Filed Pursuant to Rule 424(b)(3)

Registration No. 333-273935

PROSPECTUS

Petros Pharmaceuticals, Inc.

184,828,846 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders named

in this prospectus from time to time of up to an aggregate of 184,828,846 shares of our common stock, par value $0.0001 per share

(the “Common Stock”), issuable upon the conversion of shares of our newly designated Series A convertible preferred stock

(the “Preferred Shares”) and shares of our Common Stock issuable upon exercise of certain warrants (the “Warrants”).

The Preferred Shares and Warrants were acquired by the selling stockholders under the Securities Purchase Agreement (the “Purchase

Agreement”), dated July 13, 2023, by and among the Company and the investors listed therein (the “Investors”), and an

engagement agreement (the “Engagement Agreement”), dated July 13, 2023, between the Company and Katalyst Securities LLC (the

“Placement Agent”), as applicable. The shares of Common Stock issuable upon the conversion of the Preferred Shares are herein

referred to as “Conversion Shares,” and the shares of Common Stock issuable upon the exercise of the Warrants are herein referred

to as “Warrant Shares.”

The Conversion Shares and the Warrant Shares were issued in reliance

upon the exemption from the registration requirements in Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities

Act”) and Regulation D promulgated thereunder.

We are registering the resale of the Conversion Shares and Warrant

Shares covered by this prospectus as required by the Registration Rights Agreement, dated July 17, 2023, by and among the Company and

the Investors (the “Registration Rights Agreement”). The selling stockholders will receive all of the proceeds from any sales

of the shares offered hereby. We will not receive any of the proceeds, but we will incur expenses in connection with the offering. To

the extent the Warrants are exercised for cash, if at all, we will receive the exercise price of the Warrants. We intend to use those

proceeds, if any, for general corporate purposes.

Our registration of the shares of Common Stock covered by this prospectus

does not mean that the selling stockholders will offer or sell any of such shares of Common Stock. The selling stockholders named in this

prospectus, or their donees, pledgees, transferees or other successors-in-interest, may resell the shares of Common Stock covered by this

prospectus through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately

negotiated prices. For additional information on the possible methods of sale that may be used by the selling stockholders, you should

refer to the section of this prospectus entitled “Plan of Distribution.”

Any shares of Common Stock subject to resale hereunder will have been

issued by us and acquired by the selling stockholders prior to any resale of such shares pursuant to this prospectus.

No underwriter or other person has been engaged to facilitate the sale

of the Common Stock in this offering. We will bear all costs, expenses and fees in connection with the registration of the Common Stock.

The selling stockholders will bear all commissions and discounts, if any, attributable to their respective sales of the Common Stock.

Our

Common Stock is listed on the Nasdaq Capital Market under the symbol “PTPI.” On September 18, 2023, the last reported

sales price for our Common Stock was $1.755 per share.

Investment in our Common Stock involves risk.

See “Risk Factors” contained in this prospectus, in our periodic reports filed from time to time with the Securities and

Exchange Commission, which are incorporated by reference in this prospectus and in any applicable prospectus supplement. You should carefully

read this prospectus and the accompanying prospectus supplement, together with the documents we incorporate by reference, before you

invest in our Common Stock.

We are an “emerging growth company” as defined under

the federal securities laws and, as such, have elected to comply with certain reduced reporting requirements for this prospectus and may

elect to do so in future filings.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this prospectus. Any representation

to the contrary is a criminal offense.

The date of this prospectus is September

18, 2023.

Table of Contents

About this Prospectus

This prospectus is part of the registration statement that we filed

with the Securities and Exchange Commission (the “SEC”) pursuant to which the selling stockholders named herein may, from

time to time, offer and sell or otherwise dispose of the shares of our Common Stock covered by this prospectus. As permitted by the rules

and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus.

This prospectus and the documents incorporated by reference into this

prospectus include important information about us, the securities being offered and other information you should know before investing

in our securities. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date

set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent

to the date of the document incorporated by reference, even though this prospectus is delivered or shares of Common Stock are sold or

otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including

the documents incorporated by reference therein, in making your investment decision. You should also read and consider the information

in the documents to which we have referred you under “Where You Can Find More Information” and “Incorporation of Certain

Information by Reference” in this prospectus.

You should rely only on this prospectus and the information incorporated

or deemed to be incorporated by reference in this prospectus. We have not, and the selling stockholders have not, authorized anyone to

give any information or to make any representation to you other than those contained or incorporated by reference in this prospectus.

If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer

to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer

or solicitation in such jurisdiction.

We further note that the representations, warranties and covenants

made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made

solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties

to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties

or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied

on as accurately representing the current state of our affairs.

Unless otherwise indicated, information contained or incorporated by

reference in this prospectus concerning our industry, including our general expectations and market opportunity, is based on information

from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted

by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions

based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s

future performance are necessarily uncertain due to a variety of factors, including those described in “Risk Factors” beginning

on page 6 of this prospectus. These and other factors could cause our future performance to differ materially from our assumptions

and estimates.

Prospectus Summary

This summary provides an overview of selected information contained

elsewhere or incorporated by reference in this prospectus and does not contain all of the information you should consider before investing

in our securities. You should carefully read the prospectus, the information incorporated by reference and the registration statement

of which this prospectus is a part in their entirety before investing in our securities, including the information discussed under “Risk

Factors” in this prospectus and the documents incorporated by reference and our financial statements and related notes that are

incorporated by reference in this prospectus. In this prospectus, unless the context indicates otherwise, “Petros,” the “Company,”

the “registrant,” “we,” “us,” “our,” or “ours” refer to Petros Pharmaceuticals,

Inc. and its consolidated subsidiaries.

Overview

Petros is a pharmaceutical company focused on men’s health therapeutics,

consisting of wholly owned subsidiaries, Metuchen Pharmaceuticals, LLC, Timm Medical Technologies, Inc., Neurotrope, Inc., and Pos-T-Vac,

LLC.

On September 30, 2016, the Company entered into a License and Commercialization

Agreement (the “License Agreement”) with Vivus, Inc to purchase and receive the license for the commercialization and development

of Stendra® for a one-time fee of $70 million. The License Agreement gives the Company the right to sell Stendra® in the U.S and

its territories, Canada, South America, and India. Stendra® is a U.S. Food and Drug Administration (“FDA”) approved PDE

5 inhibitor prescription medication for the treatment of erectile dysfunction (“ED”) and is the only patent protected PDE

5 inhibitor on the market. Stendra® offers the ED therapeutic landscape a valuable addition as an oral ED therapy that may be taken

as early as approximately 15 minutes prior to sexual engagement, with or without food when using the 100mg or 200mg dosing (does not apply

to 50mg dosing). Petros is also currently conducting non-clinical consumer studies in connection with the contemplated pursuit of FDA

approval for Stendra® for Non-Prescription / Over-The-Counter use in treating ED.

