UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

(Amendment No. 6)

Under the Securities Exchange Act of

1934

CLPS Incorporation

(Name of Issuer)

Common Stock

(Title of Class of Securities)

G31642

(CUSIP Number)

Raymond Ming Hui Lin

c/o Unit 1000, 10th Floor, Millennium City III

370 Kwun Tong Road

Kwun Tong, Kowloon

Hong Kong SAR

Tel: +852 37073600

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

August 16, 2023

(Date of Event which Requires Filing of

this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule

13D, and is filing this schedule because of Rule 13d-1(b)(3) or (4), check the following box ☐.

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be

sent.

| CUSIP No. G31642 |

13D |

Page 2 of 5 Pages |

1 |

NAME OF REPORTING PERSON

Raymond Ming Hui Lin |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS*

PF/OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Hong Kong Special Administrative Region of the People’s Republic of China |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

7,605,873 common shares |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

7,605,873 common shares |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

7,605,873 common shares |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES: Not Applicable*

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

29.7% of the Company’s outstanding common shares |

| 14 |

TYPE OF REPORTING PERSON*

IN |

| CUSIP No. G31642 |

13D |

Page 3 of 5 Pages |

EXPLANATORY NOTE

This Amendment No. 6 to Schedule 13D amends the

Amendment No. 4 to Schedule 13D filed on February 14, 2022 (the “Original 13D”). This Amendment and the Original 13D are hereby

referred to as the “Schedule 13D”.

Except as specifically amended

below, all other provisions of the Schedule 13D remain in effect. Capitalized terms used and not defined in this Amendment are used as

defined in the Original 13D. This Amendment is being filed to reflect the disposition by Mr. Raymond Ming Hui Lin, a Reporting Person,

of 211 common shares of the Company in May 2022, the acquisitions of 300,000 shares and 325,000 shares by the vesting of award shares

under the 2020 Equity Incentive Plan on May 23, 2022 and November 14, 2022, respectively, and the acquisition of 530,000 shares by the

vesting of award shares under the 2023 Equity Incentive Plan on August, 16, 2023. This Amendment is being filed voluntarily and is not

being filed as required by Rule 13d-1 of the Securities Exchange Act of 1934, as amended.

Item 1. Security and Issuer.

The title and class of equity

securities to which this Schedule 13D relates is the common shares, par value $0.0001 per share (“Common Shares”), of CLPS

Incorporation, a Cayman Islands corporation (the “Company”). The Company’s principal executive office is located at

Unit 1000, 10th Floor, Millennium City III, 370 Kwun Tong Road, Kwun Tong, Kowloon, Hong Kong SAR.

Item 2. Identity and Background.

(a)-(c) This report is being filed by Raymond

Ming Hui Lin (the “Reporting Person”). Raymond Ming Hui Lin is the Chief Executive Officer and a director of the Company.

This business address is Unit 1000, 10th Floor, Millennium City III, 370 Kwun Tong Road, Kwun Tong, Kowloon, Hong Kong SAR.

Qinhui Ltd. is a holding company

formed under the laws of the British Virgin Islands. The principal business of Qinhui Ltd. is managing Raymond Ming Hui Lin’s personal

assets and investments. Qinhui Ltd.’s mailing address is c/o Ogier Global (BVI) Ltd., Ritter House, Wickham’s Cay II, Road

Town, Tortola, VG 1110, British Virgin Islands. Raymond Ming Hui Lin has the sole control of Qinhui Ltd.

(d)-(e) Neither Raymond Ming Hui Lin nor Qinhui

Ltd. has, during the last five years, (i) been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors)

or (ii) been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting activities subject to, federal or

state securities laws or finding any violation of such laws.

(f) Raymond Ming Hui Lin is a citizen of Hong

Kong Special Administrative Region of the People’s Republic of China. Qinhui Ltd. is a British Virgin Islands corporation.

Item 3. Source and Amount of Funds and Other Consideration.

