bAs filed with the U.S. Securities and Exchange Commission on September 27, 2023

Registration Statement No. 333-274227

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RESHAPE LIFESCIENCES INC.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

3841

(Primary Standard Industrial

Classification Code Number)

|

|

|

26-1828101

(I.R.S. Employer

Identification Number)

|

|

18 Technology Dr, Suite 110

Irvine, California 92618

(949) 429-6680

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul F. Hickey

President and Chief Executive Officer

ReShape Lifesciences Inc.

18 Technology Dr, Suite 110

Irvine, California 92618

(949) 429-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| |

Brett Hanson

Emily Humbert

Fox Rothschild LLP

33 South Sixth Street, Suite 3600

Minneapolis, Minnesota 55402

(612) 607-7000

|

|

|

Barry I. Grossman

Sarah Williams

Matthew Bernstein

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas

New York, New York 10105

(212) 370-1300 (telephone number)

(212) 370-7889 (facsimile number)

|

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☐

|

|

|

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☒

|

|

|

Smaller reporting company

☒

|

|

| |

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any state where the offer or sale of these securities is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 27, 2023

PRELIMINARY PROSPECTUS

UP TO 8,510,638 UNITS CONSISTING OF COMMON STOCK,

OR PRE-FUNDED WARRANTS TO PURCHASE SHARES OF COMMON

STOCK, AND WARRANTS TO PURCHASE SHARES OF COMMON STOCK

We are offering on a best efforts basis up to 8,510,638 units, each consisting of one share of our common stock, par value $0.001 per share, and warrants to purchase one and one-half shares of common stock, at an assumed offering price of $0.94 per unit, which is equal to the closing price of our common stock on the Nasdaq Capital Market on September 6, 2023, for gross proceeds of up to $8,000,000. Each common warrant will have an exercise price of $0.94 per share of common stock (based upon the assumed offering price and equal to 100% of the public offering price of each unit sold in this offering), will be exercisable immediately, and will expire five years from the date of issuance.

We are also offering to each purchaser of units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock immediately following the consummation of this offering the opportunity to purchase units consisting of one pre-funded warrant (in lieu of one share of common stock) and one common warrant. A holder of pre-funded warrants will not have the right to exercise any portion of its pre-funded warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of shares of common stock outstanding immediately after giving effect to such exercise. Each pre-funded warrant will be exercisable for one share of common stock. The purchase price of each unit including a pre-funded warrant will be equal to the price per unit including one share of common stock, minus $0.0001, and the remaining exercise price of each pre-funded warrant will equal $0.0001 per share. The pre-funded warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the pre-funded warrants are exercised in full. For each unit including a pre-funded warrant we sell (without regard to any limitation on exercise set forth therein), the number of units including a share of common stock we are offering will be decreased on a one-for-one basis.

There is no minimum number of securities or minimum aggregate amount of proceeds for this offering to close. Because this is a best-efforts offering, the placement agent does not have an obligation to purchase any securities, and, as a result, there is a possibility that we may not be able to sell the maximum offering amount. We expect that the offering will end two trading days after we first enter into a securities purchase agreement relating to the offering and the offering will settle delivery versus payment (“DVP”)/receipt versus payment (“RVP”). Accordingly, we and the placement agent have not made any arrangements to place investor funds in an escrow account or trust account since the placement agent will not receive investor funds in connection with the sale of the securities offered hereunder.

The shares of our common stock and pre-funded warrants, if any, and the accompanying common warrants can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. We are also registering the shares of common stock issuable from time to time upon exercise of the common warrants and pre-funded warrants included in the units offered hereby.

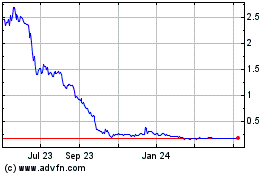

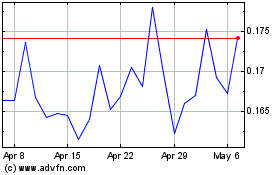

Our common stock is traded on the Nasdaq Capital Market under the symbol “RSLS.” On September 6, 2023, the closing price for our common stock, as reported on the Nasdaq Capital Market, was $0.94 per share. The public offering price per unit will be determined at the time of pricing and may be at a discount to the then current market price. The recent market price used throughout this prospectus may not be indicative of the final offering price. The final public offering price will be determined through negotiation between us and investors based upon a number of factors, including our history and our prospects, the industry in which we operate, our past and present operating results, the previous experience of our executive officers and the general condition of the securities markets at the time of this offering. We may be required to agree to other terms and conditions with potential investors in this offering as a condition to them participating in the offering, which may include agreeing to reduce the exercise price of outstanding warrants to purchase shares of common stock of the Company held by such investors.

There is no established public trading market for the pre-funded warrants or common warrants, and we do not expect a market to develop. Without an active trading market, the liquidity of the pre-funded warrants and common warrants will be limited. In addition, we do not intend to list the pre-funded warrants or the common warrants on the Nasdaq Capital Market, any other national securities exchange or any other trading system.

Investing in shares of our securities involves a high degree of risk. See “Risk Factors” beginning on page 15 of this prospectus, as well as those risk factors described in any applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| |

|

|

Per Unit(1)

|

|

|

Total

|

|

|

Public offering price(2)

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

Placement agent’s fees

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

Proceeds, before expenses, to us

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

(1)

Units consist of one share of common stock, or one pre-funded warrant to purchase one share of common stock, and common warrants to purchase one and one-half shares of common stock.

(2)

The placement agent fees shall equal 7.0% of the gross proceeds of the securities sold by us in this offering. The placement agent will receive compensation in addition to the placement agent fees described above. See “Plan of Distribution” for a description of compensation payable to the placement agent.

We have engaged Maxim Group LLC as our exclusive placement agent to use its reasonable best efforts to solicit offers to purchase our securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities.

We anticipate that delivery of the securities against payment will be made on or about [•], 2023.

Maxim Group LLC

The date of this prospectus is [•], 2023.

TABLE OF CONTENTS

| |

|

|

|

|

|

ii |

|

|

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

15 |

|

|

| |

|

|

|

|

|

33 |

|

|

| |

|

|

|

|

|

34 |

|

|

| |

|

|

|

|

|

35 |

|

|

| |

|

|

|

|

|

36 |

|

|

| |

|

|

|

|

|

37 |

|

|

| |

|

|

|

|

|

38 |

|

|

| |

|

|

|

|

|

43 |

|

|

| |

|

|

|

|

|

46 |

|

|

| |

|

|

|

|

|

53 |

|

|

| |

|

|

|

|

|

59 |

|

|

| |

|

|

|

|

|

59 |

|

|

| |

|

|

|

|

|

59 |

|

|

| |

|

|

|

|

|

60 |

|

|

| |

|

|

|

|

|

60

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 for the offering by us of units consisting of shares of common stock, or pre-funded warrants, and warrants to purchase shares of common stock.