In addition to Stendra®, Petros’ ED portfolio also includes

external penile rigidity devices, namely Vacuum Erection Devices, which are sold domestically and internationally. In addition to ED products,

Petros is committed to identifying and developing other pharmaceuticals to advance men’s health.

Private Placement of Preferred Shares and

Warrants

On July 13, 2023, we entered into the Purchase Agreement with certain

accredited investors, pursuant to which we issued and sold on July 17, 2023, in a private placement (the “Private Placement”),

(i) an aggregate of 15,000 Preferred Shares, initially convertible into up to an aggregate of 6,666,668 Conversion Shares at a conversion

price of $2.25 per share, and (ii) Warrants to acquire up to an aggregate of 6,666,668 Warrant Shares at an exercise price of $2.25 per

share. Each Preferred Share and accompanying Warrants were sold together at a combined offering price of $1,000. The terms of the Preferred

Shares are as set forth in the Certificate of Designations of Series A Convertible Preferred Stock of Petros Pharmaceuticals, Inc. (the

“Certificate of Designations”), which was filed and became effective with the Secretary of State of the State of Delaware

on July 14, 2023. The Warrants are immediately exercisable and expire 5 years from issuance.

Pursuant to the Engagement Agreement, the Company issued to the Placement

Agent and its designees Warrants to acquire up to an aggregate of 533,334 Warrant Shares, which amount is approximately equal to 8% of

the number of shares of common stock that the Preferred Shares were initially convertible into, on substantially the same terms as the

Warrants sold to investors.

In connection with the Private Placement, we entered into the Registration

Rights Agreement, pursuant to which we are obligated, among other things, to (i) file a registration statement with the SEC within 30

days of July 17, 2023 for purposes of registering 200% of the Conversion Shares and Warrant Shares for resale by the selling stockholders,

(ii) use our best efforts to have the registration statement declared effective within 90 days after the closing of the Private Placement,

and (iii) maintain the registration until the earlier of (x) the date on which the selling stockholders may sell their Conversion Shares

or Warrant Shares without restriction pursuant to Rule 144 under the Securities Act, and (y) the date on which the selling stockholders

no longer hold any Conversion Shares or Warrant Shares.

The Private Placement is exempt from the

registration requirements of the Securities Act pursuant to the exemption for transactions by an issuer not involving any public

offering under Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D of the Securities Act and in reliance on similar

exemptions under applicable state laws. Each of the investors in the Private Placement has represented to us that it is an

accredited investor within the meaning of Rule 501(a) of Regulation D and that it is acquiring the securities for investment only

and not with a view towards, or for resale in connection with, the public sale or distribution thereof. The Preferred Shares and

Warrants are being offered without any general solicitation by us or our representatives.

Preferred Shares

The Preferred Shares are convertible into Common Stock at the election

of the holder at any time at an initial conversion price of $2.25 (the “Conversion Price”). The Conversion Price is subject

to customary adjustments for stock dividends, stock splits, reclassifications and the like, and subject to price-based adjustment in the

event of any issuances of Common Stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the

then-applicable Conversion Price (subject to certain exceptions). We are required to redeem the Preferred Shares in 13 equal monthly installments,

commencing on the earlier of (x) the first trading day of the calendar month which is at least 25 trading days after the registration

statement, of which this prospectus forms a part, is declared effective by the SEC, and (y) November 1, 2023. The amortization payments

due upon such redemption are payable, at our election, in cash at 107% of the Installment Redemption Amount (as defined in the Certificate

of Designations), or subject to certain limitations, in shares of Common Stock valued at the lower of (i) the Conversion Price then in

effect and (ii) the greater of (A) a 80% of the average of the three lowest closing prices of our Common Stock during the 30 trading day

period immediately prior to the date the amortization payment is due or (B) $0.396, which is 20% of the “Minimum Price” (as

defined in Nasdaq Stock Market Rule 5635) on the date of the Nasdaq Stockholder Approval (as defined below) or such lower amount as permitted,

from time to time, by the Nasdaq Stock Market, subject to adjustment for stock splits, stock dividends, stock combinations, recapitalizations

or other similar events (the “Floor Price”). We may require holders to convert their Preferred Shares into Conversion Shares

if the closing price of the Common Stock exceeds $6.75 per share (subject to adjustment for stock splits, stock dividends, stock combinations,

recapitalizations or other similar events) for 20 consecutive trading days and the daily dollar trading volume of the Common Stock exceeds

two million dollars ($2,000,000) per day during the same period and certain equity conditions described in the Certificate of Designation

are satisfied.

The holders of the Preferred Shares are entitled to dividends of 8%

per annum, compounded monthly, which are payable in cash or shares of Common Stock at our option, in accordance with the terms of the

Certificate of Designations. Upon the occurrence and during the continuance of a Triggering Event (as defined in the Certificate of Designations),

the Preferred Shares will accrue dividends at the rate of 15% per annum. Upon conversion or redemption, the holders of the Preferred Shares

are also entitled to receive a dividend make-whole payment. The holders of Preferred Shares have no voting rights on account of the Preferred

Shares, other than with respect to certain matters affecting the rights of the Preferred Shares.

Notwithstanding the foregoing, our ability to settle conversions and

make amortization and dividend make-whole payments using shares of Common Stock is subject to certain limitations set forth in the Certificate

of Designations. Prior to receiving the Nasdaq Stockholder Approval, such limitations included a limit on the number of shares that may

be issued until the time, if any, that our stockholders have approved the issuance of more than 19.99% of our issued and outstanding shares

of Common Stock in accordance with the Nasdaq Stock Market LLC (“Nasdaq”) listing standards (the “Nasdaq Stockholder

Approval”). We agreed to seek such stockholder approval at a meeting to be held no later than October 31, 2023, and we received

the Nasdaq Stockholder Approval at a special meeting of stockholders held on September 14, 2023. The directors and officers of the

Company holding approximately 610,000 shares of Common Stock, representing approximately 29% of the Company’s issued and outstanding

Common Stock, executed an agreement to vote their shares in favor of such matter. Further, the Certificate of Designations contains a

certain beneficial ownership limitation after giving effect to the issuance of shares of Common Stock issuable upon conversion of the

Preferred Shares, or as part of any amortization payment or dividend make-whole payment under, the Certificate of Designations.

The Certificate of Designations includes certain

Triggering Events (as defined in the Certificate of Designations), including, among other things, the failure to file and maintain an

effective registration statement covering the sale of the holder’s securities registrable pursuant to the Registration Rights Agreement

and our failure to pay any amounts due to the holders of the Preferred Shares when due. In connection with a Triggering Event, each holder

of Preferred Shares will be able to require us to redeem in cash any or all of the holder’s Preferred Shares at a premium set forth

in the Certificate of Designations.

Warrants

The Warrants are exercisable for shares of Common Stock immediately

at an exercise price of $2.25 per share (the “Exercise Price”) and expire five years from the date of issuance. The Exercise

Price is subject to customary adjustments for stock dividends, stock splits, reclassifications and the like, and subject to price-based

adjustment, on a “full ratchet” basis, in the event of any issuances of Common Stock, or securities convertible, exercisable

or exchangeable for Common Stock, at a price below the then-applicable Exercise Price (subject to certain exceptions).

Until we received the Nasdaq Stockholder Approval, we could not issue

any Warrant Shares if the issuance of such Warrant Shares (taken together with the issuance of any Conversion Shares or other shares of

Common Stock issuable pursuant to the terms of the Certificate of Designations) would exceed 19.99% of our issued and outstanding shares

of Common Stock prior to the Private Placement, which amount is the aggregate number of shares of Common Stock which we may issue under

the rules or regulations of Nasdaq. We received the Nasdaq Stockholder Approval at a special meeting of stockholders held on September

14, 2023.

Implications of Being an Emerging Growth

Company and a Smaller Reporting Company

As a company with less than $1.235 billion in revenue during our last

fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (the “JOBS

Act”) enacted in April 2012. An “emerging growth company” may take advantage of exemptions from some of the reporting

requirements that are otherwise applicable to public companies. These exceptions include:

| · | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion

and Analysis of Financial Condition and Results of Operations in this prospectus; |

| · | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes–Oxley Act of 2002, as

amended (the “Sarbanes–Oxley Act”); |

| · | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements;

and |

| · | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden

parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our

fiscal year following the fifth anniversary of our first sale of common equity securities pursuant to an effective registration statement

under the Securities Act. However, if certain events occur prior to the end of such five-year period, including if we become a “large

accelerated filer,” our annual gross revenue exceeds $1.235 billion or we issue more than $1.0 billion of non-convertible debt in

any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

In addition, the JOBS Act provides that an emerging growth company

can take advantage of an extended transition period for complying with new or revised accounting standards. We have elected to avail ourselves

of this exemption.

Finally, we are a “smaller reporting company” (and may

continue to qualify as such even after we no longer qualify as an emerging growth company) and accordingly may provide less public disclosure

than larger public companies. As a result, the information that we provide to our stockholders may be different than you might receive

from other public reporting companies in which you hold equity interests.

Corporate Information

Petros Pharmaceuticals, Inc. is a Delaware corporation

with its principal business office at 1185 Avenue of the Americas, 3rd Floor, New York, New York 10036. Our telephone number is 973-242-0005

and our website can be found at www.petrospharma.com. Through our website, we will make available, free of charge, our annual

report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those

reports, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange

Commission, or SEC. Information contained on, or that can be accessed through, our website is not and shall not be deemed to be a part

of this prospectus.

The Offering

| Common Stock to be Offered by the Selling Stockholders |

|

Up to an aggregate of 184,828,846 shares of Common Stock, which are issuable to such selling stockholders pursuant to the terms of the Preferred Shares and Warrants. The terms of the Registration Rights Agreement require us to register the number of shares of Common Stock equal to the sum of (i) 200% of the maximum number of Conversion Shares issuable upon conversion of the Preferred Shares (assuming for purposes hereof that (x) the Preferred Shares are convertible at the Floor Price, (y) dividends on the Preferred Shares shall accrue through July 17, 2025 and will be converted into shares of Common Stock at the Floor Price and (z) any such conversion shall not take into account any limitations on the conversion of the Preferred Shares set forth in the Preferred Shares), and (ii) 200% of the maximum number of Warrant Shares issuable upon exercise of the Warrants issued to the Investors (assuming for purposes hereof that the exercise price of such Warrants is equal to the Floor Price and without taking into account any limitations on the exercise of such Warrants set forth therein). |

| |

|

|

| Use of Proceeds |

|

We will not receive any proceeds from the sale of the Conversion Shares and Warrant Shares by the selling stockholders. However, we will receive proceeds from the exercise of the Warrants if such warrants are exercised for cash. We currently intend to use such proceeds for general corporate purposes |

| |

|

|

| Plan of Distribution |

|

The selling stockholders named in this prospectus, or their pledgees,

donees, transferees, distributees, beneficiaries or other successors-in-interest, may offer or sell the shares of Common Stock from time

to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately

negotiated prices. The selling stockholders may also resell the shares of Common Stock to or through underwriters, broker-dealers or agents,

who may receive compensation in the form of discounts, concessions or commissions.

See “Plan of Distribution” beginning on page 15 of this

prospectus for additional information on the methods of sale that may be used by the selling stockholders. |

| |

|

|

| Nasdaq Capital Market Symbol |

|

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “PTPI.” |

| |

|

|

| Risk Factors |

|

Investing in our Common Stock involves significant risks. See “Risk Factors” beginning on page 6 of this prospectus and the documents incorporated by reference in this prospectus. |

Risk Factors

Investing in our securities involves a high degree of risk. In addition

to the other information contained in this prospectus and in the documents we incorporate by reference, you should carefully consider

the risks discussed below and under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2022 as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC, before making

a decision about investing in our securities. The risks and uncertainties discussed below and in the documents incorporated by reference

are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial,

may also harm our business. If any of these risks occur, our business, financial condition and operating results could be harmed, the

trading price of our Common Stock could decline and you could lose part or all of your investment.

Risks Related to this Offering and Our Common

Stock

Substantial future sales or other issuances

of our Common Stock could depress the market for our Common Stock.

Sales of a substantial number of shares of our Common Stock and any

future sales of a substantial number of shares of Common Stock in the public market, including the issuance of shares or any shares issuable

upon conversion of the Preferred Shares or exercise of the Warrants, or the perception by the market that those sales could occur, could

cause the market price of our Common Stock to decline or could make it more difficult for us to raise funds through the sale of equity

and equity-related securities in the future at a time and price that our management deems acceptable, or at all. In addition, as opportunities

present themselves, we may enter into financing or similar arrangements in the future, including the issuance of debt securities, preferred

stock or Common Stock, which could also depress the market for our Common Stock. We cannot predict the effect, if any, that market sales

of those shares of Common Stock or the availability of those shares for sale will have on the market price of our Common Stock.

You may experience future dilution as

a result of future equity offerings and other issuances of our securities.

In order to raise additional capital, we may in the future offer additional

shares of Common Stock or other securities convertible into or exchangeable for our Common Stock prices that may not be the same as the

price per share paid by the investors in this offering. We may not be able to sell shares or other securities in any other offering at

a price per share that is equal to or greater than the price per share paid by the investors in this offering, and investors purchasing

shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional

shares of Common Stock or securities convertible into shares of Common Stock in future transactions may be higher or lower than the price

per share paid to the selling stockholders. Our stockholders will incur dilution upon exercise of any outstanding stock options, warrants

or other convertible securities or upon the issuance of shares of Common Stock under our stock incentive programs.

We expect to require additional capital in the future in order to pursue

out strategic goals, including our Non-Prescription / OTC strategies related to Stendra®. If we do not obtain any such additional

financing, it may be difficult to effectively realize our long-term strategic goals and objectives.

Our current cash resources will not be sufficient to fund the development

of our product candidates through all of the required clinical trials to receive regulatory approval and commercialization. If we cannot

secure this additional funding when such funds are required, we may fail to develop our product candidates or be forced to forego certain

strategic opportunities.

Any additional capital raised through the sale of equity or equity-backed

securities may dilute our stockholders’ ownership percentages and could also result in a decrease in the market value of our equity

securities.

The terms of any securities issued by us in future capital transactions

may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative

securities, which may have a further dilutive effect on the holders of any of our securities then outstanding.

In addition, we may incur substantial costs

in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance

fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with

certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Special Note Regarding

Forward-Looking Statements

This prospectus and the information incorporated by reference in this

prospectus contain “forward-looking statements,” which include information relating to future events, future financial performance,

strategies, expectations, competitive environment and regulation. Our use of the words “may,” “will,” “would,”

“could,” “should,” “believes,” “estimates,” “projects,” “potential,”

“expects,” “plans,” “seeks,” “intends,” “evaluates,” “pursues,”

“anticipates,” “continues,” “designs,” “impacts,” “forecasts,” “target,”

“outlook,” “initiative,” “objective,” “designed,” “priorities,” “goal”

or the negative of those words or other similar expressions is intended to identify forward-looking statements that represent our current

judgment about possible future events. Forward-looking statements should not be read as a guarantee of future performance or results and

will probably not be accurate indications of when such performance or results will be achieved. All statements included or incorporated

by reference in this prospectus, and in related comments by our management, other than statements of historical facts, including without

limitation, statements about future events or financial performance, are forward-looking statements that involve certain risks and uncertainties.

These statements are based on certain assumptions and analyses made

in light of our experience and perception of historical trends, current conditions and expected future developments as well as other factors

that we believe are appropriate in the circumstances. While these statements represent our judgment on what the future may hold, and we

believe these judgments are reasonable, these statements are not guarantees of any events or financial results. Whether actual future

results and developments will conform with our expectations and predictions is subject to a number of risks and uncertainties, including

the risks and uncertainties discussed in this prospectus, any prospectus supplement and the documents incorporated by reference under

the captions “Risk Factors” and “Special Note Regarding Forward-Looking Statements” and elsewhere in those documents.

Consequently, all of the forward-looking statements made in this prospectus

as well as all of the forward-looking statements incorporated by reference to our filings under the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), are qualified by these cautionary statements and there can be no assurance that the actual results

or developments that we anticipate will be realized or, even if realized, that they will have the expected consequences to or effects

on us and our subsidiaries or our businesses or operations. We caution investors not to place undue reliance on forward-looking statements.

We undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information,

future events, or other such factors that affect the subject of these statements, except where we are expressly required to do so by law.

Use of Proceeds

All shares of our Common Stock offered by this prospectus are being

registered for the accounts of the selling stockholders and we will not receive any proceeds from the sale of these shares. However, we

will receive proceeds from the exercise of the Warrants if the Warrants are exercised for cash. We intend to use those proceeds, if any,

for general corporate purposes. The holders of the Warrants are not obligated to exercise their Warrants for cash, and we cannot predict

whether holders of the Warrants will choose to exercise all or any of their Warrants for cash.

Selling Stockholders

Unless the context otherwise requires, as used in this prospectus,

“selling stockholders” includes the selling stockholders listed below and donees, pledgees, transferees or other successors-in-interest

selling shares received after the date of this prospectus from the selling stockholders as a gift, pledge or other non-sale related transfer.

We have prepared this prospectus to allow the selling stockholders

or their successors, assignees or other permitted transferees to sell or otherwise dispose of, from time to time, up to 184,828,846 shares

of our Common Stock.

The Common Stock being offered by the selling stockholders are those

issuable to the selling stockholders upon conversion of the Preferred Shares and exercise of the Warrants. For additional information

regarding the issuance of the Preferred Shares and the Warrants, see “Private Placement of Preferred Shares and Warrants”

above. We are registering the Conversion Shares and Warrant Shares in order to permit the selling stockholders to offer the shares for

resale from time to time. The selling stockholders may also sell, transfer or otherwise dispose of all or a portion of their shares in

transactions exempt from the registration requirements of the Securities Act, or pursuant to another effective registration statement

covering those shares.

Relationships with the Selling Stockholders

Except for the ownership of the Preferred Shares and the Warrants issued

pursuant to the Purchase Agreement and the Engagement Agreement, as applicable, and except as disclosed in our periodic reports and current

reports filed with the SEC from time to time, the selling stockholders have not had any material relationship with us within the past

three years.

Information About Selling Stockholders Offering

The table below lists the selling stockholders and other information

regarding the beneficial ownership (as determined under Section 13(d) of the Exchange Act and the rules and regulations thereunder)

of the shares of Common Stock held by each of the selling stockholders. The second column (titled “Number of Shares of Common Stock

Owned Prior to Offering”) lists the number of shares of Common Stock beneficially owned by the selling stockholders, based on their

respective ownership of shares of Common Stock, Preferred Shares and Warrants as of September 14, 2023, assuming conversion

of the Preferred Shares and exercise of the Warrants and any other warrants held by each such selling stockholder on that date, but taking

account of any limitations on conversion and exercise set forth therein.

The third column (titled “Maximum Number of Shares of Common

Stock to be Sold Pursuant to this Prospectus”) lists the shares of Common Stock being offered by this prospectus by the selling

stockholders and does not take in account any limitations on (i) conversion of the Preferred Shares set forth therein or (ii) exercise

of the Warrants set forth therein.

The third, fourth and fifth columns (titled “Number of Shares

of Common Stock Owned After Offering” and “Percentage of Common Stock Owned After Offering”) assume the conversion of

the Preferred Shares and exercise of the Warrants at the Floor Price and the sale of all of the shares offered by the selling stockholders

pursuant to this prospectus. Because the conversion price of the Preferred Shares and the exercise price of the Warrants may be adjusted,

the number of shares that will actually be issued may be more or less than the number of shares being offered by this prospectus.

The terms of the Registration Rights Agreement require us to register

the number of shares of Common Stock equal to the sum of (i) 200% of the maximum number of Conversion Shares issuable upon conversion

of the Preferred Shares (assuming for purposes hereof that (x) the Preferred Shares are convertible at the Floor Price (as defined in

the Certificate of Designation), (y) dividends on the Preferred Shares shall accrue through July 17, 2025 and will be converted into shares

of Common Stock at the Floor Price and (z) any such conversion shall not take into account any limitations on the conversion of the Preferred

Shares set forth in the Preferred Shares), and (ii) 200% of the maximum number of Warrant Shares issuable upon exercise of the Warrants

issued to the Investors at the Floor Price (assuming for purposes hereof that the exercise price of such Warrants is equal to the Floor

Price and without taking into account any limitations on the exercise of the Warrants set forth therein).

Under the terms of the Preferred Shares and the Warrants, a selling

stockholder may not convert the Preferred Shares or exercise the Warrants to the extent (but only to the extent) such selling stockholder

or any of its affiliates would beneficially own a number of shares of our shares of Common Stock which would exceed 4.99%, or, at the

election of the selling stockholder, 9.99% of the outstanding shares of the Company. The number of shares in the second column reflects

these limitations. The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

| Name of Selling Stockholder | |

Number of

Shares of

Common

Stock Owned

Prior to

Offering (1) | | |

Maximum

Number of

Shares of

Common

Stock to be

Sold

Pursuant to

this

Prospectus | | |

Number of

shares of

Common

Stock Owned

After

Offering | | |

Percentage of

Common

Stock Owned

After

Offering | |

| Iroquois Capital Investment Group, LLC (2) | |

| 268,820 | | |

| 7,701,200 | | |

| 46,807 | | |

| * | |

| Iroquois Master Fund Ltd. (3) | |

| 304,602 | | |

| 33,766,800 | | |

| 97,290 | | |

| * | |

| Intracoastal Capital LLC (4) | |

| 357,907 | | |

| 41,468,000 | | |

| 167,139 | | |

| * | |

| Five Narrow Lane LP (5) | |

| 111,006 | | |

| 17,772,000 | | |

| - | | |

| * | |

| The Hewlett Fund LP (6) | |

| 111,006 | | |

| 7,405,000 | | |

| - | | |

| * | |

| Cavalry Fund I, LP (7) | |

| 111,006 | | |

| 3,850,600 | | |

| - | | |

| * | |

| WVP-Emerging Manager Onshore Fund, LLC-Structured Small Cap Lending Series (8) | |

| 111,006 | | |

| 2,073,400 | | |

| - | | |

| * | |

| Brio Capital Master Fund Ltd. (9) | |

| 111,006 | | |

| 5,924,000 | | |

| 41,304 | | |

| * | |

| Alto Opportunity Master Fund, SPC-Segregated Master Portfolio B (10) | |

| 234,580 | | |

| 11,848,000 | | |

| - | | |

| * | |

| Kingsbrook Opportunities Master Fund LP (11) | |

| 111,006 | | |

| 5,924,024 | | |

| 2,329 | | |

| * | |

| Boothbay Absolute Return Strategies, LP (12) | |

| 111,006 | | |

| 7,848,116 | | |

| - | | |

| * | |

| Boothbay Diversified Alpha Master Fund LP (13) | |

| 111,006 | | |

| 3,999,900 | | |

| - | | |

| * | |

| V4 Global, LLC (14) | |

| 111,006 | | |

| 4,739,200 | | |

| - | | |

| * | |

| 3i, LP (15) | |

| 111,006 | | |

| 16,587,200 | | |

| - | | |

| * | |

| StenED, LLC (16) | |

| 111,006 | | |

| 6,812,600 | | |

| - | | |

| * | |

| Benjamin Abrams (17) | |

| 10,000 | | |

| 133,290 | | |

| | | |

| * | |

| Jordan Smith (18) | |

| 13,334 | | |

| 177,728 | | |

| | | |

| * | |

| Barbara J Glenns (19) | |

| 40,000 | | |

| 266,580 | | |

| | | |

| * | |

| Stephen Renaud (20) | |

| 85,493 | | |

| 533,160 | | |

| 5,493 | | |

| * | |

| Jeffrey Berman (21) | |

| 35,000 | | |

| 466,514 | | |

| | | |

| * | |

| Michael Silverman (22) | |

| 111,006 | | |

| 5,531,534 | | |

| 44,892 | | |

| * | |

* Less than 1%

| |

(1) |

This table and the information in the notes below are based upon information supplied by the selling stockholders and upon 2,113,570 shares of Common Stock issued and outstanding as of September 14, 2023 (prior to any deemed issuance of any Conversion Shares or Warrant Shares). Except as expressly noted in the footnotes below, beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. The amounts set forth in this column reflect the application of various limitations on the issuance of Conversion Shares and Warrant Shares in the Certificate of Designations and the Warrants, respectively, including beneficial ownership limitations and limitations under the rules or regulations of Nasdaq. |

| |

(2) |

Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder. Other shares of Common Stock beneficially owned prior to this offering consist of 46,807 shares underlying other warrants that are currently exercisable or exercisable within 60 days of September 14, 2023. |

The shares are held directly by Iroquois Capital Investment Group, LLC, a limited liability company (“ICIG”). Richard Abbe

is the managing member of ICIG. Mr. Abbe has voting control and investment discretion over securities held by ICIG. As such, Mr. Abbe

may be deemed to be the beneficial owner (as determined under Section 13(d) of the Exchange Act) of the securities held by ICIG. Mr. Abbe

disclaims beneficial ownership over the securities listed except to the extent of his pecuniary interest therein. ICIG’s address

is 2 Overhill Road, Suite 400, Scarsdale, NY 10583.

| |

(3) |

Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder. Other shares of Common Stock beneficially owned prior to this offering consist of (1) 14,701 shares of Common Stock and (2) 82,589 shares underlying other warrants that are currently exercisable or exercisable within 60 days of September 14, 2023.

The shares are held directly by Iroquois Master Fund Ltd. (“IMF”). Iroquois Capital Management L.L.C. is the investment manager of IMF. Iroquois Capital Management, LLC has voting control and investment discretion over securities held by IMF. As Managing Members of Iroquois Capital Management, LLC, Richard Abbe and Kimberly Page make voting and investment decisions on behalf of Iroquois Capital Management, LLC in its capacity as investment manager to IMF. As a result of the foregoing, Mr. Abbe and Mrs. Page may be deemed to have beneficial ownership (as determined under Section 13(d) of the Exchange Act) of the securities held by Iroquois Capital Management and IMF. Each of Iroquois Capital Management, LLC, Mr. Abbe and Ms. Page disclaims beneficial ownership over the securities listed except to the extent of their pecuniary interest therein. IMF’s address is 2 Overhill Road, Suite 400, Scarsdale, NY 10583. |

| |

(4) |

Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder. Other shares of Common Stock beneficially owned prior to this offering consist of (1) 24,413 shares of Common Stock and (2) 142,726 shares underlying other warrants that are currently exercisable or exercisable within 60 days of September 14, 2023.

Mitchell P. Kopin (“Mr. Kopin”) and Daniel B. Asher (“Mr. Asher”), each of whom are managers of Intracoastal Capital LLC (“Intracoastal”), have shared voting control and investment discretion over the securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of the securities reported herein that are held by Intracoastal. Intracoastal’s address is 245 Palm Trail, Delray Beach, FL 33483. |

| (5) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in

the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling

stockholder.

Messrs. Arie Rabinowitz and Joe Hammer have voting and investment control over the securities held by Five Narrow Lane LP. Five Narrow

Lane LP’S address is 510 Madison Avenue, Suite 1400, New York, NY 10022. |

| (6) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in

the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling

stockholder.

Martin Chopp has voting and dispositive power over the securities held by The Hewlett Fund LP (“Hewlett”). Hewlett’s

address is 100 Merrick Road, Suite 400W, Rockville Centre, NY 11570. |

| (7) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in

the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling

stockholder.

Cavalry Fund I GP LLC, the General Partner of Cavalry Fund I, LP, has discretionary authority to vote and dispose of the shares held by

Cavalry Fund I, LP and may be deemed to be the beneficial owner of these shares. Thomas Walsh, in his capacity as CEO of Cavalry Fund

I GP LLC, may also be deemed to have investment discretion and voting power over the shares held by Cavalry Fund I, LP. Cavalry Fund I

GP LLC and Mr. Walsh each disclaim any beneficial ownership of these shares. The address of Cavalry Fund I GP is 82 E. Allendale Road,

Suite 5B, Saddle River, NJ 07458. |

| (8) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in

the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling

stockholder.

WVP Management, LLC, the Managing Member of WVP Emerging Manager Onshore Fund LLC - Structured Small Cap Lending Series (the “WVP

Selling Stockholder”), has discretionary authority to vote and dispose of the shares held by the WVP Selling Stockholder and may

be deemed to be the beneficial owner of these shares. Cavalry Fund I Management LLC and Worth Venture Partners, LLC, in their capacity

as advisors to the WVP Selling Stockholder, may also be deemed to have investment discretion and voting power of the shares held by the

WVP Selling Stockholder. Thomas Walsh, in his capacity as General Partner, CEO, and CIO of Cavalry Fund I Management LLC, may also be

deemed to have investment discretion and voting power over the shares held by the WVP Selling Stockholder. Abby Flamholz, in her capacity

as Managing Member of WVP Management, LLC and in her capacity as Managing Member of Worth Venture Partners, LLC, may also be deemed to

have investment discretion and voting power of the shares held by the WVP Selling Stockholder. WVP Management, LLC, Cavalry Fund I Management

LLC, Worth Venture Partners, LLC, Mr. Walsh and Ms. Flamholz each disclaim any beneficial ownership of these shares. The address of this

WVP Selling Stockholder is 82 E. Allendale Road, Suite 5B, Saddle River, NJ 07458. |

| |

(9) |

Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder. Other shares of Common Stock beneficially owned prior to this offering consist of 41,304 shares underlying other warrants that are currently exercisable or exercisable within 60 days of September 14, 2023.

Shaye Hirsch has voting and investment control over the securities held by Brio Capital Master Fund, Ltd. Brio Capital Master Fund, Ltd.’s address is 100 Merrick Road, Suite 401W, Rockville Centre, NY 11570. |

| (10) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in

the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling

stockholder.

Ayrton Capital LLC, the investment manager to Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B, has discretionary authority

to vote and dispose of the shares held by Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B and may be deemed to be the

beneficial owner of these shares. Waqas Khatri, in his capacity as Managing Member of Ayrton Capital LLC, may also be deemed to have investment

discretion and voting power over the shares held by Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B. Alto Opportunity

Master Fund, SPC - Segregated Master Portfolio B and Mr. Khatri each disclaim any beneficial ownership of these shares. The address of

Ayrton Capital LLC is 55 Post Rd West, 2nd Floor, Westport, CT 06880. |

| |

(11) |

Shares of

Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the

aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the

selling stockholder. Other shares of Common Stock beneficially owned prior to this offering consist of 2,329 shares underlying

other warrants that are currently exercisable or exercisable within 60 days of September

14, 2023. |

Kingsbrook Partners LP (“Kingsbrook Partners”)

is the investment manager of Kingsbrook Opportunities Master Fund LP (“Kingsbrook Opportunities”) and consequently has voting

control and investment discretion over securities held by Kingsbrook Opportunities. Kingsbrook Opportunities GP LLC (“Opportunities

GP”) is the general partner of Kingsbrook Opportunities and may be considered the beneficial owner of any securities deemed to be

beneficially owned by Kingsbrook Opportunities. KB GP LLC (“GP LLC”) is the general partner of Kingsbrook Partners and may

be considered the beneficial owner of any securities deemed to be beneficially owned by Kingsbrook Partners. Ari J. Storch, Adam J. Chill

and Scott M. Wallace are the sole managing members of Opportunities GP and GP LLC and as a result may be considered beneficial owners

of any securities deemed beneficially owned by Opportunities GP and GP LLC. Each of Kingsbrook Partners, Opportunities GP, GP LLC and

Messrs. Storch, Chill and Wallace disclaim beneficial ownership of these securities. Kingsbrook’s address is 689 Fifth Avenue, 12th

Floor, New York, NY 10022.

| (12) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in

the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling

stockholder.

Boothbay Absolute Return Strategies LP, a Delaware limited partnership (the “Boothbay ARS Fund”), is managed by Boothbay Fund

Management, LLC, a Delaware limited liability company (the “Boothbay Adviser”). The Boothbay Adviser, in its capacity as the

investment manager of the Boothbay ARS Fund, has the power to vote and the power to direct the disposition of all securities held by the

Boothbay ARS Fund. Ari Glass is the Managing Member of the Boothbay Adviser. Each of the Boothbay ARS Fund, the Boothbay Adviser and Mr.

