extent the Lender determines at any time and in its sole discretion that additional actions are required to secure by the Lien on all

Collateral granted by Karamba Limited under the laws of Malta, amounts in excess of the original principal amount of the Loan or the Revolving

Loan resulting from the accrual of PIK Interest, the Borrower shall fully cooperate with the Lender to assure that such Lien is extended

to secure amounts in excess of the original principal amount of the Loan.

9. Reaffirmation of

Loan Balance. The Borrower confirms that, as of the date hereof, upon giving effect to this Agreement, it is indebted to the Lender

in respect of the Loan in the principal amount of TWENTY-SIX MILLION THREE HUNDRED EIGHTY-FOUR THOUSAND SIX HUNDRED THIRTY-FOUR DOLLARS

and 66/100 CENTS (US$26,384,634.66), together with interest accrued and unpaid thereon (including PIK Interest), and in respect of

the Revolving Loan in the principal amount of ONE MILLION SIX HUNDRED NINETY THOUSAND SEVEN HUNDRED FORTY-FOUR DOLLARS and 58/100 CENTS

(US$1,690,744.58), together with interest accrued and unpaid thereon, together with all fees, costs, expenses and other charges due

and owing by the Borrower under the Credit Documents and that all such amounts are unconditionally owing by the Borrower to the Lender,

without offset, defense or counterclaim of any kind, nature or description whatsoever.

10. Credit Documents.

This Agreement, constitutes a “Credit Document” as defined in the Credit Agreement, as the same may be amended from time to

time. All references in the Credit Agreement to “this Agreement”, “hereunder”, “hereof” or words of

like import referring to the Credit Agreement, and each reference in the other Credit Documents to the Credit Agreement, “thereunder”,

“thereof” or words of like import referring to the Credit Agreement shall be deemed to refer to the Credit Agreement as modified

by this Agreement. For the avoidance of doubt, any default by the Borrower or any Guarantor under the terms of this Agreement shall constitute

an Event of Default under the Credit Agreement.

11. Governing Law, Jurisdiction,

Counterparts, Jury Trial Waiver Confidentiality. This Agreement shall be governed by, and construed in accordance with, the law of

New York without reference to its conflicts of law principles (other than Section 5-1401 of the New York General Obligations Law). The

provisions of Sections 9.7, 9.8, 9.9 and 9.16 of the Credit Agreement are hereby incorporated by reference as if fully set forth herein

and shall apply mutatis mutandis.

12. Effect on Credit Documents.

The Credit Agreement and each of the other Credit Documents shall be and remain in full force and effect in accordance with their respective

terms and are hereby ratified and confirmed in all respects. The execution, delivery, and performance of this Agreement shall not operate,

except as expressly set forth herein, as a modification or waiver of any right, power, or remedy of the Lender under the Credit Agreement,

or any other Credit Document. The amendments contained in this Agreement are limited to the specifics hereof, shall not apply with respect

to any facts or occurrences other than those on which the same are based, shall not excuse future non-compliance by the Borrower or any

Guarantor with respect to any Credit Document to which it is a party, and shall not operate as a waiver or forbearance to any further

or other matter under the Credit Documents. Each Credit Party hereby ratifies and reaffirms (i) the validity, legality and enforceability

of the Credit Documents; (ii) that its reaffirmation of the Credit Documents is a material inducement to the Lender to enter into this

Agreement; and (iii) that its obligations under the Credit Documents shall remain in full force and effect until all the Obligations have

been paid in full. Guarantors expressly agree that the Guaranty of each extends to all Obligations under the Credit Documents, including

Obligations under the Revolving Note and this Agreement. The Borrower and each Credit Party represents and warrants that the representations

and warranties contained in this Agreement, Credit Agreement and in the other Credit Documents are true and correct in all material respects

(except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified

by materiality in the text thereof), except to the extent such representations and warranties specifically relate to an earlier date,

in which case such representations and warranties were true and correct on and as of such earlier date.