You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus, even though this prospectus is delivered or our securities registered under the registration statement of which this prospectus forms a part are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the captions “Where You Can Find Additional Information” in this prospectus.

Neither we nor the Placement Agent have authorized anyone to provide any information or to make any representation other than those contained in this prospectus. You must not rely upon any information or representation not contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities of the Company in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

We obtained certain statistical data, market data and other industry data and forecasts used in this prospectus from publicly available information. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the data, and we do not make any representation as to the accuracy of the information.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read “Cautionary Note Regarding Forward- Looking Statements” and “Risk Factors”.

Effective December 23, 2022 we effected a 1-for-50 reverse stock split of our issued and outstanding common stock (the “Reverse Stock Split”). All references to shares of our common stock in this prospectus refer to the number of shares of common stock after giving effect to the Reverse Stock Split and are presented as if the Reverse Stock Split had occurred at the beginning of the earliest period presented.

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering and selected information contained in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our securities. For a more complete understanding of our company and this offering, we encourage you to read and consider the more detailed information included in this prospectus, including risk factors, see “Risk Factors” beginning on page 13 of this prospectus, and our most recent consolidated financial statements and related notes.

Throughout this prospectus, the terms “we,” “us,” “our,” “ReShape,” and “our company” refer to ReShape LifeSciences Inc., a Delaware corporation, and its consolidated subsidiaries, unless the context requires otherwise.

About ReShape Lifesciences Inc.

ReShape Lifesciences Inc. is a worldwide premier weight-loss solutions company, offering an integrated portfolio of proven products and services that manage and treat obesity and metabolic disease throughout the care continuum.

Our current portfolio includes the FDA-approved and reimbursed Lap-Band® system, which provides minimally invasive, long-term treatment of obesity and is a safer surgical alternative to more invasive and extreme surgical stapling procedures such as the gastric bypass or sleeve gastrectomy. Our ReShapeCare™ virtual health coaching program is a novel weight-management program that supports healthy lifestyle changes for all medically managed weight-loss patients, not just individuals who qualify for Lap-Band surgery, further expanding our reach and market opportunity. Our ReShape Marketplace™ online store provides top of the line products with bariatric patients in mind. Our ReShape Optimize™ supplement options, purchased through the ReShape Marketplace, includes therapeutic offerings to optimize health, including multivitamins.

Recent Market Dynamics and ReShape’s Opportunity

Recent statements from the bariatric surgeon societies in the U.S. and abroad including the American Society for Metabolic and Bariatric Surgery (ASMBS) and the International Federation for the Surgery of Obesity and Metabolic Disorders (IFSO), confirm that obesity is a complex, lifelong disease that requires personalized treatment to ensure long-term weight loss goals are achieved.

The market dynamics in 2023 included the introduction and growing popularity of GLP-1 agonists that have brought significant benefits to those suffering from type 2 diabetes and have helped those who are obese. At a historic level, GLP-1’s have helped normalize the stigma that often occurs around obesity and medical intervention and have helped increase those seeking medical attention for weight loss. ReShape’s increased market opportunity is related to the fact that as a standalone therapy, there is growing evidence that weight loss due to these GLP-1 pharmacological therapies levels off and can often lead to notable non-compliance due to their currently known side effects. Excitingly, from a continuum of care perspective, these patients are likely potential candidates for bariatric surgery as the next viable weight loss treatment. We feel we are well positioned with our current portfolio that includes the FDA-approved and reimbursed Lap-Band® system, which provides a minimally invasive, long-term treatment of obesity and is a safer surgical alternative to more invasive and extreme surgical stapling procedures such as the gastric bypass or sleeve gastrectomy. We also believe, based on market feedback, that our Lap-Band® 2.0 will be a growth catalyst for the Company’s Lap-Band® franchise once approved. Similarly, our ReShapeCare™ virtual health coaching program is a novel weight-management program that supports healthy lifestyle changes for all medically managed weight-loss patients, not just individuals who qualify for Lap-Band surgery, further expanding our reach and market opportunity.

ReShape’s Pillars for Growth

In August of 2022, Paul F. Hickey joined ReShape as President and Chief Executive Officer. Under this new leadership, the Company has pivoted its business strategy with the intent of helping to ensure growth and profitability. The Company has executed the following three growth strategies, or pillars for growth:

•

Growth Pillar I: Executing disciplined, metrics-driven business operations.

In executing the first growth pillar, the Company is focused on revenue growth and profitability. When the Company completes this offering, it believes it will have sufficient cash on hand to continue executing on its growth pillars and achieve its goal of becoming profitable within the next year. This estimated timeline could be compressed or extended depending on many factors, including revenue growth from new product introductions, or strategic investments not yet foreseen.

This first growth pillar remains, in the Company’s opinion, paramount for ReShape to deliver shareholder value and, ultimately, profitability. Starting shortly after Mr. Hickey’s appointment, ReShape has made several operational changes to help ensure future performance and return on investment by prioritizing investments supporting revenue growth.

Progress on this first pillar is evidenced by the operational results reported in the Company’s Form 10-Q for the second quarter of fiscal 2023 that was filed on August 7, 2023. As reported, the Company achieved a 53.4% reduction in operating expenses compared to last year’s second quarter. More specifically, the rightsizing and organizational efficiencies made across the company resulted in a net loss of $3.5 million, and Non-GAAP adjusted EBITDA loss of $3.7 million, for the three months ended June 30, 2023, compared to a net loss of $9.4 million, and Non-GAAP adjusted EBITDA loss of $7.8 million, for the same period last year. Similarly, the Company’s net loss was $6.2 million, and Non-GAAP adjusted EBIDTA loss was $9.1 million, for the six months ended June 30, 2023, compared to a net loss of $17.6 million, and Non-GAAP adjusted EBITDA loss of $15.0 million, for the same period last year. Further, in July, in response to the Company’s revenue shortfall caused by GLP-1 adoption and other market factors, the Company made additional operational improvements, with annualized savings estimated to total more than $4 million dollars.

The Company is prioritizing investments, including marketing automation to support scalable lead acquisition, segmented consumer-centric messaging via an updated website for improved patient engagement, and a frictionless booking system with qualified providers. This is expected to dramatically increase Lap-Band procedures and ultimately revenue. Additionally, ReShape has shifted resources to data-driven, targeted marketing outreach in markets with known surgeon advocates. As a result,

lead costs in the third and fourth quarters of 2022 dropped over 50% as compared to the second quarter of 2022. The company has also taken steps to right-size the organization in several areas to ensure sustainability and scalability.

•

Growth Pillar II: Expanding the product portfolio and future product pipeline.

