As filed with the Securities and Exchange Commission

on September 28, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SENMIAO TECHNOLOGY LIMITED

(Exact name of registrant as specified in its charter)

| Nevada |

35-2600898 |

|

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification Number) |

16F, Shihao Square, Middle Jiannan Blvd.

High-Tech Zone, Chengdu

Sichuan, People’s Republic of China 610000

+86 28 61554399

(Address, including zip code, and telephone number,

including area code, of registrant’s principal

executive offices)

CSC Services of Nevada,

Inc.

2215 Renaissance Dr.

Las Vagas, NV 89119

+1(888)921-8397

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

With copies to:

Elizabeth F. Chen, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 326-0199

Approximate date of commencement

of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, other

than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

Smaller reporting company |

x |

| |

|

Emerging growth company |

¨ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION

STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT

WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF

THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION ACTING

PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus

is not complete and may be changed. Senmiao may not sell these securities until the registration statement filed with the Securities and

Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these

securities in any jurisdiction where the offer or sale is not permitted.

| PROSPECTUS |

Subject to Completion, Dated September 28, 2023 |

SENMIAO TECHNOLOGY LIMITED

$150,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

By this prospectus, Senmiao Technology Limited,

a Nevada holding company (“Senmiao”, or the “Company”) may offer and sell from time to time, in one or more series

or classes, up to $150,000,000 in aggregate principal amount of Senmiao’s common stock, preferred stock, debt securities, warrants,

rights and/or units. Senmiao may also offer securities as may be issuable upon conversion, redemption, repurchase, exchange or exercise

of any securities registered hereunder, including any applicable anti-dilution provisions. This prospectus provides a general description

of the securities Senmiao may offer. Each time Senmiao offers securities, it will provide specific terms of the securities offered in

a supplement to this prospectus. The prospectus supplement may also add, update or change information contained in this prospectus. You

should carefully read this prospectus and the applicable prospectus supplement, as well as any documents incorporated by reference, before

you invest in any of the securities being offered.

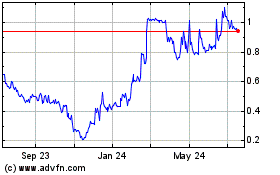

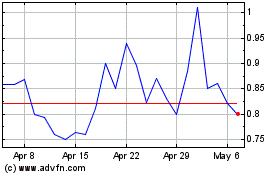

Senmiao’s common stock is listed on The

Nasdaq Capital Market under the symbol “AIHS.” On September 27, 2023, the closing price for Senmiao’s common stock,

as reported on The Nasdaq Capital Market, was $0.46 per share, and the aggregate market value of Senmiao’s outstanding common stock

held by non-affiliates (Senmiao’s “public float”), was 3,160,104.32, calculated based on 6,869,792 shares of outstanding

common stock held by non-affiliates as of September 27, 2023 and the price per share of $0.46. Pursuant to General Instruction I.B.6 of

Form S-3, in no event will Senmiao sell securities registered on the registration statement of which this prospectus is a part in

a public primary offering with a value exceeding more than one-third of Senmiao’s public float in any 12-month period, so long as

Senmiao’s public float remains below $75.0 million. As of the date hereof, Senmiao has not offered any securities pursuant to General

Instruction I.B.6 of Form S-3 during the 12 calendar months prior to and including the date of this prospectus.

Senmiao may offer and sell these securities directly

to investors, through agents designated from time to time or to or through underwriters or dealers, including on a continuous or delayed

basis. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution”

in this prospectus. If any agents or underwriters are involved in the sale of any securities with respect to which this prospectus is

being delivered, the names of such agents or underwriters and any applicable fees, commissions, discounts or over-allotment options will

be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds Senmiao expects to receive from

such sale will also be set forth in a prospectus supplement.

INVESTING IN SENMIAO’S

SECURITIES INVOLVES SUBSTANTIAL RISKS. SENMIAO IS NOT A CHINESE OPERATING COMPANY, BUT A

HOLDING COMPANY INCORPORATED IN NEVADA. AS A HOLDING COMPANY WITH NO MATERIAL OPERATIONS OF ITS OWN, IT CONDUCTS A SUBSTANTIAL MAJORITY

OF ITS OPERATIONS THROUGH ITS OPERATING ENTITIES ESTABLISHED IN THE PEOPLE’S REPUBLIC OF CHINA, OR THE PRC, PRIMARILY ITS WHOLLY

OWNED SUBSIDIARIES.

ADDITIONALLY,

SENMIAO, AND ITS SUBSIDIARIES ARE SUBJECT TO CERTAIN LEGAL AND OPERATIONAL RISKS ASSOCIATED WITH THE subsidiaries’ OPERATIONS IN

CHINA. PRC LAWS AND REGULATIONS GOVERNING THE COMPANY’S CURRENT BUSINESS OPERATIONS ARE SOMETIMES VAGUE AND UNCERTAIN, AND THEREFORE,

THESE RISKS MAY RESULT IN A MATERIAL CHANGE IN subsidiaries’ OPERATIONS, SIGNIFICANT DEPRECIATION OF THE VALUE OF SENMIAO’S

COMMON STOCK, OR A COMPLETE HINDRANCE OF SENMIAO’S ABILITY TO OFFER OR CONTINUE TO OFFER ITS SECURITIES TO INVESTORS. RECENTLY,

THE PRC GOVERNMENT INITIATED A SERIES OF REGULATORY ACTIONS AND STATEMENTS TO REGULATE BUSINESS OPERATIONS IN CHINA WITH LITTLE ADVANCE

NOTICE, INCLUDING CRACKING DOWN ON ILLEGAL ACTIVITIES IN THE SECURITIES MARKET, ADOPTING NEW MEASURES TO EXTEND THE SCOPE OF CYBERSECURITY

REVIEWS, AND EXPANDING THE EFFORTS IN ANTI-MONOPOLY ENFORCEMENT. SINCE THESE STATEMENTS AND REGULATORY ACTIONS ARE NEW, IT IS HIGHLY

UNCERTAIN HOW SOON LEGISLATIVE OR ADMINISTRATIVE REGULATION MAKING BODIES WILL RESPOND AND WHAT EXISTING OR NEW LAWS OR REGULATIONS OR

DETAILED IMPLEMENTATIONS AND INTERPRETATIONS WILL BE MODIFIED OR PROMULGATED, IF ANY, AND THE POTENTIAL IMPACT OF SUCH MODIFIED OR

NEW LAWS AND REGULATIONS WILL HAVE ON THE COMPANY’S DAILY BUSINESS OPERATION, THE ABILITY TO ACCEPT FOREIGN INVESTMENTS AND LIST

ON AN U.S. OR OTHER FOREIGN EXCHANGE.

ON

FEBRUARY 17, 2023, THE CHINA SECURITIES REGULATORY COMMISSION, OR THE “CSRC”, PROMULGATED THE TRIAL ADMINISTRATIVE MEASURES

OF OVERSEAS SECURITIES OFFERING AND LISTING BY DOMESTIC COMPANIES (THE “TRIAL MEASURES”), WHICH BECAME EFFECTIVE ON MARCH

31, 2023. ON THE SAMED DATE, THE CSRC CIRCULATED SUPPORTING GUIDANCE RULES NO.1 THROUGH NO.5, NOTES ON THE TRIAL MEASURES, NOTICE ON ADMINISTRATION

ARRANGEMENTS FOR THE FILING OF OVERSEAS LISTINGS BY DEMOSTICE ENTERPRISES AND RELEVEANT CSRC ANSWERES TO REPORTOR QUESTIONS, OR COLLECTIVELY,

THE GUIDANCE RULES AND NOTICE, ON CSRC’S OFFICIAL WEBSITE. THE TRIAL MEAURES, TOGETHER WITH THE GUIDANCE RULES AND NOTICE REITERARE

THE BASIC PRINCIPLES OF DRAFT ADMINSTRATIVE PROVISIONS AND DRAFT FILING MEASURES AND IMPAOSE SUBSTANTILLY THE SAME REQUIREMENTS FOR THE

OVERSEAS SECURITIES OFFERING AND LISTING BY DEMESTIC ENTERPRISES, AND CLARIFIED AND EMPHASIZED SERVAL ASPECTS. BECAUSE WE ARE ALREADY

PUBLICLY LISTED IN THE U.S., THE TRIAL MEASURES AND THE GUIDANCE RULES AND NOTICE DO NOT IMPOSE OBVIOUS ADDITIONAL REGULATORY BURDEN ON

US BEYOND THE OBLIGATION TO REPORT TO THE CSRC AND COMPLY WITH THE FILING REQUIREMENTS ON ANY FUTURE OFFERINGS OF OUR SECURITIES, OR MATERIAL

EVENTS SUCH AS A CHANGE OF CONTROL OR DELISTING. AS THE TRIAL MEASURES AND THE GUIDANCE RULES AND NOTICE ARE NEWLY ISSUED, THERE REMAINS

UNCERTAINTY AS TO HOW IT WILL BE INTERPRETED OR IMPLEMENTED. THEREFORE, WE ARE SUBJECT TO SUCH FILING REQUIREMENTS UNDER THE TRIAL MEASURES

UPON FUTURE SUBSEQUENT OFFERING, AND MAY BE SUBJECT TO ADDITIONAL FILING REQUIREMENTS IF THERE ARE ANY CHANGES ON THE TRIAL MEASURES,

UPON THAT TIME, WE MAY NOT BE ABLE TO GET CLEARANCE FROM THE CSRC IN A TIMELY FASHION.

