0001571934

false

--12-31

0001571934

2023-09-22

2023-09-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 22, 2023

Synaptogenix, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

001-40458 |

46-1585656 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

1185

Avenue of the Americas, 3rd

Floor

New York, New

York 10036

(Address of principal executive offices and zip code)

Registrant’s telephone number, including

area code: (973) 242-0005

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, $0.0001 par value per share |

|

SNPX |

|

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company. x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

As previously disclosed, on November

21, 2022, Synaptogenix, Inc. (the “Company”) filed a Certificate of Designations of Series B Convertible Preferred Stock of

Synaptogenix, Inc. (the “Certificate of Designations”) with the Secretary of State of the State of Delaware (the “Delaware

Secretary of State”), thereby creating a new series of preferred stock of the Company designated as “Series B Convertible

Preferred Stock” (the “Preferred Shares”). Also as previously disclosed, the Company filed Certificates of Amendment

to the Certificate of Designations with the Delaware Secretary of State on each of March 17, 2023 and May 12, 2023.

On September 22, 2023, the Company

filed a Certificate of Amendment to the Certificate of Designations (the “Amendment”) with the Delaware Secretary of State. The Amendment amended the terms of the Preferred Shares by providing that the Company and the holders

of the Preferred Shares (the “Investors”) shall be permitted to mutually agree, in connection with any waiver of an Equity

Conditions Failure (as defined in the Certificate of Designations), as to (i) whether the monthly amortization payments made to the Investors

will be made in cash or shares of common stock, (ii) the methodology for calculating any applicable true-up shares required to be paid

in connection with an amortization payment (including whether such true-up shares will be paid in cash or shares of common stock) and

for calculating the conversion price in connection with any accelerated conversions, and (iii) whether any premium will apply in connection

with any payment of true-up shares in cash instead of shares of common stock, subject to certain limitations as set forth in the Amendment.

The Amendment provides the Company with additional flexibility to induce the Investors to permit the Company to use shares of common stock

instead of cash for amortization payments even when an Equity Conditions Failure is in effect. Accordingly, the Amendment will support

the Company’s efforts to conserve cash.

The foregoing description of the

Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which is filed

as Exhibit 3.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: September 22, 2023 |

By: |

/s/ Robert Weinstein |

| |

Name: |

Robert Weinstein |

| |

Title: |

Chief Financial Officer |

Exhibit 3.1

CERTIFICATE OF AMENDMENT

OF

CERTIFICATE OF DESIGNATIONS

OF

SERIES B CONVERTIBLE PREFERRED STOCK OF

SYNAPTOGENIX, INC.

PURSUANT TO SECTION 242 OF THE

DELAWARE GENERAL CORPORATION LAW

This Certificate of Amendment

to the Certificate of Designations of Series B Convertible Preferred Stock (the “Amendment”) is dated as of September

22, 2023.

WHEREAS, the board of directors

(the “Board”) of Synaptogenix, Inc., a Delaware corporation (the “Corporation”), pursuant to the

authority granted to it by the amended and restated certificate of incorporation of the Corporation (the “Certificate of Incorporation”),

has previously fixed the rights, preferences, restrictions and other matters relating to a series of the Company’s preferred stock,

consisting of 15,000 authorized shares of preferred stock, classified as Series B Convertible Preferred Stock (the “Series B

Preferred Stock”) and the Certificate of Designations of the Series B Convertible Preferred Stock (the “Certificate

of Designations”) was initially filed with the Secretary of State of the State of Delaware on November 21, 2022 evidencing such

terms and amendments to the Certificate of Designations were filed with the Secretary of State of the State of Delaware on March 17, 2023

and May 11, 2023;

WHEREAS, pursuant to Section

32(b) of the Certificate of Designations, the Certificate of Designations or any provision thereof may be amended by obtaining the affirmative

vote at a meeting called for such purpose, or written consent without a meeting in accordance with the General Corporation Law of the

State of Delaware (the “DGCL”), of the holders of at least a majority of the outstanding Series B Preferred Stock (the

“Required Holders”), voting separately as a single class, and with such stockholder approval, if any, as may then be

required pursuant to the DGCL and the Certificate of Incorporation;

WHEREAS, the Required Holders

pursuant to the Certificate of Designations have consented, in accordance with the DGCL, on September 20, 2023, to this Amendment on the

terms set forth herein; and

WHEREAS, the Board has duly

adopted resolutions proposing to adopt this Amendment and declaring this Amendment to be advisable and in the best interest of the Corporation

and its stockholders.