ReShape’s second growth pillar is intended to further differentiate the Company as a leading provider of innovative products and services to meet unmet customer needs. ReShape is committed to drive and scale its new product development and commercialization capacity, providing a cadence of new product introductions and revenue growth. The growth can either be through organic internal Research and Development efforts, or through strategic partnerships, mergers, or acquisitions. Key growth drivers within second growth pillar include:

LapBand 2.0 — Potential new product revenues beyond 2023 include the Lap-Band 2.0, for which the Company filed a PMA supplement application to the FDA in June of 2023, with feedback from the FDA expected by year-end 2023. Similar to the current Lap-Band, the Lap-Band 2.0 is adjustable, postoperatively, to increase or decrease the opening of the band to optimize an individual’s eating habits and comfort, thereby improving therapy effectiveness. At the same time, a new feature of the Lap-Band 2.0 is a band reservoir technology that serves as a relief valve. Pieces of food that are too large to pass through the narrowed passage, created by the current band, can pass through because the new feature allows the band to relax momentarily and then return to its resting diameter. This could allow for increased Lap-Band constriction and resultant satiety, while helping to minimize discomfort from swallowing large pieces of food, which may otherwise require emergency in-office patient band adjustments. Based on customer feedback, Lap-Band 2.0 will allow us to engage new surgeons and reengage many of those who have used the Lap-Band, historically.

ReShapeCare’s DTC, Employee, and Women’s Health Initiatives — Management anticipates that new product revenue in 2023 will also include ReShapeCare. ReShapeCare is a holistic approach to health and wellness evaluating the member as an individual and focusing on an overall goal, while breaking down that goal into micro habits. The program solely consists of evidence-based information, making it a program that its members can trust. In 2023, ReShapeCare introduced the community feature of our program with a peer forum so members can share their experiences and request feedback from their fellow ReShapeCare “Wellness Warriors” as they participate in the program. This is in addition to our interactive group sessions hosted on ReShapeCare TV. While ReShapeCare is 100% virtual today, it does provide an element of in-person dichotomy with video-based sessions. Engaging a real human to discuss one’s health journey, versus texting a chat bot, can have an enormous impact on the member’s response to their personalized program.

ReShapeCare Employer Engagement — The Company is continuing discussions with several self-insured employers to provide ReShapeCare to their employees in order to positively impact overall health and, thus, reduce employers’ healthcare costs. ReShapeCare fulfills an unmet need with companies that are looking for a holistic approach that can be customized to meet the needs of the employer and their employees. Some employers have indicated that ReShapeCare could replace/consolidate 3-4 vendors from current employer-sponsored wellness programs.

ReShapeCare Women’s Health Program — ReShapeCare does not currently have a program specifically for women, by women, to support them across their life stages. While approximately 80% of bariatric surgery patients are female, almost 90% of our ReShapeCare users were female and the average age was 47. Other researchers confirm our experience. Women are more likely to use health apps as compared to men and differences in app usage based on sex and age indicate that tailored technologies are needed to support different groups. We intend to launch this vertical of our program to provide a more tailored experience for women through all stages of their adult life allowing them to seek vitality and age gracefully.

ReShape Obalon Balloon — The ReShape Obalon® Balloon system is the first and only swallowable, gas filled, FDA-approved balloon system. In 2023 the Company has been working to establish an OEM partnership and appropriate distribution partnerships which would be intended to support the successful relaunch and commercialization of the balloon system. We anticipate having an OEM manufacture partnership by early 2024.

DBSN Device — ReShape remains committed to furthering our proprietary Diabetes Bloc-Stim Neuromodulation (DBSN™) technology that can potentially reduce the dependence on medications by those with type 2 diabetes. The DBSN™ device is a technology under development as a new treatment for type 2 diabetes mellitus. The device is expected to use bioelectronics to manage blood glucose in the treatment of diabetes and individualized 24/7 glucose control. Preclinical evidence on the DBSN device was presented at multiple conferences. The DBSN technology development has received nondilutive NIH grant support.

•

Growth Pillar III: Ensuring that our portfolio spans the weight loss care continuum and is evidence based.

ReShape’s third growth pillar represents the Company’s commitment to collaborate with healthcare professionals worldwide and further develop evidence supporting ReShape’s portfolio of treatment options. Aligned with goal of pillar three, in early 2023, ReShape established their first-ever global Scientific Advisory Board (SAB) to provide needed expertise and feedback on initiatives related to the Company’s growth pillars. The SAB is fully engaged in helping validate company strategies to collect and publish data on both our Lap-Band 2.0 and data on Lap-Band patients who are also using GLP-1s as a combination therapy. Combination therapies comprising GLP-1s and other gastric surgeries, including the Lap-Band, are being prescribed today, to help those who have plateaued with their weight loss.

ReShapeCare® Market Detail

In addition to the market information included in our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q that are incorporated herein by reference, the following sets forth additional detail regarding the market for ReShapeCare.

Virtual Health and Wellness Apps

The fast adoption of virtual technology related to changes stemming from the COVID-19 pandemic has led to an overwhelming growth in the wellness app sector. While the pandemic brought many such apps to the forefront of everyday life, a good number of them only focus on improving sleep and/or stress management, and nutrition. Additionally, many of the nutrition apps are solely focused on nutritional intake and, possibly, caloric expenditure through activity. Between 2019 and 2021, the market increased by 54.6% and there were over 1.2 billion installs of the top 100 wellness apps in 2020. While this sudden growth has stabilized, the outlook remains positive for this sector. The wellness sector had an estimated revenue of $2.7 billion in 2022 and is forecasted to reach $9.9 billion in 2030 with North America representing 37.4% of the total revenue. When comparing wellness app data to health apps, there are similar trends. Revenue from health apps was estimated to be $8.2 billion in 2022 and is forecasted to grow to $35.7 billion by 2030.

The top 8 wellness apps and top 10 health apps as seen in the tables below, while quite successful, are very different from what ReShapeCare offers the consumer.