13. Successors and Assigns.

This Agreement binds and benefits the respective successors and assigns of the parties, except that neither the Borrower nor any Guarantor

may assign or delegate any of its rights or obligations under this Agreement without the prior written consent of the Lender. The Lender

may assign all or a portion of all of its rights and obligations under this Agreement.

14. No Amendment. Any

amendment, or waiver of, or any consent given under, any provision of this Agreement shall be in writing and, in the case of any amendment,

signed by the parties or their permitted successors and assigns.

15. Entire Agreement.

This Agreement and the other Credit Documents represent the final and complete agreement of the parties hereto with respect to the subject

matter herein, and all prior negotiations, representations, understandings, writings and statements of any nature with respect thereto

are hereby superseded in their entirety by the terms of this Agreement and the other Credit Documents.

16. Further Assurances.

The Borrower and each Guarantor shall execute and deliver any and all reasonable additional documents, agreements and instruments, and

take such additional reasonable action (including the filing and recording of financing statements) as may be reasonably requested by

the Lender, without payment of further consideration, to effectuate the intent and purpose of this Agreement and consistent with the provisions

of, and limitations contained in, the Credit Documents. The Borrower and each Guarantor agree to cooperate with, and shall cause their

Subsidiaries and their advisors to cooperate with, any financial advisors or appraisers that may from time to time be retained by or on

behalf of the Lender, including, without limitation, providing reasonable access (upon reasonable advance notice) to their premises, personnel

and books and records.

17. Advice of Counsel.

Each Credit Party has freely and voluntarily entered into this Agreement with the advice of legal counsel of its choosing, or has knowingly

waived the right to do so.

18. Reimbursement of Costs

and Expenses. Each Credit Party agrees to pay all costs, fees and expenses of the Lender (including attorneys' fees), expended or

incurred by the Lender in connection with the negotiation, preparation, administration and enforcement of this Agreement, the Credit Documents,

the Obligations, any of the Collateral and all fees, costs and expenses incurred in connection with any bankruptcy or insolvency proceeding

(including, without limitation, any adversary proceeding, contested matter or motion brought by the Lender or any other Person). Without

in any way limiting the foregoing, each Credit Party hereby reaffirms its agreement under the applicable Credit Documents to pay or reimburse

the Lender for certain costs and expenses incurred by the Lender. The Credit Parties are jointly and severally liable for their obligations

under this Section 18.

19. Release. The Borrower

and each Guarantor hereby release, waive, and forever relinquish all claims, demands, obligations, liabilities and causes of action of

whatever kind or nature, whether known or unknown, which any of them have, may have, or might assert at the time of execution of the Agreement

against the Lender and/or its parents, affiliates, participants, officers, directors, employees, agents, attorneys, accountants, consultants,

successors and assigns, directly or indirectly, which occurred, existed, was taken, permitted or begun prior to the execution of this

Agreement, arising out of, based upon, or in any manner connected with (i) any transaction, event, circumstance, action, failure to act

or occurrence of any sort or type, whether known or unknown, with respect to the Credit Agreement, any other Credit Document and/or the

administration thereof or the Obligations created thereby; (ii) any discussions, commitments, negotiations, conversations or communications

with respect to the refinancing, restructuring or collection of any Obligations related to the Credit Agreement, any other Credit Document

and/or the administration thereof or the Obligations created thereby, or (iii) any matter related to the foregoing, in each case, prior

to the execution of this Agreement.

