Heritage Global Inc. Announces Filing of Form S-3 to Replace Expired Shelf Registration Statement

September 21 2023 - 9:00AM

Business Wire

Heritage Global Inc. (NASDAQ: HGBL) (“Heritage Global,” “HG” or

“the Company”), an asset services company specializing in financial

and industrial asset transactions, announced that it has filed a

universal shelf registration statement on Form S-3 with the United

States Security and Exchange Commission, replacing a previous

universal shelf registration on Form S-3 that expired September 15,

2023.

Once declared effective by the SEC, the new shelf registration

statement will provide Heritage Global the flexibility to, from

time-to-time, publicly offer and sell debt securities, common

stock, preferred stock, warrants and other securities in amounts,

at prices and on terms announced if and when the securities are

ever offered. The specifics of any potential future offerings,

along with the use of proceeds of any such securities offered by

the company, would be described in detail in a prospectus

supplement at the time of any such offering.

Heritage Global Chief Executive Officer Ross Dove commented, “As

noted, the shelf filing was a renewal of our prior filing, which

was set to expire. Having a shelf available is appropriate, as it

preserves our flexibility. That said, we have no current plans to

raise equity capital, as we continue to successfully generate the

funds needed to support our growth.”

The shelf registration statement relating to these securities

has been filed with the SEC but has not yet become effective. The

securities referred to in this press release may not be sold nor

may offers to buy be accepted prior to the time the registration

statement is declared effective by the SEC. This press release

shall not constitute an offer to sell or the solicitation of an

offer to buy, nor shall there be any sale of these securities in

any state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to the registration or qualification under

the securities laws of any such state or jurisdiction.

About Heritage Global Inc. (“HG”)

Heritage Global Inc. (NASDAQ: HGBL) values and monetizes

industrial & financial assets by providing acquisition,

disposition, valuation, and lending services for surplus and

distressed assets. This aids in facilitating the circular economy

by diverting useful industrial assets from landfills and operating

an ethical supply chain by overseeing post-sale account activity of

financial assets. Specialties consist of acting as an adviser, in

addition to acquiring or brokering turnkey manufacturing

facilities, surplus industrial machinery and equipment, industrial

inventories, real estate, charged-off account receivable

portfolios, through its two business units: Industrial Assets and

Financial Assets.

Forward-Looking Statements

This communication includes forward-looking statements based on

our current expectations and projections about future events. For

these statements, the Company claims the protection of the safe

harbor for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995. While the Company

believes the forward-looking statements contained in this

communication are accurate, these forward-looking statements

represent the Company’s beliefs only as of the date of this

communication, and there are a number of factors that could cause

actual events or results to differ materially from those indicated

by such forward-looking statements, including variability in

magnitude and timing of asset liquidation transactions, the impact

of changes in the U.S. national and global economies, and interest

rate and foreign exchange rate sensitivity, as well as other

factors beyond the Company’s control. Unless required by law, we

undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. In light of these risks, uncertainties and

assumptions, you should not place undue reliance on these

forward-looking statements, which speak only as of the date of this

release. For more details on factors that could affect these

expectations, please see our filings with the Securities and

Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230921560264/en/

Investor Relations Contact: John Nesbett/Jennifer

Belodeau IMS Investor Relations 203/972.9200

InvestorRelations@hginc.com

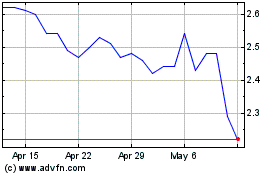

Heritage Global (NASDAQ:HGBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

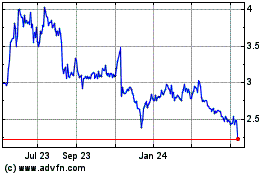

Heritage Global (NASDAQ:HGBL)

Historical Stock Chart

From Apr 2023 to Apr 2024