Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

September 29 2023 - 8:33AM

Edgar (US Regulatory)

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2023

Portfolio of Investments (Unaudited)

| Security

| Shares

| Value

|

| Aerospace & Defense — 1.0%

|

| Safran S.A.

|

| 92,201

| $ 15,306,575

|

|

|

|

| $ 15,306,575

|

| Air Freight & Logistics — 1.9%

|

| GXO Logistics, Inc.(1)(2)

|

| 410,853

| $ 27,555,911

|

|

|

|

| $ 27,555,911

|

| Automobile Components — 0.6%

|

| Pirelli & C SpA(3)

|

| 1,576,171

| $ 8,402,597

|

|

|

|

| $ 8,402,597

|

| Automobiles — 1.3%

|

| Stellantis NV

|

| 481,129

| $ 9,871,748

|

| Tesla, Inc.(1)

|

| 35,739

| 9,557,681

|

|

|

|

| $ 19,429,429

|

| Banks — 7.5%

|

| Banco Santander S.A.

|

| 3,010,967

| $ 12,201,285

|

| Bank Polska Kasa Opieki S.A.

|

| 572,956

| 16,918,176

|

| Barclays PLC

|

| 8,256,092

| 16,382,654

|

| Citigroup, Inc.

|

| 220,371

| 10,502,882

|

| HDFC Bank, Ltd.

|

| 832,085

| 16,692,870

|

| HSBC Holdings PLC

|

| 1,433,971

| 11,911,155

|

| Toronto-Dominion Bank (The)

|

| 192,962

| 12,725,117

|

| Truist Financial Corp.

|

| 358,444

| 11,907,510

|

|

|

|

| $ 109,241,649

|

| Beverages — 3.0%

|

| Coca-Cola Co. (The)(4)

|

| 495,096

| $ 30,661,296

|

| Diageo PLC

|

| 306,338

| 13,369,282

|

|

|

|

| $ 44,030,578

|

| Biotechnology — 1.0%

|

| CSL, Ltd.

|

| 82,193

| $ 14,804,286

|

|

|

|

| $ 14,804,286

|

| Broadline Retail — 3.2%

|

| Amazon.com, Inc.(1)(4)

|

| 353,490

| $ 47,254,543

|

|

|

|

| $ 47,254,543

|

| Security

| Shares

| Value

|

| Capital Markets — 1.6%

|

| Intercontinental Exchange, Inc.

|

| 102,864

| $ 11,808,787

|

| Stifel Financial Corp.

|

| 173,140

| 11,001,316

|

|

|

|

| $ 22,810,103

|

| Commercial Services & Supplies — 0.8%

|

| Waste Management, Inc.

|

| 75,983

| $ 12,445,256

|

|

|

|

| $ 12,445,256

|

| Consumer Staples Distribution & Retail — 1.8%

|

| Dollar Tree, Inc.(1)(4)

|

| 167,435

| $ 25,840,244

|

|

|

|

| $ 25,840,244

|

| Electric Utilities — 3.6%

|

| Endesa S.A.

|

| 472,058

| $ 10,117,547

|

| Iberdrola S.A.

|

| 1,477,928

| 18,446,804

|

| NextEra Energy, Inc.

|

| 207,978

| 15,244,787

|

| Redeia Corp. S.A.

|

| 519,193

| 8,683,846

|

|

|

|

| $ 52,492,984

|

| Electrical Equipment — 1.8%

|

| AMETEK, Inc.

|

| 98,809

| $ 15,671,108

|

| Schneider Electric SE

|

| 63,069

| 11,249,745

|

|

|

|

| $ 26,920,853

|

| Electronic Equipment, Instruments & Components — 4.2%

|

| CDW Corp.(4)

|

| 125,088

| $ 23,400,212

|

| Halma PLC

|

| 399,290

| 11,466,760

|

| Keyence Corp.

|

| 17,507

| 7,856,126

|

| Keysight Technologies, Inc.(1)(4)

|

| 47,452

| 7,643,568

|

| TE Connectivity, Ltd.

|

| 72,229

| 10,364,139

|

|

|

|

| $ 60,730,805

|

| Entertainment — 1.8%

|

| Walt Disney Co. (The)(1)(4)

|

| 290,119

| $ 25,788,678

|

|

|

|

| $ 25,788,678

|

| Financial Services — 2.0%

|

| Fidelity National Information Services, Inc.

|

| 186,934

| $ 11,287,075

|

| Visa, Inc., Class A

|

| 74,331

| 17,670,709

|

|

|

|

| $ 28,957,784

|

| Food Products — 4.1%

|

| Mondelez International, Inc., Class A

|

| 351,236

| $ 26,037,125

|

| Nestle S.A.