[signature pages follow]

IN WITNESS WHEREOF, the

parties hereto have caused this Agreement to be duly executed and delivered by their respective officers thereunto duly authorized as

of the date first written above.

| |

LENDER:

|

| |

|

| |

CP BF LENDING, LLC |

| |

By: CP Business Finance GP, LLC, its manager, |

| |

By: Columbia Pacific Advisors, LLC, its manager |

| |

|

| |

|

| |

By: /s/ Brad Shain |

| |

Name: Brad

Shain |

| |

Title: Fund Manager |

| |

|

[signature page to Forbearance Agreement Amendment

No. 2]

| |

BORROWER:

|

| |

|

| |

EBET, INC. F/K/A ESPORTS |

| |

By: Columbia Pacific Advisors, LLC, its manager |

| |

|

| |

|

| |

By: /s/ Aaron Speach |

| |

Name: Aaron Speach |

| |

Title: CEO |

| |

|

[signature page to

Forbearance Agreement Amendment No. 2]

GUARANTORS:

GLOBAL E-SPORTS ENTERTAINMENT

GROUP LLC

By: /s/ Aaron Speach

Name: Aaron Speach

Title: CEO

ESPORTSBOOK TECHNOLOGIES LIMITED

By: /s/ Aaron Speach

Name: Aaron Speach

Title: CEO

ESEG LIMITED

By: GLOBAL E-SPORTS ENTERTAINMENT GROUP LLC, its Director

By: /s/ Aaron Speach

Name: Aaron Speach

Title: CEO

ESPORTS PRODUCT TECHNOLOGIES

MALTA LTD

By: /s/ Aaron Speach

Name: Aaron Speach

Title: CEO

ESPORTS MARKETING TECHNOLOGIES

LIMITED

By: /s/ Aaron Speach

Name: Aaron Speach

Title: CEO

[signature page to Forbearance Agreement Amendment

No. 2]

GOGAWI ENTERTAINMENT GROUP

LIMITED

By: /s/ Aaron Speach

Name: Aaron Speach

Title: CEO

KARAMBA LIMITED

By: /s/ Aaron Speach

Name: Aaron Speach

Title: CEO

ESPORTS PRODUCT TRADING MALTA

LIMITED

By: /s/ Aaron Speach

Name: Aaron Speach

Title: CEO

ESPORTS TECHNOLOGIES (ISRAEL) LTD

By: /s/ Aaron Speach

Name: Aaron Speach

Title: CEO

EBET CURACAO N.V.

By: /s/ Aaron Speach

Name: Aaron Speach

Title: CEO

[signature page to Forbearance Agreement

Amendment No. 2]

Exhibit 10.5

AMENDED AND RESTATED

NOTE CONVERSION OPTION AGREEMENT

THIS AMENDED AND RESTATED

NOTE CONVERSION OPTION AGREEMENT (this “Agreement”) is effective as of October 1, 2023, by and among EBET,

Inc. (formerly, eSports Technologies, Inc.), a Nevada corporation (the “Company”) and CP BF LENDING, LLC, a

Delaware limited liability company (together with its successors, assigns and Related Parties, “Lender”), each

a “Party” and collectively the “Parties”, upon the following premises:

WHEREAS, the Parties

entered into that certain Note Conversion Option Agreement, dated June 7, 2022, as amended by that certain Amendment to Note Conversion

Option Agreement dated June 15, 2022 (the “NCOA”), in connection with that certain Credit Agreement, dated November

29, 2021 (the “Credit Agreement”) pursuant to which Lender made a single loan to the Company of $30.0 million

(the “Term Loan”);

WHEREAS, the Lender

has extended a discretionary revolving line of credit to the Company for up to $4.0 million dollars (the “Revolving Loan”,

with the aggregate amount outstanding under the Term Loan and the Revolving Loan referred to herein as the “Convertible Debt”);

WHEREAS, the Company

has agreed to amend and restate the NCOA to permit Lender to convert the entire Convertible Debt, including accrued interest thereon,

into shares of Company common stock (the “Common Stock”) as set forth herein. Each capitalized term used herein,

and not otherwise defined, shall have the meaning ascribed thereto in the Credit Documents (as such term is defined in the Credit Agreement);

and

WHEREAS, this Agreement,

constitutes a “Credit Document” as defined in the Credit Agreement, as the same may be amended from time to time.