NOW, THEREFORE, this Amendment

has been duly adopted in accordance with Section 242 of the DGCL and has been executed by a duly authorized officer of the Corporation

as of the date first set forth above to amend the terms of the Certificate of Designations as follows:

1. Section

9(b) of the Certificate of Designations is hereby amended and restated to read as follows (emphasis added):

(b) Mechanics of

Installment Conversion. Subject to Section 4(d), if the Company delivers an Installment Notice or is deemed to have delivered an

Installment Notice certifying that such Installment Amount is being paid, in whole or in part, in an Installment Conversion in

accordance with Section 9(a), then the remainder of this Section 9(b) shall apply. The applicable Installment Conversion Amount, if

any, shall be converted on the applicable Installment Date at the applicable Installment Conversion Price and the Company shall, on

such Installment Date, (A) deliver to each Holder’s account with DTC any True-Up Shares and (B) in the event of the Conversion

Floor Price Condition, the Company shall deliver to the Holder the applicable Conversion Installment Floor Amount, provided that the

Equity Conditions are then satisfied (or waived in writing by such Holder) on such Installment Date and an Installment Conversion is

not otherwise prohibited under any other provision of the Certificate of Designations. For purposes hereof, “True-Up

Shares” means, in the event that the number of shares of Common Stock calculated by taking the applicable Installment

Conversion Amount divided by the Installment Conversion Price (the “Adjustment Shares”), is greater than the

number of Pre-Installment Conversion Shares received with respect to the Installment Date, a number of additional Conversion Shares

equal to the difference between (A) such number of Adjustment Shares and (B) such number of Pre-Installment Conversion Shares. If

the Company confirmed (or is deemed to have confirmed by operation of Section 9(a)) the conversion of the applicable Installment

Conversion Amount, in whole or in part, and there was no Equity Conditions Failure as of the applicable Installment Notice Date (or

is deemed to have certified that the Equity Conditions in connection with any such conversion have been satisfied by operation of

Section 9(a)) but an Equity Conditions Failure occurred between the applicable Installment Notice Date and any time through the

applicable Installment Date (the “Interim Installment Period”), the Company shall provide each Holder a

subsequent notice to that effect. If there is an Equity Conditions Failure (which is not waived in writing by such Holder) during

such Interim Installment Period or an Installment Conversion is not otherwise permitted under any other provision of this

Certificate of Designations, then, at the option of such Holder designated in writing to the Company, such Holder may require the

Company to do any one or more of the following: (i) the Company shall redeem all or any part designated by such Holder of the

unconverted Installment Conversion Amount (such designated amount is referred to as the “Designated Redemption

Amount”) and the Company shall pay to such Holder within three (3) days of such Installment Date, by wire transfer of

immediately available funds, an amount in legally available funds equal to 125% of such Designated Redemption Amount, provided,

however, at the option of the Holder, (1) the Designated Redemption Amount shall be reduced by an amount equal to the product of the

(x) the number of Pre-Installment Conversion Shares issued to the Holder in connection with such Installment Conversion Amount and

(y) and the actual prices at which the Holder sold such Pre-Installment Conversion Shares during the Interim Installment Period or

(2) such Pre-Installment Conversion Shares shall be retained by the Holder and applied to the next instance in which the Company

issues Pre-Installment Conversion Shares; provided, further however, that if the Company does not elect to pay a future Installment

Amount by means of an Installment Conversion in accordance with this Section 9, the Holder shall return the number of

Pre-Installment Conversion Shares to the Company and/or (ii) the Installment Conversion shall be null and void with respect to all

or any part designated by such Holder of the unconverted Installment Conversion Amount and such Holder shall be entitled to all the

rights of a holder of the Preferred Shares with respect to such designated part of the Installment Conversion Amount; provided,

however, the Conversion Price for such designated part of such unconverted Installment Conversion Amount shall thereafter be

adjusted to equal the lesser of (A) the Installment Conversion Price as in effect on the date on which such Holder voided the

Installment Conversion and (B) the Installment Conversion Price that would be in effect on the date on which such Holder delivers a

Conversion Notice relating thereto as if such date was an Installment Date; provided, further, however, at the option of the Holder,