On August 23, 2021, the Board

of Directors of the Company authorized the award of 300,000 shares of restricted stock (the “Shares”) to Mr. Lin under the

Company’s 2020 Equity Incentive Plan, which vested on May 23, 2022. On November 14, 2022, the Board of Directors of the Company

authorized the award of 300,000 Shares to Mr. Lin under the Company’s 2020 Equity Incentive Plan, which vested on the same day.

On August 16, 2023, the Board of Directors of the Company authorized the award of 530,000 Shares to Mr. Lin under the Company’s

2023 Equity Incentive Plan, which vested on the same day. Mr. Lin did not pay any additional consideration for the Shares.

| CUSIP No. G31642 |

13D |

Page 4 of 5 Pages |

Item 4. Purpose of Transaction.

Mr. Lin was awarded the Shares

under the Company’s 2020 Equity Incentive Plan and 2023 Equity Incentive Plan stated above. Mr. Lin is currently the Chief Executive

Officer and a director of the Company and therefore will continue to participate in and receive awards under the Company’s incentive

programs for as long as he is an employee of the Company. These share awards did not result in a material change in Mr. Lin’s ownership

of the Company’s common shares as defined by Rule 13d-1 of the Securities Exchange Act of 1934, as amended. Mr. Lin files this Schedule

13D voluntarily.

Item 5. Interest in Securities of the Issuer.

(a)-(d) The calculations in this Item are based

upon 25,584,122 common shares issued and outstanding as of August 16, 2023. The foregoing calculation is made pursuant to Rule 13d-3 promulgated

under the Securities Act of 1933, as amended to date.

| Reporting Person | |

Amount of

Securities

Beneficially

Owned | |

Percentage of

Class | | |

Sole Power to

Vote or Direct

the Vote | |

Shared Power

to Vote or

Direct the Vote | |

Sole Power to

Dispose or to

Direct the

Disposition | |

Shared Power

to Dispose or to

Direct the

Disposition |

| Raymond Ming Hui Lin | |

7,605,873 common shares* | |

| 29.7 | % | |

7,605,873 common shares | |

- | |

7,605,873 common shares | |

- |

| Qinhui Ltd. | |

4,999,996 common shares | |

| 19.5 | % | |

- | |

4,999,996 common shares | |

- | |

4,999,996 common shares |

| * |

Includes the vested portion of the restricted stock granted dated as of August 16, 2023. |

Because Mr. Lin controls all

of the voting and disposition interests of Qinhui Ltd. with respect to the securities, he may be deemed to have indirect beneficial ownership

of the common shares directly beneficially owned by Qinhui Ltd. Neither Raymond Ming Hui Lin nor Qinhui Ltd. has effected any transactions

in the securities of the Company in the past sixty days. The Reporting Persons affirm that no other person has the right to receive or

the power to direct the receipt of dividends from, or the proceeds from the sale of, the common shares beneficially owned by the Reporting

Persons reported herein.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

Other than as described above, there are no contracts,

arrangements, understandings or relationships (legal or otherwise) between the Reporting Persons and any other person with respect to

any securities of the Company, including, but not limited to, the transfer or voting of any of the securities, finder’s fees, joint

ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding

of proxies or any pledge or contingency, the occurrence of which would give another person voting or investment power over the securities

of the Company.

Item 7. Materials to be Filed as Exhibits.

None.

| CUSIP No. G31642 |

13D |

Page 5 of 5 Pages |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief,

the undersigned certify that the information set forth in this Schedule 13D is true, complete and correct.

Dated: September 22, 2023

| |

/s/ Raymond Ming Hui Lin |

| |

Raymond Ming Hui Lin |

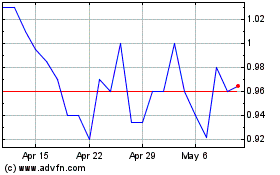

CLPS Incorporation (NASDAQ:CLPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

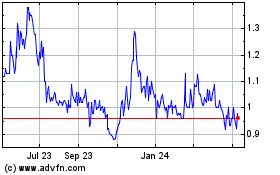

CLPS Incorporation (NASDAQ:CLPS)

Historical Stock Chart

From Apr 2023 to Apr 2024