NOW THEREFORE, on the

stated premises and for and in consideration of the mutual covenants and agreements hereinafter set forth and the mutual benefits to the

Parties to be derived herefrom, it is hereby agreed as follows:

ARTICLE I

REPRESENTATIONS AND WARRANTIES OF

LENDER

As an inducement to and to

obtain the reliance of the Company, Lender represents and warrants as follows:

Section 1.01 Organization;

Authorization. Lender has the requisite corporate power and authority to enter into and to consummate the transactions contemplated

by this Agreement and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of this Agreement by

Lender and the consummation by it of the transactions contemplated hereby and thereby have been duly authorized by all necessary action

on the part of Lender and no further action is required by Lender in connection therewith. This Agreement has been duly executed by the

Lender and, when delivered in accordance with the terms hereof will constitute the valid and binding obligations of Lender enforceable

against Lender in accordance with its terms.

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

As an inducement to, and to

obtain the reliance of Lender, the Company represents and warrants as follows:

Section 2.01 Organization;

Authorization. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated

by this Agreement and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of this Agreement by

the Company and the consummation by them of the transactions contemplated hereby and thereby have been duly authorized by all necessary

action on the part of the Company and no further action is required by the Company in connection therewith. This Agreement has been duly

executed by the Company and, when delivered in accordance with the terms hereof will constitute the valid and binding obligations of the

Company enforceable against the Company in accordance with its terms.

ARTICLE III

CONVERSION TERMS

Section 3.01 The Conversion.

(a) At

any time prior to the indefeasible repayment of the Obligations in full, Lender shall have the right at any time to convert all or any

portion of the principal balance and accrued interest of the Convertible Debt into Common Stock (the “Conversion Shares”)

at the Conversion Price (as defined below).

(b) Exercise

of the conversion right set forth in Section 3.01(a) may be made on one or more occasions by delivery to the Company of notice of Lender’s

intention in accordance with Section 9.2 of the Credit Agreement. Within two (2) Business Days following the receipt of the foregoing

notice, the Company shall cause the Conversion Shares to be transmitted by the Company’s transfer agent to Lender via book-entry

confirmation.

(c) “Conversion

Price” shall mean (i) $1.25 per share of Common Stock for the first $5.0 million of Convertible Debt, and (ii) $2.50 per

share of Common Stock for the remainder of the Convertible Debt. The Conversion Price shall be subject to adjustment resulting from a

stock split, stock distribution, stock subdivision, stock combination, reclassification and other similar corporate actions.

Section 3.02 Principal

repayment; No Prepayment Penalty. Upon the issuance of the Conversion Shares, in Lender’s sole and absolute discretion, the

principal amount of one or both of the Term Loan and the Revolving Loan shall be reduced by the amount that Lender elects to convert pursuant

to this Agreement, until the Obligations are repaid in full. Lender agrees that the exercise of its conversion rights hereunder shall

not be deemed to be a prepayment pursuant to the Credit Documents that would require the Company to pay the Applicable Prepayment Premium

or any other amounts due in connection with a prepayment.

Section 3.03 Resale

Registration. As soon as practicable (and in any event within 45 calendar days of the date of this Agreement), the Company shall file

a resale registration statement (the “Resale Registration Statement”) providing for the resale by Lender of

the Conversion Shares issued and issuable upon full exercise of the conversion right. The Company shall use commercially reasonable efforts

to cause such Resale Registration Statement to become effective within one hundred twenty (120) days following the date of this letter

agreement and to keep such Resale Registration Statement effective at all times until Lender has fully exercised its conversion right

or the Obligations are paid in full.

Section 3.04 Limitations

on Conversion.

(a) Notwithstanding

any other provision herein, Lender shall not have the right to convert any portion of the Convertible Debt into Conversion Shares to the

extent that, after giving effect to such conversion, Lender, together with its affiliates would beneficially own (as determined in accordance

with Section 13(d) of the Securities Exchange Act of 1934, as amended, and the rules thereunder) in excess of 9.99% of the then issued

and outstanding shares of Common Stock of the Company (the “Beneficial Ownership Blocker”). The Beneficial Ownership

Blocker may be adjusted at the written request of Lender, provided such adjustment shall not become effective for a period of 61 days

after such written request.