(3) any Pre-Installment Conversion Shares delivered in connection with such voided Installment Conversion shall be deemed to redeem

a number of Preferred Shares having a Stated Value equal to the product of (i) the number of such Pre-Installment Conversion Shares

and (y) the actual prices at which the Holder sold such Pre-Installment Conversion Shares during the Interim Installment Period or

(4) such Pre-Installment Conversion Shares shall be retained by the Holder and applied to the next instance in which the Company

issues Pre-Installment Conversion Shares; provided, further however, that if the Company does not elect to pay a future Installment

Amount by means of an Installment Conversion in accordance with this Section 9, the Holder shall return the number of

Pre-Installment Conversion Shares to the Company. If the Company fails to redeem any Designated Redemption Amount by the second

(2nd) day following the applicable Installment Date by payment of such amount by such date for any reason (including, without

limitation, to the extent such payment is prohibited pursuant to the DGCL), then such Holder shall have the rights set forth in

Section 12(a) as if the Company failed to pay the applicable Installment Redemption Price (as defined below) and all other rights

under this Certificate of Designations (including, without limitation, such failure constituting a Triggering Event described in

Section 5(a)(iv)). Notwithstanding anything to the contrary in this Section 9(b), but subject to Section 4(d), until the Company

delivers Common Stock representing the Installment Conversion Amount to such Holder, the Installment Conversion Amount may be

converted by such Holder into Common Stock pursuant to Section 4. In the event that a Holder elects to convert the Installment

Conversion Amount prior to the applicable Installment Date as set forth in the immediately preceding sentence, the Installment

Conversion Amount so converted shall be deducted from the Installment Amount(s) of such Holder relating to the applicable

Installment Date(s) as set forth in the applicable Conversion Notice. For further clarification, if any conversion is applied

against an Installment Amount, the Pre-Installment Conversion Shares issued in connection with such Installment Amount (and that

were not already applied to such conversions) shall be applied first against such conversions or, at the option of the Holder as

indicated in the Conversion Notice, retained by the Holder and applied to the next instance in which the Company issues

Pre-Installment Conversion Shares. The Company shall pay any and all taxes that may be payable with respect to the issuance and

delivery of any shares of Common Stock in any Installment Conversion hereunder. In addition and notwithstanding anything to the

contrary in this Section 9(b), but subject to Section 4(d), in connection with any waiver of any Equity Conditions Failure, the

Company and the Investors shall be permitted to mutually agree in connection with such waiver as to (i) whether an applicable

Installment Amount shall be paid, in whole or in part, as an Installment Conversion or an Installment Redemption, (ii) the

methodology for calculating (A) any applicable True-Up Shares and whether any such True-Up Shares are to be paid in shares of common

stock or in cash and (B) the applicable Installment Conversion Price with respect to any Accelerations pursuant to Section 9, and

(iii) any applicable premium with respect to the payment of any True-Up Shares in cash in lieu of shares of common stock; provided,

however, that in no event shall any such premium exceed 125% of the amount equal to (A) the number of True-Up Shares multiplied by

(B) the applicable Installment Conversion Price; and, provided further, however, that in no event shall any shares of common stock

be issued pursuant to this Agreement at a price per share less than the Floor Price. For the avoidance, nothing in the immediately

preceding sentence shall be deemed to limit or otherwise impair an Investors right to require the Company’s strict adherence

to the terms and conditions of this Certificate of Designation.

[Signature Page Follows]

IN WITNESS WHEREOF, the Corporation

has caused this Amendment to be signed by its duly authorized officer this 22nd day of September, 2023.

| |

By: |

/s/ Robert Weinstein |

| |

|

Name:Robert Weinstein |

| |

|

Title: Chief Financial Officer |

v3.23.3

Cover

|

Sep. 22, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 22, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-40458

|

| Entity Registrant Name |

Synaptogenix, Inc.

|

| Entity Central Index Key |

0001571934

|

| Entity Tax Identification Number |

46-1585656

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1185

Avenue of the Americas

|

| Entity Address, Address Line Two |

3rd

Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

973

|

| Local Phone Number |

242-0005

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

SNPX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

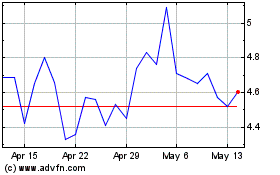

Synaptogenix (NASDAQ:SNPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synaptogenix (NASDAQ:SNPX)

Historical Stock Chart

From Apr 2023 to Apr 2024