ON MAY 20, 2020, THE U.S.

SENATE PASSED THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT REQUIRING A FOREIGN COMPANY TO CERTIFY IT IS NOT OWNED OR CONTROLLED BY A

FOREIGN GOVERNMENT IF THE PCAOB IS UNABLE TO AUDIT SPECIFIED REPORTS BECAUSE THE COMPANY USES A FOREIGN AUDITOR NOT SUBJECT TO PCAOB INSPECTION.

IF THE PCAOB IS UNABLE TO INSPECT THE COMPANY’S AUDITORS FOR THREE CONSECUTIVE YEARS, THE ISSUER’S SECURITIES ARE PROHIBITED

TO TRADE ON A U.S. STOCK EXCHANGE. ON DECEMBER 2, 2020, THE U.S. HOUSE OF REPRESENTATIVES APPROVED THE HOLDING FOREIGN COMPANIES ACCOUNTABLE

ACT. ON DECEMBER 18, 2020, THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT WAS SIGNED INTO LAW. PURSUANT TO THE HOLDING FOREIGN COMPANIES

ACCOUNTABLE ACT, THE PCAOB ISSUED A DETERMINATION REPORT ON DECEMBER 16, 2021 WHICH FOUND THAT THE PCAOB IS UNABLE TO INSPECT OR INVESTIGATE

COMPLETELY REGISTERED PUBLIC ACCOUNTING FIRMS HEADQUARTERED IN: (1) MAINLAND CHINA OF THE PRC BECAUSE OF A POSITION TAKEN BY ONE OR MORE

AUTHORITIES IN MAINLAND CHINA; AND (2) HONG KONG, A SPECIAL ADMINISTRATIVE REGION AND DEPENDENCY OF THE PRC, BECAUSE OF A POSITION TAKEN

BY ONE OR MORE AUTHORITIES IN HONG KONG. ON AUGUST 26, 2022, THE PCAOB ANNOUNCED AND SIGNED A STATEMENT OF PROTOCOL (THE “PROTOCOL”)

WITH THE CHINA SECURITIES REGULATORY COMMISSION AND THE MINISTRY OF FINANCE OF THE PEOPLE’S REPUBLIC OF CHINA. THE PROTOCOL PROVIDES

THE PCAOB WITH: (1) SOLE DISCRETION TO SELECT THE FIRMS, AUDIT ENGAGEMENTS AND POTENTIAL VIOLATIONS IT INSPECTS AND INVESTIGATES, WITHOUT

ANY INVOLVEMENT OF CHINESE AUTHORITIES; (2) PROCEDURES FOR PCAOB INSPECTORS AND INVESTIGATORS TO VIEW COMPLETE AUDIT WORK PAPERS WITH

ALL INFORMATION INCLUDED AND FOR THE PCAOB TO RETAIN INFORMATION AS NEEDED; (3) DIRECT ACCESS TO INTERVIEW AND TAKE TESTIMONY FROM ALL

PERSONNEL ASSOCIATED WITH THE AUDITS THE PCAOB INSPECTS OR INVESTIGATES. OUR AUDITOR IS HEADQUARTERED IN SINGAPORE, SINGAPORE AND WILL

BE INSPECTED BY THE PCAOB ON A REGULAR BASIS. OUR AUDITOR IS NOT SUBJECT TO THE DETERMINATION. OUR AUDITOR IS SUBJECT TO LAWS IN THE UNITED

STATES PURSUANT TO WHICH THE PCAOB CONDUCTS REGULAR INSPECTIONS TO ASSESS OUR AUDITOR’S COMPLIANCE WITH THE APPLICABLE PROFESSIONAL

STANDARDS. ON JUNE 22, 2021, THE U.S. SENATE PASSED THE ACCELERATING HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT (“AHFCAA”)

WHICH, PROPOSED TO REDUCE THE NUMBER OF CONSECUTIVE NON-INSPECTION YEARS REQUIRED FOR TRIGGERING THE PROHIBITIONS UNDER THE

HFCAA FROM THREE YEARS TO TWO. ON DECEMBER 29, 2022, THE CONSOLIDATED APPROPRIATIONS ACT, 2023 (THE “CAA”) WAS SIGNED INTO

LAW, WHICH OFFICIALLY REDUCED THE NUMBER OF CONSECUTIVE NON-INSPECTION YEARS REQUIRED FOR TRIGGERING THE PROHIBITIONS UNDER THE HFCAA

FROM THREE YEARS TO TWO, THUS, REDUCE THE TIME BEFORE AN APPLICABLE ISSUER’S SECURITIES MAY BE PROHIBITED FROM TRADING OR DELISTED.

CURRENTLY, OUR AUDITOR IS SUBJECT TO INSPECTION BY PCAOB. HOWEVER, IF AHFCAA WERE ENACTED INTO LAW, IT MAY POSE MORE RISKS OF POTENTIAL

DELISTING AS WELL AS DEPRESS THE PRICE OF COMPANY’S ORDINARY SHARES. ON DECEMBER 15, 2022, THE PCAOB ISSUED A NEW DETERMINATION

REPORT WHICH CONCLUDED THAT IT WAS ABLE TO INSPECT AND INVESTIGATE COMPLETELY PCAOB-REGISTERED ACCOUNTING FIRMS HEADQUARTERED IN MAINLAND

CHINA AND HONG KONG IN 2022, AND THE PCAOB VACATED THE DECEMBER 16, 2021 DETERMINATION REPORT. SHOULD THE PCAOB AGAIN ENCOUNTER IMPEDIMENTS

TO INSPECTIONS AND INVESTIGATIONS IN MAINLAND CHINA OR HONG KONG AS A RESULT OF POSITIONS TAKEN BY ANY AUTHORITY IN EITHER JURISDICTION,

INCLUDING BY THE CSRC OR THE MOF, THE PCAOB WILL MAKE DETERMINATIONS UNDER THE HFCAA AS AND WHEN APPROPRIATE. HOWEVER, WHETHER THE PCAOB

WILL CONTINUE TO CONDUCT INSPECTIONS AND INVESTIGATIONS COMPLETELY TO ITS SATISFACTION OF PCAOB-REGISTERED PUBLIC ACCOUNTING FIRMS HEADQUARTERED

IN MAINLAND CHINA AND HONG KONG IS SUBJECT TO UNCERTAINTY AND DEPENDS ON A NUMBER OF FACTORS OUT OF ABLE VIEW’S, AND ABLE VIEW’S

AUDITOR’S, CONTROL, INCLUDING POSITIONS TAKEN BY AUTHORITIES OF THE PRC. THE PCAOB IS EXPECTED TO CONTINUE TO DEMAND COMPLETE ACCESS

TO INSPECTIONS AND INVESTIGATIONS AGAINST ACCOUNTING FIRMS HEADQUARTERED IN MAINLAND CHINA AND HONG KONG IN THE FUTURE AND STATES THAT

IT HAS ALREADY MADE PLANS TO RESUME REGULAR INSPECTIONS IN EARLY 2023 AND BEYOND. THE PCAOB IS REQUIRED UNDER THE HFCAA TO MAKE ITS DETERMINATION

ON AN ANNUAL BASIS WITH REGARDS TO ITS ABILITY TO INSPECT AND INVESTIGATE COMPLETELY ACCOUNTING FIRMS BASED IN THE MAINLAND CHINA AND

HONG KONG. SHOULD THE PCAOB AGAIN ENCOUNTER IMPEDIMENTS TO INSPECTIONS AND INVESTIGATIONS IN MAINLAND CHINA OR HONG KONG AS A RESULT OF

POSITIONS TAKEN BY ANY FOREIGN AUTHORITY INCLUDING BUT IS NOT LIMITED TO MAINLAND CHINA OR HONG KONG JURISDICTION, THE PCAOB WILL ACT

EXPEDITIOUSLY TO CONSIDER WHETHER IT SHOULD ISSUE A NEW DETERMINATION.