Glass disclaim beneficial ownership of these securities, except to the extent of any pecuniary interest therein. The Boothbay ARS Fund’s

address is c/o Boothbay Fund Management, LLC, 140 East 45th Street, 14th Floor, New York, NY 10017. |

| (13) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in

the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling

stockholder.

Boothbay Diversified Alpha Master Fund, LP, a Cayman Islands limited partnership (the “Boothbay DAMF Fund”), is managed by

the Boothbay Adviser. The Boothbay Adviser, in its capacity as the investment manager of the Boothbay DAMF Fund, has the power to vote

and the power to direct the disposition of all securities held by the Boothbay DAMF Fund. Ari Glass is the Managing Member of the Boothbay

Adviser. Each of the Boothbay DAMF Fund, the Boothbay Adviser and Mr. Glass disclaim beneficial ownership of these securities, except

to the extent of any pecuniary interest therein. The Boothbay DAMF Fund’s address is c/o Boothbay Fund Management, LLC, 140 East

45th Street, 14th Floor, New York, NY 10017. |

| (14) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in

the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling

stockholder.

The shares are held by V4 Global, LLC (“V4”). Scot Cohen has voting and dispositive control with respect to the securities

being offered. V4 and Scot Cohen disclaim beneficial ownership of the securities except to the extent of their respective pecuniary interests

therein. V4’s address is 445 Grand Bay Drive, Apt. P1A, Key Biscayne, FL 33149. |

| (15) | Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in

the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling

stockholder.

The business address of 3i, LP is 2 Wooster St. Fl 2, New York, NY 10013. 3i, LP's principal business is that of a private investor. Maier

Joshua Tarlow is the manager of 3i Management, LLC, the general partner of 3i, LP, and has sole voting control and investment discretion

over securities beneficially owned directly by 3i, LP and indirectly by 3i Management, LLC. |

| (16) |

Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder.

Jonathan Schechter (“Mr. Schechter”), is the manager of StenED, LLC (“StenED”), has voting control and investment discretion over the securities reported herein that are held by StenED. As a result, Mr. Schechter may be deemed to have beneficial ownership (as determined under Section 13(d) of the Exchange Act) of the securities reported herein that are held by StenED. StenED’s address is 135 Sycamore Drive, Roslyn, NY 11576. |

| |

|

| (17) |

Shares of Common Stock

to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon conversion

or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder.

Mr. Abrams’ address is c/o Katalyst Securities LLC, 655 Third Avenue, 18th floor, New York, NY 10017. |

| |

|

| (18) |

Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder.

Mr. Smith’s address is c/o Katalyst Securities LLC, 655 Third Avenue, 18th floor, New York, NY 10017. |

| |

|

| (19) |

Shares of Common Stock to

be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon

conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder.

Ms. Glenns’ address is 30 Waterside Plaza, Suite 7, New York, NY 10010. |

| |

|

| (20) |

Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder. Other shares of Common Stock beneficially owned prior to this offering consist of 5,439 shares underlying other warrants that are currently exercisable or exercisable within 60 days of September 14, 2023.

Mr. Renaud’s address is c/o Katalyst Securities LLC, 655 Third Avenue, 18th floor, New York, NY 10017. |

| |

|

| (21) |

Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder.

Mr. Berman’s address is c/o Katalyst Securities LLC, 655 Third Avenue, 18th floor, New York, NY 10017. |

| |

|

| (22) |

Shares of Common Stock to be sold pursuant to this prospectus represent the number of shares of Common Stock that may be issued, in the aggregate, upon conversion or exercise (as the case may be) of any Preferred Shares or any Warrants beneficially owned by the selling stockholder. Other shares of Common Stock beneficially owned prior to this offering consist of 44,892 shares underlying other warrants that are currently exercisable or exercisable within 60 days of September 14, 2023.

Mr. Silverman’s address is c/o Katalyst Securities LLC, 655 Third Avenue, 18th floor, New York, NY 10017. |

Plan of Distribution

We are registering the shares of Common Stock

issuable upon conversion of the Preferred Shares and exercise of the Warrants to permit the resale of these shares of Common Stock by

the holders of the Preferred Shares and Warrants from time to time after the date of this prospectus. We will not receive any of the proceeds

from the sale by the selling stockholders of the shares of Common Stock, although we will receive the exercise price of any Warrants not

exercised by the selling stockholders on a cashless exercise basis. We will bear all fees and expenses incident to our obligation to register

the shares of Common Stock.

Each selling stockholder of the securities and

any of their pledgees, assignees and successors-in-interest may sell all or a portion of the shares of Common Stock held by them and offered

hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of Common Stock are sold

through underwriters or broker-dealers, the selling stockholders will be responsible for underwriting discounts or commissions or agent’s

commissions. The shares of Common Stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time

of the sale, at varying prices determined at the time of sale or at negotiated prices. These sales may be effected in transactions, which

may involve crosses or block transactions, pursuant to one or more of the following methods:

| · | on any national securities exchange or quotation service on which the securities may be listed or quoted

at the time of sale; |

| · | in the over-the-counter market; |

| · | in transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

| · | through the writing or settlement of options, whether such options are listed on an options exchange or

otherwise; |

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the securities as agent but may position

and resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | short sales made after the date the Registration Statement is declared effective by the SEC; |

| · | broker-dealers may agree with a selling security holder to sell a specified number of such shares at a

stipulated price per share; |

| · | a combination of any such methods of sale; and |

| · | any other method permitted pursuant to applicable law |

The selling stockholders may also sell securities

under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

In addition, the selling stockholders may transfer

the securities by other means not described in this prospectus. If the selling stockholders effect such transactions by selling securities

to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form

of discounts, concessions or commissions from the selling stockholders or commissions from purchasers of the securities for whom they

may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers

or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the securities or otherwise,

the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the securities

in the course of hedging in positions they assume. The selling stockholders may also sell securities short and deliver securities covered

by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholders

may also loan or pledge securities to broker-dealers that in turn may sell such securities.

The selling stockholders may pledge or grant a

security interest in some or all of the securities owned by them and, if they default in the performance of their secured obligations,

the pledgees or secured parties may offer and sell the securities from time to time pursuant to this prospectus or any amendment to this

prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending, if necessary, the list of selling stockholders

to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer and donate the

securities in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling

beneficial owners for purposes of this prospectus.

To the extent required by the Securities Act and

the rules and regulations thereunder, the selling stockholders and any broker-dealer participating in the distribution of the securities

may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or

concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At

the time a particular offering of securities is made, a prospectus supplement, if required, will be distributed, which will set forth

the aggregate amount of securities being offered and the terms of the offering, including the name or names of any broker-dealers or agents,

any discounts, commissions and other terms constituting compensation from the selling stockholders and any discounts, commissions or concessions

allowed or re-allowed or paid to broker-dealers.

Under the securities laws of some states, the

securities may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the securities

may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification

is available and is complied with.

There can be no assurance that any selling stockholder

will sell any or all of the securities registered pursuant to the registration statement of which this prospectus forms a part.

The selling stockholders and any other person

participating in such distribution will be subject to applicable provisions of the Exchange Act, and the rules and regulations thereunder,

including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of purchases and

sales of any of the shares of securities by the selling stockholders and any other participating person. To the extent applicable, Regulation

M may also restrict the ability of any person engaged in the distribution of the securities to engage in market-making activities with

respect to such securities. All of the foregoing may affect the marketability of the securities and the ability of any person or entity

to engage in market-making activities with respect to the securities.

We will pay all expenses of the registration of

the securities pursuant to the Registration Rights Agreement, estimated to be $158 in total, including, without limitation, SEC

filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, a selling stockholder

will pay all underwriting discounts and selling commissions, if any. We will indemnify the selling stockholders against liabilities, including

some liabilities under the Securities Act in accordance with the registration rights agreements or the selling stockholders will be entitled

to contribution. We may be indemnified by the selling stockholders against civil liabilities, including liabilities under the Securities

Act that may arise from any written information furnished to us by the selling stockholder specifically for use in this prospectus, in

accordance with the related registration rights agreements or we may be entitled to contribution.

Once sold under the registration statement, of

which this prospectus forms a part, the securities will be freely tradable in the hands of persons other than our affiliates.

Legal Matters

The validity of the securities offered by this

prospectus will be passed upon for us by Haynes and Boone, LLP, New York, New York.

Experts

The consolidated balance sheets of Petros Pharmaceuticals,

Inc. and Subsidiaries as of December 31, 2022 and 2021, and the related consolidated statements of operations, changes in stockholders’

equity, and cash flows for each of the years then ended have been audited by EisnerAmper LLP, independent registered public accounting

firm, as stated in their report which is incorporated herein by reference (which report includes an explanatory paragraph about the existence

of substantial doubt concerning our ability to continue as a going concern). Such consolidated financial statements have been incorporated

herein by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

Where You Can Find

More Information

We have filed with the SEC a registration statement on Form S-3 under

the Securities Act with respect to the securities offered by this prospectus. This prospectus, filed as part of the registration statement,

does not contain all the information set forth in the registration statement and its exhibits and schedules, portions of which have been

omitted as permitted by the rules and regulations of the SEC. For further information about us, we refer you to the registration statement

and to its exhibits and schedules.

We file annual, quarterly and current reports and other information

with the SEC. The SEC maintains an internet website at www.sec.gov that contains periodic and current reports, proxy and information statements,

and other information regarding registrants that are filed electronically with the SEC.

These documents are also available, free of charge, through the Investors

section of our website, which is located at https://petrospharma.com. Information contained on our website is not incorporated

by reference into this prospectus and you should not consider information on our website to be part of this prospectus.

Incorporation of

Certain Information by Reference

The SEC allows us to “incorporate by reference”

the information we have filed with it, which means that we can disclose important information to you by referring you to those documents.

The information we incorporate by reference is an important part of this prospectus, and later information that we file with the SEC will

automatically update and supersede this information. We incorporate by reference the documents listed below and any future documents (excluding

information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) we file with the SEC pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, subsequent to the date of this prospectus and prior to the termination

of the offering:

| |

● |

Our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 31, 2023; |

| |

|

|

| |

● |

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 15, 2023, and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the SEC on August 14, 2023; |

| |

|

|

| |

● |

Our Current Reports on Form 8-K filed with the SEC on July 13, 2023, August 15, 2023, and September 15, 2023; and |

| |

|

|

| |

● |

The description of our Common Stock that is included in the Form 8-A filed with the SEC on December 1, 2020, as amended by Exhibit 4.4 to our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 31, 2022. |

All filings filed by us pursuant to the Securities

Exchange Act of 1934, as amended, after the date of the initial filing of this registration statement and prior to the effectiveness of

such registration statement (excluding information furnished pursuant to Items 2.02 and 7.01 of Form 8-K) shall also be deemed to be incorporated

by reference into the prospectus.

You should rely only on the information incorporated

by reference or provided in this prospectus. We have not authorized anyone else to provide you with different information. Any statement

contained in a document incorporated by reference into this prospectus will be deemed to be modified or superseded for the purposes of

this prospectus to the extent that a later statement contained in this prospectus or in any other document incorporated by reference into

this prospectus modifies or supersedes the earlier statement. Any statement so modified or superseded will not be deemed, except as so

modified or superseded, to constitute a part of this prospectus. You should not assume that the information in this prospectus is accurate

as of any date other than the date of this prospectus or the date of the documents incorporated by reference in this prospectus.

We will provide without charge to each person to whom a copy of this

prospectus is delivered, upon written or oral request, a copy of any or all of the reports or documents that have been incorporated by

reference in this prospectus but not delivered with this prospectus (other than an exhibit to these filings, unless we have specifically

incorporated that exhibit by reference in this prospectus). Any such request should be addressed to us at:

Petros Pharmaceuticals,

Inc.

Attn: Vice President of Accounting

1185 Avenue of the Americas, 3rd Floor

New York, New York 10036

973-242-0005

You may also access the documents incorporated by reference in this

prospectus through our website at www. petrospharma.com. Except for the specific incorporated documents listed above, no information available

on or through our website shall be deemed to be incorporated in this prospectus or the registration statement of which it forms a part.

184,828,846 Shares

COMMON STOCK

PROSPECTUS

September 18, 2023

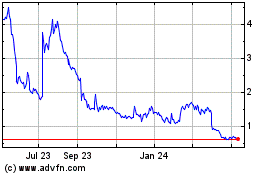

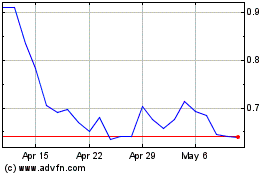

Petros Pharmaceuticals (NASDAQ:PTPI)

Historical Stock Chart

From Apr 2024 to May 2024

Petros Pharmaceuticals (NASDAQ:PTPI)

Historical Stock Chart

From May 2023 to May 2024