Section 3.05 Short Sales.

Until such time as Lender no longer holds any Conversion Shares, Lender agrees not to effect any “short sales” as defined

in Rule 200 of Regulation SHO under the Exchange Act.

Section 3.06 Conversion

Lock-up. During the forty-five (45) day period following the date of this Agreement, Lender shall not convert any portion of the Convertible

Debt.

Section 3.07 Successors

and Assigns. In the event that the Lender sells, transfers, or otherwise disposes of all or any portion of the Convertible Debt, the

Company hereby agrees that, at the request of Lender, it shall enter into a new note conversion option agreement with the purchaser or

transferee of the Convertible Debt on terms and conditions identical to those set forth in this Agreement. Lender shall provide the Company

with written notice of any transfer of Convertible Debt, including the identity of the new holder, within two (2) Business Days of such

transfer.

ARTICLE IV

MISCELLANEOUS

Section 4.01 Governing

Law. This Agreement shall be governed by, enforced, and construed under and in accordance with the laws of the State of New York without

giving effect to principles of conflicts of law thereunder.

Section 4.02 Entire

Agreement. This Agreement represents the entire agreement between the parties relating to the subject matter thereof and supersedes

all prior agreements, term sheets, understandings and negotiations, written or oral, with respect to such subject matter.

Section 4.03 Counterparts.

This Agreement may be executed in multiple counterparts, each of which shall be deemed an original and all of which taken together shall

be but a single instrument.

Section 4.04 Construction. The Parties

acknowledge that each of them has had the benefit of legal counsel of its own choice and has been afforded an opportunity to review this

Agreement with its legal counsel and that this Agreement shall be construed as if jointly drafted by the Parties hereto. In this Agreement,

the word “include”, “includes”, “including” and “such

as” are to be construed as if they were immediately followed by the words, without limitation.

Section 4.05 Severability. The invalidity

or unenforceability of any term, phrase, clause, paragraph, restriction, covenant, agreement or other provision of this Agreement shall

in no way affect the validity or enforcement of any other provision or any part thereof.

Section 4.06 Headings. The paragraph

headings contained in this Agreement are for convenience only, and shall in no manner be construed as part of this Agreement.

Section 4.07 Effect of PDF and Photocopied

Signatures. This Agreement may be executed in several counterparts, each of which is an original. It shall not be necessary in making

proof of this Agreement or any counterpart hereof to produce or account for any of the other counterparts. A copy of this Agreement signed

by one Party and scanned and emailed to another Party (as a PDF or similar image file) shall be deemed to have been executed and delivered

by the signing Party as though an original. A photocopy or PDF of this Agreement shall be effective as an original for all purposes.

[Remainder of page left intentionally blank.

Signature page follows.]

IN WITNESS WHEREOF,

the Parties hereto have caused this Agreement to be executed as of the date first-above written.

(“Company”)

EBET, Inc.

By: /s/ Aaron Speach

Its: Chief Executive Officer

Printed

Name: Aaron Speach

(“Lender”)

CP BF LENDING, LLC

By: CP Business Finance GP, LLC, its manager,

By: Columbia Pacific Advisors, LLC, its manager

By: /s/ Brad Shain

Its:

Fund Manager

Printed

Name: Brad Shain

[signature page to Amended and Restated Note

Conversion Option Agreement]

Exhibit 99.1

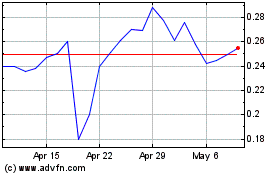

EBET Announces Reverse Stock Split

LAS VEGAS, September 29, 2023 -- EBET, Inc., (Nasdaq:

EBET) a leading global provider of advanced wagering products and technology, announced, today announced that it filed an amendment to

articles of incorporation with the Secretary of State of the State of Nevada to effect a 1-for-30 reverse stock split of its common stock.