THE

CHINESE REGULATORY AUTHORITIES COULD DISALLOW THE COMPANY’S STRUCTURE, WHICH COULD RESULT IN A MATERIAL CHANGE IN THE COMPANY’S

OPERATIONS AND THE VALUE OF SENMIAO’S SECURITIES COULD DECLINE OR BECOME WORTHLESS. FOR A DESCRIPTION OF THE COMPANY’S CORPORATE

STRUCTURE, SEE “CORPORATE STRUCTURE” ON PAGEs 13 and 14. SEE ALSO “RISK FACTORS - RISKS RELATED TO OUR CORPORATE STRUCTURE”

INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

SEE

THE SECTION TITLED “RISK FACTORS” BEGINNING ON PAGE 25 OF THIS PROSPECTUS TO READ ABOUT FACTORS YOU

SHOULD CONSIDER BEFORE BUYING SHARES OF SENMIAO’S COMMON STOCK.

NONE OF SENIMAO’S

SUBSIDIARIES OR ITS FORMER VIES HAS ISSUED ANY DIVIDENDS OR DISTRIBUTIONS TO RESPECTIVE HOLDING COMPANIES, OR TO ANY INVESTORS AS OF THE

DATE OF THIS PROSPECTUS. SENMIAO’S SUBSIDIARIES IN THE PRC GENERATE AND RETAIN CASH GENERATED FROM OPERATING ACTIVITIES AND RE-INVEST

IT IN THE COMPANY’S BUSINESS. IN THE FUTURE, CASH PROCEEDS RAISED FROM OVERSEAS FINANCING ACTIVITIES, INCLUDING THE CASH PROCEEDS

FROM THE CONVERSION OF THE SERIES A CONVERTIBLE PREFERRED STOCK AND THE EXERCISE OF THE WARRANTS BY THE WARRANT HOLDERS, MAY BE TRANSFERRED

BY SENMIAO TO SENMIAO’S PRC SUBSIDIARIES VIA CAPITAL CONTRIBUTION AND SHAREHOLDER LOANS, AS THE CASE MAY BE.

THE MAJORITY OF SENMIAO’S

AND THE FORMER VIES’ INCOME IS RECEIVED IN RMB AND RESTRICTIONS IN FOREIGN CURRENCIES MAY LIMIT THE COMPANY’S ABILITY

TO PAY DIVIDENDS OR OTHER PAYMENTS, OR OTHERWISE SATISFY THE COMPANY’S FOREIGN CURRENCY DENOMINATED OBLIGATIONS, IF ANY. UNDER

EXISTING PRC FOREIGN EXCHANGE REGULATIONS, PAYMENTS OF CURRENT ACCOUNT ITEMS, INCLUDING PROFIT DISTRIBUTIONS, INTEREST PAYMENTS

AND EXPENDITURES FROM TRADE-RELATED TRANSACTIONS, CAN BE MADE IN FOREIGN CURRENCIES WITHOUT PRIOR APPROVAL FROM THE STATE ADMINISTRATION

OF THE FOREIGN EXCHANGE (“SAFE”) IN THE PRC AS LONG AS CERTAIN PROCEDURAL REQUIREMENTS ARE MET. APPROVAL FROM APPROPRIATE

GOVERNMENT AUTHORITIES IS REQUIRED IF RENMINBI IS CONVERTED INTO FOREIGN CURRENCY AND REMITTED OUT OF CHINA TO PAY CAPITAL EXPENSES SUCH

AS THE REPAYMENT OF LOANS DENOMINATED IN FOREIGN CURRENCIES. THE PRC GOVERNMENT MAY, AT ITS DISCRETION, IMPOSE RESTRICTIONS ON ACCESS

TO FOREIGN CURRENCIES FOR CURRENT ACCOUNT TRANSACTIONS AND IF THIS OCCURS IN THE FUTURE, SENMIAO MAY NOT BE ABLE TO PAY DIVIDENDS

IN FOREIGN CURRENCIES TO ITS SHAREHOLDERS. SEE THE SECTION TITLED “CASH TRANSFER AND DIVIDEND PAYMENT” BEGINNING ON PAGE

16 OF THIS PROSPECTUS FOR DETAILS.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY

OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is September 28,

2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that Senmiao filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process.

Under this shelf registration process, Senmiao may from time to time sell any combination of the securities described in this prospectus

in one or more offerings for an aggregate offering price of up to $150,000,000.

This prospectus provides you with a general description

of the securities Senmiao may offer. Each time Senmiao sells securities, it will provide one or more prospectus supplements that will

contain specific information about the terms of the offering. The prospectus supplement may also add, update or change information contained

in this prospectus. You should read both this prospectus and the accompanying prospectus supplement together with the additional information

described under the heading “Where You Can Find More Information” in this prospectus.

You should rely only on the information contained

in or incorporated by reference in this prospectus, any accompanying prospectus supplement or in any related free writing prospectus filed

by Senmiao with the SEC. Senmiao has not authorized anyone to provide you with different information. This prospectus and the accompanying

prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities

described in the accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any

circumstances in which such offer or solicitation is unlawful. Persons who come into possession of this prospectus in jurisdictions outside

the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of

this prospectus applicable to those jurisdictions. You should assume that the information appearing in this prospectus, any prospectus

supplement, the documents incorporated by reference and any related free writing prospectus is accurate only as of their respective dates.

Our business, financial condition, results of operations and prospects may have changed since such date. Other than as required under

the federal securities laws, Senmiao undertakes no obligation to publicly update or revise such information, whether as a result of new

information, future events or any other reason.

Any trade names, trademarks and service marks

of others that are contained in this prospectus are the property of their respective owners. Solely for convenience, trademarks and trade

names referred to in this prospectus may appear without ®, TM or similar symbols.

Some of the industry data contained in this prospectus

is derived from data from various third-party sources. Senmiao has not independently verified any of this information and cannot assure

you of its accuracy or completeness. Such data is subject to change based on various factors, including those discussed under the “Risk

Factors” section beginning on page 25 of this prospectus.

Unless otherwise stated in

this prospectus, references to:

| |

· |

“China” or the “PRC” refers to the People's Republic of China, excluding, for the purposes of this prospectus only, Hong Kong, Macau and Taiwan; |

| |

· |

“Company” refers to collectively Senmiao Technology Limited, our public holding company incorporated in the State of Nevada and its wholly-owned subsidiaries; |

| |

· |

“Corenel” refers to Chengdu Corenel Technology Limited, a PRC limited liability company and wholly owned subsidiary of Senmiao Consulting; |

| |

· |

“Didi” refers to Beijing Xiaoju Science and Technology Co., Ltd. and its affiliates, the world’s largest mobility technology platform, who operates the largest ride-hailing platform in China; |

| |

· |

“Hunan Ruixi” refers to Hunan Ruixi Financial Leasing Co., Ltd., a PRC limited liability company and our majority owned subsidiary in China; |

| |

· |

“Jiekai” refers to Chengdu Jiekai Technology Ltd., a PRC limited liability company in China and a majority owned subsidiary of Corenel; |

| |

· |

“Jinkailong” refers to Sichuan Jinkailong Automobile Leasing Co., Ltd., our former variable interest entity, a PRC limited liability company with 35% equity interest held by Hunan Ruixi; |

| |

· |

“Operating Entities” refers to Corenel, Hunan Ruixi, Jiekai, Senmiao Consulting, XXTX and Yicheng; |

| |

· |

“Restructuring” refers to the establishment of a wholly foreign owned entity and the execution of a series of agreements among the Company, Senmiao Consulting, Sichuan Senmiao and the equity holders of Sichuan Senmiao, pursuant to which we have gained control of and became the primary beneficiary to Sichuan Senmiao; |

| |

· |

“RMB” and “Renminbi” refer to the legal currency of China; |

| |

· |

“Senmiao” refers to Senmiao Technology Limited; |

| |

· |

“Senmiao Consulting” refers to Sichuan Senmiao Zecheng Business Consulting Co., Ltd., our wholly owned subsidiary in China; |

| |

· |

“Sichuan Senmiao,” refer to Sichuan Senmiao Ronglian Technology Co., Ltd., a PRC limited liability company, the majority owned subsidiary of Senmiao Consulting and our former variable interest entity in China; |

| |

· |

“we,” “us,” “our company” and “our” refer to Senmiao Technology Limited and its subsidiaries; |

| |

· |

“US$,” “U.S. dollars,” “$,” and “dollars” refer to the legal currency of the United States; |

| |

· |

“XXTX” refers to Hunan Xixingtianxia Technology Co., Ltd. and its subsidiaries, a PRC limited liability company and wholly owned subsidiary of Senmiao Consulting; |

| |

· |

“Yicheng” refers to Yicheng Financial Leasing Co., Ltd., a PRC limited liability company and our wholly owned subsidiary in China; and |

| |

· |

“Youlu” refers to Chengdu Youlu Technology Ltd. (“Youlu”), our former variable interest entity in China |

We use U.S. dollars as reporting

currency in our financial statements and in this prospectus. Monetary assets and liabilities denominated in Renminbi are translated into

U.S. dollars at the rates of exchange as of the balance sheet date, equity accounts are translated at historical exchange rates, and revenues,

expenses, gains and losses are translated using the average rate for the period. In other parts of this prospectus, any Renminbi denominated

amounts are accompanied by translations. We make no representation that the Renminbi or U.S. dollar amounts referred to in this prospectus

could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. The PRC government

restricts or prohibits the conversion of Renminbi into foreign currency and foreign currency into Renminbi for certain types of transactions.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, including the documents that

Senmiao incorporates by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended ( the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Any statements about Senmiao’s expectations, beliefs, plans, objectives, assumptions or future events or performance

are not historical facts and may be forward-looking. These statements are often, but are not always, made through the use of words or

phrases such as “may,” “will,” “could,” “should,” “expects,” “intends,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,”

“potential,” “continue,” and similar expressions, or the negative of these terms, or similar expressions. Accordingly,

these statements involve estimates, assumptions, risks and uncertainties which could cause actual results to differ materially from those

expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this

prospectus, and in particular those factors referenced in the section “Risk Factors.”

This prospectus contains forward-looking statements

that are based on our management’s belief and assumptions and on information currently available to our management. These statements

relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that

may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels

of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements include,

but are not limited to, statements about:

| · | our goals and strategies, including our ability to expand our automobile transaction and related services

business and our online ride-hailing platform services business in China; |

| · | our management’s ability to properly develop and achieve any future business growth and any improvements

in our financial condition and results of operations; |

| · | the regulations and the impact by public health epidemics in China on the industries we operate in and

our business, results of operations and financial condition; |

| · | the growth or lack of growth in China of disposable household income and the availability and cost of

credit available to finance car purchases; |

| · | the growth or lack of growth of China’s online ride-hailing, automobile financing and leasing industries; |

| · | taxes and other incentives or disincentives related to car purchases and ownership; |

| · | fluctuations in the sales and price of new and used cars and consumer acceptance of financing car purchases; |

| · | changes in online ride-hailing, transportation networks, and other fundamental changes in transportation

pattern in China; |

| · | our expectations regarding demand for and market acceptance of our products and services; |

| · | our expectations regarding our customer base; |

| · | our plans to invest in our automobile transaction and related services business and our online ride-hailing

platform services business; |

| · | our ability to maintain positive relationships with our business partners; |

| · | competition in the online ride-hailing, automobile financing and leasing industries in China; |

| · | macro-economic and political conditions affecting the global economy generally and the market in China

specifically; and |

| · | relevant Chinese government policies and regulations relating to the industries in which we operate. |

These forward-looking statements are neither promises

nor guarantees of future performance due to a variety of risks and uncertainties and other factors more fully discussed in the “Risk

Factors” section in this prospectus, the section of any accompanying prospectus supplement entitled “Risk Factors” and

the risk factors and cautionary statements described in other documents that Senmiao files from time to time with the SEC. Given these

uncertainties, readers should not place undue reliance on Senmiao’s forward-looking statements. These forward-looking statements

speak only as of the date on which the statements were made and are not guarantees of future performance. Except as may be required by

applicable law, Senmiao does not undertake to update any forward-looking statements after the date of this prospectus or the respective

dates of documents incorporated by reference herein or therein that include forward-looking statements.

Except as required by law, Senmiao assumes no

obligation to update these forward-looking statements publicly, or to revise any forward-looking statements to reflect events or developments

occurring after the date of this prospectus, even if new information becomes available in the future.

PROSPECTUS SUMMARY

Overview

Senmiao is not

a Chinese operating company but a U.S. holding company incorporated in the State of Nevada on June 8, 2017. As a holding company with

no material operations of its own, Senmiao conducts a substantial majority of its operations through its Operating Entities established

in the PRC, including its subsidiaries and former VIEs. Senmiao received the economic benefits of its former VIEs’ business operations

through certain contractual arrangements. The VIE structure was used to allow non-Chinese companies to consolidate the financial statements

of the China-based companies where Chinese law prohibits or restricts direct foreign investment in the operating companies, and that investors

may never directly hold equity interests in the Chinese Operating Entities. However, Senmiao has terminated all its VIE Agreements

and has no VIEs in its consolidation scope for its financial statements since March 31, 2022.

Since November 2018, Senmiao have been providing

automobile transaction and related services focusing on the online ride-hailing industry in the PRC through its wholly owned subsidiaries,

Yicheng, Corenel and Jiekai, and our majority owned subsidiaries, Hunan Ruixi, and its equity investee company and former VIE, Jinkailong.

Since October 2020, Senmiao also operates an online ride-hailing platform through XXTX, which is a wholly owned subsidiary

of Senmiao Consulting. XXTX’s platform enables qualified ride-hailing drivers to provide transportation services mainly in Chengdu,

Changsha, Guangzhou and other 23 cities in China. Our business includes Automobile Transaction and Related Services (as defined hereinbelow)

and Online Ride-hailing Platform Services, which constituted a series of services as follows:

Automobile Transactions and Related Services

The automobile transaction and related services

(the “Automobile Transaction and Related Services”) are mainly comprised of (i) automobile operating lease where our

Operating Entities provide car rental services to individual customers to meet their personal needs with lease term no more than twelve months

(the “Auto Operating Leasing”); (ii) service fees from new energy vehicles (“NEVs”)

leasing, automobile purchase and management services where we charge NEVs lessees or automobile purchasers for a series of the services

provided to them throughout the leasing or purchase process based on the chosen product solutions, such as ride-hailing driver training,

assisting with a series of administrative procedures and other consulting services (the “Purchase and NEVs Services”);

(iii) automobile sales where we sell new purchased or used cars to our customers (the “Auto

Sales”); (iv) automobile financing where we provide our customers with auto finance solutions through financing leases (the

“Auto Financing”); (v) auto management and guarantee services provided to online ride-hailing drivers after the delivery

of automobiles (the “Auto Management and Guarantee Services”); and (vi) other supporting services provided to online

ride-hailing drivers. Our Operating Entities started the Purchase and NEVs Services, Auto Management and Guarantee Services,

and other supporting services in November 2018, the Auto Sales in January 2019, and Auto Operating Leasing and Auto Financing in March

2019, respectively.

The following chart illustrates the constitution

of our automobile transactions and related services:

Auto Operating Leasing

We, through our subsidiaries, Hunan Ruixi, Corenel,

Jiekai, and former VIE, Jinkailong (the “Auto Business Entities”) in China, have generated revenue since March 2019 from

operating lease services, where the Auto Business Entities lease their own automobiles or sublease automobiles leased from third-parties

or rendered from certain online ride-hailing drivers they served before with their authorization, to other individuals, including new

online ride-hailing drivers for a lease term of no more than twelve months. Due to the intense competition and the COVID-19 pandemic,

as of March 31, 2023 and 2022, approximately 1,335 and 1,327 online ride-hailing drivers (primarily in Chengdu City) have exited

the online ride-hailing business and rendered their automobiles to Hunan Ruixi and Jinkailong, respectively.

We have shifted our business focus to automobile leasing in accordance with the change of market condition and industry development. Hunan

Ruixi is and Jinkailong was authorized to sublease or sell these drivers’ automobiles in order to offset the repayments those drivers

owed to us and the financial institutions. We also purchase and lease NEVs for subleasing with rental periods of twelve months or less.

Excluding Jinkailong,

other Auto Business Entities leased over 1,800 automobiles with an average monthly rental income of $478 per automobile resulting in a

rental income of $3,453,392, including rental income of $344,120 from Jinkailong, for the year ended March 31, 2023. We leased over 1,000

automobiles with an average monthly rental income of approximately $491 per automobile, resulting in a rental income of $1,056,394, including

rental income of $13,748 from Jinkailong, for the three months ended June 30, 2023.

Purchase and NEVs Services

Our Auto Business Entities

charge lease service fees to lessees who rent NEVs from us, in accordance with the increasing demand for NEVs in the online ride-hailing

industry in Chengdu and Changsha. We also charge automobile purchasers services fees for a series of the services provided to them throughout

the purchase process such as credit assessment, installment of GPS devices, ride-hailing driver qualification and other administrative

procedures. The amount of services fees for NEVs leasing and purchase is based on the product solutions. Excluding Jinkailong, our other

Auto Business Entities had revenue of services of $350,510 from NEVs leasing and $33,585 from automobile purchase for the year ended March

31, 2023, respectively. We had revenues of $20,271 from NEVs leasing and $12,232 from automobile purchase for the three months ended June

30, 2023, respectively.

Auto Management and Guarantee Services

The management and guarantee

services of Hunan Ruixi are provided to online ride-hailing drivers after the delivery of automobiles, covering (i) management services

including, without limitation, ride-hailing driver training, assisting with purchase of insurances, insurance claims and after-sale automobile

services, handling traffic violations and other consulting services; and (ii) guarantee services for the obligations of online ride-hailing

drivers under their financing arrangement with financial institutions. The management and guarantee fees of Hunan Ruixi are and the management

and guarantee fees of Jinkailong were based on the costs of our services and the results of our credit assessment of the automobile purchasers.

Excluding Jinkailong, our other Auto Business Entities had revenue of $40,158 and $6,592 for the year ended March 31, 2023 and the three

months ended June 30, 2023, respectively.

As of June 30,

2023 and March 31, 2023, the maximum contingent liabilities Hunan Ruixi would be exposed to, was zero and approximately $10,000, respectively,

assuming all the automobile purchasers were in default, which may cause an increase in guarantee expense and cash outflow in financing

activities. Besides, as of June 30, 2023, the maximum contingent liabilities our former VIE, Jinkailong, would be exposed to was approximately

$3.2 million, assuming all the automobile purchasers were in default, which may cause an increase in guarantee expense and cash outflow

in its own financing activities.

Auto Sales

Our Auto Business Entities

are also engaged in the sales of automobiles through Hunan Ruixi and our former VIE, Jinkailong. Excluding Jinkailong, our other Auto

Business Entities sold one new and 42 used automobiles, resulting in income of $243,065 during the year ended March 31, 2023. They sold

one used-automobile with income of $5,044 during the three months ended June 30, 2023.

Auto Financing

Hunan Ruixi began offering

auto financing services in March 2019. In a self-operated financing transaction, Hunan Ruixi is a lessor and a customer (i.e., online

ride-hailing driver) is a lessee. Hunan Ruixi offers to the customer a selection of automobiles that were purchased by Hunan Ruixi in

advance. The customer will choose the desirable automobile to be purchased and enter into a financing lease with Hunan Ruixi. During the

term of the financing lease, the customer will have use rights with respect to the automobile. Hunan Ruixi will obtain title to the automobile

upfront and retain such title during the term of the financing lease, as lessor. At the end of the lease term, the customer will pay a

minimal price and obtain full title of the automobile after the financing lease is repaid in full. In connection with the financing lease,

the customer will enter into a service agreement with Hunan Ruixi. Hunan Ruixi recognized a total interest income of $41,738 and $13,600

for the year ended March 31, 2023 and the three months ended June 30, 2023, respectively.

Since November 22, 2018,

the acquisition date of Hunan Ruixi, and as of June 30, 2023, the Auto Business Entities have facilitated financing for an aggregate of

1,687 automobiles with a total value of approximately $23.9 million, sold an aggregate of 1,467 automobiles

with a total value of approximately $14.1 million and delivered approximately 2,996 automobiles under operating leases (including 1,826

automobiles used to be delivered by Jinkailong before March 31, 2022) and 148 automobiles under financing leases to customers, the vast

majority of whom are online ride-hailing drivers.

Ride-Hailing Platform Services

As part of our goal

to provide an all solution for online ride-hailing drivers as well as to increase our competitive strengths in an increasingly competitive

online ride-hailing industry and to take advantage of the market potential, in October 2020, we, through XXTX, began operating an

online ride-hailing platform in Chengdu. The platform (called Xixingtianxia) was

owned and operated by XXTX, of which Senmiao Consulting acquired the 100% equity interest pursuant to a series of investment and supplementary

agreements. As of the date of this prospectus, Senmiao Consulting has made accumulated capital contribution of RMB40.01 million (approximately

$5.52 million) to XXTX and the remaining amount is expected to be paid before December 31, 2025.

Our ride

hailing platform enables qualified ride-hailing drivers to provide application-based transportation services in China. XXTX holds a national

online reservation taxi operating license. The platform is presently servicing ride-hailing drivers in 26 cities in China, including Chengdu,

Changsha, Guangzhou and so on, providing them with a platform to view and take customer orders for rides. XXTX

currently collaborates with Gaode Map a well-known aggregation platform in China on our ride-hailing platform services. Under the collaboration,

when a rider using the platform searches for taxi/ride-hailing services on the aggregation platform, the platform provides such rider

a number of online ride-hailing platforms for selection, including ours and if XXTX’s platform is selected by the rider, the order

will then be distributed to registered drivers on our platform for viewing and acceptance. The rider may also simultaneously select multiple

online ride-hailing platforms in which case, the aggregation platform will distribute the requests to different online ride-hailing platforms

which they cooperate with, based on the number of available drivers using the platform in a certain area and these drivers’ historical

performance, among other things. XXTX generates revenue from providing services to online ride-hailing drivers to assist them in providing

transportation services to the riders looking for taxi/ride-hailing services. XXTX earns commissions for each completed order as the difference

between an upfront quoted fare and the amount earned by a driver based on actual time and distance for the ride charged to the rider.

XXTX settles its commissions with the aggregation platforms on a weekly basis.

Meanwhile, in order to strengthen

the market position in certain cities, the collaboration model with Meituan of our Operating Entities has been changed from the one the

same as Gaode, to the one focusing on automobile operating lease and drivers’ management services since August 2021. During

the three months ended June 30, 2023, our subsidiary, Jiekai, and equity investee company and former VIE, Jinkailong, cooperated with

other online ride-hailing platforms (“Partner Platforms”), such as Chengdu Anma Zhixing Technology Co., Ltd. and Sichuan Peitu

Kuaixing Technology Co., Ltd., whereby the online ride-hailing requests and orders shall be completed on Partner Platforms utilizing the

network of cars and drivers of us and Jinkailong. Jiekai and Jinkailong earned rental income from drivers and earned commissions from

Partner Platforms.

Transaction Process

The following chart illustrates our typical process

of XXTX’s ride-hailing platform services:

During the year ended March 31,

2023, approximately 6.1 million rides with gross fare of approximately $19.9 million were completed through Xixingtianxia and an average

of over 5,100 Active Drivers each month. During the year ended March 31, 2023, we earned online ride-hailing platform service fees of

approximately $3.7 million, after netting off approximately $0.5 million incentives paid to Active Drivers.

During the

three months ended June 30, 2023, approximately 1.7 million rides with gross fare of approximately $5.3 million were completed through

Xixingtianxia and an average of approximately 6,200 ride-hailing drivers completed rides and earned income through Xixingtianxia (the

“Active Drivers”) each month. During the three months ended June 30, 2023, we earned online ride-hailing platform service

fees of approximately $0.9 million, after netting off approximately $0.1 million incentives paid to Active Drivers.

We plan to expand our driver base

for the platform and automobile rental business while strengthening the royalty of the drivers who both lease our cars and use our platform

while expanding, but our platform is available to others. We plan to launch Xixingtianxia in more cities across China the next 12 months.

The executive offices are located in Chengdu City,

Sichuan Province, China. Substantially all of the operations are conducted in China.

Corporate History

Senmiao Technology Limited was incorporated in

the State of Nevada on June 8, 2017. It established a wholly owned subsidiary, Senmiao Consulting in China in July 2017. Sichuan

Senmiao, our former VIE, was established in China in June 2014. Senmiao Consulting provided services to Sichuan Senmiao, pursuant

to a series of contractual arrangements (the “VIE Agreements”) with Sichuan Senmiao and each of its equity holders. Senmiao

Consulting became the primary beneficiary of Sichuan Senmiao. The contractual arrangements had been in place since the establishment of

Senmiao Consulting (the “Restructuring”). On March 23, 2022, shareholders with 94.5% equity interests of Sichuan Senmiao

and Senmiao Consulting terminated the VIE Agreements. On March 28, 2022, these shareholders further sold a total of 94.5% equity

interests of Sichuan Senmiao to Senmiao Consulting with a total consideration of zero. Sichuan Senmiao became the majority owned subsidiary

of Senmiao Consulting accordingly.

On September 25, 2016, Sichuan Senmiao acquired

a P2P platform (including website, internet content provider (“ICP”) registration, operating systems, servers, management

system, employees and users) from Sichuan Chenghexin Investment and Asset Management Co., Ltd. (“Chenghexin”), which

had established and operated the platform for two years prior to our acquisition (the “Acquisition”), for a total cash consideration

of RMB69,690,000 (approximately $10.1 million). Prior to the Acquisition, Sichuan Senmiao was a holding company that owned a 60% equity

interest in an equity investment fund management company. Sichuan Senmiao sold its 60% equity interest for a cash consideration of RMB60

million (approximately $8.9 million) immediately following the Acquisition, in order to focus on the online marketplace lending business.

We ceased the online lending services business in October 2019.

On November 21, 2018, Senmiao Technology

Limited entered into an Investment and Equity Transfer Agreement (the “Investment Agreement”) with Hunan Ruixi and all the

shareholders of Hunan Ruixi, pursuant to which we acquired an aggregate of 60% of the equity interest of Hunan Ruixi for no consideration.

Senmiao Technology Limited closed the acquisition on November 22, 2018 and agreed to make a cash contribution of $6,000,000 to Hunan

Ruixi, representing 60% of its registered capital, in accordance with the Investment Agreement. Senmiao Technology Limited has made the

full cash contributions (in the aggregate amount of $6,000,000) to Hunan Ruixi. Hunan Ruixi holds a business license for automobile sales

and financial leasing and has been engaged in automobile financial leasing services and automobile sales since March 2019 and January 2019,

respectively.

Hunan Ruixi has a wholly owned subsidiary, Ruixi

Leasing, a PRC limited liability company formed in April 2018 with a registered capital of RMB10 million (approximately $1.5 million).

Ruixi Leasing had no operations and was dissolved in June 2022.

Hunan Ruixi also owns 35% equity interest in Jinkailong

and used to receive economic benefits of the remaining 65% equity interest through two voting agreements with four shareholders of Jinkailong.

On March 31, 2022, the voting agreements were terminated by the four shareholders of Jinkailong and Hunan Ruixi. As a result, Jinkailong

ceased being a VIE. Jinkailong is an automobile transaction and related services company in Chengdu City, Sichuan Province, China, which

primarily targets drivers in the ride-hailing service sector, focus on automobile operating lease, and facilitates sales and financing

transactions for its clients and provides relevant after-transaction services to them. Although Jinkailong was ceased from our consolidation

scope since March 31, 2022, Huana Ruixi, Corenel and Jiekai continuously provide automobile transaction and related services similar to

Jinkailong in Changsha and Chengdu.

In May 2019, Senmiao formed Yicheng Financial

Leasing Co., Ltd. (“Yicheng”), a PRC limited liability company and a wholly owned subsidiary, with a registered capital

of $50 million in Chengdu City, Sichuan Province, China. Yicheng obtained its business licenses for automobiles sale and has engaged in

the sales of automobiles since June 2019. As of the date of this prospectus, Senmiao Technology Limited has made contributions in

the aggregate amount of $5,750,000 to Yicheng.

On September 11, 2020, Senmiao Consulting

entered into an Investment Agreement relating to XXTX with all the original shareholders of XXTX, pursuant to which Senmiao Consulting

would make an investment of RMB3.16 million (approximately $0.44 million) in XXTX in cash and obtain a 51% equity interest accordingly.

As of the date of this prospectus, the Company had remit approximately full amount of investment to XXTX pertained to above mentioned

XXTX Investment Agreement.

On October 23, 2020, the registration procedures

for the change in shareholders and registered capital were completed and XXTX became a majority owned subsidiary of Senmiao Consulting.

On February 5, 2021, Senmiao Consulting and all the original shareholders of XXTX entered into a

supplementary agreement related to XXTX’s Investment agreement (the “XXTX Increase Investment Agreement”). Under the

XXTX Increase Investment Agreement, all the shareholders of XXTX agreed to increase the total registered capital of XXTX to RMB50.8 million

(approximately $7.40 million). Senmiao Consulting shall pay an additional amount of RMB36.84 million (approximately $5.08

million) in cash in exchange of additional 27.74% of XXTX’s equity interest. As of the date of this prospectus, the Company had

remitted approximately RMB36.84 million ($5.08 million) to XXTX pertained to above mentioned XXTX Increase Investment Agreement.

On October 22, 2021, Senmiao Consulting entered

into a Share Swap Agreement (the “Share Swap Agreement”) with certain shareholders of XXTX. Pursuant to which the Senmiao

Consulting shall acquire all of the remaining equity interests from the original shareholders of XXTX at a total purchase price of $3.5

million, payable in Senmiao’s shares of common stock, par value $0.0001 per share at a per share price of the average closing price

of a share of common stock reported on the Nasdaq Capital Market for ten (10) trading days immediately preceding the date of the

Share Swap Agreement. On November 9, 2021, the issuance of 533,167 (5,331,667 pre reverse split) shares of the Company’s common

stock for this transaction has been completed and on December 31, 2021, the registration procedures for the change in shareholders

have been completed. As a result, XXTX became a wholly-owned subsidiary of Senmiao Consulting.

As of the date of this prospectus, Senmiao Consulting

has made a cumulative capital contribution of RMB40.01 million (approximately $5.52 million) to XXTX and the remaining amount is expected

to be paid before December 31, 2025. As of the date of this prospectus, XXTX had eight wholly owned subsidiaries and two of them

have operations.

In December 2020, Senmiao Consulting formed

a wholly owned subsidiary, Corenel, with a registered capital of RMB10.0 million (approximately $1.6 million) in Chengdu City, Sichuan

Province. Corenel has engaged in automobile operating lease since March 2021.

In December 2020, Hunan Ruixi and a third

party jointly formed a subsidiary, Chengdu Xichuang Technology Service Co., Ltd. (“Xichuang”), with a registered capital

of RMB200,000 (approximately $32,000) in Chengdu City, Sichuan Province. Hunan Ruixi holds 70% of the equity interests of Xichuang. In

August 2021, Hunan Ruixi signed an equity transfer agreement with the remaining shareholder of Xichuang. Pursuant to the equity transfer

agreement, the remaining shareholder of Xichuang would transfer 30% of his shares to Hunan Ruixi for free. However, in November 2021,

Xichuang was dissolved. The dissolution of Xichuang did not have a material impact to the Company’s financial results.

In April 2021, Senmiao formed Senmiao Technology

(Hong Kong), Ltd. (“Senmiao HK”), a limited liability company with a registered capital of $10,000 in Hong Kong. We hold

99.99% of the equity interests of Senmiao HK. As of the date of this prospectus, Senmiao HK has no operations.

In March 2022, Corenel and another company

in Chengdu formed a subsidiary, Jiekai, with a registered capital of RMB500,000 (approximately $80,000) in Chengdu City, Sichuan Province.

Corenel holds 51% equity interests of Jiekai. Jiekai is engaged in automobile operating lease business since April 2022. In July 2023,

Corenel fully transfered its equity interests in Jiekai to Senmiao Consulting. As of the date of this prospectus, Jiekai had a subsidiary

without operation.