Top Wellness Apps

|

App Name

|

|

|

Focus/Approach

|

|

|

BetterMe

|

|

|

BetterMe markets itself as a healthy lifestyle program without extreme weight loss, focusing on wellbeing.

|

|

|

BetterSleep

|

|

|

Formally known as Relax Melodies, BetterSleep analyses users’ chronotypes, tracks sleep and creates bedtime routines.

|

|

|

Calm

|

|

|

Calm includes meditation tools, sleep aids and video lessons on gentle stretching.

|

|

|

Fabulous

|

|

|

A self-care coaching app to build daily habits such as drinking water, exercising and focused working.

|

|

|

Headspace

|

|

|

A meditation app that offers courses for stress, anger, depression, and work performance, as well as programs for sleep and exercise.

|

|

|

I Am

|

|

|

I Am centers around daily affirmations to build self-confidence and change thought patterns.

|

|

|

Relax

|

|

|

Users have access to exercises and programs to improve mindfulness and mental health.

|

|

|

Sleep Cycle

|

|

|

Intended to improve users’ sleep by analyzing sleep and recordings of snoring and sleep talking to provide an alarm based on those patterns.

|

|

Top Health Apps

|

App Name

|

|

|

Focus/Approach

|

|

|

Apple Health

|

|

|

Collects health information from iPhones, Apple Watches and other devices, sets medication reminders and organizes health records.

|

|

|

MyFitnessPal

|

|

|

Contains a database of food items with nutritional values and a fitness component.

|

|

|

Fitbit

|

|

|

Utilizes the sensors on fitness tracker, Fitbit, to track heartrate, electrodermal activity, temperature, sleep and menstrual cycles.

|

|

|

BetterMe

|

|

|

BetterMe markets itself as a healthy lifestyle program without extreme weight loss, focusing on wellbeing.

|

|

|

Noom

|

|

|

Weight management business Noom has extended into behavior change programs for chronic and non-chronic health conditions.

|

|

|

Lose It!

|

|

|

Lose It! Tracks food and water intake for users to meet diet goals and lose weight.

|

|

|

WeightWatchers

|

|

|

A weight loss program converts nutritional information into a points system to track caloric intake.

|

|

|

Flo

|

|

|

The most popular ovulation and period tracker, fertility calendar and pregnancy assistant app.

|

|

|

Waterlogged

|

|

|

Water tracking app that allows users to set goals for water consumption and receive reminders to drink.

|

|

|

Fastic

|

|

|

Fastic promotes weight loss through a program of intermittent fasting, mindfulness, improved nutrition and sleep.

|

|

Women’s Health

Approximately 80% of bariatric surgery patients are female. Almost 90% of our ReShapeCare users have been female with an average age of 47. Women are more likely than men to use health apps, and differences in app usage based on sex and age indicate that tailored technologies are needed to support different groups. Interestingly, women make 80% of the healthcare decisions of the household, making them the ‘chief medical officers’ of the home. Women are also seeking healthcare information online much more frequently than men, with 75% or more of women aged 65 and older stating that they seek online sources for health information.

Between 2013 and 2016, nearly 50% of adults attempted to lose weight, with the highest percentage of those between the ages of 40 and 59 years old. However, 95% of all Americans have tried to lose weight

within the last 5 years. Women, specifically, are attempting to lose weight at a higher rate than men, 56% compared to 42%, respectively.

Obesity continues to be one of the greatest health concerns of our country, and women have different needs beyond just the health of their reproductive organs. According to the Centers for Disease Control and Prevention (CDC), the top five leading causes of death among women are heart disease, cancer, stroke, chronic lower respiratory disease, and Alzheimer’s disease. The CDC also states that 15% of women, ages 18 years and older, are in fair or poor health and only 20% of adult women met the federal physical activity guideline. Unfortunately, 10% of women 18 and older are cigarette smokers. Almost 46% of adult women have been diagnosed with hypertension. Sadly, 42% of women 20 years of age and older suffer from obesity, which is a known independent risk factor for the top three causes of women’s death.

Almost one-third of adults said COVID-19 made them more worried than ever about suffering from obesity, prompting about 28 million people to consider weight loss methods they had not previously thought about. Nearly 6.4 million individuals thought about turning to bariatric surgery or taking prescription anti-obesity medications for the first time, according to a survey published in the Surgery for Obesity and Related Diseases journal. ReShapeCare can improve each of these women’s health concerns, as well as many more of the personal topics for which women are truly interested in acquiring support.

Other areas of concern for women include the changes that come during varying life stages. One in 10 women of reproductive age is estimated to suffer from endometriosis, which can lead to debilitating pelvic pain and infertility, something that often takes 10 years, on average, to diagnose and there is currently incurable. Women spend more than a third of their lives in peri- or post-menopause and trends indicate that 1.2 billion women, globally, will be in these life stages by the year 2030. Most women find that menopausal symptoms, such as hot flashes, night sweats, and sleep disturbances interfere with their lives, and only about 25% of women seek treatment. This already hindering and frustrating situation is made worse with treatment’s significant economic impact, with over $1,400 in healthcare costs and $770 in lost productivity per person per year for untreated hot flashes alone.

Women have broad healthcare needs, and it is important to note that over 91% of women 65 years old and younger have health insurance.

What Differentiates ReShapeCare?

ReShapeCare is a holistic approach to health and wellness, evaluating each member by framing an overall goal and breaking it down to microhabits. As such, ReShapeCare may positively impact chronic disease, and it easily parallels that of a preventative/wellness approach to healthcare. ReShapeCare’s board-certified health coaches are well versed in their scope of practice and adhere to proper escalations, including referring members to mental health providers, as needed.

Should the member desire, our health coaches can provide care coordination and communication with any provider to ensure continuity of care throughout the member’s health journey. Health, diversity, equity, and inclusion are part of ReShapeCare’s core values and standard training for its team. The program’s foundation consists of evidence-based information, making it trustworthy. In 2023, we introduced the community feature of our program with a peer forum that facilitates members sharing their experiences and asking for feedback from their fellow ReShapeCare Wellness Warriors as they participate in the program. This is in addition to our interactive group sessions hosted on ReShapeCare TV. ReShapeCare is 100% virtual today, though it does provide an element of in-person dichotomy with the video-based sessions. Engaging a real human to discuss your health journey versus texting a chat bot can have an enormously positive impact on the member’s response to their personalized program.

ReShapeCare focuses on the four dimensions of wellness — nutrition, exercise, sleep and stress. ReShapeCare provides a holistic approach to tackle wellness from all angles, truly providing an opportunity for lifestyle change while meeting the members where they are along their wellness journey. Members work with real humans to help solve real problems. Some of the features and benefits our members enjoy include:

•

One-on-one coaching with board certified health coaches via video sessions.

•

Access to unlimited texting between sessions with each member’s health coach.

•

Unlimited access to group sessions via ReShapeCare TV.

•

Unlimited access to the community forum with like-minded peers.

•

The ability to track data in real time (e.g., Bluetooth weight scale, smart watches, etc.).

•

Unlimited access to our smart app with over 1,500 pieces of engaging, evidence-based content.

ReShapeCare has built-in algorithms in the backend to help drive engagement, the cornerstone of success for any wellness app and to ensure each member has a customized program with personalized content to meet their needs, ultimately driving their success. Weight loss may be a component of ReShapeCare, while not always the focus and sometimes the by-product of other health goals. The ReShapeCare program often shows that focusing on the dimension that the member is ready to address allows future improvements in the other dimensions, ultimately allowing the individual to meet their personal health and wellness goals.