|

| 279,607

| 34,257,205

|

|

|

|

| $ 60,294,330

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

| Shares

| Value

|

| Gas Utilities — 0.4%

|

| Enagas S.A.

|

| 325,441

| $ 5,775,446

|

|

|

|

| $ 5,775,446

|

| Ground Transportation — 1.1%

|

| Union Pacific Corp.

|

| 68,024

| $ 15,782,929

|

|

|

|

| $ 15,782,929

|

| Health Care Equipment & Supplies — 3.5%

|

| Alcon, Inc.

|

| 149,865

| $ 12,752,255

|

| Boston Scientific Corp.(1)(4)

|

| 277,506

| 14,388,686

|

| Intuitive Surgical, Inc.(1)(4)

|

| 43,699

| 14,175,956

|

| Straumann Holding AG

|

| 56,311

| 9,317,944

|

|

|

|

| $ 50,634,841

|

| Health Care Providers & Services — 0.8%

|

| UnitedHealth Group, Inc.(4)

|

| 23,876

| $ 12,090,090

|

|

|

|

| $ 12,090,090

|

| Health Care REITs — 0.8%

|

| Healthpeak Properties, Inc.

|

| 550,206

| $ 12,010,997

|

|

|

|

| $ 12,010,997

|

| Hotels, Restaurants & Leisure — 3.4%

|

| Amadeus IT Group S.A.

|

| 186,956

| $ 13,411,492

|

| Compass Group PLC

|

| 941,837

| 24,504,365

|

| InterContinental Hotels Group PLC

|

| 169,837

| 12,552,176

|

|

|

|

| $ 50,468,033

|

| Household Products — 0.7%

|

| Reckitt Benckiser Group PLC

|

| 133,947

| $ 10,034,244

|

|

|

|

| $ 10,034,244

|

| Industrial Conglomerates — 1.1%

|

| Siemens AG

|

| 97,156

| $ 16,559,477

|

|

|

|

| $ 16,559,477

|

| Insurance — 5.0%

|

| AIA Group, Ltd.

|

| 1,521,156

| $ 15,218,764

|

| Allstate Corp. (The)

|

| 103,164

| 11,624,519

|

| Assurant, Inc.

|

| 91,151

| 12,260,721

|

| AXA S.A.

|

| 395,236

| 12,149,099

|

| Poste Italiane SpA(3)

|

| 852,173

| 9,734,788

|

| RenaissanceRe Holdings, Ltd.

|

| 61,909

| 11,562,125

|

|

|

|

| $ 72,550,016

|

| Security

| Shares

| Value

|

| Interactive Media & Services — 3.7%

|

| Alphabet, Inc., Class C(1)(4)

|

| 410,553

| $ 54,648,710

|

|

|

|

| $ 54,648,710

|

| IT Services — 1.1%

|

| Accenture PLC, Class A

|

| 53,009

| $ 16,769,397

|

|

|

|

| $ 16,769,397

|

| Leisure Products — 0.8%

|

| Yamaha Corp.

|

| 309,483

| $ 11,991,909

|

|

|

|

| $ 11,991,909

|

| Life Sciences Tools & Services — 2.0%

|

| Danaher Corp.

|

| 79,888

| $ 20,376,233

|

| Sartorius AG, PFC Shares

|

| 20,572

| 8,487,583

|

|

|

|

| $ 28,863,816

|

| Machinery — 1.3%

|

| Daimler Truck Holding AG

|

| 229,629

| $ 8,618,043

|

| Ingersoll Rand, Inc.

|

| 154,220

| 10,065,939

|

|

|

|

| $ 18,683,982

|

| Media — 2.1%

|

| Dentsu Group, Inc.

|

| 390,489

| $ 13,066,299

|

| Publicis Groupe S.A.

|

| 213,055

| 17,177,640

|

|

|

|

| $ 30,243,939

|

| Metals & Mining — 1.4%

|

| Anglo American PLC

|

| 327,361

| $ 10,066,931

|

| Rio Tinto, Ltd.

|

| 125,515

| 9,938,879

|

|

|

|

| $ 20,005,810

|

| Multi-Utilities — 0.7%

|

| CMS Energy Corp.

|

| 101,212

| $ 6,181,017

|

| Hera SpA

|

| 1,218,207

| 3,782,580

|

|

|

|

| $ 9,963,597

|

| Oil, Gas & Consumable Fuels — 3.8%

|

| ConocoPhillips(4)

|

| 252,278

| $ 29,698,166

|

| EOG Resources, Inc.