Our Corporate Structure

The following diagram illustrates the Company’s

corporate structure, including its subsidiaries, as of the date of this prospectus:

Former VIE Agreements with Sichuan Senmiao

Senmiao Consulting, Sichuan Senmiao and all the

shareholders of Sichuan Senmiao (the “Sichuan Senmiao Shareholders”) entered into an Equity Interest Pledge Agreement, an

Exclusive Business Cooperation Agreement, an Exclusive Option Agreement, Power of Attorneys, and Timely Report Agreements in September 2017

(collectively, the “Sichuan Senmiao VIE Agreements”). For the details of such agreements, please refer to the audited financial

statements contained in the annual report on Form 10-K filed with the SEC on July 8, 2021. According to the VIE Agreements,

Senmiao Consulting was the primary beneficiary of Sichuan Senmiao. And the financial statements of Sichuan Senmiao are consolidated in

the consolidated financial statements. Sichuan Senmiao suffered accumulated loss of approximately $18.0 million as of March 31, 2022 with

shareholders’ deficiency of $7.6 million. Due to such loss from Sichuan Senmiao, on March 23, 2022, Senmiao Consulting and

other shareholders with 94.5% equity interests of Sichuan Senmiao terminated the VIE Agreements and purchased Sichuan Senmiao’s

94.5% equity interests with total consideration of zero. Sichuan Senmiao became the majority owned subsidiary of Senmiao Consulting accordingly.

The termination and equity transaction has no significant impact on the consolidated financial statements.

Former Voting Agreements with Jinkailong’s

Other Shareholders

Hunan Ruixi entered into two voting agreements

signed in August 2018 and February 2020, respectively, as amended (the “Voting Agreements”), with Jinkailong and

other Jinkailong’s shareholders holding an aggregate of 65% equity interests. Pursuant to the Voting Agreements, all other Jinkailong’s

shareholders will vote in concert with Hunan Ruixi on all fundamental corporate transactions in the event of a disagreement for periods

of 20 years and 18 years, respectively, ending on August 25, 2038.

On March 31, 2022,

Hunan Ruixi entered into an Agreement for the Termination of the Agreement for Concerted Action by Shareholders of Jinkailong (the “Termination

Agreement”), pursuant to which the Voting Agreements mentioned above shall be terminated as of the date of the Termination Agreement.

The termination will not impair the past and future legitimate rights and interests of all parties in Jinkailong. Since March 31,

2023, the parties no longer maintain a concerted action relationship with respect to the decision required to take concerted action at

its shareholders meetings as stipulated in the Voting Agreements. Each party shall independently express opinions and exercise various

rights such as voting rights and perform relevant obligations in accordance with the provisions of laws, regulations, normative documents

and the Jinkailong’s articles of association.

As a result of the Termination

Agreement, the Company no longer has a controlling financial interest in Jinkailong and have determined that Jinkailong was deconsolidated

from the Company’s consolidated financial statements effective as of March 31, 2022. However, as Hunan Ruixi still holds 35% equity

interests in Jinkailong, Jinkailong is the equity investee company of the Company since then. As of March 31, 2023, the paid-in capital

of Jinkailong was zero.

Former VIE Agreements with Youlu

On December 7, 2021,

XXTX entered into a series of contractual arrangements (collectively, the “Youlu VIE Agreements”) with Youlu and each of its

equity holders (“Youlu Shareholders”). The terms of Youlu VIE Agreements were similar to the Sichuan Senmiao VIE Agreements.

According to the VIE Agreements, Youlu was obligated to pay XXTX service fees approximately equal to its net income. Youlu’s entire

operations were, in fact, directly controlled by XXTX. There were no unrecognized revenue-producing assets that were held by Youlu. However, on March 31, 2022, the Youlu VIE Agreements were terminated by XXTX and Youlu Shareholders. As Youlu has limited operation,

the termination has no significant impact on the consolidated financial statements.

Cash Transfer and Dividend Payment

None of Senmiao’s subsidiaries and former

VIEs have issued any dividends or distributions to respective holding companies, or to any investors as of the date of this prospectus.

Senmiao’s subsidiaries in the PRC generate and retain cash generated from operating activities and re-invest it in our business.

In the future, cash proceeds raised from overseas financing activities may be transferred to Senmiao’s PRC subsidiaries via capital

contribution and shareholder loans, as the case may be. Senmiao Consulting will transfer funds to XXTX and Sichuan Senmiao, respectively,

to meet the capital needs of their business operations.

The PRC government imposes controls on the convertibility

of RMB into foreign currencies and, in certain cases, the remittance of currency out of China. All of Senmiao’s subsidiaries’

income is and, in the case of its former VIEs’ income, was, received in RMB and shortages in foreign currencies may restrict our

ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Under existing

PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures

from trade-related transactions, can be made in foreign currencies without prior approval from The State Administration of the Foreign

Exchange (“SAFE”) in the PRC as long as certain procedural requirements are met. Approval from appropriate government authorities

is required if Renminbi is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of

loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies

for current account transactions and if this occurs in the future, Senmiao may not be able to pay dividends in foreign currencies to its

shareholders.

Cash dividends, if any, on Senmiao’s common

stock will be paid in U.S. dollars. If Senmiao is considered a PRC tax resident enterprise for tax purposes, any dividends Senmiao pays

to its overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax. As of the

date of this prospectus, Senmiao has not made any dividends nor distributions to any U.S. investors.

Relevant PRC laws and regulations permit the PRC

companies to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and

regulations. Additionally, Senmiao’s PRC subsidiaries and long-term investments can only distribute dividends upon approval of the

shareholders after they have met the PRC requirements for appropriation to the statutory reserves. As a result of these and other restrictions

under the PRC laws and regulations, Senmiao’s PRC subsidiaries and long-term investments are restricted to transfer a portion of

their net assets to Senmiao either in the form of dividends, loans or advances. Even though Senmiao currently does not require any such

dividends, loans or advances from Senmiao’s PRC subsidiaries and long-term investments for working capital and other funding purposes,

Senmiao may in the future require additional cash resources from its PRC subsidiaries due to changes in business conditions, to fund future

acquisitions and developments, or merely declare and pay dividends to or distributions to Senmiao’s shareholders.

During each of the fiscal years ended March 31,

2023 and 2022, the only transfers of assets among our Company, were transfers of cash. Senmiao provided cash to its subsidiaries by way

of capital contribution and by way of loan, from the proceeds it received from financings. Meanwhile, Hunan Ruixi also repaid historical

loan to the Company by cash. In addition, there were loans obtained by certain of Senmiao’s Chinese subsidiaries, and those subsidiaries

loaned money to other of Senmiao’s Chinese subsidiaries to meet their working capital needs. The cash was transferred within our

Company by means of bank wires.

As of June 30, 2023 and March 31, 2023, Senmiao

invested or loaned directly an aggregate of approximately $23.9 million and $24.0 million in cash in its subsidiaries, Hunan Ruixi, Senmiao

Consulting and Yicheng. During the three months ended June 30, 2023 and the year ended March 31, 2023, Senmiao did not invest or loan

to its subsidiaries while Hunan Ruixi repaid $100,000 and $750,000 from the loan from Senmiao.

Under PRC laws and regulations, there are restrictions

on Senmiao’s PRC subsidiaries with respect to transferring certain of their net assets to Senmiao either in the form of dividends,

loans or advances. A PRC company is required to set aside general reserves of at least 10% of its after-tax profit, until the cumulative

amount of such reserves reaches 50% of its registered capital unless the provisions of laws regarding foreign investment provide otherwise.

As of June 30, 2023 and March 31, 2023 , the total respective registered capital of all the Company’s consolidated subsidiaries

was approximately RMB663 million (approximately $91.5 million) and RMB661 million (approximately $96.2 million), respectively.

Market Opportunity and Government

Regulations in China

Online Ride-hailing Platform

Services

The demand for XXTX’s

services depends on overall market conditions of the online ride-hailing industry in China. The continuous growth of the urban population

places increasing pressure on the urban transportation and the improvement of living standards has increased the market demand for quality

travel in China. Traditional taxi service is limited, and the merging online platforms have created good opportunities for the development

of the online ride-hailing service market. According to the 51th Statistical report on Internet

Development in China published in March 2023 by the China Internet Network Information Center (the “CNNIC”), the number of

online ride-hailing service users had reached 473 million by the end of December 2022, and took approximately 40.9% of the total number

of Chinese internet users. The online ride-hailing industry is facing increasing competition in China

and is attracting more capital investment. According to the MOT of the People’s Republic of China, as

of June 30, 2023, approximately 318 online ride-hailing platforms have obtained booking taxi operating licenses and the total volume of

online ride-hailing orders was approximately 763 million in June 2023 in China. Meanwhile, approximately 2.43 million online booking taxi

transportation certificates and approximately 5.79 million online booking taxi driver’s licenses were issued nationwide in China. Since

2019, in addition to the traditional online ride-hailing platforms, automobile manufacturers, offline operation service companies, financial

and map service providers, among others, have built cooperation relationships with each other to make the online ride-hailing industry

a more aggregated industry.