Currently, ReShapeCare does not have a program specifically for women by women to support them across their life stages. Our goal is to launch this vertical of our program to provide a more tailored experience for women through all stages of their adult life, allowing them to seek greater vitality.

Recent Developments

In July 2023, the Company made additional operational improvements to further invest in growth drivers and reduce expenses, with annualized savings estimated at more than $4 million.

In June 2023, the Company signed a preferred partner agreement with Hive Medical (Hive) for lead optimization software to improve patient engagement strategy, utilizing AI, machine-learning, SMS, and patient self-service technology to increase patient volume and, potentially, Lap-Band® surgeries.

In June 2023, the Company submitted a Premarket Approval (PMA) supplement application to the U.S. Food and Drug Administration (FDA) for the company’s next generation Lap-Band® 2.0, with an enhanced band reservoir technology that serves as a relief valve, designed to alleviate discomfort from swallowing large pieces of food, which may require in-office band adjustments.

In May 2023, the Company presented preclinical data on its proprietary Diabetes Bloc-Stim Neuromodulation™ (DBSN™) device in a poster at the Keystone Symposia on Type 2 Diabetes (T2D) in Palm Springs, CA, further validating the potential of this technology to treat T2D and reduce patients’ dependence on medication.

In April 2023, the Company completed a $2.5 million registered direct offering with a single institutional investor, extending the company’s cash runway into 2024, creating a sustainable path to profitability.

In April 2023, the Company received a Notice of Allowance from the U.S. Patent and Trademark Office (USPTO) for patent application 16/792,094, entitled, “Systems and Methods for Determining Failure of Intragastric Devices,” related to the company’s Obalon® Balloon System. The patent is expected to provide protection into at least January 2031, excluding any potential Patent Term Extension (PTE).

On September 19, 2023, we entered into an Exclusive License Agreement (the “License Agreement”) with Biorad Medysis Pvt. Ltd. (“Biorad”), pursuant to which we granted an exclusive license to Biorad to manufacture, commercialize and distribute our Obalon® Gastric Balloon System in the territory of India, Pakistan, Bangladesh, Nepal, Bhutan, Sri Lanka, and the Maldives. The License Agreement provides for $200,000 in upfront payments from Biorad and ongoing royalty payments of 4% on gross sales of the Obalon Balloon System in the territory. The License Agreement also contemplates that Biorad will become our exclusive worldwide manufacturer and supplier of the Obalon Balloon System pursuant to a supply agreement to be entered into between the parties, the form of which is attached as an exhibit to the License Agreement.

Our Corporate Information

We were incorporated under the laws of Delaware on January 2, 2008. On June 15, 2021, we completed a merger with Obalon Therapeutics, Inc. Pursuant to the merger agreement, a wholly owned subsidiary of

Obalon merged with and into ReShape, with ReShape surviving the merger as a wholly owned subsidiary of Obalon. As a result of the merger, Obalon, the parent company, was renamed “ReShape Lifesciences Inc.” and ReShape was renamed ReShape Weightloss Inc. ReShape Lifesciences shares of common stock trade on the Nasdaq under the symbol RSLS.

Our principal executive offices are located at 18 Technology Drive, Suite 110, Irvine, California 92618, and our telephone number is (949) 429-6680. Our website address is www.reshapelifesciences.com. The information on, or that may be accessed through, our website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus.

THE OFFERING

ReShape Lifesciences Inc., a Delaware corporation

Up to 8,510,638 units on a best efforts basis at an assumed public offering price of $0.94 per unit. Each unit consists of one share of common stock and warrants to purchase one and one-half shares of common stock.

We are also offering to each purchaser, with respect to the purchase of units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase one pre-funded warrant in lieu of one share of common stock. A holder of pre-funded warrants will not have the right to exercise any portion of its pre-funded warrant if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of shares of common stock outstanding immediately after giving effect to such exercise. Each pre- funded warrant will be exercisable for one share of common stock. The purchase price per pre-funded warrant will be equal to the price per share of common stock, minus $0.0001, and the exercise price of each pre-funded warrant will equal $0.0001 per share. The pre- funded warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time in perpetuity until all of the pre-funded warrants are exercised in full. The units will not be certificated or issued in stand-alone form. The shares of common stock, and/or pre-funded warrants, and the common warrants comprising the units are immediately separable upon issuance and will be issued separately in this offering.

Description of common warrants:

The common warrants will be immediately exercisable on the date of issuance and expire on the five-year anniversary of the date of issuance at an initial exercise price per share equal to $0.94 (based upon the assumed offering price and equal to 100% of the public offering price of each unit sold in this offering), subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock. Subject to certain exemptions outlined in the common warrants, while the common warrants are outstanding, if we sell, enter into an agreement to sell, or grant any option to purchase, or sell, enter into an agreement to sell, or grant any right to reprice, or otherwise dispose of or issue (or announce any offer, sale, grant or any option to purchase or other disposition) any shares of common stock or Convertible Security (as defined in the common warrants), at an effective price per share less than the exercise price of the common warrants then in effect, the exercise price of the common warrants shall be reduced to equal the effective price per share in such dilutive issuance; provided, however, in no event shall the exercise price of the common warrants be reduced to an exercise price lower than 20% of closing price of our common stock on the day prior to the pricing of this offering. On the 30-day anniversary of the issuance date of the common warrants, the exercise price of the common warrants will adjust to be equal to the greater of 20% of closing price of our

common stock on the day prior to the pricing of this offering per share and 100% of the last volume weighted average price per share of common stock immediately preceding the 30th day following the issuance date of the common warrants, provided that such value is less than the exercise price in effect on that date. The terms of the common warrants will be governed by a Warrant Agency Agreement, dated as of the closing date of this offering, that we expect to be entered into between us and American Stock Transfer & Trust Company, LLC or its affiliate (the “Warrant Agent”). This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the common warrants. For more information regarding the common warrants, you should carefully read the section titled “Description of Securities We Are Offering” in this prospectus.

Assumed public offering price per unit:

$0.94 per unit

Common stock outstanding prior to this offering:

3,452,447 shares(1)

Common stock to be outstanding after this offering:

11,963,085 shares

Placement Agent Warrants:

Upon the closing of this offering, we have agreed to issue to Maxim Group LLC (or its permitted assignees) a warrant to purchase a number of our shares of common stock equal to an aggregate of up to 5% of the total number of securities sold in this offering (the “Placement Agent Warrant”). The Placement Agent Warrant will have an exercise price equal to 110% of the public offering price of the Units sold in this offering and may be exercised on a cashless basis. The Placement Agent Warrant is non-exercisable for six months from the commencement of sales of this offering, and will expire five years after the commencement of sales of this offering.

Assuming all of the securities we are offering in this offering are sold, we estimate that our net proceeds from this offering will be approximately $7.2 million.

We intend to use the net proceeds of this offering for working capital and general corporate purposes. See “Use of Proceeds” beginning on page 34 of this prospectus.

You should read the “Risk Factors” beginning on page 13 of this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities.

Our common stock is listed on the Nasdaq Capital Market under the symbol “RSLS.” We do not intend to list the common warrants or pre-funded warrants offered hereunder on any stock exchange. There are no established public trading markets for the common warrants or the pre-funded warrants, and we do not expect such markets to develop. Without an active trading market, the liquidity of the common warrants and the pre-funded warrants will be limited.

(1)

Except as otherwise noted, all information in this prospectus reflects and assumes (i) no sale of pre- funded warrants in this offering, which, if sold, would reduce the number of shares of common stock that we are offering on a one-for-one basis and (ii) no exercise of the common warrants issued in this

offering. The above discussion and table are based on 3,452,447 shares of common stock outstanding as of August 7, 2023 and excludes:

•

17,153 shares of common stock issuable upon the exercise of outstanding options granted as of August 7, 2023 under our equity incentive plans at a weighted average exercise price of $351.35 per share;

•

1,632,514 shares of common stock issuable upon the exercise of outstanding warrants issued as of August 7, 2023;

•

2,319 shares of common stock issuable upon vesting of outstanding restricted stock units granted as of August 7, 2023; and

•

10 shares of our common stock issuable upon the conversion of 95,388 shares of series C convertible preferred stock outstanding as of August 7, 2023.

SUMMARY RISK FACTORS

The following is a summary of the principal risks and uncertainties that could materially adversely affect our business, results of operations, financial condition, cash flows, prospects and/or the price of our outstanding securities, and make an investment in our securities speculative or risky. You should read this summary together with the more detailed description of each risk factor contained below.

Risks Related to Our Business and Industry

•

If we are unable to either substantially improve our operating results or obtain additional financing, we may be unable to continue as a going concern.

•

Public health crises, such as COVID-19 pandemic, have had, and could in the future have a negative effect on our business.

•

We may be unable to attract and retain management and other personnel we need to succeed.

•

The shares of series C convertible preferred stock issued in connection with our acquisition of ReShape Medical have certain rights and preferences senior to our common stock, including a liquidation preference that is senior to our common stock.

•

No Obalon directors, officers or employees continued employment with ReShape which could hinder the ability to transfer the Obalon technology, restart manufacturing operations and maintain FDA regulatory compliance for the Obalon Balloon System and negatively impact our results of operations.

•

We are a medical device company with a limited history of operations and sales, and we cannot assure you that we will ever generate substantial revenue or be profitable.

•

Previously, we recorded a non-cash indefinite-lived and definite-lived intangible assets impairment loss, which significantly impacted our results of operations, and we may be exposed to additional impairment losses that could be material.

•

We incur significant costs as a result of operating as a public company, and our management is required to devote substantial time to compliance initiatives.

•

We have identified material weaknesses in our internal control over financial reporting and any failure to maintain effective internal control over financial reporting, may have a material and adverse effect on our business, operating results, financial condition and prospects.

•

We reached a determination to restate certain of our previously issued consolidated financial statements, which resulted in unanticipated costs and may affect investor confidence and raise reputational issues.

•

General economic and political conditions could have a material adverse effect on our business.

•

We face significant uncertainty in the industry due to government healthcare reform.

•

We are subject, directly or indirectly, to United States federal and state healthcare fraud and abuse and false claims laws and regulations. Prosecutions under such laws have increased in recent years and we may become subject to such litigation. If we are unable to, or have not fully complied with such laws, we could face substantial penalties.

•

Failure to protect our information technology information technology infrastructure against cyber-based attacks, network security breaches, service interruptions or data corruption could materially disrupt our operations and adversely affect our business.

Risks Associated with Development and Commercialization of the LAP-BAND System, ReShapeCare, ReShape, Lap-Band 2.0 System, Obalon Balloon System, DBSN Device

•

Our efforts to increase revenue from our Lap-Band System, ReShapeCare, Lap-Band 2.0 System, Obalon Balloon System, and commercialize our DBSN device and expanded line of bariatric surgical accessories, including ReShape Calibration Tubes, may not succeed or may encounter delays which could significantly harm our ability to generate revenue.

•

We may not be able to obtain required regulatory approvals for our DBSN device in a cost-effective manner or at all, which could adversely affect our business and operating results.

•

We depend on clinical investigators and clinical sites to enroll patients in our clinical trials, and on other third parties to manage the trials and to perform related data collection and analysis, and, as a result, we may face costs and delays that are outside of our control.

•

Modifications to the Lap-Band System and Lap-Band 2.0 may require additional approval from regulatory authorities, which may not be obtained or may delay our commercialization efforts.

•

If we or our suppliers fail to comply with ongoing regulatory requirements, or if we experience unanticipated product problems, our Lap-Band system could be subject to restrictions or withdrawal from the market.

Risks Related to Intellectual Property

•

If we are unable to obtain or maintain intellectual property rights relating to our technology and neuroblocking therapy, the commercial value of our technology and any future products will be adversely affected, and our competitive position will be harmed.

•

We may lose important patent rights if we do not timely pay required patent fees or annuities.

•

Many of our competitors have significant resources and incentives to apply for and obtain intellectual property rights that could limit or prevent our ability to commercialize our current or future products in the United States or abroad.

•

If we are unable to protect the confidentiality of our proprietary information and know-how, the value of our technology and products could be adversely affected.

•

Intellectual property litigation is a common tactic in the medical device industry to gain competitive advantage. If we become subject to a lawsuit, we may be required to expend significant financial and other resources and our management’s attention may be diverted from our business.

•

We are currently in a lawsuit, and may in the future become involved in lawsuits, to protect or enforce our intellectual property, which can be expensive and time consuming and could result in the diversion of significant resources.

Risks Relating to Ownership of Our Common Stock

•

The trading price of our common stock has been volatile and is likely to be volatile in the future.

•

Sales of a substantial number of shares of our common stock in the public market by existing stockholders, or the perception that they may occur, could cause our stock price to decline.

•

We have a significant number of outstanding warrants, which may cause significant dilution to our stockholders, have a material adverse impact on the market price of our common stock and make it more difficult for us to raise funds through future equity offerings.

•

If we fail to meet all applicable Nasdaq Capital Market requirements, Nasdaq could delist our common stock, which could adversely affect the market liquidity of our common stock and the market price of our common stock could decrease.

•

Our organizational documents and Delaware law make a takeover of our company more difficult, which may prevent certain changes in control and limit the market price of our common stock.

Risks Relating to this Offering

•

Management will have broad discretion as to the use of the net proceeds from this offering, and we may not use these proceeds effectively.

•

Future sales of substantial amounts of our common stock could adversely affect the market price of our common stock.

•

There is no public market for the common warrants or pre-funded warrants.

•

The common warrants in this offering are speculative in nature.

•

Holders of the common warrants will not have rights of holders of our common stock until such warrants are exercised.

•

A large number of shares issued in this offering may be sold in the market following this offering, which may depress the market price of our common stock.

•

This is a best efforts offering, and no minimum number or dollar amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business plans.

RISK FACTORS

An investment in our securities is speculative and involves a high degree of risk and uncertainty. You should carefully consider the risks described below, together with the other information contained in this registration statement, including the consolidated financial statements and notes thereto, before deciding to invest in our securities. The occurrence of any of the events described below could have a material adverse effect on our business, financial condition, results of operations, cash flows, prospects or the value of our common stock. These risks are not the only ones that we face. Additional risks not currently known to us or that we currently deem immaterial also may impair our business.

Risks Related to Our Business and Industry

If we are unable to either substantially improve our operating results or obtain additional financing, we may be unable to continue as a going concern.

We currently do not generate revenue sufficient to offset operating costs and anticipate such shortfalls to continue, partially due to the unpredictability of COVID-19, which has resulted and may continue to result in a slow-down of elective surgeries and restrictions in some locations, and supply chain disruptions. As of June 30, 2023, we had net working capital of approximately $6.1 million, primarily due to cash and cash equivalents and restricted cash of $4.7 million. Additionally, our anticipated expansion of our product portfolio and future products may not come to fruition. Our principal source of liquidity as of June 30, 2023 consisted of approximately $4.7 million of cash and cash equivalents and restricted cash and $2.0 million of accounts receivable. Based on our available cash resources, we may not have sufficient cash on hand to fund our current operations for more than 12 months from the date of this prospectus. This condition raises substantial doubt about our ability to continue as a going concern.

Public health crises, such as the COVID-19 pandemic, have had, and could in the future have, a negative effect on our business.

Pandemics or disease outbreaks, such as the COVID-19 pandemic, have created and may continue to create significant volatility, uncertainty and economic disruption in the markets we sell our products into and operate in and may negatively impact business and healthcare activity globally. In response to the COVID-19 pandemic, governments around the world have imposed measures designed to reduce the transmission of COVID-19. In particular, elective procedures, such as the Lap-Band procedure, were delayed or cancelled, there was a significant reduction in physician office visits, and hospitals postponed or canceled purchases as well as limited or eliminated services. While elective procedures have increased from the reduced levels during the height of the COVID-19 pandemic, the reduction in elective procedures has had, and we believe may continue to have, a negative impact on the sales of our products. The extent to which fear of exposure to or actual effects of COVID-19, new variants, disease outbreak, epidemic or a similar widespread health concern impacts our business will depend on future developments, which are highly uncertain and cannot be predicted with confidence.

We may be unable to attract and retain management and other personnel we need to succeed.

Our success depends on the services of our senior management and other key employees. The loss of the services of one or more of our officers or key employees could hinder our sales and marketing efforts, or delay or prevent the commercialization of our Lap-Band System, ReShapeCare, ReShape Marketplace, Lap-Band 2.0, the Obalon Balloon System, and the development of our DBSN device. Our continued growth will require hiring a number of qualified clinical, scientific, commercial and administrative personnel. Accordingly, recruiting and retaining such personnel in the future will be critical to our success. There is intense competition from other companies and research and academic institutions for qualified personnel in the areas of our activities. If we fail to identify, attract, retain and motivate these highly skilled personnel, we may be unable to continue our development and commercialization activities.

The shares of series C convertible preferred stock issued in connection with our acquisition of ReShape Medical have certain rights and preferences senior to our common stock, including a liquidation preference that is senior to our common stock.

There are currently 95,388 shares of our series C convertible preferred stock outstanding, which are convertible into a total of 10 shares of our common stock. We originally issued the shares of our series C

convertible preferred stock in connection with our acquisition of ReShape Medical. The series C convertible preferred stock has a liquidation preference of $274.88 per share, or approximately $26.2 million in the aggregate. In general, the series C convertible preferred stock is entitled to receive dividends (on an as-if- converted-to-common stock basis) actually paid on shares of common stock when, as and if such dividends are paid on shares of common stock. No other dividends will be paid on shares of series C convertible preferred stock. Except in connection with the election of directors and limited protective provisions, the series C convertible preferred stock generally does not have voting rights. However, as long as any shares of series C convertible preferred stock remain outstanding, we cannot, without the affirmative vote of holders of a majority of the then-outstanding shares of series C convertible preferred stock, (a) alter or change adversely the powers, preferences or rights given to the series C convertible preferred stock (including by the designation, authorization, or issuance of any shares of preferred stock that purports to have equal rights with, or be senior in rights or preferences to, the series C convertible preferred stock), (b) alter or amend the series C convertible preferred stock certificate of designation, (c) amend our certificate of incorporation or other charter documents in any manner that adversely affects any rights of the holders of series C convertible preferred stock, (d) increase the number of authorized shares of series C convertible preferred stock, (e) except for stock dividends or distributions for which adjustments are to be made pursuant to the Series C Certificate of Designation, pay dividends on any shares of capital stock of the Company, or (f) enter into any agreement with respect to any of the foregoing.

No Obalon directors, officers or employees continued employment with the Company which could hinder the ability to transfer the Obalon technology, restart manufacturing operations and maintain FDA regulatory compliance for the Obalon Balloon System and negatively impact our results of operations.

Following the consummation of the merger, no directors, officers or employees of Obalon continued with ReShape. In order to restart manufacturing of the Obalon Balloon System, ReShape would have to hire and train new personnel to appropriately perform manufacturing operations that meet required performance specifications and maintain quality system and regulatory compliance related to the Obalon Balloon System without the knowledge and expertise of the Obalon management team, including completing a FDA-mandated post-approval study which was halted due to the effects of COVID-19. Obalon’s prior suppliers have not supplied Obalon since Obalon halted manufacturing and they may be unwilling or unable to supply ReShape on the prior terms or at all. Obalon had not manufactured or shipped products to customers since March 2020 and customers may not accept a relaunch of the Obalon Balloon System by ReShape.

We are a medical device company with a limited history of operations and sales, and we cannot assure you that we will ever generate substantial revenue or be profitable.

We are a medical device company with a limited operating history upon which you can evaluate our business. The success of our business will depend on our ability to generate increased sales and control costs, as well as our ability to obtain additional regulatory approvals needed to market new versions of our Lap-Band System, ReShapeCare, ReShape Marketplace, Obalon Balloon System, or regulatory approvals needed to market our DBSN device and any other products we may develop in the future, all of which we may be unable to do. If we are unable to successfully market our Lap-Band System for its indicated use, successfully launch and sell ReShapeCare and ReShape Marketplace, re-introduce the Obalon Balloon System, or develop and commercialize the DBSN device, we may never become profitable and may have to cease operations as a result. Our lack of a significant operating history also limits your ability to make a comparative evaluation of us, our products and our prospects.

Previously, we recorded a non-cash indefinite-lived intangible and definite-lived assets impairment loss, which significantly impacted our results of operations, and we may be exposed to additional impairment losses that could be material.

We conduct our annual indefinite-lived intangible assets impairment analysis during the fourth quarter of each year or when circumstances suggest that an indicator for impairment may be present. Previously, we performed a qualitative impairment analysis of the in-process research and development (“IPR&D”). Due to delays in the clinical trials experienced, we revised its expectations of when revenues would commence for the ReShape Vest, thus reducing the projected near-term future net cash flows related to the ReShape Vest.

During the quarter ended September 30, 2022, we stopped the clinical trials for the ReShape Vest and closed out the previous trial that occurred, as significant additional clinical work and cost would be required to achieve regulatory approval for the ReShape Vest. In addition, due to continued market decline and projected cash flows, the Company recorded an impairment of the developed technology related to the Lap-Band and Obalon Balloon System and our tradenames. As such, we determined the carrying value of the IPR&D and developed technology assets and trademarks were impaired and recognized a non-cash impairment charge of approximately $18.7 million on the condensed consolidated balance sheet as of December 31, 2022. In the future, we may have additional impairments requiring us to record an impairment loss related to our remaining finite-lived intangible assets, which could also have a material adverse effect on our results of operations.

We incur significant costs as a result of operating as a public company, and our management is required to devote substantial time to compliance initiatives.

As a public company, we incur significant legal, accounting and other expenses. In addition, the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), as well as rules subsequently implemented by the SEC have imposed various requirements on public companies, including establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. Our management and other personnel devote a substantial amount of time to these compliance initiatives. Moreover, these rules and regulations result in increased legal and financial compliance costs and will make some activities more time-consuming and costly.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective internal controls for financial reporting and disclosure. In particular, we are required to perform system and process evaluation and testing of our internal controls over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. Our testing may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. We have incurred and continue to expect to incur significant expense and devote substantial management effort toward ensuring compliance with Section 404. Moreover, if we do not comply with the requirements of Section 404, or if we identify deficiencies in our internal controls that are deemed to be material weaknesses, the market price of our stock could decline and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would entail expenditure of additional financial and management resources.

For example, our management assessed the effectiveness of our internal control over financial reporting as of June 30, 2023, and determined that our internal control over financial reporting was not effective at a reasonable assurance level due to a material weakness in our internal control over financial reporting. We had insufficient internal resources with appropriate accounting and finance knowledge and expertise to design, implement, document and operate effective internal controls around our financial reporting process. The insufficient internal resources resulted in a lack of review over our weighted average share calculation spreadsheet which included a formula error resulting in the inaccurate reporting of our earnings per share. We are currently implementing our remediation plan to address the material weaknesses identified above. Such measures include: hiring additional accounting personnel to ensure timely reporting of significant matters; designing and implementing controls to formalize roles and review responsibilities to align with our team’s skills and experience and designing and implementing formalized controls; and designing and implementing formal processes, policies and procedures supporting our financial close process.

We have identified material weaknesses in our internal control over financial reporting and any failure to maintain effective internal control over financial reporting, may have a material and adverse effect on our business, operating results, financial condition and prospects.

Our management assessed the effectiveness of our internal control over financial reporting as of December 31, 2022, and determined that our internal control over financial reporting was not effective at a reasonable assurance level due to material weaknesses in our internal control over financial reporting. We had insufficient internal resources with appropriate accounting and finance knowledge and expertise to design, implement, document and operate effective internal controls around our financial reporting process. We are currently implementing our remediation plan to address the material weaknesses identified above. Such

measures include: hiring additional accounting personnel to ensure timely reporting of significant matters; designing and implementing controls to formalize roles and review responsibilities to align with our team’s skills and experience and designing and implementing formalized controls; and designing and implementing formal processes, policies and procedures supporting our financial close process.

We reached a determination to restate certain of our previously issued consolidated financial statements, which resulted in unanticipated costs and may affect investor confidence and raise reputational issues.

We also reached a determination to restate our consolidated financial statements and related disclosures for the year ended December 31, 2021, and the unaudited consolidated information for the interim periods ended September 30, 2022, June 30, 2022, March 31, 2022, September 30, 2021, and June 30, 2021 following the identification of certain misstatements contained in those financial statements, which resulted in an understatement of impairment of goodwill by approximately $1.9 million. We have determined that it is appropriate to correct the misstatements in our previously issued financial statements. The restatement also included corrections for additional identified out-of-period and uncorrected misstatements in the impacted periods. As a result, we have incurred unanticipated costs for accounting and legal fees in connection with or related to the restatement, and have become subject to a number of additional risks and uncertainties, which may affect investor confidence in the accuracy of our financial disclosures and may raise reputational issues for our business.

General economic and political conditions could have a material adverse effect on our business.

External factors can affect our financial condition. Such external factors include general domestic and global economic conditions, such as interest rates, tax law including tax rate changes, and factors affecting global economic stability, and the political environment regarding healthcare in general. We cannot predict to what extent the global economic conditions may negatively impact our business. For example, negative conditions in the credit and capital markets could impair our ability to access the financial markets for working capital and could negatively impact our ability to borrow.

We face significant uncertainty in the industry due to government healthcare reform.

In the United States, there have been and continue to be a number of legislative initiatives to contain healthcare costs. The Patient Protection and Affordable Care Act, as amended, (the “Affordable Care Act”) as well as any future healthcare reform legislation, may have a significant impact on our business. The impact of the Affordable Care Act on the health care industry is extensive and includes, among other things, the federal government assuming a larger role in the health care system, expanding healthcare coverage of United States citizens and mandating basic healthcare benefits.

Congress regularly considers legislation to replace or repeal elements or all of the Affordable Care Act. At this time, it is not clear whether the Affordable Care Act will be repealed in whole or in part, and, if it is repealed, whether it will be replaced in whole or in part by another plan and what impact those changes will have on coverage and reimbursement for healthcare items and services covered by plans that were authorized by the Affordable Care Act. We expect that additional state and federal healthcare reform measures will be adopted in the future, any of which could limit the amounts that federal and state governments will pay for healthcare products and services, and also indirectly affect the amounts that private payers are willing to pay. In addition, any healthcare reforms enacted in the future may, like the Affordable Care Act, be phased in over a number of years but, if enacted, could reduce our revenue, increase our costs, or require us to revise the ways in which we conduct business or put us at risk for loss of business. In addition, our results of operations, financial position and cash flows could be materially adversely affected by changes under the Affordable Care Act and changes under any federal or state legislation adopted in the future.