|

| 198,669

| 26,329,603

|

|

|

|

| $ 56,027,769

|

| Personal Care Products — 0.6%

|

| Kose Corp.

|

| 85,605

| $ 8,382,972

|

|

|

|

| $ 8,382,972

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

| Shares

| Value

|

| Pharmaceuticals — 8.5%

|

| AstraZeneca PLC

|

| 142,958

| $ 20,539,662

|

| Eli Lilly & Co.(4)

|

| 39,494

| 17,951,998

|

| Novo Nordisk A/S, Class B

|

| 108,419

| 17,482,801

|

| Roche Holding AG PC

|

| 71,328

| 22,115,342

|

| Sanofi

|

| 182,751

| 19,496,703

|

| Zoetis, Inc.

|

| 142,206

| 26,747,527

|

|

|

|

| $ 124,334,033

|

| Professional Services — 2.6%

|

| Recruit Holdings Co., Ltd.

|

| 451,168

| $ 15,626,496

|

| RELX PLC

|

| 268,946

| 9,051,837

|

| Verisk Analytics, Inc.

|

| 55,411

| 12,685,794

|

|

|

|

| $ 37,364,127

|

| Semiconductors & Semiconductor Equipment — 5.9%

|

| ASML Holding NV

|

| 29,583

| $ 21,189,379

|

| Infineon Technologies AG

|

| 375,113

| 16,480,764

|

| Micron Technology, Inc.

|

| 286,215

| 20,432,889

|

| NVIDIA Corp.

|

| 32,135

| 15,016,364

|

| Taiwan Semiconductor Manufacturing Co., Ltd. ADR

|

| 136,650

| 13,548,847

|

|

|

|

| $ 86,668,243

|

| Software — 8.8%

|

| Adobe, Inc.(1)(4)

|

| 49,705

| $ 27,147,380

|

| Intuit, Inc.

|

| 45,501

| 23,282,862

|

| Microsoft Corp.(4)

|

| 230,804

| 77,531,679

|

|

|

|

| $ 127,961,921

|

| Specialty Retail — 1.4%

|

| TJX Cos., Inc. (The)

|

| 235,459

| $ 20,374,267

|

|

|

|

| $ 20,374,267

|

| Technology Hardware, Storage & Peripherals — 3.2%

|

| Apple, Inc.(4)

|

| 237,112

| $ 46,580,652

|

|

|

|

| $ 46,580,652

|

| Textiles, Apparel & Luxury Goods — 1.0%

|

| LVMH Moet Hennessy Louis Vuitton SE

|

| 15,917

| $ 14,783,193

|

|

|

|

| $ 14,783,193

|

| Trading Companies & Distributors — 1.9%

|

| Ashtead Group PLC

|

| 141,907

| $ 10,498,817

|

| Security

| Shares

| Value

|

| Trading Companies & Distributors (continued)

|

| IMCD NV

|

| 116,679

| $ 17,680,300

|

|

|

|

| $ 28,179,117

|

Total Common Stocks

(identified cost $1,402,068,559)

|

|

| $1,590,040,132

|

| Security

| Principal

Amount

(000's omitted)

| Value

|

| Banks — 6.2%

|

| Australia & New Zealand Banking Group, Ltd., 6.75% to 6/15/26(3)(5)(6)

| $

| 375

| $ 374,046

|

| Banco Davivienda S.A., 6.65% to 4/22/31(3)(5)(6)

|

| 1,000

| 790,700

|

| Banco Mercantil del Norte S.A./Grand Cayman:

|

|

|

|

| 7.50% to 6/27/29(3)(5)(6)

|

| 2,470

| 2,242,612

|

| 7.625% to 1/10/28(3)(5)(6)

|

| 1,160

| 1,068,379

|

| 8.375% to 10/14/30(3)(5)(6)

|

| 1,105

| 1,084,071

|

| Bank of America Corp.:

|

|

|

|

| 3.846% to 3/8/32, 3/8/37(6)

|

| 75

| 64,696

|

| Series TT, 6.125% to 4/27/27(5)(6)

|

| 2,338

| 2,328,180

|

| Bank of New York Mellon Corp. (The), Series G, 4.70% to 9/20/25(5)(6)

|

| 350

| 342,572

|

| Bank of Nova Scotia (The):

|

|

|

|

| 4.90% to 6/4/25(5)(6)

|

| 1,175

| 1,115,796

|

| 8.625% to 10/27/27, 10/27/82(6)

|

| 3,960

| 4,119,935

|

| Barclays PLC:

|

|

|

|

| 6.125% to 12/15/25(5)(6)

|

| 3,796

| 3,472,445

|

| 8.00% to 3/15/29(5)(6)

|

| 3,629

| 3,384,043

|

| BBVA Bancomer S.A., 8.45% to 6/29/33, 6/29/38(3)(6)

|

| 1,000

| 1,019,000

|

| Bilbao Vizcaya Argentaria S.A., 6.125% to 11/16/27(5)(6)

|

| 3,800

| 3,292,153

|

| BNP Paribas S.A.:

|

|

|

|

| 4.625% to 2/25/31(3)(5)(6)

|

| 1,210

| 928,347

|

| 7.75% to 8/16/29(3)(5)(6)

|

| 3,950

| 3,941,705

|

| Citigroup, Inc., Series W, 4.00% to 12/10/25(5)(6)

|

| 7,326

| 6,592,960

|

| Farm Credit Bank of Texas, Series 3, 6.20% to 6/15/28(3)(5)(6)

|

| 3,200

| 2,832,000

|

| HSBC Holdings PLC, 4.60% to 12/17/30(5)(6)

|

| 3,637

| 2,911,224

|

| Huntington Bancshares, Inc., Series F, 5.625% to 7/15/30(5)(6)

|

| 3,676

| 3,385,916

|

| ING Groep NV, 6.50% to 4/16/25(5)(6)

|

| 983

| 927,385

|

| JPMorgan Chase & Co., Series KK, 3.65% to 6/1/26(5)(6)

|

| 3,253

| 2,929,001

|

| Lloyds Banking Group PLC, 7.50% to 6/27/24(5)(6)

|

| 6,125

| 5,974,447

|

| Natwest Group PLC:

|

|

|

|

| 4.60% to 6/28/31(5)(6)

|

| 752

| 536,090

|

| 6.00% to 12/29/25(5)(6)

|

| 1,642

|

1,540,771

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

| Principal

Amount

(000's omitted)

| Value

|

| Banks (continued)

|

| Natwest Group PLC: (continued)

|

|

|

|

| 8.00% to 8/10/25(5)(6)

| $

| 5,035

| $ 4,983,970

|

| PNC Financial Services Group, Inc. (The), Series V, 6.20% to 9/15/27(5)(6)

|

| 2,475

| 2,388,375

|

| Regions Financial Corp., Series D, 5.75% to 6/15/25(5)(6)

|

| 2,250

| 2,163,776

|

| Societe Generale S.A.:

|

|

|

|

| 5.375% to 11/18/30(3)(5)(6)

|

| 3,548

| 2,838,755

|

| 9.375% to 11/22/27(3)(5)(6)

|

| 662

| 675,141

|

| Standard Chartered PLC, 4.75% to 1/14/31(3)(5)(6)

|

| 2,349

| 1,829,342

|

| Toronto-Dominion Bank (The), 8.125% to 10/31/27, 10/31/82(6)

|

| 5,625

| 5,792,625

|

| UBS Group AG:

|

|

|

|

| 4.375% to 2/10/31(3)(5)(6)

|

| 2,750

| 2,058,513

|

| 6.875% to 8/7/25(5)(6)(7)

|

| 1,471

| 1,371,082

|

| UniCredit SpA, 7.296% to 4/2/29, 4/2/34(3)(6)

|

| 3,765

| 3,656,212

|

| Wells Fargo & Co., Series BB, 3.90% to 3/15/26(5)(6)

|

| 5,420

| 4,877,051

|

| Zions Bancorp NA, Series I, 9.352%, (3 mo. USD LIBOR + 3.80%)(5)(8)

|

| 1,501

| 1,264,593

|

|

|

|

| $ 91,097,909

|

| Capital Markets — 0.4%

|

| AerCap Holdings NV, 5.875% to 10/10/24, 10/10/79(6)

| $

| 1,360

| $ 1,316,679

|

| Charles Schwab Corp. (The):

|

|

|

|

| Series G, 5.375% to 6/1/25(5)(6)

|

| 1,775

| 1,739,876

|

| Series I, 4.00% to 6/1/26(5)(6)

|

| 3,551

| 3,174,558

|

|

|

|

| $ 6,231,113

|

| Diversified Financial Services — 0.6%

|

| Air Lease Corp., Series B, 4.65% to 6/15/26(5)(8)

| $

| 2,579

| $ 2,293,538

|

| Ally Financial, Inc., 6.70%, 2/14/33

|

| 1,215

| 1,131,988

|

| Alpha Holding S.A. de CV:

|

|

|

|

| 9.00%, 2/10/25(3)(9)

|

| 3,050

| 45,746

|

| 10.00%, 12/19/22(3)(9)

|

| 443

| 6,644

|

| American AgCredit Corp., Series A, 5.25% to 6/15/26(3)(5)(6)

|

| 5,139

| 4,567,286

|

| Goldman Sachs Group, Inc. (The), Series V, 4.125% to 11/10/26(5)(6)

|

| 1,046

| 890,530

|

| Unifin Financiera SAB de CV, 7.375%, 2/12/26(3)(9)

|

| 1,325

| 76,188

|

|

|

|

| $ 9,011,920

|

| Electric Utilities — 0.9%

|

| Dominion Energy, Inc., Series C, 4.35% to 1/15/27(5)(6)

| $

| 1,941

| $ 1,675,859

|

| Edison International, Series B, 5.00% to 12/15/26(5)(6)

|

| 757

| 655,919

|

| Emera, Inc., Series 16-A, 6.75% to 6/15/26, 6/15/76(6)

|

| 3,025

|

2,953,058

|

| Security

| Principal

Amount

(000's omitted)

| Value

|

| Electric Utilities (continued)

|

| Sempra, 4.125% to 1/1/27, 4/1/52(6)

| $

| 4,252

| $ 3,498,149

|

| Southern California Edison Co., Series E, 9.833%, (3 mo. USD LIBOR + 4.199%)(5)(8)

|

| 1,705

| 1,706,875

|

| Southern Co. (The), Series 21-A, 3.75% to 6/15/26, 9/15/51(6)

|

| 2,980

| 2,578,033

|

|

|

|

| $ 13,067,893

|

| Food Products — 0.4%

|

| Land O' Lakes, Inc., 8.00%(3)(5)

| $

| 5,982

| $ 5,623,080

|

|

|

|

| $ 5,623,080

|

| Independent Power and Renewable Electricity Producers — 0.2%

|

| Algonquin Power & Utilities Corp., 4.75% to 1/18/27, 1/18/82(6)

| $

| 2,886

| $ 2,331,455

|

|

|

|

| $ 2,331,455

|

| Insurance — 1.1%

|

| Corebridge Financial, Inc., 6.875% to 9/15/27, 12/15/52(6)

| $

| 3,575

| $ 3,493,866

|

| Liberty Mutual Group, Inc., 4.125% to 9/15/26, 12/15/51(3)(6)

|

| 6,337

| 5,078,444

|

| Lincoln National Corp., Series C, 9.25% to 12/1/27(5)(6)

|

| 1,046

| 1,111,412

|

| Prudential Financial, Inc., 5.125% to 11/28/31, 3/1/52(6)

|

| 1,490

| 1,358,950

|

| QBE Insurance Group, Ltd., 5.875% to 5/12/25(3)(5)(6)

|

| 6,060

| 5,831,278

|

|

|

|

| $ 16,873,950

|

| Multi-Utilities — 0.2%

|

| Centerpoint Energy, Inc., Series A, 6.125% to 9/1/23(5)(6)

| $

| 2,795

| $ 2,740,562

|

|

|

|

| $ 2,740,562

|

| Oil and Gas — 0.2%

|

| Petroleos Mexicanos, 6.50%, 3/13/27

| $

| 2,750

| $ 2,448,156

|

|

|

|

| $ 2,448,156

|

| Oil, Gas & Consumable Fuels — 0.4%

|

| EnLink Midstream Partners, L.P., Series C, 9.618%, (3 mo. USD LIBOR + 4.11%)(5)(8)

| $

| 3,952

| $ 3,418,895

|

| Odebrecht Oil & Gas Finance, Ltd., 0.00%(3)(5)

|

| 6,981

| 39,267

|

| Plains All American Pipeline, L.P., Series B, 9.431%, (3 mo. USD LIBOR + 4.11%)(5)(8)

|

| 2,668

| 2,425,285

|

|

|

|

| $ 5,883,447

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

| Principal

Amount

(000's omitted)

| Value

|

| Pipelines — 0.1%

|

| Energy Transfer, L.P., Series B, 6.625% to 2/15/28(5)(6)

| $

| 2,514

| $ 2,001,773

|

|

|

|

| $ 2,001,773

|

| Telecommunications — 0.1%

|

| Rogers Communications, Inc., 5.25% to 3/15/27, 3/15/82(3)(6)

| $

| 1,075

| $ 992,517

|

|

|

|

| $ 992,517

|

Total Corporate Bonds

(identified cost $178,732,602)

|

|

| $ 158,303,775

|

| Exchange-Traded Funds — 0.2%

|

| Security

| Shares

| Value

|

| Equity Funds — 0.2%

|

| Global X U.S. Preferred ETF

|

| 81,664

| $ 1,598,165

|

| iShares Preferred & Income Securities ETF

|

| 36,546

| 1,140,966

|

Total Exchange-Traded Funds

(identified cost $3,023,343)

|

|

| $ 2,739,131

|

| Security

| Shares

| Value

|

| Banks — 0.9%

|

| AgriBank FCB, 6.875% to 1/1/24(6)

|

| 50,890

| $ 5,150,068

|

| Farm Credit Bank of Texas, 6.75% to 9/15/23(3)(6)

|

| 4,562

| 453,349

|

| JPMorgan Chase & Co., Series LL, 4.625%

|

| 353,588

| 7,382,917

|

|

|

|

| $ 12,986,334

|

| Capital Markets — 0.6%

|

| Affiliated Managers Group, Inc., 4.75%

|

| 143,480

| $ 2,654,380

|

| KKR Group Finance Co. IX, LLC, 4.625%

|

| 191,825

| 3,493,133

|

| Stifel Financial Corp., Series D, 4.50%

|

| 115,200

| 1,874,304

|

|

|

|

| $ 8,021,817

|

| Electric Utilities — 0.7%

|

| Brookfield BRP Holdings Canada, Inc., 4.625%

|

| 178,000

| $ 2,823,080

|

| SCE Trust III, Series H, 5.75% to 3/15/24(6)

|

| 70,122

| 1,647,867

|

| SCE Trust IV, Series J, 5.375% to 9/15/25(6)

|

| 37,216

| 758,462

|

| SCE Trust V, Series K, 5.45% to 3/15/26(6)

|

| 68,884

| 1,556,090

|

| Southern Co. (The), 4.95%

|

| 125,000

| 2,768,750

|

|

|

|

| $ 9,554,249

|

| Security

| Shares

| Value

|

| Insurance — 0.3%

|

| American Equity Investment Life Holding Co., Series B, 6.625% to 9/1/25(6)

|

| 97,580

| $ 2,263,856

|

| Athene Holding, Ltd., Series C, 6.375% to 6/30/25(6)

|

| 113,887

| 2,697,983

|

|

|

|

| $ 4,961,839

|

| Oil, Gas & Consumable Fuels — 1.0%

|

| Energy Transfer, L.P.:

|

|

|

|

| Series C, 9.86% (3 mo. USD LIBOR + 4.53%)(8)

|

| 116,000

| $ 2,927,840

|

| Series E, 7.60% to 5/15/24(6)

|

| 100,950

| 2,493,465

|

| NuStar Energy, L.P., Series B, 11.151%, (3 mo. USD LIBOR + 5.643%)(8)

|

| 359,474

| 8,728,029

|

|

|

|

| $ 14,149,334

|

| Real Estate Management & Development — 0.3%

|

| Brookfield Property Partners, L.P.:

|

|

|

|

| Series A, 5.75%

|

| 115,762

| $ 1,565,681

|

| Series A-1, 6.50%

|

| 102,075

| 1,566,851

|

| Series A2, 6.375%

|

| 134,005

| 1,959,153

|

|

|

|

| $ 5,091,685

|

| Retail REITs — 0.1%

|

| SITE Centers Corp., Series A, 6.375%

|

| 88,127

| $ 2,130,911

|

|

|

|

| $ 2,130,911

|

| Wireless Telecommunication Services — 0.3%

|

| United States Cellular Corp., 5.50%

|

| 282,650

| $ 4,078,640

|

|

|

|

| $ 4,078,640

|

Total Preferred Stocks

(identified cost $72,237,657)

|

|

| $ 60,974,809

|

| Security

| Shares

| Value

|

| Diversified Financial Services — 0.0%

|

| Alpha Holding S.A., Escrow Certificates(1)(10)

|

| 7,410,000

| $ 0

|

Total Miscellaneous

(identified cost $0)

|

|

| $ 0

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2023

Portfolio of

Investments (Unaudited) — continued

| Short-Term Investments — 0.6%

|

| Security

| Shares

| Value

|

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional

Class, 5.19%(11)

|

| 8,574,924

| $ 8,574,924

|

Total Short-Term Investments

(identified cost $8,574,924)

|

|

| $ 8,574,924

|

Total Investments — 124.6%(12)

(identified cost $1,664,637,085)

|

|

| $1,820,632,771

|

| Other Assets, Less Liabilities — (24.6)%

|

|

| $ (359,499,798)

|

| Net Assets — 100.0%

|

|

| $1,461,132,973

|

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

|

| (1)

| Non-income producing security.

|

| (2)

| Security (or a portion thereof) has been pledged to cover margin requirements on open futures contracts.

|

| (3)

| Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from

registration (normally to qualified institutional buyers). At July 31, 2023, the aggregate value of these securities is $66,190,007 or 4.5% of the Fund's net assets.

|

| (4)

| All or a portion of this security was on loan at July 31, 2023 pursuant to the Liquidity Agreement. The aggregate market value of securities on loan at July 31, 2023 was

$262,071,753 and the total market value of the collateral received by State Street Bank and Trust Company was $266,090,197 comprised of cash.

|

| (5)

| Perpetual security with no stated maturity date but may be subject to calls by the issuer.

|

| (6)

| Security converts to variable rate after the indicated fixed-rate coupon period.

|

| (7)

| Security exempt from registration under Regulation S of the Securities Act of 1933, as amended, which exempts from registration securities offered and sold outside

the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933, as

amended. At July 31, 2023, the aggregate value of these securities is $1,371,082 or 0.1% of the Fund's net assets.

|

| (8)

| Variable rate security. The stated interest rate represents the rate in effect at July 31, 2023.

|

| (9)

| Issuer is in default with respect to interest and/or principal payments.

|

| (10)

| For fair value measurement disclosure purposes, security is categorized as Level 3.

|

| (11)

| May be deemed to be an affiliated investment company. The rate shown is the annualized seven-day yield as of July 31, 2023.

|

| (12)

| The Fund has granted a security interest in all the Fund’s investments, unless otherwise pledged, in connection with the Liquidity Agreement.

|

| Country Concentration of Portfolio

|

| Country

| Percentage of

Total Investments

| Value

|

| United States

| 55.8%

| $1,015,724,317

|

| United Kingdom

| 9.6

| 175,010,215

|

| France

| 5.4

| 98,546,903

|

| Switzerland

| 5.1

| 92,236,480

|

| Spain

| 4.0

| 71,928,573

|

| Japan

| 3.1

| 56,923,802

|

| Germany

| 2.8

| 50,145,867

|

| Netherlands

| 2.2

| 39,797,064

|

| Italy

| 2.0

| 35,447,925

|

| Canada

| 1.8

| 32,853,583

|

| Australia

| 1.7

| 30,948,489

|

| Ireland

| 1.0

| 18,086,076

|

| Denmark

| 1.0

| 17,482,801

|

| Poland

| 0.9

| 16,918,176

|

| India

| 0.9

| 16,692,870

|

| Hong Kong

| 0.8

| 15,218,764

|

| Taiwan

| 0.7

| 13,548,847

|

| Bermuda

| 0.6

| 11,562,125

|

| Mexico

| 0.4

| 7,990,796

|

| Colombia

| 0.0(1)

| 790,700

|

| Brazil

| 0.0(1)

| 39,267

|

| Exchange-Traded Funds

| 0.2

| 2,739,131

|

| Total Investments

| 100.0%

| $1,820,632,771

|

| (1)

| Amount is less than 0.05%.

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2023

Portfolio of

Investments (Unaudited) — continued

| Futures Contracts

|

| Description

| Number of

Contracts

| Position

| Expiration

Date

| Notional

Amount

| Value/Unrealized

Appreciation

(Depreciation)

|

| Equity Futures

|

|

|

|

|

|

| E-Mini S&P 500 Index

| 287

| Long

| 9/15/23

| $ 66,218,075

| $ 3,252,362

|

| STOXX Europe 600 Index

| (2,141)

| Short

| 9/15/23

| (55,649,277)

| (1,016,588)

|

| STOXX Europe 600 Utilities Index

| (477)

| Short

| 9/15/23

| (10,119,488)

| (47,518)

|

|

|

|

|

|

| $2,188,256

|

| Abbreviations:

|

| ADR

| – American Depositary Receipt

|

| LIBOR

| – London Interbank Offered Rate

|

| PC

| – Participation Certificate

|

| PFC Shares

| – Preference Shares

|

| REITs

| – Real Estate Investment Trusts

|

| Currency Abbreviations:

|

| USD

| – United States Dollar

|

At July 31, 2023, the

Fund had sufficient cash and/or securities to cover commitments under open derivative contracts.

The Fund is subject to

equity price risk in the normal course of pursuing its investment objective. The Fund enters into equity futures contracts on securities indices to gain or limit exposure to certain markets, particularly in connection

with engaging in the dividend capture trading strategy.

Affiliated Investments

At July 31, 2023, the

value of the Fund's investment in funds that may be deemed to be affiliated was $8,574,924, which represents 0.6% of the Fund's net assets. Transactions in such investments by the Fund for the fiscal year to date

ended July 31, 2023 were as follows:

| Name

| Value,

beginning

of period

| Purchases

| Sales

proceeds

| Net

realized

gain (loss)

| Change in

unrealized

appreciation

(depreciation)

| Value, end

of period

| Dividend

income

| Shares,

end of period

|

| Short-Term Investments

|

| Liquidity Fund, Institutional Class(1)

| $11,487,539

| $386,626,668

| $(389,539,283)

| $ —

| $ —

| $8,574,924

| $552,293

| 8,574,924

|

| (1)

| Represents investment in Morgan Stanley Institutional Liquidity Funds - Government Portfolio.

|

Fair Value

Measurements

Under generally accepted

accounting principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs

is summarized in the three broad levels listed below.

| •

|

Level 1 – quoted prices in active markets for identical investments

|

| •

|

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

|

| •

| Level 3 – significant unobservable inputs (including a fund's own assumptions in determining the fair value of investments)

|

In cases where the inputs

used to measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The

inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2023

Portfolio of

Investments (Unaudited) — continued

At July 31, 2023, the hierarchy of

inputs used in valuing the Fund’s investments and open derivative instruments, which are carried at value, were as follows:

| Asset Description

| Level 1

| Level 2

| Level 3*

| Total

|

| Common Stocks:

|

|

|

|

|

| Communication Services

| $ 80,437,388

| $ 30,243,939

| $ —

| $ 110,681,327

|

| Consumer Discretionary

| 77,186,491

| 95,517,480

| —

| 172,703,971

|

| Consumer Staples

| 82,538,665

| 66,043,703

| —

| 148,582,368

|

| Energy

| 56,027,769

| —

| —

| 56,027,769

|

| Financials

| 122,350,761

| 111,208,791

| —

| 233,559,552

|

| Health Care

| 105,730,490

| 124,996,576

| —

| 230,727,066

|

| Industrials

| 94,206,937

| 104,591,290

| —

| 198,798,227

|

| Information Technology

| 281,717,989

| 56,993,029

| —

| 338,711,018

|

| Materials

| —

| 20,005,810

| —

| 20,005,810

|

| Real Estate

| 12,010,997

| —

| —

| 12,010,997

|

| Utilities

| 21,425,804

| 46,806,223

| —

| 68,232,027

|

| Total Common Stocks

| $ 933,633,291

| $656,406,841**

| $ —

| $1,590,040,132

|

| Corporate Bonds

| $ —

| $158,303,775

| $ —

| $ 158,303,775

|

| Exchange-Traded Funds

| 2,739,131

| —

| —

| 2,739,131

|

| Preferred Stocks:

|

|

|

|

|

| Communication Services

| 4,078,640

| —

| —

| 4,078,640

|

| Energy

| 14,149,334

| —

| —

| 14,149,334

|

| Financials

| 20,366,573

| 5,603,417

| —

| 25,969,990

|

| Real Estate

| 7,222,596

| —

| —

| 7,222,596

|

| Utilities

| 9,554,249

| —

| —

| 9,554,249

|

| Total Preferred Stocks

| $ 55,371,392

| $ 5,603,417

| $ —

| $ 60,974,809

|

| Miscellaneous

| $ —

| $ —

| $ 0

| $ 0

|

| Short-Term Investments

| 8,574,924

| —

| —

| 8,574,924

|

| Total Investments

| $1,000,318,738

| $820,314,033

| $ 0

| $1,820,632,771

|

| Futures Contracts

| $ 3,252,362

| $ —

| $ —

| $ 3,252,362

|

| Total

| $1,003,571,100

| $820,314,033

| $ 0

| $1,823,885,133

|

| Liability Description

|

|

|

|

|

| Futures Contracts

| $ (1,064,106)

| $ —

| $ —

| $ (1,064,106)

|

| Total

| $ (1,064,106)

| $ —

| $ —

| $ (1,064,106)

|

| *

| None of the unobservable inputs for Level 3 assets, individually or collectively, had a material impact on the Fund.

|

| **

| Includes foreign equity securities whose values were adjusted to reflect market trading of comparable securities or other correlated instruments that occurred

after the close of trading in their applicable foreign markets.

|

Level 3 investments at the beginning

and/or end of the period in relation to net assets were not significant and accordingly, a reconciliation of Level 3 assets for the fiscal year to date ended July 31, 2023 is not presented.

For information on the Fund's policy

regarding the valuation of investments and other significant accounting policies, please refer to the Fund's most recent financial statements included in its semiannual or annual report to shareholders.

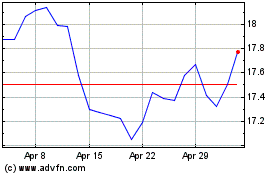

Eaton Vance Tax Advantag... (NYSE:ETG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eaton Vance Tax Advantag... (NYSE:ETG)

Historical Stock Chart

From Apr 2023 to Apr 2024