The online ride-hailing industry

may also be affected by, among other factors, the general economic conditions in China. The interest rates and unemployment rates may

affect the demand of ride-hailing services and automobile purchasers’ willingness to seek credit from financial institutions. Adverse

economic conditions could also reduce the number of qualified automobile purchasers and online ride-hailing drivers seeking credit from

the financial institutions, as well as their ability to make payments. Should any of those negative situations occur, the volume and value

of the automobile transactions we service will decline, and our revenue and financial condition will be negatively impacted.

In order to manage the rapidly

growing ride-hailing service market and control relevant risks, on July 27, 2016, seven ministries and commissions in China, including

the MOT, jointly promulgated the “Interim Measures for the Administration of Online Taxi Booking Business Operations and Services”

(“Interim Measures”) and amended on December 28, 2019, and November 30, 2022, which legalizes online ride-hailing services

such as XXTX and requires the online ride-hailing services to meet the requirements set out by the measures and obtain taxi-booking service

licenses and take full responsibility of the ride services to ensure the safety of riders.

On November 5, 2016, the

Municipal Communications Commission of Chengdu City and a number of municipal departments jointly issued the “Implementation Rules for

the Administration of Online Booking Taxi Management Services for Chengdu”, which was abolished and replaced by the updated version

issued on July 26, 2021. On August 10, 2017, the Transportation Commission of Chengdu further issued the detailed guidance “Working

Process for the Online Booking Taxi Drivers Qualification Examination and Issuance” and the “Online Booking Taxi Transportation

Certificate Issuance Process.” On November 28, 2016, Guangzhou Municipal People’s Government promulgated Interim Measures

for the Management of Online Ride Hailing Operation and Service in Guangzhou, as amended on November 14, 2019. According to these regulations

and guidelines, three licenses /certificates are required for operating the online ride-hailing business in Chengdu and Guangzhou: (1) the

ride-hailing service platform such as XXTX should obtain the online booking taxi operating license; (2) the automobiles used for

online ride-hailing should obtain the online booking taxi transportation certificate (“automobile certificate”); (3) the

drivers should obtain the online booking taxi driver’s license (“driver’s license”). Besides, all the new cars

used for online ride-hailing in Chengdu should be NEVs since July 2021.

On July 23, 2018, the General

Office of Changsha Municipal People’s Government issued the “Detailed Rules for the Administration of Online Booking

Taxi Management Services for Changsha.” On June 12, 2019, the Municipal Communications Commission of Changsha City further

issued “Transfer and Registration Procedures of Changsha Online Booking of Taxi.” According to the regulations and guidelines,

to operate a ride-hailing business in Changsha requires similar licenses in Chengdu, except those automobiles used for online ride-hailing

services are required to meet certain standards, including that the sales price (including taxes) is over RMB120,000 (approximately $17,000).

In practice, Hunan Ruixi is also required to employ a safety administrator for every 50 automobiles used for online ride-hailing services

and submit daily operation information of these automobiles such as traffic violation to the Transport Management Office of the Municipal

Communications Commission of Changsha City every month. On November 28, 2016, Guangzhou Municipal People’s Government also promulgated

Interim Measures for the Management of Online Ride Hailing Operation and Service in Guangzhou, as amended on November 14, 2019.

In addition to the national online

reservation taxi operating license, XXTX and its subsidiaries also obtained the online reservation taxi operating license in 31 cities,

Chengdu, Changsha, Guangzhou, Tianjin, Shenyang, Harbin, Nanchang, Haikou, Xining, two cities in Zhejiang, Shandong, and Guangxi Province,

respectively, three cities in Guizhou Province, five cities in Jiangsu Province, other two cities in Hunan and Guangdong Province, respectively,

and other four cities in Sichuan Province from June 2020 to July 2023, to operate the online ride-hailing platform services.

However, approximately 61% of

the ride-hailing drivers we served had not obtained the driver’s license as of June 30, 2023, while all of the cars used for online

ride-hailing services which we provided management services to have the automobile certificate. Without requisite automobile certificate

or driver’s license, these drivers may be suspended from providing ride-hailing services, confiscated their illegal income and subject

to fines of up to 10 times of their illegal income. Starting in December 2019, Didi began to enforce such limitation on drivers in

Chengdu who have a driver’s license but operate automobiles without the automobile certificate.

Furthermore, according

to the Interim Measures, no enterprise or individual is allowed to provide information for conducting online ride-hailing services to

unqualified vehicles and drivers. Pursuant to the Interim Measures, XXTX and its subsidiaries may be fined between RMB5,000 to RMB30,000

(approximately $690 to $4,137) for violations of the Interim Measures, including providing online ride-hailing platform services to unqualified

drivers or vehicles. During the three months ended June 30, 2023, we have been fined by approximately $19,000 by Traffic Management Bureaus

in Chengdu and Changsha, of which, approximately $15,000 was further compensated by drivers or cooperated third parties. If we are deemed

in serious violation of the Interim Measures, our Online Ride-hailing Platform Services may be suspended and the relevant licenses may

be revoked by certain government authorities.

We are in the process of assisting

the drivers to obtain the required certificate and license both for our Automobile Transaction and Related Services and our Online Ride-hailing

Platform Services. However, there is no guarantee that all of the drivers affiliated with us would be able to obtain all the certificates

and licenses. Our business and results of operations will be materially and adversely affected if our affiliated drivers are suspended

from providing ride-hailing services or imposed substantial fines or if we are found to be in serious violation of the Interim Measures

due to the drivers’ failure to obtain requite licenses and/or automobile certificates in connection with providing services through

our platform.

The Chinese government has exercised

and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership.

For example, the Chinese cybersecurity regulator announced on July 2, 2021 that it had begun an investigation of Didi and two days

later ordered that the company’s app be removed from smartphone app stores. We believe that our current operations are in compliance

with the laws and regulations of the Chinese cybersecurity regulator. However, the Company’s operations could be adversely affected,

directly or indirectly, by existing or future laws and regulations relating to its business or industry.

Vehicle Rental Services

Pursuant to the Administration

Measures for Operations and Services of Small and Micro Passenger Vehicles issued by the Ministry of Transport on December 20, 2020 and

last amended on August 11, 2021, rental business operators of small and micro passenger vehicles shall carry out record-filing procedures

with the city or county level counterparts of the Ministry of Transport where the business operations are conducted, within 60 days after

completing the relevant registration formalities with the local counterparts of the State Administration for Market Regulation, or within

60 days after establishing new service agencies to carry out relevant business activities. To qualify for the record filing procedures,

an applicant entity shall satisfy, among others, the following requirements: (i) being an independent legal person registered under the

PRC law; (ii) the vehicles used for rental business operations passing quality inspections, and the registered nature of these vehicles

being “rental”; (iii) having the business premises and management personnel eligible for the rental business; (iv) establishing

corresponding service institutions and having corresponding service capabilities locally; (v) developing comprehensive operation and management

systems, service procedures, safety management systems, and emergency response plans. Failure to complete the record-filing procedures

may subject the rental business operators of small and micro passenger vehicles to orders to rectify and fines ranging from RMB3,000 (approximately

US$437) to RMB10,000 (approximately US$1,456). All vehicles used for our Auto Operating Leasing have obtained the required licenses and

completed the registration.

Financial Leasing

In September 2013, the Ministry

of Commerce of the People’s Republic of China (“MOFCOM”) issued the Administration Measures of Supervision on Financing

Lease Enterprises (the “Leasing Measures”), to regulate and administer the business operations of financial leasing enterprises.

According to the Leasing Measures, financial leasing enterprises are allowed to carry out financial leasing businesses in such forms as

direct lease, sublease, sale-and-lease-back, leveraged lease, entrusted lease and joint lease in accordance with the provisions of relevant

laws, regulations and rules. However, the Leasing Measures prohibit financial leasing enterprises from engaging in financial businesses

such as accepting deposits, and providing loans or entrusted loans. Without the approval from relevant authorities, financial leasing

enterprises may not engage in inter-bank borrowing and other businesses. In addition, financial leasing enterprises are prohibited from

carrying out illegal fund-raising activities in the name of financial leases. The Leasing Measures require financial leasing enterprises

to establish and improve their financial and internal risk control systems, and a financial leasing enterprise’s risk assets may

not exceed ten times that of its total net assets.

In April 2018, China Banking