The reverse stock split will take effect at 4:01 pm (Eastern Time) on September 29, 2023, and the Company’s common stock will open

for trading on The Nasdaq Capital Market on October 2, 2023 on a post-split basis, under the existing ticker symbol “EBET”

but with a new CUSIP number 278700 208.

As a result of the reverse stock split, every

30 shares of the Company’s common stock issued and outstanding prior to the opening of trading on October 2, 2023 will be consolidated

into one issued and outstanding share, with no change in the nominal par value per share of $0.001. No fractional shares will be issued

as a result of the reverse stock split. Stockholders of record who would otherwise be entitled to receive a fractional share will be entitled

to the rounding up of the fractional share to the nearest whole number.

As a result of the reverse stock split, the number

of shares of common stock outstanding will be reduced from approximately 448.2 million shares to approximately 14.9 million shares, and

the number of authorized shares of common stock will remain at 500 million shares. As a result of the reverse stock split, proportionate

adjustments will be made to the per share exercise price and/or the number of shares issuable upon the exercise or vesting of all outstanding

stock options and warrants, which will result in a proportional decrease in the number of shares of the Company’s common stock reserved

for issuance upon exercise or vesting of such stock options and warrants, and a proportional increase in the exercise price of all such

stock options and warrants. In addition, the number of shares reserved for issuance under the Company’s equity compensation plan

immediately prior to the reverse stock split will be reduced proportionately.

About EBET, Inc.

EBET operates and develops award-winning, groundbreaking

and engaging wagering products for bettors around the world. The company is focused on bringing better entertainment and technology solutions

to cater to the Millennial and Gen-Z demographics in the wagering space. EBET operates online sportsbook and casino brands Karamba, Hopa,

Griffon Casino, BetTarget, Dansk777, GenerationVIP and Gogawi, which have over 1.4 million deposited customers in more than 15 countries.

The company recently was awarded Esport Product of the Year at the 2021 SiGMA Europe and the 2022 SiGMA Asia and SiGMA Americas Awards.

Its brand Karamba received SBC’s award for Innovation in Casino & Gaming Entertainment and the 2022 SiGMA Americas award

for Online Casino of the Year. EBET, Inc. was previously Esports Technologies Inc. The name changed on May 5, 2022, to better reflect

the company’s business and mission.

For more information, visit: https://ebet.gg/.

Forward-Looking Statements

This press release includes forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities

Litigation Reform Act of 1995, which statements involve risks and uncertainties. Forward-looking statements include, without limitation,

the timing and completion of the reverse split. These statements relate to future events, future expectations, plans and prospects. You

can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,”

“should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,”

“plans,” “projected,” “predicts,” “potential,” or “hopes” or the negative

of these or similar terms. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable

as of the date made, actual results or outcomes may prove to be materially different from the expectations expressed or implied by such

forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors,

including those discussed in the Company’s filings with the Securities and Exchange Commission, including as set forth in Item 1A.

“Risk Factors” in our most recently filed Form 10-K filed with the Securities and Exchange Commission and updated from time

to time in our Form 10-Q filings and in our other public filings with the SEC. The Company does not undertake any obligation to release

publicly any revisions to forward-looking statements as a result of subsequent events or developments, except as required by law.

Contacts

For Investors & Media:

Aaron Speach

CEO

aaron.speach@ebet.gg

v3.23.3

Cover

|

Sep. 29, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 29, 2023

|

| Current Fiscal Year End Date |

--09-30

|

| Entity File Number |

001-40334

|

| Entity Registrant Name |

EBET, Inc.

|

| Entity Central Index Key |

0001829966

|

| Entity Tax Identification Number |

85-3201309

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

3960

Howard Hughes Parkway, Suite 500,

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Las

Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89169

|

| City Area Code |

(888)

|

| Local Phone Number |

411-2726

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

EBET

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |